Introduction

New categories of innovations create new solutions for various categories of insurance clients, including business incubators or their products (for example, created startups) . To be viable, the business incubator support policy is based on the differences between the countries of the European Union and the Republic of Moldova. Each state has a special set of institutions, many of which complement each other.

At the national level, the activities of small and medium-sized enterprises began to be carried out as an independent part of the economic development of the Republic of Moldova in the late 1980s, when the first trade cooperatives appeared, demonstrating the advantages of a modern financial and economic system, including the advantages of private insurance.

This is due to the new logic of financing the economy and supporting innovation. The vast majority of investments today are intangible in the form of intellectual property, data and knowledge.

Literature Review

The legislative basis, in which the normative conditions of activity of small business and the conditions of creation of business incubators were regulated, was represented by the Law on the support and protection of small business, no. 112-XTTT of 20.05.1994 which established the economic, organizational and legal conditions for the development and support of micro and small enterprises. The law sets out the criteria for reporting to micro and small enterprises.

The concept of efficiency in the field of insurance has given rise to various expressions of opinion. Thus, some authors argue that the economic efficiency of insurance depends exclusively on the efficiency of the action, the means for recovering the destroyed goods, being given by the ratio between the economic effects (benefits) and the costs involved in recovering material losses. A similar definition is proposed by Ciumaș C. and Negru T. (2006) , who claim that “the degree of efficiency of the insurance and reinsurance action is expressed by the ratio between the volume of total damages and the volume of compensations received by natural or legal persons (insured)” .

Research by foreign scientists North and Weingast (1989); Libecap (1993); Acemoglu et al. 2001; Baumol (2002); Rodrik et al. (2004); Acemoglu and Johnson (2005); Besley and Ghatak (2010) that the legal principle that the state should not be ruled by arbitrary decisions by autocratic leaders or government officials is essential for any prosperous country. Also, private property rights – legal titles of ownership and protection of property – are probably the most fundamental of all economic institutions and are relevant to all participants in the structure of the competence ecosystem.

Insurance, in a research study by Seulean V., and Raileanu M (2001), can be formulated as a form of accumulation of a centralized financial fund at the expense of decentralized means: from payments made by participants in insurance services. This definition is very important because it is universal for all types of insurance and explains the working concept of insurance, even social insurance.

An important contemporary example is found in Jaffe and Lerner (2004); Cohen (2005); Acs and Sanders (2012), is the protection of intellectual property, which has been strengthened in recent years in ways that are probably overly defensive, especially in the UK, increasing both the costs and risks associated with innovation.

Reasearch Question

- What forms of support are possible for companies at a time when there is an unstable balance of inflows and outflows, when financial resources are depleted and development stops?

- Have the conditions and legal framework been created for the development of small and medium-sized enterprises and support for business incubators at the national level. And also, have there been conditions for the use of insurance products to minimize the risks of innovative companies?

- Will the introduction of economic and mathematical forecasting models make it possible to optimize the distribution of external financial resources and stimulate the definition of business incubator development policy? And will it ensure the creation of tools for the development of intellectual capital in the context of the use of insurance in the agro-industrial complex in order to increase the competitiveness of national companies through the introduction of innovations?

Research design and methodology

Of particular importance for the support of small and medium-sized businesses, as well as the development of national business incubators, was the “Law on Entrepreneurship and Entrepreneurship”, adopted in 1992, as well as the Decree of the President of the Republic of Moldova of 1993 “State Protection of Entrepreneurship”.

The official terms for innovation in the Republic of Moldova are the terms used in the innovation policies of the Republic of Moldova which are determined in the Innovation Strategy of the Republic of Moldova for the period 2013-2020 “Innovations for Competitiveness”, approved by Government Decision no. 952 of 27.11.2013. These, together with the landmarks stipulated in the National Development Strategy “Moldova 2020”, will contribute to the economic development of the Republic of Moldova.

The information base of the research was composed of data from the National Bureau of Statistics of the Republic of Moldova, laws and methodological recommendations of the ministries and departments of the Republic of Moldova on the development of innovative activities of insurance companies.

