Introduction

Tax evasion has always been a topic of interest to governments, scholars and tax experts given its widespread adoption (Benk et al., 2016) and its drastic consequences on the economy (Khalil and Sidani, 2020). A profound understanding of the determining factors of tax evasion is thus necessary to improve the tax collection process and reduce the negative magnitudes of this behavior. Several studies have examined this topic from different perspectives. Earlier studies have looked at the topic from an economic point of view (Allingham and Sandamo, 1972; Posner, 2000) by focusing simply on the financial impact of tax evasion. These studies have been criticized for ignoring other non-economics factors affecting tax evasion such as demographics, social and psychological factors. This limitation has led to the emergence of behavioral studies that acknowledged the fact that taxpayers are human beings that can be affected by their culture, values, community and demographic variables (Hasseldine and Bebbington, 1991; Kirchler, 2007). Some recent studies have also investigated taxpayers’ perception of the severity of tax evasion (Benk et al., 2015a; Preobragenskaya and McGee, 2016; James et al., 2019).

Studies that have explored the influence of demographic variables such as age, gender and income on tax evasion (Jackson and Milliron, 1986; Devos, 2008; Ross and McGee, 2011) have been mainly conducted in western countries where the tax system is rather regulated. Moreover, studies that have tackled the topic from various religious standpoints by examining tax evasion ethics in Islam (McGee, 1997), Christianity (Gronbacher, 1998) and Judaism (McGee and Cohn, 2006) have mostly been conducted in communities which lack of religious diversity. While Khalil and Sidani (2020) investigated tax evasion attitudes in Lebanon, the primary focus of their study was the impact of the religiosity and spirituality of taxpayers on their tax behavior. Unlike earlier studies on the topic that have examined the impact of demographic variables on tax evasion in western countries and in communities predominated by specific religions, this study contributes to the literature by thoroughly examining the demographics of tax evasion in Lebanon, a religiously diversified country, suffering from a high corruption level (Sidani et al., 2014) and a high tax evasion gap (The Daily Star, 2018). Another contribution of this study is that it takes into consideration the motives behind tax evasion while analyzing variances based on demographics. Though some people are motivated by their selfish desire to reduce their tax payment, others evade taxes simply because they believe that the tax system is unfair. To assess the drivers behind tax evasion, the study distinguishes between two types of tax evasion: Self-interest tax evasion (SITE) which emanates from taxpayers’ selfish desire to increase personal benefits and Justice of tax system tax evasion (JSTE) which emerges from the perception of inequity in the tax system. The aim is to aid academicians and policymakers to understand the factors leading to non-compliance in Lebanon in an attempt to reduce tax evasion behavior.

Literature Review

Earlier studies have inspected the influence of demographic variables on ethical conduct in general and specifically on tax evasion attitudes. While the results were inconclusive, several demographic factors were suggested as determinants of tax evasion such as age, gender, education, income level, religion, etc. The following sections scrutinize the literature on the topic and present the research questions of the study.

Age and Tax Evasion

According to Jackson and Milliron (1986), age is one of the most important determinants of tax evasion. In fact, most studies that analyzed this relationship found that older individuals are more opposed to tax evasion than younger ones (Tittle, 1980; McGee and Tyler, 2006, McGee and Bose, 2008). A recent study by James et al. (2019) also indicates that older age groups have higher respect to law then younger generations. Tittle (1980) relates this finding to lifecycle variations and generational differences. He suggests that older taxpayers are more risk averse and sensitive to penalties than younger ones which leads to lower tax evasion attitudes. He also states that each generation’s behavior relates to the period in which it was raised. Some studies, however, found no significant association between the two variables (Richardson, 2006).

According to Babakus et al. (2004), age influences ethical attitudes but this influence depends on culture. While older people in the USA, UK and France are more ethical than younger individuals, the opposite is true for Austrians. This study will test the association between Age and Tax Evasion attitudes in Lebanon, a new cultural context. Given the contradictions in the literature, the study will attempt to answer the following research question:

RQ1: How does the age of Lebanese taxpayers influence their attitudes towards tax evasion?

Gender and Tax Evasion

Many studies have compared the ethical attitudes of men and women. Most studies have found that women are more ethical than men (Beltramini et al., 1984; Ruegger and King, 1992; Hoffman, 1998). Others have found insignificant association between the two variables (Harris, 1990; Kum-lung and Teck-Chai, 2010). A few studies have found that men are more ethical than women (Barnett and Karson, 1987; Weeks et al., 1999).

