Introduction

Over the past decade, the interaction of four very dynamic areas has accelerated significantly: trade, finance, social communications, and networking. Their association has become one of the most promising areas of business. It also affected the lifestyle. Digital innovations in these areas make socio-economic connections more convenient, large-scale and effective for all participants. Commercial and financial applications of social networks in social networks, as well as the mining of information about network users by merchandisers and banks, open up promising prospects for commercial and financial intermediation, social networks and network users.

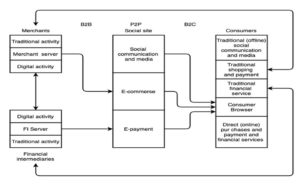

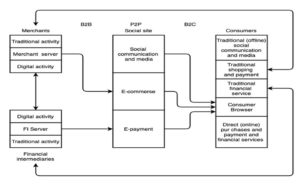

Social networks have the broadest communication features. They accelerate and simplify interactions, meet the requirements of openness and freedom of communication (Jasek, 2019). Such properties of social networks allow them to be used for commercial purposes (Stelzner, 2018; NMC/CoSM, 2008). Ultimately, social networks foster people-to-people (P2P), business-to-consumer (B2C), and business-to-business (B2B) relationships (Mangold and Faulds, 2009). Social media are perceived as marketing tools and resources (Golden, 2011), which become inexpensive forms of direct contact with consumers (Haenlein, 2017). At the same time, social networks are increasingly becoming the basis of new business ideas and processes (Dost et al. 2018). A promising direction for leading social networking sites is providing users with the opportunity to make commercial transactions and payments without leaving the site. The changes allow social networks to retain users on sites, expand the scope of activities, increase traffic and receive additional revenue. In turn, merchants and banks can attract new customers, increase sales and services, receive information about consumers, introduce new services and, thereby, generate additional income.

According to Statista (2019a), by 2021 the number of active users of social networks will exceed 3 billion. In the 2019, Facebook attracted up to 2.3 billion active users, WhatsApp – 1.6 billion, Facebook Messenger – 1.3 billion, WeChat – 1.1 billion, Instagram – 1 billion, Reddit – 330 million, Twitter – 313 million, Pinterest – 110 million (Statista, 2019b). This entire Internet audience is involved in trading and financial interactions. Social sites allow sellers to promote their products and communicate directly with consumers, as well as provide website users with the opportunity to make purchases, make payments and receive loans. Also, they provide merchants and bankers with information about consumers and help maintain their online reputation (Dolle, 2014). On the one hand, social sites are not competitors for sellers and banks – they only provide them with a platform for marketing and distribution of products and financial services to network users. On the other hand, they gain experience in new areas of activity, connect consumers to their websites and get the opportunity to influence both commercial and financial activities, dictate conditions for sellers and banks, and also switch to new areas of activity.

Social networks and their interactions with economics are a widely studied topic (Jackson, 2008; Kapron and Maartens, 2017). Studies are conducted from different points of view – from graph theory and centrality to data science and network user behavior. They are also considered Social Networks in terms of marketing (Kotler et al. 2017), loyalty to the bank (Atmaca et al. 2019), and the use of these social networks in financial activities (Rezayat, 2017) and business (Mutuku, 2017). Nevertheless, the topic of embedding commercial and financial services in social networks is new, and its development is just beginning.

In this paper, theoretical and scientific-strategic assumptions are made at different levels. At the most general level in social networks, commercial and financial inclusions are formed. Organizationally, they are created in the form of various applications related to recommendation systems, as well as payment systems, money transfer, and credit systems. At a more specific level, it is shown that new functions are added to the two main functions of social networks (social interaction and dissemination of information). Among them, mediation in the commercial and financial fields stands out. For its implementation, “conventional” technologies are involved, which are already used both in social networks, as well as in commerce and banking. New ones are also being developed that are specifically designed to implement new tasks and applications.

At the most specific level, one of the first attempts was made to analyze the behavior, on the one hand, of commercial and financial intermediaries in the system of financial and commercial inclusion in social networks, and on the other hand, social networks and their users in the new conditions. In addition, some mechanisms for promoting goods and services on social networks are examined and evaluated. The subordinate goal of this publication is to develop the basis for the conceptual justification of the commercial and financial functions of social networks and to prepare the conditions for the development of possible approaches for the subsequent modeling of these processes. At the most specific level, one of the first attempts was made to analyze the behavior, on the one hand, of commercial and financial intermediaries in the system of financial and commercial inclusions in social networks, and on the other, in social networks and among their users. It also discusses the working conditions of some mechanisms for promoting goods and services in social networks. The subordinate goal of this paper is to develop the basis for the conceptual justification of the commercial and financial functions of social networks and to prepare the conditions for the development of possible approaches for the subsequent modeling of these processes.

The study has several limitations. They are based on the absence of long time series, based on which one can evaluate the place and role of commercial and financial applications in social networks, which allowed changes in relations with consumers to expand and strengthen ties with them.