The development of the SME sector and business incubators in the Republic of Moldova must also take into account the legal provisions of the Government of the Republic of Moldova regarding the regional development of the republic, which is guided by a range of strategic policy documents and programs in this direction:

- National Strategy for Regional Development for the years 2016-2020,

- National program for the development of cities-growth poles in the Republic of Moldova for the years 2021-2027 in which the emphasis is on sustainable regional development, based on the recognition of three statistical areas per republic: South, Center and North.

In the Republic of Moldova, the concerns of the Government regarding the development of business incubators are foreseen in many legislative documents, such as:

- National Development Strategy “Moldova-2030”,

- Sectoral Development Strategy “Education 2020” and medium-term sectoral policy priorities (2019-2020);

- The National Employment Strategy for the period 2017-2021,

- National Strategy for the Development of the Youth Sector for the years 2014-2020.

The Result and Discussion

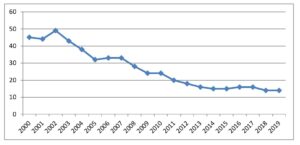

Economic reforms in the country have influenced the creation of business incubators and the development of the insurance industry. In recent years, the range of services provided has significantly expanded, the mechanisms for their provision have been modernized, various business incubator products have been developed that support the creation of new companies in the Republic of Moldova, as well as innovation and start-up insurance tools have been improved.At the same time, over the course of 17 years, the insurance sector has also seen a concentration in the sector. With the amendment of the legislation in the field of insurance from 49 companies operating on the market in 2002, the number of companies decreased about 3 times. A number of 14 insurers carried out their activity in 2018, taking into account the appearance of a new player on the market at the end of 2016 – GENERAL Asigurări. And in 2017, another company appeared on the insurance market – Intact Asigurări Generale JSC.

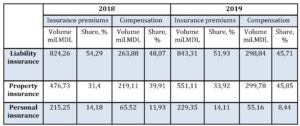

Figure 1: Evolution of the number of insurance companies in the Republic of Moldova

during the years 2000-2019

Source: Developed by the authors based on National Financial Market Commission data

We are witnessing a narrowing of the insurance market in the last two decades. Currently, the reality is that the insurance market is becoming increasingly important in the Republic of Moldova. The insurance market has suffered in recent years, both a significant increase in product quality and a great diversification of services.

In the Republic of Moldova, insurance companies have great difficulties due, first of all, to the way people perceive this type of activity. If in 2003, there were 43 insurance companies on the market, which collected an amount of about 290 million MDL from premiums, which is almost as much as the amount received by one of the insurance companies in 2016 (Moldasig SA) – 244.31 million MDL. Only a third of the companies operating in 2002 survived, some never actually operated, others could not increase their capital, and some were “swallowed” by much larger companies. The legislation in the insurance branch operating in the European economic area has been implemented and continues to be modernized. These changes also led to an increase in total gross written premiums. Therefore, it is found that one of the important features of the insurance market in the Republic of Moldova is the predominance of business in the general insurance sector.

The legislative basis, in which the normative conditions of activity of small business and the conditions of creation of business incubators were regulated, was represented by the Law on the support and protection of small business, no. 112-XTTT of 20.05.1994 which established the economic, organizational and legal conditions for the development and support of micro and small enterprises. The law sets out the reporting criteria for micro and small enterprises.

Over the next few years, the Law on Supporting and Protecting Small Business was amended and supplemented. Thus, they were introduced in the Law on Supporting the Small and Medium Enterprises Sector, no. 206 – XVT of 7 July 2006:

- new criteria for reporting small business agents to micro, small and medium enterprises,

- the sources of training for the financial funds “Fund for the support of entrepreneurship and small business development” have been established,

- The content of the State Small Business Support Programs was determined.

Taking into account the special importance of these enterprises in the economy of the Republic of Moldova and the difficulties encountered by the SME sector, the Parliament of the Republic of Moldova approved Law no. 179 of 21.07.2016 on SMEs. The law established the legal framework for micro, small and medium-sized enterprises and incentives for the creation and development of business incubators, with the aim of promoting the sustainable development of SMEs by improving the economic and legal ecosystem .

