Introduction

The main objective of this paper is to analyze the impact that corporate governance has on a company’s performance indicators during a period of maximum uncertainty, when the health crisis is affecting, and the upper hierarchical levels of a company are forced to make important decisions to reduce the risk of Covid-19 virus. And, to make the proposed objective tangible, a variety of statistical panel models were approached to allow the most in-depth study of profitability indicators for companies listed on the Bucharest Stock Exchange (BVB). The database will consider three years, more precisely 2019-2021; we chose these years specifically because in 2019 this virus broke out in China, and 2021 was the last year in which it had an impact on the Romanian company, the measures on the evolution of the virus being lifted at the beginning of 2022. Thus, it is intended to highlight the stock market in Romania during this period, where this state of alert had limited effects on the profitability of a company. The empirical results will provide an overview of the performance of companies listed on the Romanian Stock Exchange, where it will be found that over time, listed companies were in the first year in a limited amount affected by this epidemiological context, following that in the year 2021 to adapt more easily to the new strains. Also considering that, the board of the company has taken balanced measures and their actions have been safe not only because of the financial situation, but also because of the responsibility for the employees, but at the same time on the community where develop their activity.

The novelty element that this paper has compared to the literature is that this study aims to be entirely original, as it is a recently conducted analysis. In an epidemiological period that has not only developed into a health crisis, but it has also had an implicit impact on the financial area where a financial crisis has occurred. Studies that we identify in the literature reviewed consider the impact of corporate governance before this context on the profitability indicators of companies. We chose Romania because we wanted to analyze this impact on listed shares on the Romanian stock market at national level first. But also, in order to capture mainly the power of coordination and control of company management in such a period, but also the power of adaptation to a less stable market, but also to the new context created by the emergence of the virus.

Following these aspects, this paper has a logical structure, where the following aspects have been followed: the first part highlights the introduction where a broader description of what is going to be presented is made, the second part considers the current state of knowledge, where we will present works that highlight the impact that Corporate Governance has on the performance of a company. Another aspect to be highlighted is the research methodology where the econometric study will be presented, which will surpass the fulfilment of the proposed objective. And the last part is the conclusion that we have from the econometric model.

Current state of knowledge

In recent years, corporate governance has become quite an issue, especially at a time when the epidemiological context has also brought many changes in the board structures of companies. At the same time, this unfavorable context has led the hierarchical branches of a company to take decisions with a high level of difficulty.

Gherghina (2017) captures the definition of Corporate Governance, in a traditional style, mentioning that it outlines principles, system of rules and mechanisms by which companies are controlled and governed, more specifically, it specifies that it is a set of unraveled links between a company’s management, shareholders, Board of Directors/Supervisory Board, Audit Committee, have other committees, Management Board or other stakeholders. At the same time, it also highlights the Stakeholder theory where it argues that it highlights management decisions that need to be set in such a way that they honor stakeholder promises to avoid “agent problems”.

Nițescu & Boitan (2017) stated about this concept that it appeared for the first time in 1970, in the USA (United States of America) which was mainly aimed at regaining confidence after an unfavorable financial crisis, so then the word governance was defined which is of Greek origin and means to steer a ship, and over time it expanded its meaning and reached global economic governance and then was restricted to the financial governance of a company. And the term corporate governance emerged following the crises of 2001-2003 and 2007-2009. At the same time, they also mention that there have been many significant contributions to define this concept over a period, which need to be understood and connected to the context, through Corporate Governance codes, in the European Union or adopted in several years, more than 35 such codes.

Thus, it can also be identified that over the years corporate governance issues have been an increasingly important component. Previous studies reveal several aspects in which corporate governance plays a significant role. For example: the impact of gender diversity of the Board members on the value of the company. Jurkus, Park & Woodard (2011) identify a negative relationship between the percentage of female board members and agent costs. From another perspective, we identify the paper published by Adams & Funk (2012) which reveals confluences that female individuals in general are less power-oriented, but these female board members have higher risk appetite compared to male board members. Another opinion is that of the authors, Elsaid & Ursel (2011), when they want to appoint a female CEO, they want to reduce risk. Other works captured in the literature hold aspects of poor returns obtained by companies, which hold in management positions female persons; this perspective is confirmed by several authors: Sharder, Blackburn & Iles (1997), Robb & Watson (2012) and Lee & James (2007). Conversely, Erhardt, Werbel & Sharder (2003), noted the following hypothesis; economic profitability is positively influenced by the presence of a female Board of Directors (BoD). Khan & Vieito (2013) found a reduced risk held by companies, where the position of executive manager is held by a female person.

