* This study was carried out in partnership with the CRES, the Research and Social Studies Centre-Tunisia

Introduction

The Tunisian social security system has been gradually built around two principles: universality and financial equilibrium. The system is managed by the public sector and its financing is partly covered by the State budget. In the absence of regulatory reforms and in the face of critical demographic and economic developments, there has been a rapid increase in the budget deficits of the two main pension funds for years: the CNSS and the CNRPS. As a result, the system faces several challenges, including its ability to meet its commitments to its policyholders and ensure its financial balance.

This study aims, first, to describe the current Tunisian pension systems while focusing on the origin of the problems they face. Then, it presents the evolution of the financial situation of pension funds in the case of unchanged legislation and without the adoption of reforms by the government. Finally, in the last part, it concludes and makes recommendations.

Financial Equilibrium of The Pay-As-You-Go Pension Scheme and Economic and Demographic Developments: A Literature Review

Theory of Financial Equilibrium in The Pay-As-You-Go Pension Scheme

The intergenerational model developed by Allais (1947), Samuelson (1958), Diamond (1965) and Malinvaud (1987) is particularly suitable to discuss the question of redistributing pension funds between different generations of individuals, known as the pay-as-you-go pension scheme.

This model stipulates a transfer between generations living at each period. In the pay-as-you-go pension scheme, an agent born at time t must pay contribution on their salary when they are active at time, consumes and invests and receives as a retirement pension at time and gains a return r on their investment during period . This scheme is as follows:

Introduction

The Tunisian social security system has been gradually built around two principles: universality and financial equilibrium. The system is managed by the public sector and its financing is partly covered by the State budget. In the absence of regulatory reforms and in the face of critical demographic and economic developments, there has been a rapid increase in the budget deficits of the two main pension funds for years: the CNSS and the CNRPS. As a result, the system faces several challenges, including its ability to meet its commitments to its policyholders and ensure its financial balance.

This study aims, first, to describe the current Tunisian pension systems while focusing on the origin of the problems they face. Then, it presents the evolution of the financial situation of pension funds in the case of unchanged legislation and without the adoption of reforms by the government. Finally, in the last part, it concludes and makes recommendations.

Financial Equilibrium of The Pay-As-You-Go Pension Scheme and Economic and Demographic Developments: A Literature Review

Theory of Financial Equilibrium in The Pay-As-You-Go Pension Scheme

The intergenerational model developed by Allais (1947), Samuelson (1958), Diamond (1965) and Malinvaud (1987) is particularly suitable to discuss the question of redistributing pension funds between different generations of individuals, known as the pay-as-you-go pension scheme.

This model stipulates a transfer between generations living at each period. In the pay-as-you-go pension scheme, an agent born at time t must pay contribution on their salary when they are active at time, consumes and invests and receives as a retirement pension at time and gains a return r on their investment during period . This scheme is as follows:

Thus, during period , employees who were born at the beginning of period and retirees who were born at the beginning of period and who will pass away at the end of the period coexist together. The pensions distributed to retirees are financed by contributions deduced from active workers.

Inspired by this model, Davanne &Pujol (1997) developed a financial equation that estimates the relationship between demographic and economic variables under the pay-as-you-go pension scheme. This condition of financial equilibrium was taken up and developed by Dupuis and El Moudden (2002) and is then expressed in such a way that the contributions received are equal to the pensions paid.

From the above, we deduce the two ratios that define the financial equilibrium of the pay-as-you-go pension scheme. These are:

(B/W): the recovery rate is the retirement pension to the active population’s average wage ratio. This ratio reflects a commitment to retirees to keep their living standards aligned with those of the working population. This is the constraint that is imposed on the regime.

(P/N): the ratio of economic dependence, that expresses the number of pensioners to be paid by contributors, is the constraint imposed on this regime and brings about its financial imbalances. Indeed, an increase in this ratio leads to an increase in paid pensions vis a vis contribution, if it is not regulated by the other parameters of the scheme.

The Impact of Demographic and Economic Developments on The Financial Equilibrium of Pension Schemes

To ensure lasting stability, pension schemes should adapt their policies to economic factors, such as inflation rates, unemployment, interest rates and demographic factors conditioning the change in the characteristics of the covered population covered. Thus, pension schemes are affected by the environment in which they operate and the financial balance of their funds is closely linked to the country’s demographic trends (Silva et al. (2004)).