Some studies have specifically examined the association between gender and tax evasion attitudes. Women were found to be more opposed to tax evasion in most studies (Alm and Torgler, 2004; McGee and Guo, 2007; McGee and Tyler, 2006). Insignificant association was found in several studies including McGee and Ho (2006) and Richardson (2006). Men were found to be more opposed to tax evasion only in few studies (McGee and Tusan, 2006).

Given the inconclusiveness of the results, this paper looks at the relationship between gender and tax evasion attitudes in a new Middle Eastern context, Lebanon. To this end, the below research question was formulated:

RQ2: How does the gender of Lebanese taxpayers influence their attitudes towards tax evasion?

Education and Tax Evasion

Education is another proposed determinant of tax evasion that was discussed in the literature. However, findings were inconclusive. While Kasipillai et al. (2003) and McGee and Tyler (2016) found that less educated people are more opposed to tax evasion than better educated people, Song and Yarbrough (1978), Wallschutzky (1984), Witte and Woodbury (1985) and Richardson (2006) found that tax evasion decreases, the higher the level of general education. In order to get a better understanding of the relationship between education and tax evasion, the following research question will be explored:

RQ3: How does the educational level of Lebanese taxpayers influence their attitudes towards tax evasion?

Income Level and Tax Evasion

The level of income has always been considered as a major factor influencing tax evasion behavior (Kirchler et al., 2010). Porcano (1988) found that tax evasion is more common among lower income individuals. Other studies suggest that individuals in high income brackets have a higher tendency to evade taxes (Anderhub et al., 2001). Khalil and Sidani (Forthcoming) also found that income tempers the relationship between tax evasion and other variables. McGee (2012) discussed this association from two points of view. From one side, high income people are expected to be more engaged in tax evasion to avoid being overtaxed. On the other hand, poor people are sought to evade taxes given their inability to satisfy their basic needs. McGee (2012) came to the conclusion that despite the fact that there is no discernable trend for the relationship between income and tax evasion, the level of income influences tax evasion. To further analyze this relationship, this study will attempt to answer the following research question:

RQ4: How does the income level of Lebanese taxpayers influence their attitudes towards tax evasion?

Religion and Tax Evasion

Religion is sought to be an important factor influencing people’s ethical behavior (Zimbardo and Ruch, 1979). Several studies have looked at tax evasion from a religious perspective by investigating the influence of religion on tax evasion and tax behavior in Christian, Muslim, Jewish and other religious traditions (Al-Ttaffi and Abdul-Jabbar, 2015; Benk et al., 2015b; Gronbacher, 1998, Strielkowski and Čábelková, 2015). The results of earlier studies show that views towards tax evasion differ among different religions. However, no evidence on the involvement of individuals pertaining to a specific religion in tax evasion more than those affiliated with another religion was found. Previous studies tackling the topic from an Islamic perspective reveal that the payment of taxes is a legal and moral duty for Muslims. However, when the collected taxes are used to fund unethical activities, tax evasion would be permissible (Jalili, 2012). Crowe (1944) discusses tax evasion from a Christian perspective. Although tax evasion has never been endorsed in the bible (Schansberg, 1998), Crowe argues that only “just taxes” imposed by a legitimate authority and justly distributed to contribute to a fair cause should be paid. He adds that there is no moral obligation to pay taxes that do not apply to the definition of “just taxes”. Accordingly, the perception of taxpayers of the fairness of the tax system is eminent in determining their tax evasion attitudes. The present study will further investigate variances in tax evasion attitudes by exploring the following research question:

RQ5: How does the religion of Lebanese taxpayers influence their attitudes towards tax evasion?

Employment Type and Tax Evasion

Self-employed individuals have undoubtedly greater opportunities for tax evasion than salaried employees whose taxes are directly withhold by their employer. Engström and Holmlund (2009) found that households that have at least one self-employed member underreport their taxable income by around 30%. This practice is more common among the self-employed in unincorporated businesses. This study will further explore this relationship by investigating the below research question:

RQ6: How does the employment type of Lebanese taxpayers influence their attitudes towards tax evasion?

