Introduction

Monetary policy as a macroeconomic tool is widely used by National banks, Federal banks or other regulatory committees to control quantity and rate of money supply in an economy, essentially affecting interest rates. Stability of any equity market against economic shocks cannot be overemphasized. A country’s macroeconomy environment is affected by its monetary policy through an effect on the financial markets (Gust and López-Salido, 2014). Monetary policies and pronouncements by developed economies such as the United States among others may have a global or regional effect on equity markets (Wang and Mayes, 2012; Kishor and Marfatia, 2013; Bowman, Londono and Sapriza, 2015; Ko and Lee, 2015) It is critical to arrange academic research on monetary policy and equity price volatility in a structured manner as done in other relevant studies (Nejad, 2016). New research findings on the relation between the two variables continue to be generated, however, a summary of literature is the missing link.

Monetary policy, whether expansionary or contractionary, is meant to facilitate maximum employment, stabilize prices (such as equity prices) as well as moderate long-term interest rates. Stock market stability is crucial in assessing the economic environment of a country but very sensitive to monetary policies, although the level and nature of sensitivity differs in each country (Rahman and Mohsin, 2011). Tsai (2011) notes the importance of monetary policy in dictating equity returns as it adjusts the discount rate when the present value model of asset pricing is used. Any economic or business policy that pushes stock markets to be volatile, results in assets (equities) being risky. A clear understanding of the transmission of these policies in the securities market is important (Lee and Chang, 2011). The neutrality of monetary policy on stock returns has been a contentious topic before. Thorbecke (1997) addressed the question by noting that expansionary policy increases ex-post stock return.

This study aims to examine two areas of interest on the subject matter. One, what is the current state of the literature on the relationship between monetary policy and equity market volatility? Two, what aspects of this area of the study have received less attention, thus unveil areas that need further attention. The researchers performed an extensive search of articles published in top journals. Only studies that relate or closely relate to the ‘monetary policy and equity market volatility’ were included in the study. A comprehensive search narrowed down to 67 papers whose content analysis was based on; Publication year/journal, Geographical region, Statistical Methodology, Unit of Analysis, Sample and Data Analysis Approach. To the best of the author’s knowledge, no other review article exists or is close to this article.

Research Methodology

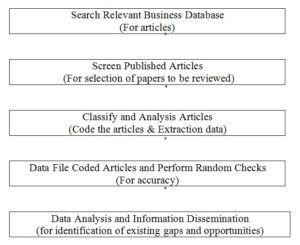

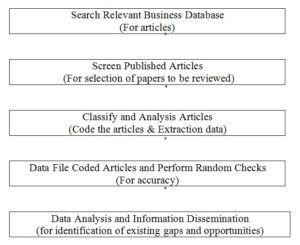

The paper adopts a quantitative and structured methodology in its review of the literature by analyzing the number of publications in peer-reviewed journals as one of the variables. This approach has been used previously in review studies on financial services innovation (Nejad, 2016). Only studies that relate to both monetary and equity markets volatility from the start of 2010 to end of 2017 were reviewed. A diagrammatic approach of the methodology is shown in figure 1 below.

Figure 1: The Research Methodology

The researchers established a criterion for a structured and quantitative literature review. The search was based on keywords, time frame, databases and an inclusion and exclusion criteria; the approach is like that used in a review study of Behavioral Biases in Investment Decision Making (Kumar and Goyal, 2015). Web of Science core collection, Science Direct, and Springer-premier business publication database was used for literature search for keywords: ‘monetary policy’ and ‘equity market volatility’. The review spans over eight years from 2010-2017 to capture both a substantial number and most recent studies. For an article to be considered it had to be:

- A scientific paper with full access and in English

- accepted by or published in top peer-reviewed journals

- the article must contain keywords in the title, abstract and keywords

The articles were retrieved from various peer-reviewed journals as shown in table 1 below. Numerous articles emerged based on the search criteria (n=4474), however on scrutiny of the title, abstract, keywords and the entire article in ambiguous cases or duplicates; 67 articles were selected for a review. The number is much more than that used in a review study of Behavioral Biases on Institutional Investors (Kumar and Goyal, 2015).

Table 1: Search Protocol in Database

Analysis and Results

The selected articles for review were thoroughly analyzed objectively and coded as per geographical location/country, year of publication, study interest, methodology used, unit of analysis and data analysis technique. This being a quantitative paper, the researcher used the number of publication in the review period as a dependent variable

Year of Publication

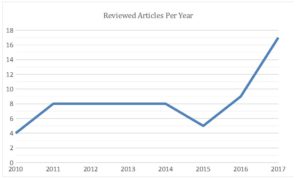

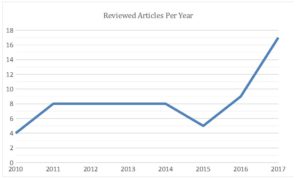

Figure 2 below indicates the number of publication reviewed from the beginning of 2010 to the end of 2017, a complete eight-year duration. One article accepted for publication in 2018 but authored in 2017 was included in the last year of review. The lowest number of publication was in the first year of review (nn2010=4), there was constancy in subsequent years (n2011-2014=8), a decline in the sixth year of review (n2015=5) then an increase (n2016= 9) before a sudden upsurge in the last year of study (n2017=17). This elucidates that the relation between monetary policy and equity markets reaction is keenly followed. There are a few possible explanations for the changes in the number of publications. For example, the 2007 Great Financial Recess affected most countries with returns on investment taking a beating. Between 2007/8 most Central banks were easing monetary policies to mitigate the effects of the recession. However, from mid-2011 a majority of countries adopted contractionary policies with the great exception of US Federal bank and Bank of England; the two countries together with the European Central Bank pursued a zero interest rate policy to avoid a repeat of the global financial recession.

