Introduction and context

The digital economy has three main components: the underlying technologies and infrastructures, the ICT and digital sectors themselves, and the wider range of sectors in which digital products and services are in growing use, such as for e-commerce. The multiple layers of growth of the global web and technology-based services have propelled the development of the digital economy. (Bukht and Heeks, 2017)

The Organization for Economic Cooperation and Development (OECD) defines e-commerce as “the sale or purchase of goods or services, conducted over computer networks by methods specifically designed for the purpose of receiving or placing of orders” and places it at the center of the digital economy. (OECD, 2020). These networks allow for the ordering of goods and services, with options for online or offline payment and delivery, creating a complicated business environment and a wide range of alternatives.

To maintain some commercial and social activities away, digital solutions are becoming more and more important. E-commerce’s share of global retail trade increased from 14% in 2019 to around 17% in 2020 as a result of businesses and consumers increasingly “going digital” and offering and purchasing more products and services online, respectively. (UNCTAD, 2021). In addition, the International Telecommunication Union estimates that the percentage of persons using the Internet increased from 29.3% in 2010 to 53.6% in 2019, and among young people between the ages of 15 and 24 this number increases to about 70%. (ITU, 2020).

Digital markets have not slowed over the past two years, even while lockdowns have become the new standard and the overall economy is obviously the decline. On the contrary, the COVID-19 pandemics has led to accelerated digital transformation and a surge in e-commerce sales for brands throughout all sectors, grocery and food retail businesses being of no exception.

Indeed, 89% of EU-27 citizens used the internet in 2020, and 73% of them made purchases online (up from 68% in 2019), which is expected to bring the EU-27’s Gross Domestic Product (GDP) to 12,987 billion euros in 2021 and the proportion of e-commerce sales to GDP to 3.99%, up from 12,602 and 3.26%, respectively, in 2019. In fact, according to Eurostat, 89% of EU-27 citizens used the internet in 2020. However, despite the annual growth in e-commerce transactions, both in volume and value, grocery and food purchases made online in Europe are still rather low; just 19% of people did so, compared to 63% of people who bought apparel, including clothing for sports, shoes, and accessories. E-commerce is creating opportunities for a vast number of business owners as customers depend more and more on online purchasing (95% of purchases will likely be conducted online by 2040).

While 87% of the population now has access to the internet (up from 80% in 2019), Eurostat reports that only 54% of internet users made purchases online in 2021 as opposed to 29% in 2019. Romania offers an unusual market within the European landscape. In addition, the e-commerce component of the Romanian GDP increased from 2.78% and 159 billion euros in 2019 to 4.19% and 164 billion euros respectively in 2021.

In other words, according to ARMO (Association of Romanian Online Stores) estimates, the e-commerce sector, which includes local merchants and foreign online shops, exceed the 5.6-billion-euro threshold at the end of 2020, 30% more than in 2019, when the value of e-commerce was estimated at 4.3 billion euro. The COVID-19 outbreak, which sped up the pace of online buying and the percentage of card payments made there, contributed to the surge, which was almost 500 million euros more than original projections. In a market that hasn’t yet attained the maturity level of other nations in Northern and Western Europe, ample growth rates over the previous two years have reduced the distance from the European average, and they also demonstrate the enormous future development potential of the e-commerce industry.

“A high number of Romanians faced their fear of ordering online in 2020 and discovered how easy, convenient, and secure it is, while others, already familiarised with online shopping, extended their product options. We expect these clients will stay loyal to this shopping method, thus creating the premises for a significant opportunity for local retailers to take full advantage of the local or international digital market, accessing marketplace platforms and maximizing their online business”, stated Florinel Chiș, ARMO Executive Director.

Therefore, if a business is not already involved in e-commerce, it needs to start if it wants to survive in the pandemic economy and the years that will follow, both internationally and locally on the Romanian market. In light of the fact that 66% of customers choose a product based on convenience and that consumer behaviour has changed significantly as a result of external factors, a recent report from Catalyst Digital revealed that current strategies are ineffective and are causing businesses to experience revenue declines. The top e-commerce service is now considered to be data and analytics, among other things.