Methodology

Sample and data collection

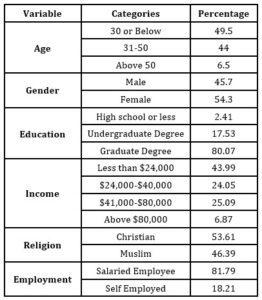

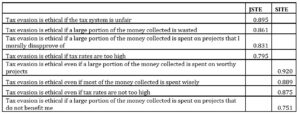

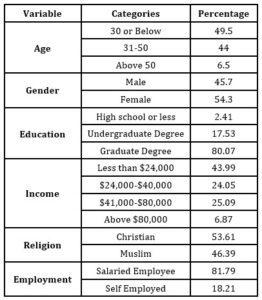

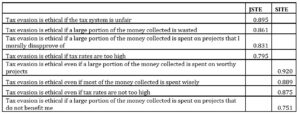

This study relies on online self-administered questionnaires to collect data. The questionnaire consisted of two sections: the first section collected demographic information about taxpayers and the second section collected data about tax evasion attitudes. The survey was adapted from Sidani et al. (2014). Attitudes towards tax evasion were measured by asking taxpayers if they believe that tax evasion is ethical in eight situations (Table 2). Some statements were indicators of Self-interest tax evasion (SITE) and others were indicators of Justice of tax system tax evasion (JSTE). A five-point Likert scale was used where 1 stands for strongly disagree and 5 stands for strongly agree. 359 taxpayers were initially surveyed, however the final number of valid completed surveys was 291 (47 surveys were incomplete and 21 surveys were completed by non-residents or unemployed individuals). Table 1 shows the diversified sample in terms of Age, Gender, Education, Income, Religion and Employment.

Table 1: Demographic distribution of Participants

Data Analysis

Principal Component Analysis (PCA) was conducted on the eight tax evasion statements. A Kaiser-Meyer-Olkin (KMO) measure of sample accuracy of 0.853 and a significant Bartlett’s test of sphericity (P<0.0001) indicated the suitability of the data for PCA. The PCA explains around 77% of the variance in tax evasion. Two factors having eigenvalue greater than 1 were generated. Listed below are the two identified factors:

Justice of Tax system tax evasion (JSTE) which represents tax evasion attitudes emanating from perceptions of injustice in the tax system. The factor included four statements with a Cronbach alpha of 0.884.

Self-interest tax evasion (SITE) which represents tax evasion attitudes emerging from the selfish desire of taxpayers. The factor included four statements with a Cronbach alpha of 0.903.

Table 2 displays the factors loading on each tax evasion statement.

Table 2: PCA analysis results

Results

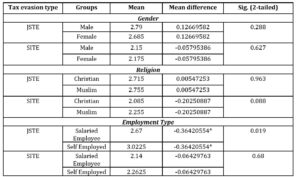

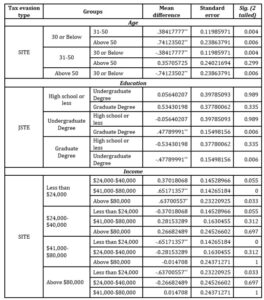

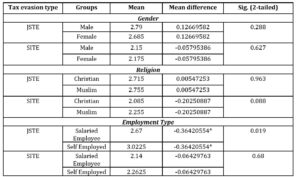

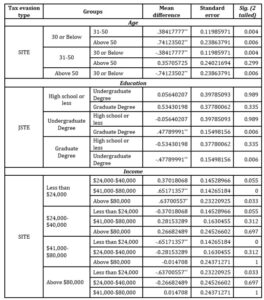

The study compares the mean scores of JSTE and SITE among different demographic groups in an attempt to determine variances in tax evasion attitudes based on demographic variables. When the means of two groups are compared, the t-test is used (Table 3), but when means of more than two groups are compared, one-way ANOVA and Tukey post hoc test (Table 4) are adopted.

Table 3: T-test results across gender, religion and employment type

*Significant at 0.05 level.

Table 4: Tukey post hoc results across Age, Education and Income

*Significant at 0.05 level, **Significant at 0.01 level.