The contractionary monetary policies adopted by most countries whereas developed economies approach remained neutral may explain in general terms the near constancy of published articles in some years of review. Britain’s exit of the European Union in 2016, US Federal bank’s decision to increase the federal funds rate by 25-basis points in 2017; while European Central Bank maintained its rate as Bank of Japan modified its Quantitative and Qualitative, its large-scale monetary easing program, could be a pointer to upsurge of articles in the last two years of review. Most developing economies faced a delicate balancing act since US Federal bank monetary pronouncements tend to have a global effect.

Figure 2: Distribution of Reviewed Published Articles from 2010-2017

Journal of publication

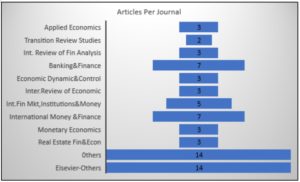

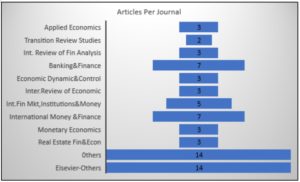

Reviewed articles were spread across many peer-reviewed journals. These journals are also region based mostly in Asia, Europe and America. For simplicity, Elsevier Publishing had most of the articles reviewed under its different flagship journals (n=49). Some of the journals under Elsevier include Banking and Finance, Economics Letters, International Money and Equity, Empirical Finance among others. Equally, Applied Economics journal (n=3) provided some articles whereas under others (n=15) are journals found in North America or Asia such as Eurasian Economic Review, Asia-Pacific Financial Markets, North American Journal of Economics and Finance and others. Comprehensive list of journals is found in the reference section. Figure 3 below illustrates the distribution. Interestingly, no single journal from Africa or the Arab region produced an article.

Figure 3: Journals of Publication

Study Focus and Content Analysis

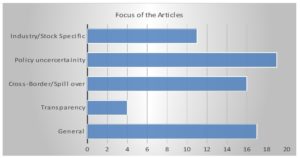

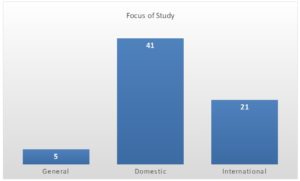

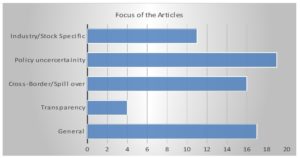

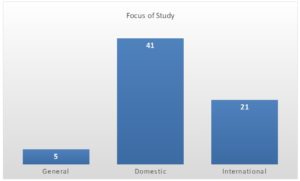

This section systematically analyses content between monetary policy and equity market volatility either in single or multiple equity markets. Empirical findings of selected studies are grouped depending on the study interest as shown in figure 3 below. Monetary policy effectiveness depends on the extent to which the chosen interest rate influences other financial prices such as the entire term structure of interest rates, credit rates, exchange rates, and asset prices (Avci and Yucel, 2017). It’s important to note that some studies cut across two or more areas of focus and the author tried as much as possible to have a balance.

A general monetary policy that is both conventional and unconventional was one of the focal points of studies (n=17). For example, on conventional perspective; Triantafyllou and Dotsis (2017) find that monetary policy has no systematic and timely response to sudden changes in option implied expectations of commodity investors (Mishra and Singh, 2012). Gospodinov and Jamali (2012) analysis found that the expected component of a target rate change and the target rate change itself do not significantly affect volatility; larger than expected decreases in the Federal fund’s target rate tends to lower the volatility risk premium. Equally, Rahman and Mohsin (2011) find a short-term relationship between expected interest rates and stock return. Laopodis (2013) found the absence of a consistent dynamic relationship between monetary policy and the stock market in the three monetary regimes analyzed. In India, implied volatility increases prior to the scheduled monetary and macroeconomic announcements (Shaikh and Padhi, 2013). Kumari and Mahakud (2014) document similar findings in the Asian market on the relationship between conditional macroeconomic (monetary) and stock market volatility.