The Effect of a Combination of Three Spheres

In the mid-1990s, online markets revolutionized retail, payment systems, and consumer lending. In the past decade, businessmen and bankers began to establish interactions with social networks. The result was an increase in retail operations in commodity markets and in the banking sector, which led to changes in relations with consumers to expand and strengthen ties with them. The result was an increase in retail operations in commodity markets and in the banking sector. The main motive for the change was the desire of sellers and bankers to be where there are consumers. Maintaining constant contacts with network users, sellers and banks received the necessary information about demand. In general, such changes lead to the transformation of the main economic mechanism for regulating economic life, which is based on supply and demand.

If we transfer the problem to a more specific level of consideration, then within the framework of social networks there is a merger of trading and financial channels of communication with consumers. The result is a transition from a multi-channel and multi-functional way of satisfying the needs of the consumers to omnichannel (Clara, 2018). This process has been outlined at the turn of two decades. It is associated with the emergence of a new type of digital market. It is based on social networking platforms designed not only for social communications but also for economic interactions. The result of such changes was the transition to the scalable supply of goods and services for the entire consumers and theoretically unlimited demand satisfaction.

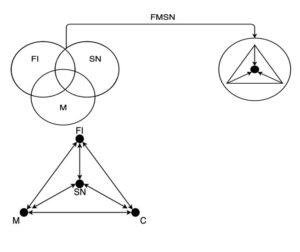

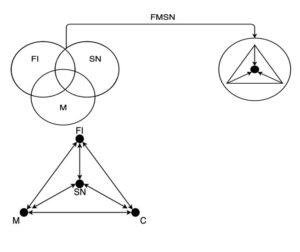

To organize the work, first of all, you need to find the right content, select the nodes and determine the relationships between them. Modeling Ideas (Haase et al. 2019) for the sharing economy, in this paper we will examine through the interaction of three systems: a social network (SN) with a certain part of the merchandising (M) and financial intermediation (FI), during which a new quality is formed – financial/trading social network (FMSN) (Figure 1). Within the framework of such a network, a new system of relations is being formed, which by its nature possesses the properties of a joint economy. In this regard, the offer of commercial and financial services on the pages of social sites ensures business sustainability and convenience for the population (Carrigan et.al. 2020).

Figure 1: Financial intermediary/Merchant and Social Network (FMSN)

The first condition was implemented by improving access to customers. Merchants and banks received a free platform for:

1) The expansion of commercial and monetary offers. As a result, any enterprise or bank received a mass audience. Merchants and bankers have found a new niche for expansion.

2) Offering a wide range of goods and new types of financial services, which in traditional conditions simply would not have found a place on the shelves of physical stores and with physical contacts of customers with bank clerks.

3) Attracting niche customers to the service sector, that is, those in which sellers and bankers were not previously interested.

Concentrating in one place of service all the vital functions of regular visitors to the site allowed sellers and banks to collect various pieces of information and analyze the behavior of participants, identify needs, personalize offers, sell products and provide services at one place. Thus, the old multi-channel system of relations with consumers is replaced by a universal single-channel system. It becomes possible to maintain social contacts and at the same time make purchases and payments. As a result, network users receive savings in the most important resource – time.

Schematically, the communication lines between the three areas and the network user can be represented as follows (Figure 1).

Fig. 1: Financial intermediary – Merchant – Social network – Network users

The scheme represents both the traditional relations of sellers of goods and financial intermediaries, as well as mediated relations by social networks.

Synergies of Three Areas: A Detailed Approach

In the transition of social networks to providing users of commercial and financial services networks, the approach of single-channel presence is used: determining client intentions, managing interactions, collecting information and using effective ideas.

Various methods of analytics allow us to grasp the meaning of interaction through channels. Web analytics can analyze customer behavior on the Internet and collect location information, as well as use a speech analyzer to identify customer emotions. As a result, the life of the client becomes clearer, and the social mood is more defined.

Data Mining

Some intentions, inclinations, and desires received through various channels are easily structured and classified, while others are not structured enough. These include, in particular, video/audio information and free-form texts. Nevertheless, modern algorithms take into account not only structured, but also unstructured information and extract from it the main points that characterize the mood, interests, motives, and requests of network users, and on this basis, personalized assessments and offers are made.

Analysis and Use

Big data technology allows merchants, banks and social networks to quickly and reliably receive current consumer data and quickly respond to them. This technology enriches the idea of understanding customers and is invaluable for providing intelligent and differentiated services, as well as targeted marketing offers in the product and financial markets.

We define social networks with built-in applications for the provision of commercial and financial services as social networks 4.0 since they correspond to the general direction of the modern technological revolution leading to the formation of a new business model and a change in consumer behavior.

Technological Innovation – The Basis for the Interaction of Finance, Trade, and Social Networks

Social networking sites with commercial and financial inclusion are social networks with technological solutions designed to support and apply commercial and financial services for Internet users. Today they are often considered as the framework for combining commercial and financial services with social networks. They are based on modern information technology.

