Introduction

During the last recent years, the speed at which Islamic banking has been growing and its resilience to the 2007 financial crisis ( see for instance Beck, Demirgüç-kunt, & Merrouche, 2013; Olson & Zoubi, 2016) provide evidence of its ability to compete with or outperform well-established conventional banks (CBs).Martin & Hesse (2010) and Olson & Zoubi (2016), document that more than 300 IBs are operating throughout 51 countries in the financial industry and hold almost $ 1.5 million dollars of assets. Similarly, Ernst & Young (2016) argue that over the period of 2009-2013, Islamic banking assets value growth reached 17%.The creation of Islamic stock market indices in the world’s largest stock exchanges such as the MSCI Global Islamic Indices (2007), FTSE Global Islamic Indices and S&P Sharia Indices (2006), Dow Jones Islamic Market Indices (1999), or the Russell-Ideal Ratings Islamic Indices (2013) is important to sustain the idea of IBs growth.

As Compared to conventional banks, Islamic banks rely on a sharia-compliant finance that prevents them the right of charging interest, does not allow for illicit investments and speculation and also strengthens the risk sharing principle both on assets and liabilities. For Gueranger (2009), Islamic finance is an ethical finance whose priority objective is not only the frantic search of profit.

Following the aforementioned literature, our study’s objective is to assess what determines the performance of IBs compared to conventional banks. We seek to contribute to the literature in two ways. (I) First, we follow the existing literature on the performance in the banking industry in general. Most generally, bank performance is measured by accounting ratios such as return on equity, return on asset and net interest margin (see for instance Athanasoglou, Brissimis, & Delis,(2008); Dietrich&Wanzenried,(2011); García-herrero,Gavilá,& Santabárbara,(2009); Pathan&Faff,(2013). In most recent studies, some use measures of stock performance such as Tobin’s Q (Mollah & Zaman, 2015), Sharpe ratio (Gropper, Jahera, & Chul, 2015) and stock return. Our innovation relies on the fact that we use both Jensen ratio and Treynor ratio (both as stock performance measures) that have not been used as proxy of bank performance to the best of our knowledge. We will provide an answer to how well systematic risk is able to predict bank performance by distinguishing between IBs and CBs. (II) we use mainly African conventional banks because African banking industry is still the least developed in the world. By doing so, we complement the existing literature by documenting the gap between conventional banks evolving in least developed country (which are supposed to have low margin) to IBs.

The remainder of this paper is organized as follows; (1) We document the existing literature on conventional bank and Islamic performance. (2) In the following section, we present the data and the methodology that are used to study performance. (3) Section 3 presents our results from different empirical applications and section 4 concludes.

Literature Review

Performance is among the most discussed issues within the banking industry in an empirical perspective. Some researchers used to investigate bank performance in terms of ownership structure (knyaeva et al 2013) by comparing private to public bank and foreign to host banks. Other studies focus on the factors driving performance without relying on bank-type analysis (see Poin Hoin et al 2016; Rashid & Jabeen 2016; Jawadi 2016).For instance Figueira, Nellis and Parker (2006) have studied the ownership structure and performance of African banks. They found that, when private shareholders introduce foreign shareholders into the ownership structure of African banks, this tends to have a positive effect on the performance of the latter. These studies have documented for some cases a significant link between governance mechanisms and banks performance (mollah & Zaman 2015) or relevant information about comparative performance between IBs and CBs (Johnes et al 2013).

Prior to the tremendous growth of Islamic banks, an important body of literature have emerged to most importantly address to which extend Islamic banks are different from conventional banks. To address this issue, Bourkhis & Sami (2013) investigate the difference between IBs and BCs resilience to the 2007-2008 financial crisis and find no difference with regard to their soundness because IBs tend to diverge from their business model. Beck et al. (2013) address business model and efficiency issues by comparing Islamic to conventional bank. They found that IBs are better capitalized, have higher ratio of intermediation, high asset quality although they are less cost-efficient. They also suggest that IBs were less affected by the 2007-2008 financial crisis because of the high asset quality they carry.