The key is to do research on the online market environment, which explains consumer behaviour or the movement of internet users between search engines, media websites, other intermediaries, and an organization and its opponents. “Analysing the impact of different ecosystems on online consumer behaviour or customer journeys is, today, as important as observing their physical behaviour in the real world.” (Chaffey, 2015).

Several studies works found online tackle the issue of online grocery shopping, but very few of them link e-commerce for foods with consumer behaviour in general and loyalty habit in particular, according to a survey of the literature on the specific topic.

For instance, Anderson and Zahaf (2007) profiled the Business to Consumers buyers, answering the “Who buys what?” question, while Kesharwani et al. (2017) provide us with a more comprehensive integrated model while also revealing the aspects influencing customer happiness and loyalty in online grocery purchasing: “From consumer behaviour perspective, it can be reasoned that grocery shopping in itself is fundamentally different to any other typical shopping experience by its nature, in both traditional brick-and-mortar and online contexts. A typical grocery shopping trip involves selecting and purchasing multiple products with multiple quantities, while other shopping typically involves purchasing one or a limited number of items. And it is expected that marketers engaged in grocery shopping should reflect these considerations as they endeavour to support users fulfil these traditional patterns of behaviour.” (Kesharwani et al., 2017)

A qualitative study was conducted to better understand the main factors influencing the online food shopper’s behaviour and to gather observations and insights into attitudes in order to better understand the catalyst change in this specific behaviour, which differs significantly from that of online shoppers in the fashion, IT, and electronics industries. It is worth noting that this qualitative research will be followed by a quantitative investigation on a representative panel of at least 250 respondents to test the most critical factors identified in the qualitative research.

Methodology

Consequently, considering the e-commerce current evolution and future potential, a qualitative study regarding online shoppers’ behaviour was conducted, aimed mainly at finding the triggers and barriers within the main identified profiles of online grocery shoppers in Romania and the consequent changes in behaviour during the pandemics, in order to have a better understanding on how to grow e-commerce sales in Foods.

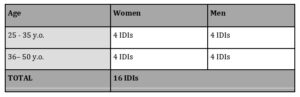

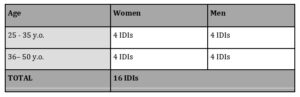

During August – October 2021, a qualitative research – based on a questionnaire – was conducted among internet users in general and food online shoppers in particular, on a sample of online grocery shoppers, by a professional and well-experienced Romanian market research agency. In total, the dimension of the sample was customized for the exploratory research and consisted of 16 interviews with very well selected Romanian shoppers who have specific demographic characteristics for each shopping experience. The respondents sample is representative for the Romanian urban population aged 25-50 and, in terms of sex segmentation, the relevant demographic split was made. Individuals working in marketing, PR and Research agencies as well as employees of the retailers e-commerce shops, food producers or distributors were excluded from the target audience. As such, the sample group of the research consisted only of medium-heavy users of e-commerce platforms in Romania, individuals who shop online for food products (including groceries) at least 2-3 times / month or at least once / week, who order directly on retailers e-commerce platforms (Carrefour.ro, Cora.ro, Auchan.ro, megaimage.ro, emag.ro, etc.) or using a delivery provider such as Bringo, FoodPanda, Glovo, Tazz, TakeAway, Bolt Food.

Additional aspects regarding the recruitment of the sample of individuals were taken into consideration for the purpose of the qualitative research, including: each respondent should be of at least medium education and earn monthly at least a medium income, have a habit of e-shopping for foods, including packed meat products.