Differences across Age groups

The one-way ANOVA was used to determine whether there are any statistically significant differences between the three age groups. The results show that there is a significant difference in the mean values of Self-interest tax evasion (SITE) between the different age groups (p<0.0001) but no statistically significant difference was found for Justice of system tax evasion (JSTE) (p=0.213). Tukey post hoc test (Table 4) shows that there is a statistically significant difference in SITE between the “30 or below” age group and each of the “31 to 50” (p= 0.004) and the “above 50” age groups (p = 0.006). The SITE mean scores for the three age groups are 2.365, 1.995 and 1.7475 respectively for the “30 and below”, “31 to 50” and “50 and above” age groups. A comparison of mean scores indicates that with age, taxpayers seem to express less favorable attitudes towards self-interest tax evasion.

Differences across Gender

The t-test results displayed in table 3 show no statistically significant variance in the mean values of both JSTE and SITE between males and females (P>0.05). Accordingly, gender seems to have no influence on tax evasion attitudes in Lebanon. Mean scores of JSTE and SITE are in the same range for both genders.

Differences across Education

ANOVA test results show that there is a significant difference in the mean scores of JSTE between the different educational groups (p<0.0001) but no statistically significant difference was found for SITE (p=0.687). Tukey post hoc test (Table 4) shows that there is only a statistically significant difference in JSTE between the “undergraduate” (Mean=3.1325) and the “graduate” (Mean=2.6325) group (p = 0.006). A comparison of mean scores shows that the higher the general educational level of taxpayers, the lower their tendency towards tax evasion.

Differences across Income

One-way ANOVA results show the presence of a significant difference in the mean of SITE between the different income levels (p<0.0001) but no statistically significant difference was found for JSTE (p=0.160). Tukey post hoc test (Table 4) shows that there is a statistically significant difference in SITE between the “less than $24,000” income level and each of the “$41,000 to $80,000” (p<0.0001) and the “above $80,000” income levels (p = 0.033). The mean scores for the three income levels are 2.4525, 1.82 and 1.7875 respectively which indicates that tax evasion attitudes decrease as income increases.

Differences across Religion

The t-test results exhibited in Table 3 show no statistically significant variance (p>0.05) in the mean values of both JSTE and SITE between the two studied religious affiliations, Islam and Christianity. Affiliation to a specific religion seems to have no influence on taxpayers’ attitudes towards tax evasion in Lebanon. Mean scores of SITE and JSTE for both religions displayed in table 4 are very comparable.

Differences across Employment Type

The t-test results displayed in Table 3 indicate no statistically significant variance (p>0.05) in the mean values of SITE based on employment status. However, a statistically significant variance (p=0.019) in the mean values of JSTE between salaried employees and self-employed individuals was found. A comparison of mean scores shows a higher tendency towards tax evasion among self-employed individuals (Mean=3.0225) than among salaried employees (Mean=2.67).

Discussion

The study explores variances in both types of tax evasion attitudes across several demographic variables in Lebanon. Findings show that tax evasion attitudes emanating from self-interest (SITE) decrease with age. This result is in line with the findings of previous studies (Tittle, 1980; McGee and Tyler, 2006; McGee and Bose, 2008) which also demonstrated that older individuals express more negative views towards tax evasion than younger people. As noted by Tittle (1980), a possible explanation for this finding is the maturity gained with age which renders individuals more risk averse and attentive to penalties. While young people are compulsive, older people in general tend to analyze the risks of their acts. The study also found no statistically significant variances across age groups in tax evasion attitudes emanating from the perception of injustice in the tax system (JSTE). This implies that despite the wisdom gained with age, people will express similar views towards tax evasion when they perceive the tax system as unfair.

The study also found that JSTE drops as the general educational level increases. This finding is in agreement with the results of Witte and Woodbury (1985) and Richardson (2006) who also indicated that tax evasion drops as the level of education increases. As the educational level rises, people seem to better comprehend the risks of tax evasion and its negative economic and societal consequences which might render them more reluctant to engage in such behavior.

Moreover, as noted by McGee (2012), this study demonstrates that income influences tax evasion. The results show that as income level increases, tax evasion emanating from self-interest (SITE) drops. This finding is consistent with Khalil and Sidani (2020) results. Given the harsh economic conditions in Lebanon, taxpayers in the lower income brackets tend to avoid the tax burden given their limited income and their inability to cover their basic needs. The same does not apply however to tax evasion attitudes emerging from perceptions of injustice in the tax system (JSTE). The lack of variance in JSTE across income groups could be explained by the fact that perceptions of taxpayers are comparable when they identify the tax system as unjust.

