Introduction

The importance of foreign direct investment flows in determining the variation of economic growth is visible both in generating macroeconomic impuls and in the efficient use of resources, technological development and improving productivity. The investment process continuously stimulates economic growth through invested capital, trained human resources, technology transfer, market competitiveness and international organizational culture.

Regarding the main objective of this study, it is desired to determine the correlation between foreign direct investments and economic growth in the case of emerging countries in Europe in the last 24 years, the period 1997-2020. Secondary objectives take into account the influence of the following relevant factors in the economy: net exports, government expenditure, gross fixed capital formation, openness of the economy on economic growth, while maintaining foreign direct investments in the presence of these control variables. The motivation behind this study is the desire to highlight the importance of foreign direct investments in the evolution of economic growth and how foreign direct investment influences economic growth. The quantitative analysis focuses on the relationship between foreign direct investments and economic growth and is based on panel data from a group of nine emerging European countries: Bulgaria, the Czech Republic, Estonia, Lithuania, Latvia, Poland, Romania, Slovakia and Slovenia.

The research is based on the following hypotheses: foreign direct investments have a positive impact on economic growth (Tahir, Estrada and Afridi (2019), Belașcu et al (2018), Pogkas (2015), Iamsiraroj and Ulubaşoğlu (2015), Makiela and Ouattara (2018), Mehic et al (2013)), and there is a unidirectional causal relationship from foreign direct investments to economic growth or bidirectional relationship (Bakirtas and Alpdogan (2020), Adali and Yüksel (2017), Sunde (2017), Omri and Kahouli (2013)). The new element that this paper captures in the analysis is the beginning of the period of health crisis COVID-19, the year 2020, which generated the reduction of global economic growth and which produced a major imbalance in the global economy. The different results regarding the causal relationship are explained by the fact that studies in the literature have captured the economic period before the health and economic crisis COVID-19, and the results obtained in this study include in the analysis the year 2020 which captures an atypical economic evolution.

The structure of this paper includes the literature review of the last decade on the relationship between economic growth and foreign direct investments, the research methodology regarding multiple panel regressions with fixed effects and Granger causality test, the empirical analysis with the results obtained and the concluding remarks with future reasearch directions.

Literature Review

Although the relationship between economic growth and foreign direct investments has been debated in the international literature, this study brings to the readers’ attention the impact of the COVID-19 health crisis, which has caused a considerable imbalance in the economy, affecting all world economies. This article contains a detailed study of the empirical results present in the literature in which most have concluded that foreign direct investments have a positive influence on economic growth.

Giofré (2022) presented a study regarding the existence and magnitude of international investments in advanced economies at the beginning of the global health crisis COVID-19. The empirical analysis gradually considers several categories of countries: countries with a high GDP/capita (higher than the median), countries considered with advanced economies in the IMF classification and two subgroups including the most advanced economies (G7) and the euro area countries. The empirical analysis involved a Robust Least Squares estimation, an OLS model and a Quantile regression at the median and the results showed that advanced countries were significantly less affected by the pandemic effects compared to emerging countries.

Bakirtas and Alpdoğan (2020) developed a quantitative analysis related to the following five countries: Brazil, Russia, India, China and Turkey, during the years 1992-2013. Unit root tests, Fully Modifiecd OLS and Dynamic OLS methods, Granger causality testing and panel data causality testing by Dumitrescu-Hurlin method were performed in the analysis. The research showed that the expected results are positive and statistically significant. Granger causality testing has shown that there is a unidirectional relationship between gross domestic product and foreign direct investments, while the Dumitrescu-Hurlin method has shown a bidirectional relationship.

Adali and Yüksel (2017) conducted an econometric study to determine the existence of a causal relationship between foreign direct investments and economic growth in the case of 30 developing countries selected according to the criterion of the highest GDP growth rates in year 2016. The causal analysis of the panel data was performed by Dumitrescu Hurlin method, 1991-2015 period, and the results showed that there is a bidirectional relationship between economic growth and foreign direct investments.

