Introduction

The phenomenon of mergers and acquisitions continues to emerge in different countries and sectors, realizing record numbers of corporate purchases reaching in 2020 a total volume of $3.6 trillion, with an evolving trend for the years to come. In the African continent, the value of these operations amounted to $15.3 billion in 2020, of which $2.8 billion are carried out in the North Africa region (Refinitiv, 2020) . Despite the importance of these operations, and their considerable weight in the economic fabric of countries (Pervez, 2014), they remain quite complex and need to be meticulously studied, due to the substantial risks associated with them which can sometimes fail. Indeed, mergers and acquisitions strategies assume the achievement of performance and at the same time involve additional risks (Vanwalleghem and al, 2020). These risks can lead to additional information problems that would limit the potential for value creation (Berger and al., 2017), especially when deciding on the method of financing (Deng, 2014). Moreover, these risks are accentuated in some countries with economic, political and regulatory barriers, such as the case of African countries (Sehoole, 2005; Akinbuli and Kelilume, 2013). Thus, a good mastery of financing methods during mergers and acquisitions can lead to the creation of more value observed after the merger operation (Tarba and al., 2010; Bodt and al., 2013; Kanungo, 2021).

The use of a specific mode of financing to finance a merger-acquisition has been explained by numerous theories and research carried out mainly in developed countries (Yuan and al., 2016). The theory of information asymmetry largely explains the attitudes of the acquirer and the target in terms of risk-sharing, and consequently, the choice of a method of financing (Faccio and Masulis, 2005a). The theory of the hierarchical order explains the use of the modes of financing diffusing the strict minimum of information on the market (Myers and Majluf, 1984). The signaling theory explains the use of a particular mode of financing to send privileged information to the financial market (Kalinowska and Mielcarz, 2014). Market efficiency theory explains the impact of the form of the market on market capitalization, and thus on the choice of financing method (Charles and al., 2016).

In the current context of economic internationalization, external growth strategies through the relocation of activities have a competitive advantage, especially in emerging countries that are gaining more and more weight in the global economy (Ghauri and Mayrhofer, 2016). In the African continent, mergers and acquisitions operations have become a real field for investments by global and local market players. Nevertheless, there are regional disparities within the continent, as the market is mainly dominated by North Africa, and Southern Africa (aka, 2019). In North Africa, studies on mergers and acquisitions are very rare and only analyze data from a specific country such as Tunisia (Ferchichi and Souam, 2015, Egypt (A.Elhakeem and Elgiziry, 2016) and Morocco (Ibrahimi, 2021). To our knowledge, there is no study dealing with mergers and acquisitions in the North African region by measuring the impact of financing methods on the performance of mergers and acquisitions, knowing that the latter represent the main driver of foreign direct investment in emerging countries (Deng and Yang, 2015).

The objective of this work consists in filling this vacuum by analyzing the markets of North Africa countries, which become in a context of saturation of developed markets and robust economic growth, more and more attractive for the conclusion of mergers and acquisitions transactions (Wilson and Bala, 2019). We focus more on the study of financing methods, and the impact of these financing methods on the performance of mergers and acquisitions carried out in North Africa. The results and conclusions of our study would provide a basis for continued scientific progress, as well as for companies interested in investment opportunities in the region, enabling them to make the right financing decisions.

Literature Review and Hypotheses

Mergers and Acquisitions in Africa

The upward trend in private equity deals around the world and the untapped market, are increasingly pushing Africa towards the next big mergers and acquisitions market (mergermarket, 2012; Clifford, 2015). In terms of investment, France is the main investor in Africa with a stock of foreign direct investment of $64 billion, followed by the Netherlands with $63 billion and the United States with $50 billion. At the African level, Egypt remains the first host economy in the continent with a total investment of $6.6 billion followed by South Africa with $5.3 billion, Congo with 4$.3 billion, Morocco with $3.6 billion, Ethiopia with $3.3 billion. In addition, South Africa is positioned as the leading African investor in the continent with a total direct investment of $27 billion (UNCTAD, 2019).

The dynamics of mergers and acquisitions in Africa indicate an increasingly frequent growth in business involving targets of different nationalities, offering attractive growth opportunities for multinationals, but also risks of uncertainty, which make the relationship between partners more subtle (Chalençon, 2020). For Sholes (2005), the growth of the African market remains generally disrupted by political and regulatory constraints which interact to influence the rationale, processes and results of mergers and acquisitions. Luiz and Charalambous (2009) assume that the political and economic stability of countries remains the main explanatory factor for the expansion of mergers and acquisitions in Africa. The authors add that more developed countries can use mergers and acquisitions strategies to exploit the profitability and long-term growth potential of neighboring underdeveloped markets and expand their presence on the African continent (Adeleye and al., 2018 ). DeBerry-Spence and Dadzie (2008) concluded in their studies on the characteristics of the culture of global companies established in African markets, that it is the cultural similarities that confer power of trust between acquirers and targets favoring a good synergy between countries that share the common challenges and cultural ties less distinct from other economies. Other authors like Estrin and al. (2016) and Hitt (2016) claim that it is the institutional quality of countries that influences the success of mergers and acquisitions, and more specifically their degrees of influence on the markets, in terms of their ability to support or hinder companies in their location strategies and to guarantee their rights as foreign investors. The quality of institutions also attests to the level of corruption, and the presence of common practices such as favoritism and illicit agreements between institutions (Malhotra and al., 2009 ; Opsahl and Lacoste, 2018). It should be noted that African countries have the highest score in the world in terms of corruption index (Transparency International, 2019). Add to this the political, social, and economic characteristics of African countries, which create real challenges for foreign buyers and the success of mergers and acquisitions.