The findings of the study show also that self-interest tax evasion (SITE) is influenced by employment type. Unlike salaried employees who have limited opportunities to evade taxes, self-employed individuals have more tolerant views towards tax evasion. This outcome agrees with the results of Engström and Holmlund (2009) who also concluded that households with self-employed members engage more in tax evasion than those having exclusively salaried members.

A notable observation is that the variance in mean scores across demographic variables stands in certain cases for JSTE but not SITE and vice versa. Therefore, the influence of demographics differs based on the way taxpayers perceive the tax system. The perception of taxpayers of the fairness of the tax system plays an eminent role in their decision to comply or otherwise evade taxes (Khalil and Sidani, 2020). The Lebanese tax system characterized by an unjust tax distribution and a lack of transparency might constitute a motive for tax evasion.

Implications for research and practice

This study has shown that demographic variables notably age, education, income and employment type affect tax evasion attitudes in Lebanon. However, this influence might vary with culture. Further studies on the topic could explore the demographics of tax evasion in other cultural context and identify variances based on culture. Variances in tax evasion across other demographic variables such as industry type and employment sector could also be explored in upcoming studies. Further longitudinal studies on the topic could also complement the work.

On the practical level and in light of the empirical findings, this study assists the government and tax authorities in identifying the typology of taxpayers that are more prone to tax evasion. Accordingly, tax authorities could more effectively target tax audits in respect of non-compliers based on the results of the study.

Moreover, the study shows that the perception of auditors of the tax system influences their tax evasion attitudes. An unfair tax system characterized by corruption, an unfair distribution of taxes and a lack of transparency could increase the motives behind tax evasion. While it is true that some demographic variables might affect the way people perceive tax evasion, their attitude could be affected by their perception of the fairness of the tax system. Therefore, the government should take measures to increase the justice of the tax system by reducing reliance on indirect taxes, increasing transparency and imposing taxes adapted to citizens’ capacity. Such measures might lead to a reduction in tax evasion occurrences.

Conclusion

This paper investigates the influence of several independent demographic variables on tax evasion in a Middle Eastern religiously diversified country suffering from a widespread tax evasion gap. The results are based on 359 collected surveys from Lebanese taxpayers. The findings failed to identify a significant variance in tax evasion based on gender and religion. However, results show variances in tax evasion attitudes influenced by age, education, income and employment type.

The study also explores motives behind tax evasion by dividing the dependent variable tax evasion into two types: Tax evasion stemming from perceptions of inequality in the tax system (JSTE) and tax evasion emanating from the selfishness of the taxpayer (SITE). The purpose of this subdivision was to determine whether the impact of demographics on tax evasion differs based on their perception of the justice of the tax system. As anticipated, results show a significant positive association between the age and income variables and SITE. On the other hand, the education and self-employment variables were positively related to JSTE.

In light of these findings, it can be concluded that the influence of demographic variables on tax evasion could stand for one type of tax evasion but not for the other. The motives behind tax evasion and the perception of taxpayers of the fairness of the tax system might influence such association and constitute in certain cases a main driver behind tax evasion. Accordingly, it is worthwhile for the government and tax authorities to take measures to increase the equity of the tax system in an attempt to improve tax compliance.

References

- Allingham, M. G. and Sandmo, A. (1972), ‘Income tax evasion: A theoretical analysis’, Journal of Public Economics, 1(3-4), 323–338.

- Alm, J. and Torgler, B. (2004), ‘Estimating the determinants of tax morale’, In Proceedings. Annual conference on taxation and Minutes of the annual meeting of the National Tax Association (Vol. 97, pp. 269-274). National Tax Association.

- Al-Ttaffi, L. H. A. and Abdul-Jabbar, H. (2015), ‘Does muslim view on tax influence compliance behaviour?’, Presented at the International Conference on Accounting Studies (ICAS), 17-20 August 2015, Johor Bahru, Johor, Malaysia.

- Anderhub, V., Giese, S., Güth, W., Hoffmann, A. and Otto, T. (2001), ‘Tax evasion with earned income-an experimental study’, FinanzArchiv/Public FinanceAnalysis, 58(2), 188–206.