The interaction of trade with technology occurred at all stages of human socialization. Everything went in the direction of the development of exchange, money, accounting, and communications. In the 19th century, railways, steamboats, telegraphs, and telephones revolutionized trade. New communication opportunities have expanded the scope of trade, accelerated settlements, and delocalized markets. As a result, global commodity markets have been formed. The Internet has led to a new stage in the development of product markets. Theoretically, territorial restrictions from their development were completely removed and opportunities appeared for connecting almost the entire population to the markets.

As for the interaction of banking with technology, it also has a long history. There are three different stages in which banking and technology have evolved together. The first and longest, century-old period can be attributed to the analog phase (1866-1967). Relations developed in waves – periods of increasing financial transactions alternated with their weakening. Cycling largely determined the course of development of banking, not only from the quantitative, but also the qualitative sides. There were many different interactions that led, on the one hand, to organizing the circulation of checks and bills, trading stocks and bonds, and on the other, to the use of computers, various computing technologies in finances associated with the advent of actuarial calculations, indices, and analytics. According to some estimates, the second stage began in the last third of the last century (Armer, et.al. 2016). It was based on the digitization of trade and finance, which led to the emergence of digital commodity and financial markets. After the financial crisis of 2008, the third stage began. Its basis was a change in attitude to information, a sharp increase in the volume of data processed by financial and trading intermediaries. Digitized unstructured text, visual and audio information was connected to the information flow. An even more important circumstance was the fact that technologies appeared that made it possible to take this information into account in trading and banking and to proceed with building new models of customer relationships based on it. Various financial startups quickly mastered a new niche. They set about creating a new financial ecosystem. However, quite quickly, traditional financial intermediation joined the fintech and, in several cases, even headed it. Recently, one of the areas of fintech has been the development of the interaction of banking, insurance, investment, and exchange business with social networks.

Work in the era of social networks

The current stage of technological transformations has affected not only the technology but also culture, working methods, decision making, customer relationships, and new leadership ideas. In general, the new communication prospects were open not only to social contacts but also to trade, finance and the organization of jobs and cooperation between remote and autonomous freelancers.

Technological innovation, combined with the growth of a service-based economy and the spread of social networks, are fundamentally changing the work (Harding, 2017a). Digital technologies have enabled virtual teams to work more efficiently than traditionally organized with the physical interaction of employees. According to some estimates, the digital organization of the work will become the future form of the work process (Harding, 2017b). Flexible working conditions, on the one hand, allow people to more effectively combine both work and non-working obligations, and on the other hand, employers use new advantages – to achieve higher labor productivity, attract and retain high-quality personnel, reduce staff turnover, and reduce staff costs (Harding, 2020). Thanks to new technologies, in particular, their development in social networks and finance, freelancers and independent contractors were able to not only effectively organize their work, but also integrate into the payment system. Receiving money for a remote contractor is no longer a problem. Various systems such as PayPal have billing and global payment functions that simplify charging and expand cross-border work. Employees have access to various payment options, including paying and receiving foreign currency, as well as paying with gift cards, which is especially convenient for freelancers from countries having problems with cross-border payments.

The Economic Structure and Ecosystem of Social Sites with Commercial and Financial Applications

A market can be thought of as a set of transactions. With this approach, traders exchange goods and services for money, and financial intermediaries help the exchange. Under the influence of new technologies, changes are occurring that divide the market into various subsystems. First of all, the market is differentiated into a traditional and digital market.

Theoretically, the entire economy and the entire market can be digitized and rebuilt digitally. However, this can hardly be done practically, at least at the present stage. The world around us has physical realities that have many real interactions. This requires certain physical transactions and real markets. Many markets and physical assets can be fully digitized, others can be partially digitized, but there are probably those that cannot be digitized. In many cases, after the sale, the need arises for the physical transfer and use of assets. Evaluation of traditional assets, transactions, markets and the economy from the perspective of their digitization is necessary to determine their ability to penetrate the sphere of interests and enter the orbit of social networks. To do this, it is necessary to segment potential markets based on their digital properties and interests on the part of users of social networks. From these positions, three submarkets can be distinguished: a market based on social networks with commercial and financial services, a digital market based on direct connections of traders and bankers with consumers, and a traditional market (table 1).

Depending on the structure and functions of the market, the value will be created, circulated and accumulated in different ways for both types of assets – digital and physical. The digital market can either use and circulate on traditional money and traditional monetary systems, or use digital money – in some cases based on fiat money (rather inflationary systems), and in others – on cryptocurrency (deflationary systems). The traditional market pays significant attention to documentary safeguarding of property rights, agreements, and contractual cash flows. Smart contracts based on decentralized block technologies can change approaches to the assessment, observance, and enforcement of property rights.

Table 1: Distinctions and Properties of Economies

Note: compiled by the authors.

Market for regular users of social networks

Currently, a market is emerging that can function as part of social networks with commercial and financial services. For regular users of the network, such a market can become the main one, that is, all the transactions necessary for life can be done without leaving conventional social sites. In social networks, decision-making authority can be not only decentralized but also distributed among participants. Therefore, the market can be centralized – associated with specific suppliers of goods and services (B2C), and decentralized – in monetary transactions between network users (P2P). Theoretically, the blockchain and technology of distributed ledgers bring the decentralization of the market to a logically perfect one.