For Akinbuli and Kelilume (2013), mergers and acquisitions carried out in Africa certainly lead to good growth but not to performance improvements, especially when it is a hostile operation, imposed by regulation. Indeed, the degree of economic policy uncertainty in countries slows the evolution of the number and volume of transactions, especially in the case of cross-border mergers and acquisitions (Zhou and al., 2021). Conversely, other authors such as Adegoroye and Oladejo (2012), claim that mergers and acquisitions play an important role in improving the governance of African companies and the performance of sectors, especially in times of crisis, and that this allows African companies to stay in business and promote business in the regions (Aduloju and al., 2008). Several studies have analyzed the motivations and explanatory factors behind the use of mergers and acquisitions strategies. The majority of these research works consider that the main objective of the implementation of mergers and acquisitions is the achievement of performance (Hodgkinson and Partington, 2008 ; Chalençon, 2011; Jacque, 2019). The results of Healy and al. (1992) confirm the achievement of performance during mergers and acquisitions and show positive effects on the profitability of merged companies. Gugler and al. (2003) concluded that mergers and acquisitions lead to significant increases in profits for shareholder. Similarly, Moeller and al. (2005) confirm that mergers and acquisitions generate positive abnormal returns, creating value for shareholders. Triky and al. (2011) add that mergers and acquisitions carried out by companies with previous experience in Africa record higher returns. Given the above, we test the following basic hypothesis:

H 1: mergers and acquisitions in North Africa generate positive stock market returns.

Financing Methods

Many hypotheses and theories have been developed to explain the financing decision during mergers and acquisitions, whether for financing in cash only, shares only or a combination of the two (Nivoix and Briciu, 2009). Myers and Majluf (1984) in their theory of the pecking order recommend that companies tend to use the methods allowing to diffuse the bare minimum of information on the market. As a result, they consider that cash financing responds perfectly to information literacy objectives. However, other criteria such as the insufficiency of internal resources, the influence of market preferences for a specific method of financing or the effect of taxes on capital gains can push firms to opt for other methods of financing.

The cash financing method is a means widely used in mergers and acquisitions transactions, in particular when it concerns an unlisted target (Rocap, 2018; André and al., 2018). According to Myers and Majluf (1984), acquirers tend to opt for cash offers if they believe that their company is undervalued, while they prefer other means of financing if they believe that their company is overvalued. Indeed, the market interprets a cash offer as good news about the true value of the acquiring firm (Travlos, 1987). Martin (1996) explains this by the fact that cash financing warns other stock market players that there are significant potential gains with significant returns. Linn and Switzer (2001) also note that the return of merged companies is higher during cash-financed transactions. Franks and al. (1988) believe that if acquirers are well informed of the high value of the target, they will be ready to offer cash to avoid sharing these gains with the target.

By highlighting the role of banks in financing mergers and acquisitions, the transactions financed by cash through bank loans record more performance since banks use their information and evaluation capacity to identify good acquisitions (Marina and al., 2008). However, overconfident acquirers with liquid short-term investment positions are more likely to opt for cash financing without having to resort to bank loans in the first place (Malmendier and Tate, 2008), consistent with hierarchical order and hubris theories. Huang and Walkling (1987) support the idea that the targets can achieve significant stock market returns if one masters the method of financing to be used, the degree of resistance of the targets and the type of offer. The authors add that there is an inseparable interdependence between these three characteristics and specifies that cash payment offers are sources of wealth creation for shareholders. In the light of these findings, cash financing is the means most used to finance a value-creating merger-acquisition operation. On this basis, we propose the following hypothesis:

H 2: the return on cash-financed mergers and acquisitions is higher than other financing methods.

Unlike cash, equity financing makes it possible to carry out a merger-acquisition without using cash or resorting to bank debt, and to save more taxes, because cash financing is taxed immediately while the tax on shares is deferred until the date of the actual sale. On the other hand, equity financing takes longer than other methods to complete the transaction, and involves more costs and legal procedures to complete the transaction (Brown and Ryngaert, 1991; Yang, and al, 2019). For Bragg (2008) this method of financing is used when the buyers do not have short-term liquid investment positions. Fishman (1989) considers payment by shares as a more risky offer compared to cash, because the value of a shares depends on the profitability of the acquisition, while the cash value does not. Mitchell and Stafford (2000) find that equity-financed mergers and acquisitions create negative abnormal returns for acquiring shareholders, especially over the long term. Heron and Lie (2002) add that acquiring companies often disappoint their investors in transactions paid for in shares. Tao and al. (2017) observes a drop in returns for acquirers who opted for equity financing, when they already had excess cash, and explains this by agency theory. Cho and Ahn (2017) conclude in a study carried out on cross-border mergers and acquisitions that equity financing negatively impacts the market value of acquirers over the long term. Similarly, Fischer (2017) finds short- and long-term underperformance of equity-financed mergers and acquisitions.

