Introduction

Past studies have shown that an evolution of human behaviour occurs over a period of time. The need to adopt a particular set of planned behaviour arises as a result of the propensity to fulfil psychological and social needs (Ajzen and Fishbein, 2000). In a technological system adoption, Davis (1989) stated that perceived usefulness, perceived ease of use may affect one’s intention. This study attempts to investigate the extent to which socio-psychological related factors affect consumers’ attitude and intention to use contactless payment transactions of goods and services amidst the current global pandemic.

Contactless payments have proven to provide benefits to both businesses and consumers alike, in terms of higher levels of control and convenience for consumers, and higher return on investment (ROI) for business merchants (Brett, 2017). Essentially, it is an act of financial transactions for goods and services without any physical need to exchange cash, write a cheque or enter a Personal Identification Number or PIN (Brett 2017; Joifin, 2018). The contactless payment existence comes in many forms, most commonly as credit and debit cards, key fobs, smart cards and other similar devices that allow secure payment by near field communication (NFC). Nagashree, Rao and Aswini (2014) stated that NFC has evolved from a combination of radio-frequency identification (RFID) to other non-contact inter-connection technologies. The relative simplicity of NFC combined with its compatibility, with existing Bluetooth and Wi-Fi standards, presents an advantageous solution for facilitating any contactless transactions (Balachandran, 2015).

From a consumer’s perspective, this latest technology allows for fast, easy and secure payments for purchases and has increased convenience for consumers when making everyday transactions such as transportation tolls, parking facilities, food shopping and petrol stations (Mokhtar, 2019). Perhaps, the potential increased acceptance of contactless payments is also due to fear of the ongoing global disease outbreak, namely corona virus or COVID 19 (The Star Online, 2020). Although there seems to be a decline in corona virus infection rates and plans are in place to begin easing lockdown measures in some parts of the developed world, it has provided a hint of hope after weeks of unrelenting gloom (Mohamad, 2020).

Nevertheless, it is not the case for many developing countries (Mohamed, 2020) who cautioned that the crisis may barely have begun, and the human toll of a major COVID-19 outbreak would be much larger than in any advanced economy. In addition to fear of any microbial infections (Lee, Mathis, Jobe & Pappalardo, 2020), many consumers fear shopping physically and adhere instead towards practicing extreme social distancing and other relevant hygienic measures in ensuring transfer avoidance of such infections. There is also a potential opportunity to explore alternative forms of shopping and payment mechanisms in light of the rising concern of COVID 19 pandemic (Star Online, 2020; Chin, 2020). In view of the above, this study examines the socio-psychological related factors that may affect consumers’ attitude and intention to fully adopt contactless payment transactions of goods and services during the current global pandemic situation.

Literature Review

Drawing from the Technological Acceptance Model (TAM) (Davis, 1989) and Protection Motivation Theory (Rogers, 1975), other earlier seminal works and relevant constructs from literature are also justifiably warranted to further understand intention and actual behavioural adoption. Theory of Planned Behaviour, for one, proposes that intention is a proximal predictor to actual behaviour (Ajzen, 1991) while Theory of Reasoned Action by Fishbein & Ajzen (1975) further explains that intentions and behaviour are considered to be strongly related when they are measured at an equal level of specificity. Following these concerns, several predicting factors are further explored in this study. These factors may determine the extent to which there will likely be a subtle shift in consumers’ propensity to use contactless payment transactions in light of COVID19 pandemic situation.

Behavioural Intention

In understanding the mechanics of adoption, any usage of product and services can be explained in terms of its execution, habit, application, or fulfilment (Liu & Gong, 2008). Many researchers found that actual adoption is difficult to be measured accurately on its own (Schuitema, Anable, Skippon, & Kinnear, 2013). Most of the studies related to the technology or innovation have investigated behavioural intention as a predictor of adoption (Irani, Gunsegaran & Dwivedi, 2010). It is considered as an indicator of actual behaviour; and actual behaviour is found to be directly and closely affected by behavioural intention (Fishbein & Ajzen, 1975).