The market, which is formed within the framework of social networks, implements the conditions and principles of cooperation of the unknown participants. Within its framework, conditions are created for the distribution of value created in the digital economy among members based on their contribution. Google experimented with fluid democracy built on an internal social network known as Google Votes (Hardt and Lia, 2015). Thanks to the delegation of votes, the best food products were found. Social networks allow delegated democracy to be not only representative enough, but also economical and quickly implemented (Ford, 2018). One of the main objectives of a liquidity democracy is to increase market efficiency by ensuring greater transparency in the choosing of goods and services and the decision-making process.

Digital Market

Most traditional markets can be digitized, which will become the backbone of a digitally supported economy. Full digitization is suitable for financial markets, as well as for all stock markets. Theoretically, any assets can be digitized, and their accounting and circulation in digital form organized. When using the blockchain, assets can be programmed using tokens. In this case, it will be possible to create new markets with new asset allocation and structuring models (for example, the tokenization of intellectual property, knowledge, human capital, etc.). Thus, a transition to the differentiation of the digital market will occur. There will also be a digital economy in which new digital products and services will interact less with physical markets (e.g. market of forecasts) or perhaps there will be no interaction.

In the digital economy, decision-making can be decentralized to some extent. Ideally, the blockchain brings this process to perfection. Nevertheless, modern systems allow, through node management, to influence decentralization and actually lead to the effects of “managed” or “regulated” or “controlled” decentralization. Central banks in several countries (e.g., Canada, Singapore, and Taiwan) are developing systems for quasi-centralized Eferium or R2 based distributed ledger technologies. Digital market networks will satisfy the needs of different participants. In the digital economy, incentives for collaboration between unfamiliar participants already exist, but they are more fully implemented in the markets of social networks.

Traditional Markets

Finally, there will remain a large number of markets that are still strongly tied to physical assets and markets such as real estate, agriculture, and social services. Of course, all real estate, as well as agricultural products can be digitized, but in the real world, the physical transfer of the real estate, agricultural products or social services is necessary. Most of these markets are geographically localized, differentiated by local rules and regulations. The regular local currency is likely to remain the unit of account in such markets, although transactions can also be made using digital currencies, including cryptocurrencies. In the traditional economic system, a centralized decision-making process takes place in a democratic market – the principle of “controlled freedom” applies.

FMSN Ecosystem

In conditions of increasing uncertainty, the key conditions for stabilizing commerce and banking are innovative transformations of activities (Forcadell et al. 2019) and strengthening customer relations (Herzig and Moon, 2013). Through innovation, new products, services, or processes are introduced to the market (Yip and Bocken, 2017). Strengthening customer relationships can increase the competitiveness of companies (Kaartemo et al. 2018).

Social networks allow entrepreneurs to establish direct contacts with potential consumers of goods and services. Moreover, such contacts can be quite long-term, focused and varied. The combination of social networks with payment systems allows you to expand and consolidate such contacts, maintain and develop retail sales. Everything is aimed at interest and simplification of commercial and financial services for network users, the behavior of which depends on many factors and is largely controlled and determined by the leaders and laws of centrality (Aleto and Moreno, 2019). Under the influence of various factors, a special ecosystem of social networks arises.

The prospects for the ecosystem of social networks (Table 2) are different in each country, but in general, everything is moving towards improving the interaction of social networks with commercial and financial business in many areas.

Table 2: The ecosystem of social networks

Note: compiled by the authors;

* Statista (2019c)

Modern business and social networks demonstrate a high degree of interdependence (Babus and Allen, 2011; Kaniss and Oerlemans, 2008). There are various possible sources of links between commercial and financial institutions arising from the circulation of goods and related payments and loans, as well as investment. Ultimately, business communications are aimed at the end-users – only with their approval (consumption) does the business receive confirmation of the correctness of the business model and the decisions made. Network users are users of goods and services, as well as suppliers of financial resources for financial institutions. It is they who are involved in confirming the conformity of the business offer to consumer demand. Netizens utilize goods and services and also supply financial resources to financial institutions. It is they who are involved in confirming the conformity of the business offer to consumer demand.

The development of commercial, financial and social networks depends on many circumstances, which are ultimately determined by end-users – consumers of the relevant goods and services. All participants form a special network ecosystem. Currently, this system is in the process of restructuring towards the universalization of platforms that were previously differentiated and used for specific purposes, worked in different environments and solved independent tasks – commercial, financial, or social-informational. The ecosystem FMSNU (financial intermediaries – merchandisers – social networks – network users) is a concept whose key provision is commercial and financial inclusion in social sites, which allows users of social sites not only to receive information and provide social contacts but also to receive commercial and financial services on social sites.