At the same time, the Law on SMEs aims to ensure and increase competitiveness at national and international level, to stimulate economic and technological innovations and the performance of micro, small and medium enterprises.

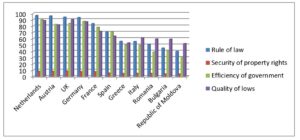

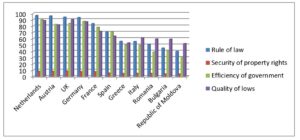

Figure 2. Rule of law and quality of governance: four indicators for EU Member States and the Republic of Moldova

Source: Developed by authors based on World Money data, Global Governance Indicators 2019

In order for citizens and businesses to reap the full benefits of the rule of law, the laws and regulations in question must be of high quality and the government must be effective in maintaining the rule of law. The third and fourth indicators in Table 1 show that the differences between the EU countries and the Republic of Moldova are large in these respects as well. However, it should be noted that the quality of laws and regulations in those countries tends to outweigh the effectiveness of government in enforcing compliance. In the Republic of Moldova, the adoption of correct laws is easier than their effective application.

According to the development policies and the legislative framework aimed at supporting business incubators at national level, there are currently the following areas of support for business incubators in the Republic of Moldova:

- In order to increase competitiveness and develop the entrepreneurial spirit among young people, the document provides for the introduction of entrepreneurship education at all levels of the education system, starting with the primary one.

- According to the adopted provisions, the state controls carried out in the first three years of activity of the enterprise have an advisory character, except for the cases of finding the crimes.

- It comes to facilitate the access of loans by companies that do not have enough collateral, offering guarantees to repay the loan under the established conditions.

- The Law on SMEs establishes the creation of the Consultative Council for SMEs, empowered to analyze “the evolution of the sector and to develop recommendations for the improvement of the business environment. It represents a platform for dialogue between entrepreneurs and public authorities in order to offer the business environment the opportunity to participate in the improvement of the legislative and normative framework “, the law states.

- At the same time, entrepreneurs who do not have sufficient resources for business development will be able to request assistance from the Credit Guarantee Fund of small and medium enterprises.

The main document of development policies and support of the SME sector and business incubators of the Government of the Republic of Moldova is the Government Decision no. 685 of 13.09.2012 on the Development Strategy of the Small and Medium Enterprises Sector for the years 2012-2020, as well as the Action Plan on the implementation of the Development Strategy of the Small and Medium Enterprises Sector for the years 2018-2020.

The strategy for the development of the small and medium enterprise sector for the years 2012-2020 provides the long and medium term policy framework for the development of SMEs in the Republic of Moldova in the context of the transition from the consumption-based economic development model to a new paradigm – oriented towards exports, investment and innovation, the political goal of European integration and world economic trends.

This document served as a basis for the development and implementation of programs, policies and action plans of central and local public authorities, as well as projects in the field of innovation of foreign donors, designed to create the necessary conditions for the development of business incubators in Moldova.

In order to achieve the objectives of the program, the following priority directions were outlined:

- Development of business partnerships;

- Developing the green economy for SMEs;

- Improving SMEs’ access to finance;

- Development of human capital by promoting entrepreneurial skills and culture;

- Development of female entrepreneurship in the Republic of Moldova;

- Increasing the competitiveness of SMEs and encouraging the spirit of innovation in business incubators;

- Adjusting the regulatory framework to the development needs of business incubators;

- Facilitating the development of SMEs in the regions.

Legislation and regulations on the labor market, as well as wage policy, influence the development of entrepreneurial activity, including the introduction and development of innovations with the support of business incubators. As a result, possible combinations of factors of production and the best use of various entrepreneurial skills and ideas, especially those associated with professionals or innovators in this field, are reduced.