Actually, the choice of the mode of equity financing seems less probable insofar as the market recognizes this source of financing and reacts negatively, because it interprets this information as a sign of overvaluation of the target company ( Goergen and Renneboog, 2004) . This finding is confirmed by Savor and Lu (2009) who believe that managers opt for equity financing when the company’s shares are overvalued by the market, and will subsequently experience a negative correction in their stock market prices. Therefore, the acquirer tries to minimize the risk by paying targets per share. Marina and al. (2008) add that scientific research provides evidence supporting the idea that incorrect evaluation of targets is also an important reason for choosing equity as a means of financing. Based on these findings, we propose the following hypothesis:

H 3: Equity financing is used less in the North Africa region and generates lower returns.

Mixed financing is a transaction that includes a portion in cash and a portion in shares, thus offering the advantage to the acquirer of minimizing both the outflow of cash required to purchase the target and the dilution of control of the acquirer. Scheuering (2014) thinks that in mixed finance transactions, the abnormal returns of the acquirer and the target company are different from other modes of financing. Eckbo and Langohr (1989) found empirically that abnormal returns are positive and significantly higher in mixed finance. On the other hand, Kling and al. (2014) specify that target returns are not significant in mixed finance transactions. As for Kalinowska and Mielcarz (2014b), they analyzed the Eastern European market in terms of average return on assets and the choice of a specific mode of financing, the latter confirming a lower return during a mixed financing compared to other methods. In fact, it is the asymmetry of information that explains the attitudes of the acquirer and the target in terms of risk sharing, and the choice of a combination of mixed financing.

Faccio and Masulis (2005a) point out that acquirers often justify the use of mixed financing by reducing the company’s level of indebtedness and risk sharing. It should also be noted that companies that carry out large mergers and acquisitions operations are often unable to obtain bank loans to finance the total amount of the operation in cash and may opt for mixed financing. In this case, the target can claim a higher price, which results in an overpayment borne by the acquirer (DePamphilis, 2003). Hansen (1987) ; Fischer (2017) and Yang and al. (2019) consider that the main methods used to finance mergers and acquisitions are cash and shares . For Liu and Ma (2018 ) acquirers do not attach enough importance to this method of mixed financing, which has only started to gain momentum in recent years, because it poses higher and more demanding requirements difficult for buyers and targets, especially at the time of negotiation. For the mixed financing method, we propose the following hypothesis:

H 4: mixed financing method remains few used in mergers and acquisitions carried out in North Africa.

Data and Methodology

Data

Our study covers a period of 20 years from 1999 to 2019 and concerns all mergers and acquisitions operations initiated by listed companies belonging to the North African region with listed or unlisted targets belonging or not to this region same region, and whose number was initially displayed at 541 operations. First, we collected our data from the Bloomberg and Thomson Reuters EIKON databases. Then we removed the transactions in progress or suspended (object of rumours), as well as those which do not correspond to a merger of two companies, such as buyouts and disposals in the context of recapitalization. To focus on relevant transactions, we have selected transactions whose value is greater than one million dollars and whose acquisition covers more than 10% of the target’s capital. Our final sample underwent a final filter of data availability and consequently reduced to 97 listed North African companies having carried out a merger and acquisition operation between 1999 and 2019.

To guarantee a correct interpretation of the results, we have separately studied the transactions carried out in periods impacted by the presence of an event that could influence the mergers and acquisitions market. We have therefore divided the total period, which is 20 years, into three sub-periods, namely: the pre-global financial crisis period from 1999 to 2006, the global financial crisis period from 2007 to 2008 and the post-financial crisis period from 2009 to 2019. Although these periods remain unbalanced, their analyzes will make it possible to capture and eliminate the effect of the global crisis in our research work.

Our study concerned companies in the North African region. This region includes from West to East, Morocco, Algeria, Tunisia, Libya, and Egypt. It should be noted that the selection criteria in our sample (including stock market listing) did not extract acquiring companies from Algeria and Libya, knowing that only 5 companies are listed on the Algerian stock exchange, and 15 companies on the Libyan stock exchange.

Performance Measurement

To analyze the reactions of stock market prices to announcements of mergers and acquisitions, and to financing methods used we employ the event study method. The basic idea of this method is to calculate the abnormal return attributable to the event under study. The event study method remains the method most used by the scientific community to measure returns from mergers and acquisitions operations ( MacKinlay , 1997 ; Ahern 2009 ; Ibrahimi , 2014; Chen and al., 2020).

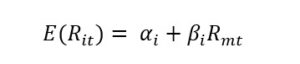

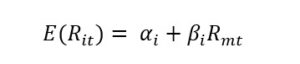

The first step in investigating the event is to define the event and identify the period over which the data involved in the event is examined. Several windows are proposed by different researchers to measure the impact of the short-term event, like MacKinlay (1997), our work will be based on a 5 day event window. We have set an estimation period of 120 days before the event. The second step is to calculate the abnormal returns using a regression where the parameters are defined in the estimation period according to the market model. Widely used as a benchmark in event studies (Ding and al., 2018), the market model assumes a linear relationship between the return of a specific shares and the return of the market portfolio. It is calculated as follows:

Where is the expected return, αi is the performance of shares based in market index, is the sensitivity of the firm’s return to market returns, is the return on the market portfolio.

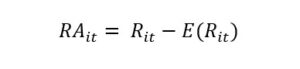

After anticipating the normal returns for each company, we calculated the abnormal returns for each day of the event period using the following equation:

Where is the abnormal return, is the actual observed return, and is the expected return.