Approaches to Performance and Effectiveness

Currently, important shifts are taking place both in business processes and in the dynamics of business relationships with consumers. These changes are based on both technological and socio-economic transformations. COVIT-19 and the pandemic caused by it, undoubtedly contribute to cardinal changes in business models and business relationships with consumers. As a result, business and population behavior are changing. FMSNU fully complies with the requirements of the time, as it provides the conditions for maintaining social distance behavior for both business and the public.

Position of financial intermediaries

Under the influence of Fintech, the financial intermediation strategy is changing: firstly, there is a reorientation of attention from traditional to new channels of communication with clients; secondly, attitudes towards financial startups are changing – from the fight against them (at the beginning and middle of the last decade) to their involvement by traditional financial intermediaries to solve problems of increasing their competitiveness; thirdly, the emphasis is on interaction with social networks (a source of information about clients, a mechanism for expanding and deepening relations with them).

Merchandizing Positions

Different groups of merchandisers consider social networks as an important direction of marketing, expanding sales and gaining customer loyalty.

Social Network Position

In all their diversity, the following are distinguished: (i) monetization and commercialization of services; and (ii) connecting commercial and banking applications to serve users. As a result, the nature and content of leading social networks are changing. Social networks have become a “global power” that connects users not only in the socio-informational but also in economic terms. They increasingly determine the interests of consumers and contribute to their satisfaction. In this regard, the trading and financial services of social networks allow network users to quickly solve many everyday problems.

Joint Positions

Common positions are determined by strategic interests and technical capabilities, as well as by the connections of the FNSNU system participants, which becomes the basis for embedding financial services in social networks. In the digital online market, market mechanisms based on social networks stand out in a special field, because they have mixed characteristics.

The focus of both commercial and financial intermediaries and social networks is not so much a combination of efforts as the creation of conditions for the development of commercial and financial services in the “shell” of social sites for network users. As a result, there is a growing interest of three parties – sellers, bankers, and social sites – in interacting and embedding additional services on the basis of social communication. Commercial operations and financial services on the “pages” of social sites are not reduced to turning social networks into commercial and financial intermediaries. The following comes: (i) expanding the scope of activities of social sites, (ii) financial intermediaries gain access to new customers, (iii) trading and financial intermediation is launched on the “pages” of social sites. For sellers and financial intermediaries, they must receive a new digital platform for an almost unlimited expansion of activities. At the same time, buffers between financial managers and clients are eliminated. They were in the form of personal contacts, manual labor, and limited information about potential customers. Trade organizations remove restrictions on the demonstration of goods to customers, caused by the physical limitation of shelves in stores. Social networks receive a new way of monetizing activities and additional participation in value chains in the service sector, as well as keeping users on the site and increasing traffic. Social media financial services are becoming a new and relatively independent field of activity. Their organizational basis is, first of all, recommendation systems and new applications. A common strategic setting, supported by technical and computational progress, unites all participants.

Social networks can be represented as an online structure designed to exchange information, collaborate (Kaniss and Oerlemans, 2008), develop relationships, foster learning, grow individuals and organizations (Cullen et al. 2015), and so on. All the development of social networks aimed at fuller use of their structure – continuous improvement in performance, the connection of new applications, expanding the scope of activity. With the transition to commercial and financial services, social networks are moving to a new stage of development, which is characterized not so much by a sharp expansion of communication flows, but by the transformation of social ties and their transformation into social-commercial-economic-financial flows.

The performance of social networks has changed in stages as complexity increases and new features are added to the network. One of the conditions for high performance of online communications is simplicity, speed and agility apps. The slowness of the application slows down communication and makes social interaction difficult. In this regard, the inclusion of commercial and financial apps on social networks allows you to speed up and simplify the processes associated with the purchase of goods and payments for them, as well as cross-border money transfer, which increase the level of performance of netizens. There are other nuances, in particular, socio-economic conditions and lifestyles are changing, and these changes will vary depending on the nature, complexity, and interaction with traditional institutions.

Usually, network efficiency refers to the efficiency of information exchange in a network (Latora and Marchiori, 2001), that is, efficiency reflects both the cost-effectiveness of network structures (costs-benefits – the cost of building and maintaining networks in working condition, necessary to obtain the corresponding effect – intranet information exchange) and the reliability of their work. When evaluating the effectiveness of the results of the interaction of commerce and financial intermediation with social network communications, the subject of analysis is not so much the work of networks as their interaction with external sources and consumers of information. The transition to the definition of a measure of effectiveness requires establishing the effectiveness of what and why it needs to be measured. For this, it is necessary to conceptually define a system (or systems) of cost-benefit, in which at one pole is a social site with commercial and financial services, and at the other, users are both netizens and commerce and financial intermediaries. In our opinion, the emergence of social networks with commercial and financial services can be viewed from the perspective of changes in efficiency in commerce, finance, and social communications both globally and locally. When connected to social sites of commerce and finance, a network effect arises, which can be viewed from micro- and macro-positions, since the network effect can spread to society as a whole.

