Introduction

Technologies have shaped society over time, so contemporaneously, innovations in Information and Communication Technologies (ICT) have boosted a new and intense transformation called digital transformation (Weiss. M, 2019). It is a fact that this transformation is not limited to improving the quality of human life but includes the remodeling of several areas and the continuous development of new technologies.

Accounting, as an area of knowledge integrated into the social and business environment, also suffers from the effects of digital transformation. The truth is that the emergence of the term Digital Transformation (DT) fundamentally impacted the discourse on business practices, and thus, it is considered the process that companies use as the most innovative in technology to productivity enhancement and improve their results. Also found spelled, DT consists of a broad process, in which technology becomes central to the organization and companies making use of technological data analysis tools and methodology – such as Robotization, Big Data, Business Intelligence, Artificial Intelligence, Blockchain among others – to increase your performance and create more value. Tomelin et al (2011) mentioned that a strategic alliance between accounting and new information technologies provides safer conditions for decision-making organizations.

Information technologies have changed the way information is managed by “producers” as well as accountants and auditors to “consumers” – as investors, creditors and other users of information (Elliott, RK, 2002). Digital Transformation provides the impetus to reconsider the very nature of accounting information system (AIS) in their purpose to manage data and information to be used by decision-makers in accounting and finance functions, and to contribute to strategy implementation and internal control of the enterprise (Quinn, Martin et al, 2017). In other words, information technology solutions are part of the processes in the accounting area and data security has become vital for business continuity.

It is also important to highlight that other aspects of the accounting profession, such as occupations, activities, the job market, professional education, skills, and competences to be developed, are being largely affected by the digital transformation.

In view of the relevance of this theme, the work describes the digital transformation in Accounting, maps the literature on the subject, and proposes a categorization for it, highlighting the main questions which have been dealt with to date in the research contained in the indexed databases, recognized as important to the scientific community. Moreover, based on a critical review of the subjects found, new research questions are proposed that are capable of increasing the quality and the relevance of future studies on the subject. The research approach selected was a Systematic Literature Review (SLR), applying bibliometric and network analysis. This Systematic Literature Review (SLR) provides researchers and practitioners with a structured, categorized view of what has been produced in the literature on digital transformation in Accounting to the present (December 2019).

Research Method

This study consists of a Systematic Literature Review (SLR), scientific on digital transformation in Accounting. The systematic review of the literature, generally referred to as a systematic review, is a means of identifying, evaluating and interpreting all available research relevant to a research question or thematic area or phenomenon of interest (Kitchenham et al, 2013). A crucial step in the systematic review process is to fully define the scope of the research question. This requires an understanding of the existing literature, including gaps and uncertainties, clarification of definitions related to the research question and an understanding of how they are conceptualized in the existing literature. (Armstrong et al, 2011).

SLR is a less demanding scientific investigation, it is a research article with pre-defined systematic methods to systematically identify all relevant published and unpublished documents for a research question, it evaluates the quality of these articles, extracts the data and synthesizes the results (Siddaway AP et al, 2019).

During RSL, a rigorous methodology should be followed to define the research question, write a protocol, search the literature, collect and perform the screening and analysis of the literature. It is important to mention that all process must also be carefully documented. For this study, the review protocol was developed in the planning phase.

The protocol is an essential component in the RSL process and helps to ensure consistency, transparency, and integrity (Donato et al, 2019). This review protocol includes detailing of the questions, definition of the research terms, study selection, data extraction and data analysis. Fig. 1 is highlighting the five steps of the review protocol to be used in this study.

Fig. 1: Review protocol steps

Research questions

For the study to achieve its objectives, that is, to provide researchers and practitioners with a structured categorized view of what has been produced in the digital transformation in Accounting literature, here are the two proposed research questions. The first concerns the presentation of a global amount of work on the subject, described below:

RQ1. How has the literature on digital transformation in accounting evolved over time?

Seeking answers of a more quantitative nature, this question has been broken down into the following:

RQ1.1. How has the number of publications on this subject evolved over time?

RQ 1.2 What are the main journals for this subject?

