Introduction

The liquidity risk is a systemic risk that has been generally discussed in the scientific literature as the consequence of another financial risk or an abnormal stressful situation that had originated in the real economy.

Banks, in their role of liquidity suppliers to the economy, bear a liquidity risk in relation with their mission, even if they are perfectly fulfilling the capital requirements. In fact, any internal or external dysfunction can produce a tremendous variation of the liquidity risk with the possibility of becoming a market liquidity risk, per se, the systemic component that’s involving all the actors of the financial markets.

To face this situation, banks hold voluntarily and mostly a mandatory liquidity buffer composed of assets that can be easily transformed into liquidity to satisfy a massive withdraw wave. To this buffer, banks have other possibilities like contracting liquidity short term loans with the central bank or with prominent private banks either national or international.

A bank fails to raise enough liquidity, if not bailed out by the central bank default. The central bank in some circumstances may be reticent to play its fundamental role of lender of last resort especially if it’s in contradiction with its monetary policy. Nonetheless, this intervention become unavoidable, in the case of a systemic crisis, or if a bank is considered so, the contagion risk to the financial market and to the real economy is greater than it is when the bank involved is “normal”. In some cases, the central bank is urged to bail out a great bank (with a considerable total asset) experiencing illiquidity, rather than rescuing multiple small banks. The central bank may also in order to ensure the soundness of the system, let the small illiquid and troubled banks default or be swallowed by their competitors, thus, this situation is not always favored because the banking system is slowly becoming more and more concentrated and then the remaining banks develop a greater power on the market and on the regulators.

The central bank is faced with another dilemma which is distinguishing the illiquid banks from the insolvable ones who would use the public funding for gambling through more speculative strategies that are potentially more profitable yet more risky. In other words, the information asymmetry between the central bank and the commercial banks unable the first one to intervene properly and so the central bank must, in order to ensure the stability of the financial system, intervene widely, which leads to the emergence of a moral hazard. The 1st figure shows how the increasing volume of intervention weaken the position of the central bank and the financial system, downgrade the sovereign rating, downgrade the rating of the commercial banks operating under the scope of the central bank and rarefy the international funding sources.

Figure 1 : support-degradation cycle

The central bank’s incapacity to distinguish the solvable from the illiquid banks leads as said before to the emergence of the moral hazard when some banks acquiring the superlative of “Too BIG to FAIL” are granted the perpetual support of the monetary authorities in case of emergency.

The information asymmetry is a variable commonly managed in the developed economies due to the increased mandatory regulatory and accounting transparency ( (Chaplin, G., Emblow, A., Michael, I., 2000)[i] ; (Bennet, P., Peristiani, S., 2002)[ii]. As for underdeveloped and emerging countries, the central bank and the other monetary policies makers must impose a greater number of prudential regulations in order to reduce the opacity of the commercial banks practices in relation to their portfolio, to the capital requirement satisfaction and to the risk profile (Freedman, P., Click, R., 2006)[iii].

Those systemic banks may be identified through various aspects such as their relative size to the financial system or to the national economy, their interconnection (the volume of interbank transactions) and the complexity of their activities (the portfolios and the extraterritorial relations).

Literature Review

The increasing liberalization of the financial system is reducing the probability of a single bank default, yet the probability of a nationwide bank run is amplified through banking contagion mechanisms (Philippe Aghion, Patrick Bolton, Mathias Dewatripont, 2000)[iv]. Therefore, in this paper, we are going to present several theoretical notions in order to discuss the foundations of our reflection.

Liquidity risk is a constant known by banks and regulators since (Bagehot W., 1873)[v] era, liquidity risk captures the incapacity or incapability of a financial intermediary to serve its debts when they reach maturity. Several liquidity risk definition emphasizes the time horizon, because the probability of defaulting due to liquidity issues is measured in time and can differ regarding the time period in question ( (Matz L. and P. Neu, 2006)[vi] ; (Drehman M. and N. Nikolaou, 2008)[vii]. Funding liquidity risk depends on the availability of the funding sources but also of the ability of the intermediary to satisfy its budgetary constraint for different time period.