From an unconventional monetary policy angle; Eksi and Tas (2017) find the response of stock returns to monetary policy actions to be almost seven times higher after the federal fund’s rate hit the zero lower bound (Haitsma, Unalmis and de Haan, 2016). Guidolin, Orlov, and Pedio (2017) find the responses of corporate bonds to unconventional monetary policies to be statistically significant, large and of the sign expected by policymakers during a crisis state. Shogbuyi and Steeley (2017) find Quantitative Easing operations to generally reduce equity volatility and day to day operations generated spikes in volatility in UK equities. Similar findings were documented by other researchers as Moessner, (2014). Kurov (2012) documents how during periods of economic expansion, stocks respond negatively to announcements of higher rates ahead whereas in recessions, however, there is a strong positive reaction of stocks to similar signals of future monetary tightening (Zolotoy, Frederickson and Lyon, 2017). On the reverse, Obi, Dubihlela, and Choi (2012) demonstrate why risk indicators associated with the equity market need to be considered in monetary policy decisions. More studies: (Castelnuovo and NisticÒ, 2010); (Airaudo, Cardani, and Lansing, 2013)

Some studies focused on cross-border/multiple equity markets and spillovers (n=16). The findings were varied. For example, there was no significant relationship between non-standard monetary policies (Quantitative Easing) by US and international yield (Belke and Osowski, 2017). On the contrary, Chortareas and Noikokyris (2017) document how US monetary policy surprises exert significant inverse effects on global equity returns. For developed economies and on timing; Hussain (2011) states that monetary policy decisions generally exert immediate and significant influence on stock index returns and volatilities in both European and US market (Shogbuyi and Steeley, 2017). Equally, Ramos-Francia Santiago Garcia-Verdu (2017) found negative correlations in emerging market economies bond flows, and risk-reversal and negative feedback in such flows and their respective risk premiums (MacDonald, 2017). In support, Turner (2015) illustrates dependency of emerging markets to the monetary policies in the advanced economies. Fratzscher, Lo Duca, and Straub (2016) find spillovers to advanced economies and emerging markets to have had a positive impact on equity markets and confidence. Bernal, Gnabo and Guilmin (2016) note that economic policy uncertainty in the core economies of the Eurozone can exacerbate the transmission of risk arising from abnormal developments of individual countries’ sovereign spreads to the whole Eurozone bond market (Hanousek and Kočenda, 2011; Anaya, Hachula, and Offermanns, 2017). A similar study touching on new European union member was equally conducted (Pirovano, 2012). Hayo, Kutan, and Neuenkirch (2010) find European markets to be influenced by a greater variety of U.S target rate and communications than Pacific markets. Galloppo and Paimanova (2016) carried out a similar study with emerging economies, BRICS, as the boundary. On the ASEAN5 countries (Malaysia, Indonesia, Singapore, the Philippines, and Thailand); contractionary monetary policy has a stronger long-run effect on stock market volatility in bear markets than bulls (Zare, Azali, and Habibullah, 2013). More studies were by Hung and Ma (2017); Challe and Giannitsarou (2014).

Surprise element was equally well studied by some researcher at both national and global levels (n=19). The surprise element relates to unanticipated statements released by relevant authorities as well as uncertainties in some policies. For example, Gospodinov and Jamali (2012) document that surprise changes in the target rate significantly increase volatility. Kishor and Marfatia (2013) find that the foreign stock markets respond more to U.S. monetary policy surprises in the crisis times; and the stock markets in Europe and the U.S. had responded negatively to unanticipated Federal rate cuts during the recent financial crisis (David and Veronesi, 2014; Bowman, Londono and Sapriza, 2015). J. Wang and Zhu (2013) document similar findings but note that effect of unanticipated monetary policy actions may not to be so strong to change the correlation structure of international equity returns. Contrarily, Kontonikas, MacDonald, and Saggu (2013) find stock prices to react positively outside the crisis period (increased) but negatively during the crisis as a response to unexpected Federal Fund Rate cuts. Similarly, analyzed responses of aggregate stock price indices of New Zealand, Australia, the UK and the euro area to monetary policy rate surprise announcements found significant negative stock price reactions to monetary policy surprises (Wang & Mayes, 2012). Rosa (2011) finds that both the surprise component of policy actions and official communication have statistically significant and economically relevant effects on equity indices; statements have the much greater explanatory power of the reaction of stock prices to monetary policy (Tsai, 2011; Marfatia, 2014). Similar findings were noted in the Australian, Taiwan, US equity market and Pakistan (Lee and Chang, 2011; Rahman and Mohsin, 2011; Ko and Lee, 2015; Brown and Karpavičius, 2017). There are studies by other researchers that had similar findings (Gust and López-Salido, 2014; Kurov and Stan, 2018). Equally, other studies find uncertainty about future monetary policies to weaken equity markets reactions to macroeconomic news (Kurov and Stan, 2018). More studies on uncertainty include Gospodinov and Jamali (2015); (Tsai, 2014).

There are researchers who opted to analyze specific stocks or industries (n=11). Chen, Peng, Shyu, and Zeng (2012) found equity real investment trust returns to be sensitive to changes to monetary policy at different equity REIT returns ranges in different market states (Chang, Chen, and Leung, 2011; Cesa-Bianchi and Rebucci, 2017). A similar relationship was noted on pension funds (Boubaker et al., 2017). Xu and Yang (2011) find most international securitized real estate markets to have significantly positive responses to surprise decrease in current or future expected federal funds rates, but responses vary greatly across countries. Berndt and Yeltekin (2015) found unconventional monetary policies to have a positive effect on bond returns. However, Fratzscher, Lo Duca, and Straub (2016) find effects of European Central Bank policies on bond markets outside the euro area to be negligible. For advanced economies bond market, Hughes and Rogers (2016) find significant changes both in the evaluated assets’ correlations with each other and in their general behavior. Shahzad, Mensi, Hammoudeh, Balcilar, and Shahbaz (2017) find a negative relationship for swaps. Luo, Cheng, and Vijverberg (2016) find responses to policy shocks as varying by industry and across firms in the U.S for listed firms. In India, Prabu A, Bhattacharyya and Ray (2016) find unanticipated policy announcements to have a weakly significant impact on banking stocks. In Thailand, stock prices of firms in different industries react heterogeneously to the interest rate announcement (Vithessonthi and Techarongrojwong, 2012).