RQ1.3. Which countries contribute the most in terms of publications (considering the number of publications)?

The systematic review answers a well-defined research question and is characterized by being methodologically comprehensive, transparent, and replicable (Donato H, et al, 2019). In this work of identifying the existing literature to create and develop new studies, a grouping of the major subjects and research questions was taken from the digital transformation in Accounting activities found in the publications from the sample in categories. Thus, the second question of this work is:

RQ2. What are the main issues in the scientific literature on digital transformation in Accounting?

The next section describes the process carried out to perform this systematic literature review.

The sampling process

The initial sample was taken from the indexed databases of the Scopus® portal by Elsevier B.V and the Web of Science Core ™ Collection (WOS) accessed through the ISI Web of Knowledge ™ portal. These databases were selected, because they provide interfaces that make it possible to carry out research from different sources through a common set of research chains. In a broad way, that is, without restriction of journals, periods or areas of knowledge, were selected and identified sources studies from 1974 to December 2019, such as: Journal of Corporate Accounting and Finance, Journal of Applied Accounting Research, Pacific Business Review International , focused on the area of Accounting and sources, such as, Journal of Information Technology, Advances in Intelligent Systems and Computing, Journal of Information Technology, as well as ACM and IEEE studies aimed at research in the area of Technology and Systems Engineering.

The initial sample was taken from the indexed databases, only publications classified as “Article” and “Conference”, which include the principles of these studies, were selected because they have undergone a rigorous peer review process prior to publication. Moreover, these works also contain all the information necessary (metadata) to undertake bibliometric analysis, with authors, references, number of citations and date of publication. Works that did not meet the above requirements were rejected under the quality criterion (Kitchenham and Charters, 2007).

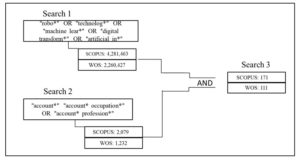

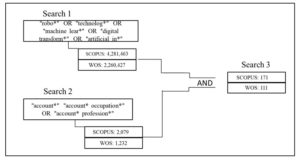

Fig. 2 is a schematic presentation of the process for identifying and selecting the sample for the study. From the preliminary definitions of the keywords for searches 1 and 2, they were applied to the databases indexed in Web of Science and Scopus. Then, the identical “scripts” of Search 1 and Search 2 were applied in databases used, restricting the search to “Summary”, “Job Title” and “Keywords”.

Fig. 2: Search and selection process – search phase – keyword

In Search 3 (Fig. 2), language verification was also inserted, restricting the materials to only the English and Portuguese languages for the authors’ appreciation. The refined data from Survey 3 were inserted in the online tool Parsifal[i], which allows researchers to carry out systematic analyses of the literature, in the application of the review protocol, management of conduct and research documentation.

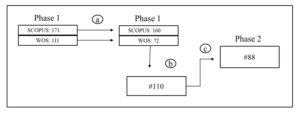

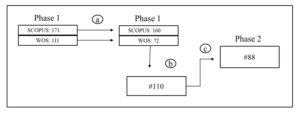

During the processing phase at Parsifal, this tool performs the identification of duplicate studies between the two sources of data Scopus and WOS, resulting in 232 relevant ones, demonstrated in the transition from Phase 1 to Phase 2 in Fig. 3.

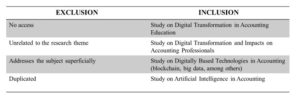

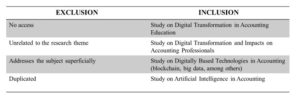

As Carvalho et al. (2013) suggested, during the triage process the authors of the present study read the titles and abstracts publication. And finally, they kept in the sample only those publications that everyone agreed met the inclusion criteria, that is, they fit the scope of the digital transformation in Accounting and had the necessary metadata for the following stages of analysis. The authors created inclusion criteria, which provide potential data to answer the research questions, and exclusion criteria, as shown in Table 1.

Table 1: Search Classification Criteria

Among the 232 publications, 112 were rejected, through the analysis of title and abstract, and classified by the exclusion criteria, therefore, they were excluded from the bibliometric analysis and content phases (extraction). Thus, 110 publications were accepted and were analyzed in this study.