(Matz L. and P. Neu, 2006)[viii] consider the liquidity risk as the consequence of the increase of one or more other financial risks. In their article, (Drehman M. and N. Nikolaou, 2008)[ix] admit the similarities between the funding and the market liquidity risk, mainly since those two behave in a similar fashion, stable and low in a stable environment but also violently volatile in crisis period as it has been the case during the 2008 financial meltdown. This liquidity risk shafting from the banking sphere to the markets becomes systemic and can have heavy consequences, especially in destabilizing the entire financial system by bursting out financial crises and even economical ones ( (Hoggarth, G. and Saporta, , 2001)[x]; (Ferguson, R.W., Hartmann, P., Panetta, F., and R. Portes, 2007)[xi].

This situation implies a certain information asymmetry that mantles the solvability of the banks, which is a notion difficult to establish and it exacerbates the fear of counterparty risks ( (Allen, F. and G. Douglas, 2000)[xii]; (Drehmann, M., J. Elliot and S. Kapadia, 2007)[xiii] ; (Brusco S. and F. Castiglionesi, 2007)[xiv] ; (Strahan, P. , 2008)[xv]). This situation can generate moral hazard where some insolvable banks pretending to be only facing some liquidity tensions are bailed out. Those banks then engage in risky strategies by investing in illiquid assets and gambling on their capability of achieving high returns and consequently solvability.

Those banks that are “TOO BIG TO FAIL” benefits from crises because they are assured to be bailed out by the governments but also gain much more power over the financial system by market cannibalism inherent to crisis times. In fact, the central bank is distorting the free market efficiency by issuing unequal funding among the commercial banks (Schich, S., Lindh, S., 2012)[xvi]. By weakening the markets mandatory discipline level, banks start undertaking risky strategies in order to eliminate the weaker ones (Gropp, R., Hakenes, H., Schnabel, I., 2011)[xvii]. In addition, giving the belief that the central bank or the government support is positively linked to the size of a bank, banks expand to reach the status of “TOO BIG TO FAIL” in such fashion that the moral hazard increase ostentatiously.

The latest research in the field contradict the classical tendency instituted since (Diamond, D., 1984)[xviii] that fictitiously eliminate the risk of moral hazard in the banking system by “perfectly” diversifying the credit risk and the income sources. In reality, (J.-P. Niinimaki, 2012)[xix] concluded that diversification does not end moral hazard even if revenues and the balance sheet of the bank are ideal, it could be in a situation of insolvability and operating under some hidden losses under the assets side, especially for the distributed loans. Two methods are used by banks in order to hide their true situation, the first is by rescheduling their debts, the other is by contracting new lines of credit that eventually consist of a Ponzi scheme (J.-P. Niinimaki, 2012).

In order to maximize their credit distribution market share, banks gamble on the future values of the collaterals taken to guarantee the loans granted to their clients. These strategies of funding projects repose on the optimistic projection under which there will always be a supposedly ever after growing value of those collaterals, so even in a failure case, banks suppose that the value will cover the loans they had been issuing (J.-P. Niinimäki , 2009)[xx].

Empirical context

During the last global financial crisis, the state bailout and the market cannibalism have revived the systemic bank issue, that cannot be, in a public interest optic, abandoned to themselves even if it means transferring great volumes of private debt over the shoulders of the taxpayers as it was the case in Iceland in 2008, Ireland in 2010 and Cyprus in 2013 (Demirgüç-Kunt, A., Huizinga, H.,, 2013)[xxi].

Some studies have shown that the main causes underlying banking failure in the developed countries are the outcomes of macroeconomic factors ( (Rojas-Suarez, L, 1998)[xxii] (Bongini, P., Claessens, S., Ferri, G., 2000)[xxiii]) . As shown by ( (Benston, G., Kaufman, G., 1995)[xxiv] ; (Gavin, M., Hausman, R., 1996)[xxv] ; (Gonzalez-Hermosillo, B., Pazarbasioglu, C., Billings, R., 1997)[xxvi] ; (Demirguc ̧-Kunt, A., Detragiache, E., 1998)[xxvii]). It’s easier to say that banking crises occur in periods of macroeconomic tensions. Nonetheless, it’s important to emphasis that those macroeconomic factors are just exposing the weaknesses of the banking structures (Gill, M., Hilbers, P., Leone, A., Evens, O., 2000)[xxviii]. Other non-financial factors have been used to explain those failures such as the size (Boyd, J., Gertler, M., 1993)[xxix] or a private foreign shareholding (Goldstein, M., Turner, P., 1996)[xxx].

