Introduction

Given the background of globalization and “the new economy”, corporate governance’s particularities within the banking sector increase the awareness of both practitioners and world organizations, concerned in advocating worldwide soundproof doctrines – whichever we talk about the Organisation for Economic Co-operation and Development (O.E.C.D.), Basel Committee’s or the community law.

The first delineation of the concept dates back to the 1970s, when the Securities and Exchange Commission (SEC) brought the issue of corporate governance to the forefront when it was brought as a stance on the official corporate governance reform. The term appeared for the first time in 1976, in the Federal Register, the official journal of the Federal Government.

Corporate governance is defined by the O.E.C.D. as the set of relationships between a company’s management and its stakeholders. In other words, it is the “procedures and processes according to which an organisation is directed and controlled”. The corporate governance structure specifies the distribution of rights and responsibilities among the different participants in the organisation – such as the Board, managers, shareholders and other stakeholders – and lays down the rules and procedures for decision-making.

Correspondingly, the M.E.N.A.-O.E.C.D. Initiative (2019) drafts some guidelines regarding the effectiveness of corporate governance structures in banks, “given the prevailing role of banking institutions as a source of finance for the corporate sector. Improved board structures, administrative procedures and disclosure requirements could result in better governed banks, which are more likely to allocate capital efficiently”.

Therefore, corporate governance incorporates managerial accountability, Board structure and shareholders rights.

High standards in the governance of banks and companies are essential for emerging markets and economic growth. Banks have a critical position in the progress of economies due to their major role in running the financial system.

Moreover, the banking industry is distinctive since it is concurrently consolidating and diversifying. Therefore, robust bank corporate governance is, indeed, an essential constituent for promoting a more resilient financial system (Deliu, 2019a).

Previous research highlights the consequences of banks’ specific traits on their corporate governance framework, emphasising two foremost aspects: higher opaqueness and imperviousness and, of course, higher regulation.

Furthermore, unfortunately, over the last years, consequent to the 2007-2008 financial crisis, it is observed that Boards have not thrived in actually comprehending some specific risks in banks, so several discontinuity gaps have been encountered, as well as a sturdy lack of authority in terms of decisional issues, consisting in the spawn of a substantial trust deficit in credit institutions in general. This situation may repeat, as we speak, due to the turbulences, instability and volatility in the socio-economic environment, all spawned by the crisis generated by the current Coronavirus (CoVid-19) pandemic.

No one can accurately predict what will happen in the future, but we need to keep in mind some of the “changes that are probably waiting for us:

- Corporate governance needs to be integrated into the business strategy of companies and not just as a mere compliance obligation;

- Effective corporate governance depends on management success;

- The fundamental objective of the management body must be built on the sustained growth of the company;

- Shareholders must have a long-term responsibility and economic interest in making decisions dutifully and responsibly;

- Well-governed companies must ensure good transparency towards all stakeholders” (Deliu, 2019b).

The way in which corporate governance systems will evolve in the future is hard to anticipate, however, the socio-economical revolutions in the business environment will make banks resort to changing processes, approaches, attitudes, as well as the stakeholder interaction models. The main scope of a corporate governance system is to ensure the sustainable growth in the current context of globalization. In this context, as Fülöp and Pintea (2015) observe, BSE should focus on one main priority: developing a Corporate Governance Index in order to efficiently assess the degree of applying and aligning with the Code’s principles and provisions, as well as to measure the corporate governance performance. Vintilă and Moscu (2014) also deliberate that a respected legal framework of a corporate governance regulation is necessary in Romania, considering that corporate governance principles should be implemented through the development of a legally binding framework.

This study does not aim to investigate exhaustive topics associated with corporate governance in banks during crisis, since they have already been portrayed by previous tremendous researches – Mehran et al (2011), Mehran and Mollineaux (2012), de Haan and Vlahu (2013) – but it rather aims to outline an exploration of the capability of the Romanian bank system to stand by the corporate governance principles in the context of an imminent socio-economic crisis, that may be generated by the current CoVid-19 pandemic.

A critical feature of the Corporate Governance Codes is that they are implemented on the basis of the “comply-or-explain” norm which provides disclosures of clear, accurate, relevant and up-to-date information regarding the compliance of the listed economic entities with the corporate governance principles.