Figure 3: Phase selection

After the selection, it was also identified that in the selection we have articles from the Web of Science Core ™ Collection. The studies were transferred to Parfisal with the characteristics of “inprocessing”, that is, a study that has not yet been granted full access, thus the publications approved for Phase 2 “C” were from 88 publications.

As shown in Fig. 1, the first activity in the selection and extraction ended the planning phase. Once the research protocol was completed, the practice of separating the sample was established excluding publications that did not meet the inclusion criteria.

Data Analysis

In the data analysis, bibliometric analysis and content analysis were used in order to identify the variety of scientific literature on digital transformation in Accounting, describing trends and identifying patterns.

Bibliometric Analysis

Bibliometric analysis aims are: to answer the questions related to the evolution of literature, making it possible to identify the most productive authors, journals and periods in which publications were produced, the evolution of publications over time (Ikpaahindi, 1985).

This subsection contains the results of the process of collecting quantitative data related to periods, publications, authors, citations and other information involving the journals that are part of the sample in order to answer questions RQ1.1, RQ1.2 and RQ1.3 of study.

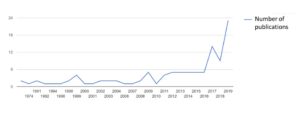

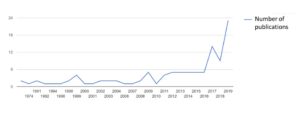

Publications / year / period

The sample covers the period from 1974 to December 2019 and contains 88 publications written in English and Portuguese. Only 13 articles (11%) were published between 1974 and 2000, between 2016 and 2017 there was an increase from 5 to 14 studies, and only in 2019 we had 23 (21%) of the total number of publications. It should be noted that 51% of the publications are from the last three years, clearly showing the intensity and growing interest of researchers in the subject.

Fig. 3: Publications by Year

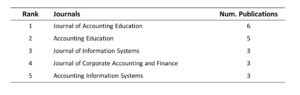

Publications / journals / periods

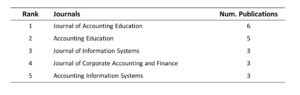

The 88 works in the sample were published in 50 different journals. Table 1 shows only the 5 main journals with the highest number of publications about this study. Moreover, 12% of the selected publications are concentrated in two journals: Journal of Accounting Education and Accounting Education.

Table 2: Number of publications by Periodicals

Countries / Publications

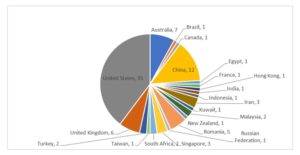

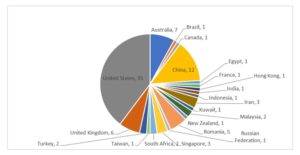

Finally, a location analysis of the main references on the digital transformation of Accounting was made (Fig. 4). Of the 88 articles considered, the United States has more publications (35), followed by China (12); Australia (7); United Kingdom (6); Romania (5), Iran and Singapore (3), Malaysia and Turkey (2) and the other countries with only one publication.

Fig. 4: Publications by country

Content Analysis

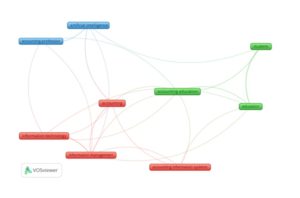

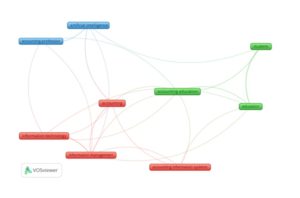

During the study, content analysis was used to search for main topics, approaches and methods, most important of the subject in question. For this study, the VosView tool was used, which allows organizing the data generated in a “cluster” from the most frequent words and building relationships between them, as shown in Figure 5. The cluster analysis included a variety of methods to classify data multivariate in subgroups, which can help to reveal the characteristics of any structure or pattern present (BS Everitt, 2011).