In morocco, there has been no failure or crisis which is explained by the low level interconnection between the Moroccan financial system and those that have been torn apart by the subprime crisis since 2007. In the contrary, the Moroccan banking sector is one of the flagships of the Moroccan economy and has been increasingly developed for many years, largely not only for an important population banking, a financial products and services flourishment but also to an international opening to its African roots especially to accompany the Moroccan and African companies operating in the area.

This development, is not without any constraints, in effect, it’s primordial to analyze the relative importance of the financial system actors in order to identify those that became of systemic importance and which can be nicknamed “TOO BIG TO FAIL”, thus forcing the monetary and financial authorities to intervene in default situations. In addition, this situation, if those actors are aware of, may turn them into institution that are risk addict, and there is the beginning of a vicious cycle of moral hazard plunged by the belief of the central bank backing up.

Giving the confidentiality of banking data, this study is limited to a balance sheet analysis supported by the annual reports of the Moroccan financial institutions and the data provided by the Moroccan central bank related to the domestic financial system. Primarily, we will decorticate the Moroccan financial sector structure with the intention of distinguishing some of the entities that could be significant and also to understand its evolution

Analysis

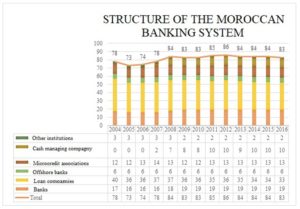

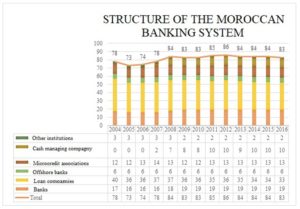

The Moroccan banking sector is relatively concentrated giving the fact that few actors are actively operating in it and those actors are conglomerated under 9 banking groups. During the last years, this sector population had not radically changed, in fact only 10 cash managing companies were granted approval to start their business since 2006 when they were none and some loan companies vanished in some merger and acquisition operations.

In late 2016, the financial institutions committee has granted the approval to 5 banks and to 3 participative banking windows (by which some classical banks can place participative banking products) as part of the participative banking introduction. Those banks have started their activities during 2017, so they would be excluded from our study.

[i]Chaplin, G., Emblow, A., Michael, I. « Banking system liquidity : Developments and issues. » Bank of England Financial Stability Review (December), 2000 : 93–112.

[ii] Bennet, P., Peristiani, S. « Are US reserve requirements still binding ?» Fed. Reserve Bank New York Econ. Pol. Rev. 8., 2002.

[iii] Freedman, P., Click, R. « Banks that don’t lend ? Unlocking credit to spur growth in developing countries. » Devel. Pol. Rev. 24, 2006 : 279–302.

[iv] Philippe Aghion, Patrick Bolton, Mathias Dewatripont. (2000). Contagious bank failures in a free banking system. European Economic Review , 44, 713-718.

[v] Bagehot W. (1873). Lombard Street : A Description of the Money Market. H.S. King.

[vi] Matz L. and P. Neu. (2006). Liquidity Risk : Measurement and Management. Wiley.

[vii] Drehman M. and N. Nikolaou. (2008). Funding Liquidity Risk : Definition and Measurement. Working Paper Series n° 1024.

[viii] Matz L. and P. Neu. (2006). Ibidem.

[ix] Drehman M. and N. Nikolaou. (2008). Ibidem.

[x] Hoggarth, G. and Saporta, (2001). Costs of Banking System Instability : Some Empirical Evidence. Financial Stability Review Bank of England.

[xi] Ferguson, R.W., Hartmann, P., Panetta, F., and R. Portes. (2007). International Financial Stability in Geneva Reports on the World Economy. CEPR, 9.

[xii] Allen, F. and G. Douglas. (2000). Financial Contagion. Journal of Political Economy, 108, 1-31.

[xiii] Drehmann, M., J. Elliot and S. Kapadia. (2007). Funding Liquidity Risk : Potential Triggers and Systemic Implications.

[xiv] Brusco S. and F. Castiglionesi. (2007). Liquidity Coinsurance, Moral Hazard, and Financial Contagion. The Journal of Finance, 2275-2302.

[xv] Strahan, P. (2008). Liquidity Production in the 21st Century. NBER Working Paper.

[xvi] Schich, S., Lindh, S. (2012). Implicit guarantees for bank debt: where do we stand? Financ. Market Trends , 1, 1-22.

[xvii] Gropp, R., Hakenes, H., Schnabel, I. (2011). Competition, risk-shifting, and public bail- out policies. Rev. Financ. Stud. , 24, 2084–2120.