Also, in previous works, negative links can be found between the size of the Board of Directors (BoD) and the value of the company; this was also confirmed by Vintilă, Onofrei & Gherghina (2015). Another paper that also considered the same link is the one published by Uchida (2011) where a negative link between board size and firm value is also identified. There are studies that have also noted the negative link between DCA and enterprise profitability, these are: De Andres, Azofra & Lopez (2005), Mak & Kusnadi (2005) and Bennedsen, Kongsted & Nielsen (2008).

When it comes to CEO duality (DCEO), studies have been identified that show a positive relationship between this variable and the returns recorded by companies; the authors who reached these conclusions are Kula (2005) and Dayli & Dalton (2001). These studies being conducted on samples from Turkey and America.

Another important link when it comes to corporate governance indicators is the link between board membership and corporate performance ratios. O`Connell & Cramer (2010) identified a positive link between Board Members and company performance indicators.

In the final section, studies of high interest to researchers will be presented, highlighting the links between a company’s advisory boards and their related risks. Armeanu et all (2017) highlight a negative link between the existence of an Audit Committee and the risk of bankruptcy. Another approach, being that of Tao & Hutchinson (2013) who highlight a valuable aspect in which companies, with a high level of risk, must necessarily have a Risk Management Committee.

Research Methodology

In terms of research methodology, this study considers the use of quantitative methods, where both independent and dependent variables will be included, which will help to obtain an econometric model, following which, we will analyze the relationship between performance indicators and corporate governance indicators using several panel regressions.

The information on the variables was collected from several official sources, which helped to obtain complete and real data and to make real economic regressions more efficient. Thus, we considered financial reports, Thomson Reuters (TR) platform, companies’ websites, but also the BVB website. In the first phase, the database consisted of all 81 companies listed until 2021, from these we reduced the companies that did not have financial information in 2021, information on the website about Governance, but also companies that are financially incomprehensible (e.g., banks, insurance companies, SIFs, but also FP). Thus, the database consists of 41 companies, and analyzed over a period of three years, more precisely 2019-2021, the date chosen according to the emergence and evolution of the pandemic period, forming a total of 123 observations. The information collected from the financial and non-financial statements helped to choose the indicators introduced into the model and used both as dependent and independent variables.

The empirical studies used in multivariate econometric models, mainly included in this study, as specified earlier are panel data regressions. These models will be estimated mainly with the least squares method (OLS), but also with fixed effects models.

In econometrics books, panel regression is found in the following form:

To determine which regression model is optimal, the one with fixed effects, or the one with random effects, we use the Hausman test. This test has as its null hypothesis “it” which represents model errors, to be uncorrelated with Xit, more precisely the independent variables. Mainly models with random effects start from this assumption.

Based on the data presented, the following four hypotheses will be highlighted in this paper:

Hypothesis 1: Corporate governance indicators have a positive influence on economic profitability (ROA).

Hypothesis 2: Corporate governance indicators negatively and/or positively influence economic profitability (ROA).

Hypothesis 3: Corporate governance indicators have a positive influence on financial returns (ROE).

Hypothesis 4: Corporate governance indicators negatively and/or positively influence financial returns (ROE).

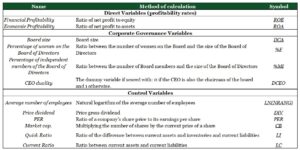

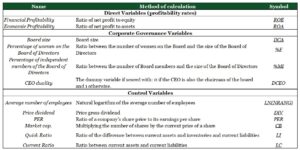

To have an overview of the indicators used, a table (Table 1) will be used; the indicators found will help to explain the hypotheses presented above.

