Introduction

The debate on the issue of corporate capital structure originated in the work of Modigliani and Miller (MM, 1958), based on a set of assumptions underlying the context of a perfect capital market, which concluded that the capital structure is irrelevant in the market value of the company. The main point of these authors was to establish the conditions under which the choice of securities issued by the firm is independent of its market value. However, the theorem of (MM, 1958) does not provide a realistic description of how firms finance their activities, but it allows us to find the reasons related to the importance of financing for firms.

The theoretical and empirical refutation of the article’s assumptions has been the most popular version used in theoretical and empirical models in the subsequent financial literature, realized in trade-off theory, Agency theory, Pecking Order theory, Market Timing theory, and other theories of capital structure and these studies have shown that MM’s theory (1958) can fail under a variety of circumstances, particularly when considering taxes, transaction costs, bankruptcy costs, agency conflicts, adverse selection, varying terms of financial market opportunities, and investor-client effects.

The precursors of the trade-off theory admitted the existence of taxes, transaction costs, bankruptcy costs, and customer effects, and advocated the existence of an optimal capital structure that maximizes the market value of the firm, and Frank and Goyal (2008) suggest the division of the trade-off theory into two distinct perspectives: the static trade-off theory and the dynamic trade-off theory. The dynamic trade-off theory is also based on the existence of an optimal capital structure, but argues for the existence of a partial adjustment behaviour of the current debt leverage level in relation to its optimal leverage, which emerged after the introduction of the partial adjustment model of leverage, as an important tool in theoretical forecasting models [Ozkan (2001) and Flannery & Ragan (2006)].

The Pecking Order theory emerged with the studies of Myers (1984) and Myers and Majluf (1984); based on the assumption of the existence of asymmetric information problems, the firm’s capital structure decisions are made according to a hierarchical order for funding sources. Later, the Agency theory, initiated by Jensen and Meckling (2019), is based on the management of conflicts caused by the existence of differences in the utility function between the agent and the principal. This approach also argues for the existence of an optimal capital structure, as a function of the costs/benefits binomial related to the principal’s monitoring activity to control the agent’s performance.

The Market Timing theoretical approach was introduced by Baker and Wurgler (2002), according to which a firm’s capital structure is the cumulative result of past attempts at stock market timing, as managers issue new shares when they perceive that the firm’s shares are overvalued by the market, and repurchase when they consider that their shares are undervalued. This persistence of the Market Timing effect has led to the development of other studies like Frank and Goyal (2004), Welch (2004), Hovakimian (2006), and Kayhan and Titman (2007).

In point two, we explain the influence of firm-specific and macro-financial factors on firms’ capital structure. In point three, we characterize the sample and the estimation methods, and, in point four, we present the analysis and discussion of the results. Finally, in point five, we describe the findings on the financing patterns of Spanish and Portuguese firms.

Determinants of Company’s Capital Structure

The studies by Rajan and Zingales (1995), Demirgüç-Kunt and Maksimovic (1999), Booth et al (2001), Claessens et al (2001) and Bancel and Mittoo (2004) have shown that the capital structure of a firm is influenced by firm-specific factors and by country-specific factors.

Firm-specific factors

In this paper, the firm-specific factors used as determinants of the capital structure of companies are: i) transaction costs; ii) agency costs; iii) asymmetric information; and iv) market conditions.

Transaction costs

The dynamic trade-off theory on capital structure suggests that firms adjust their current debt level relative to their optimal debt level, as firms that are over leveraged relative to their optimal value reduce their leverage ratio in subsequent periods. In contrast, if the firm is underleveraged relative to its optimal value, it increases its leverage ratio in subsequent periods. Furthermore, Leary and Roberts (2005) point out that transaction costs are potentially important in explaining the behaviour of firms’ capital structure and may imply different patterns of variation in firms’ leverage.

Agency costs

The financial literature suggests that firms can minimize potential agency problems with creditors by issuing collateralized debt and use tangible assets to maintain its value in case the firm defaults on debt service payments [Galai & Masulis (1976), Jensen & Meckling (2019). Thus, in this study, tangibility of assets and intangibility of assets are considered as study variables.

Tangibility of assets

The empirical literature on the determinants of capital structure has shown that firms with higher levels of tangible assets tend to have higher debt levels, that is, empirical evidence suggests the existence of a positive relationship between asset tangibility and leverage, namely the studies of Rajan and Zingales (1995), Shyam-Sunder and Myers (1999), Hovakimian et al (2001), Baker and Wurgler (2002), Frank and Goyal (2003), Korajczyk and Levy (2003), and Gaud et al (2005). Thus, the asset tangibility ratio considered as a determinant of capital structure will be calculated as a function of the ratio between tangible fixed assets and total assets.