[xviii] Diamond, D. (1984). Financial intermediation and delegated monitoring. Review of Economic Studies , 51, 393–414.

[xix] J.-P. Niinimaki. (2012). Hidden loan losses, moral hazard and financial crises. Journal of Financial Stability , 8, 1-14.

[xx] J.-P. Niinimäki . (2009). Does collateral fuel moral hazard in banking? Journal of Banking & Finance , 33, 514-521.

[xxi] Demirgüç-Kunt, A., Huizinga, H., (2013). “Are Banks Too Big to Fail or Too Big to Save ? International evidence from equity prices and CDS spreads”. Journal of Banking & Finance, 37 (3) : 875-894

[xxii] Rojas-Suarez, L. (1998). Early warning indicators of banking crises : What works for Emerging markets.

[xxiii] Bongini, P., Claessens, S., Ferri, G. (2000). The Political Economy of Distress in East Asian Financial Institutions. Working Paper. World Bank.

[xxiv] Benston, G., Kaufman, G. (1995). Is the banking and payments system fragile ? Journal of Financial Services Research 9, 209–240.

[xxv] Gavin, M., Hausman, R. (1996). The Roots Banking Crises : The Macroeconomic Context. Working Paper. Inter-American Development Bank.

[xxvi] Gonzalez-Hermosillo, B., Pazarbasioglu, C., Billings, R. (1997). Determinants of banking system fragility : a case study of Mexico. IMF Staff Papers 3, 295–314.

[xxvii] Demirgüç-Kunt, A., Detragiache, E. (1998). The determinants of banking crises in developing and developed countries. IMF Staff Papers 1, 81–109.

[xxviii] Gill, M., Hilbers, P., Leone, A., Evens, O. (2000). Macroprudential indicators of financial system soundness. IMF Occasional Papers 192.

[xxix] Boyd, J., Gertler, M. (1993). US commercial banking : trends, cycles, and policy. (O. F. In : Blanchard, Éd.)

[xxx] Goldstein, M., Turner, P. (1996). Banking Crises in Emerging Economies : Origins and Policy Options. Working Paper, 46.

Figure 2 : the evolution of the Moroccan banking system structure

The Moroccan banking sector capital structure has changed drastically during the last decades notoriously in the process of an important disengagement of the government from the capital of the Moroccan banks in order to encourage the private shareholders to take position in the banking sector which represents 70% in 2016. The government remains in control of 5 banks and 4 loan companies. The foreign presence is also considerable; in fact 15 financial institutions are subsidiaries of foreign banks or financial holdings.

In order to detect banks that are too big to fail, we studied many factors that permitted us to elaborate more on the position of the 3 biggest Moroccan banking groups.

In fact, these 3 biggest Moroccan groups, which are ATTIJARIWAFA BANK (ATW), LE CREDIT POPULAIRE DU MAROC (CPM) and LA BANQUE MAROCAINE DE COMMERCE EXTERIEUR (BMCE), are prime actors of the Moroccan banking system, pillars of the government banking and decompartmentalization policies. Those banks are also shinning superstars in the global ambitions of the kingdom which is palpable by the number of implantations in several countries all over the continent, but also by its subsidiaries and branches in Europe, Middle East and North America. These implantations help ensuring a perpetual increase in the transfers of the Moroccan diaspora but also by offering their expertise and knowledge of the Moroccan and African markets to the investors projecting investment in the region.

Primarily, we are going to investigate the BANK AL MAGHRIB (Moroccan central bank) interventions to the markets before analyzing the financial institution operating under its sphere of influence, focalizing especially on those that are big, interconnected and complex enough to be considered of a significant importance.

Central Bank Interventions

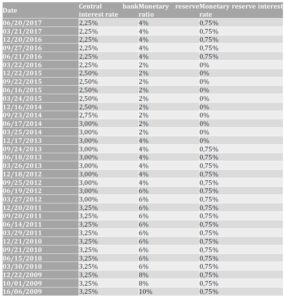

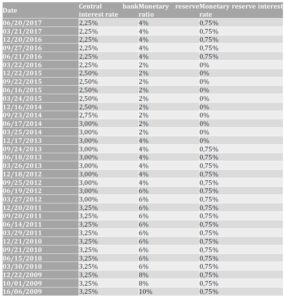

During the last decade, the Moroccan central bank had intensified its interventions on the monetary markets either by injecting directly liquidities to the banks via the markets or indirectly by quantitative easing and by lowering the monetary reserve which had been rectified from 16,5% in 2002 to 4% since 21 June 2016.