Table 1: Variables used in the econometric model

Source: Authors’ own processing

Source: Authors’ own processing

As far as the sources of the data are concerned, they were collected as follows: from the TR platform and the Bucharest Stock Exchange, we collected the dependent variables as well as the control variables, while the corporate governance variables were collected from the company’s website, from the annual reports and from the CVs of the board members.

Estimation of econometric models

As specified in the research methodology, we have a sample of 41 enterprises, analyses over three years. For Romania 2019 was a prosperous year, which was unbolted at the beginning of 2020 by the emergence of the epidemiological context. Thus, we have a total of 123 observations, the data w initially processed in Excel software and transferred to Eviews software to obtain panel regressions.

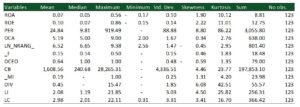

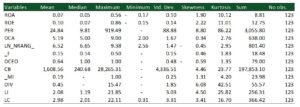

A development of the descriptive statistics can be seen below (Table 2).

Table 2: Descriptive statistics

Source: Authors’ own analysis in Eviews

To get an overview of the study, a descriptive analysis is carried out (Table 2). It can be noticed that the dependent variables that show us the companies’ returns have a positive average of 7% (ROA) or even 10% (ROE), so we can conclude that even during the pandemic period the Romanian companies listed on the BVB recorded profits, which shows us that the managerial decisions during this period were optimal. The biggest loss being recorded by UAMT S.A. in 2020, holding an economic return of -17%, and a financial return of -15%. On average, there are about 5 members in the Board of Directors, the maximum being 9 and the minimum 2 members. It can also be noticed that obviously the Market Capitalization that we have taken from TR registers a maximum of 28.265,31 RON, while at the same time values of 0 have been registered, especially in the 2 companies (with symbols ONE and TTS) listed on the Stock Exchange in 2021. At the same time, we have a CEO duality that is less than 50%, which means that less than half of the companies have CEO and Chairman of the Board.

In the current study for the correlation matrix (Table 3), a minimum correlation threshold of 0.5 is considered. Thus, it can be noted that indicators with a correlation level of +/- 50% have a high level of correlation and cannot be used in the same regression, that there is a strong correlation between the analysed indicators, which means that the two indicators cannot be used in the same regression equation.

Table 3: Correlation matrix of indicators

Source: Authors’ own analysis in Eviews

From table 3, it can be noticed that the dependent variables have a high level of correlation between them, but at the same time it can be noticed that between economic profitability and stock market capitalization there is a high degree of correlation of 0.67 pp, which means that they cannot be used in the same regression. Also in the correlation matrix, a high correlation of 97% between the two-liquidity analyses can be noticed. Which means that we cannot perform regressions where the two indicators are present at the same time.

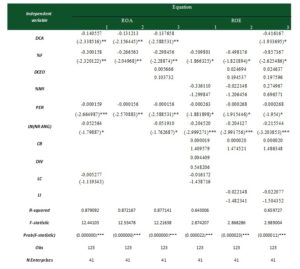

Table 4 shows the Hausman tests for each econometric regression to be presented; it can be seen from this test, the possibility of using fixed effect panel data.

Table 4: Hausman tests

Source: Surse propria prelucrate in Eviews, P-value: *p<0.1, **p<0.05, ***p<0.01

The Hausman test shows the following aspect: it is chosen to use random effects regressions when the probability exceeds 5%, and otherwise fixed effects regressions will be used. Thus, we can notice in the above table that the optimal is to use fixed effects models; this applies to all 6 regressions.

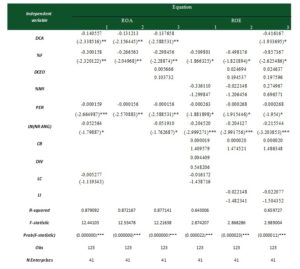

Table 5 presents the results of econometric models showing the link between corporate governance indicators and profitability indicators.

Table 5: Results of fixed effects panel regressions

Source: Authors’ own sources processed in Eviews, P-value: *p<0.1, **p<0.05, ***p<0.01. For each variable we only took from the regression the coefficients and t-values statistically.