The methodology used to conduct this qualitative study was simple but very effective. Being fitted to investigate peoples’ deep seated needs and expectations with respect to the topics of interest and link them with their psychographic and user profile so as to provide a more actionable way of addressing in-depth assessment of online grocery shopping experience, in-depth individual one-on-one discussions/interviews were organized with very well selected online food shoppers. The respondents had 60 minutes to answer to a series of established questions included in the research questionnaire – as an instrument for collecting data. In addition, at the end of each interview, a real online shopping order took place together with the interviewer, in which the participants became <<real live shoppers>> and tried to order <<just as they usually do>> the chosen food products needed in the household, explaining why the steps were done in that specific manner. Practically, each participant had to be able to perform an online shopping session during the interviews, using their favorite app (the website or app they usually use for placing orders at least 2-3 times per month, in the case of 50% of the respondents and at least once per week, for the other half of participants). This 2-step research was specifically chosen because it mainly addresses the online food shoppers target and the shopper experience is as close as possible to a real one, while allowing the interviewer to understand the main triggers and barriers.

The efficiency of the method also resides in the Interviewer’s opportunity to see and hear all factors that motivate each shopper’s decisions. An un-structured method was used for data collection. Regarding the food products categories, this study was focused on foods belonging to the meat packed products category.

Table 1: The 16 in-depth interviews with banks clients:

The qualitative study only represents the first step towards modelling an efficient e-commerce strategy on how to build – create and implement – digital campaigns aimed to persuade Romanian consumers to buy food products in general and meat packed products in particular using the retailers online shopping platforms and/or using food deliveries platforms or apps.

As such, the main objective of the presented study was to qualitatively understand the marketing phenomenon and to identify the shoppers/consumers motivations (triggers and barriers), for each respective main profile identified among the Romanian online grocery shoppers, during the Covid-19 pandemics. Translating this main objective into specific research objectives includes secondary objectives more related to the motivations like: the meaning of grocery shopping – offline vs online grocery shopping, understanding the pattern(s) of online shopping for food, understanding the main triggers and barriers for e-commerce in the case of food products (specifically on cold-cuts meat products) and identifying the main decision criteria for shopping for food products. Configuring the main digital persona for the online shopper of food products played an important part in order to further explore the shopping profiles. For each shopper segment identified during the study, the research also revealed the current shopper experience when buying food online and the tailored take outs and recommendations.

Research Key Findings

An overview on shopping meaning and habits during current context. Focus on online grocery shopping

EFFICIENCY is the key word brought to light by this study, as time is the most important resource people gained or treasured in the last couple of years and they are now building all their life around this asset. Smartness in product usage and money management are also heavily considered when making the acquisition decision to help people become more immune to change or waste. The selection criteria during online grocery shopping is predominantly the rational criteria.

By comparison, grocery shopping before pandemics (no later than 2019) was very much about pleasure of strolling and browsing through the shelves, in offline stores, enjoying the abundance of all possible choices (although the need for more efficiency and less waste of time was emerging even then) – a way to mix social activities with the utility of doing shopping. Before pandemics, a high number of families would consider a trip to a hypermarket as if it was a “going-out” trip for the whole family, spending at least half day for grocery shopping. Efficiency was not considered an active asset then, as people did not consider time spent in shopping as waste, but as fun time with the whole family, especially if the hypermarket or/and the supermarket was placed into a mall.

In today’s context, still, efficiency does not necessary diminish the pleasure of shopping (especially offline). Retail preserved its role of showroom, display and discovery when it comes to novelties, a way to put senses at work and feel alive and human again. The online grocery shopping process has thus become an efficient and fast way to gain access to the consumer’s favourite products, directly to their homes, without having to carry the groceries, a clear advantage especially when considering the big and heavy boxes of water or other liquids. Moreover, ONLINE SHOPPING is associated with the notion of vitality and flexibility precisely because it is a quick and easy way available at any time. An effective way to bring additional joy and comfort, getting the desired products without having to leave the comfort and safety of one’s home or spend much time doing it.

The qualitative responses detected throughout this exploratory research showed that online grocery shopping also has a clear-cut side pointing to rationality and necessity, in contrast with the in-store shopping experience where participants describe themselves as being more tempted to explore and engage in impulse shopping.