In other words, a qualitative corporate governance finds its correspondence in efficient rules, policies and procedures of business management, administration and control.

The primary sources of the corporate governance legislation in Romania are the Companies Law, the Accounting Regulation, the Capital Markets Law, the Government Emergency Ordinance on Credit Institutions and Capital Adequacy, and the Government Emergency Ordinance 109/2011 on state owned enterprises (amended by Law 111/2016).

In 2008, the Bucharest Stock Exchange (BSE) adopted a corporate governance code addressed to the listed companies, to be implemented as “comply-or-explain”, the Code of Corporate Governance being revised in 2015, whereas a new Code entered into force in January 2016. Along with the Code, BSE also published a Compendium of Corporate Governance Practices and a Manual for Reporting Corporate Governance, in order to assist companies to implement the Code. The BSE has committed to have a leading role in monitoring the Code’s implementation, as the European Bank for Reconstruction and Development (hereafter, EBRD) observes (ERBD, 2016).

A corporate governance code comprises a set of principles and recommendations for economic entities whose shares are admitted to trading in the regulated market, hence, by emphasizing best practices and based on transparency and trust, it aims at building an internationally attractive capital country in the region. Henceforth, it encourages companies to build a strong relationship both with their shareholders and stakeholders, through an effective and transparent communication and by showing openness towards all potential investors.

BSE has taken a significant step towards better, more qualitative corporate governance at Romania’s listed economic entities, by adopting a new corporate governance code in 2015, developed together with EBRD. This new Code replaced the original Code which was issued in 2001 and revised in 2008.

The new corporate governance framework promotes higher standards of governance and transparency through a new system of compliance and enforcement (BSE, 2015), aiming to “improve confidence in the listed companies through promoting positive developments in the corporate governance of these companies”, by:

- Putting emphasis on the value of establishing a continuous relationship with investors,

- Highlighting the quality of disclosure,

- Deploying new measures so as to lay down a solid base for the capital market in Romania.

This paper aims to measure the degree to which the banks listed on the Bucharest Stock Exchange (BSE) comply with the principles and provisions of the Code of Corporate Governance issued by the BSE regarding the:

- Responsibilities of the Board (either the Board of Directors – in a one-tier system, or the Supervisory/Management Board – in a two-tier system) vs. the responsibilities of the executive management,

- Reliability and efficiency of the risk management system and internal control system,

- Fair rewards and motivation of the members of the Board;

- Added value created through the relationship with the current and potential investors.

By means of the Corporate Governance Statement, included in the Annual Report in a separate section, the listed banks perform a self-assessment of how to respect the provisions with which they should comply and, subsequently, outline the measures taken to abide by, taking into consideration the aspects that are not yet fully met.

Bunea (2013) and Manea (2015) both conclude some key features that are “pertinent for analysing and testing the degree of enabling corporate governance principles in banks”, these comprising: tasks and duties of both governance structures and control structures (with an emphasis on the Supervisory Board’s responsibilities); monitoring structures’ roles (and possible contiguous conflicts of interest); minority shareholders’ and interest owners’ status; corporate governance risks and the amendments made to the internal control function (in order to prevent and detect these risks); role of the internal audit; and importance of ethics.

Banking governance – and particularly the banks’ non-executive directors – must recognize the clear and present danger to the sector, and use this crisis as an opportunity to transform banks into respected corporate citizens rather than the perennial corporate villain.

Research Methodology

This study seeks to explore the degree to which the key concepts, principles and techniques typical to corporate governance are spread and enabled, by taking the four banks that are currently listed on BSE as a reference. The research methodology used; the observation, which was based mainly on the analysis of the Annual Reports and on the “Comply-or-Explain” Statement published by the banks analysed in 2018. The analysed sample consists of four banks that are currently listed on BSE: Banca Transilvania (TLV), BRD (BRD), Erste Group (EBS) and Patria Bank (PBK), included in the Monthly Bulletin drawn up by the BSE in December 2018.