Observing most event studies carried out on stock market performance, average abnormal returns are calculated and accumulated over a given number of periods to fully capture the effect of the event on the market:

- Accumulated Abnormal Return

- Cumulative Average Abnormal Return

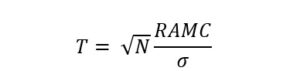

To demonstrate the robustness of the results obtained, we applied the significance test, as follows:

Where N is the sample number, RAMC is the average of the cumulative abnormal return and the standard deviation of the abnormal return.

Results and analyzes

Descriptive statistics

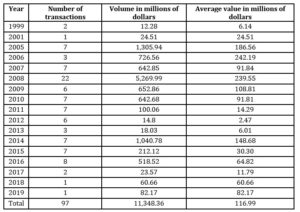

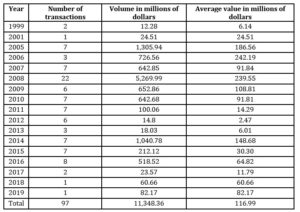

According to Table 1, we observe a pronounced variation in the number of transactions over time. In the first sub-period of our sample, from 1999 to 2006, the number of mergers and acquisitions operations was very low and represented only 14%, despite the importance of the amounts of the transactions. Over the following years, we see a substantial increase in the number of transactions and average volumes, for the sub-periods of 2007 to 2009 and 2010 to 2019 where we record 36% and 50% of merger activity respectively- sample acquisition. In neoclassical theory, waves of mergers and acquisitions are explained by the rational reactions of companies to industrial or technological shocks (Harford, 2005) or by Tobin’s Q where companies engage more in mergers and acquisitions when the average market value of companies is greater than the amount invested.

Table 1: Distributions of mergers and acquisitions by period

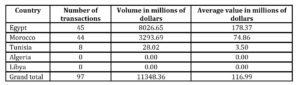

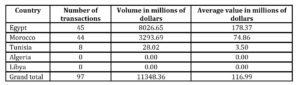

In terms of number of transactions, the sample studied places Egypt and Morocco in first place, far ahead of Tunisia, whose number of transactions represents only 8%. However, Egypt holds the largest proportion, with a 70% share in terms of the volume of mergers and acquisitions carried out in North Africa (Table 2).

Table 2: Distributions of mergers and acquisitions by country

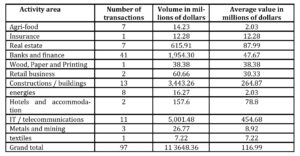

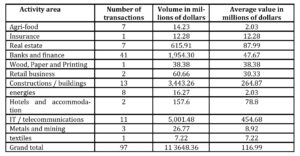

Table 3 classifies the transactions by sector of activity. In North Africa, nearly half of transactions are in the banking and finance sector, followed by the construction and building sector and the IT and telecommunications services sector.

Table 3: Distributions of mergers and acquisitions by sector

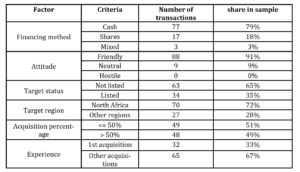

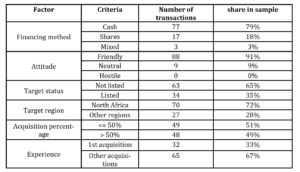

Table 4 provides additional descriptive statistics for a good understanding of the factors influencing the financing methods chosen during a merger-acquisition operation. We clearly observe the dominance of cash financing with a percentage of 79%, while equity financing represents only 17% of the sample and the mixed financing method shows a negligible number of transactions, representing 3% of the sample. No case of hostile acquisition has been identified. We also observe that 65% of the targets are unlisted companies and that almost half of our sample corresponds to acquisitions of more than 50% of the shares of the target. It should be noted that 67% of the companies in our sample have carried out more than one merger-acquisition operation and that only 28% of operations concern targets established outside the North African region.

Table 4: Characteristics of mergers and acquisitions transactions

Performance analysis

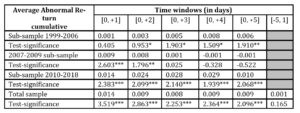

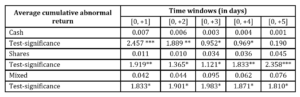

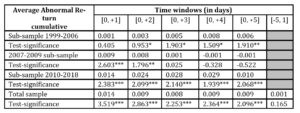

Table 5 presents our results obtained from the study of abnormal returns on 97 acquiring companies during the period from 1999 to 2019. The stock market reacted positively to announcements of mergers and acquisitions in the five windows, with the realization of significant abnormal returns based on Student test for all windows. We have extended our analyzes by dividing our period into three sub-periods: before the financial crisis of 2007, during the crisis and after the crisis. Our sub-sample from 1999 to 2006, which includes 12 companies, presents positive abnormal returns which become significant from the second window. The second sub-sample from 2007 to 2009, which includes 36 companies, recorded during this period positive abnormal returns in the first two windows, and negative returns in the last remaining windows. This underperformance can be linked mainly to the effects of the global financial crisis of 2007-2008 (Reddy and al., 2014). It should also be noted that this period was characterized by the completion of many mergers and acquisitions, despite the context of the crisis. Indeed, the financial crisis of 2008 changed the landscape of mergers and acquisitions by revealing new targets in new geographical areas. Thus, companies responded to the crisis by focusing more on growth outside their home regions (Grave and al., 2012). We should also add that this period coincided with the end of the sixth wave of mergers and acquisitions, which was fueled by expansion, globalization and government support for specific countries to make strong national and global champions (Chalençon, 2017). Our last sub-sample, which records 49 companies, also experienced a positive performance, which remains very significant throughout the period observed. To verify the absence of information leaks preceding the announcement of mergers and acquisitions in our sample, and which may influence the significance of the returns observed, we also calculated the average of the cumulative abnormal return recorded during the 5 days prior to the event, over a window of [-5, -1]. The test of the latter appears to be insignificant and confirms the absence of information leaks.