According to Ajzen (1991), intention is likely to play a crucial role in controlling the motivational factors that will be contributing to the actual behaviour. If the intention to deal with behaviour is stronger, there will be a higher possibility that an actual behaviour will be performed. Putit, Nurhani, Suki, Afiqah, Nurul & Nurul Amirah (2020) and Putit & Muhammad (2015), for example, focused on the need to investigate the web-based travel transaction intention and loyalty behaviour while Mutahar, Norzaidi, Ramayah, & Putit (2017) used intention to study on the mobile banking adoption amongst consumers in Yemen. These studies found that intentions play significant roles in the actual adoption of technology-related behaviours. Jusoh & Teng (2019) further found that an intention to adopt e-payment has a strong positive effect on the actual usage of e-payment. In view of the above, intention is looked into as a measure to examine potential acceptance and usage of such contactless payment transactions.

Attitude

Attitude towards usage has been recognized as a factor that guides future behaviour. In TAM, attitude towards usage is referred to as an evaluative impact of an individual’s positive or negative sentiment when displaying a specific behaviour (Ajzen & Fishbein, 2000). Singh, Sinha & Liébana-Cabanillas (2020) found that a user’s positive attitude towards e-wallet will improve behavioural intention. This study has the comparative outcomes to which attitude towards behaviour influences intention to use SakuKu, a form of e-wallet contactless payment amongst Generation Y consumers in Indonesia (Jerry & Maulana, 2017). On the other hand, Shroff, Deneen & Ng (2011) found that attitude and behavioural intention has a non-significant relationship.

Teoh, Hoo & Lee (2020), however, found that Malaysians have positive attitudes and are ready to use mobile cashless payment transaction services, given that this strategy improves payment speed just as it is simpler to utilize. Nonetheless, the study was not generalizable since it only specified certain sampled population of interest that were not representative. The Technology Acceptance Model by Venkatesh and Davis (1996) stated that both perceived usefulness and perceived ease of use were found to impact behavioural intention, but at the same time, highlighting the need to develop an attitudinal construct. As mentioned by Nidhi et al (2020), positive attitude may influence intention to adopt e-wallet payment transactions. In view of these contentions, it is postulated that attitude can influence the adoption of contactless payment transactions.

Perceived usefulness and perceived ease of use

Perceived usefulness (PU) reflects the degree to which an individual regards a specific framework to support their activity performance (Mathwick, 2001). Perceived ease of use (PEOU) is referred to as the degree to which a particular conversion is considered straightforward (Davis, 1989). As stated by Venkatesh and Davis (2000), attitude towards information system is affected by both of these variables. Venkatesh et al (2003) further explained in the United Theory of Acceptance and Use Technology (UTAUT) model that perceived ease-of-use, perceived usefulness and social influence also affect users’ intention to adopt information system. Alaeddin, Altounjy, Zainudin & Kamarudin (2018) supported the contention to which PEOU and PU significantly affect attitude towards technology usage. Further to that, Wijayanthi (2019) asserted that perceived helpfulness also impacted attitude toward technology utilization, and was supported by Jin, Seong & Khin (2020). Isrososiawan, Hurriyati, & Dirgantari (2019) also found that PEOU has a positive and significant impact on the use of mobile payment.

Nevertheless, prior research considers perceived ease of use as a basic requirement for system design and should not have an influence on attitude in the later stages of adoption (e.g., Agarwal and Prasad, 1998; Chau and Hu, 2002; Davis et al., 1989). This is further supported by Ajibade (2018) who stated that the association between attitude towards using innovation and genuine use can also be influenced by factors that are not controllable by the likely users such as other facilitating conditions involving knowledge, money, time and effort. In this study, PU and PEOU are still worthy of investigation on their potential influence on attitude, which is posited to also influence consumers’ intention to adopt contactless payment transactions

Trust

Trust is an outcome of both social and financial collaborative significance, to which vulnerability is available (Pavlou, 2003). Social influence and trust were referenced in TAM2 and TAM3 individually (Venkatesh and Davis, 2000; Venkatesh and Bala, 2008). Past research by Jin et al., (2020) has shown that there is significant positive relationship between social and behavioural influences to accept mobile wallets. Lai (2017) has inferred that TAM2 and TAM3 were not positively significant in determining innovation of a single-stage e-payment System. Aslam, Ahmad, Akhtar & Maqbool (2017) indicated that consumers are not confident enough to use cashless payments. Nonetheless, Jerry & Maulana (2017) suggested that trust be explored in determining its influence on cashless payment usage. In view of this, it is postulated that trust influences consumers’ attitude towards technological usage of cashless payments in their business transactions.

