Introduction

For the contemporary organizations and their managers, maintaining a profitable business becomes more and more complicated task. This is mostly because they have to operate in a highly competitive and rapidly changing environment. This may sound as a truism repeated for many years but what is exceptional nowadays is that companies strive to beat their competitors by being more human-centered organizations (Bissola & Imperatori, 2020). The companies understand that it is essential to identify effective ways to manage their employees and they build more or less advanced human resources management (HRM) systems to support their business performance.

The literature review provides a rich collection of publications in which the authors present empirical research findings on the relationship between the HRM advancement level and organizational performance results. Some of them focus on the overall human resources management (HRM) advancement level or significance to the company’s results, whereas others consider individual contribution of particular HRM subfunctions to the organizational performance results (Ginevičius et al. 2010). However, there are also those who study the consistency of the HRM internal logic and are interested in the internal coherence of HRM subfunctions and their synergistic impact on a company’s success (Ridder et al, 2012). Anyway, the problem is much more complicated in multinational companies (MNCs) than in those operating on a single home market. It is because of more complex both internal and external environment.

Until now only a few studies have focused on some of the above-mentioned phenomena from the perspective nested in economies such as Central and Eastern Europe (Farndale et al., 2017:1630). In most cases the research on MNCs has covered the companies deriving from developed countries (usually from Western Europe and the USA) whose foreign direct investment (FDI) was located in less developed countries (e.g. Brewster, 2007; Morley et al., 2009; Wilkinson and Wood, 2017). No specific research in this scope has been performed in MNCs headquartered in economies in transition or just after-the-transition, like those in Central and Eastern Europe (Festing, Sahakiants, 2013; Haromszeki 2014; Stor and Kupczyk 2017). Then, the more complex and interrelated ties between the HRM advancement level and organizational performance in such organizations stay rather unknown what makes a clear research gap. Hence the main goal of the paper is to determine in what way the coherence of the advancement levels of HRM subfunctions may influence the performance financial results of MNCs headquartered in Central Europe. In this context, our research problem to be solved in this paper covers the identification and analysis of the relationships between the advancement levels of HRM subfunctions and the financial performance results of local subsidiaries of MNCs. In this publication, we provide a revised version of our conference paper presented at the IBIMA conference (Stor & Haromszeki, 2020).

In consequence, the paper is structured as follows. After this short introduction, the authors discuss the theoretical background of the study based on a literature review. This results in the formulation of two research hypotheses. Furthermore, the focus is on the research methodology, sample and measures. The empirical research findings and discussion over them come next. The article ends with a research summary and final conclusions.

The theoretical background of the study

The advancement level of HRM and company’s performance results

The sense and logic of HRM conceptual developments and practice for business success is not a new topic in management literature. Over the past few decades there has been a considerable scientific interest in investigating the relationship between HRM and different indicators of organizational performance (c.f. Kazlauskaite, Buciuniene, 2010) as well as in the impact strength of the HRM practices and systems themselves on the overall organizational performance (Kapondoro et al., 2015). Different perspectives (c.f. Stor, 2018) and different paradigms (c.f. Kaufman, 2015) have been taken to determine such associations.

In the literature, there are various classifications of company’s performance results which the researchers have proved to be correlated with HRM practices. In most cases they refer to such four general categories of performance results as: organizational, behavioral, financial, and managerial. In this paper, we are interested in the two last categories. In short, the financial results cover financial liquidity, profits, market share, sales, company’s goodwill, share price, and firm value (Richey, Wally, 1998; Pfeffer, Veiga 1999; Arthur 1994; MacDuffie 1995; Huselid 1995; Becker, Gerhart 1996; Combs et al., 2006). The managerial results refer to research on interrelations and levels of coherence between business strategies and particular subfunctions of HRM with company’s performance results (Beer et al., 1984; Schuler, Jackson 1987; Wright and Snell 1991; 1995; Guest, 1997; Chanda and Shen, 2009; Guest et al., 2011; Stor, Suchodolski 2016; Stor, Haromszeki 2019).