Sunde (2017) presented an empirical analysis related to South Africa during the years 1990-2014, using the following methods: the Autoregressive Distributed Lag approach, the Error Correction Model and VECM Granger Causality approach. The quantitative analysis showed that there is a cointegration relationship between the variables of interest and also highlighted the following causal relationships: unidirectional from foreign direct investments to economic growth, unidirectional from investments to exports and bidirectional between economic growth and exports.

Tahir, Estrada and Afridi (2019) analyzed the impact of foreign flows such as: foreign direct investments, trade, foreign aid, debt and remittances, on economic growth in the countries of the SAARC region (South Asian Association for Regional Cooperation) over the years 2008-2015. Empirical analysis used panel data and fixed effects estimation procedures with OLS and GLS. The study showed that there is a significant relationship between selected flows and economic growth, but each flow has a different role and impact on growth – the inflows of foreign direct investment have a positive and significant impact on growth.

An analysis conducted by Omri and Kahouli (2013) on 13 MENA countries during the years 1990-2010 used models of simultaneous equations and a growth framework. The study highlighted the following causal relationships: bidirectional between economic growth and foreign investments, unidirectional from foreign investments to domestic capital and bidirectional between economic growth and domestic capital.

The analysis of the relationship between economic growth and foreign direct investments was also made by Belașcu et al (2018) on a group of five Central and Eastern European countries, using panel data from the years 1999-2013. This study showed a positive influence of foreign direct investments on economic growth, including also the capital and international trade. Following the results of this study, we considered in the current empirical analysis one of the essential control variables, the gross fixed capital formation.

In the study developed by Pogkas (2015) on a group of 18 Eurozone countries between 2002-2012 years, were used both Fully Modified OLS and Dynamic OLS with panel data collected. The results of this study highlighted the existence of a positive long-term cointegration relationship between economic growth and foreign direct investments in the countries analyzed.

An econometric analysis of the relationship between economic growth and foreign direct investments on a global sample was conducted by Iamsiraroj and Ulubaşoğlu (2015). This study covers the analysis period 1970-2009 and 140 countries, and the empirical results showed a positive influence of foreign direct investments on economic growth, following the analysis of a meta-regression. The study also concluded that the positive effect that foreign direct investments have on economic growth depends mainly on the absorption capacity of the host country’s economy.

Another quantitative study conducted by Makiela and Ouattara (2018) analyzed the relationship between economic growth and foreign direct investments based on a sample of 180 developing and developed countries, the analysis period being 1970-2007. The study involved the use of the Bayesian stochastic border and the GMM model based on the panel data, and the results showed that foreign direct investments have a positive impact on economic growth, both in developing and developed countries.

Mehic et al (2013) analyzed the relationship between economic growth and foreign direct investments in seven countries in Southeast Europe. The empirical analysis took into account the period 1998-2007, using the PCSE OLS method (OLS with the standard errors corrected by the panel). The results of the study showed a positive and significant impact of foreign direct investments on economic growth in the countries analyzed, the impact being robust in the presence of domestic investments.

Alvarado, Iñiguez and Ponce (2017) developed an empirical study related to 19 Latin American countries. In this study were analyzed data from 1980-2014 period and panel regressions with random effects were tested. The empirical results have shown that there is a positive and significant effect of foreign direct investments on economic growth in high-income countries, an uneven and insignificant effect in upper-middle-income countries and a negative effect on low-middle-income countries.

Forte and Moura (2013) conducted a study highlighting the fact that the internal environment of the host country directly influences how foreign direct investments impact the country’s economic growth, being essential, the absorption capacity, labor force and the level of development that the country has. The research focused on the analysis of empirical studies from the literature and it was concluded that most empirical studies have obtained a positive effect of foreign direct investments on economic growth and have highlighted a bidirectional causal relationship between them.

