Introduction

Theories of capital structure have gone through two distinct phases: traditional theories of capital structure and new empirical approaches to firms’ financing decisions. More traditional theories of capital structure are based on a series of rigorous assumptions, stated by MM theory and static trade-off theory (Zhao, 2018).

In the new empirical approach on capital structure theories, researchers have introduced modern analytical tools in the analysis of firms’ financing decisions, such as game theory, agency cost theory and transaction costs, signal transmission theory and country information economics (Zhao, 2018). Thus, the factors that explain capital structure include variables representing the activity of firms and country-specific factors, particularly the macro-financial factors of the financial system that contribute to the economic growth of the countries.

The contribution of the financial system to long-term economic growth is related to the allocation of the economy’s savings to investment opportunities, carried out by financial intermediaries or directly in the capital markets, which creates value added to the output of a country’s economy. Financial intermediaries play a key role in reducing the information costs of the financial system, as they can achieve economies of scale in the acquisition and management of information to assist in the decision process of granting external financing to companies (Levine, 2002).

Capital markets allow the mobilization and allocation of savings from surplus to deficit economic agents, increase the diversification of firms’ external financing sources for their long-term investments, increase the liquidity of the securities market and allow for better risk management, with the possibility of creating diversified asset portfolios [Carp (2012) and Levine (2005]. Furthermore, efficient capital markets contribute to the reduction of information costs when they reflect all available information in the share or bond price of the issuing companies (Levine, 2002).

Thus, the allocative efficiency of a country’s financial system is determined by its ability to mobilize savings between surplus and deficit economic agents, reducing information costs related to moral hazard risk and adverse selection problems, and lowering transaction costs for the most productive sectors of the economy (Rajan and Zingales, 1998).

The Capital Structure and the Financial System

The importance of the development of the country’s financial system documented by different empirical studies on capital structure is evidenced through the interconnection between theories of capital structure and the financial system, the battle between financial systems, and financial system convergence.

Capital structure theories and the financial system

The interconnection between corporate financing and countries’ financial systems can be established from the perspective of the asymmetric information model of the Pecking Order theory, where Myers (1984) associates the problematic of the capital structure with putting together a “puzzle” with a set of difficult pieces, and for that reason it is unknown why companies issue stocks, bonds or a mix of these classes of securities.

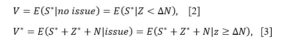

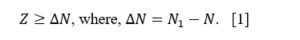

The Pecking Order theory assumed that the firm wants to raise N monetary units for new investment, with which the firm will obtain a net present value (NPV) of Z and, in turn, without the investment the firm’s NPV will correspond to the value of S (Murinde et al, 2004).

According to Murinde et al (2004), if the company can obtain N monetary units through an issue, its benefit will be Z, but the possible cost of this issue may correspond to an undervaluation; that is, the sale value of the shares may be lower than what they are really worth N1, whose value is known by the company’s manager S. However, while the financial manager knows the values of S and Z, capital market investors do not know the true values and will therefore make their investment decisions based on a joint distribution of possible values (S*, Z*).

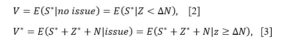

Consequently, the decision to issue shares by the company’s manager will materialize by the following expression:

, where,

Therefore, managers will consider the following rational expectations equilibrium conditions in their financing decision:

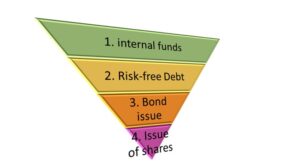

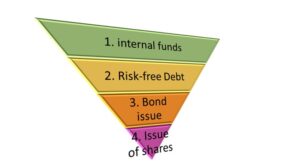

Thus, in the presence of imperfect capital markets, firms face a hierarchy of financing options, with internal financing at the top and equity issuance at the bottom of the pyramid, in the face of the rising costs of financial distress inherent in the risk class of debt and equity securities. Next, figure 1 illustrates the hierarchy of the choice of funding sources according to the Pecking Order theory.

Figure 1. Hierarchy of financing choices according to the Pecking Order theory

Source: Author’s own elaboration.

Figure 1 illustrates that firms first use internal funds, and then later use external financing, such as bank debt, bond issuance, and equity issue, respectively.

In line with this, Brealey and Myers (2003) report that for a set of non-financial firms, over the period 1981-1994, they found that internal financial funds were the dominant source of financing, averaging about 75% of capital requirements, including investments in inventory and other current assets. The remaining external financing was obtained through loans and, with minimal representativity, net issues of new shares.