All in all, there is a vast array of various approaches to the relationships between the HRM advancement level and organizational performance results. Anyhow, being interested in both managerial and financial results, all this leads us to our first research hypothesis:

H1: The higher the advancement level of HRM subfunctions, the better the financial performance results of foreign subsidiaries of MNCs.

The internal coherence of HRM and company’s performance results

Both theorists and practitioners adopting the configurational approach posit that internal coherence among individual HRM subfunctions is a key of success (Huff, Schüssler, 2016), and that – assuming that these subfunctions are internally consistent – combinations of HRM subfunctions are likely to have larger effects on organizational outcomes than the sum of the component effects due to individual practices (Bamberger et al., 2014). That is, the contribution of HRM to performance is explained through “the synergic integration of the elements that build it” (Martin-Alcazar et al., 2005, p. 637).

The argument that the impact of HRM on organizational performance is dependent on the adoption of an effective combination of HRM practices (Villajos et al., 2019), often referred to as HRM bundles (Gooderham, et al., 2008; Pocztowski, 2018), is crucial to the configurational perspective. Thus, the configurational approach has as its basis that maximizing firm performance is dependent not on the HRM subfunctions implemented in isolation but on the bundling together of interrelated elements of HRM practices in an internally consistent manner (Urlich, Brockbank, 2005:171-172; Ridder et al, 2012). Configurational theories propose that the relationship between HRM and a company’s performance involves complex interactions between bundles of HRM activities and outcomes (Arthur 1994; MacDuffie 1995). Such bundles of complementary and congruent practices are held to produce substantially greater performance effects than individual HRM practices or subfunctions (MacDuffie 1995; Ichniowski, et al., 1997; Perry-Smith, Blum, 2000; Vergurg et al., 2007). Configurations represent recurring patterns of how key organizational variables fit together to form an identifiable whole (Walker, et al., 2015, p. 41). When applied in the research conducted in MNCs, the configurational perspective with its equifinality effect has revealed that such an approach captures more aspects of the complexity surrounding MNCs’ examination and evaluation of their foreign subsidiaries (Dikova et al., 2017:406). In some more advanced studies on strategic management, the researchers have even developed special models of hierarchical relationships among different HRM strategies and substrategies in MNCs (e.g. Stor, 2007).

On the whole, research results suggest significant organizational benefits from effective and efficient management of coherent HRM subfunctions. Accordingly, assuming that the consistency of HRM internal logic may determine company performance results, our second hypothesis is formulated in the following way:

H2: The stronger the internal associations between the advancement levels of HRM subfunctions, the better the financial performance results of foreign subsidiaries of MNCs.

The Empirical Research Methodology

As mentioned in the introduction, our research problem covered the identification and analysis of the relationships between the advancement levels of HRM subfunctions and the financial performance results of local subsidiaries of MNCs. To solve this problem, we have formulated two hypotheses – as a result of theoretical studies – which were presented in the previous section.

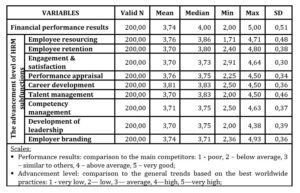

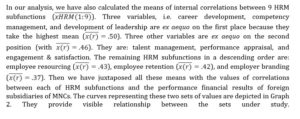

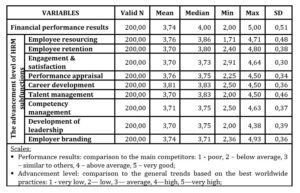

In our research, the company’s financial performance results make a dependent variable. HRM and its subfunctions are treated as the independent variables. Their advancement level was measured with comparison to the general worldwide trends based on the best practices. Basing on the literature review the authors have selected 9 subfunctions of HRM that are the most popular or valuable in business organizations. The subfunctions, measures and scales used to the particular variables incorporated in the tested hypotheses are presented in Table 1.