Table 1: the central bank decisions regarding the central interest

rate and the monetary reserve rate

We notice that 2009 was a pretty dynamic year that had known 3 quantitative easing (from 15% to 8%). In the same way, the return of the funds expected from the funds placed at the central bank was constant since 2003 before being deleted and reintroduced another time since 06/21/2016

Figure 3 : the evolution of the Central bank interventions

The 3rd figure marks the emergence of liquidity tensions since the 2007 summer where the central bank had to fund the commercial banks with two peaks near 80 billion Dirhams in august 2012 and November 2013. During the period between 2014 and 2016, the tensions were getting weaker but in august 2017, the monetary market experienced another huge liquidity funding from the central bank with more than 70 billion Dirhams.

The 4th figure shows us a diminishing in the amount of bank deposits in the central bank vaults though a constant increase of the deposits gathered by the commercial banks. This situation is the direct effect of the several quantitative easing that took place during the period between the late 2007 and mid-2016. The central bank deposit ratio reached a maximum of 12.76% in December 2004 with more than 47 billion.

Figure 4 : Evolution of the commercial banks deposits at the central bank

The size

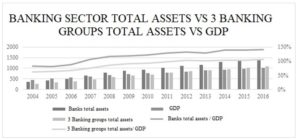

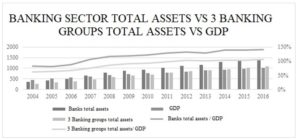

In order to approach the size of those banking groups relatively to the Moroccan financial system but also in comparison to the Moroccan economy, we must study various parameters among which the total asset of the overall sector and of those 3 groups relatively to the national GDP.

Figure 5: banking Sector total assets vs 3 banking groups vs the GDP

The previous figure shows the evolution of the 3 parameters studied, the total asset, the total asset of the 3 groups and the evolution of the GDP. During 2007, the total asset of the Moroccan banks has exceeded the Moroccan GDP and reached in 2016 a comparative value of 146%. In 2012, the total asset of those groups has also surpassed the GDP and in 2016, it represented 107% of it. This situation demonstrates clearly that those 3 groups are heavyweights for the financial sectors and the Moroccan economy.

We must also study their weight in the financial markets, actually, in the Casablanca stock exchange, 14 securities represent the financial institutions, six of them are relative to banks and represent a third of the total capitalization of the stock exchange. In the next figure, we study the behavior of the Casablanca stock exchange and the weight of the capitalization of those 3 groups relatively to the overall market over a year.

Figure 6 : Evolution of the MASI INDEX and the Evolution of the 3 banking group weights in the overall capitalization

After some years of decrease, the Casablanca stock exchange has regained some strength in 2017, which is positively followed by the weight of the 3 groups capitalization which represents almost 30% of the overall market.

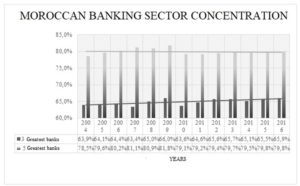

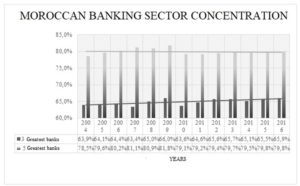

As we already mentioned before, the Moroccan banking sector is characterized by a strong concentration, but it’s simpler to explain it by presenting the weight of the 3 and the 5 most important banks as it’s shown in the 7th figure.

Figure 7 : The concentration rate of the 3 and 5 biggest banks

The evolution of the power of the 3 first banks increase rapidly more than the 5 first banks because they are engaging in some aggressive commercial strategies and by acquiring more and more subsidiaries.

The Interconnection

For (Lev Ratnovski, 2009)[i], the systemic illiquidity is a major factor that let a sound bank engage in some risky strategies obviously leading to illiquidity because all the actors are doing so and the probability for a global public bail out is higher. The role of the central bank to regulate, as the lender of last resort, is compromised since it is incapable of correctly monitoring the interbank relations; this situation weakens the systemic stability as demonstrated by (Bagehot, W., 1873)[ii]. Giving the fact that banks are related across interbank credit, this relation becomes vicious as they transform to contagion channels in liquidity crisis periods. thus the central bank is giving a unique opportunity of funding the entire system by only bailing out some of the actors through the interbank markets.