Transparency and openness of financial authorities or markets (n=4) had the least publications. Papadamou, Sidiropoulos, and Spyromitros (2014) find a negative link between stock prices volatility and central bank transparency. On the discrete disclosure practices by the Reserve Bank of Australia, McCredie, Docherty, Easton, and Uylangco (2016) document that both monetary policy announcements and explanatory minutes releases have a significant and comparable impact on the returns and volatility of the Australian equity market. Li, Işcan, and Xu (2010) find the immediate response of stock prices to a domestic contractionary monetary policy shock to be small and the dynamic response brief in Canada while in the United States, the immediate response of stock prices to a shock of the same magnitude is relatively large with a relatively prolonged dynamic response. Vithessonthi and Techarongrojwong (2013) find the expected change in the repurchase rate to have a negative effect on stock returns whereas the unexpected change had no effect on stock returns.

Figure 3: Focus of the Study

Research Methodology and Data

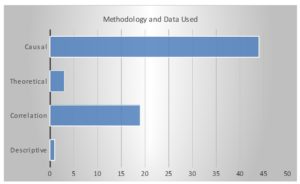

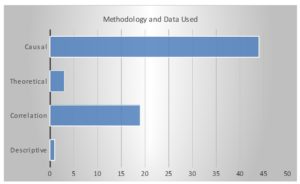

A review of literature based on methodology and data pinpoints focus areas for previous studies. The paper appreciates the existence of exploratory, descriptive, and causal types of studies; however, the author classifies reviewed studies into descriptive, correlation, causal and theoretical. Almost all the studies reviewed are empirical-analytical in nature. Analytical studies relate to those that sort to analyze specific hypotheses or facts; whereas empirical studies include those based on actual observations or findings. Conceptual/theoretical research (n=3) include literature that relates to the development or advancement of a model or body of theory; such as (Gust and López-Salido, 2014; Gospodinov and Jamali, 2015). Descriptive study (n=1) such as (Turner, 2015). Correlation approach (n=19) was the second most used methodology, some studies include (Kishor and Marfatia, 2013; Chortareas and Noikokyris, 2017; Zolotoy, Frederickson and Lyon, 2017). Causal methodology (n=44) was the most used (Rosa, 2011; Belke and Osowski, 2017; Guidolin, Orlov and Pedio, 2017). Researchers relied on secondary data, apart from the one theoretical study used hypothetical data.

Figure 4: Article by Methodology and Data

Unit of Analysis

An examination of the unit of analysis for any review study is crucial since it pictures the aspect of a study. The studies selected were those that dealt with monetary policy and stock price volatility. Data from both monetary regulatory institutions and stock markets was relied upon by the researchers of these articles. The unit of analysis was the stock market either of a single (equity market) country (n=41), cross-border (multiple) equity markets for international studies (n=21) and a mixture of both for general studies (n=5, theoretical and qualitative); as illustrated in figure 5 below. Most of the studies have focused on single securities markets with few on cross-border and or from a general perspective

Figure 5: Distribution of Units of Analysis

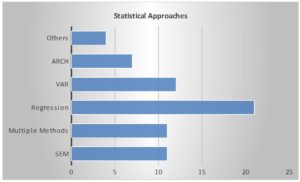

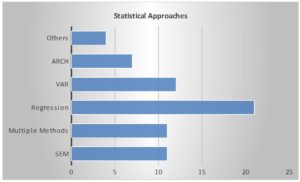

Statistical Approach

Selected articles were classified according to the type and frequency of the data analytical technique used. In this analysis, one article which was qualitative in nature was omitted (n=67-1), thus only 66 articles were considered. The importance of this is that it singles out the most popular and commonly used technique in the studies as illustrated in figure 6 below. Regression analysis (n=21) was frequently (Rosa, 2011; Brown and Karpavičius, 2017); vector autoregressive (VAR) (n=12) various models such as integrated, co-integrated, structured was the second commonly (Tsai, 2011; Guidolin, Orlov and Pedio, 2017; Triantafyllou and Dotsis, 2017). Structured equation models (n=11; SEM) was equally fairly used (David and Veronesi, 2014; Ko and Lee, 2015; Cesa-Bianchi and Rebucci, 2017). Other studies used multiple (n=11) models (Marfatia, 2014; Hughes and Rogers, 2016). Autoregressive conditional heteroskedasticity (n=7) models such as exponential, generalized were noted (Hanousek and Kočenda, 2011; Lee and Chang, 2011). Others (n=4) employed Markovian process, panel data analysis and non-parametric approaches (Mishra and Singh, 2012; Papadamou, Sidiropoulos and Spyromitros, 2014; Zolotoy, Frederickson, and Lyon, 2017)