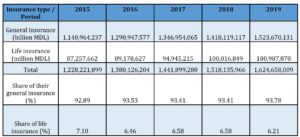

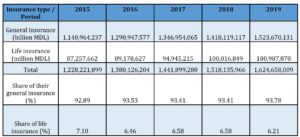

Based on this, we will analyze some indicators on the dynamics of indicators of insurance companies that have a direct impact on the activities of business incubators in the field of supporting and stimulating innovation:

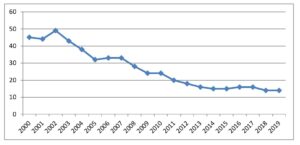

Table 1: Dynamics of the distribution on insurance segments of the gross premiums written in the fourth quarter for the period 2015-2019

Source: Developed by the authors based on National Financial Market Commission data.

There are no insurers that only practice life insurance. This situation is due to a number of factors. In particular, due to the low interest of the population in life insurance specified, on the one hand, by the low level of disposable income of the population, these insurances require the permanent and long-term availability of financial resources above the average level in the country, and on the other hand, the high capitalization requirements of insurers who practice exclusive life insurance, which reduce the interest of the emergence of new insurers, as a result of the reduction of interest for competition, which may have the effect of promoting insurance products more promptly.

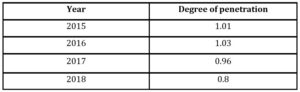

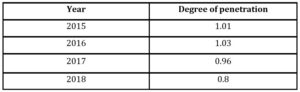

For a more in-depth analysis of the insurance market, we analyzed: the degree of penetration of insurance in the Gross Domestic Product and the density of insurance. The evolution of the degree of insurance and reinsurance penetration in the Gross Domestic Product is presented in Table 3.

Table 2: Evolution of the degree of penetration of insurance and reinsurance in the Gross Domestic Product in the Republic of Moldova

Source: Developed by the authors based on National Financial Market Commission data

From the data presented in Figure 5 we can conclude that the degree of insurance penetration in GDP in the Republic of Moldova decreased in 2018, reaching a level of 0.80%, which shows a decrease of this indicator compared to 2017 by 0.96 percentage points.

Significantly, this trend is explained by the higher growth rate of Gross Domestic Product compared to the growth rate of the volume of insurance premiums, which rather denotes an involution of the domestic insurance market, given that this indicator in regional terms exceeds 1.0-1.5%.

Another indicator specific to the insurance sector is the density of insurance or income from insurance premiums per capita, which indicates that in the Republic of Moldova the interest and capacity of society to assimilate insurance is extremely low.

The density of the per capita insurance premium is an indicator that expresses the scale of use of insurance products by the population. In 2018, the per capita premium was approximately 427.94 MDL / inhabitant – an increase of 21.87 MDL compared to the previous year. However, this increase does not indicate the increase of the interest for insurance, but rather the increase of the value of the insured goods, of the insurance tariffs and of the number of insured vehicles through the compulsory motor third party liability insurances.

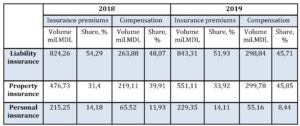

Table 3: Structure of gross written premiums and compensations and indemnities paid for the years 2018-2019

Source: Developed by the authors based on National Financial Market Commission data.

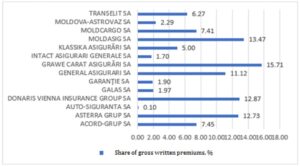

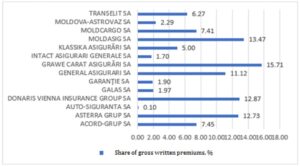

During the reference period, the share of the volume of gross written premiums from civil liability insurance decreased by 2.36 pp. compared to the previous year, the premiums from the goods insurances registered an increase of 2.52 p.p., those from the persons insurances decreased by 10.36 p.p. Figure 3 shows the distribution of gross written premiums per company.