In the first three regressions, it can be seen that between the DCA and % F negatively and significantly influences the ROA indicator statistic. From this framework, it can be interpreted that when the number of board members increases or the number of women on the board increases, total assets increase or net profit decreases, which is consistent with previous studies [Sharder, Blackburn & Iles (1997), Robb & Watson (2012) and Lee & James (2007)]. Thus, we infer that fewer board members generate higher returns, which is consistent with previous studies [De Andres, Azofra & Lopez (2005), Mak & Kusnadi (2005) and Bennedsen, Kongsted & Nielsen (2008)].

At the same time, this aspect can also be interpreted by the following aspects: when the number of women on the board increases, companies have lower returns, also proven by Jurkus, Park & Woodard (2011). At the same time, the following aspect can also be noted that when the PER indicator influences the ROA negatively and statistically significantly. What emerges is that when the PER market index increases the returns of companies decrease. Another noteworthy aspect in the first and third regression is the negative and statistically significant relationship between the number of employees and ROA, which shows that when the number of employees increases, the level of profitability decreases. Another aspect to mention in the first 3 regressions is the CEO duality, where it can be noticed that this is the only indicator that positively but insignificantly influences the ROA statistic. Which means that when the CEO is also the chairman of the board, the company’s profitability increases. Another aspect to mention is the indirect but statistically insignificant link between current liquidity and ROA, which shows that when the company becomes increasingly liquid, the level of profitability of the company decreases. Thus, the first 2 assumptions are met.

The last three regressions show the same negative and statistically significant relationship between %F, PER, and LN (NR ANG) and ROE, which means that economic profitability and financial profitability, also decrease when the number of women on the board increases, when the market indicator PER increases, or even when the number of employees increases. Thus, we can conclude that regardless of the profitability used, these indicators negatively influence profitability. Another point to note is that, as with ROA and ROE, there is a downward trend when the number of women on the board increases.

Another important surprise is the positive but statistically insignificant relationship between CEO duality (regressions 2 and 3) or CB indicator (regressions 1, 2 and 3) and ROE. From this we can conclude that when the CEO is both CEO and chairman of the board, companies generate profit, or when there is an increasing CB market indicator, company profit increases; the results are consistent with those in the Kula (2005) and Dayli & Dalton (2001) studies. Also, the last three regressions show the following: when %MI increases, the financial rate of return decreases, this argument is not statistically significant. Another positive but statistically insignificant relationship is that between Div and ROE, indicating that when Div increases, automatically ROE increases. And the last control variables, the two liquidity variables LC (regression 1) and LI (regressions 2 and 3) have a negative and statistically insignificant influence on ROE, which shows that when companies are highly liquid, companies decrease their profitability. Thus, the last two hypotheses are satisfied.

Conclusions

It can be observed that the main objective of analyzing the impact that corporate governance has on a company’s performance indicators has been achieved in a period of maximum uncertainty, when the health crisis is affecting, and the upper hierarchical levels of a company are forced to make important decisions to reduce the risk of Covid-19 virus infection. And, to make the proposed objective tangible, a variety of statistical panel models were approached to allow the most in-depth study of profitability indicators for companies listed on the Bucharest Stock Exchange (BVB). In the database, there is an analysis on the three years, more precisely 2019-2021; this period was chosen especially because in 2019 this virus broke out in China and was the last prosperous year (anti-crisis); in the beginning of 2020, it overshadowed approximately all sectors of activity including the health sector, and 2021 was the last year in which it had an impact on society in Romania, the measures on the evolution of the virus being lifted at the beginning of 2022. Thus, it is intended to highlight the stock market in Romania during this period, where the national alert status had limited effects on a company’s profitability over time. The empirical results will provide an overview of the performance of companies listed on the Romanian Stock Exchange, where it will be found that, over time, listed companies were in the first year in a limited amount affected by this epidemiological context, and in the year 2021 will adapt more easily to the new strains. Also considering that, the board of the company has taken balanced measures and their actions have been safe not only because of the financial situation, but also because of the responsibility for the employees, but at the same time on the community where develop their activity.