Intangibility of assets

Myers (1984) argues that companies with intangible assets show lower leverage when compared to companies that have a higher level of tangible assets. The studies by Harris and Raviv (1991) and Giannetti (2003) suggest that there is a negative relationship between intangible assets and leverage. Therefore, the proxy of the intangibility of assets will be calculated through the ratio between intangible fixed assets and total assets.

Asymmetric Information

The influence of firm-specific factors related to asymmetric information according to the Pecking Order perspective will be tested using the profitability and liquidity proxies (De Jong et al, 2007).

Profitability

Several empirical studies find a negative relationship between profitability and firm debt, particularly in the studies by Long and Malitz (1985), Titman and Wessels (1988), Harris and Raviv (1991), Rajan and Zingales (1995), Shyam-Sunder and Myers (1999), Booth et al (2001), Baker and Wurgler (2002), Frank and Goyal (2003), and Korajczyk and Levy (2003). The profitability proxy is calculated as the ratio of operating cash flow (EBITDA) to total assets (Myers, 1984).

Liquidity

De Jong et al (2007) indicated that managers of firms in countries with a capital market-based financial system prefer to maintain high levels of liquidity. In contrast, in countries with a bank-based financial system, firms that have a close relationship with banks are able to reduce asymmetric information costs to a minimum and their liquidity needs tend to be lower than firms located in countries with a capital market-based financial system. Consequently, a negative relationship between liquidity and debt is expected for firms in countries with a capital market based financial system (Ozkan,2001). The proxy of the liquidity variable is calculated by the ratio of current asset value to current liability value.

Market conditions

Baker and Wurgler (2002) and Welch (2004) analysed the relationship between the Market-to-Book (MTB) ratio and leverage and concluded that fluctuations in stock market value give rise to persistent effects on firms’ capital structure, as firms do not immediately reverse the influence of stock price on capital structure. Similarly, Bie and Haan (2004) also analysed the effects of the Market Timing theory on the capital structure of a set of German non-financial firms, during the period from 1983 to 1997, and found a negative relationship between leverage and firm’s stock price behaviour, as firms issued shares when there was a rise in stock price.

By contrast, the Pecking Order theory suggests that there should be a positive relationship between growth opportunities and leverage, according to which firms’ debt increases as investment opportunities exceed retained earnings, and debt should decrease when retained earnings exceed the value of growth opportunities (Myers, 1984). Thus, in accordance with this approach for constant profitability levels, we expect a positive relationship between debt and the MTB ratio, based on Hovakimian et al (2001), Fama and French (2002) and Frank and Goyal (2003). In this paper, the MTB variable is defined as the quotient between the market value of assets and the book value of assets.

Also, Kuč and Kaličanin (2021) in their study on capital structure in the period after the economic crisis in 2008 suggest that country-specific determinants, such as inflation and banking sector development, have a significant impact on the capital structure of the largest companies in Serbia.

Macrofinancial factors

Fan et al (2012) concluded that firms located in countries with a high level of financial constraints face more problems when trying to use external sources of financing. Thus, in this paper, to study the relationship between the impact of macro-financial factors and leverage company, we used the stock market capitalization and bank deposits.

Stock market capitalization

Market capitalization in relation to Gross Domestic Product (GDP) is used as the preferred proxy to analyse the impact of the stock market on the capital structure of companies. The disadvantage of this measure is that it only represents the number of listed shares and not the amount of financial funds raised in the capital market. The main advantage of using this variable is based on the fact that its behaviour is less cyclical than the variable related to the issue of shares and, therefore, it is a good proxy to make comparisons between countries, especially for long periods of analysis (Rajan and Zingales, 2001).

The development of the stock and bond market gives access to different sources of external financing for a larger number of companies.

However, the impact of the development of financial markets on company leverage may not be explicit. On the one hand, the level of leverage should decrease as a result of the development of the stock market through the issuance of new shares by firms. On the other hand, the debt level may increase in the case of the development of the bond market. In this paper we use market capitalization in relation to the respective country’s GDP as a measure of stock market development.