Figure 3: Distribution of gross written premiums by companies,%

Source: Developed by the authors based on National Financial Market Commission data

In 2019, 1,820,209 insurance policies were issued based on contracts concluded with individuals and legal entities, increasing by 84,172 policies compared to 2018. Out of the total number of policies, 1,817,507 policies were issued for general insurance, and for life insurance – 2,702 policies. The insurance market is characterized by an increased degree of concentration, where 5 insurance companies subscribed 1,040.64 million MDL (about 64.05%) of the total volume of premiums (1624.65 million MDL). These are: MOLDASIG JSC, GRAWE CARAT ASIGURĂRI JSC, GENERAL ASIGURĂRI JSC, DONARIS VIENNA INSURANCE GROUP JSC, ASTERRA GRUP JSC. The insurance company AUTO-SIGURANȚA JSC registers the lowest degree of concentration on the insurance market, having only 0.1%.

Assistance of insurance companies in the development of business incubators provides for the following actions:

- Development and expansion of the services of the Center for Business Consulting and Assistance in the regions. Responsible institutions are: Small and Medium Enterprise Sector Development Organization (ODIMM) and local authorities;

- Development of the AI network in the Republic of Moldova. Responsible institutions are: Ministry of Economy and Infrastructure; ODIMM.

The main activities of ODIMM in this direction are:

- Provision of loan guarantees to SMEs through the Credit Guarantee Fund (FGC);

- Implementation of the Additional Education Program “Effective Business Management (GEA)”;

- Implementation of the Program for attracting remittances to the economy (PARE 1+ 1);

- Implementation of programs and projects to support women’s entrepreneurship (Women in Business Program);

The main objective of developing business incubators at national level is to contribute to increasing economic competitiveness at European level by developing small and medium-sized enterprises.

Development strategies in the field of supporting business incubators provide for the correlation of the education system with the requirements of the labor market in order to increase the efficiency of the economy to ensure continuous economic growth.

The success of policies for the development and implementation of the legislative framework aimed at supporting business incubators at national level depends on the real involvement of all stakeholders (social partners, higher education institutions, central and local public authorities).

Thus, based on the development policies of business incubators, the directions of activity of the Government of the Republic of Moldova, ODIMM and RIAM, will be the following:

- improving the economic environment at all levels by making more efficient use of the economic potential in the Republic of Moldova;

- developing a business infrastructure that will be able to cope with competitive pressures;

- improving the access of incubated SMEs to information, high value-added consulting services, sources of funding, etc.;

- the establishment and development of innovative SMEs, able to use efficiently the existing resources and which will leave business incubators, being financially stable;

- promoting close cooperation between the main partners at national, regional and local level for the achievement of a sustained economic development.

In the Republic of Moldova, at present, in many sectors, when creating a new business in the conditions of business incubators, for example, when introducing innovations in agriculture, various difficulties arise, one of which is the low level of labor productivity. As a result, agricultural products (and not only) cannot effectively compete with imported products, even in the domestic market. In order to protect domestic production, in order to stimulate it, two financial levers are usually used: the imposition of additional taxes and import taxes; subsidies (subsidies) of a domestic producer.

It is easy to see that, in this case, it is necessary to formulate the problem of optimizing the allocation of increases for imported products and subsidies, stimulating both own production and the flow of goods needed.

The task is as follows: it is necessary to find for a certain type of goods or group of goods the amount of the import increase and the subsidies which ensure the conditions:

(1) – taking into account margins and subsidies, domestic goods should not be more expensive than imported ones;

(2) – the amount of imported and domestic goods must ensure the minimum necessary needs of the population;

(3) – domestic production must meet the specified minimum demand;

(4) – the amount of the expenditure of the population for the necessary need must not exceed its purchasing power for these purposes;

(5) – the amount of the subsidies must not exceed the amount of the additional tax;

(6) – the stimulation of production and imports should be determined by maximizing the profits of both the importer and the domestic producer.

The Republic of Moldova, in this case, pursues a protectionist policy in relation to its producer.