Convenience

Convenience refers to an individual’s assessment of service encounters that provide easy access to products and services (Hsu & Chang, 2013). A study on English learning through PDAs by Chang, Mokhtar, Majid, Luyt & Theng (2012) revealed significant impact of perceived convenience on attitude toward using PDAs. Hsu & Chang (2013) also demonstrated that perceived convenience clearly influences attitude toward using Moodle. Moreover, Cristobal, Flavián & Guinalíu (2018) found that mobile payment application is convenient to use and both genders concurred about the convenience of using the mobile phones for making payment. Lee & Jun (2007) contended that TAM should consider investigating factors influencing selection goals in addition to convenience and usefulness. In any case, Lai & Zainal (2015) mentioned that convenience is useful in determining the use of a single-stage e-payment system. In fact, convenience was an extension of TAM for the novel innovation of a single-stage e-payment system (Lai, 2017). In this study, it postulates that convenience affects consumers’ attitude to use contactless payment in their business transactions.

Fear

Fear has been long recognized as a powerful motivator that educates humans on how to react towards dangerous situations as a matter of survival. It is viewed as an extrinsic motivator considering that fear is created by environmental incentives; specifically, threat. In most psychology studies, this phenomenon is explicated through the Protection Motivation Theory (PMT) developed by Rogers (1975). The PMT model attempts to explain people’s motivation for a particular behaviour based on the perceived threat encountered. Drawing from this assumption, both businesses and consumers alike may find that their anxiety towards microbial infections are effective motivators for them to be proactively involved in hygienic practices in their daily activities. These activities include self-grooming, eating, socializing, travelling, and, interestingly, making payments in the retail setting.

Despite the fact that Covid19 pandemic has affected global economy through social clampdowns and business closures, essential services including the retail marketing sector are very much active in terms of the number of visits by consuming patrons (Bernama, 2020). Apart from wearing face mask, a customer could still be infected through contact with contaminated surfaces that include card terminals and banknotes during the check-out process. Hence, customers who are fearful of the risk of infection, and highly cognizant of this threat during COVID 19 pandemic (Lee, Jobe & Mathis, 2020; Lee et al, 2020), are motivated to consider contactless form of payment that prevents physical exposure to these contact surfaces (The Star Online, 2020). Hence, it is postulated that fear may influence consumers’ attitude towards contactless payment transactions.

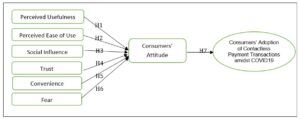

Following the above review of extant literature, several hypotheses are developed for this study.

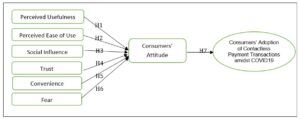

H1 – Perceived usefulness affects attitude towards contactless payment transactions

H2 – Perceived ease of use affects attitude towards contactless payment transactions

H3 – Social Influences affect attitude towards contactless payment transactions

H4 – Trust affects attitude towards contactless payment transactions

H5 – Convenience affects attitude towards contactless payment transactions

H6 – Fear affects attitude towards contactless payment transactions

H7 – Attitude influences intention to adopt contactless payment transactions

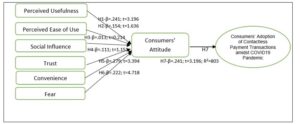

Figure 1.0: Theoretical Model of the Study

Source: Adopted and adapted from Jin et al. (2020), Lee et al (2020), Hsu & Chang (2013), Venkatesh et al (2003), Pavlou (2003), Venkatesh & Davis (2000), Ajzen (1991), Davis (1989), and Rogers (1975)

Methodology

The targeted population of this study were generally retail customers who carried out transactions of goods and services via offline and online retail outlets. Hair et al., (2010) stated that sample sizes that are within the range of 100 and 200 would be fitting and adequate. Consequently, the target population size in this study was 200 respondents, but only 185 usable feedbacks were used for further data analyses. This study adopted quota sampling from a non-probability sampling technique, to which a population is segmented into fundamentally unrelated sub-groups dependent on a specified proportion (Brick, 2011). In this study, the sample is obtained by segregating the respondents as per diverse ethnicities into identified sampled size ratio. The research instruments used to measure all items are adopted from previous research and adapted to this study. Data analyses were carried out using both SPSS Version 26.0 and Smart PLS version 3.0 software respectively.