The research data have been gathered in two ways: CAWI (computer aided Web interview) and CATI (computer aided telephone interview). All the questions were asked in the context of the last two fiscal years and this time framework was reminded by the interviewer several times during the interview survey. This procedure was to assert that the respondents were considering a specific period of time in which they were able to logically assess the interconnections between HRM and business phenomena under study. The survey was conducted in January 2018. The collected data were analyzed both within descriptive and correlational statistics. All calculations were performed by means of Statistica v. 12.5 – an advanced analytics software package with the level of significance set to alpha = 0.05. Kolmogorov–Smirnow test was performed to determine the normality of data distribution. To assess the questionnaire reliability, Cronbach’s alpha, as a measure, was used. The relationships between the quantitative variables were examined by the means of Pearson correlation coefficient (referred to as Pearson’s r).

The research sample covered 200 headquarters of MNCs deriving from a Central European country (Poland). They were nonfinancial economic entities, existing on the market no less than two years, with a dominant share of the Polish capital, which possessed at least one foreign subsidiary, and this subsidiary was an effect of a foreign direct investment (FDI). The reference base for the number of business entities was the last report drawn by the Polish Central Statistical Office. The report indicated that there were 1760 Polish economic entities which confirmed possessing 4086 subsidiaries in 150 countries in 2015 (Activities of Enterprises…, 2017). Hence, we assumed that the size of a sample composed of 200 entities is sufficient to conduct the research because when the confidence coefficient stays at the level of 0.95 the maximum measurement error amounts to 0.065.

The sampling was of the purposive type to fulfill the requirements specified above. The structure of the research sample was diverse in terms of the companies’ business profiles – according to the European Classification of Business Activity (ECBA) – although not all of the sectors of the economy were represented; length of operation in years; size of organizations (as measured by number of employees); type of FDI investment; and the ownership share of the HQs in their foreign subsidiaries. Furthermore, the MNCs under research differed in the number of total and foreign entities they controlled, number of host countries in which their subsidiaries were located, and level of the country’s development in which their most representative subsidiary operated. An average MNC operated on the market longer than 11 years, was rather a large organization, had about 13 entities, about 8 of them were foreign subsidiaries, located in 4 countries, established as greenfield investment with a majority ownership share belonging to the Polish HQ.

We assumed that some specific parameters, for example, an industrial area, size of the company, its legal form or country’s economic development could influence the performance of businesses in the sample. However, the results of statistical testing did not demonstrate the impact of these parameters on business performance.

The empirical research findings

Descriptive statistics and internal consistency

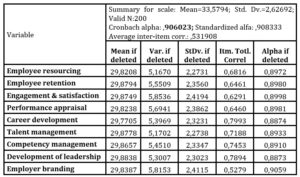

The primary analysis of the research data starts with the basic descriptive statistics for the variables connected with the main research problem (see: Table 1). On average, the financial performance results of MNCs, when compared to their main competitors, are somewhere between “similar to others” and “above average” (). So, their financial standing on average is good. The advancement levels of particular HRM subfunctions are relatively high. The means calculated for each of them ranges from to . The min scale value is reached by employee resourcing () and the highest by employer branding ().

Table 1: Basic descriptive statistics for the main variables under study: HRM subfunctions and MNCs‘ performance financial results

Source: own research data

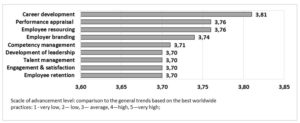

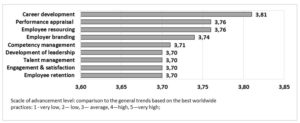

The research findings show that among 9 HRM subfunctions being analyzed the highest advancement level belongs to career development (). The second position is occupied ex aequo by performance appraisal and employee resourcing (. The full ranking list is depicted in Graph 1.

Source: own research data

Graph. 1: The ranking of the mean values of the advancement level of HRM subfunctions

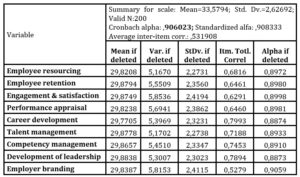

Before proceeding further in the analysis, Cronbach’s alpha coefficient was computed to check for the internal consistency within the questionnaire (see table 2). The reliability analysis covered 9 five-point scale items (HRM subfunctions). Cronbach’s alpha showed the questionnaire to reach high reliability, α = 0.906. All items appeared to be worthy of retention, resulting in a decrease in the alpha if deleted.