Doublet (1953) describes social security as an institution that redistributes income between several categories of the population. This institution depends on the economic situation but also on demographic figures and trends.

Demographic trends and pension schemes

Fleurbaey and Michel (1992) consider that the pay-as-you-go pension regime works through an implicit contract between generations: an active person contributes today to finance a retiree’s pension while waiting to receive a retirement pension that will be financed by tomorrow’s working people. They argue that this financing method makes the pension scheme vulnerable to any change in the popolation’s demographic structure.

Masson (2002) considers that the pay-as-you-go scheme allows for the transfer of income between generations under the guarantee of the State. Intergenerational imbalance is a major consequence of the population ageing in most countries. The State must then be able to honor its pension commitments while protecting the rights acquired for current generations and without harming future generations and thus creating an intergenerational imbalance. Butare (2006) argues that the burden of ageing will pose a major financial problem for pension schemes in almost all countries, if the different parameters are maintained as they are. However, some authors admit that ageing will only be a major problem if rapidly ageing societies fail to control the overall social dependence rate.

To study the effect of this demographic trend on the balance of the pay-as-you-go pension scheme, it is necessary to take into account the demographic dependency ratio. This latter represents the ratio between over 60 years of age population and working age population. It makes it possible to measure the burden that retired people represent on the likely working age people. Vernière (2003) states that a disproportionate evolution of these two categories could alter the balance of pension schemes managed by the pay-as-you-go regime both in terms of pensions (expenditure) and contributions (income).

Blanchet & Kessler (1990) argue that a decline in birth rate reduces the proportion of working age population. Such a trend would have a negative impact on the growth of the contribution base and therefore on the amount of revenues. At the same time, an increase in life expectancy at birth increases the proportion of the population aged “over 60” and thus increases the amount of pensions paid to retirees and therefore expenditure.

Economic Developments and Pension Schemes

The financial equilibrium of the pay-as-you-go pension scheme is sensitive to both demographic changes and economic cycles. According to Teulade (2000), economic growth is an essential vector for the stability and sustainability of public pension schemes. A high level of production increases the number of contributors and thus increases the volume of contributions. Hoskins (2002) states that a difficult labor market situation or reduced contribution rates is as worrying as population ageing because these two factors directly affect publicly-funded pension schemes.

Indeed, pension schemes are closely linked to economic trends. There are three parameters that affect the balance of these schemes. On the one hand, there is the unemployment rate, which determines the current number of contributors. On the other hand, there is the production growth rate, which, in the event of an increase, generates an excess that can ultimately be allocated to retirees. Finally, economic fluctuations may affect the balance of pensions in the events of expansion or recessions.

The following section describes the financial situation of the Tunisian pension funds and the difficult economic context that affects financing these pension plans.

The Tunisian Pension Schemes and Financial Imbalance

The Tunisian pension scheme is based on the Bismarckian principle, offering a compulsory, professional and contributory pay-as-you-go scheme.

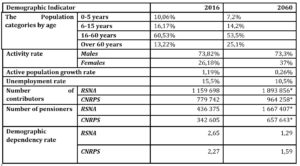

Changing demographic structures and economic trends have systematically affected the demographic outreach of pension schemes and the financial base of social security funds.

In the following, we will first describe the demographic and financial structures of the two main Tunisian pension funds, CNSS and CNRPS, and then present the characteristics of all the parameters taken into account in determining the financial balance of these funds. The last section will be devoted to modelling forecasts to study the evolution of the financial situation of pension funds over the 2015 to 2050 period.

The organization of the pension system in Tunisia

Under the Tunisian pension system, the legislator has established several pension schemes. A main distinction is made according to the category of the active population, by referring to the sector to which they belong, namely, the public and private sectors. Within the same sector, other distinctions are made on the basis of the nature of activity pursued (employee/non-employee, agricultural/non-agricultural…). The table below presents a general view of the number of Tunisian insured population (active and retired) covered by each pension scheme, the CNSS and CNRPS.

Table 1: Distribution of The Population Covered by The Cnrps Pension Scheme

Source: CNRPS Annual Reports 2015, 2016, 2017

Table 2: Distribution of The Population Covered by The Cnss Pension Scheme

Source: CNSS Statistical Yearbooks 2015, 2016, 2017

The above figures show the differences in the number of working people and pensioners across the two pension schemes.

In order to better understand the origin of the financial imbalance facing pension funds, it would be necessary to first present the operating mechanism of the Tunisian pension system as well as the demographic and economic developments that have characterized it over the past decade.