Findings and Discussion

Descriptive Statistics

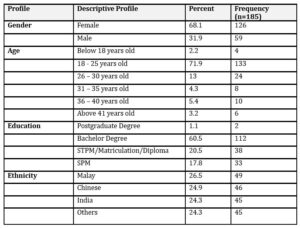

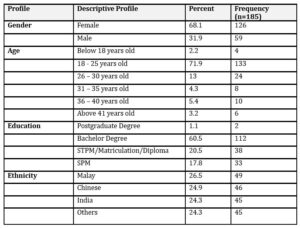

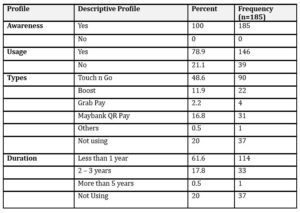

From the 200 survey distribution, only 185 usable data were collected and analysed to determine the demographic characteristics of targeted respondents and their usage patterns of contactless payment transactions. Table 1 shows the demographic profile of the respondents who had participated in this study. For gender, the highest percentage was female at 68.1% (n=126) and male respondents made up 31.9% (n= 59). Therefore, the highest number of respondents of the study are female compared to male. The age group ranged from below 18 years old until 41 years old and above age group. The highest age range for this study was those between 18 to 25 years old at 71.9% (n=133). The analysis is based on 185 online respondents as shown in Table 1 below:

Table 1: Demographic Profile

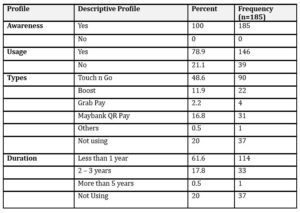

Table 2 shows the target respondents’ general usage characteristics of contactless payment. Generally, all respondents were aware of the contactless e-wallet payment application system. In terms of usage, the majority have experienced using it at 78.9% (n=146) as compared to the non-users at 21.1% (n=39). In terms of the types of contactless payment cards, most respondents were using Touch n GO e- wallet system at 48.6% (n=90), followed by Maybank QR Pay system at 16.8% (n=31) and others at 5% (n=1). However, 20% (n=37) were still not using the e-wallet payment system. Most respondents have used the e-wallet payment system for less than 1 year at 61.6% (n=114), while 17.8% (n= 33) have used it for nearly 2 to 3 years, and 5% have used it for more than 5 years. 20 % (n=37) of the respondents have not used this system before.

Table 2: Usage Characteristics of Contactless e-Wallet Payment

Inferential Statistics

Partial Least Square – Structural Equation Modelling

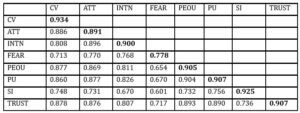

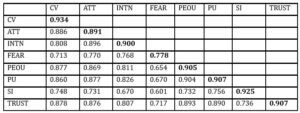

By using the partial least square–structural equation modelling techniques, the convergent validity and discriminant validity testing were subsequently used in measuring the model. Convergent validity of the measurement is usually ascertained by reviewing the loadings, average variance extracted (AVE) and composite reliability (CR). The results in this study showed all loadings to be above 0.7; CR were all higher than 0.7, and the AVE were also greater than 0.5 as shown in Table 3 below.

Table 3: Convergent Validity

Note: Items C5, C15, F4 were deleted due to low loadings, meanwhile items C1, C3, CI1, PEOU3, PEOU4, PU2, PU4, SI1, SI2, SI4 and T2 were deleted due to cross loadings.

Using Fornell and Larcker (1981), discriminant validity of the measurement criteria was used in comparing the correlations between constructs and the average variance extracted (AVE) from that construct. Table 4 below shows that all values of the square root of AVE were greater, thus indicating that the measures were discriminant.