Table 5: Average cumulative abnormal returns by period and by financing method

*, ** and *** indicate significance levels of 10%, 5% and 1%.

Indeed, Table 5 shows us the presence of a cumulative abnormal return during the period of the announcement of mergers and acquisitions over short-term windows of 5 days after the event. We also find that these returns are positive and significant for the total sample. However, the breakdown of this sample into three periods shows a greater return at the level of the first and third sub-samples. The second sub-sample shows, at the level of certain windows, an underperformance during the years 2007 to 2009, caused by the effects of the financial crisis of 2007-2008. In conclusion, we confirm the first hypothesis:

H 1: mergers and acquisitions in North Africa generate positive stock market returns.

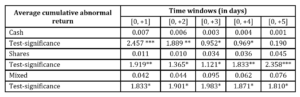

The results presented in Table 6 show the presence of abnormal returns recorded for the three financing methods used and which are significant in several windows. Nevertheless, in terms of value, these returns are higher in equity and mixed financing method, although cash is the most used medium in North Africa.

Table 6: Average cumulative abnormal returns by mode of financing

*, **, and *** indicate significance at the 10%, 5%, and 1% levels.

We also note, from the results detailed in Table 6, that the stock market return varies according to the mode of financing chosen by the investor to carry out the transaction of mergers and acquisitions, and that the operations financed by mixed and by shares generate an average cumulative return greater than the cash financing over all the periods observed. Contrary to what we expected, we therefore, reject the hypothesis below:

H 2: the stock market return of cash-financed mergers and acquisitions in North Africa is higher than other financing methods.

Given the statistics on equity financing which present 18% of our studied sample and given that the latter was constituted empirically (according to the country criterion), we believe that these statistics can be applied to the global sample, and we confirm the first part of our hypothesis below. On the other hand, we reject the second part of the said hypothesis, following the results showing higher returns from equity-financed transactions:

H 3: Equity financing is less usable in the North Africa region and yields lower returns.

As for mixed financing, it represents only 3% of our sample, so we cannot respond to our fourth hypothesis on the frequency of use of this method of payment. This hypothesis can be part of a future research work.

Discussion

In our article, we studied the short-term performance of mergers and acquisitions carried out in North Africa. The event study method allowed us to test the impact of the announcements of these operations in this region on the behavior of the stock market, by considering the financing mode criterion chosen by the investors to finance the operation. Our sample is composed exclusively of listed acquiring companies, whose transaction status is complete. By calculating and comparing cumulative abnormal returns following the market model, we find that mergers and acquisitions have a positive effect on the stock market. In line with numerous studies carried out in other regions, we can confirm the positive performance of mergers and acquisitions in North Africa.

The study supports our initial hypothesis that mergers and acquisitions transactions generate short-term returns. However, when we analyze only the mode of financing, we notice higher cumulative abnormal returns for equity and mixed financing, compared to cash. It should be noted that cash financing is very preferable in North Africa with a percentage of 79% based on our sample against 18% for equity financing. According to the signal theory, companies opt for cash financing, to send positive information to the merger and acquisitions market, which interprets this offer as good news as to the true value of the acquiring company.

Opposing to several studies confirming the performance of cash compared to other modes of financing, our results indicate the presence of higher returns during equity or mixed financing. It should also be noted that the African market is a market with a low form of efficiency and according to the theory of market efficiency, the form of the market has an influence on market capitalization, and thus on the choice of mode of financing. This can also be explained by the theory of information asymmetry on the attitudes of the acquirer and the target in terms of risk-sharing, and consequently, the choice of a specific mode of financing. As a result, acquirers opt for equity financing to share the risk of uncertainty and target valuation in the African market. Given that equity financing makes it possible to share the risks and possible financial losses resulting from an incorrect evaluation of a merger and acquisition transaction, we can also deduce that the primacy of the returns observed in our study during equity financing, probably comes from a better evaluation of targets financed by equity. African countries have still weak governance rules and practices linked to problems of transparency and institutional quality of the countries. In this case, the acquirer is likely to consider the exchange of shares as a safer, more profitable, and less risky means of financing, especially when it comes to a first merger-acquisition operation in the African market. Thus, the stability and the robustness of the institutions of the countries favor the success and the yield of mergers and acquisitions and reduce the risks of companies wishing to invest outside their country of origin. In the end and following the example of previous research cited in our literature review, we can say that there is an inseparable interdependence between information asymmetry, the mode of financing and the stock market return of mergers and acquisitions.