Functioning and Characteristics of Pension Plans

These are defined pension plans with annuities under the pay-as-you-go regime. This latter uses working people’s contributions to fund pensions for retirees. The system undertakes to pay a pension at a level determined in advance according to a calculation method adopted by the scheme to which the pensioner belongs. On the other hand, the current terms and conditions of contributions and pensions vary significantly from one plan to another.

Financing of public sector pension plans:

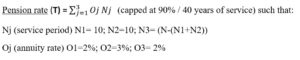

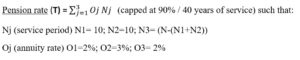

Pension contributions are obtained by multiplying the contribution rate by the contribution base, while public pension benefits are defined as follows:

Pension (Pi)= Pension Rate x Reference Salary

The reference salary SR1 corresponds to the last remuneration for which contributions were made to CNRPS for a period of three years or more or the remuneration for the highest position held for at least two years.

Financing of pension plans in the private sector

Pension contributions are obtained by multiplying the contribution rate by the contribution base, while the calculation rules and conditions to access to retirement pensions in the private sector vary according to the contributory pension scheme. In the following, we will present in detail the main parameters included in the calculation of pensions for the Non-Agricultural Waged Scheme and the Non-Agricultural Self-employed Scheme. The pension conditions for the other plans will be summarized in Table II.

RSNA plan parameters

P = Reference salary × Pension rate = SR x Tp

The parameters of the RINA Regime

P = Calculation Base x Pension Rate

Calculation base= Average multiplier of the SMIG (minimum wage) over the entire affiliation period multiplied by the SMIG in effect at retirement.

The Parameters of The Other CNSS-Managed Pension Plans

The calculation and granting of retirement pensions for pensioners affiliated to the other CNSS pension schemes are subject to various parameters summarized in the Following table :

TABLE III: PENSIONS FOR PLANS MANAGED BY THE CNSS

Source: Official Journal of the Tunisian Republic.

The above table shows that contribution rates and pension calculation rules differ from one plan to another. These rules take into account the vulnerability of members of certain plans and the importance of maintaining acceptable living standards after retirement.

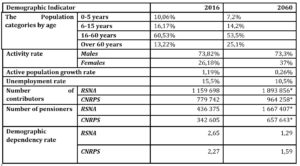

The demographic and financial structures of Tunisian pension systems:

The evolution of the Tunisian population and economic and structural changes systematically affect the demographic commitments of pension systems and, consequently, the financial situation of social security funds (Ben Brahem 2004). Demographic changes in the Tunisian population have mainly resulted in a simultaneous improvement in the Synthetic Fertility Index, which rose from 3.27 in 1992 to 2.20 in 2012 and in life expectancy reaching 74 years in 2012. These changes led to an ageing population characterized by a continuous increase in the share of the population aged 60 and over and a decrease in the share of working age population. Economic indicators have witnessed a slowdown in growth over the past few years from 6.23% in 2007 to 2.5% in 2014, an increase in unemployment rate to 15.2% in 2014 and an expansion of the informal sector.

These demographic and economic developments have had a significant impact on the demographic and financial commitments of Tunisian pension systems (Mzid 2010, Houssi 2004). It would then be necessary to study successively the current situation of public and private pension funds.

The demographic and financial situation of the CNRPS public plan:

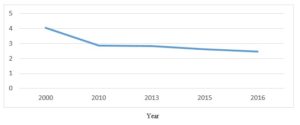

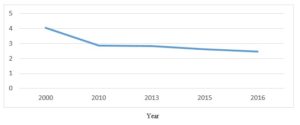

There has been a disproportionate evolution of public sector workers and retirees in recent years, resulting in a rapid increase in the demographic ratio, which expresses the proportion of working people contributing to pensioners. The graph below shows the evolution of the demographic ratio[1] in the public sector over the 2003-2013 period.

[1] CNRPS demographic ratio= (contributors/ retired +spouse alive+ orphans)

Fig.1: Evolution of the demographic ratio of CNRPS affiliates between 2000 and 2016

Source: CNRPS annual reports 2000-2016

The curve representing the demographic ratio for the CNRPS shows a continuous decrease over the 2000-2016 period.

Several socio-economic and demographic factors may explain this trend. We can mention improvement in life expectancy, the massive exit of retirees over the past ten years, as well as the decline in recruitment rates in the public sector.