Table 4: Discriminant Validity

Note: Values on the diagonal (bolded) are square root of the AVE while the off-diagonals are correlations.

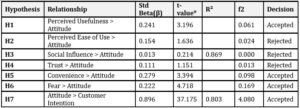

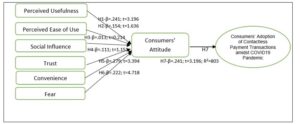

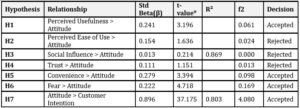

Further data analyses were then undertaken to test the relationship between independent, mediator and dependent variables. The result revealed that four out of seven tested hypotheses were accepted. H1, H5, H6, and H7 were accepted, to which convenience served as the strongest predictor (β = 0.279, p< 0.05), followed by perceived usefulness (β = 0.526, p< 0.05) and fear (β = 0.222, p< 0.05) indicating a significant relationship with consumer attitude towards intention. The R² values of 0.869 (or 80% variance in attitude) were above the 0.26 value as suggested by Cohen (1988) indicating a solid model.

Next, the predictive construct of attitude towards intention was further analysed. The results indicated that attitude (β = 0.896, p< 0.05) had a significant relationship with customer intention. The R² values explained 80 % of the variance in customer intention. Table 5 illustrates the overall hypothesis testing of the said relationships.

Table 5: Hypothesis Testing

Note: *p< 0.05

Figure 2.0: Inferential Findings of the Study

From the above analyses and findings, several discussions were generated. Firstly, the effect of perceived usefulness on consumers’ attitude was significant in this study, hence accepting H1. This is concurrent with Wijayanthi (2019) who found the significant influence of perceived usefulness on attitude toward using e-wallets as a payment method for services. For instance, Touch n Go e-wallet payment permits the users to utilize them at anytime and anywhere. In this study, it was revealed that many respondents liked to use the Touch n Go’s e-wallet payment applications at Tealive Sdn. Bhd. retail outlet because they can get special discounted rates on any beverage purchases.

Secondly, perceived ease of use was found to have an insignificant effect on consumers’ attitude towards contactless payment usage, thus rejecting H2. This finding confirms prior research that considers perceived ease of use as a basic requirement for system design and should not have an influence on attitude in the later stages of adoption (Agarwal and Prasad, 1998; Chau and Hu, 2002; Davis et al., 1989). It further supports Ajibabe’s (2018) contention that the impact perceived ease of use has on attitude towards using technology is weak because other facilitating factors beyond user’s control could also influence attitude. Another plausible explanation for this finding could be due to respondents’ familiarity with Internet and mobile phone usage that may increase their expectancies of service usefulness rather than influencing their attitudes toward the service. (Agarwal and Prasad, 1999; Liaw, 2002).

Thirdly, social influence and trust were also found to have no significant influence on consumers’ attitude towards the use of contactless payment. Hence, H3 and H4 are rejected. This study aligns with Lai (2017) who stated that TAM2 and TAM3 were not worthy of investigation in relation to the innovation of single-stage e-payment systems. Being seasoned Internet users, the need for trusted and reliable business merchants and other social influences on this contactless payment usage is minimal since experience has played a major part in reducing trust and risk issues and social references (Lai, 2017; Pavlov, 2003.).

Further to that, convenience was found to have a significant effect on consumers’ attitude towards the use of contactless payment transactions. Hence H5 is supported. This finding supports past research by e.g., Lai & Zainal (2015), who stated that convenience is crucial in determining the use of single-stage e-payment system. E-wallet gives convenience to the customers because the customers do not have to queue at the bank or any automated teller machines (ATM) kiosks. With an e-wallet usage, customers simply need to display the scanner tag given from the e-wallet system application in making a payment offline or online.

Fear was further revealed to significantly affect consumers’ attitude towards the use of contactless e-wallet payment during the COVID-19 pandemic, thus accepting H6. The findings support past research (e.g., Lee, et al, 2020; Lee et al, 2020) showing significant effects of fear and anxiety on attitude across different age, gender, and racial groups. With an increased number of COVID 19 medical cases, many individuals fear going to crowded places to avoid potential infection of such disease, and in turn, such fear may influence their attitude towards the use of contactless payment systems for consumption transaction activities (The Star Online, 2020).