Positive network externalities include the following: firstly, the value of social communications for users increases, because in its course users receive additional benefits and satisfy their needs not only with social communication, but also in solving many everyday tasks; secondly, the value of the network is growing, as the number of users, as well as the directions and areas of network use, is growing, that is, network users get more opportunities to fulfill their needs; thirdly, the effect of the two-sided market emerges because social sites unite different groups of users, which leads to the emergence of network effects between them – between trading enterprises, payment systems, and social contacts.

In the latter case, the social site platform acts as a transitional or intermediary platform that has two or more groups of users (in this case, trading enterprises and payment systems) that provide each other with network advantages, which, in turn, benefit users of network sites. To achieve a network effect, social sites when choosing services for their clients start with fairly limited, but the most massive commercial services, transfer of funds and payment for goods and services.

So, social networking sites enhance economic and social activity in society through various online mechanisms. At the same time, they are likely to enter into a competition, in particular, with online matchmaking – known as B2B matchmaking (e.g., using a system of algorithms and a large database, is looking for business partners (Noventure, 2020) by bringing together different stakeholders together also Airbnb, Uber, TaskRabbit, Baidu). In the past, investment banks, various brokers and traditional matchmakers seeking business partners, investors, mergers, etc., were engaged in similar activities.

From a conceptual point of view, the embedding of trade and financial intermediation in social networks can be considered from the prospect of the platform for users’ interaction (Zambrano, 2016), which creates new value by facilitating exchanges between consumers and seller (Asadullah et al. 2018). The basis of the new model of value formation is not the means of production that are characteristic of classical production structures, but the communication facilities. Social sites provide platforms for social and economic communication, which become a decisive factor in the new business model and lifestyle, as well as one of the notable trends of the Internet.

Research Findings

We are witnessing the emergence of a universal digital platform for the deployment of various activities – from social communications to commerce and financial interactions. An important distinguishing feature of the nascent industry is the lack of clear regulatory rules. However, before setting the standards for regulating and monitoring of the inclusion in social networks of new areas of activity, it is necessary to clarify the economic certainty of innovative technologies and latter-day forms of social-economic interactions. And for this, it is necessary to establish a consensus regarding concepts, definitions, terms, and legal norms.

Regulators are trying to establish control over new areas of network activity, classify and define it. Lawyers also seek to understand and classify areas and types of activity that were not previously classified. The unprecedented nature of the interpenetration of commerce, finance and social networks based on the latest technologies, on the one hand, opens up prospects for restructuring the accepted forms of business and social relationships, as well as for new forms of labor communications, on the other hand, can undermine traditional institutions, including banks and retailers that can create rather intimidating challenges for society as a whole.

In our opinion, an attempt to transfer old terms to new ideas and new relationships becomes a fatal error. Such an approach is a road to nowhere and never feasible until the end. Attempts are often made to classify and conceptually define new types of activities and forms of service from the professional positions of programmers who are inclined to define them from a technological point of view, or users – from the point of view of service amenities, investors – from the point of view of investment attractiveness, lawyers – from a legal point of view, legislators – from the point of view of supervision and regulation, antitrust services – from the point of view of delineation of areas of activity.

Thus, instead of criticism and replacement of specific or definitions with more complex and abstract ones, we offer analysis and the classification of new areas of activity within social networks from an economic point of view. There are long established economic methods with which you can explore innovative changes in the economy, to use for the classification of new areas of activity and distribute them to certain species, categories, and subcategories, as well as set umbrella terms and brands and deal with that with which we are dealing. Before proceeding, be sure to note that this is not a qualitative analysis of any particular social site and its activities or its interaction with commercial enterprises and financial intermediaries, or its direct participation in commerce and payments, and also not an opinion on whether this type of activity is any technological or market, either economic meaning.

To be able to define something new, it is important to understand its nature. A social network with commercial offers and the ability for users to make purchases and make payments without leaving the site is a universal communication platform on the basis of which various types of socio-economic activity are built. In the case of an independent provider of commercial and financial services by social sites, such a platform has a multi-purpose purpose. Its purpose and capabilities are fundamentally changing – all types of network activity can be included in its framework and scope. As a result, the line between the various processes is erased – business processes are presented as one of the varieties of the general network activity of web users. Everything looks completely different, if social sites offer their business partners from other areas their platform for providing services to users of social sites, then, in this case, the rules of the game do not change – just sites expand the audience of users and the purpose and functions of social contacts. From the point of view of transactions that are made on social sites during their commercial and financial use, they functionally do not differ from ordinary trading and financial transactions. Truly commercial and financial transactions are messages about certain changes in the legal status and / or possession and / or control of goods, services, financial assets, and money. Whoever performs commercial and financial operations from this does not change their essence. However, their institutional and organizational nature is changing. In case of successful implementation of the Facebook project on the internal circulation of the Libra cryptocurrency, the site will receive additional functions in the institutional plan, and with the expansion of financial functions, it will also include banking operations, which requires appropriate licensing. From a more general perspective, a social site with commercial and financial inclusion is already becoming a socio-economic site. They become a player not only in the social sphere but also in the economic sphere, which requires regulation by the relevant authorities. Consequently, there will be a reclassification of social sites – some will remain social, others social and commercial, thirds – social and financial, fourths – social, commercial and financial. This difference allows us to relate and consider a variety of social sites and differ their activities and to adjust their regulation in different ways.

