Introduction

The automobile industry is a core industry for China’s economic and social development. With the rapid development of the economy and urbanisation, the demand for automobiles in China will continue to grow significantly in the future. With the rapid development of the automobile industry, the energy shortage and pollution caused by the production and use of automobiles are becoming increasingly serious, affecting the stable and sustainable development of China’s economy. Accelerating the cultivation and development of the new energy automobile industry is not only an urgent task to effectively alleviate energy tension and environmental pressure and promote the sustainable development of the automobile industry, but also an important strategic initiative to accelerate the transformation and modernisation of the automobile industry to create a new growth point and an industry with international competitive advantages.(Wei, 2013).

Taxation in the purchase and use of automobiles in China is analysed in terms of the total tax burden on individuals during the purchase and ownership of automobiles, as well as the specific taxes and fees for each act.

The subjects of this study are individuals purchasing domestic and imported automobiles; the differences in tax payments between Chinese residents purchasing domestic and imported automobiles are analysed. Finally, the article analyses the tax rates on new energy vehicles in China.

The purpose of this study is to analyse the taxation details in the process of purchasing and using domestic and imported cars in China.

Literature Review

As a pillar industry of the national economy, the automobile industry plays a key role in China’s industrial upgrading. Meanwhile, taxation is the ultimate economic lever for the government’s macro-control of the market. The authors (Zongwei et al., 2017) found that China’s auto tax system does not have sufficient impact on the market in terms of energy saving and emission reduction, and has limited incentives for small-emission vehicles. In addition, transport taxes in China vary across the stages of vehicle production, owner purchase, and subsequent operation. It was also noted that the scheme of distribution of tax revenues across phases was unreasonable.The Chinese transport taxation system is slated to undergo a number of changes, including giving smaller-engine vehicles more advantages, distributing taxes fairly across phases, and putting the concepts of “encouraging ownership and rationalizing use,” “targeted taxation,” and “burdening beneficiaries” into effect.

Chinese scholars Lin B. and Jia Z. investigate the relationship between the tax rate (direct tax on labor income), government revenues and economic performance in terms of the Laffer curve using a computed general equilibrium (CGE) model. The results show that the top of China’s Laffer curve is about 40%. The government should consider changes in the entire tax system, not just changes in direct taxes, when the direct tax rate increases. If China wants to maximize tax revenue, the direct tax rate should be 35%. They argue that the peak of government taxes is always 5-10% earlier than the top of the Laffer curve. So, if a country has reached the top of the Laffer curve, their article recommends that tax cuts have positive effects on the economy and government revenues (Lin and Jia, 2019).

In reaction to the burden of green energy and the country’s rapidly expanding automobile market, the Chinese government is considering enacting various energy and environmental taxes, such as a fuel tax, mileage restriction, or tax cut programs for low-emission vehicles (Sun et al., 2006).

The Chinese government has introduced several financial and other incentives to encourage the development and deployment of electric vehicles (EV). Driven by this policy, China’s EV sales in 2016 exceeded 500,000 units. However, EV subsidies will be cancelled after 2020. In order to maintain market stability, EV-related taxes need to be innovative. However, it is unclear how effective various tax incentives are. Using a discrete choice experiment with 247 respondents and a mixed Logit model, the article explores the effectiveness of several potential incentives (excluding subsidy policies) and the impact of psychosocial determinants. Electric vehicles are not subject to purchase restrictions (not subject to licence plate control policies) or usage restrictions in China. These two transport policy incentives have the most significant positive effect on the diffusion of EVs.In addition, free or heavily subsidized charging contributes significantly to the growing popularity of electric vehicles in China. The concept of priority access to dedicated bus lanes is becoming more and more popular. Wang N. contends that since the exemption from taxes on car purchases increases demand, it ought to be extended. However, other incentives (such lower parking costs) for using electric vehicles are less successful (Wang, 2017).