In the same spirit, Olson&Zoubi(2016) investigate the convergence of IBs and CBs performance. They argue that CBs converge faster than IBs especially after the financial crisis.

Methodology

This study focuses on publicly traded African conventional and worldwide Islamic banks. We chose publicly traded banks since our study employs equity performance measures as proxies of performance in the banking industry. Our sample is split into 48 IBs and 61 CBs on the period of 2006-2015. To conduct this study, our data are retrieved from different sources: (I) Bank level data are retrieved from Bankscope database which was provided by Bureau Van Dijk Belgium until December 2015 (II), stock market data (here stock prices and market capitalization) stem from DataStream and (III), Macroeconomic data to account for country heterogeneity in terms of economic performance and financial depth are obtained from the World development indicator part of the world Bank website. (iv) Risk-free rates were mostly downloaded from Central Bank websites and it is represented by a 91 days’ maturity treasury bills and some countries we proxy the risk-rate by a one-month US treasury bill retrieved from Kenneth Fama-French data library[1]. We compute stock return using arithmetic approach, Treynor and Jensen performance measures are driven from a CAPM[3] model using different stock indices as market proxy as retrieved from DataStream. Overall, our correlation matrix as reported in Table 4.1 suggest that our variables as mostly significantly correlated although their value are not high to suspect a potential multicolinearity. Descriptive statistics are reported in the annex and show that Islamic banks have higher asset quality than conventional.

In order to investigate factors driving bank performance, we follow Athanasoglou, Brissimis, & Delis(2008); Dietrich & Wanzenried (2011); García-herrero, Gavilá, & Santabárbara, (2009) and Pathan & Faff (2013) from whom we choose to set up the following specification:

[1] http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

[3] Capital Asset Pricing Model

Where PFOit stands for the performance of the bank i at time t (here the year), βi and δi are the parameters we intend to estimate, Xit represents bank specific and Fit denote macroeconomic variables and other control variables, et the error term, represent fixed-effects among different banks. PFOit-1represents the lagged value of the performance measured due to the persistence of bank performance with respect to regional and macroeconomic factors as suggested by Berger, Bonime, Covitz& Hancock (2000).To estimate our parameters, we use a dynamic panel approach suggested by Arellano, M.; Bond, (1991).

Table 3‑1: Variables presentation and expected signs

Table 4‑1: Correlation Matrix of different variables

Empirical Results

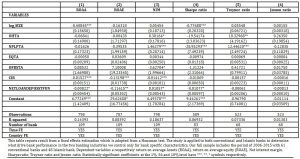

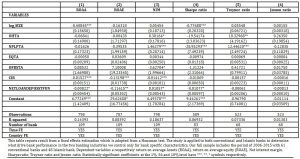

Fixed effects estimations are presented in Tab 4.2 and Tab 4.3 which respectively account for only bank-specific variables and macroeconomic variables. The R-squared of our models are different when we split our sample into IBs and CBs compared to when we use the full sample. Indeed, the first estimation report much higher R-squared than the second which can be explained by the heterogeneity between the two types of bank. In general, our models fit with fixed effect according to the Hausman test. Globally, we found that when we only control for bank-specifics variables, size, and Cost-to-income ratio, NPLP and Overheads to total assets are the main determinants of bank performance.

Our findings are consistent with the existing literature on the size impact on bank performance. When we measure performance by ROAA, ROAE and Sharpe ratio, we find a negative effect of size. These results are consistent with the findings of (Beck et al., 2013; Dietrich & Wanzenried, 2011; Mollah & Zaman, 2015; Olson & Zoubi, 2016). As our study encompasses also the crisis period, it is possible that bigger banks had large amounts of non-performing loan provision, which might affect negatively their performance. For Islamic banks, especially where loans issued through the so-called Mudarabah have to be provisioned with a special account (IADS), this would affect IBs performance with a long term mechanism and most importantly have larger size.