Table 2: Reliability and item-total statistics

Source: own research data

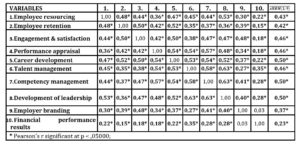

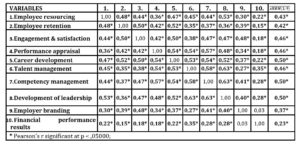

Correlation Analysis

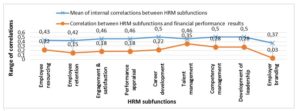

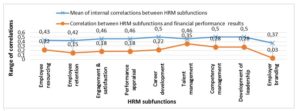

After the study based on the descriptive statistics, the correlation analysis has been conducted. The results of the correlation tests (at p<.05) for the main research variables are presented in Table 3. Apart from the advancement level of employer branding, all the other advancement levels of HRM subfunctions are positively correlated with the financial performance results of MNCs. The range of values for the correlation coefficient of these variables is in the interval between r=.15 and r=.35, where the lowest value is gained by employee retention and the highest by talent management.

All this means that our hypothesis H1 can be partially accepted because – with the exception of the advancement level of employer branding – the other 8 advancement levels of HRM subfunctions are positively correlated with the financial performance results of MNCs.

Table 3: The results of a correlation test for the advancement levels of HRM subfunctions and the financial performance results of MNCs

Source: own research data

Source: own research data

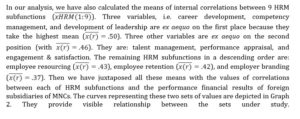

Graph .2: The coherence of HRM subfunctions and company’s performance financial results

Source: own research data

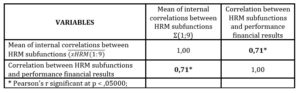

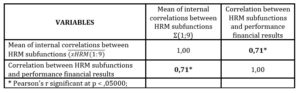

Finally, the correlation test conducted for the mean of internal relationships between advancement levels of HRM subfunctions and the financial performance results of foreign subsidiaries of MNCs reveals statistically significant and strong correlation r=.71. Hence, our last analysis leads us to the confirmation of hypothesis H2. As shown in Table 4, the stronger the internal associations between the advancement levels of HRM subfunctions, the better the financial performance results of foreign subsidiaries of MNCs.

Table 4: The results of a correlation test for the mean of internal associations between advancement levels of HRM subfunctions and the financial performance results of MNCs

Source: own research data

Research Summary

As formulated in the research problem, in our research we were particularly interested in the identification and analysis of the relationships between the advancement levels of HRM subfunctions and the financial performance results of local subsidiaries of MNCs. Successfully, we have identified some regularities within the scope of the selected variables and the analysis of the empirical research findings leads to the conclusion that the higher the advancement levels of HRM subfunctions and the stronger the associations between the advancement levels of these HRM subfunctions – the better the financial performance results of foreign subsidiaries of MNCs. This does not include employer branding which makes an exception. Namely, no statistically significant correlation has been found in this scope. The possible reason is that it’s difficult or even impossible to identify a straightforward relationship between the advancement level of employer branding and the financial performance results of company because there may be a mediating variable that intermediates the casual relationship between the dependent and independent variables. In our study, we have applied some simplified statistical correlational analysis which is not dedicated to such type of investigation. Hence, as about the future research we would recommend to look for some mediating variable(s) that may explain in details or discover new ties between the variables under study.

Final Conclusions

Our final conclusion based on the analysis of the empirical research findings suggests that there is a clear, identifiable impact that the coherence of the advancement levels of HRM subfunctions may exert on the financial performance results of MNCs. It means that by manipulation of the HRM advancement level we may influence the company’s financial results in such a manner that raising the HRM advancement level we can expect an increase in the company’s financial outcomes. However, it is important to emphasize that individual HRM subfunctions show much weaker correlations with the financial outcomes than the internally coherent HRM. So, the logic of internal HRM consistency may significantly determine the synergic impact of HRM subfunctions advancement levels on a company’s performance financial results. We believe that this final conclusion authorizes us to state that the goal of our paper has been achieved. We have successfully determined in what way the coherence of the advancement levels of HRM subfunctions may influence the performance financial results of MNCs.