Since this paper’s purpose is to assess the degree of applying sound corporate governance principles by the significant players in the Romanian banking system, the research methodology was fundamentally based on non-participating observation, which is an analysis of the disclosed documents published on the websites of the analysed banks. Moreover, a scoring method was used (Spătăcean and Ghiorghiţă, 2012; Manea, 2015; Deliu, 2020), so as to assess the degree of smearing corporate governance principles and transparency disclosing elements, which permitted transforming assertive and qualitative data into numerical quantitative data.

Data collection finds its correspondence in developing methods of mediated information collection from examining the Code of Corporate Governance issued by the BSE, Corporate Governance Codes made public on the official websites of the analysed banks, as well as their published Annual Reports on 31st of December 2018, namely the “Comply-or-Explain” Statement. Therefore, the research required both a qualitative and a quantitative approach, on the basis of the empirical data collected out of the sample of the four banks that are currently listed on BSE.

The qualitative approach is enlightened by the fact that the research has prerequisite interpretations, clarifications, explanations and deep understanding of the analysed phenomena, while the quantitative method has concentrated on quantifying through numerical expressions by using the score system for each bank from the sample.

Data

According to BSE (2015), the purpose of the Code of Corporate Governance Code is to create an internationally attractive capital market in Romania, based on best practices, transparency and trust, namely to determine whether the listed entities comply, to a great extent, with all the principles and provisions or not.

As stated by the BSE’s Code of Corporate Governance, the general principles and the provisions to comply with , applied and accounted for by the listed companies, are structured in four sections, as follows:

Fig. 1: Bucharest Stock Exchange Market’s Code of Corporate Governance

Source: own projection, after B.S.E.’s Code of Corporate Governance (2015) (https://www.bvb.ro/info/Rapoarte/Diverse/ENG_Corporate%20Governance%20Code_WEB_revised.pdf)

On one hand, the principles postulated in BSE’s Code of Corporate Governance are the following:

Table 1: Corporate governance – general principles, as per BSE’s Code of Corporate Governance (2015)

Source: B.S.E.’s Code of Corporate Governance (2015) (https://www.bvb.ro/info/Rapoarte/Diverse/ENG_Corporate%20Governance%20Code_WEB_revised.pdf)

It is observed that through enunciating these 14 general principles, BSE maintains a mechanism based on the “comply-or-explain” principle which gives the market clear, accurate and actual information about the listed companies’ compliance with corporate governance rules.

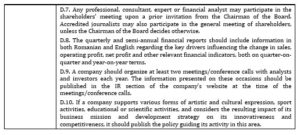

On the other hand, the provisions stipulated in BSE’s Code of Corporate of Governance are, as follows:

Table 2: Corporate governance – provisions to comply with, as per BSE’s Code of Corporate Governance (2015)

Source: B.S.E.’s Code of Corporate Governance (2015) (https://www.bvb.ro/info/Rapoarte/Diverse/ENG_Corporate%20Governance%20Code_WEB_revised.pdf)

It is also observed that the new Code is much precise and more focused on what is required form the listed companies, providing a clear list of functions that are expected from the corporate governance structures, therefore, complementing the law in force.

Method

The aim of the paper is to assess the degree of compliance of the Romanian banks that are listed on BSE with the Code of Governance issued by BSE. Hence, by using a scoring system, the enounciative (and qualitative) data were transformed into numerical (and quantitative data), revealing, henceforth, the extent to which they align with the principles and comply with the provisions presented above.

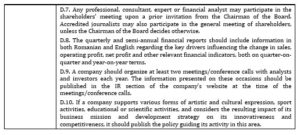

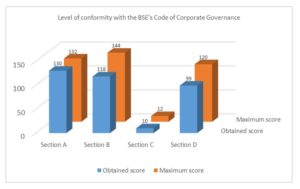

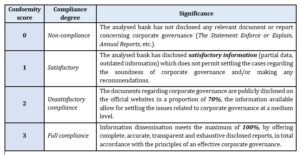

Taking into consideration the fact that in the “Comply-or-Explain” Statement, the banks, by performing a self-assessment, have four options that reflect either full compliance, satisfactory compliance, unsatisfactory compliance or non-compliance, the following table presents the used scoring system, consistent with the response disclosed by the banks:

Table 3: Significance of the conformity score given to the collected and interpreted information