This observation is consistent with the findings of Rajan and Zingales (1995) on their international comparisons of capital structures in seven OECD countries and with the results of Bertero’s (1994) study of capital structure, the French banking sector and capital markets. However, these studies indicated the change in the pattern of firms’ external financing decisions, both through bank loans and direct financing in the securities market, in particular bond issuance.

The capital structure and battle of the financial systems

The battle between different concepts of financial systems is based on the competing structures of design of countries’ financial systems that began to show with the process of financial liberation that began in the 1970s in some countries, and particularly from the mid-1980s in the United Kingdom and France (Bertero, 1994).

The 1980s and early 1990s were characterized by an explosion of securitization in the use of financial instruments and the net result of this process, combined with the single financial market program within the EU (Mullineux, 1994), increased competition within and between the banking systems of the European Union (EU) member countries and between these systems and the capital markets.

In the context of the EU member countries, the observed corporate financing patterns seem to “mask” (hide) a marked dichotomy (differentiation) in the structure of the financial system of the EU member countries, as the results show a contrast between the Anglo-Saxon financial systems represented by the United Kingdom, and the continental financial systems typified by Germany with the Universal Banking System and by most of continental Europe, particularly France (Bertero, 1994), where the banking sector influences corporate management, as they are both debt providers and the main institutional holders of capital.

In contrast, in countries with a capital market-based financial system, the main institutional shareholders are pension and insurance funds, particularly in the UK where ownership is heavily concentrated. Capital markets in the UK also influence management behaviour through the threat posed by aggressive mergers and acquisitions and, by contrast, in continental Europe, the takeover bid has been strongly unsolicited or even mostly unknown (Murinde et al, 2004).

In this context, Bertero (1994) studied the interaction of the banking system, financial markets and capital structure by analysing data on the financial flow of funds into France and observed two important links, one link between changes in the banking sector and the securities market, and another link between the financing pattern of French firms and the capital structure.

The changes in the French banking sector did not marginalize the activities of banks in the development of financial markets, but rather their role suffered a fundamental transformation with the conversion of banking institutions into universal banks, which allowed them to perform all financial activities and to become innovative financial intermediaries in securities markets, widening their range of credit markets, financial instruments and contracts available to both companies and investors (Bertero, 1994).

The cohesion of the French banking system and the dominant role of banks in managing the securities markets, in providing long-term loans, has implied that bank intermediation has remained the core of the French banking sector; although a greater proportion of corporate financing comes from the securities markets, the main financial intermediaries are still banks, changing the financing pattern of French companies with the reduction of short-term bank financing, at the same time, the increase of internal financing and financing through the securities market (Bertero, 1994).

However, Rajan and Zingales (1995) did not observe significant differences in the leverage of firms from countries with a banking-based financial system, for example Japan, Germany, France and Italy, and in the leverage of firms from countries with a capital market-based financial system, particularly the United States, the United Kingdom and Canada. The evidence obtained suggests a similar behaviour of indebtedness between firms from countries with a capital market-based financial system and firms from countries with a bank-based financial system, reflected in the choice between issuing shares and bonds and borrowing from banks.

Still, Rajan and Zingales (1995) indicate two explanations why firms in countries with a bank-based financial system do not have an excessive level of leverage when compared to firms in countries with a capital market-based financial system: i) firms’ excessive leverage has very high costs; ii) banks finance firms’ activities through equity.

The first explanation is related to the fact that firms in countries with a bank-based financial system support lower financing costs through bank credit, since banks are able to better monitor and control the firm’s management. The second explanation is related to the possibility that banks in countries with a bank-based financial system finance corporate activity by issuing shares (Rajan and Zingales, 1995).

De Miguel and Pindado (2001) argue that the non-observation of significant differences in corporate debt between the two financial systems is related to asymmetric information and agency problems. Adverse selection problems can be mitigated with the use of debt obtained through a financial intermediary, since this type of creditor may have specific information about the real value of the firm, that is, access to information not publicly disclosed that helps to reduce asymmetric information problems.

The magnitude of morale risk problems decreases when a firm uses an intermediary as a source of debt financing, reducing agency costs related to securities issuance, protecting private creditors in the enforcement of securities contracts and monitoring firms’ performance. Thus, the decrease in information costs allows the reduction of agency costs for firms with more bank debt and allows firms to diversify their sources of external financing with the capital market (De Miguel and Pindado, 2001).