In a study by Sapienza (2010) on the relationship between economic growth and foreign direct investments in 25 Central, Eastern and Southern European countries, the Dynamic OLS method with fixed-effect panel data was used. The results of this study showed that foreign direct investments have a delayed positive impact with a lag on economic growth, while foreign direct investments in the current year have a negative influence on economic growth.

Gui-Diby (2014) presented a study related to Africa, using the GMM method with panel data from 50 African countries, the analysis period being 1980 – 2009. The research results showed that there was a negative effect of foreign direct investments on economic growth between 1980-1994, a period when the development of African countries was very low, and a positive effect between 1995-2009, as in that period the business environment gradually improved and the export of goods contributed to the economic growth.

Yotzov (2020) developed an empirical study related to Bulgaria, 1990-2019 period, using the Autoregressive Distributed Lag approach with the following control variables: labor, domestic investment, government expenditure and financial development. The results of the study showed mainly a long-term positive effect of foreign direct investments on economic growth, but weak statistically significant, which led to the conclusion that foreign direct investments would be more effective in the short term in the case of Bulgaria.

Ma’in and Mat Isa (2020) presented a quantitative analysis regarding the Malaysian economy during the years 1975-2015. This study used the Autoregressive Distributed Lag approach, including also control variables such as: gross fixed capital formation, population growth and life expectancy. The results of this study highlighted the long-term relationship between foreign direct investments and growth and a positive and significant impact of investments on economic growth.

The study conducted by Hassen and Anis (2012) regarding the relationship between economic growth and foreign direct investments in Tunisia, data from 1975-2009, showed the existence of a cointegration relationship between the variables of interest, including the financial development, human capital and trade opening. Using the Error Correction Model, it was demonstrated the existence of a positive short-term relationship between the two variables of interest and also was highlighted the positive long-term influence of foreign direct investments in stimulating economic growth.

Szkorupová (2014) developed an empirical study on the relationship between economic growth, foreign direct investments and exports in Slovakia, the analysis period being between 2001-2010. The Vector Error Correction Model and Johansen test methods were used in the quantitative analysis. The results of this study highlighted a long-term causal relationship in the case of the variables included in the model and the Johansen test showed a positive long-term cointegration relationship between the analyzed variables.

Research Methodology

Regarding the research methodology, this study considers the use of quantitative research methods that will include variables of interest related to econometric models. Thus, the analysis of the relationship between economic growth and foreign direct investments could be done by using multiple panel regressions, but also by testing the Granger causality through which the causal relationship between the variables can be established. The first step in the empirical analysis was to test the unit root of the data series using the Levin, Lin and Chu test, recommended for small to medium-sized panel data. Following the tests, we found that almost all data sets used in the analysis are stationary at intercept level, only one exception in the case of net exports which are stationary at the first difference with intercept.

This analysis covers a group of nine emerging European countries between the period 1997-2020, respectively 24 years, so according to Brooks (2008), we will classify the data of this study as panel data that include both information over time and in space, with observations for N countries over periods of time T.

The panel regression approached by Brooks (2008) is presented in the following general form:

yit = α + β xit + uit (1), where:

- yit – endogenous variable

- xit – exogenous variable

- α – constant

- uit – time-varying random component

- i = 1,…,N, and N is the size of the sample of countries;

- t = 1,…,T, and T is the size of the time series.

The method used to determine the most appropriate regression model, the one with random or fixed effects, is the Hausman test. Therefore, the Hausman test assumes in the null hypothesis that the model errors uit are not correlated with the explanatory variables xit, the models with random effects starting from this hypothesis.

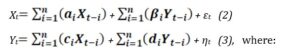

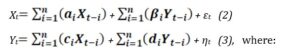

Granger (1969) proposed the causal model in the following form:

εt and ηt are unrelated series of white noise.