Thus, it can be noticed from the study that the corporate governance indicators in most of the cases negatively and statistically significantly influenced the two returns ROA and ROE. It was proved the fact that when the Board Size and the percentage of female persons as Board Members negatively and statistically significantly influenced the two returns (ROA and ROE). At the same time, it is observed in the descriptive statistics that the enterprises in the sample also make profit during the crisis period. This shows that the decisions taken by the management during this period were optimal. Another aspect to be mentioned is the positive but statistically insignificant link between the DCEO and the two Profitability (ROE and ROA).

The econometric results show a negative and statistically significant relationship between the percentage of female board members and the respective economic rates of return and financial rates of return, which is consistent with previous studies (Sharder, Blackburn & Iles (1997), Robb & Watson (2012) and Lee & James (2007)).

Bibliography

- Adams, R. B. & Funk, P. 2012. Women in the boardroom and their impact on guvernance and performance. Journal of Financial Economics. 94 (20), 291-309.

- Bennedsen, M. Kongsted, H.C. & Nielsen K.M. 2008. The causal effect of board size in the performance of small and medium-sized firms. Journal of Banking & Finance, 32 (6), 1098-1109.

- Armeanu, Ș. D., Vintilă, G., Gherghina, Ș. C. & Petrache, D. C. 2017. Approachers on corelation between board of directors and risk management in resilient economies. 9 (2), 1-15.

- Daily, C, M & Dalton, D. R. 1992. The relationship between governance structure and corporate performance in entrepreneurial firms. Journal of Business Venturing, 7 (5), 375-386.

- De Andres, P., Azofra, V. & Lopez, F. 2005. Corporate boards in OECD countries: Size, composition, fractioning of effectiveness. Corporate Governance: An International Review, 13 (2), 197 – 210.

- Elsaid, E. & Ursel, N.D. 2011. CEO succession, gender and risk taking. Gender în Management: An International 26 (7), 499-512.

- Erhardt, L. Werbel, J. D. & Sharder, C.B. 2003. Board of director diversity and firm financial performance. Corporate Governance: An International Review, 11 (2), 102-111.

- Gherghina, G. C. 2017. Guvernanta corporative si valoarea intreprinderii, Editura ASE

- Jurkus, A. F., Park, J. C. & Woodard, L. S. 2011. Women in top management and agency cost. Journal of Business Research. 64 (2), 180-186,

- Khan, W. A. & Vieito, J. P. 2013. CEO gender and firm performance. Journal of Economics and Business. 67, 55-66.

- Kula, V. 2005. The impact of the roles structure and process of boards on firm performance: Evidence from Turkey. Corporate Governance: An International Review, 13 (2), 265-276.

- Lee M. & James E. H. 2007. She`-e-os: Gender effects and investor reactions to amouncements of top executive appointments. Strategic Management Journal, 28 (2), 227-241.

- Mak, Y. T. & Kusnadi, Y. 2005. Size really matters: Futher evidence on the negative relationship between board size and firm value. Pacific Basin Finance Journal, 13 (3), 301-318.

- Nitescu, D. C. & Boitan I. A. 2017. Guvernanta si auditul intern in domeniul bancar, Editura ASE.

- O`Connell, V. & Cramer, N. 2010. The relationship between firm performance and board characteristic in Ireland. European Management Journal, 28 (5), 387-399.

- Robb, A. M. & Watson, J. 2012. Gender differences in firm performance: Evidence from new ventures in the United States. Journal of Business Venturing. 27, (5), 544-558.

- Shrarder, B. Blackburn, V. B. & Iles, P. 1997. Woman in management and firm financial value: An exploratory study. Jorunal of Managerial Issues, 9 (3), 355-372.

- Tao, N. B. & Hutchinson, M. 2013. Corporate guvernance and risk management: The role of risk management and compensation committees. Journal Contemporary Accouting & 9 (1), 83-99.

- Uchida, K. 2011. Does corporate board downsizing increase sharehoder value? Evidence from Japan. International Review of Economics and Finance. 4 (11), 562-573.

- Vintilă, G., Onofrei, M. & Gherghina Ș. C. 2015. The effects of corporate board and CEO characteristics on firm value: Empirical evidence listed companies on the Bucharest Stock Exchange. Emerging Markets Finance and Trade. 51 (6), 1244-1260.