As opposed to the offline shopping which rather remains anchored in a more emotional area through its direct contact with products and implies more sensorially while feeling at contact with outside world (- a way to feel in contact/ still connected with others/ the outside universe), the online shopping experience is maintained at a rather impersonal level. Respondents feel that the relationship is rather transactional (place the order, receive the order) and they would like to have more interactivity and personalisation, which could lead to users and retailers becoming emotionally closer.

Analysing the main TRIGGERS for online shopping revealed by the research, five key aspects were brought to light:

- easy to access – anywhere (on mobile or laptop), anytime (not being constrained by the shop’s opening hours);

- most convenient way of shopping – fast, comfortable, handy; drafting the shopping list represents the buying process itself and not a preliminary step like in offline shopping.

- providing easy access to reassess and restructure the shopping basket – just a click is needed to add/remove each product.

- the shopping list can be reused at a later session (although this behaviour tends to apply more frequently in the case of non-food products, like cleaning products), can be saved until the next shopping order or can be re-used from the previous order, already containing the preferred brands.

An opportunity for raising the brand awareness and even increase sales has emerged from the possibility to insert a specific product in an online shopping list because it will be present automatically on the list for the next order.

- with some platforms, there is a feeling of great variety of available products.

The ideal online grocery shopping experience for most of the respondents was defined to be as not only efficient but also immersive and even exciting. While preserving the anchor in efficiency and smartness, but adding even more elements to increases this feature- i.e. voice command -, respondents showed their wish for more infusion of “life” and enjoyment to this moment. Thus, the online shopping experience needs to borrow some elements from the offline like design, information about the products and a more personalized experience.

From the respondents perspective, the design/presentation of the product in the online should be closer to the one seen on the in-store shelves, thus also making it easier for people to orientate. This means there’s a need for a better and clearer display of product provided, fast/ easy access to the information on product (i.e., clear focus of back label so as for people can check ingredients/ properties) or even serving suggestion so as to arise appetite. Meanwhile, the easy access to information on products that can even inspire people should be very easily seen: i.e., “1.5% fat” (good for recipes under 500 calories) or “top picked product” are useful information which can pop-out while shoppers slide the mouse over the pack image of the product. Also, in the online, such an approach can furthermore inspire & ease peoples’ life by providing “meal ideas/ ideas-of-the-day” and offer the possibility to buy a kit for cooking a specific meal. More personalized promotions & even loyalty programs is another way to improve the online shopping experience that can be devised with the help of retailers online.

When talking about the BARRIERS for online shopping revealed by the research, one needs to consider the fact that consumers still have reserves related to buying food online, especially in the case of perishable products. Further analysis of the main barriers for online shopping revealed by the research brought to light other five key aspects:

- associated with the idea of risk, participants lack information related to the product’s quality preservation. Different questions emerged regarding how long the product is/was kept out of the fridge before being placed in their order, how did the shopping assistant choose the product, who the responsible person is for the integrity of the product. Consumers even wondered if the were going to receive products closer to the expiration date since when shopping online, they are unable to check this for themselves.

- not engaging or stimulating in any way, it seems the online provides scarce information on products purchased (e.g., the product picture is a stock image, and not of the product one is actually buying), a fact which can generate a certain lack of trust for some buyers as well as not stimulating really “wanting” that product.

- Since the online shopping is generally a personal experience (other family members are not directly involved), it has limited potential to discover novelties and explore

- Respondents also feel they are not able to benefit from loyalty cards/ programs in the online

- Online grocery shoppers are less willing to buy bulk products (this activity is marked as risky) and thus find themselves limited in terms of quantities they can buy either small or very large quantities, no intermediary option.

In order to overcome the barriers revealed by the Romanian online grocery shoppers, brands need to go beyond a simple and linear presence of their products in online (namely be present/ provide some prices cut off promos). More “alive/present/active” brands’ presence is needed, as it can stimulate appetite simply by providing more detailed information on product benefits (i.e. larger and more visible icons of LOW fat products/ NO sugar / 100% meat, easy to see without consumers having to click on the package, etc.).