Bank deposits

Rajan and Zingales (2001) used the ratio of deposits (deposits of commercial banks and savings banks) to GDP to analyse the development of the banking sector. However, a disadvantage of this measure is that it only represents the liability side of banks, ignoring differences in the composition of their assets. Another disadvantage of this measure is associated with the fact that it is not possible to detect whether banks operate in the form of a cartel, forming a closed store for new industrial players. The advantage of using bank deposits is that data on this variable are available for a long period of time, and for a wide range of countries. In addition, Wanzenried (2002) and Rajan and Zingales (2001) suggest a positive effect of financial intermediaries on firms’ leverage, especially on small firms. In this study, the banking sector development variable is the ratio of net bank deposits to each country’s GDP.

Methodology

This point characterizes the database used in the estimations and describes the estimation methods used to analyse the object of study.

Database

The empirical approach of this study is based on quantitative research to analyse the determinants of financing decisions of companies, using the secondary sources of information for company-specific factors, information made available by the online version of the DATASTREAM database, and was based on a screening procedure involving several steps. In the first stage, the selection of companies was made from the online version of the DATASTREAM database, obtaining a total of sixty-seven Spanish companies and thirty-five Portuguese companies, using as criteria: very large and large companies; national; non-financial companies; and listed on the capital market of their country. Additionally, indicators of the country’s macro-financial factors were obtained from the online version of the World Bank Development

Estimation Methods

In this paper, to test the influence of firm-specific factors and country macro-financial factors on the leverage of Spanish and Portuguese firms, the following model was estimated:

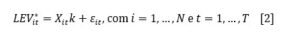

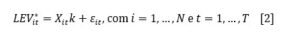

The empirical study was based on the use of dynamic estimators, namely the dynamic estimators Arellano and Bond (1991), Blundell and Bond (1998) and the Least Square Dummy Variable Corrected (LSDVC) estimator proposed by Bruno (2005), which lead to robust estimations, as eliminating the individual specific effects of unobservable firms, originated by estimation in first differences, that under orthogonal conditions between the lagged variable and the error, the use of these dynamic estimators allows eliminating the potential correlation problem between the lags of the dependent variable and the error. Thus, the optimal debt level analytically can be defined by , which is the linear function of the various determinants and the random disturbance term encompassing the specific effects, which is expressed as follows:

Where, = optimal leverage level that ignores transaction costs for a new leverage level.

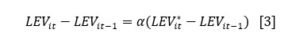

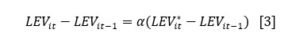

However, market imperfections, transaction costs caused by frictions, random events and institutional factors, prevent firms from reaching their optimal leverage level, in the sense of achieving a complete adjustment from one period to the next, and, as such, is not directly observable due to the presence of transaction costs, so economic agents can only observe the real value of the level of leverage . The relationship between e can be expressed as follows:

The previous equation assumes that the change in the observed leverage level is a fraction of the optimal leverage level for that same period of time and the value of is inversely proportional to the ability of firms to adjust their current level of leverage to the optimal level of leverage, thus facing a partial adjustment process.

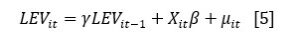

Consequently, the observed level of leverage of the period t is a weighting of the target leverage level for the same time period and the observed leverage level from the immediately preceding time period, where e are the respective weights. So, the model can be rewritten as:

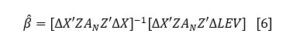

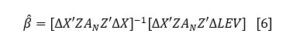

The estimator indicated by Arellano and Bond (1991) is based on a set of orthogonal conditions between the lagged values of debt and the error term , in order to generate a consistent estimator when e T is fixed. Then, the estimator can be obtained as follows:

Subsequently, the system of equations in the GMM System (1998) estimator simultaneously combines a set of first-difference equations using the lagged variables as instruments, and an additional set of level equations using the lagged first-differenced variables as instruments.

However, the estimators Bruno (2005) suggested that in situations characterized by a not very high number n of sectional data, and consequently of observations nT, the use of dynamic estimators, namely GMM (1991) and GMM System (1998), due to the small number of instruments obtained by the estimators, may lead to parameter bias. Consequently, the LSDVC estimator is given by , where: matrix of the set of determinants of the firm, as well as of the dependent variable, lagged one time period.