In order to determine the relationship between economic growth and foreign direct investments, the Granger causality test involves the following two research hypotheses:

H0: Variable X, in this case being represented by foreign direct investment, does not cause Granger variable Y which is represented by economic growth and reciprocal.

H1: Variable X, in this case being represented by foreign direct investment, causes Granger variable Y which is represented by economic growth and reciprocal.

Empirical Analysis

Presentation of the data used

The quantitative analysis related to this study is based on data collected from the official website of the World Bank, the data being with annual frequency between 1997-2020. The data were processed in both Excel and Eviews 10 programs, and the econometric study includes a total of 216 observations related to the nine selected countries and 24 years of analysis.

Modeling the impact of foreign direct investments on economic growth will be done in the form of a linear equation in which the real GDP growth rate (GDP_GRW) is the endogenous variable and foreign direct investment (FDI_INFL) is the main exogenous variable. Also, there are included into the linear equation the relevant control variables as: net exports (EXP_NET) – calculated as the difference between exports and imports expressed as a weight in the country’s nominal GDP – public expenditure (GOV_EXP), gross fixed capital formation (GR_FIX_CAP) and the openness of the economy (EC_OPEN) – calculated as the sum of exports and imports expressed as a weight in the country’s nominal GDP. All variables are expressed as a percentage; the real rate of economic growth is the percentage change in annual real GDP, and exogenous variables are expressed as a weight in the country’s nominal GDP.

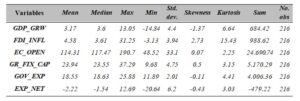

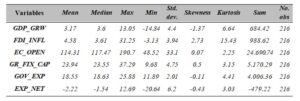

Table 1. Descriptive statistics

Source: Authors’ own processing using Eviews 10

Source: Authors’ own processing using Eviews 10

Descriptive statistics show that during the years 1997-2020 there was an average real growth rate of about 3.17%, and the net inflows of foreign direct investment were on average about 4.58%. During the period under review, the highest real growth rate was recorded in 1997 in Estonia (13.05%), and the lowest was recorded in 2009 in Lithuania (-14.84%). The maximum value of foreign direct investments as a weight in GDP was recorded in 2007 in Bulgaria (-31.25%), and the minimum value was recorded by Estonia in 2015 (-3.13%). During the analyzed period, we can notice that the extreme values were not registered in the pandemic year 2020, but we will detail in the following the evolution of the real rate of economic growth during the years 2019-2020.

Fig 1. Evolution of the real GDP growth rate in the first part of COVID-19 pandemic

Source: Authors’ own processing using the data available on the World Bank website

Figure 1 shows the evolution of the real growth rate in the case of the nine countries selected for analysis in the context of the year before COVID-19 versus the beginning of the COVID-19 health crisis. Thus, we can note that in 2019 all the countries recorded positive real growth rate. In contrast, in 2020, the first year of the pandemic, all countries recorded negative real growth rates, with significant declines. Therefore, the pandemic year has a visible impact in our analysis, the data for 2020 being unusual because no country included in the analysis has recorded a negative real rate of economic growth since 2014 and until the appearance of COVID-19.

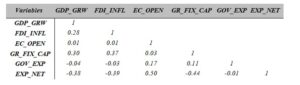

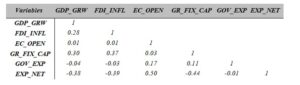

Table 2. Correlation matrix

Source: Authors’ own processing using Eviews 10

The correlation matrix highlights the interdependences between the six variables included in the econometric analysis, how they influence each other, the intensity of the relationships and their direction.

We note that there is an interdependence between the endogenous variable represented by the real growth rate and all the explanatory variables considered. The dependent variable shows the strongest relationship with foreign direct investments (28%) and gross fixed capital formation (30%), and the weakest relationships are with the openness of the economy (1%) and public expenditure (-4%). There is a fairly strong relationship between independent variables gross fixed capital formation and foreign direct investments. At the same time, the openness of the economy and net exports are strongly correlated (50%), so that the two variables will not be associated in the same econometric model.