In principle, commercial inclusion in social sites can be defined as an “app commercial” of social sites and financial inclusion – “app financial”. In such cases, the sites are considered from the perspective of a software application.

Global integration and advances in the field of Internet technologies radically change the nature and structure of trade and financial services. Social networks are pushing the boundaries of this process and add new qualities to it. The Internet has allowed businesses, banks and financial startups to use social networks to increase the efficiency of their business – brand awareness, promotion of goods and services, studying preferences and consumer potential, as well as the creditworthiness of users of social sites. On the other hand, social networks provide their platforms for making purchases, payments, and providing loans to their users.

In the course of digitization of trade and banking, the concept of organizing social networks is changing. As new technologies suit customers, they can positively perceive the transition to “all on one site.” The availability of a reliable multi-channel infrastructure and multi-channel interaction for social communications, purchases of goods and payments allow network users to receive not only comprehensive but also personalized service in any geographic point. As the world becomes increasingly digital, it is time for businesses to take advantage of the available information about customers and move to a new level of interaction with them, broaden the geography of trade, expand the scope of financial services, enlarge and fasten customer base and accelerate the process of product promotion and services.

The combination of the three spheres gives a synergistic effect – a new kind of sites and universal communication of regular visitors of site, combining media information and social contacts with purchases and financial operations. Social sites are becoming more complex and sophisticated with a variety of applications and interaction channels that provide not only communication and relationships in the P2P system, but also B2C, C2C, and B2B. A new stage in the development of social networks can be defined as Social Networks 2.0: the transition from traditional social networks to networks with channels and apps for the promotion and sale of goods and services, as well as making payments and other financial transactions.

The authors are aware of the limitations of the research – the role of government regulation in the development of commercial and financial functions by social networks is not taken into account. Naturally, the regulation will make adjustments to this process.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Aleto, A. and Moreno, A. (2019), ‘The dynamics of collective social behavior in a crowd controlled game,’ EPJ Data Science, December 2019, [Online], [Retrieved March 30, 2020], https://link.springer.com/article/10.1140/epjds/s13688-019-0200-1.

- Arner, D., Barberis, J. and Buckley, R. (2016), The evolution of fintech: a new post-crisis paradigm? University of New South Wales Law Research Series, Research Paper No. 2015/047, 44.

- Asadullah, A., Faik, I. and KankanHalli, A. (2018), Digital Platforms: A Review and Future Directions, Twenty-Second Pacific Asia Conference of Information Systems. PACIS 2018 Proceedings. Japan, 6-26-2018, [Online], [Retrieved March 30, 2020], https://aisel.aisnet.org/pacis2018/248/

- Atmaca, S., Schoors, K., and Verschelde ,M. (2019), ‘Bank Loyalty, Social Networks and Crisis,’ Journal of Banking and Finance, July 2019.

- Babus, A. and Allen, F. (2011), Networks in Finance. Wharton Financial Institutions Center Working Paper No. 08-07, 4 Dec 2011, 20.

- Carrigan, M., Magrizos, S., Lazell, J. and Kostopoulos, I. (2020), ‘Fostering sustainability through technology-mediated interactions: Conviviality and reciprocity in the sharing economy,’ Information Technology & People, 20 February 2020.

- (2018), ‘Learn More about Omnichannel: A Multitasking Way to Satisfy Customer,’ Medium, Mar 9, 2018.

- Cullen, K.L., Palus, C.J. and Appaneal, C. (2014), Developing Network Perspective Understanding the Basics of Social Networks and their Role in Leadership. White Paper. Center for Creative Leadership, 26.

- Dolle, R. (2014), Online Reputation Management, 4th IBA Bachelor Thesis Conference. University of Twente. The Netherlands, November 6th, 1-11.

- Dost, F., Haenlein, M., Phieler ,U., and Libai, B. (2018), ‘Seeding as Part of the Marketing Mix: World-of-Mouth Program Interaction for Fast Moving Consumer Goods,’ Journal of Marketing, October 2018.

- Ford, B. (2018), Liquid Democracy: Promises and Challenges, Decentralized and Distributed Systems Lab (DEDIS) Computer and Communications Sciences, Ecole Polytechnique Federal De Laisanne, Triby, January 15, 2018, [Online], [Retrieved March 30, 2020], http://www.icare.cl/assets/uploads/2018/01/bryan-ford-ppt.pdf.

- Forcadell, J., Aracil, E. and Ubeda, F. (2019), ‘The Influence of Innovation on Corporate Sustainability in the International Banking Industry,’ Sustainability, 11, 10 June 2019, 1-15.

- Golden, M. (2011), Social Media Strategies for Professionals and Their Firms: The Guide to Establishing Credibility and Accelerating Relationships, New Jersey, John Wiley and Sons.

- Haase, M., Becker, I. and Pick, D. (2019), ‘Alternative Economies as Marketing Systems? The Role of Value Creation and the Criticism of Economic Growth,’ Journal of Macromarketing, 38(1), 57-72.