Results

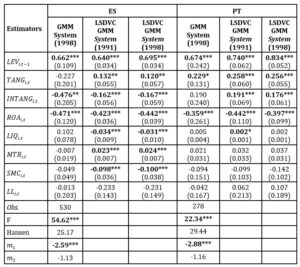

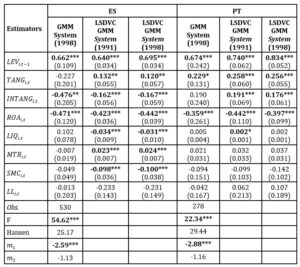

In this section, we first present the results obtained for the different estimated models. The following table (see Table 3) shows the results obtained for the dynamic GMM (1991), GMM System (1998) and LSDVC (2005) estimators for the Spanish and Portuguese listed firms.

Table 1: GMM System Estimator, LSDVC Estimator [Convergence Regression – FE Correction – GMM (1991)] and LSDVC Estimator [Convergence Regression – FE Correction – GMM System (1998)]

Source: Authors’ own elaboration

Notes: see note 1.

The coefficient that measures the impact of previous period leverage on current period leverage is positive, and statistically significant, at a significance level of 1%, for Spanish and Portuguese firms. The values obtained by applying the dynamic estimators vary between 0.662 and 0.695 for Spanish firms and between 0.674 and 0.834 for Portuguese firms, so that the coefficient of adjustment of the current leverage level towards the optimal leverage level varies between 0.338 and 0.305 for Spanish firms and varies between 0.326 and 0.166 for Portuguese firms. The results of the present study are in line with the results of other studies by Shyam-Sunder and Myers, (1999), Miguel and Pindado (2001), Ozkan (2001), Dang (2005), Leary and Roberts (2005), Gaud et al (2005), Rogão (2006), Serrasqueiro and Rogão (2009), Serrasqueiro and Rogão (2014).

This means that adjustment coefficient of the current leverage level of Portuguese firms towards the optimal level of leverage varies between 0.674 and 0.834, presenting higher values than those obtained by Serrasqueiro et al (2014), with a range of the variation between 0.360 and 0.443 and with a range of 0.479 and 0.711, Serrasqueiro and Rogão (2009), indicating the increase of transaction costs in their financing operations of Portuguese firms between 2008 and 2016.

The results obtained for the dynamic estimators indicate the existence of a positive and statistically significant relationship, at 1% significance level, between asset tangibility and leverage in Spanish and Portuguese firms, which is in accordance with the assumptions of the static trade-off theory and the Agency Theory and in line with the results obtained by Rajan and Zingales (1995), Hovakimian et al (2001), Baker and Wurgler (2002), Frank and Goyal (2003), Korajczyk and Levy (2003), Frank and Goyal (2004) and Gaud et al (2005).

The results obtained for the dynamic estimators indicate the existence of a positive and statistically significant relationship, at 1% significance level, between asset tangibility and leverage in Spanish and Portuguese firms, which is in accordance with the assumptions of the static trade-off theory and the Agency Theory and in line with the results obtained by Rajan and Zingales (1995), Hovakimian et al (2001), Baker and Wurgler (2002), Frank and Goyal (2003), Korajczyk and Levy (2003), Frank and Goyal (2004) and Gaud et al (2005).

The results obtained suggest the existence of a negative, and statistically significant, relationship, at 1% significance, between the intangibility of assets and the leverage of Spanish companies, and this result is in line with the study of Long and Malitz (1985).

However, the results indicate the existence of a positive relationship, at 1% significance level, between the intangibility of assets and the leverage of Portuguese firms. On the opposite, they indicate the existence of a negative relationship, at 1% significance, between profitability and leverage of Spanish and Portuguese firms, and between liquidity and leverage of Spanish firms, in line with the results obtained by Rajan and Zingales (1995), Miguel and Pindado (2001), Ozkan (2001), Baker and Wurgler (2002), Fama and French (2002), Korajczyk and Levy (2003), Jorgensen and Terra (2003), Frank and Goyal (2004), Coelho et al (2004), Leary and Roberts (2005), Gaud et al (2005), and De Jong et al (2007).

Also, the results indicate the existence of a significant negative relationship, at 1% significance level, between market capitalization and leverage of Spanish firms; this result is in line with the studies Demirgüç-Kunt and Maksimovic (1999), Booth et al (2001), Wanzenried (2002), Fan et al (2012) and Rajan and Zingales (2001).

Finally, by applying the dynamic estimators, we observe the inexistence of a statistically significant relationship between bank deposits and the leverage of Spanish and Portuguese firms. And similarly, we find the absence of a statistically significant relationship between Portuguese firms’ leverage and liquidity, MTB ratio, market capitalization and bank deposits.