- Babakus, E., Bettina Cornwell, T., Mitchell, V. and Schlegelmilch, B. (2004), ‘Reactions to unethical consumer behavior across six countries’, Journal of Consumer marketing, 21(4), 254-263.

- Barnett, J. H. and Karson, M. J. (1987), ‘Personal values and business decisions: An exploratory investigation’, Journal of Business Ethics, 6(5), 371-382.

- Beltramini, R. F., Peterson, R. A. and Kozmetsky, G. (1984), ‘Concerns of college students regarding business ethics’, Journal of Business Ethics, 3(3), 195-200.

- Benk, S., Budak, T., Püren, S. and Erdem, M. (2015a), ‘Perception of tax evasion as a crime in Turkey’, Journal of Money Laundering Control, 18(11), 99-111.

- Benk, S., Budak, T., Yüzbas, B. and Mohdali, R. (2016), ‘The impact of religiosity on tax compliance among Turkish self-employed taxpayers’, Religions, 7(4), 37.

- Benk, S., McGee, R. W. and Yüzbas¸ i, B. (2015b), ‘How religions affect attitudes toward ethics of tax evasion? A comparative and demographic analysis’, Journal for the Study of Religions and Ideologies, 14(41), 202–223.

- Crowe, M. T. (1944), ‘The moral obligation of paying just taxes’, In The catholic university of America studies in sacred theology, 84, Doctoral dissertation.

- Devos, K. (2008), ‘Tax evasion behaviour and demographic factors: An exploratory study in Australia’, Revenue Law Journal, (18), 1- 44.

- Engström, P. and Holmlund, B. (2009), ‘Tax evasion and self-employment in a high-tax country: evidence from Sweden’, Applied Economics, 41(19), 2419-2430.

- Gronbacher, G. M. (1998), ‘Taxation: Catholic social thought and classical liberalism’, Journal of Accounting, Ethics & Public Policy, 1(1), 91.

- Harris, J. R. (1990), ‘Ethical values of individuals at different levels in the organizational hierarchy of a single firm’, Journal of Business Ethics, 9(9), 741-750.

- Hasseldine, D. J. and Bebbington, K. J. (1991), ‘Blending economic deterrence and fiscal psychology models in the design of responses to tax evasion: The New Zealand experience’, Journal of Economic Psychology, 12(2), 299–324.

- Hoffman, J. J. (1998), ‘Are women really more ethical than men? Maybe it depends on the situation’, Journal of Managerial Issues, 10 (1), 60-73.

- Jackson, B. R. and Milliron, V. C. (1986), ‘Tax compliance research: Findings, problems and prospects’, Journal of Accounting Literature, 5, 125–165.

- Jalili, A. R. (2012), ‘The ethics of tax evasion: An Islamic perspective’, In R. W. McGee (Ed.), The ethics of tax evasion: Perspectives in theory and practice. New York, NY: Springer.

- James, S., McGee, R.W., Benk, S.and Budak, T. (2019), ‘How seriously do taxpayers regard tax evasion? A survey of opinion in England’, Journal of Money Laundering Control, 22 (3), 563-575. https://doi.org/10.1108/JMLC-09-2018-0056

- Kasipillai, J., Aripin, N. and Amran, N. A. (2003), ‘The influence of education on tax avoidance and tax evasion’, eJTR, 1, 134.

- Khalil S. and Sidani Y. (2020), ‘The influence of religiosity on tax evasion attitudes in Lebanon’, Journal of International, Accounting, Auditing and Taxation, 40, 1-14.

- Khalil S. and Sidani Y. (Forthcoming), ‘Personality, traits, religiosity, income and tax evasion attitudes: An exploratory study in Lebanon’, Journal of International, Accounting, Auditing and Taxation.

- Kirchler, E. (2007), ‘The economic psychology of tax behaviour’, Cambridge University Press.

- Kum-Lung, C. and Teck-Chai, L. (2010), ‘Attitude towards business ethics: Examining the influence of religiosity, gender and education levels’, International journal of marketing studies, 2(1), 225-232.

- McGee, R. W. (1997), ‘The ethics of tax evasion and trade protectionism from an Islamic perspective’, Commentaries on Law and Public Policy, 1, 250–262.

- McGee, R. W. (2012), ‘Income level and the ethics of tax evasion’, In R. McGee (Ed.), The ethics of tax evasion. New York, NY: Springer.