Notwithstanding this accomplishment, there are some limitations of our research. For example, the final conclusions can’t be extended on the whole population of MNCs worldwide because the research sample, even though deliberatively selected, was composed only of those MNCs that were headquartered in one Central European country. Additionally, although it was diverse in terms of the companies’ business profiles, not all sectors of the economy were represented. Some other flaws are also noticeable in the measurement scales or the calculations based exclusively on the mean values. Yet the other reservations may concern asking the informants the general questions about the company’s financial performance results instead of using hard performance indicators. This practice is not at odd within this type of research; however, it may undermine the subjectivity of evaluation.

Despite all these constraints, our study contributes to the scientific discipline of management. On one side, as said above, MNCs headquartered only in Central Europe make a limit to the research, but on the other side they provide a unique perspective. To our best knowledge, it’s been the first research of this type. We have confirmed the phenomena – identified also by other researchers as mentioned in the introductory part of the paper – referring to the positive relations between HRM and organizational performance results, and in our case in MNCs. Our study has also some novelty value which consists in the identification of a statistically significant association between the internal coherence of the advancement levels of HRM subfunctions and the financial performance results of MNCs. It proves that the logic of maintaining internal HRM consistency within the high advancement levels of its particular subfunctions may result in their positive synergic impact on the company’s performance. Nonetheless, the primary and fundamental action is to select proper configuration of HRM bundles.

In the above context, it’s worth noticing that the relationships between the advancement levels of HRM subfunctions and the financial performance results of MNCs headquartered in Central Europe seem to be similar within their strength to those identified in the companies in Western Europe (cf. Stavrou, Brewster, 2005). They only seem to be similar because when the particular researchers use different measures and classifications of HRM subfunctions (also called bundles) in their studies (cf. Verburg et al., 2007) their research results are hardly comparable (Boon et al., 2019). Anyway, to the best knowledge of the authors of this article none of the published papers so far has addressed the impact of the internal coherence of HRM on MNC’s financial outcomes in such a comprehensive way as it has been done in this work.

As for the practical implications of the research results, they mostly rely on indicating that if there is so strong positive relationship between the associations among the advancement levels of HRM subfunctions and the financial performance results, then there is huge potential and opportunity in using HRM subfunctions in a more effective and efficient way that will lead to higher financial outcomes. Of course, it’s necessary to remember that HRM is only one of the factors that determine such outcomes. There are many others, as to mention economic growth, production technology, market competition, prices for components, service or product demand etc. All in all, the presented research findings may help the managers of MNCs uncover some hidden opportunities existing in the management practices of their regional businesses and inspire them to create such logic of ties between HRM subfunctions which can successfully impact their business performance.

Funding

This work was supported by National Science Center, Poland [No 2016/23/B/HS4/00686].

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Activities of Enterprises Having Foreign Entities in 2015, (2017), Central Statistical Office, Warsaw.

- Arthur, J.B. (1994). ‘Effects of human resource systems on manufacturing performance and turnover’, Academy of Management Journal 37(3).

- Bamberger, P. A., Biron, M., Meshoulam, I. (2014), Human Resource Strategy. Formulation, Implementation, and Impact. Taylor& Francis, New York.

- Becker B., Gerhart B. (1996). ‘The impact of human resource management on organizational performance: Progress and prospects,’ Academy of Management Journal

- Beer, M., Spector, B., Lawrence, P.R., Quinn Mills, D., Walton, R.E.(1984), Managing Human Assets. The Free Press. New York, 1984.

- Bissola, R., Imperatori, B., (2020), HRM 4.0. For Human-Centered Organizations. Emerald Publishing Limited, Bingley, UK.

- Boon, C., Den Hartog, D. N., & Lepak, D. P. (2019). ‘A Systematic Review of Human Resource Management Systems and Their Measurement.’ Journal of Management, 45(6), 2498–2537.