Conclusion

This document highlights the importance of financing methods chosen during mergers and acquisitions, as a value creation effect for African investors, particularly in the North Africa region. Through an empirical study of 97 companies, we were able to confirm that there are positive results on stock market performance, and even if the acquirer prefers payment in cash, payment in action can create more value than other financing methods. The North African market stands out in terms of the number and value of transactions carried out and paid mainly in cash but remains upset by institutional and cultural factors leaving a shortfall in terms of investments in the region. The results of this study could help to facilitate understanding and better identify the behavior of investors in Africa for financing practices and help business managers to understand the phenomenon of mergers and acquisitions which is gaining more and more scale in a region characterized by the scarcity of research in this field. The size of our representative sample and the absence of acquiring companies from Algeria and Libya present a limit for our research work. Future research can be the subject of a complementary scientific contribution, through studies led on a sample including acquiring companies from countries outside North Africa, and by pushing the analyzes on other characteristics and factors impacting the financing and performance of mergers and acquisitions in the region.

References

- Adegoroye, A.A., Oladejo, M., 2012. Strategic Human Resources Management practices in the Post Consolidated Nigerian commercial banks. European Journal of Business and Management 4, 168-176–176.

- Adeleye, I., Ngwu, F., Iheanachor, N., Esho, E., Oji, C., Onaji-Benson, T., Ogbechie, C., 2018. Banking on Africa: Can Emerging Pan-African Banks Outcompete Their Global Rivals? in: Adeleye, I., Esposito, M. (Eds.), Africa’s Competitiveness in the Global Economy, AIB Sub-Saharan Africa (SSA) Series. Springer International Publishing, Cham, pp. 113–136.

- Aduloju, S.A., Awoponle, A.L., Oke, S.A., 2008. Recapitalization, mergers, and acquisitions of the Nigerian insurance industry. Journal of Risk Finance 9, 449–466.

- Elhakeem, A., Elgiziry, K., 2016. The impact of acquisitions deals announcement according to financing decisions on value of listed acquiring companies at Egyptian Stock Exchange. Accounting and Finance Research 5, 115.

- Ahern, K.R., 2009. Sample selection and event study estimation. Journal of Empirical Finance 16, 466–482.

- Aka, 2019. Mergers and Acquisitions in Africa [WWW Document]. Our Africa, Our Thoughts. URL https://blogs.afdb.org/fr/blogs/afdb-championing-inclusive-growth-across-africa/post/mergers-and-acquisitions-in-africa-10163 (accessed 8.2.20).

- Akinbuli, S.F., Kelilume, I., 2013. The Effects of Mergers and Acquisition on Corporate Growth and Profitability: Evidence from Nigeria (SSRN Scholarly Paper No. ID 2147879). Social Science Research Network, Rochester, NY.

- André, P., Ben-Amar, W., Huang, Z., 2018. Entreprises familiales, richesse socio-affective et méthode de paiement des fusions et acquisitions (Family firms, socio-emotional wealth and the method of payment in mergers and acquisitions). Revue Française de Gouvernance d’Entreprise 19, 11–39.

- Berger, A.N., Ghoul, S.E., Guedhami, O., Roman, R.A., 2017. Internationalization and Bank Risk. Management Science 63, 2283–2301.

- Bodt, E.D., Cousin, J.-G., Imad’Eddine, G., 2013. Fusions-acquisitions et efficience allocationnelle. Revue d’economie financiere N° 110, 15–43.

- Boubakri, N., Chun, O.M., Triki, T., 2011. Does Good Governance Create Value for International Acquirers in Africa: Evidence from US Acquisitions. SSRN Electronic Journal.

- Bragg, S.M., 2008. Mergers and Acquisitions: A Condensed Practitioner’s Guide, 1 edition. ed. Wiley, Hoboken, N.J.

- Brown, D.T., Ryngaert, M.D., 1991. The Mode of Acquisition in Takeovers: Taxes and Asymmetric Information. The Journal of Finance 46, 653–669.

- Chalençon, L., 2020. Stratégies de Localisation des Acquéreurs et Influences des Institutions Formelles et Informelles sur les Fusions-Acquisitions. Finance Contrôle Stratégie N°23-2.

- Chalençon, L., 2017. Les stratégies de localisation et la création de valeur des fusions-acquisitions internationales. ISTE Editions, 350 p.

- Chalençon, L., 2011. La Performance des Fusions-Acquisitions : une Revue de la Littérature. Presented at the 2ème colloque franco-tchèque ” Trends in International Business “, p. 14p.

- Charles, A., Darné, O., Kim, J.H., Redor, E., 2016. Stock exchange mergers and market efficiency. Applied Economics 48, 576–589.

- Chen, F., Ramaya, K., Wu, W., 2020. The wealth effects of merger and acquisition announcements on bondholders: new evidence from the over-the-counter market. Journal of Economics and Business 107, 105862.

- Cho, H., Ahn, H.S., 2017. Stock payment and the effects of institutional and cultural differences: A study of shareholder value creation in cross-border M&As. International Business Review 26, 461–475.

- Clifford, C., 2015. Clifford Chance’s Insights into M&A Trends 2015 – Global Dynamics [WWW Document]. Clifford Chance. URL https://www.cliffordchance.com/content/cliffordchance/briefings/2015/02/clifford_chance_sinsightsintomatrends2015.html (accessed 5.12.20).

- CNUCED, 2019. World Investment Report – Special economic zone. CNUCED, Geneva.

- DeBerry-Spence, B., Dadzie, K.Q., 2008. Culture and marketing in emerging market economies. Journal of Business & Industrial Marketing 23.

- Deng, B., 2014. Analysis of Financial Risk Prevention in Mergers and Acquisitions. International Business and Management 9, 138–144.