Research Methodology

The data in this article are taken from tax policy statements and declarations published by the State Tax Administration of the People’s Republic of China, the Ministry of Finance of the People’s Republic of China, the Customs Tariff Commission of the State Council, and the official website of the Ministry of Communications of the People’s Republic of China. Methods of mathematical analysis are used to calculate the amount of tax paid for the purchase and ownership of new and imported cars and domestically produced cars. A comparison method is used, as well as a comparative analysis method to compare the benefits of buying domestically produced cars.

Research Results

Consumption Tax

The purchase tax that is often mentioned when buying a car is actually an additional tax. As a matter of fact, automobile companies have to pay automobile production tax, including consumption tax, which is a kind of value-added tax. Automobile consumption tax is an additional tax introduced in the reform of the national tax system in 1994.

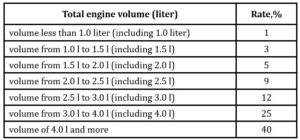

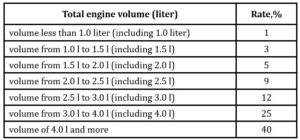

Automobile consumption tax is a tax levied on the amount of different sizes of automobiles sold by producers. From 1 September 2008, the Ministry of Finance and the State Administration of Taxation adjusted the automobile tax policy applicable only to producers, including increasing the consumption tax rate for large passenger cars and reducing the consumption tax rate for small-displacement passenger cars . Automobile consumption tax adjustments affect the macro-control of prices, markets and industries in a country.

Table 1. Adjusted consumption tax rate for passenger cars

Source:Public data from the State Administration of Taxation

Based on the priority objective of energy conservation and emission reduction, the Government has decided to use future emissions as the criterion for this tax.

Value Added Tax

Value added tax is understood as a value added tax levied on the added value created during the circulation of goods (including taxable services) as a tax base. A tax rate of 17% applies to car sales.

Excise tax on the purchase of a car

Taxation on the acquisition of motor vehicles is levied on the purchase process (including purchases, imports, including homemade, donated and rewarded vehicles). For individuals purchasing taxable vehicles for their own use, the tax rate is 10% of the value. The tax on the purchase of new vehicles using alternative energy sources remains favourable. After the termination of the purchase tax exemption for small cars, the purchase tax exemption for new energy vehicles has become a highlight.

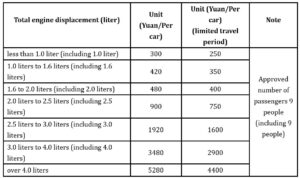

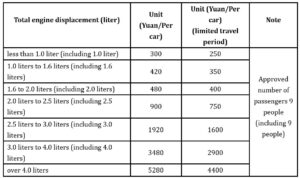

Tax on vehicles and vessels

Vehicle and vessel tax is also a tax levied on the use of vehicles. The tax is levied depending on the type of vehicle (e.g. motor vehicle, non-motorised vehicle, car, truck, etc.), tonnage and engine size. A distinction can also be made between vehicles travelling along public roads and the tracks of ships travelling along rivers, lakes or territorial sea ports. These vehicles must pay a vehicle tax before they are insured. The rate of payment of this tax is not consistent in different regions. Also, the amount of tax varies from region to region. Table 2 shows the rate of vehicle and vessel tax in Beijing.

Table 2. Tax rates on vehicles and vessels of the PRC (Beijing, capital city)

Source: Public data from Beijing Local Taxation Bureau.

Import duties (imported cars)

In order to protect local car brands from excessive competition, the Government has imposed relatively high import duties. Some of the country’s car companies have also been able to gain market share through price advantages. The legal framework for the collection of tariffs is the Customs Tariff Regulations of the People’s Republic of China promulgated by the State Council on 23 November 2003, which came into effect on 1 January 2004. Duties on imported vehicles are levied during the importation process. The duty paid price (i.e. CIF) is used as the basis for calculating the duty. The most-favoured-nation (MFN) duty rate is 25 %.

On 22 May 2018, the State Council’s Customs Tariff Commission published an announcement on the reduction of import tariffs on automobiles and parts from 2018 onwards. Due to China’s accession to the World Trade Organisation, it is safe to say that China will inevitably continue to reduce tariffs On imported cars. Reducing tariffs on imported cars immediately boosted sales of those cars. For example, in 2001, China imported just over 70,000 cars, and in 2014, it imported over 1.42 million cars. Although there was a decline in the following years, the total number is still high. It is evident that the reduction of tariffs on imported cars is indeed a favourable policy for the increasingly diversified automotive market.