Fan et al (2005), in their study on the choice between debt obtained from financial intermediaries and debt obtained in capital markets, suggest that firms in countries with a well-developed banking sector, where banks play a key role in economic activity, preferentially use bank credit as the main source of external financing, and its importance decreases as the stock and bond markets develop. In turn, companies in countries with a capital market-based financial system, when they need external financing, in the presence of asymmetric information problems, prefer to issue bonds rather than new shares.

Antoniou et al (2008) suggest similarities and differences in the determinants of capital structures of firms operating in capital market-oriented economies (United Kingdom and United States) and bank-oriented economies (France, Germany and Japan). The similarities are found in the existence of a positive relationship between debt and asset tangibility and firm size for firms in both financial systems, and in the existence of a negative relationship between debt and profitability, growth opportunities, and stock price performance.

The differences in financial systems relate to the impacts of asset tangibility, capital premium, profitability, effective tax rate and the speed of adjustment of debt towards the optimal level, being faster in France and slower in Japan. Thus, Antoniou et al (2008) suggest that a comparative analysis of financing decisions in the context of the financial system improves understanding of how firms choose their capital structure mix and helps regulators design a financial system consistent with achieving an efficient allocation of resources.

Also, the study by Murinde et al (2004) brought together in an innovative way three strands of economic and financial literature: the study of the financing patterns of firms, in the context of the structure of financial systems, and the analysis of the convergence of the financial systems of the EU member countries over time, following the various changes to the treaties of the Economic and Monetary Union.

Convergence of financial systems

Studies of financial system convergence derive from endogenous growth models that follow the tendency of countries to converge in their growth paths over time (Barro and Sala-i-Martin, 1995, cited by Murinde et al, 2004). Additionally, a relevant issue for understanding the financing patterns of firms relates to the question of whether the different financial systems in the EU have shown a tendency to converge over time, given the creation of the European Single Market in 1993, as well as the creation of a single currency adopted by most EU member countries in January 1999.

Schmidt et al (2001) examined the development of the financial system in Germany, France and the United Kingdom during the period 1980 to 1988, and results did not support the assumption of convergence of the financial systems of the EU member countries, in that the German financial system remained banking sector oriented, while the British system remained capital market oriented. However, as for the French system it was more difficult to classify, as it suffered substantial changes in the organization of the capital market during the last few years.

Similarly, Hartman et al, (2003) compared financial system structure in the Eurozone, the US and Japan, over the period 1995-2001 and observed that the financial system in the Eurozone member countries continued to be bank-oriented, although banks played a smaller role in providing financial intermediation to institutional investors.

Also, in the models specified by Murinde et al (2004) for analysing the financing patterns of firms and convergence of the financial systems of some EU member countries, the authors found no significant evidence for the convergence trend among the financial systems of the EU member countries in the use of bank debt by non-financial firms to finance their new Investments.

In the issue of shares, the authors found a trend towards convergence among EU member countries in the use of this source of equity financing by firms, indicating that the financial structure of EU member countries is converging towards a financial system based on the capital market in the form of the bond market. In contrast, the authors noted that there is no significant evidence to conclude that the financial structure of the EU member countries is moving towards a bond market-based financial system in the financing of new investments by non-financial firms (Murinde et al, 2004).

The non-financial companies in the seven countries converged in terms of the use of internal funds for financing new investments, showing an overall convergence of the EU financial system into a variant of the Anglo-Saxon model, with a strong dependence on internal financing, decreasing importance of bank loans, and increasing financing of companies through equity markets, to the detriment of the bond market for external financing of investment.

Accordingly, Schmidt and Hackethal (2004) in their study on the financing patterns of German, Japanese and American firms, suggest internal funds as the dominant source of financing of firms’ capital structure and observed that both differences in countries’ financial systems and differences in their corporate governance systems affected their capital structure.

Mylonidis and Kollias (2010) focused on the dynamic process of capital market convergence in four of the most developed European countries: Germany, France, Spain and Italy. Their results suggest the existence of a continuous convergence over time in the four capital markets, particularly with a higher degree of convergence in the German and French markets, with the German market assuming a more dominant position of Germany within the eurozone.