- McGee, R. W. and Bose, S. (2008), ‘Attitudes toward tax evasion in the Middle East: A comparative study of Egypt, Iran and Jordan’, Working paper, Florida International University.

- McGee, R. W. and Cohn, G. (2006), ‘Jewish perspectives on the ethics of tax evasion’, Andreas School of Business Working Paper, Barry University.

- McGee, R. W. and Guo, Z. (2007), ‘A survey of law, business and philosophy students in China on the ethics of tax evasion’, Society and Business Review, 2(3), 299-315.

- McGee, R. W. and Ho, S. S. (2006), ‘The ethics of tax evasion: A survey of accounting, business and economics students in Hong Kong’, Available at SSRN: https://ssrn.com/abstract=869306 or http://dx.doi.org/10.2139/ssrn.869306

- McGee, R. W. and Tusan, R. (2006), ‘The Ethics of Tax Evasion: A Survey of Slovak Opinion’, Andreas school of business working paper series, Barry University.

- McGee, R. W. and Tyler, M. (2006), ‘Tax evasion and ethics: A demographic study of 33 countries’, Andreas School of Business Working Paper, Barry University.

- Porcano, T. M. (1988), ‘Correlates of tax evasion’, Journal of Economic Psychology, 9(1), 47–67.

- Posner, E. A. (2000), ‘Law and social norms: The case of tax compliance’, Virginia Law Review, 86(8), 1781–1819.

- Preobragenskaya, G. and McGee, R. W. (2016), ‘A demographic study of Russian attitudes toward tax evasion’, Journal of Accounting, Ethics and Public Policy, 17(1).

- Richardson, G. (2006), ‘Determinants of tax evasion: A cross-country investigation’, Journal of International Accounting, Auditing and Taxation, 15(2), 150-169.

- Ross, A. M. and McGee, R. W. (2011), ‘Attitudes toward tax evasion: A demographic study of Malaysia’, Asian Journal of Law and Economics, 2(3).

- Ruegger, D. and King, E. W. (1992), ‘A study of the effect of age and gender upon student business ethics’, Journal of Business Ethics, 11(3), 179-186.

- Schansberg, D. E. (1998), ‘The Ethics of Tax Evasion within Biblical Christianity: Are There Limits to Rendering Unto Caesar’, Journal of Accounting, Ethics & Public Policy, 1(1), 77–90.

- Sidani, Y. M., Ghanem, A. J. and Rawwas, M. Y. (2014), ‘When idealists evade taxes: the influence of personal moral philosophy on attitudes to tax evasion–a Lebanese study’, Business Ethics: A European Review, 23(2), 183-196.

- Song, Y. D. and Yarbrough, T. E. (1978), ‘Tax ethics and taxpayer attitudes: A survey’, Public administration review, 38 (5), 442-452.

- Strielkowski, W. and Čábelková, I. (2015), ‘Religion, culture, and tax evasion: Evidence from the Czech Republic’, Religions, 6(2), 657-669.

- The Daily Star (2018), ‘Tax evasion in Lebanon close to $5B: Bank Audi’ [Online], [Retrieved September 20, 2019], http://www.dailystar.com.lb/Business/Local/2018/Aug-09/459595-tax-evasion-inlebanon-close-to-5b-bank-audi.ashx.

- Tittle, C. R. (1980), ‘Sanctions and social deviance: The question of deterrence’, US Department of Justice, Office of Justice Program, [Retrieved October 20, 2021], https://www.ojp.gov/ncjrs/virtual-library/abstracts/sanctions-and-social-deviance-question-deterrence.

- Wallschutzky, I. G. (1984), ‘Possible causes of tax evasion’, Journal of economic psychology, 5(4), 371-384.

- Weeks, W. A., Moore, C. W., McKinney, J. A. and Longenecker, J. G. (1999), ‘The effects of gender and career stage on ethical judgment’, Journal of Business Ethics, 20(4), 301-313.

- Witte, A. D. and Woodbury, D. F. (1985), ‘The effect of tax laws and tax administration on tax compliance: The case of the US individual income tax’, National Tax Journal, 38(1), 1-13.

- Zimbardo, P. G. and Ruch, F. (1979), ‘Psychology and life’ (10th ed.), Glenview, IL: Scott, Foresman & Company.