According to the cost formula

P = C+V+m (1)

Where,

C – the cost of material costs transferred to the product;

V- salary;

m- profit

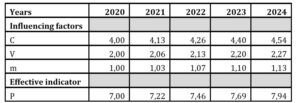

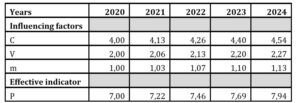

Mathematical model related to the cost formula, P = C+V+m, is a theoretical model of optimizing the allocation of increases for imported products and subsidies, stimulating both own production and the flow of goods needed. Using a case study the impact on the insurance industry can be presented in the following table:

Table 4 : Predicted impact of the factors on cost in the insurance industry for period 2020-2024

Source: Developed by the authors based on average annual inflation rate in the Republic of Moldova

According to the obtained data, as a result of the influence of inflationary factors on material costs transferred to the product, salary and profit the effective indicator of the cost of the insurance product will grow from 7 to 7.94 MDL for the period from 2020 to 2024, or by 13.43%

We will note:

X1, X2 – volumes of own, foreign products;

Xmin – the need for this product;

X0 – minimum production of domestic goods;

П- the general purchasing power of the population for this type of product (goods);

Н0 – permanent subsidy to the domestic producer of the relevant product.

Subsidies in the form of money to all domestic producers, as is done in the Republic of Moldova, are more than controversial.

Grants should be “barter” in the form of costs for research, reproduction, innovation and the like.

The required initial data are formed on the basis of existing standards and expert evaluations, as well as by analyzing the available statistical data.

The profit of a domestic producer, due to low labor productivity, will certainly be lower than the corresponding indicator of the importer.

Therefore, to the formula C10( 1 + α 1 ), it is necessary to add the amount of the subsidy,

C10( 1 + α 1 )+ C10( 1 + α 1 ) * λ,

Where λ – the share of subsidies in the price of a domestic product.

The economic and mathematical model will look like this:

F1= C10( 1 + α 1 )( 1 + λ) * X1– C10X1 ⇒ max

sau F1= ( 1 + α 1 )( 1 – λ) * C10X1⇒ max – the total profit, determined in the problem-solving process, of the domestic producer;

F2= C20X2 α2 ⇒ max – the total profit of a foreign producer under the conditions

X1+X2 ≥ Xmin (4)

The sum of the volumes of domestic and foreign products must provide the necessary need for this product (product);

X1 ≥ X0 (5)

The domestic producer must supply the domestic market with at least the minimum volume;

C10( 1 + α 1 ) * X1+ C20( 1 + α 2 )(1 + Q)* X2 ≤ П (6)

The volume of sales of domestic and foreign products must not exceed the general purchasing power of the population for this type of product;

Н0 +C10( 1 + α 1 ) X1 * λ ≤ C20( 1 + α 2 )X2 *Q (7)

Subsidies to domestic producers, costs of research, growth, innovation and the like, plus subsidies on the price of domestic products should not exceed financial “taxes” by margins for foreign products:

Therefore, the tasks solved taking into account a set of indicators (criteria) are called multifunctional. In our case, the economic interests of domestic and foreign producers. The activity plans obtained according to different criteria will be different. The purpose of solving the problem is to find a plan in which the first and second criteria are the best, maximum. For tasks for which the criteria are not equivalent, the concession method is used. The economic and mathematical model obtained by us belongs to the parametric programming problems.

Criteria F1 and F2 depend on two parameters Q and λ. Parameters Q, λ – arbitrary real numbers and a known interval.

When solving the problem according to the model proposed above, certain difficulties can be encountered. The expert and normative evaluation of the initial data allows their wide dispersion, which leads to a significant dispersion in the results of solving the problem. To eliminate such situations, the system of restrictions will be “normalized”.

Conditions (4) X1 + X2 ≥ Xmin divides by

The coordinates of points M1 and M2 are the solution to the problems:

(1) – a domestic producer occupies a large part of the domestic market;

(2) – a smaller part of the market.

Effective management of firms in difficulty requires well-designed and efficient insolvency law and insolvency regulation to do the following: (i) minimize time and cost to society in phasing out unprofitable and inefficient firms so that resources can be reallocated to more efficient uses and (ii) minimize damage to other parties involved, such as creditors, customers, suppliers, employees and government. However, not all insolvent companies should be closed.