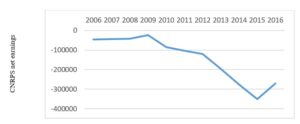

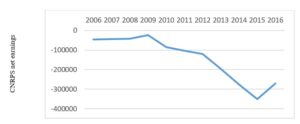

The decrease of the demographic ratio has led to a significant imbalance between expenditures and resources of the CNRPS plan, which has created enormous financial difficulties for the pension fund. The finances of CNRPS result from the annual contributions (income) on the one hand and the pensions paid (expenditure) on the other. The graph below shows the evolution of CNRPS finances over the 2006-2016.period.

Fig.2: The evolution of CNRPS direct earnings between 2006 and 2016 (in MD)

Source: CNPRS statistics yearbooks

The graph above shows that the last ten years have been marked by a collapse in the finances of CNRPS due to the growing imbalance between pensions paid to pensioners (expenditure) and working population’s contributions (income) even before 2006. The figures show that the CNRPS fund’s expenditures have increased at a faster rate than its revenues over the past decade, the financial balance could not be restored and the financial situation has become alarming over the years reaching a deficit of -271,921 MD in 2016.

The Demographic and Financial Situation of Pension Plans in Private Sector

Similar to the public sector, the demographic changes in the Tunisian population have led to changes in the demographic and financial commitments of private pension schemes. The graph below shows the evolution of the demographic ratio in the private sector, on the one hand, for all pension plans combined and, on the other hand, for the RSNA non-agricultural employees’ scheme.

Fig. 3: Evolution of the CNSS demographic ratio for the 2006-2016 period

Source: CNSS Statistics Yearbook

The graph shows that there is a sharp decrease in the demographic ratio due to a disproportionate growth of working people and retirees in the private sector. This decrease resulted in a significant imbalance between expenditures and revenues of the RSNA plan, leading to financial difficulties for the pension fund. The graph below shows the evolution of CNSS earnings over the 2006-2016 period.

Fig.4: Evolution of CNSS earnings over the 2006-2016 period in MD

Source: CNSS Finance Department

The figures show that the CNSS has a chronic and structural deficit in the pension branch due to the aggravated mismatch between revenues and expenditure. It is the retirement pensions that represent the source of the CNSS financial imbalance. Moreover, pensions increased from 854,600 MD in 2006 to 2,620,300 MD in 2016, an increase of 300% in ten years.

The increase in expenses is weighing increasingly on the fund’s balanced budget and has caused a financial deficit that is beginning to grow at an alarming rate. On the other hand, CNSS revenues have not increased in proportion to the increase in paid pensions. The analysis of the current Tunisian pension system has enabled us to observe many difficulties facing the pension systems. The country is facing an ageing population and economic difficulties that are causing a deep change in the budgetary balances of pension funds and that require tangibly reforming social security policies. However, to date, no parametric reforms have been considered by the government. Accordingly, our study includes a modeling of forecasts, aimed at studying the evolution of the financial situation and the budgetary balance of pension systems over the 2015 to 2050 period, in the event of unchanged pension legislation.

The Evolution of The Financial Situation of Pension Funds in The Event of Unchanged Legislation: Forecasts 2015-2050

Over the past decade, the sustainability of these pay-as-you-go pension plans has become a major concern for the Tunisian government, following the corrosion of the financial situation of the two pension funds, CNSS and CNRPS. As seen in the previous section, these schemes are affected by budgetary problems related mainly to adverse economic indicators, namely high unemployment, low wage growth and high price inflation. These economic indicators are worsened by a demographic change in the Tunisian population resulting in a decrease in fertility and an increase in life expectancy, leading to a distortion in the age pyramid and a decrease in the demographic ratio.

In what follows, we will highlight the worsening of the budget deficit in the coming decades, if unchanged legislation is maintained and parametric and structural reforms are not implemented. To this end, an in-depth modelling that takes into account the interaction between demographics, the economy and pension systems is seen fit. The performance of actuarial simulations requires a tool that supports actuarial calculations that project future flows of contributions and pensions and determine the evolution of the financial situation of pension funds, as well as the average pension level and the equilibrium contribution rate.