- Deng, P., Yang, M., 2015. Cross-border mergers and acquisitions by emerging market firms: A comparative investigation. International Business Review 24, 157–172.

- DePamphilis, D.M., 2003. Mergers, Acquisitions, and Other Restructuring Activities: An Integrated Approach to Process, Tools, Cases, and Solutions. Academic Press.

- Ding, Y., Hicks, D., Ju, J., 2018. The Secondary Market Impact of Quality and Pricing Decisions for New Product Generations. Pacific Economic Review 23, 309–355.

- Eckbo, B.E., Langohr, H., 1989. Information disclosure, method of payment, and takeover premiums: Public and private tender offers in France. Journal of Financial Economics 24, 363–403.

- Estrin, S., Meyer, K.E., Nielsen, B.B., Nielsen, S., 2016. Home country institutions and the internationalization of state-owned enterprises: A cross-country analysis. Journal of World Business 51, 294–307.

- Faccio, M., Masulis, R., 2005a. The choice of payment method in european mergers and acquisitions. Journal of Finance 60, 1345–1388.

- Faccio, M., Masulis, R.W., 2005b. The Choice of Payment Method in European Mergers and Acquisitions. The Journal of Finance 60, 1345–1388.

- Ferchichi, R., Souam, S., 2015. Caractéristiques, motivations et performances des fusions et acquisitions en Tunisie. Revue d’économie industrielle 9–50.

- Fischer, M., 2017. The source of financing in mergers and acquisitions. The Quarterly Review of Economics and Finance 65, 227–239.

- Fishman, M.J., 1989. Preemptive Bidding and the Role of the Medium of Exchange in Acquisitions. The Journal of Finance 44, 41–57.

- Franks, J.R., Harris, R.S., Mayer, C., 1988. Means of Payment in Takeovers: Results for the United Kingdom and the United States. Corporate Takeovers: Causes and Consequences 221–264.

- Gao, L., Tao, F., Liu, X., Xia, E., 2017. Do Cross-border Mergers and Acquisitions Increase Short-term Market Performance? The Case of Chinese Firms. International Business Review 26.

- Ghauri, P., Mayrhofer, U., 2016. Les relations entre multinationales et gouvernements dans les économies émergentes (No. hal-01299581), Post-Print. HAL.

- Goergen, M., Renneboog, L., 2004. Shareholder Wealth Effects of European Domestic and Cross-border Takeover Bids. European Financial Management 10, 9–45.

- Grave, K., Vardiabasis, D., Yavas, B., 2012. The Global Financial Crisis and M&A. International Journal of Business and Management 7, p56.

- Gugler, K., Mueller, D., Yurtoglu, B., Zulehner, C., 2003. The effects of mergers: an international comparison. International Journal of Industrial Organization 21, 625–653.

- Hansen, R.G., 1987. A Theory for the Choice of Exchange Medium in Mergers and Acquisitions. The Journal of Business 60, 75–95.

- Harford, J., 2005. What drives merger waves? Journal of Financial Economics 77, 529–560.

- Healy, P.M., Palepu, K.G., Ruback, R.S., 1992. Does corporate performance improve after mergers ? Journal of Financial Economics 31, 135–175.

- Heron, R., Lie, E., 2002. Operating Performance and the Method of Payment in Takeovers. Journal of Financial and Quantitative Analysis 37, 137–155

- Hitt, M.A., 2016. International Strategy and Institutional Environments. Cross Cultural & Strategic Management 23.

- Hodgkinson, I., Partington, G., 2008. The Motivation for Takeovers in the UK. Journal of Business Finance & Accounting 35, 102–126.

- Huang, Y.-S., Walkling, R.A., 1987. Target abnormal returns associated with acquisition announcements: Payment, acquisition form, and managerial resistance. Journal of Financial Economics 19, 329–349.

- Ibrahimi, M., Liassini, J.E., 2021. Mergers and acquisitions in Morocco: reality and perspectives. International Journal of Emerging Markets.

- Ibrahimi, M., Taghzouti, A., 2014. Les fusions et acquisitions : un paradoxe toujours inexpliqué. Recherches en Sciences de Gestion 99–116.

- Jacque, L.L., 2019. International Corporate Finance : Value Creation with Currency Derivatives in Global Capital Markets. John Wiley & Sons.

- Kalinowska, A., Mielcarz, P., 2014. Methods of Payment in M&A Transactions and the Operational Performance of Acquirers (SSRN Scholarly Paper No. ID 2419742). Social Science Research Network, Rochester, NY.

- Kanungo, R.P., 2021. Payment choice of M&As: Financial crisis and social innovation. Industrial Marketing Management 97, 97–114.

- Kling, G., Ghobadian, A., Hitt, M.A., Weitzel, U., O’Regan, N., 2014. The Effects of Cross-border and Cross-industry Mergers and Acquisitions on Home-region and Global Multinational Enterprises. British Journal of Management 25, S116–S132.

- Linn, S., A Switzer, J., 2001. Are Cash Acquisitions Associated with Better Post-Combination Performance Than Stock Acquisitions? Journal of Banking & Finance 25, 1113–1138.

- Liu, Y., Ma, D., 2018. Research on the Correlation between Payment Methods of M&A and M&A Performance of Listed Company. International Journal of Economics and Finance 10, p90.