Based on the National Development Strategy “Moldova-2030”, we have developed proposals for the development strategy of business incubators in the Republic of Moldova as a form of support for SMEs:

Figure 4: Proposals for the development strategy of business incubators in the Republic of Moldova as a form of support for SMEs

Source: Developed by the authors

Study limitations and Conclusion

In our view, this is due to the fact that the demand for certain categories of insurance services is declining and there is virtually no stimulation of innovative activity, both within insurance organizations and of the efficient insurance mechanism for innovative enterprises.

At a certain point in the company’s existence, there is a balance of inflows and outflows, which, moreover, is unstable due to the multiplicity of external relations. Under conditions of limited financial resources, each input and output implements an oscillating mode.

While developing countries (eg the Republic of Moldova) need to improve their legislative framework in the field of supporting business incubators in order to become more innovative and entrepreneurial, this cannot be done separately. Reforms in this direction must be combined with the strengthening of the rule of law and the protection of property rights; otherwise, reforms may be ineffective or even contribute to abuse and fraud.

The main objectives of the AI development strategy in the Republic of Moldova as a form of SME support, for the period 2021-2023, are the following:

- Facilitating the establishment of AI in territorial statistical areas;

- Creating the premises for the establishment and development of new AI in other areas with high economic and social potential;

- Assisting existing business incubators in higher education institutions.

As a result, in the development of the company there are peaks of intense growth and failures in its activities. The form of existence of insurance companies is an oscillating regime.

The economic and mathematical model, when calculating the share of the increase in imported products and subsidies to the domestic producers, allows:

- Ensuring the competitiveness of domestic producers by introducing innovations in order to increase labor productivity;

- Encouraging imports of reasonable amounts;

- Organization of the targeted subsidies;

- Reducing the burden on the state budget;

- Reducing the risks of domestic producers;

- Creating financial funds for the development of intellectual capital in the context of the agricultural industry. To solve this problem, there is a whole arsenal of algorithms and programs, for example, [1], [2]. The using of a model with two variables (Q and λ) belongs to the field of parametric programming. In this model, not constant values are considered, but some functions that in a certain way depend on the parameters of certain variables.

Note: The article was developed within the application Project within the “State Program” competition (2020-2023): 20.80009.0807.38 “Multidimensional assessment and development of the entrepreneurial ecosystem at national and regional level in order to boost the SME sector in the Republic of Moldova”, funded from the state budget of the Republic of Moldova.

References

- Acs, Z. J., Autio, E., & Szerb, L. (2014). Global entrepreneurship and development index 2014. Washington, D.C.: Global Entrepreneurship and Development Institute

- Beterley, Richard S. Intellectual Property and Media Liability Insurance Market Survey, 2013. In: The Betterley Report. April.2013. 12-16;

- Dolghi V., “Calculation of the solvency rate of insurance companies in the Republic of Moldova”, [accessed the site 17.02.2021]. Available: http://www.fmd.md/publications;

- Fotescu S., Tugulschi A., “Insurance and Reinsurance”, Chisinau 2006;

- Government Decision no. 463 of 23.05.2018 The action plan regarding the implementation of the Development Strategy of the SME sector for the years 2018-2020 // In: Official Monitor of the Republic of Moldova, 25.05.2018, no. 167-175, art no: 514

- KPMG, Study into the methodology to assess the overall financial position of an insurance undertaking from the perspective of prudential supervision, 2002, pag. 98

- Law on Entrepreneurship and Enterprises, no. 845-XII of 03.01.92 // Parliament Monitor, 28.02.1994, no. 2, art. No: 33

- Law on supporting the small and medium enterprise sector, no. 179 of July 21, 2016 // In: Official Monitor of the Republic of Moldova, 16.09.2016, no. 306-313, art no: 651.

- Niklas Elert, Magnus Henrekson, Mikael Stenkula, (2017) Institutional Reform for Innovation and Entrepreneurship An Agenda for Europe Springer ISBN 978-3-319-55092-3 (eBook)

- Seulean V., Raileanu M., Commercial insurance, Mirton Publishing House, Timisoara, 2001;