In terms of market composition, there is little overlap between the consumer groups targeted by imported cars and domestic brands. At present, most of the imported cars sold in the market are medium- and large-displacement models, while domestic cars are mainly small- and medium-displacement models. Even if the prices of a few products are relatively close, there is generally no direct competition between them. Therefore, it can be said with certainty that the reduction of tariffs on imported cars will not have a significant impact on China’s domestic car market. Prices of imported cars have also risen as a result of costs such as customs clearance fees, commodity inspection fees and transport fees.

The used car market

The used car taxes include vehicle purchase tax, vehicle and vessel tax, vehicle insurance, passenger and cargo surcharges and so on. Vehicle Purchase Tax is a tax levied by the government on units and individuals purchasing automobiles. The current tax rate is 10 % of the taxable value of the vehicle. At present, vehicle and vessel tax is usually collected by insurance companies, i.e., together with compulsory insurance premiums. There are two types of car insurance in China: basic insurance and supplementary insurance. Participants can choose insurance based on standard insurance coverage and according to their needs. There is a close relationship between basic and supplementary insurance. In case of conflict between the terms of the supplementary insurance and the terms of the main insurance, the terms of the supplementary insurance shall prevail. If no additional insurance clause is specified, the main insurance clause shall prevail. Compulsory motor vehicle third party liability insurance is the first compulsory insurance system enacted by national legislation in China. Passenger and cargo surcharges are special mandatory fees levied by the State on legal entities and individuals engaged in passenger and cargo operations, and are determined by each Chinese province and city.

VAT For Electric Vehicles

New Energy Vehicles (NEVs) purchased between January 1, 2018 and December 31, 2020 are exempt from vehicle purchase tax. To date, this law has helped increase sales of low-emission vehicles. The Chinese government announced that it would cut subsidies on electric vehicles before they were completely canceled in 2020. In addition, in an effort to focus attention on the conditions for rolling out electric vehicles in China, the government has tightened the rules for the respective startups (Yang et. al., 2019). Also, the restriction on the number of license plates available for electric vehicles was lifted (of course, they remain limited for polluting vehicles (Yu et.al., 2020).

New Energy Vehicle Incentive Policy

In order to support the development of the new energy automobile industry and promote automobile consumption, the State Administration of Taxation of China has issued the “Catalogue of New Energy Automobile Models Exempted from Vehicle Purchase Tax.” From January 1, 2021, to December 31, 2022, the purchase of new energy vehicles will be exempted from vehicle purchase tax. At the same time, since pure electric passenger vehicles are not within the scope of the vehicle and vessel tax, they are exempt from the annual vehicle and vessel tax. In addition, since the first half of 2018, new energy vehicles can obtain special vehicle licenses in all cities in China. Starting from June 1, 2015, in Beijing, pure electric vehicles will not be subject to peak hours or traffic restrictions on working days. In Tianjin, Shanghai, and Guangzhou, new energy vehicles enjoy free special licenses, no bidding is required, and no restrictions are imposed. Other provinces and regions, such as Central China, South China, Southwest, Northwest and other regions also implement reductions and exemptions for new energy vehicle parking fees.

The Impact Of Tax Policies On Vehicle Sales

In October 2015, China decided to implement a preferential policy of halving the vehicle purchase tax on the purchase of passenger cars with an engine displacement of 1.6 liters and below, which obviously stimulated the Chinese automobile market.As shown in Figure 1,In 2016, the sales of passenger vehicles hit 24.293 million units, a record high in production and sales. On December 15, 2016, the Ministry of Finance of China officially announced that passenger cars with a displacement of 1.6 liters and below will be levied at a tax rate of 7.5% for vehicle purchase in 2017. Since then, starting from January 1, 2018, the statutory tax rate of 10% will be restored. In 2017, except for the obvious increase in sales in February, sales in the remaining months did not change much. Affected by the adjustment of the purchase tax preferential policy, the sales of passenger vehicles of 1.6 liters and below were 17.193 million, a year-on-year decrease of 1.1%. Compared with the same period last year in 2018, the growth rate in the first half of the year was significantly higher than that in the second half. In 2019, monthly sales of passenger cars showed a downward trend year-on-year. Although the passenger car market recovered in the fourth quarter, it was still lower than expected. Due to the Covid-19 pandemic, the monthly sales of passenger cars from January to April of 2020 showed a downward trend. From May, sales began to increase, and consumer demand began to grow, too, reflecting the recovery of household consumption in the wake of the pandemicCom.