Model and Data

The model and data included in this study cover demographic and economic trends as well as the operating techniques of the CNSS and CNRPS funds.The PROST software developed by the World Bank and used for pension forecasts will be used to examine the evolution of the financial situation of pension funds over the 2015-2050 period.Based on data from the National Institute of Statistics (NIS) on contributors and retirees and taking into account the different demographic and economic parameters used for the actuarial valuation of pension plans, as well as the recent financial situations for the two CNSS and CNRPS funds, an attempt was made to consider a forecast made only on the two main Tunisian pension plans, namely the RSNA private sector plan and the general public sector plan CNRPS. These are are considered to be the two most representative plans for the Tunisian working population.

Demographic Parameters

Population forecasts and the different demographic and economic assumptions considered in the reform scenarios are provided by the INS and the ILO and presented below.

Tableau III: Demographic Data Used For The Actuarial Valuation Of Pension Regimes

INS Demographic Data & BIT- ILO-POP Model- Demographic Forecasts

In addition to demographic forecasts made on the overall population, the actuarial valuation of pension plans takes into account long-term forecasts of the active population and pensioners. The assumptions used are summarized in the table below.

TABLE IV: A Summary of The Data on Contributors and Pensions Included in The Actuarial Valuation of The Pension Plans

INS Demographic Data & BIT- ILO-POP Model- Demographic Forecasts

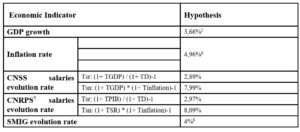

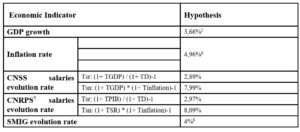

Economic Parameters

The economic assumptions used in the reform simulation scenarios mainly relate to employment and wage policy, as well as GDP and inflation. The table below summarizes the main assumptions used in the study of the future of pension funds.

Table V: A Summary of The Macroeconomic Data Used in The Actuarial

Valuation of Pension Plans

BIT- ILO-POP Model – Demographic Forecasts

These data have been compiled from research carried out by the International Labor Office (ILO). The long-term macroeconomic forecasts refer to GDP growth modelling that takes into account labor productivity, change rate in the labor force in the public and private sectors and available capital.

In addition to demographic and economic data, other data on the operating parameters of pension funds (CNSS and CNRPS) are taken into account in the study of the future development of pension funds, in particular, wage increase rate, change rate in the minimum wage and inflation rate.

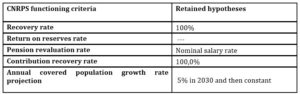

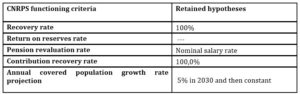

The table below describes the data used in the simulations of the operating characteristics of the CNSS and CNRPS pension funds, namely, pension revaluation rate, rate return on reserves and the annual covered population growth rate. These characteristics have a significant impact on the evolution of the pension funds’ financial situation.

TABLE VI: Hypothesis of The Functioning of CNRPS Pension Plan

Source: Center of Research and Social Studies CRES Tunisia- PROST Model

TABLE VII: Hypothesis of The Functioning of CNSS Pension Plan

In what follows, we will formulate the hypotheses to be tested by our model referring to the above empirical research (section one) and using the different sets of data reported above.

The hypotheses

As explained above, the financial equilibrium of pension funds depends mainly on demographic and economic factors.

Demographic Factors

According to the above-reviewed empirical research, population ageing, reflected in a decrease in the demographic ratio, will lead to a greater increase in expenditure than in revenues for pension funds, which will lead to a widening of their financial deficit. The first hypothesis of our study can then be formulated as follows:

H1: The demographic ageing of the Tunisian population, along with an increase in the dependency ratio, will increase the budget deficit of pension funds in the coming years.

Economic Factors

The literatures suggests that economic slowdown, reflected in a high unemployment rate among the working-age population, has a negative impact on the financial situation of pension funds. The second hypothesis of this study can then be formulated as follows:

H2: Economic slowdown along with high unemployment will increase the deficit of Tunisian pension funds in the coming years

The PROST software developed by the World Bank and used for pension forecasts will be used to examine the evolution of the financial situation of pension funds over the 2015-2050 period and to check our hypotheses.

The Results

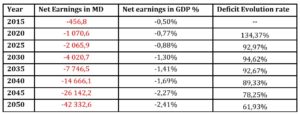

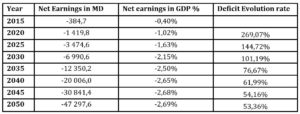

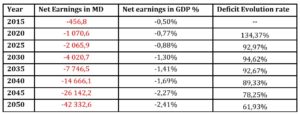

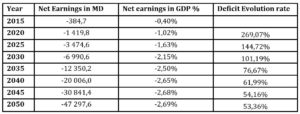

The results of our forecasts are presented year by year over the 2015-2050 period and are detailing the net financial earnings of the pension plan in MD and as a % of GDP.