Conclusions

The results obtained allow us to conclude that Spanish and Portuguese firms support transaction costs in their financing operations, as the adjustment coefficient of current leverage towards the optimal level of leverage varies between 0.662 and 0.695 for Spanish firms and between 0.674 and 0.834 for Portuguese firms.

As for agency costs, the results obtained for the indebtedness of Spanish companies indicate the existence of a positive relationship with the tangibility of assets and the existence of a negative relationship with the intangibility of assets, suggesting that the tangibility of assets and the intangibility of assets influence the financing decisions of Spanish companies, suggesting the blurring of possible agency problems between creditors and shareholders/managers. However, the results obtained for Portuguese firms only confirm this behaviour by the existence of a positive relationship between indebtedness and asset tangibility.

The factors related to asymmetric information problems in the capital structure of firms show the existence of negative and significant relationships between leverage and the variables profitability and liquidity for Spanish firms and between profitability and leverage for Portuguese firms, allowing the conclusion that Spanish and Portuguese firms follow a hierarchy in the choice of their sources of financing.

We also find that market conditions only positively influence the leverage of Spanish firms, suggesting that Spanish firms resort to debt as a way to finance their investment opportunities, in line with the assumptions of the Pecking Order theory. And the development of the stock market contributes to decreasing the leverage of Spanish firms. However, financial intermediaries do not influence the capital structure of Spanish and Portuguese firms.

Therefore, the determinants of Spanish and Portuguese firms’ financing decisions are based on agency costs, problems associated with asymmetric information and transaction costs, although to a greater magnitude for Portuguese firms. In addition, the financing decisions of Spanish firms are also influenced by market conditions and stock market development.

Notes

1: The instruments are: for the equations in first differences and for the equations in levels. 2. The F-test has distribution N (0.1) and tests the null hypothesis of no joint significance of the parameters of the explanatory variables. 3. The Hansen test has distribution N (0,1) and tests the null hypothesis of significance of the validity of the instruments used against the alternative hypothesis of non-validity of the instruments. 4. The m1 test has normal distribution N (0,1) and tests the null hypothesis of absence of first-order autocorrelation. 5. The m2 test has N (0,1) normal distribution and tests the null hypothesis of absence of second-order autocorrelation. 6. Standard deviations in parentheses. 7. *** Significant at 1% significance; ** significant at 5% significance; * significant at 10% significance.

References

- Arellano, M. and Bond, S. (1991) ‘Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations’, The Review of Economic Studies, 58(2), p. 277.

- Arellano, M. and Bond, S. (1998) ‘Dynamic Panel Data estimation using DPD98 for GAUSS: a fuide for users¤’, Mimeo, p. 27.

- Baker, M. and Wurgler, J. (2002) ‘Market Timing and Capital Structure’, The Journal of Finance, 57(1), pp. 1–32.

- Blundell, R. and Bond, S. (1998) ‘Initial conditions and moment restrictions in dynamic panel data models’, Journal of Econometrics, 87(1), pp. 115–143.

- Booth, L. et al (2001) ‘Capital Structures in Developing Countries’, The Journal of Finance, 56(1), pp. 87–130.

- Bruno, G.S.F. (2005) ‘Approximating the bias of the LSDV estimator for dynamic unbalanced panel data models’, Economics Letters, 87(3), pp. 361–366.

- Coelho, L., Pereira, J. and Rebelo, E. (2004) ‘Capital structure determinants: the case of Euronext market countries’, in Conference Proceedings, 4th Portuguese Finance Network, Lisbon, July.

- Fama, E.F. and French, K.R. (2002) ‘Testing Trade-Off and Pecking Order Predictions About Dividends and Debt’, Review of Financial Studies, 15(1), pp. 1–33.

- Fan, J.P.H., Titman, S. and Twitw, G. (2012) ‘An International Comparison of Capital Structure and Debt Maturity Choices’, Journal of Financial and Quantitative Analysis, 47(1), pp. 23–56.

- Frank, M.Z. and Goyal, V.K. (2003) ‘Testing the pecking order theory of capital structure’, Journal of Financial Economics, 67(2), pp. 217–248.

- Frank, M.Z. and Goyal, V.K. (2004) ‘The effect of market conditions on capital structure adjustment’, Finance Research Letters, 1(1), pp. 47–55.

- Frank, M.Z. and Goyal, V.K. (2008) ‘Trade-Off and Pecking Order Theories of Debt’, in Handbook of Empirical Corporate Finance. Elsevier, pp. 135–202.