Bruno et al (2012) studied the issue of convergence of financial systems using the most important financial instruments: deposits, debt securities, shares and insurance products in OECD countries; the results indicate significant convergence in the stock market and in insurance products, confirming a growing importance of capital markets in developing countries. However, for debt securities and deposits, the results obtained do not show significant convergence, with mixed results, possibly deriving from differences across countries in the weight of national public debts and the role of the respective banking sectors.

Kılınç et al (2017) studied the convergence of financial development in the EU 15-member countries, where they aimed to analyse whether the transition of the European monetary system to a single currency has led to the integration of financial markets and found convergence in all Eurozone members, both in the banking sector, banking markets, and capital markets.

Barucci and Colozza (2018) found that, during the 2008 financial crisis, the balance sheets of non-financial firms showed a shift in funding sources, as during the pre-crisis period, between 1999 and 2007, these firms used bank loans as a source of external funding, while in the post-crisis period there was an increase in bond issues as they became a preferred alternative source of funding, accompanied by a decrease in bank loans.

Barucci, Colozza (2018) argued that the 2008 financial crisis significantly affected the landscape of financial systems in Europe, with a reduction in the role of monetary and financial institutions compared to financial markets, with other financial intermediaries partially replacing the role played by the banking sector. Before the crisis, the authors found a significant increase in the indebtedness of non-financial companies, showing evidence of convergence among European countries, but after the crisis this trend was reversed, allowing for a convergence towards the observation of a deleveraging process in terms of the real economy of the countries.

Yet, the study by Kristofik et al (2020) analysed the convergence of financial liabilities, between 2001 and 2017, of Eurozone and non-Eurozone member countries, particularly equity and investment funds, debt securities, bank loans and trade credit, and the results showed a strong convergence in terms of the use of equity capital against total liabilities and bank loans against total liabilities.

In addition, the results also indicate a slight convergence in terms of the use of debt securities against total liabilities and trade credit against total liabilities. However, the results indicate that, although a certain degree of EU financial integration was achieved, the 2008 financial crisis slowed down the financial integration process and, after the crisis, the integration and convergence process slowly restarted at a slower pace than the pre-crisis value observed (Kristofik et al, 2020).

Conclusions

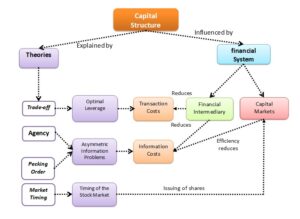

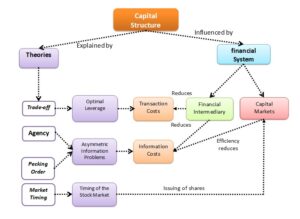

The review of the various empirical studies that have examined the link between the capital structure of firms and the financial system suggests that the configuration of the financial system influences the financing decisions of firms in different countries, and, to illustrate this connection, figure 2 is presented below to complement the puzzle on the issue of corporate capital structure.

Figure 2: Puzzle of capital structure theories and the financial system

Figure 2: Puzzle of capital structure theories and the financial system

Source: Author’s own elaboration.

From figure 2 it can be seen that, on the one hand, the capital structure problem is explained by capital theories based on market imperfections such as the existence of transaction costs, asymmetric information costs and stock market timing. On the other hand, the capital structure is also influenced by the concept of the financial system, where financial intermediaries play a key role in reducing transaction costs and information costs underlying firms’ financing decisions and, simultaneously, the efficiency of capital markets contributes to reducing the information costs of external financing sources through the issuance of securities, with special attention to firms that are able to time the issuance of shares.

References

- Abu-Bader, S. and Abu-Qarn, A.S. (2008) ‘Financial Development and Economic Growth: Empirical Evidence from Six MENA Countries’, Review of Development Economics, 0(0), pp. 080414152145312-??? Available at: https://doi.org/10.1111/j.1467-9361.2008.00427.x.

- Antoniou, A., Guney, Y. and Paudyal, K. (2008) ‘The Determinants of Capital Structure: Capital Market-Oriented versus Bank-Oriented Institutions’, Journal of Financial and Quantitative Analysis, 43(1), pp. 59–92. Available at: https://doi.org/10.1017/S0022109000002751.

- Arestis, P. and Demetriades, P. (1997) ‘Financial Development and Economic Growth: Assessing the Evidence’, The Economic Journal, 107(442), pp. 783–799.