The most important aspects for the selection criteria during the online grocery shopping experience has also been included in this part of the study, presented below in an ascending order (1 meaning the least important and 5 being the most important), according to the ratings given by the respondents to the qualitative research:

- BRAND FAMILIARITY is a highly relevant criteria, as people are less willing and/or stimulated to make experiments in online – not able to check, see the product, not feeling they receive the product information in a visible way.

- PROMOTIONS are generally appreciated as more visible in online and fit with this channel (where people can easily see/check/compare prices); One of the few “exciting” aspects of current online shopping is the possibility to make a good deal.

- POSITION IN APP/ SITE appears to be a relevant criterion in a context of time constraints and when the intended purchase targets only a type of product, without considering a specific brand. Respondents are inclined to shop for products placed in the first positions/pages within the category.

- PRODUCT/PACK IMAGE: an appealing and very life-like image of the product stimulates the desire to try/explore; participants, however, express reluctance in trying out a new product by ordering it online;

- DETAILS ON PRODUCT: although theoretically an important aspects, the survey showed that consumers rarely consult the list of ingredients for products they buy. A simpler and more visual way of presenting information are preferred, as well as hints on product differentiation key points that help people upgrade.

Conclusions

In a nutshell, online firstly needs to provide reassurance regarding product quality (freshness, quality) by talking on how products are chosen/transported/handled etc.

Also, online should find support to also help shoppers discover, by providing recommendations based on previous carts/ samples to test at home etc.

Defining main shopper profiles. An overview on the changes of target profile in online shopping

When it comes to online shopping, with respect to the target specifics, the study revealed the increase of women power for grocery shopping: traditionally women oversaw grocery/ household shopping, yet in the era of online other members (man & kids) had a saying, as shopping was mostly a family moment. Now, given the fact online shopping session is individual, it tends to be more and more influenced by women, impacting strongly kids products, as the choice is even more in the hands of mothers – “When in store, my little girls used to put stuff in the basket. When it’s online, she takes a look, but without much interest.”, stated one of the Respondents.

Secondly, the study showed youngsters as a point of entrance for online shopping: young adults still living with their parents have taken over the task of food shopping. They follow a list prepared by parents (mother) in which the desired products are specified in detail. Yet, they can also make suggestions and add products to the cart which makes them an entry point for new products as well, since they are also more open to novelties.

Mapping most relevant online shopper profiles, three main SHOPPER RPOFILES were revealed: The independent shopper, The easy-going /relaxed shopper and The conscious and cautions shopper.

Values time first and foremost, both in personal and business/professional life. They try to do things as well as possible and have the same expectation of professionalism and self-improvement from brands/products they use.

An overall technology fan (as it enables them to be more efficient), the independents are interested in the welfare of the community, try to adapt own choices so as to be environmentally friendly. They know what they want, look for quality and at same time, are open to upgrade.

The Independent values decisiveness, having a fast way to deal with chores. Their main need regarding shopping is access to products fit to their lifestyle: far from being a pleasure, shopping is about maintaining the living standard and healthy living for self and family. Most relevant occasion (online): REFILL

Figure 1: The Independent Shopper – online vs offline characteristics

Figure 1: The Independent Shopper – online vs offline characteristics

Further analysis of the independent shows that their behaviour as online grocery shoppers, when dealing with Product types & choosing criteria, is characterised by choosing familiar brands they know from offline, pay attention to product presentation – observing more details on product/ingredients (checking if relevant information is easy to see), being attracted to nice pictures of pack/ product etc. They search for promotions, but for “favorite” products/ brands in their list, so not to waste time searching for other discounted products. Their tensions / barriers in the online include dull presentations which makes them less interested in trying something new, no method to help people discover alternatives/ new products and new products not being well promoted or poorly presenting their benefits.

By comparison, the independent’s behaviour offline when dealing with Product types & choosing criteria, includes looking for ingredients/ product properties (including fresh products) and can make new choices based on “superior” quality. They are interested in extra features like taste – being open to novelty and upgrade, they see aspect /design as a sign of product quality, and they benefit fully from recommendations / ideas on product combinations. Their tensions / barriers in the online include wasting time in crowded shops or queues, changes in how products are arranged, not displaying well novelties (wants information to be clearly visible/ signalized).