Figure 6: Statistical Technique Frequency

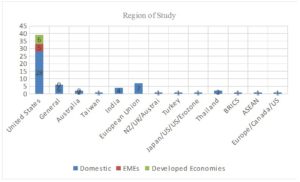

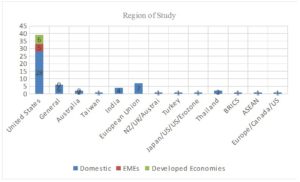

Geographical Area/Country of Study

In this section, studies were classified as per where the study was conducted; pointing out areas that produced many studies as demonstrated in figure 7 below. The United States (n=39) leads in the number of publications. The studies varied: for example those that focused on the NYSE (n=23) such as by (Tsai, 2011; Marfatia, 2014; Moessner, 2014; Belke and Osowski, 2017); emerging market economies (n=5) (Bowman, Londono and Sapriza, 2015; Anaya, Hachula and Offermanns, 2017) and in general or developed economies (n=6) (Hussain, 2011; Shogbuyi and Steeley, 2017). On political and or trading blocks, the European Union (n=7) focused studies include (Hanousek and Kočenda, 2011; Bernal, Gnabo and Guilmin, 2016; Fratzscher, Lo Duca, and Straub, 2016); BRICS (n=1) as (Galloppo and Paimanova, 2016) and ASEAN (n=1) like (Zare, Azali and Habibullah, 2013). Asia focused- India (n=4) studies (Mishra and Singh, 2012; Shaikh and Padhi, 2013; Kumari and Mahakud, 2014), Thailand (n=2) as (Vithessonthi and Techarongrojwong, 2012, 2013). Australia studies (n=2) like (McCredie et al., 2016; Brown and Karpavičius, 2017). The general study (n=6) includes studies not specific to any given region such as theoretical and qualitative studies (Gust and López-Salido, 2014; Papadamou, Sidiropoulos, and Spyromitros, 2014; Turner, 2015)

Figure 7: Studies in a Region/Country

Discussion, Future Research Directions, and Limitations

Published articles on monetary policies and stock/equity market volatility were minimal in the first year of study 2010(n=4); between 2011 to 2014 the publications were constant (n=8). There was a decline in 2015 (n=5) then an increase in the last two years peaking in 2017 (n=17). This demonstrates the interest among researchers on the subject in recent times, an indicator that research opportunities still exist given global economic dynamics. On journals of publication, Elsevier publishing (n=49) was the most preferred outlet as it had the highest number of reviewed articles spread across various journals; as such most of the literature on the subject can be obtained from the journal’s group.

On study focus and content analysis, findings were varied. The most studied areas in the relation to equity volatility were: policy uncertainty or unanticipated monetary announcements/statements; monetary policy in general; cross-border and specific equities/industries respectively. However, the least researched area was the interaction between transparency of relevant institutions such as Central/National bank, Federal bank, and equity price volatility. The low number of studies in this aspect offers opportunities for future studies.

On methodology and data, 65.7 percent of the studies used causal research design whereas Correlational research design stood at 28.4 percent. Therefore, these two designs account for over 90 percent of all reviewed studies, with the reminding percentage split between descriptive and theoretical studies. There are few descriptive or qualitative studies that should give an in-depth analysis of the relation between the variables of interest in the subject matter. Moreover, theoretical studies meant to develop new models or add to the existing body of knowledge are equally few. Secondary data were heavily relied on with minimal effort on primary sources of information. Such shortcomings offer opportunities for further studies. In addition, an analysis of statistical technique used shows that regression was the most preferred method. Future studies could consider more of advanced mathematical equation modeling (MEM) and other related techniques.

On a unit of analysis, most of the studies dealt with single stock markets, that is, analyzed a single country’s equity market (61.19 percent), 31.34 percent were on cross-border (multiple markets) and the rest general in nature. This can further be evaluated alongside geographical/regional analysis. Most of the articles touched on developed economies such as the U.S, which coincidentally had the highest number of the reviewed article, European Union, Australia, Japan among others. Studies on or from developing economies such as in Asia or Latin America are low; interestingly nothing from Africa or the Arab region. The trend demonstrates that emerging economies or countries continue to receive less attention. Further, on political or economic unions; the European Union had a considerable number of articles, but BRICS and ASEAN5 had one study each. In addition, there are many economic unions such as in Africa, South America or Arabia among others that had not even a single study. These gaps and inconsistencies do present fertile areas for future research.

Finally, for future studies, the researcher(s) can use other useful and high-quality approaches to analyze literature, such as bibliographical coupling or co-citation analysis. There exist advanced software packages developed for such task with some being free of charge. This would significantly improve the quality of future research.