(Rochet, J.-C., Tirole, J., 1996)[iii] demonstrate the perspective of the bailing out of the central bank reinforcing the idea and the emergence of the moral hazard because the market monitoring is diminished and the markets discipline is no longer a priority. In the same manner, for (O’Hara, M., Shaw, W., 1990)[iv], the systemic banks benefit disproportionally and before every other bank, from the liquidity funding of the central bank, the smaller banks are bailed out just out of fear of a destabilized system due to a “TOO MANY TO FAIL” effect (Acharya, V., Yorulmazer, T., 2007)[v].

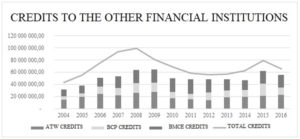

For the Moroccan market, giving the few actors, this effect is not taken into consideration, but what need to be understood is the weight of the 3 groups in the interbank credits by analyzing the balance sheet evolution of credits and debts vis à vis the other banking institutions.

[i] Lev Ratnovski. (2009). Bank liquidity regulation and the lender of last resort. Journal of Financial Intermediation, 18, 541–558.

[ii] Bagehot, W. (1873). Lombard Street : A Description of the Money Market. London : William Clowes and Sons.

[iii] Rochet, J.-C., Tirole, J. (1996). Interbank lending and systemic risk. Journal of Money, Credit, Banking, 28, 733–762

[iv] O’Hara, M., Shaw, W. (1990). Deposit insurance and wealth effects: The value of being ‘too big to fail’. Journal of Finance , 45, 1587– 1600

[v] Acharya, V., Yorulmazer, T. (2007). Too many to fail—An analysis of time-inconsistency in bank closure policies. Journal of Finance and Intermediation , 16, 1–31

Figure 8: evolution of debts to the financial institutions

It’s easy to figure out that debts of the banks had greatly increased during the last decade from 20 billion to 134 billion in 2016 with a peak in 2013 of 137 billions (12,5% of the total asset). This evolution can be explained by the central bank decision regarding the liquidity risk covering, the debt issuing and the central bank financing.

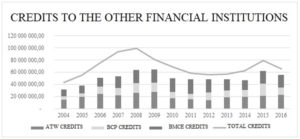

For the loans granted to the other financial institution, those 3 groups have shown a moderated evolution in comparison of the debts, but for the period between 2006 and 2008, there has been a peak. This evolution can be explained by the loan companies financing that have shown appetite for longer maturities and by the loans granted over the interbank market.

Figure 9 : evolution of credit to the financial institutions

The 8th and 9th figure show clearly that those 3 banking groups constitute the majority of interbank credits and debts, this is in favor of our idea that those groups are highly related to the other actors of the system and by so, those institutions hover a systemic risk to the Moroccan financial system.

The Operation Complexity

Those 3 banking groups are the only ones that represent the Moroccan banking industry abroad. They are implanted in over 25 African countries and across Europe, North America and in Asia especially in the middle east. The 10th figure shows the evolution of the implantation of those 3 Moroccan banking groups abroad which is operated through subsidiaries, branches and representative offices.

Figure 10 : Moroccan banks abroad implantations evolution

The number of those subsidiaries has increased with 1100% between 2004 and 2016, through an expansionary policy in prevision of the domestic market saturation but also to accompany the opening of the national economy to more prosper market especially in Africa. In 2016, those subsidiaries represented 22% in total assets, debts and loans.

Conclusion

Through the analysis of those three dimensions that are size, interconnection and operation complexity, the 3 Moroccan banking groups are of significant importance in the domestic financial sector, that can be nicknamed “TOO BIG TO FAIL” and by so, forcing the central bank to intervene in order to avoid a systemic crisis, a financial meltdown or an economic crisis.

In this eventuality, those actors that have such tremendous power over the regulators, may be determined to engage in dodgier strategies which are consistent of the idea of the manifestation of the moral hazard as a reality since they will be bailed out. We could also view the Moroccan banks’ investment in Africa as risky strategies engaged in countries where the country risk is highly reflected by the low sovereign ratings impacting the domestic banks.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Acharya, V., Yorulmazer, T. (2007). Too many to fail—An analysis of time-inconsistency in bank closure policies. Journal of Finance and Intermediation , 16, 1–31.

- Allen, F. and G. Douglas. (2000). Financial Contagion. Journal of Political Economy , 108, 1-31.