In a nutshell, the take outs regarding the ONLINE vs OFFLINE behaviour of the INDEPENDENT SHOPPER, relate to access to more inspiration and upgrade:

- Quick ready-to-use solutions (buy a recipe and avoid wasting time looking for and putting each ingredient in the basket).

- Product icons /symbols which highlight at mouse ‘touch’ or make a pop-up message appear (“naturally fed chicken”, “recyclable packaging”, “improves metabolism”)

- Mark products as suitable for certain food style (Dunakn, gluten free)

- Receive notifications about community projects and how buying a product could trigger better living for community (for example. when buying this product, a percentage is transferred to an NGO).

- The Easy-going /Relaxed Shopper:

Young, living with partner or some still with parents, without many responsibilities, they are more focussed on what gives them pleasure and on self development/ cultivating passions. They used the pandemic “spare time” to grow more at a personal level, thus starting to be less influenced by others. When assuming household related responsibilities, they focus more, being weekly online shoppers. They like to try new things and to be surprised and welcome surprises/novelties in their lives. They even search for these.

The Easy-goings are carefree, relaxed, open to novelties. Their main need shows that grocery shopping is mostly a necessity in their life; they like to take pleasure from browsing, discovering novelties and even socializing with others. They also like being inspired, finding interesting products. Most relevant occasion (online): Emergency and Craving firstly, Secondary – stocking (for family).

Figure 2: The Easy-going /Relaxed Shopper – online vs offline characteristics

Further analysis of the relaxed shows their behaviour as online grocery shoppers, when dealing with Product types & choosing criteria, being characterised by NO reluctance with regards to product they buy, they can literally shop anything or something else/ new if on promotion (buy 5 chocolates & get delivery for free) or if with a nice/ inspiring product presentation. However, since online is less inspiring/ sensorial, they tend to go for familiar brands (esp. in more “serious” categories like meat). Their tensions /barriers in the online behaviour include: expiration date cannot be checked (had experiences with products that were nearly expired), not really able to stress novelties well (or to make them more appealing), not able to find all they look for (a special crafted beer) in online offer as most retailers have more “basic” offers online and even tips for healthy options in a certain category (chocolate).

By comparison, the relaxed’s behaviour offline when dealing with Product types & choosing criteria, includes product aspect (it needs to be sensorial & inviting), pack design (to show is made with attention to details) and nice promo of the product (prefer“products with a story” even if they found the information in social media), while keep in mind that they focus on the visual. Their tensions /barriers in offline include: wasting time in crowded shops or queues, changes in how products are arranged, not displaying well novelties, less visible promotions and heavy bags to carry at home.

In a nutshell, the take outs regarding the ONLINE vs OFFLINE behaviour of the THE EASY GOING SHOPPER, are more interactivity in the shopping applications – e.g. enrolling in more engaging and interactive contests (maybe include the participation of influencers), on the one hand and more interesting product presentation – e.g. new products or brands activations can be linked towards short videos presenting the brand story (as they are more sensitive to this aspect), on the other hand.

- The conscious and cautions shopper:

They are the mature family people, who define themselves less by who they really are, but through their roles within the two major aspects of their life: work and family. They try to enjoy the little pleasures life provides (fully starting to embrace walking, reading, even cooking) and they like to make assumed choices as keen on providing right (and safe) choices to their families. They are more reluctant to buy food, fearing they migth not meet quality standards, especially fresh products.

They don’t like surprises, choose confirmed/safe and reassuring choices, don’t risk to make mistakes. Food buying (esp. fresh food) is characteristic of a more confident and upscale/demanding shopper.

The Conscious are responsible, avoid risks, look for comfort. Their main need is to provide for the family, ensure comfort & harmony inside family while also keep control over budget. They tend to choose products/ brands they know. Most relevant occasion (online): Stocking up.