- Brewster, C. . (2007). ‘European perspective on HRM.European Journal of International Management 1(3

- Chanda A., Shen J. (2009), HRM strategic integration and organizational performance. Sage publication Inc, Los Angeles.

- Combs, C., Liu, Y., Hall, A. and Ketchen, D. (2006). ‘How much do high-performance work systems matter? A meta-analysis of their effects on organizational performance.’ Personnel Psychology 59(3).

- Dikova, D., van Witteloostuijn, A., Parker, S., (2017), ‘Capability, environment and internationalization fit, and financial and marketing performance of MNEs’ foreign subsidiaries: An abductive contingency approach,’ Cross Cultural & Strategic Management, Vol. 24 Issue: 3.

- E Villajos, N Tordera, JM Peiró, M van Veldhoven, (2019), ‘Refinement and validation of a comprehensive scale for measuring HR practices aimed at performance-enhancement and employee-support.’ European Management Journal, Vol 37.

- Farndale, E., Sanders, K., (2017), ‘Conceptualizing HRM system strength through a cross-cultural lens,’ The International Journal of Human Resource Management, 28:1,132-148

- Festing, M., Sahakiants, I. (2013). ‘Path-dependent evolution of compensation systems in Central and Eastern Europe: A case study of multinational corporation subsidiaries in the Czech Republic, Poland and Hungary.’ Europen Management Journal 31(4).

- Ginevičius, R., Krivka, A., Šimkūnaitė, J. (2010). ‘The model of forming competitive strategy of an enterprise under the conditions of oligopolic market,’ Journal of Business Economics and Management, 11(3): 367–395.

- Gooderham, P., Parry, E., Ringdal, K., (2008), ‘The impact of bundles of strategic human resource management practices on the performance of European firms,’ The International Journal of Human Resource Management, Vol. 19, Issues 11.

- Guest, D. (1997), ‘Human resource management and performance: a review and research agenda.’ International Journal of Human Resource Management, No 8, Issue 3.

- Guest, D., Paauwe, J. and Wright, P. (2011), Human Resource Management and Performance: What’s Next?, Chichester: Wiley.

- Haromszeki Ł. (2014). ‘Expected features and the behavior of talented leaders in the three sectors of the Polish economy in context with other Central-Eastern European Countries,’ Journal of Intercultural Management 6(4).

- Huff, J., Schüssler, M. (2016): ‘HRM and the Role of Internal Fit – A Systems-Behavioral Model of HRM Effectiveness.’ Academy of Management. Proceedings,https://doi.org/10.5465/ambpp.2016.13701abstract.

- Huselid, M. A. (1995). ‘The impact of human resource management practices on turnover productivity and corporate financial performance’. Academy of Management Journal 38(3).

- Ichniowski, C., Shaw, K., and Prennushi, G. (1997), ‘The Effects of Human Resource Management Practices on Productivity: A Study of Steel Finishing Lines,’ American Economic Review, 87, 3.

- Kapondoro, L., Iwu, C. G., & Twum-Darko, M. (2015). ‘A meta analysis of the variability in firm performance attributable to human resource variables.’ Journal of Governance and Regulation, 4(1),8-18.

- Kaufman B.E. (2015), ‘Market competition, HRM, and firm performance: The conventional paradigm critiqued and reformulated,’ Human Resource Management Review, Vol. 25, No. 1.

- Kazlauskaite, R.; Buciuniene, I. (2010), ‘Disclosing HRM-Perfomance Linkage: Current Research Status and Future Directions. HR function developments in Lithuania.’ Transformations in Business & Economics, Vol. 9, No. 2 (21), Supplement B, p. 303-317.

- Kupczyk T., Stor M. (2017). Competency management. Theory, research and business practice, Wyższa Szkoła Handlowa, Wrocław.

- MacDuffie, J.P. (1995). ‘Human resource bundles and manufacturing performance: organizational logic and flexible production systems in the world auto industry.’ Industrial and Labor Relations Review 48(2).