- Luiz, J., Charalambous, H., 2009. Factors influencing foreign direct investment of South African financial services firms in Sub-Saharan Africa. International Business Review 18, 305–317.

- MacKinlay, A.C., 1997. Event Studies in Economics and Finance. Journal of Economic Literature 35, 13–39.

- Malhotra, S., Sivakumar, K., Zhu, P., 2009. Distance factors and target market selection: the moderating effect of market potential. International Marketing Review 26, 651–673.

- Malmendier, U., Tate, G., 2008. Who makes acquisitions? CEO overconfidence and the market’s reaction. Journal of Financial Economics 89, 20–43.

- Martin, K.J., 1996. The Method of Payment in Corporate Acquisitions, Investment Opportunities, and Management Ownership. The Journal of Finance 51, 1227–1246.

- Martynova, M., Renneboog, L., 2008. What Determines the Financing Decision in Corporate Takeovers: Cost of Capital, Agency Problems, or the Means of Payment? (SSRN Scholarly Paper No. ID 1192566). Social Science Research Network, Rochester, NY.

- mergermarket, 2012. Deal Drivers in Africa: A comprehensive review of African M&A [WWW Document]. URL http://www.mergermarket.com/PDF/Deal_Drivers_Africa.pdf (accessed 5.12.20).

- Mitchell, M.L., Stafford, E., 2000. Managerial Decisions and Long-Term Stock Price Performance. The Journal of Business 73, 287–329.

- Moeller, S.B., Schlingemann, F.P., Stulz, R.M., 2005. Wealth Destruction on a Massive Scale? A Study of Acquiring-Firm Returns in the Recent Merger Wave. The Journal of Finance 60, 757–782.

- Myers, S.C., Majluf, N.S., 1984. Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics 13, 187–221.

- Nivoix, S., Briciu, L., 2009. Les déterminants du mode de paiement lors des fusions et acquisitions. La Revue du Financier 178–179, 23–34.

- Opsahl, H.M.D., Lacoste, D., 2018. L’influence des caractéristiques des pays hôtes sur le choix des modes d’entrée des entreprises indiennes. Finance Contrôle Stratégie, N° NS-2.

- Pervez, N.G., I. Hassan, 2014. Significance of Mergers and Acquisitions, in: Evaluating Companies for Mergers and Acquisitions, International Business and Management. Emerald Group Publishing Limited, pp. 5–17.

- Reddy, K.S., Nangia, V.K., Agrawal, R., 2014. The 2007–2008 Global Financial Crisis, and Cross-border Mergers and Acquisitions: A 26-nation Exploratory Study. Global Journal of Emerging Market Economies 6, 257–281.

- Refinitiv, 2020. Global Mergers & Acquisitions Review [WWW Document]. URL https://thesource.refinitiv.com/TheSource/getfile/download/227a1b8c-01d8-4254-b4d7-e2b31d13cc85 (accessed 9.9.21).

- Rocap, G.& L., 2018. Mergers, Acquisitions, and Buyouts, December 2018 Edition (5 vols) (IL). Wolters Kluwer Law & Business.

- Samet, K., 2010. Banking and Value Creation in Emerging Market. International Journal of Economics and Finance 2, p66.

- Savor, P.G., Lu, Q., 2009. Do Stock Mergers Create Value for Acquirers? The Journal of Finance 64, 1061–1097.

- Scheuering, U., 2014. M&A and the Tax Benefits of Debt-Financing (SSRN Scholarly Paper No. ID 2411937). Social Science Research Network, Rochester, NY.

- Sehoole, M.T.C., 2005. The politics of mergers in higher education in South Africa. High Educ 50, 159–179.

- Tarba, S., Brock, D., Calipha, R., 2010. Mergers and acquisitions: A review of phases, motives, and success factors, in: Advances in Mergers and Acquisitions, Advances in Mergers and Acquisitions. Emerald Group Publishing Limited, pp. 1–24.

- Transparency Internationa, n.d. Global Corruption Barometer: Middle East and North Africa 2019 [WWW Document]. Transparency.org. URL https://www.transparency.org/en/publications/global-corruption-barometer-middle-east-and-north-africa-2019 (accessed 2.15.21).

- Travlos, N.G., 1987. Corporate Takeover Bids, Methods of Payment, and Bidding Firms’ Stock Returns. The Journal of Finance 42, 943–963.

- Vanwalleghem, D., Yildirim, C., Mukanya, A., 2020. Leveraging local knowledge or global advantage: Cross border bank mergers and acquisitions in Africa. Emerging Markets Review 42, 100656.

- Wilson, M.K., Bala, A.P., 2019. Regional Integration and Cross-Border Mergers and Acquisitions in Africa. Journal of Economic Integration 34, 109–132.

- Yang, J., Guariglia, A., Guo, J. (Michael), 2019. To what extent does corporate liquidity affect M&A decisions, method of payment and performance? Evidence from China. Journal of Corporate Finance 54, 128–152.

- Yuan, Z., Ye, Z., Ma, J., 2016. The effect of different payment methods on M&A performance – An empirical analysis based on the panel data of Shanghai and Shenzhen A-share market. SHS Web of Conferences 25, 02005.

- Zhou, K., Kumar, S., Yu, L., Jiang, X., 2021. The economic policy uncertainty and the choice of entry mode of outward foreign direct investment: Cross-border M&A or Greenfield Investment. Journal of Asian Economics 74.