Figure 3: The conscious and cautions shopper – online vs offline characteristics

Further analysis of the conscious shows their behaviour as online grocery shoppers, when dealing with Product types & choosing criteria, being characterised by NEVER buying perishable products (feels risky). They only buy familiar brands they know from offline and aren’t willing to try something new online due to a low level of trust, even if providing benefits like promotions / free delivery etc. Their tensions /barriers in the online behaviour include the fact that they cannot be sure of expiry dates as they aren’t able to check it themselves, especially in a context in which they cannot see/ feel the product and not being able to ask for advice/ recommendations (no interaction with personnel/ no assistance or guidance).

By comparison, the conscious’s behaviour offline when dealing with Product types & choosing criteria, includes familiar brands, aspect/ smell (especially for fresh food), expiration date, ads/ samples or promotions in store, staff recommendations – can also make them try new products. Their tensions /barriers in offline include: easiness to cease to impulse and thus spend more than intended, promotions /offers are somehow less visible (given numerous stimuli inside store) and the fact that personnel is not always present or helpful.

In a nutshell, the take outs regarding the ONLINE vs OFFLINE behaviour of the THE CONSCIOUS SHOPPER, deal with safety – clear information is needed on products (maybe even expiry dates or even special programs the get a refund if there is a problem with the product), better product presentation including more than just one single picture of the pack and their need for support in buying – e.g. chatbot/ assistance.

References

- Anderson, J., & Zahaf, M. (2007), ‘Profiling consumer to consumer and Business to Consumer Buyers: Who buys what?’, International Journal of Business Research Edition VII, 85-99

- Bukht, R., and Heeks, R. (2017), ‘Defining, Conceptualising and Measuring the Digital Economy’,

- International Organisations Research Journal 13(2): p 143-172, Manchester, Global Development Institute, SEED.

- Cătoiu I., (coord), Bălan, C., Popescu, I.C., Orzan. G., Vegheş, C., Dăneţiu, T. and Vrânceanu, D. (2009), Cercetări de Marketing – Tratat, Bucureşti: Uranus.

- Chaffey, D. (2015), Digital Business and e-Commerce Management. Strategy, Implementation and Practice. Edition VI. United Kingdom, Pearson Education Limited.

- Chaffey, D., Smith, P.R. (2017), Digital Marketing Excellence – Planning, Optimizing and Integrating Online Marketing, Edition V. London and New York, Routledge.

- ITU(a) – International Telecommunication Union (2019), Measuring digital development: Facts and figures 2019. Geneva: ITU. [online] Available at: https://www.itu. int/en/ITU-D/Statistics/Documents/facts/FactsFigures2019.pdf. [Accessed October 27th 2021]

- ITU(b) – International Telecommunication Union (2020), Measuring digital development: Facts and figures 2020. Geneva: ITU. [online] Available at: https://www.itu.int/en/ITU-D/Statistics/Pages/facts/default.aspx. [Accessed November 1st 2021]

- Kesharwani, A., Sreeram,, Desai, S. (2017), ‘Factors affecting satisfaction and loyalty in online grocery shopping: an integrated model’, Journal of Indian Business Research, Vol. 9 Issue: 2. Available at: http://dx.doi.org/10.1108/JIBR-01-2016-0001 [permanent link to the document]

- Lone, S., Harboul, N. & Weltevreden, J.W.J. (2021), 2021 European E-commerce Report. Amsterdam/Brussels: Amsterdam University of Applied Sciences & Ecommerce Europe.

- OECD – Organisation for Economic Cooperation and Development, 2020. E-commerce in the times of COVID-19. Paris: OECD. [online] Available at: https://read.oecd-ilibrary.org/view/?ref=137_137212-t0fjgnerdb&title=E-commerce-in-the-time-of-COVID-19. [Accessed November 5th 2021]

- UNCTAD – United Nations Conference on Trade and Development, 2021. COVID-19 and E-Commerce Crisis. A Global Review. [online] Available at: https://unctad.org/system/files/official-document/dtlstict2020d13_en_0.pdf. [Accessed November 5th 2021]