The forecasts have been prepared taking into account the legislation in force and the demographic and economic data mentioned above. In the following, we will present the results of forecasts of cash flows and the equilibrium contribution rate for the two pension plans “CNRPS” and “RSNA”. These forecasts cover the 2015-2050 period in the case of unchanged legal legislation.

The evolution of pension fund cash flows

The financial situation of the funds is expressed by the net income after deduction of expenses:

Taking into account management fees, payroll and income generated by reserves, it can be seen that the financial deficit of pension funds continues to grow over the years. The graph below describes the evolution of the financial deficit over the next 35 years, in the case of unchanged legislation.

Fig. 5: Evolution of the financial deficit of the RSNA under unchanged legislation

Source: Center of Research and Social Studies CRES Tunisia- PROST Model

Fig. 6: Evolution of the financial deficit of the CNRPS under unchanged legislation

Source: Center of Research and Social Studies CRES Tunisia- PROST Model

The graph shows that the pension funds will be in deficit and will decrease from 456.8 billion to 42,332.6 billion for the RSNA scheme and from 384.7 billion to 47,297.6 billion for the CNRPS scheme.

The results of forecasting the different pension plan parameters if unchanged legislation is maintained are summarized in the table below.

TABLE VIII: Evolution of The Parameters of The RSNA Plan Under an

Unchanged Retirement Legislation

Source: Center of Research and Social Studies CRES Tunisia- PROST Model

TABLE IX: Evolution of The Parameters of The CNRPS Plan Under an Unchanged Retirement Legislation

Source: Center of Research and Social Studies CRES Tunisia- PROST Model

The above-mentioned figures highlight the sudden and deep deterioration of the financial situation of Tunisian pension funds. Pension funds will no longer achieve financial equilibrium in the face of adverse demographic and economic developments. If legislation remains unchanged, pension funds will no longer be able to honor their commitments to affiliates.

In fact, the exponential growth of the pension fund’s financial deficit can be explained by a high unemployment rate and increasingly delayed access to the private and public labor market. As a result, there will be a decline in years of contributions and a decrease in the number of active employees proportionally to the number of pensioners.

Hence the importance of the reform concerning the statutory retirement age, the method of calculating retirement pensions and the contribution rates.

Conclusion

For years, economic and demographic changes around the world have placed pension systems under severe stress. The slowdown in the pace of economic growth, combined with an ageing population and an increase in life expectancy, have profoundly weakened the balance of these regimes. These economic and demographic trends are strongly present in the Tunisian context and have led to a sharp decrease in the active population, an increase in the number of retirees and long retirement years.

The study of the financial situation of pension funds in Tunisia in the coming years has shown that the budgetary imbalance will worsen if legislation is maintained unchanged and in the presence of unfavorable demographic and economic developments. Indeed, the financial equilibrium of the pay-as-you-go pension system is sensitive both to demographic changes and to economic trends.

On the one hand, demographic changes in Tunisia will bear on the ageing process in the country. This will lead to an increase in the proportion of elderly people (60 years and over). In most countries, this ageing trend will lead to an increasing dependence of an increasing number of elderly people on a population where the number of young people is constantly decreasing. Such dependency will alter the balance of Tunisian pension systems, managed on a pay-as-you-go basis.

On the other hand, the future of pension systems is closely linked to economic indicators, in particular the unemployment rate and the economic growth rate. The study showed that an economic slowdown along with high unemployment will increase the financial imbalance of pension funds in the coming years. This financial imbalance, which continues to grow year over year, requires urgent government intervention to reduce the budget deficit and ensure the sustainability of the schemes. Several types of parametric and structural reforms may be considered by Tunisian authorities to reduce these budget deficits while taking into account the specificity of the country’s social, economic and demographic parameters.

Acknowledgements

We would like to thank Mr. Mongi Hmidi, Deputy Director of the Unit of Actuarial and Financial Studies at CRES, for his expert advice and his valuable support in carrying out this study. Thanks also go to Mr. Nizar Oueriemmi, statistician engineer at CRES, for providing us with the databases of workers and retirees of different plans. We would also like to thank the entire MOBIDOC-PASRI team for ensuring the smooth running and funding of this research.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Allais M. (1947) « Présentation nouvelles des problèmes fondamentaux relatifs au rôle économique du taux de l’intérêt et de leurs solutions » – Economie et intérêt – Imprimerie nationale. 2 Vol. 1947.