Source: own projection, after Deliu (2020)

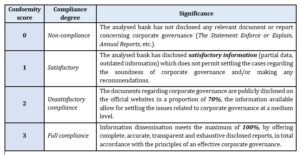

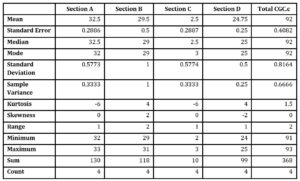

Considering this scoring system, as well as all the 4 sections of the Code of Corporate Governance issued by BSE, comprising 11 provisions to comply with (in section A), 12 provisions (in section B), 1 provision (in section C) and 10 provisions (in section D) a bank can obtain:

- for section A – a maximum of 33 points,

- for section B – a maximum of 36 points,

- for section C – a maximum of 3 points,

- for section D – a maximum of 30 points.

Hence, in total, a bank can sum up 102 points, which reflects absolute full compliance with all the sections of the BSE’s Code of Corporate Governance. Henceforth, for the studied banks, the maximum score that can be reached is 408 points.

Results and Discussions

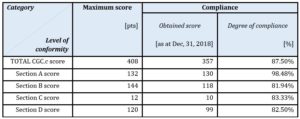

By analysing the “Comply-or-Explain” Statement disclosed for each of the 4 banks and in accordance with the proposed scoring system, the level of conformity with the principles and provisions depicted in the Code of Governance issued by the BSE was calculated:

Table 4: Quantitative determinations regarding the level of conformity with the BSE’s Code of Corporate Governance

Source: own projection

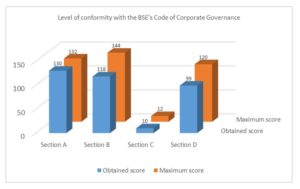

From the analysis carried out, it was revealed that the banks analysed in the sample comply, to a great extent, with the provisions of the Code of Corporate Governance.

However, the lowest result was obtained, unsurprisingly, in section B, which refers to risk management and internal control. Over the last years, subsequent to the 2007-2008 crisis, the bank practitioners did not seem to actually understand the risks and, therefore, banks do not periodically review and make amendments to the internal control function in accordance to the bank’s risk profile.

Section D also acquired a low result, due to the fact that banks should adopt a policy with respect to forecasts, whether they are distributed or not. Moreover, banks, even if they may have an Investor Relations function, they do not make the adequate disclosures and do not have a dedicated Investor Relations section on their website, both in Romanian and English, as advised by BSE.

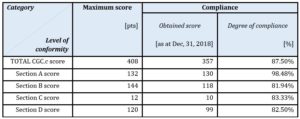

Graphically, the scores obtained by the studied banks regarding the level of compliance with the provisions of sections A, B, C and D are reflected as follows:

Fig. 2: Level of conformity with the BSE’s Code of Corporate Governance

Source: own projection

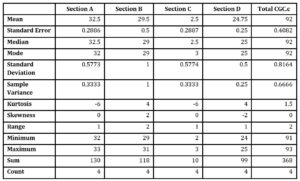

The analysis of the level of compliance with the principles and provisions depicted in the Code of Governance issued by the BSE in each section is presented in the descriptive statistics below:

Table 5: Descriptive statistics

Source: own projection

Section A’s provisions seem to be the ones with which most banks comply (98.48% compliance), especially in terms of:

- the internal regulation of the Board in terms of reference and responsibilities for the Board and key management functions of the banks;

- managing conflicts of interest;

- the composition of the Boards;

- the policies regarding the evaluation of the Boards;

- the disclosed information regarding the number of meetings of the Board and of the committees;

- appointing a nomination committee (all banks being part of the Premium Tier entities).

However, some deficiencies are observed, most of them being related to:

- insufficient information on the precise number of the independent members of the Boards.

The highest and the maximum score of section (33) is obtained by 2 banks that fully comply with the provisions of the Code in terms of the responsibilities of the Boards. Within this section, the model’s amplitude is 27 and it reflects the difference between the maximum and the minimum score obtained by the companies under study.