Finally, the relationship between customers’ attitude and their intention towards the use of e-wallet payment was also found to have a significant effect (β = 0.881, t = 25.218, sig. = 0.000). Hence, H7 is accepted. This finding was consistent with Nidhi et al., (2020) who stated that a user’s positive attitude towards e-wallet will improve their behavioural intention. This study demonstrated that customers’ attitudes can influence their intention towards the use of e-wallet payment particularly during the recent development of COVID-19 pandemic. Customer attitude fundamentally contains beliefs, emotions, and goals towards certain objects.

Acknowledgment

The authors would like to acknowledge Miss Nur Faatihah Muhammad Salh from the Faculty of Business Management, Universiti Teknologi MARA for her invaluable assistance towards undertaking data collection for this study.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Agarwal, R. and Prasad, J. (1998), “A conceptual and operational definition of personal innovativeness in the domain of information technology”, Information Systems Research, Vol. 9 No. 2, pp. 204-15.

- Agarwal, R. and Prasad, J. (1999), “Are individual differences germane to the acceptance of new information technologies?” Decision Sciences, Vol. 30 No. 2, pp. 361-91.

- Ajibade, Patrick, “Technology Acceptance Model Limitations and Criticisms: Exploring the Practical Applications and Use in Technology-related Studies, Mixed-method, and Qualitative Researches” (2018). Library Philosophy and Practice (e-journal). 1941. http://digitalcommons.unl.edu/libphilprac/1941

- Ajzen, I. (1991). The theory of planned behavior. Organizational Behaviour and Human Decision Processes, 50, 179–211.

- Ajzen, I. & Fishbein, M. (2000) Attitudes and the Attitude-Behavior Relation: Reasoned and Automatic Processes. European Review of Social Psychology Volume 11, No. 1

- Alaeddin, O., Altounjy, R., Zainudin, Z., Kamarudin, F. (2018). From Physical to Digital: Investigating Consumer Behaviour of Switching to Mobile Wallet. Polish Journal of Management Studies, 17(2), 18- 30. doi:10.17512/pjms.2018.17.2.02

- Aslam, M., Ahmad, K., Akhtar, M. A., & Maqbool, M. A. (2017). Salinity Stress in Crop Plants: Effects of stress, Tolerance Mechanisms and Breeding Strategies for Improvement. Journal of Agriculture and Basic Sciences, 2, 70-85.

- Balachandran, D. (2015). The Adoption Intention of Near Field Communication (NFC) – Enable Mobile Payment among Consumers in Malaysia. (Master of Business Administration – Corporate Management), Unpublished Dissertation, Universiti Tunku Abdul Rahman.

- (2020). Impact of Pandemic on Economy and Recovery Policy. Retrieved from https://www.bernama.com/en/features/news.php?id=1829686.

- Brett, J (2017). Dissertation Cardiff metropolitan university, U.K. http://hdl.handle.net/10369/8745

- Brick, J.M (2011). The Future of Survey Sampling. Public Opinion Quarterly, Vol. 75 (5), Special Issue 2011, Pages 872–888, https://doi.org/10.1093/poq/nfr045

- Chang, Y. Mokhtar, IA., Majid, M., Luyt, B & Theng, Y. (2012). Assessing students’ information literacy skills in two secondary schools in Singapore. Journal of Information Literacy, 6(2), http://ojs.lboro.ac.uk/ojs/index.php/JIL/article/view/PRA-V6-I2-2012-2

- Chau, P. and Hu, P. (2002), “Investigating healthcare professionals’ decisions to accept telemedicine technology: an empirical test of competing theories”, Information & Management, Vol. 39, pp. 297–311.