Conclusion

In recent years, China’s domestically developed Chinese auto brands have made rapid progress. Compared to imported cars, many brands do not differ much in terms of technology, craftsmanship, handling and comfort. Taxes paid for the purchase of vehicles from Chinese car brands are low,Coupled with the price advantage, domestic auto brands are well received in China. The policy of exempting new energy vehicles from vehicle purchase tax and halving the collection of vehicle and vessel tax has driven the buyer’s market. At the same time, the policy of not collecting value-added tax on the central subsidies for the production and sales of new energy vehicles has also reduced the burden on enterprises. Efforts to support electric vehicles are clearly effective.

Fig. 1. Dynamics of sales of passenger cars in China

Source: Public data from China Association of Automobile Manufacturers (January 2021)

Acknowledgment

The authors would like to express their gratitude to the State Administration of Taxation for providing the automobile consumption tax data and the Beijing Local Taxation Bureau for providing the China vehicle and vessel tax rate data and China Association of Automobile Manufacturers for providing the Vehicle sales data from 2016 to 2020.

The authors extend their sincere thanks to Dr. Ruonan ZHAO (Ural State Mining University, Yekaterinburg, Russia) for providing technical assistance and the editor for thorough editing.

References

- Leontyeva, Y. and Mayburov, I. (2016), ‘Theoretical Framework for Building Optimal Transport Taxation Systen’, Journal of Tax Reform, 2(3), 193-207, DOI: 10.15826/jtr.2016.2.3.024.

- Lin, B. and Jia, Z. (2019),‘Tax rate, government revenue and economic performance: A perspective of Laffer curve’. China Economic Review, DOI: 10.1016/j.chieco.2019.101307.

- Sun, L., Muto, S., Tokunaga, S. and Okiyama, M. (2006), ‘Numerical Analysis of Environmental and Energy Policies Related on Automobiles in China: Evaluation by Dynamic Computable General Equilibrium Model’, Studies in Regional Science, 36(1), 113-131, DOI: 10.2457/srs.36.113.

- Wang, N., Tang, L. and Pan, H. (2017), ‘Effectiveness of policy incentives on electric vehicle acceptance in China: A discrete choice analysis’, Transportation Research Part A: Policy and Practice 105, 210-218, DOI: 10.1016/j.tra.2017.08.009.

- Wei, B. (2013), ‘A Study of the Fiscal and Tax System to Promote the Development of the New Energy Automotive Industry’, Beijing Social Sciences, 2013(02), 103-107.

- Yang, Z. and Tang, M. (2019),‘Welfare Analysis of Government Subsidy Programs For Fuel-Efficient Vehicles and New Energy Vehicles in China’. Environmental and Resource Economics. 74(2), 911-937, DOI: 10.1007/s10640-019-00353-8.

- Yu, W., Wang, T., Xiao, Y., Chen, J. and Yan, X. (2020), ‘A carbon emission measurement method for individual travel based on transportation big data: The case of nanjing metro’, International Journal of Environmental Research and Public Health, 17(16), 1-15, DOI: 10.3390/ijerph17165957.

- Zongwei, L., Yue, W., Han, H. and Fuquan, Z. (2017), ‘Overview of China’s automotive tax scheme: Current situation, potential problems and future direction’, Proceedings of the 29th International Business Information Management Association Conference – Education Excellence and lnnovation Management through Vision 2020: From Regional Development Sustainability to Global Economic Growth, 68-78, ISBN: 978-098604197-6.