On limitations, there are a few to be highlighted for this study. One such limitation is that the author relied mostly on journals published by Elsevier publishing. The journals focus on the subject matter; thus, the literature review gives a clear and present status of research and the aspects that need focus in future. Future studies can expound the scope of journals and provide a more detailed overview of the state of the literature. However, Elsevier is premier publishing outlet for research in finance, economics, and business. The selected and reviewed 67 papers gave a reasonable sample size for this study. Equally, a quantitative approach was adopted in the review of selected articles by the researcher. Qualitative review considering aspects such as impact factor, citation among others could be an area of consideration by future studies. However, despite the limitations, this paper gives a present picture of literature on monetary policy and stock/equity price volatility; pinpointing areas for future studies.

(adsbygoogle = window.adsbygoogle || []).push({});

Reference

- Airaudo, M., Cardani, R. and Lansing, K. J. (2013) ‘Monetary policy and asset prices with belief-driven fluctuations’, Journal of Economic Dynamics and Control. Elsevier, 37(8), pp. 1453–1478.

- Anaya, P., Hachula, M. and Offermanns, C. J. (2017) ‘Spillovers of U.S. unconventional monetary policy to emerging markets: The role of capital flows’, Journal of International Money and Finance. Elsevier Ltd, 73, pp. 275–295.

- Avci, S. B. and Yucel, E. (2017) ‘Effectiveness of monetary policy: evidence from Turkey’, Eurasian Economic Review, 7(2), pp. 179–213.

- Belke, A. and Osowski, T. (2017) ‘The effectiveness of the Fed’s quantitative easing policy: New evidence based on international interest rate differentials’, Journal of International Money and Finance. Elsevier Ltd, 73(November 2008), pp. 335–349.

- Bernal, O., Gnabo, J.-Y. and Guilmin, G. (2016) ‘Economic policy uncertainty and risk spillovers in the Eurozone’, Journal of International Money and Finance. Elsevier Ltd, 65, pp. 24–45.

- Berndt, A. and Yeltekin, Ş. (2015) ‘Monetary policy, bond returns and debt dynamics’, Journal of Monetary Economics, 73(November 2014), pp. 119–136.

- Boubaker, S. et al.(2017) ‘Assessing the effects of unconventional monetary policy and low interest rates on pension fund risk incentives’, Journal of Banking and Finance. Elsevier B.V., 77, pp. 35–52.

- Bowman, D., Londono, J. M. and Sapriza, H. (2015) ‘U.S. unconventional monetary policy and transmission to emerging market economies’, Journal of International Money and Finance. Elsevier Ltd, 55, pp. 27–59.

- Brown, A. and Karpavičius, S. (2017) ‘The Reaction of the Australian Stock Market to Monetary Policy Announcements from the Reserve Bank of Australia’, Economic Record, 93(300), pp. 20–41.

- Castelnuovo, E. and NisticÒ, S. (2010) ‘Stock market conditions and monetary policy in a DSGE model for the U.S.’, Journal of Economic Dynamics and Control, 34(9), pp. 1700–1731.

- Cesa-Bianchi, A. and Rebucci, A. (2017) ‘Does easing monetary policy increase financial instability?’, Journal of Financial Stability. Elsevier B.V., 30, pp. 111–125.

- Challe, E. and Giannitsarou, C. (2014) ‘Stock prices and monetary policy shocks: A general equilibrium approach’, Journal of Economic Dynamics and Control. Elsevier, 40, pp. 46–66. doi: 10.1016/j.jedc.2013.12.005.

- Chang, K.-L., Chen, N.-K. and Leung, C. K. Y. (2011) ‘Monetary Policy, Term Structure and Asset Return: Comparing REIT, Housing and Stock’, The Journal of Real Estate Finance and Economics, 43(1–2), pp. 221–257.

- Chen, M. C. et al.(2012) ‘Market States and the Effect on Equity REIT Returns due to Changes in Monetary Policy Stance’, Journal of Real Estate Finance and Economics, 45(2), pp. 364–382.

- Chortareas, G. and Noikokyris, E. (2017) ‘Federal reserve’s policy, global equity markets, and the local monetary policy stance’, Journal of Banking and Finance. Elsevier B.V., 77, pp. 317–327.

- David, A. and Veronesi, P. (2014) ‘Investors’ and Central Bank’s uncertainty embedded in index options’, Review of Financial Studies, 27(6), pp. 1661–1716.

- Eksi, O. and Tas, B. K. O. (2017) ‘Unconventional monetary policy and the stock market’s reaction to Federal Reserve policy actions’, North American Journal of Economics and Finance. Elsevier Inc., 40(September 2012), pp. 136–147.

- Fratzscher, M., Lo Duca, M. and Straub, R. (2016) ‘ECB Unconventional Monetary Policy: Market Impact and International Spillovers’, IMF Economic Review, 64(1), pp. 36–74.

- Galloppo, G. and Paimanova, V. (2016) ‘The impact of monetary policy on BRIC markets asset prices during global financial crises’, Quarterly Review of Economics and Finance. Board of Trustees of the University of Illinois, 66, pp. 21–49.

- Gospodinov, N. and Jamali, I. (2012) ‘The effects of Federal funds rate surprises on S&P 500 volatility and volatility risk premium’, Journal of Empirical Finance. Elsevier B.V., 19(4), pp. 497–510.

- Gospodinov, N. and Jamali, I. (2015) ‘The response of stock market volatility to futures-based measures of monetary policy shocks’, International Review of Economics and Finance. Elsevier Inc., 37, pp. 42–54.