- Bagehot, W. (1873). Lombard Street: A Description of the Money Market. London.: William Clowes and Sons.

- Bennet, P., Peristiani, S. (2002). Are US reserve requirements still binding? . Fed. Reserve Bank New York Econ. Pol. Rev. 8.

- Benston, G., Kaufman, G. (1995). Is the banking and payments system fragile? Journal of Financial Services Research 9 , 209–240.

- Bongini, P., Claessens, S., Ferri, G. (2000). The Political Economy of Distress in East Asian Financial Institutions. . Working Paper. World Bank.

- Boyd, J., Gertler, M. (1993). US commercial banking: trends, cycles, and policy. (O. F. In: Blanchard, Éd.)

- Brusco S. and F. Castiglionesi. (2007). Liquidity Coinsurance, Moral Hazard, and Financial Contagion. The Journal of Finance , 2275-2302.

- Chaplin, G., Emblow, A., Michael, I. (2000). Banking system liquidity: Developments and issues. Bank of England Financial Stability Review (December) , 93–112.

- Demirguc ̧-Kunt, A., Detragiache, E. (1998). The determinants of banking crises in developing and developed countries. IMF Staff Papers 1 , 81–109.

- Demirgüç-Kunt, A., Huizinga, H.,. (2013). Are banks too big to fail or too big to save? International evidence from equity prices and CDS spreads. Journal of Banking & Finance , 37, 875-894.

- Diamond, D. (1984). Financial intermediation and delegated monitoring. Review of Economic Studies , 51, 393–414.

- Drehman M. and N. Nikolaou. (2008). Funding Liquidity Risk : Definition and measurement. Working Paper Series n° 1024 .

- Drehmann, M., J. Elliot and S. Kapadia. (2007). Funding Liquidity Risk: Potential Triggers and Systemic Implications.

- Ferguson, R.W., Hartmann, P., Panetta, F., and R. Portes. (2007). International Financial Stability in Geneva Reports on the World Economy. CEPR , 9.

- Freedman, P., Click, R. (2006). Banks that don’t lend? Unlocking credit to spur growth in developing countries. Devel. Pol. Rev. 24 , 279–302.

- Gavin, M., Hausman, R. (1996). The Roots Banking Crises: The Macroeconomic Context. . Working Paper. Inter-American Development Bank.

- Gill, M., Hilbers, P., Leone, A., Evens, O. (2000). Macroprudential indicators of financial system soundness. IMF Occasional Papers 192 .

- Goldstein, M., Turner, P. (1996). Banking Crises in Emerging Economies: Origins and Policy Options. Working Paper , 46.

- Gonzalez-Hermosillo, B., Pazarbasioglu, C., Billings, R. (1997). Determinants of banking system fragility: a case study of Mexico. IMF Staff Papers 3 , 295–314.

- Gropp, R., Hakenes, H., Schnabel, I. (2011). Competition, risk-shifting, and public bail- out policies. Rev. Financ. Stud. , 24, 2084–2120.

- Hoggarth, G. and Saporta, . (2001). Costs of Banking System Instability: Some Empirical Evidence. Financial Stability Review Bank of England .

- -P. Niinimäki . (2009). Does collateral fuel moral hazard in banking? Journal of Banking & Finance , 33, 514-521.

- -P. Niinimaki. (2012). Hidden loan losses, moral hazard and financial crises. Journal of Financial Stability , 8, 1-14.

- Lev Ratnovski. (2009). Bank liquidity regulation and the lender of last resort. Journal of Financial Intermediation , 18, 541–558.

- Matz L. and P. Neu. (2006). liquidity risk : measurement and management. Wiley.

- O’Hara, M., Shaw, W. (1990). Deposit insurance and wealth effects: The value of being ‘too big to fail’. Journal of Finance , 45, 1587– 1600.

- Philippe Aghion, Patrick Bolton, Mathias Dewatripont. (2000). Contagious bank failures in a free banking system. European Economic Review , 44, 713-718.

- Rochet, J.-C., Tirole, J. (1996). Interbank lending and systemic risk. Journal of Money, Credit, Banking , 28, 733–762.

- Rojas-Suarez, L. (1998). Early warning indicators of banking crises : What works for Emerging markets .

- Schich, S., Lindh, S. (2012). Implicit guarantees for bank debt: where do we stand? Financ. Market Trends , 1, 1-22.

- Strahan, P. . (2008). Liquidity Production in the 21st Century. NBER Working Paper .