- Ben BRAHAM M. (2004) « l’avenir des retraites en Tunisie : Leçons des expériences étrangères » – Université Paris Dauphine LEGOS.

- Blanchet D., Kessler, (1990) « Prévoir les effets économiques du vieillissement », Economie et Statistiques, N°223, pp 9-17.

- Butare T. (2006) “Financement de la sécurité sociale : Approches et défis actuels”, Association Internationale de la Sécurité Sociale Genève pp 97-117.

- Da Silva et al (2005) « An aging society- The portuguese case » Economie du vieillissement, L’Harmattan , Tome 2.

- Davanne O.& Pujol T. (1997) « Le débat sur les retraites : capitalisation contre répartition », Revue Française d’Economie, Vol 12, Num 1, pp 57-116.

- Diamond P.A. (1965) « National debt in a neoclassical Growth model » The American Economic Review. Vol 55, Issue 5, pp 1126-1150.

- Dupuis J-M., Petron A., El Mouden C. (2009) « Retraite et vieillissement démographique au Maghreb » Miméo, CREM.

- Houssi C. (2004) « La problématique des régimes de pension en Tunisie face à un vieillissement démographique »- CERP, center for research on pensions and welfare policies, Turin- WP N° 34.

- Malinvaud E. (1987) « The overlapping generation Model in 1947 » Journal of Economic littérature, Vol 15, pp 103-105.

- Masson A., Arrondel L. (2002) « Altruism, Exchange OR Indirect Reciprocity: what do the data on family transfers show » Working Paper N° 2002-18 – CNRS-EHESS-ENS.

- Mzid N. (2010) « Le système tunisien de protection sociale : émergence du principe de solidarité et défis de dysfonctionnement », International Social Security Association.

- Samuelson P.A. (1958) «An exact consumption-loan model of interest with or without the social contrivance of money », The journal of Political Economy, Vol 66, pp: 467-482.

- Vernière L. (2002) « Panorama des fonds de réserves pour les retraites à l’étranger », Revue d’Economie Financière, Vol 68, N°4.

- Annuaire des statistiques 2016 de la Caisse Nationale de Sécurité Sociale CNSS – Direction des Statistiques.

- « Les caisses de sécurité sociale en Tunisie : réalités et perspectives » (2006), Publications des départements des études et de la documentation- Union Générale Tunisienne du Travail.« Rapport sur la réforme des régimes de retraite », Ministère Tunisien des Affaires sociales (1998).

- « Rapport sur l’évolution de la population active et de la demande d’emploi 2004-2024 au niveau national » (2006) L’Institut National Tunisien des Statistiques.

- « Recueil des textes relatifs à l’organisation des régimes de sécurité sociale dans le secteur privé » Publications de l’imprimerie officielle de la république tunisienne (1992).

- « Rapport sur l’évolution démographique 2004-2034 au niveau national » (2005) L’Institut National Tunisien des Statistiques.

- Rapport d’activité 2016 de la Caisse Nationale de Retraite et de Prévoyance Sociale CNRPS – Ministère des Affaires Sociales.

- « Recueil des textes relatifs à l’organisation des régimes de sécurité sociale dans le secteur privé » Publications de l’imprimerie officielle de la république tunisienne (1992).

- « Social Security Pensions : Development and Reform” (2000) publié sous la direction de Gillion G., Turner J., Bailey C., Genève D. Bureau International du Travail.

- World Bank (1994) « Averting the Old Age Crisis: Policies to protect the old and promote growth » Oxford University Press.

Glossary

CNSS : National Social Security Fund

CNRPS : National Fund for Retirement and Social Plan

RSNA : Non-Agricultural Employee Plan

RC : Complementary retirement Plan

RACI : Artists, Creators and Intellectuals Scheme

RTRL : Limited Income Worker’s Plan

RSAA : Agricultural Workers Improved Plan

RSA : Agricultural Workers Scheme

RTTE : Foreign Tunisian Workers Plan

RTNS : Independant workers Plan

SMIG : Guaranteed Minimum Interprofessional Salary

SMAG : Guaranteed Minimum Agricultural Salary

BIT : International Labor Office