However, some studies such as Gropper et al., 2015; Pathan & Faff, (2013) among others have found positive link between size and bank performance. Because bigger banks have higher diversification possibilities, they might enjoy economies of scale and hence high performance.

As a measure of credit quality, non-performing loan provision is highly significant in this study for all our performance measures. Using all these performance measures, this variable shows a negative significant impact on bank performance either for conventional banks or Islamic banks as well as for the full sample. These results entail the fact that the higher the loss provision, the lower the credit quality of the bank and hence the lower the performance. Empirical studies (see for instance Beck et al., 2013; Gropper et al., 2015) provide supporting evidence that high loss provision is detrimental to bank performance because the amount of provision allocated decreases the bank net income. Although significant, loan provision are not as important as for conventional bank(Beck et al., 2013), Islamic banks’ performance is also negatively affected by high loan loss provision because some products have to be covered by amount of provision.

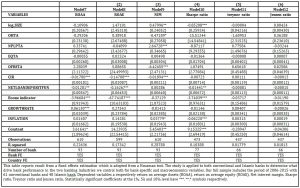

In table 4.3, we control for macroeconomic variables. Boone indicator as a measure of bank competition has a negative and significant impact on bank performance. Indeed, the structure-Conduct-Performance hypothesis suggests that a highly concentrated market indicates a low degree of competition and hence high profitability for banks. Our results support the competitive nature of the banking industry since the financial liberalization. Some studies however, use HHI concentration measure to assess the impact of bank market structure on the performance. Mirzaei, Moore, & Liu, (2013) demonstrate that market structure has a positive impact on banking both in developed and emerging economies. Moreover, we have mentioned so far that Islamic banking is growing at high pace. This result suggests that Islamic banking profits could be highly affected by the market structure despite the existence of unique regulation.

Table4‑2 :Fixed effects regressions for bank performance: Full sample

With respect to the GDP growth, our study suggests both positive and negative link with bank performance. Mirzaei et al.(2013) document that GDP growth influences bank performance through raising demand for loans. Bashir (2003) who evaluated the determinants of profitability in Middle East Islamic Banks, found a strong positive impact of GDP growth on profitability because of competition environment and innovative products channels. Goddard, John, Phi, & Wilson (2004) also estimated the profitability of 583 European Union domestic banks where cross sectional regression showed a significant positive effect of GDP on profits. Ghazali (2008) considered a six years data of 60 Islamic banks operating in 18 countries. Results ascertain that GDP and inflation positively influence the revenue of banks. On the other hand, negative links have also been reported by Naceur (2003) who found an insignificant link between Tunisian bank profitability and the annual growth rate and inflation.

Table 4‑3 : Fixed Effects Macroeconomic control variables

In a short term perspective, inflation is an important factor to growth rebound. However, this link appears to be positive when the performance is measured by Sharpe ratio. The explanation behind this may be drawn from speculative and anticipative investors’ behaviour on the financial market. The positive link between inflation and performance is documented by Albertazzi & Gambacorta ( 2009 ; 2010).

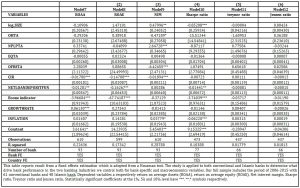

To address the issue of endogeneity and omitted variables bias, we follow (Dietrich & Wanzenried, 2011; Liang et al., 2013; Pelster, 2017) and use the Arellano & Bover (1995) and Blundell & Bond (1998)two-step system GMM that uses lagged values of dependent variable in level and difference as well as lagged values of explanatory variables in level.

Table 4‑4: System GMM estimation of bank performance

Results reported in Table 4.4 suggest that, our model fit the system GMM estimator. In fact, Hansen-J statistics of over-identifying restrictions and Arellano-Bond second order autocorrelation tests are not statistically significant. The first-order auto-correlation on the other hand appears to be statistically significant which is true by construction. All in all, after we have controlled for heterogeneity, dynamic endogeneity and simultaneity, non-performing loan loss provision, equity to total asset, cost-to-income ratio appear to have a significant impact on both conventional banks and Islamic banks performance.