Empirical Findings

In the quantitative analysis, we performed six multiple panel regressions with fixed effects, using the least squares method (OLS Panel) to capture how the independent variable foreign direct investments (FDI_INFL) impact the dependent variable represented by economic growth (GDP_GRW), being included the following control variables: net exports (EXP_NET), public expenditure (GOV_EXP), the openness of the economy (EC_OPEN) and gross fixed capital formation (GR_FIX_CAP).

The regression equations are presented in the following form:

- GDP_GRWit = α + β1 x FDI_INFLit + β2 x EXP_NETit + β3 x GOV_EXPit + uit

- GDP_GRWit = α + β1 x FDI_INFLit + β2 x GOV_EXPit + β3 x GR_FIX_CAPit + uit

- GDP_GRWit = α + β1 x FDI_INFLit + β2 x EC_OPENit + β3 x GR_FIX_CAPit + uit

- GDP_GRWit = α + β1 x FDI_INFLit + β2 x GR_FIX_CAPit + uit

- GDP_GRWit = α + β1 x FDI_INFLit + β2 x EXP_NETit + uit

- GDP_GRWit = α + β1 x FDI_INFLit + β2 x GOV_EXPit + uit

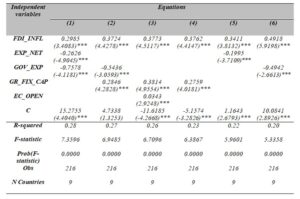

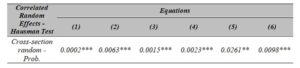

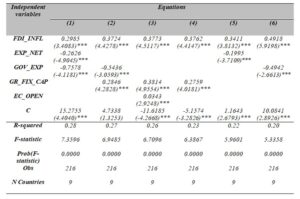

Table 3. The results of the regression analysis with panel data, fixed effects

Source: Authors’ own processing using Eviews 10, P-value ***p<1%, **p<5%,*p<10%. Each variable is presented with the value of the associated coefficient and in parentheses with the t-statistic value.

Source: Authors’ own processing using Eviews 10, P-value ***p<1%, **p<5%,*p<10%. Each variable is presented with the value of the associated coefficient and in parentheses with the t-statistic value.

Table 3 presents the results of the regression analysis with panel data with fixed effects, highlighting the impact of foreign direct investments on economic growth through six different econometric models that capture other relevant control variables in the economy. All six models presented are statistically valid, the variables included in the analysis being statistically significant, the established significance threshold being 1%. The proposed models show a positive influence of foreign direct investments on economic growth; so, at a 1 pp increase in foreign direct investments, the real growth rate will increase in proportion to the value of the coefficient related to the variable foreign direct investment, the other control variables being constant. There is also a positive influence on economic growth from the variables the openness of the economy and gross fixed capital formation. On the other hand, public expenditure and net exports have a negative influence on economic growth, as expected and in line with the results obtained in the correlation matrix. The coefficients of determination R-squared related to the analyzed models have values between 0.20 and 0.30, so the variation of the exogenous variables selected in the analysis explains in proportion of 20-30% the variation of the real growth rate.

The results of this study are consistent with the results of some studies in the literature regarding the positive impact that foreign direct investments have on economic growth (Tahir, Estrada and Afridi (2019), Belașcu et al (2018), Pogkas (2015), Iamsiraroj and Ulubaşoğlu (2015), Makiela and Ouattara (2018), Mehic et al (2013)). Therefore, the hypothesis from which we started the research related to the positive impact of foreign direct investments on economic growth is validated by the results obtained.