Conversely, Section B’s provisions seem to be the ones with which banks do not comply (only 81.94% compliance), especially when it comes to:

- the audit committee’s assessment regarding the effectiveness and scope of the internal audit function;

- the adequacy of risk management and internal control reporting to the audit committee of the Board;

- management’s responsiveness and effectiveness in dealing with identified internal control failings or weaknesses and their submission of relevant reports to the Board;

- the lack of cyclical or ad-hoc reports.

The strong points refer to:

- monitoring of the application of statutory and generally accepted standards of internal auditing;

- the existence of a separate structural division (internal audit department) within the bank/ an independent third-party entity.

It is relevant to notice that within this section, the model’s amplitude is the highest (2), reflecting the higher differences, namely the variance between the maximum and the minimum score obtained by the banks under scrutiny.

In regards to Section C, there is only one provision that must be respected by the listed banks which refers to the fair reward and motivation regarding the remuneration policy of the members Boards. The lowest score obtained is 2, while the highest score is 3, this reveals that:

some banks fully comply with the provisions regarding the publication of the guidelines and arguments underlying the remuneration policy of the members of the Boards,while some banks still do not provide a full disclosure of the aforementioned aspects. Thus, the obtained results indicate the above average compliance of the banks with the provisions of the Code (83.33%).

Section D is another problematic section, with a total compliance degree of 82.50%. The lowest score obtained is 24 points (out of maximum 30 points), which reveals that out of the 4 banks, some do not comply with the provisions of the Code of Governance regarding building the value through relationships with investors, especially when it comes to:

- having an Investor Relations function;

- adoping a policy with respect to forecasts;

- including specific information in the quarterly and semi-annual financial reports regarding the key drivers influencing the operational revenues.

The strong points relate mainly to the external auditors, namely to:

- the presence of external auditors in the shareholders’ meetings.

In conclusion, from a global perspective, the level of compliance with the principles and provisions of the Code of the 4 studied banks is reasonably high (87.50%).

Weaknesses of those charged with governance may have to be addressed in the future, requiring efforts for revision, enhancement and improvement. These weaknesses may relate to:

- a lack of diversity in the composition of the Supervisory Board and Executive Board and a lack of a clear and concrete policy on gender balance, social and cultural origin, professional profile and education;

- no real evaluation of the performances of the members of the two boards of management;

- an unsatisfactory supervision of risk management and risk exposure framework;

- a lack of authority from the risk management function, so that high risk activities can be stopped in time;

- a lack of diversification in risk management, often limited only to those categories of risk which are considered as priority and, implicitly, the inability to see g the overall picture, i.e. the totality of risks to which the credit institution is exposed;

- unreasonable and disproportionate directors’ remuneration, based on a short-term value of the bank’s action, as being the only performing criteria (Deliu, 2020).

Conclusions

Corporate governance creates a “brave new world”, in which entities have to either comply or explain.

The “Comply-or-Explain” Statement reflects the extent to which the corporate governance guidelines are applied and enforced by the listed entities, through a self-assessment that reflects the either full compliance, satisfactory compliance, unsatisfactory compliance or non-compliance with the provisions of the Code.

The purpose of corporate governance is to facilitate an effective, entrepreneurial and prudent management that can deliver long-term success for an entity activating in the banking sector.

It’s the system by which banks are directed and controlled, providing a measure for shareholders regarding the appropriateness of the governance structures.

Therefore, a cornerstone of the Code Corporate Governance issued by the BSE is the principle of “comply-or-explain”. Banks in Romania have to report each year how they have applied the principles of the Code, so that investors can evaluate the actions taken.

In this framework, valuable conclusions were reached regarding a satisfactory compliance level with corporate governance requirements in regards to the Romanian banks that are listed on BSE. In this sense, the research emphasized, to some degree, a high level of adoption of the principles and provisions.

It is emphasized that it would be timely and beneficial that BSE would develop a Corporate Governance Index in order to efficiently assess the degree of applying and aligning with the Code’s principles and provisions, as well as to measure the corporate governance performance of the entities listed on the BSE Market.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Bunea, M. (2013), ‘The Corporate Governance Impact on Banking Performance Increase’, Cross-Cultural Management Journal, 15(02), 11-21.

- De Haan, J. and Vlahu, R. (2013), ‘Corporate Governance of Banks: A Survey’, Working Paper De Nederlandsche Bank, no. 386.