- Chin, E. S. M (2020). For first time in 22 years, negative growth rate projected for Malaysia retail industry. Malay Mail. 14 Apr 2020. https://www.malaymail.com/news/malaysia/2020/04/14/for-first-time-in-22-years-negative-growth-rate-projected-for-malaysia-reta/1856489

- Cristobal, E., Flavián, C., Guinalíu, M (2017) Perceived e-service quality (PeSQ). Managing Service Quality. Int. J. 17(3), 317–340 Retreived: https://doi.org/10.1108/09604520710744326

- Davis, F.D. (1989) “Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology” MIS Quarterly 13(3), pp. 319-340.

- Davis, F.D., Bagozzi, R.P. & Warshaw, P.R. (1989), “User acceptance of computer technology: a comparison of two theoretical models”, Management Science, Vol. 35, pp. 982-1003

- Fishbein, M. and Ajzen, I. (1975), Belief, Attitude, Intention, and Behaviour: An Introduction to Theory and Research. Addison Wesley, Reading, MA.

- Fornell C, & Larcker, FD (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error, Journal of Marketing Research. Vol 1, 39-50

- Hair, J.F; Black, WC; Babin, BJ & Anderson, RE (2010). SEM: An introduction Multivariate data analysis: A global perspective

- Hsu, H., & Chang, Y. (2013). Extended TAM Model: Impacts of Convenience on Acceptance and Use of Moodle. US-China Education Review A, Vol. 3, No. 4, 211-218. ISSN 2161-623X April 2013,

- Irani, Z.; Gunasekaran, A & Dwivedi, YK (2010) Radio frequency identification (RFID): research trends and framework, International Journal of Production Research, 48:9, 2485-2511, DOI: 10.1080/00207540903564900

- Isrososiawan, S., Hurriyati, R., Dirgantari, P. D. (2019). User Mobile Payment Behavior Using Technology Acceptance Model (TAM): Study of “Dana” E-Wallet Users. Jurnal Minds: Manajemen Ide Dan Inspirasi, 6(2), 181. doi:10.24252/minds. v6i2.1127

- Jerry, M., Maulana, V. (2017). Factors Affecting Intention to Use “SAKUKU” E-Wallet of Generation Y in Indonesia.

- Jin, C. C., Seong, L. C., Khin, A. A. (2020). Consumers’ Behavioural Intention to Accept of the Mobile Wallet in Malaysia. Journal of Southwest Jiaotong University, 55(1). doi:10.35741/issn.0258- 2724.55.1.3

- Joifin, F. (2018). What is contactless payment? Retrieved from https://www.comparehero.my/credit-card/article/what-is-contactless payment

- Jusoh, Z. & Teng, Y.Z (2019). Perceived Security, Subjective Norm, Self-Efficacy, Intention, and Actual Usage towards E-Payment among UPM Students. Journal of Education and Social Sciences, Vol. 12, Issue 2, (Feb) Issn No: 2289-9855

- Lai, P. (2017). The Literature Review of Technology Adoption Models and Theories for the Novelty Technology. Journal of Information Systems and Technology Management, 14(1). doi:10.4301/s1807- 17752017000100002

- Lai, P.C. & Zainal, A.A. (2015). Perceived Enjoyment and Malaysian Consumers’ Intention to Use A Single Platform E-Payment, SHS Web of Conferences

- Liu, C-T. & Y. M. Guo. (2008). Validating the End-User Computing Satisfaction Instrument for Online Shopping Systems. Journal of Organizational and End User Computing, 20(4), 74-96.

- Lee SA, Jobe MC, Mathis AA (2020). Mental health characteristics associated with dysfunctional coronavirus anxiety. Psychological Medicine 1–2. https:// doi.org/10.1017/S003329172000121X

- Lee, S. A., Mathis, A. A., Jobe, M. C., Pappalardo, E. A. (2020). Clinically significant fear and anxiety of COVID-19: A psychometric examination of the Coronavirus Anxiety Scale. Psychiatry Research, 290, 113112. doi: 10.1016/j.psychres.2020.113112

- Mathwick, C., Malhotra, N. & Rigdon, E. (2001). Experiential value: conceptualization, measurement and application in the catalog and Internet shopping environment. Journal of Retailing, 77 (1), Spring 2001, Pages 39-56

- Mohamed A. El-Erian (2020). Chairman, President Barack Obama’s Global Development Council COVID-19: What are the biggest concerns for the developing world? Retrieved: 22nd April 2020. https://www.weforum.org/agenda/2020/04/developing-world-covid19. World Economic Forum

- Mokhtar, N. F. (2019). A Cashless society: Perception of Malaysian Consumers toward the Usage of Debit Cards. International Journal of Accounting, Finance and Business (IJAFB), 4(21), 91 -100.