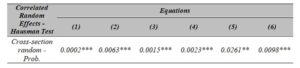

Table 4. Hausman Test results related to the previous regression equations

Source: Authors’ own processing using Eviews 10, P-value ***p<1%, **p<5%,*p<10%

The Hausman tests performed for each econometric model proposed for analysis showed that the fixed effects model is the most appropriate estimated model, this conclusion being valid for all six regression equations. The Hausman test assumes in the null hypothesis that the random effects model is preferred over the fixed effects model. In Table 4, we can see that the probabilities recorded for each proposed model are below the significance level of 5%, so, the null hypothesis is rejected. Thus, we consider that in the case of the regression equations analyzed in this study, the model with fixed effects is the optimal one.

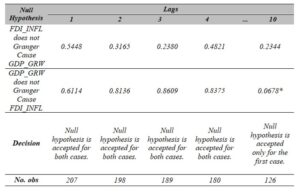

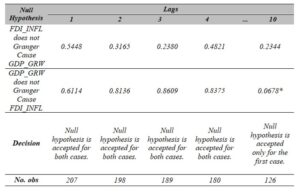

Table 5. Granger Causality Test results between the real GDP growth rate and foreign direct investments

Source: Authors’ own processing using Eviews 10, P-value ***p<1%, **p<5%,*p<10%

Source: Authors’ own processing using Eviews 10, P-value ***p<1%, **p<5%,*p<10%

Table 5 shows the results obtained from the Granger causality test, through which we can determine the relationship between the real growth rate and foreign direct investments, given the number of lags included in the analysis. We performed the test starting with one lag and continued to stage up to 10 lags, in order to capture the time when the real growth rate starts to cause Granger foreign direct investments, and reverse. Starting with testing with only one lag and up to lag 10, the probabilities record values that exceed the 5% significance threshold, so, the null hypothesis is not rejected and it is considered that there is no causal relationship between the two variables in any sense. In the case of the last 10 lag test, there is a unidirectional relationship from the real growth rate to foreign direct investments. There are inconsistencies regarding the result on the lack of a causal relationship between the variables of interest, as the literature has shown a unidirectional or even bidirectional relationship between foreign direct investments and economic growth in studies by Bakirtas and Alpdogan (2020), Adali and Yüksel (2017), Sunde (2017), Omri and Kahouli (2013), but most of the studies in the literature do not include 2020 year which is the beginning of the global health crisis COVID-19. The hypothesis related to the unidirectional or even bidirectional causal relationship between the two variables is not validated by our Granger causality test results.

Concluding Remarks

In conclusion, this study presents an empirical analysis applied to a group of nine emerging countries in Europe, during the years 1997-2020. The quantitative analysis was performed by multiple panel regressions with fixed effects that highlighted a positive impact of foreign direct investments on economic growth, but also by testing the Granger causality which highlighted the lack of a causal relationship between the two variables up to lag 10 in which there is a unidirectional relationship from economic growth to foreign direct investments. Therefore, we believe that the investment process supports the economic growth, contributing through the volume of capital invested, technology transfer, professional development of employees, management and organizational culture, which creates an environment beneficial to economic growth. We also found a positive impact of the openness of the economy on economic growth explained by the fact that international transactions have a significant contribution in terms of economic growth, the countries involved in the international trade circuit having various benefits such as export development, channels related to investors, import and advantageous partnerships. Another positive impact has been found from the gross fixed capital formation on economic growth because the domestic investments lead to an increase in productivity and long-term well-being of a country. Moreover, the results showed a negative impact of public expenditure on growth explained by a possible inefficient allocation and inappropriate prioritization of collected resources. Another negative impact was highlighted from the net exports to economic growth, as economic growth is affected by higher imports than exports, which was an anticipated result from the correlation matrix. The results of this study are useful for the investors who want to develop their activity in emerging countries in Europe and highlight the potential of countries in the pandemic period, being also a useful direction in terms of the ability of the contries to recover from the COVID-19 pandemic. At the same time, research results may be useful also for macroeconomic policy makers. This research will continue in the future to analyze how economic growth and foreign direct investments have evolved during the COVID-19 health crisis and also post-crisis using a different methodology and developing the database with many more countries from Europe, in order to highlight the different responses of the economies at the crisis. Also, we will compare in the future study the economic crises that were happening during the period that we analyse and we will investigate de intensity of each.