- Deliu, D. (2019), ‘Brief Critical Analysis of the Main Corporate Governance Traits within Romanian Banks Listed on Bucharest Stock Exchange’, Proceedings of the 34th International Business Information Management Association (I.B.I.M.A.) Conference, ISBN: 978-0-9998551-3-3, 13-14 November 2019, Madrid, Spain.

- Deliu, D. (2019), ‘Corporate Governance Issues and Vulnerabilities in the Wake of a Global Financial Crisis’, Proceedings of the 6th International Multidisciplinary Scientific Conference – SOCIAL SCIENCES, ARTS & HUMANITIES, SWS International Scientific Conference on Social Sciences, vol. Political Sciences, Law, Economics & Finance, ISBN: 978-619-7408-91-1, 24 August-02 September 2019, Albena, Bulgaria, 6(1), 297-307.

- Deliu, D. (2020), ‘Key Corporate Governance Features within Romanian Banks Listed on Bucharest Stock Exchange: A Thorough Scrutiny and Assessment’, Journal of Eastern Europe Research in Business and Economics, 271202.

- Fülöp, M-T. and Pintea, M-O. (2015), ‘The Link between Corporate Governance and Performance Evidence’, Intercultural Management, 17(1), 81-90.

- Manea, M-D. (2015), ‘Corporate Governance within the Romanian Bank System’, Procedia Economics and Finance, 27, 454-459.

- Mehran, H., Morrison, A. and Shapiro, J. (2011), ‘Corporate Governance and Banks: What Have We Learned from the Financial Crisis?’, Federal Reserve Bank, New York, Staff Report, no. 502.

- Mehran, H. and Mollineaux, L. (2012), ‘Corporate Governance of Financial Institutions’, Federal Reserve Bank, New York, Staff Report, no. 539.

- Spătăcean, I.O. and Ghiorghiţă, L. (2012), ‘Testing Compliance with Corporate Governance Principles on the Romanian Capital Market’, Studia Universitatis Petru Maior, Series Oeconomica, 1, 70–87.

- Vintilă, G. and Moscu, R. (2014), ‘Compliance with the Romanian Corporate Governance Code. Evidences from the Companies Listed on Bucharest Stock Exchange’, Journal of Public Administration, Finance and Law, 6, 235-244.

- *** – Bucharest Stock Exchange. (2015), Code of Corporate Governance. [Online]. Bucharest Stock Exchange. [01.03.2020]. Available:

- https://www.bvb.ro/info/Rapoarte/Diverse/ENG_Corporate%20Governance%20Code_WEB_revised.pdf.

- *** – Bucharest Stock Exchange. Compendium of Corporate Governance Practices. [Online]. Bucharest Stock Exchange. [01.03.2020]. Available:

- https://www.bvb.ro/info/Rapoarte/Diverse/EN_EBRD__BVB_Compendium_18.09.2015_note%206.01.2017.pdf.

- *** – Bucharest Stock Exchange. Manual for Reporting Corporate Governance. [Online]. Bucharest Stock Exchange. [01.02.2020]. Available:https://www.bvb.ro/info/Rapoarte/Diverse/EN_EBRD__Manual%20for%20reporting_CG_18.09.2015_note%206.01.2017.pdf.

- *** – European Bank for Reconstruction and Development. (2016). Corporate Governance in Transition Economies. Romania Country Report. [Online]. European Bank for Reconstruction and Development. [01.03.2020]. Available: https://www.ebrd.com/documents/legal-reform/dpdf-corporate-governance-romania.pdf.

- *** – M.E.N.A.-O.E.C.D. Initiative. 2019. Policy Brief on Corporate Governance of Banks. Building Blocks. [Online]. The Organisation for Economic Co-operation and Development (O.E.C.D.). [01.03.2020]. Available: http://www.oecd.org/corporate/ca/corporategovernanceprinciples/38187317.pdf.

- *** – The Organisation for Economic Co-operation and Development (O.E.C.D). Principles of Corporate Governance. [Online]. The Organisation for Economic Co-operation and Development (O.E.C.D.). [01.03.2020]. Available: http://www.oecd.org/corporate/principles-corporate-governance/.