This study also confirms the persistence nature of bank performance during our study period. Except for Sharpe ratio, all the first-order lagged values of our performance measures are statistically significant. These results are consistent with those of Dietrich & Wanzenried, (2011); Guidara, Lai, Soumaré, & Tchana, (2013); Liang et al., (2013); Pelster, (2017).

We have to stress that the use of stock performance measures as proxies of bank performance, especially the Treynor ratio and Jensen did provide evidence that risk-adjusted performance can provide management style for bankers.

Conclusion

The main objective of this study was to determine what drives the performance of Islamic vs conventional banks using both classical measures (ROAA, ROAE, and NIM) as well as stock market risk-adjusted measures. A sample comprising respectively 48 Islamic and 61 conventional publicly traded banks during the period stretching 2006 to 2015 is employed in our analysis. To test how Islamic banks’ performance differs from conventional banks’, we employ a two-step system GMM estimator which allows controlling for endogeneity and unobserved variables bias.

Our findings reveal that bank performance is mainly driven by non-performing loan provision, cost to income ratio, and size, net loan to total asset. Within a dynamic panel framework, NPLP has a negative impact on BCs performance whereas it affects positively IBs performance. This is consistent with Beck et al. (2013) who suggest that IBs have higher asset quality than conventional banks. This study also contradicts the idea that IBs are less cost-efficient than CBs because the cost to income ratio as a measure of efficiency is more significant for IBs than CBs.

Controlling for macroeconomic variables within a fixed effect approach, this study is consistent with the Structure-Conduct performance hypothesis that suggests a positive link between market concentration and bank performance. Measured by Boone indicator, competition as the opposite of market concentration affects negatively both IBs and CBs.

This study also confirms the persistence nature of bank performance during our study period. Except, Sharpe ratio, all the first-order lagged values of our performance measures are statistically significant.

Our study has provided evidence that bank performance could be measured both by JENSEN and Treynor ratios.

The conclusion from this study is related to our sample and would have been different in some other specific cases. For instance, a longer study period or/and a larger sample could have led to different conclusion as the sample size and heterogeneity would impact the consistency of our results. Moreover, accounting for regulatory differences, constructing a single index for each category of banks would affect our results.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Albertazzi, U., & Gambacorta, L. (2009). Bank profitability and the business cycle. Journal of Financial Stability, 5, 393–409.

- Albertazzi, U., & Gambacorta, L. (2010). Bank profitability and taxation. Journal of Banking and Finance, 34(11), 2801–2810.

- Arellano, M.; Bond, S. (1991). Some Tests of Specification for Panel Carlo Application to Data : Evidence and an Employment Equations. Review of Economic Studies, 58(2), 277–297.

- Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(August 1990), 29–51.

- Athanasoglou, P. P., Brissimis, S. N., & Delis, M. D. (2008). Bank-Specific, Industry- Specific and Macroeconomic Determinants of Bank Profitability. Journal of International Financial Markets, Institutions and Money, 18(2), 121–136.

- Beck, T., Cull, R., & Jerome, A. (2005). Bank privatization and performance : Empirical evidence from Nigeria q. Journal of Banking and Finance, 29, 2355–2379.

- Beck, T., Demirgüç-kunt, A., & Merrouche, O. (2013). Islamic vs . conventional banking : Business model , efficiency and stability. Journal of Banking and Finance, 37(2), 433–447.

- Berger, A. N. (1995). The Relationship between Capital and Earnings in Banking pp . Journal of Money, Credit and Banking, 27(2), 432–456.

- Berger, A. N., Bonime, S. D., Covitz, D. M., & Hancock, D. (2000). Why are bank profits are so persistent ? The roles of product market competition , informational opacity , and regional / macroeconomic shocks q. Journal of Banking & Finance, 24, 1203–1235.

- Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(115–143).

- Bonin, J. P., & Wachtel, P. (2005). Bank performance , efficiency and ownership in transition countries, 29, 31–53.

- Boubakri, N., Cosset, J., & Fischer, K. (205AD). Privatization and bank performance in developing countries. Journal of Banking and Finance, 29(2005), 2015–2041.

- Bourkhis, K., & Sami, M. (2013). Review of Financial Economics Islamic and conventional banks â€TM soundness during the 2007 – 2008 financial crisis . Review of Financial Economics, 22(2), 68–77.

- Bremus, F. M. (2015). Cross-border banking , bank market structures and market power : Theory and cross-country evidence. Journal Of Banking Finance, 50, 242–259.

- Claessens, S. (2001). How does foreign entry a ect domestic banking markets ? q, 25.

- Demirguc-Kunt, A., Huizinga, H. (1999). Determinants of Commercial Bank Interest Margins and Profitability : Some International Evidence. World Bank Economic Review, 13(2), 379–408.

- Demirguc-Kunt, A., Huizinga, H. (2000). Financial Sructure and Bnak profitability. World Bank Economic Review.

- Dietrich, A., & Wanzenried, G. (2011). Determinants of bank profitability before and during the crisis: Evidence from Switzerland. Journal of International Financial Markets, Institutions and Money, 21(3), 307–327.

- Gambin, L. (2004). Gender Differences in the Effect of Health on Wages in Britain.

- García-herrero, A., Gavilá, S., & Santabárbara, D. (2009). What explains the low profitability of Chinese banks ? Journal of Banking and Finance, 33(11), 2080–2092.

- García-meca, E., García-sánchez, I., & Martínez-ferrero, J. (2015). Board diversity and its effects on bank performance : An international analysis. Journal of Banking and Finance, 53, 202–214.

- Goddard, John, Phi, l M., & Wilson, J. O. . (2004). Dynamics of Growth and Profitability in Banking. Journal of Money, Credit and Banking, 36(6), 1069–1090.

- Gropper, D. M., Jahera, J. S., & Chul, J. (2015). Political power , economic freedom and Congress : Effects on bank performance q. Journal of Banking and Finance, 60, 76–92.

- Guidara, A., Lai, V. S., Soumaré, I., & Tchana, F. (2013). Banks ’ capital buffer , risk and performance in the Canadian banking system : Impact of business cycles and regulatory changes. Journal of Banking and Finance, 37(9), 3373–3387.

- Jensen, M. C. (1968). The performance of mutual funds in the period 1945-1964. The Journal of Finance, 23, 389–416.

- Liang, Q., Xu, P., & Jiraporn, P. (2013). Board characteristics and Chinese bank performance. Journal of Banking and Finance, 37(8), 2953–2968.

- Martin, Č., & Hesse, H. (2010). Islamic Banks and Financial Stability : An Empirical Analysis, 95–113.

- Mirzaei, A., Moore, T., & Liu, G. (2013). Does market structure matter on banks ’ profitability and stability ? Emerging vs . advanced economies. Journal of Banking and Finance, 37(8), 2920–2937.

- Mollah, S., & Zaman, M. (2015). Shari ’ ah supervision , corporate governance and performance : Conventional vs . Islamic banks. Journal of Banking Finance, 58, 418–435.

- Olson, D., & Zoubi, T. (2016). Convergence in bank performance for commercial and Islamic banks during and after the Global Financial Crisis. Quarterly Review of Economics and Finance. http://doi.org/10.1016/j.qref.2016.06.013

- Pathan, S., & Faff, R. (2013). Does board structure in banks really affect their performance ? Journal of Banking and Finance, 37(5), 1573–1589.

- Pelster, M. (2017). Financial penalties and bank performance. Journal of Banking and Finance.

- Sharpe, W. F. (1964). A Theory of Market Equilibrium under Conditions of Risk. The Journal of Finance, 19(3), 425–442.