- Guidolin, M., Orlov, A. G. and Pedio, M. (2017) ‘The impact of monetary policy on corporate bonds under regime shifts’, Journal of Banking and Finance. Elsevier B.V., 80, pp. 176–202.

- Gust, C. and López-Salido, D. (2014) ‘Monetary policy and the cyclicality of risk’, Journal of Monetary Economics. Elsevier, 62(1), pp. 59–75.

- Haitsma, R., Unalmis, D. and de Haan, J. (2016) ‘The impact of the ECB’s conventional and unconventional monetary policies on stock markets’, Journal of Macroeconomics. Elsevier Inc., 48, pp. 101–116.

- Hanousek, J. and Kočenda, E. (2011) ‘Foreign news and spillovers in emerging European stock markets’, Review of International Economics, 19(1), pp. 170–188.

- Hayo, B., Kutan, A. M. and Neuenkirch, M. (2010) ‘The impact of U.S. central bank communication on European and pacific equity markets’, Economics Letters. Elsevier B.V., 108(2), pp. 172–174.

- Hughes, M. P. and Rogers, K. (2016) ‘Zero Lower Bound Monetary Policy’s Effect on Financial Asset’s Correlations’, International Advances in Economic Research, 22(2), pp. 151–170.

- Hung, K. C. and Ma, T. (2017) ‘The effects of expectations-based monetary policy on international stock markets: An application of heterogeneous agent model’, International Review of Economics and Finance. Elsevier, 47(May 2016), pp. 70–87.

- Hussain, S. M. (2011) ‘Simultaneous monetary policy announcements and international stock markets response: An intraday analysis’, Journal of Banking and Finance. Elsevier B.V., 35(3), pp. 752–764.

- Kishor, N. K. and Marfatia, H. A. (2013) ‘The time-varying response of foreign stock markets to U.S. monetary policy surprises: Evidence from the Federal funds futures market’, Journal of International Financial Markets, Institutions and Money. Elsevier B.V., 24(1), pp. 1–24.

- Ko, J.-H. and Lee, C.-M. (2015) ‘International economic policy uncertainty and stock prices: Wavelet approach’, Economics Letters. Elsevier B.V., 134, pp. 118–122.

- Kontonikas, A., MacDonald, R. and Saggu, A. (2013) ‘Stock market reaction to fed funds rate surprises: State dependence and the financial crisis’, Journal of Banking and Finance. Elsevier B.V., 37(11), pp. 4025–4037.

- Kumar, S. and Goyal, N. (2015) ‘Behavioural biases in investment decision making – a systematic literature review’, Qualitative Research in Financial Markets. Emerald Group Publishing Limited , 7(1), pp. 88–108.

- Kumari, J. and Mahakud, J. (2014) ‘Relationship Between Conditional Volatility of Domestic Macroeconomic Factors and Conditional Stock Market Volatility: Some Further Evidence from India’, Asia-Pacific Financial Markets, 22(1), pp. 87–111.

- Kurov, A. (2012) ‘What determines the stock market’s reaction to monetary policy statements?’, Review of Financial Economics. Elsevier Inc., 21(4), pp. 175–187.

- Kurov, A. and Stan, R. (2018) ‘Monetary policy uncertainty and the market reaction to macroeconomic news’, Journal of Banking and Finance. Elsevier B.V., 86, pp. 127–142.

- Laopodis, N. T. (2013) ‘Monetary policy and stock market dynamics across monetary regimes’, Journal of International Money and Finance. Elsevier, 33, pp. 381–406.

- Lee, C.-W. and Chang, M.-J. (2011) ‘Announcement Effects and Asymmetric Volatility in Industry Stock Returns: Evidence from Taiwan’, Emerging Markets Finance and Trade, 47(2), pp. 48–61.

- Li, Y. D., Işcan, T. B. and Xu, K. (2010) ‘The impact of monetary policy shocks on stock prices: Evidence from Canada and the United States’, Journal of International Money and Finance, 29(5), pp. 876–896.

- Luo, H. A., Cheng, J. C. and Vijverberg, C. P. C. (2016) ‘Monetary shocks, equity returns and volatility: a firm-level panel data analysis’, Applied Economics, 48(4), pp. 261–275. doi: 10.1080/00036846.2015.1078443.

- MacDonald, M. (2017) ‘International capital market frictions and spillovers from quantitative easing’, Journal of International Money and Finance. Elsevier Ltd, 70, pp. 135–156

- Marfatia, H. A. (2014) ‘Impact of uncertainty on high frequency response of the U.S. stock markets to the Fed’s policy surprises’, Quarterly Review of Economics and Finance. Board of Trustees of the University of Illinois, 54(3), pp. 382–392.

- McCredie, B. et al.(2016) ‘The channels of monetary policy triggered by central bank actions and statements in the Australian equity market’, International Review of Financial Analysis. Elsevier Inc., 46, pp. 46–61.

- Mishra, S. and Singh, H. (2012) ‘Do macro-economic variables explain stock-market returns Evidence using a semi-parametric approach’, Journal of Asset Management. Nature Publishing Group, 13(2), pp. 115–127.