- Martín-Alcázar, F., Romero-Fernández, P. M., Sánchez-Gardey, G.,(2005), ‘Strategic human resource management: integrating the universalistic, contingent, configurational and contextual perspectives,’ The International Journal of Human Resource Management, 16:5, 633-659.

- Morley, M. J., Heraty, N., Michailova, S. [eds]. (2009). Human Resources Management in Eastern and Central Europe. London, New York.

- Perry-Smith, J. E., Blum, T. C. (2000): ‘Work-family human resource bundles and perceived organizational performance.’ Academy of Management Journal, 43.

- Pfeffer, J., Veiga, J. F. (1999). ‚Putting people first for organizational success.’ The Academy of Management Executive 13(37).

- Pocztowski, A. (2018): Zarządzanie zasobami ludzkimi. Strategie – procesy – metody. Polskie Wydawnictwo Ekonomiczne.

- Richey, B., Wally, S. (1998). ‘Strategic Human Resource Strategies for Transnationals in Europe.’ Human Resource Management Review 8 (1).

- Ridder, H. G., McCandless Baluch, A., Piening, E. P., (2012), ‘The whole is more than the sum of its parts? How HRM is configured in nonprofit organizations and why it matters,’ Human Resource Management Review 22; 1–14.

- Schuler, R. and Jackson, S. (1987), ‘Linking competitive strategies with human resource management ’ Academy of Management Executive, No 1, Issue 3.

- Stavrou, E. T., Brewster, C. (2005), ‘The configurational approach to linking strategic human resource management bundles with business performance: Myth or reality?,’ Management Revue, Vol. 16, Iss. 2, pp. 186-201.

- Stor M., Suchodolski A., (2016), ‘Istotność wybranych subfunkcji ZZL z perspektywy wyników uzyskiwanych przez przedsiębiorstwa polskie i zagraniczne w Polsce,’ Zarządzanie i Finanse, Uniwersytet Gdański, vol. 14, nr 2/2.

- Stor, M. (2007): The Internal Coherence of HRM Strategies in International Corporations in Poland – Research Findings on Managerial Staff. (in:) Changes in Society, Changes in Organizations, and the Changing Role of HRM: Managing International Human Resources in a Complex World. (ed.) P.G. Benson, A. Mahajan, R. Alas, R.L. Oliver. Conference Proceedings. Tallinn, Estonia.

- Stor, M. (2018), ‘Istotność i konfiguracja wybranych subfunkcji ZZL z perspektywy wyników uzyskiwanych przez polskie przedsiębiorstwa działające na rynkach międzynarodowych. ‘Zarządzanie i Finanse, Vol. 16, nr 1/2, pp. 153-171.

- Stor, M., & Haromszeki, Ł. (2019). ‘Organizational leadership practices in MNCs: the effect of the HRs value as a competitive factor and the FDI structure.’ Journal of Transnational Management, 24(2), 83–121.

- Stor, M., & Haromszeki, Ł. (2020). The Impact of the Coherence of the Advancement Levels of HRM subfunctions on the Financial Performance Results of MNCs. W K. S. Soliman, K. S. Soliman (ed.), Education Excellence and Innovation Management: A 2025 Vision to Sustain Economic Development during Global Challenges(pp. 10861–10872). International Business Information Management Association (IBIMA).

- Ulrich, D., Brockbank, W. (2005): The HR Value Proposition. Harvard Business School Press. Boston.

- Verburg , R. M., Den Hartog, D. N., Koopman, P. L. (2007), ‘Configurations of human resource management practices: a model and test of internal fit,’ The International Journal of Human Resource Management, 18:2, pp. 184-208.

- Walker, K., Ni, N., & Dyck, B. (2015). ‘Recipes for successful sustainability: Empirical organizational configurations for strong corporate environmental performance.’ Business Strategy and the Environment, 24.

- Wilkinson, A., Wood, G. (2017). ‘Global trends and crises, comparative capitalism and HRM,’ The International Journal of Human Resource Management 28(18).

- Wright, P. M., & Snell, S. A. (1991), ‘Toward an Integrative View of Strategic Human Resource Management.’ Human Resource Management Review, No 1, Issue 3.