- Haenlein, M. (2017), ‘How to date your clients in the 21st century: Challenges in managing customer relationships in today’s world,’ Business Horizons, 60(5).

- Harding, C. (2017a), ‘Working in the Digital Era: a brief history of work,’ Polyas, 01/03/2017, [Online], [Retrieved March 30, 2020], https://www.polyas.de/blog/en/digital-trends/work-in-the-digital-era-a-brief-history-of-work

- Harding, C. (2017b), ‘Working in the Digital Era: Digital Working Arrangements,’ Polyas, 15/03/2017, [Online], [Retrieved March 30, 2020], https://www.polyas.de/blog/en/digital-trends/digital-working-arrangements.

- Harding, C. (2017c), ‘Working in the Digital Era: Pros and Cons of Flexible Working Arrangements,’ Polyas, 22/03/2017, [Online], [Retrieved March 30, 2020], https://www.polyas.de/blog/en/digital-trends/flexible-working-arrangements.

- Hardt, S. and Lia L.C.C. (2015), ‘Google Votes: A Liquid Democracy Experiment on a Corporate Social Network,’ Technical Disclosure Commons, June 05, 2015, 16.

- Herzig, C. and Moon, J. (2013), ‘Discourses on corporate social ir/responsibility in the financial sector,’ Journal of Business Research, 66, 1870–1880.

- Jackson, M.O. (2008), Social and Economic Networks, Princeton University Press, 647.

- Jasek, P., Vrana, L., Sperkova, L. and Smutny, Z. (2019), ‘Comparative analysis of selected probabilistic customer lifetime value online shopping,’ Journal of Business Economics and Management, 20(3), 398-423.

- Kaartemo, V., Kowalkowski, C. and Edvardsson, B. (2018), Enhancing the understanding of processes and outcomes of innovation – the contribution of effectuation to S-D logic, In: The SAGE Handbook of Service-Dominant Logic, Stephen L. Vargo, Kaisa Koskela-Huotari K and Akata M,A. (eds.), SAGA, 522-535.

- Kanis, P. and Oerlemans, L. (2008), The Social Network Perspective: Understanding the Structure of Cooperation, In: The Oxford Handbook of Inter-Organizational Relations. Edited by Steve Cropper, Chris Huxham, Mark Evers, Peter Smith Ring, 289-312.

- Kapron, Z., Meertens, M. (2017), Social Networks, e-Commerce Platforms, and the Growth of Digital Payment Ecosystems in China: What It Mean for Other Countries, Case Study, April 2017, 72, [Online], [Retrieved March 30, 2020], https://ru.scribd.com/document/346080647/better-than-cash-alliance-china-report-april-2017-1

- Kotler, P., Kartajaya, H. and Setiawan, I. (2017), Marketing 4.0 Moving from Traditional to Digital. Wiley, 207.

- Latora, V. and Marchiori, M. (2001), ‘Efficient Bahavior of Small-World Networks,’ Physical Review Letters, 87, (19), 198701-1-4.

- Mangold, W.G. and Faulds, D.J. (2009), ‘Social media: The new hybrid element of the promotion mix,’ Business Horizons, 52,357-365.

- Mutuku, C. (2017), ‘Advantes and Disadvantages of Using Social Networks in Business,’ Grin, 1-7, [Online], [Retrieved March 30, 2020], https://www.grin.com/document/388758.

- NMC/CoSM Horizon Report: 2008 Australia-New Zealand Edition, 2009, 1-37.

- Novertur (2020), [Online], [Retrieved March 30, 2020], https://www.novertur.com/en/technology

- Rezayat, B. (2017), ‘Banking on Social Media Platforms,’ Fenextra. Blog, 06 March 2017, [Online], [Retrieved March 30, 2020], https://www.finextra.com/blogposting/13785/banking-on-social-media-platforms.

- Statista, (2019a), [Online], [Retrieved March 30, 2020], https://www.statista.com/topics/1164/social-networks/

- Statista, (2019b), [Online], [Retrieved March 30, 2020], https://www.statista.com/statistics/272014/global-social-networks-ranked-by-number-of-users/.

- Statista (2019c), [Online], [Retrieved March 30, 2020], https://www.statista.com/statistics/278341/number-of-social-network-users-in-selected-countries/.

- Stelzner, M. A. (2018), Social Media Marketing Industry Report, 2018, [Online], [Retrieved March 30, 2020], https://www.socialmediaexaminer.com/social-media-marketing-industry-report-2018/.

- Yip, A.W.H. and Bocken, N.M.P. (2017), ‘Sustainable business model Archetypes for the banking industry,’ Journal of Cleaner Production, 174, 150–169.

- Zambrano, E. (2016), ‘Bloomberg Reviews Applico’s Modern Monopolies,’ Applico. Blog, August 24, 2016, [Online], [Retrieved March 30, 2020], https://www.applicoinc.com/blog/applicos-modern-monopolies-reviewed-bloomberg/