- Galai, D. and Masulis, R.W. (1976) ‘The option pricing model and the risk factor of stock’, Journal of Financial Economics, 3(1–2), pp. 53–81.

- Gaud, P. et al (2005) ‘The Capital Structure of Swiss Companies: an Empirical Analysis Using Dynamic Panel Data’, European Financial Management, 11(1), pp. 51–69.

- Harris, M. and Raviv, A. (1991) ‘The Theory of Capital Structure’, The Journal of Finance, 46(1), pp. 297–355.

- Hovakimian, A. (2006) ‘Are Observed Capital Structures Determined by Equity Market Timing?’, Journal of Financial and Quantitative Analysis, 41(1), pp. 221–243.

- Hovakimian, A., Opler, T. and Titman, S. (2001) ‘The Debt-Equity Choice’, The Journal of Financial and Quantitative Analysis, 36(1), p. 1.

- Jalilvand, A. and Harris, R.S. (1984) ‘Corporate Behaviour in Adjusting to Capital Structure and Dividend Targets: An Econometric Study’, The Journal of Finance, 39(1), pp. 127–145.

- Jensen, M.C. and Meckling, W.H. (2019) ‘Theory of the firm: Managerial behaviour, agency costs and ownership structure’, in Corporate Governance. Gower, pp. 77–132.

- Jorgensen, J. and Terra, P. (2003) ‘Determinants of capital structure in Latin America: the role of firm-specific and macroeconomic factors’, in. Tenth Annual Conference of Multinational Finance Society, Montreal: Multinational Finance Society, pp. 1–48.

- Kayhan, A. and Titman, S. (2007) ‘Firms’ histories and their capital structures☆’, Journal of Financial Economics, 83(1), pp. 1–32.

- Kuč, V. and Kaličanin, Đ. (2021) ‘Determinants of the capital structure of large companies: Evidence from Serbia’, Economic Research-Ekonomska Istraživanja, 34(1), pp. 590–607.

- Leary, M.T. and Roberts, M.R. (2005) ‘Do Firms Rebalance Their Capital Structures?’, The Journal of Finance, 60(6), pp. 2575–2619.

- Modigliani, F. and Miller, M.H. (1958) ‘The Cost of Capital, Corporation Finance and the Theory of Investment’, The American Economic Review, 48(3), pp. 261–297.

- Myers, S. (1984) Capital Structure Puzzle. w1393. Cambridge, MA: National Bureau of Economic Research, p. w1393.

- Myers, S.C. and Majluf, N.S. (1984) ‘Corporate financing and investment decisions when firms have information that investors do not have’, Journal of Financial Economics, 13(2), pp. 187–221.

- Ozkan, A. (2001) ‘Determinants of Capital Structure and Adjustment to Long Run Target: Evidence From UK Company Panel Data’, Journal of Business Finance Accounting, 28(1–2), pp. 175–198.

- Rajan, R.G. and Zingales, L. (1995) ‘What Do We Know about Capital Structure? Some Evidence from International Data’, The Journal of Finance, 50(5), pp. 1421–1460.

- Rajan, R.G. and Zingales, L. (2001) ‘Financial Systems, Industrial Structure, and Growth’, Oxford Review of Economic Policy, 17(4), pp. 467–482.

- Serrasqueiro, Z., Rogão, M. and Nunes, P. (2014) ‘Capital structure decisions of european and US listed firms: is there a unique financial theory?’, Research and Applications in Economics, 2(1), pp. 1–15.

- Serrasqueiro, Z.M. and Rogão, M.C. (2009) ‘Capital structure of listed Portuguese companies: Determinants of debt adjustment’, Review of Accounting and Finance, 8(1), pp. 54–75.

- Shyam-Sunder, L. and C. Myers, S. (1999) ‘Testing static tradeoff against pecking order models of capital structure’, Journal of Financial Economics, 51(2), pp. 219–244.

- Titman, S. and Wessels, R. (1988) ‘The Determinants of Capital Structure Choice’, The Journal of Finance, 43(1), pp. 1–19.

- Welch, I. (2004) ‘Capital structure and stock returns’, Journal of political economy, 112(1), pp. 106–131.

[1] , corresponds to a matrix of dimension (nT×nT) that is symmetric and identical to eliminate the individual averages, so the LSDVC estimator proposed by Bruno (2005) allows to mitigate possible biased estimations obtained from samples with a not very large number of observations, and to analyse the robustness of dynamic estimators.