References

- Adali, Z., & Yüksel, S. (2017). Causality relationship between foreign direct investments and economic improvement for developing economies. Marmara Journal of Economics Volume, 1, 109-118.

- Alvarado, R., Iñiguez, M., & Ponce, P. (2017). Foreign direct investment and economic growth in Latin America. Economic Analysis and Policy, 56, 176-187.

- Bakirtas, T., & Alpdoğan, H. (2020). Foreign direct investment and Economic growth in BRIC-T countries: A panel data analysis. Journal of Management and Economic Engineering, 19 (2), 200-220.

- Belașcu, L., Popovici, O., & Horobeț, A. (2018). Foreign Direct Investments and Economic Growth in Central and Eastern Europe: A Panel-Based Analysis. Emerging Issues in the Global Economy, 35-46.

- Brooks, C. (2008). Introductory econometrics for finance. Cambridge University Press, UK.

- Forte, R., & Moura, R. (2013). The Effects of Foreign Direct Investment on the Host Country’s Economic Growth: Theory and Empirical Evidence. World Scientific Publishing Company, 58 (3), 1-28.

- Giofré, M. (2022). Foreign investment in times of COVID-19: How strong is the flight to advanced economies? Journal of Multinational Financial Management, 1-13.

- Granger, C. (1969). Investigating Causal Relations by Econometric Models and Cross-spectral Methods. The Econometric Society, 37, 424-438.

- Gui-Diby, S. (2014). Impact of foreign direct investments on economic growth in Africa: Evidence from three decades of panel data analyses. Research in Economics, 68, 248-256.

- Hassen, S., & Anis, O. (2012). Foreign Direct Investment (FDI) and Economic Growth: an approach in terms of cointegration for the case of Tunisia. Journal of Applied Finance & Banking, 2, 193-207.

- Iamsiraroj, S., & Ulubaşoğlu, M. A. (2015). Foreign direct investment and economic growth: A real relationship or wishful thinking? Economic Modelling, 51, 200-213.

- Ma’in, M., & Mat Isa, S. S. (2020). The impact of foreign direct investment on economic growth in Malaysia. Advances in Business Research International Journal, 6 (1), 25-34.

- Makiela, K., & Ouattara, B. (2018). Foreign direct investment and economic growth: Exploring the transmission channels. Economic Modelling, 72, 296-305.

- Mehic, E., & Silajdzic, S. B.-H. (2013). The Impact of FDI on Economic Growth: Some Evidence from Southeast Europe. Taylor & Francis, Ltd., 49, 5-20.

- Omri, A., & Kahouli, B. (2013). The nexus among foreign investment, domestic capital and economic growth: Empirical evidence from MENA region. Research in Economics, 68, 257-263.

- Pegkas, P. (2015). The impact of FDI on economic growth in Eurozone countries. The Journal of Economic Asymmetries, 12, 124-132.

- Sapienza, E. (2010). Foreign Direct Investment and growth in Central, Eastern and Southern Europe. Investigation economica, 69, 99-138.

- Sunde, T. (2017). Foreign direct investment, exports and economic growthȘ ARDL and causality analysis for South Africa. Research in International Business and Finance, 41, 434-444.

- Szkorupova, Z. (2014). A causal relationship between foreign direct investment, economic growth and export for Slovakia. Procedia Economics and Finance, 15, 123-128.

- Tahir, M., Estrada, M., & Afridi, M. (2019). Foreign inflows and economic growth: An emiprical study of the SAARC region. Economic Systems, 43, 1-8.

- Yotzov, V. (2020). Foreign Direct Investments and Economic Growth in Bulgaria:Theoretical Challenges and Empirical Results. Институт за икономически изследвания при Българска академия на науките, 4, 3-27.