- Barucci, E. and Colozza, T. (2018) ‘European Financial Systems in the New Millennium: Convergence or Bubble?’, SSRN Electronic Journal [Preprint]. Available at: https://doi.org/10.2139/ssrn.3212861.

- Bertero, E. (1994) ‘THE BANKING SYSTEM, FINANCIAL MARKETS, AND CAPITAL STRUCTURE: SOME NEW EVIDENCE FROM FRANCE’, Oxford Review of Economic Policy, 10(4), pp. 68–78.

- Bruno, G., De Bonis, R. and Silvestrini, A. (2012) ‘Do financial systems converge? New evidence from financial assets in OECD countries’, Journal of Comparative Economics, 40(1), pp. 141–155. Available at: https://doi.org/10.1016/j.jce.2011.09.003.

- Carp, L. (2012) ‘Can Stock Market Development Boost Economic Growth? Empirical Evidence from Emerging Markets in Central and Eastern Europe’, Procedia Economics and Finance, 3, pp. 438–444. Available at: https://doi.org/10.1016/S2212-5671(12)00177-3.

- Doukas, J., Murinde, V. and Wihlborg, C. (eds) (1998) Financial sector reform and privatization in transition economies. Amsterdam; New York: Elsevier (Advances in finance, investment, and banking, v. 7).

- Hartmann, P. (2003) ‘The Euro-area Financial System: Structure, Integration, and Policy Initiatives’, Oxford Review of Economic Policy, 19(1), pp. 180–213. Available at: https://doi.org/10.1093/oxrep/19.1.180.

- Kılınç, D., Seven, Ü. and Yetkiner, H. (2017) ‘Financial development convergence: New evidence for the EU’, Central Bank Review, 17(2), pp. 47–54. Available at: https://doi.org/10.1016/j.cbrev.2017.05.002.

- Kristofik, P., Slampiakova, L. and Fendekova, J. (2020) ‘DO FINANCIAL SYSTEMS IN EUROPE CONVERGE? EVIDENCE FROM ENTERPRISE FINANCIAL LIABILITIES COMPARING EUROZONE AND NON-EUROZONE COUNTRIES’, 19(3), p. 17.

- Levine, R. (2005) ‘Chapter 12 Finance and Growth: Theory and Evidence’, in Handbook of Economic Growth. Elsevier, pp. 865–934. Available at: https://doi.org/10.1016/S1574-0684(05)01012-9.

- Myers, S.C. (1984) ‘The Capital Structure Puzzle’, The Journal of Finance, 39(3), pp. 574–592. Available at: https://doi.org/10.1111/j.1540-6261.1984.tb03646.x.

- Mullineux, A.W. (1994) Small and medium-sized enterprise (SME) financing in the UK: Lessons from Germany. Anglo-German Foundation for the Study of Industrial Society.

- Murinde, V., Agung, J. and Mullineux, A. (2004) ‘Patterns of Corporate Financing and Financial System Convergence in Europe’, Review of International Economics, 12(4), pp. 693–705. Available at: https://doi.org/10.1111/j.1467-9396.2004.00476.x.

- Mylonidis, N. and Kollias, C. (2010) ‘Dynamic European stock market convergence: Evidence from rolling cointegration analysis in the first euro-decade’, Journal of Banking & Finance, 34(9), pp. 2056–2064. Available at: https://doi.org/10.1016/j.jbankfin.2010.01.012.

- Nieuwerburgh, S.V., Buelens, F. and Cuyvers, L. (2006) ‘Stock market development and economic growth in Belgium’, Explorations in Economic History, 43(1), pp. 13–38. Available at: https://doi.org/10.1016/j.eeh.2005.06.002.

- Schmidt, R.H. and Hackethal, A. (2004) ‘Financing patterns: Measurement concepts and empirical results’, Frankfurt Dept. of Finance Working Paper [Preprint], (125).

- Schmidt, R.H., Hackethal, A. and Tyrell, M. (2001) ‘The convergence of financial systems in Europe’, p. 50.

- Serrasqueiro, Z., Rogão, M. and Nunes, P. (2014) ‘Capital structure decisions of european and US listed firms: is there a unique financial theory?’, Research and Applications in Economics, 2(1), pp. 1–15.

- Zhao, L. (2018) ‘Literature Review of Capital Structure Theory and Influencing Factors’, Modern Economy, 09(10), pp. 1644–1653. Available at: https://doi.org/10.4236/me.2018.910103.