- Mutahar, A.M; Norzaidi, M.D, Ramayah, T. & Putit, L (2017). Examining the Effect of Subjective Norms and Compatibility as External Variables on Tam: Mobile Banking Acceptance in Yemen. Science International (Lahore) 29 (4), 769-776

- Nagashree, N., Rao, V., & Shiji, A. (2014). Near Field Communication. International Journal of Wireless and Microwave Technologies, 4, 20-30. doi: 10.5815/ijwmt.2014.02.03

- Pavlou, P. (2003). Consumer Acceptance of Electronic Commerce: Integrating Trust and Risk with the Technology Acceptance Model. International Journal of Electronic Commerce, 7, 101-134.

- Putit, L. & Muhammad N. (2015). Predictors of web-based transactions: Examining key variations within an intra-national culture. Advanced Science Letters21 (6), 2068-2072

- Putit, L., Nurhani, I, Suki, A.A., Afiqah, A., Nurul Aliff, A.M. & Nurul Amirah, M.N. (2020) Website Attributes’ Influence on Customer Loyalty and Travel Service Purchase: A case of Online Virtual Reality. Conference Proceedings, 6th International Conference on E-Business and Applications 2020, Kuala Lumpur, 25-27 February 2020. Association for Computer Machinery (ACM) – New York, USA – https://dl.acm.org/doi/10.1145/3387263.3387290

- Rogers, R. W. (1975). A Protection Motivation Theory of Fear Appeals and Attitude Change. Journal of Psychology. 1975; 91:93–114.

- Schuitema, G., Anable, J., Skippon, S., & Kinnear, N. (2013). The role of instrumental, hedonic and symbolic attributes in the intention to adopt electric vehicles. Transportation Research Part A: Policy and Practice, 48, 39-49.

- Shroff, R. H., Deneen, C. C., Ng, E. M. (2011). Analysis of the technology acceptance model in examining students’ behavioural intention to use an e-portfolio system. Australasian Journal of Educational Technology, 27(4). doi:10.14742/ajet.940

- Singh, N., Sinha, N., & Liébana-Cabanillas, F. J. (2020). Determining factors in the adoption and recommendation of mobile wallet services in India: Analysis of the effect of innovativeness, stress to use and social influence. International Journal of Information Management, 50, 191-205. doi: 10.1016/j.ijinfomgt.2019.05.022

- Teoh, T., M., Hoo, C., & Lee, T. (2020). E-Wallet Adoption: A Case in Malaysia. International Journal of Research in Commerce and Management Studies Vol. 2(2) ISSN 2582-2292

- The Star Online. (2020). Covid-19 Outbreak Steepens Adoption Curve of E-Wallets in Malaysia. Retrieved from https://www.thestar.com.my/news/regional/2020/04/28/covid-19-outbreak-steepens-adoption-curve-of-e-wallets-in-malaysia. The Star Online.

- Venkatesh, V. & Bala, H. (2008). Technology Acceptance Model 3 and a Research Agenda on Interventions, Decision Science, 39(2), 151-315

- Venkatesh, V., & Davis, F. D. (2000). A theoretical extension of the technology acceptance model: Four longitudinal field studies. Management Science, 46(2), 186-204.

- Venkatesh, V., Moris, M. G., Davis, G. B., & Davis, F. D. (2003). User Acceptance of Information Technology: Towards A Unified View. MIS Quarterly, 27(3), 425-478.

- Wijayanthi, I. (2019). Behavioral Intention of Young Consumers towards E-Wallet Adoption: An Empirical Study among Indonesian Users. Russian Journal of Agricultural and Socio-Economic Sciences, 85(1), 79-93. doi:10.18551/rjoas.2019-01.09

- Zeithaml, V.A. (2002). “Service excellence in electronic channels”, Managing Service Quality: An International Journal, Vol. 12 No. 3, pp. 135-139.