- Moessner, R. (2014) ‘Effects of explicit FOMC policy-rate guidance on equities and risk measures’, Applied Economics, 46(18), pp. 2139–2153.

- Nejad, M. (2016) ‘Research on financial services innovations’, International Journal of Bank Marketing. Emerald Group Publishing Limited , 34(7), pp. 1042–1068.

- Obi, P., Dubihlela, J. and Choi, J.-G. (2012) ‘Equity market valuation, systematic risk and monetary policy’, Applied Economics, 44(27), pp. 3605–3613.

- Papadamou, S., Sidiropoulos, M. and Spyromitros, E. (2014) ‘Does central bank transparency affect stock market volatility?’, Journal of International Financial Markets, Institutions and Money. Elsevier B.V., 31(1), pp. 362–377.

- Pirovano, M. (2012) ‘Monetary policy and stock prices in small open economies: Empirical evidence for the new EU member states’, Economic Systems. Elsevier B.V., 36(3), pp. 372–390.

- Prabu A, E., Bhattacharyya, I. and Ray, P. (2016) ‘Is the stock market impervious to monetary policy announcements: Evidence from emerging India’, International Review of Economics and Finance. Elsevier, 46(October 2015), pp. 166–179.

- Rahman, H. U. and Mohsin, H. M. (2011) ‘Monetary Policy Announcements and Stock Returns: Evidence from the Pakistani Market’, Transition Studies Review, 18(2), pp. 342–360.

- Ramos-Francia Santiago Garcia-Verdu, M. (2017) ‘Is Trouble Brewing for Emerging Market Economies? An Empirical Analysis of Emerging Market Economies’ Bond Flows: February 2017’, Journal of Financial Stability. Elsevier B.V., (January 2004).

- Rosa, C. (2011) ‘Words that shake traders. The stock market’s reaction to central bank communication in real time’, Journal of Empirical Finance. Elsevier B.V., 18(5), pp. 915–934.

- Shahzad, S. J. H. et al.(2017) ‘Distribution specific dependence and causality between industry-level U.S. credit and stock markets’, Journal of International Financial Markets, Institutions and Money. Elsevier B.V.

- Shaikh, I. and Padhi, P. (2013) ‘RBI’s Monetary Policy and Macroeconomic Announcements: Impact on S&P CNX Nifty VIX’, Transition Studies Review, 19(4), pp. 445–460.

- Shogbuyi, A. and Steeley, J. M. (2017) ‘The effect of quantitative easing on the variance and covariance of the UK and US equity markets’, International Review of Financial Analysis. Elsevier Inc., 52, pp. 281–291.

- Thorbecke, W. (1997) ‘On stock market returns and monetary policy’, Journal of Finance, pp. 635–654.

- Triantafyllou, A. and Dotsis, G. (2017) ‘Option-implied expectations in commodity markets and monetary policy’, Journal of International Money and Finance. Elsevier Ltd, 77, pp. 1–17.

- Tsai, C. L. (2011) ‘The reaction of stock returns to unexpected increases in the federal funds rate target’, Journal of Economics and Business. Elsevier Inc., 63(2), pp. 121–138.

- Tsai, C. L. (2014) ‘The effects of monetary policy on stock returns: Financing constraints and “informative” and “uninformative” FOMC statements’, International Review of Economics and Finance. Elsevier Inc., 29, pp. 273–290.

- Turner, P. (2015) ‘Global Monetary Policies and the Markets: Policy Dilemmas in the Emerging Markets’, Comparative Economic Studies, 57(2), pp. 276–299.

- Vithessonthi, C. and Techarongrojwong, Y. (2012) ‘The impact of monetary policy decisions on stock returns: Evidence from Thailand’, Journal of International Financial Markets, Institutions and Money. Elsevier B.V., 22(3), pp. 487–507.

- Vithessonthi, C. and Techarongrojwong, Y. (2013) ‘Do monetary policy announcements affect stock prices in emerging market countries? The case of Thailand’, Journal of Multinational Financial Management. Elsevier B.V., 23(5), pp. 446–469.

- Wang, J. and Zhu, X. (2013) ‘The reaction of international stock markets to Federal Reserve policy’, Financial Markets and Portfolio Management, 27(1), pp. 1–30.

- Wang, S. and Mayes, D. G. (2012) ‘Monetary policy announcements and stock reactions: An international comparison’, North American Journal of Economics and Finance. Elsevier Inc., 23(2), pp. 145–164.

- Xu, P. and Yang, J. (2011) ‘U.S. Monetary Policy Surprises and International Securitized Real Estate Markets’, Journal of Real Estate Finance and Economics, 43(4), pp. 459–490.

- Zare, R., Azali, M. and Habibullah, M. S. (2013) ‘Monetary Policy and Stock Market Volatility in the ASEAN5: Asymmetries Over Bull and Bear Markets’, Procedia Economics and Finance. Elsevier B.V., 7(Icebr), pp. 18–27.

- Zolotoy, L., Frederickson, J. R. and Lyon, J. D. (2017) ‘Aggregate earnings and stock market returns: The good, the bad, and the state-dependent’, Journal of Banking and Finance. Elsevier B.V., 77, pp. 157–175.