Fig. 5: Grouping by Frequency of Terms

One can see in Fig. 5 there is no direct mention of the term “Digital Transformation in Accounting”, but a grouping of related terms related to the study. However, by performing an analysis of the contents classified for inclusion criteria (Table 1), it is possible to identify synergy between the collected works.

During the analysis and classification of the contents of the collected articles, 44 articles (50%) were identified, highlighting the dynamic nature of information technologies, analyzing their impacts and the need to redefine new skills and competences for the accounting profession (Ku Bahador et al, 2013 and Wilson, et al, 1992) that were highlighted by the cluster in red in Fig. 5.

The second major aspect of the articles is aimed at studies on the impacts of Digital Transformation with a look at the Education and Training of Professionals, 19 (22%) were identified that present ways of identifying whether aspiring professional accountants acquire sufficient knowledge and develop necessary IT skills through empirical research analyzing university curricula, (Stanciu, V.et al, 2015).

Regarding the cluster highlighted in blue (fig. 6) with the theme Artificial Intelligence applied to Accounting, 6 articles were identified, with the main objective to demonstrate how Artificial Intelligence works in an innovative way with the internal control systems to help managers to produce information high quality accounting, reducing the risk of information (Askary, S. et al, 2008).

Finally, the remaining 22 articles are focused on digitally based technologies, such as Blockchain, Big Data, XBRL, among others that seek to identify barriers, group them as related to technology, as well as investigate current practice with regard to the use of these for these innovations, as cited by Perkhofer, Lisa Maria et al (2019) and Tan, BS et al (2019).

Conclusions

This article shows that, among the 88 selected studies, 2019 was the year with the largest number of studies on Digital Transformation in Accounting, and there is a growing trend of publications on this subject. In relation to the journals that published the most on the topic, the Journal of Accounting Education and Accounting Education stand out.

Among the countries, the country with the most publications is the United States, followed by China and few publications in Brazil on this subject; and the studies mainly address the relationship with Digital Transformation in Accounting and the impacts on Accounting professionals (50%), their activities and skills. Followed by the second focus is the impact of digital transformation in the educational structure, which is directly complementary to the need for IT skills and technical knowledge to be developed in your professional accounting training.

The low number of scientific studies on the impacts of digital transformation in Accounting shows that there are gaps and questions to be answered. Future studies can be carried out in the area, comparing and validating the results presented here, especially with the expanded search criteria and databases. In addition, other analysis techniques, such as the example of semantic analysis, can be used in the search for new concepts, definitions or common terms that would best characterize the works, as well as validating the results of this systematic review. Another interesting insight for future research is the relationship between topical research that appears in the network analysis as the strong relationship to the development of new skills and competences to be expected in the training of accounting professionals in technologies and what activities and functions of accounting professionals can be impacted by digital transformation.

Notes

Parsifal: Parsifal is an online tool designed to support researchers to carry out systematic reviews of the literature in the context of Software Engineering. https://parsif.al/

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Askary, S. and Abu-Ghazaleh, N. and Tahat, Y.A (2018). ‘Artificial intelligence and reliability of accounting information’. Lecture Notes in Computer Science (including Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics subseries). 315-324

- Armstrong, R., Hall, B., Doyle, J., & Waters, E. (2011). ‘Cochrane Update ‘Scoping the scope’ of a cochrane review’. Journal of Public Health, 33, 147–150. doi: 10.1093 / pubmed / fdr015

- BS Everitt, S Landau et all. Cluster analysis. 5th. Edition, 2011. Ed. Wiley.

- Carvalho, M.M., Fleury, A., Lopes, A.P., (2013). ‘An overview of the literature on technology roadmapping (TRM): Contributions and trends’. Technological Forecasting and Social Change 80, 1418–1437.

- Chui, M., Manyika, J. and Miremadi, M. (2018). ‘Where machines could replace humans-and where they can’t (yet)’, [Online] McKinsey Quarterly, July 2018. https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/where-machines-could-replace-humans-and-where-they-cant-yet

- Donato H, et al (2019). Steps in conducting a systematic review, Acta Med Port Mar; 32 (3): 227-235.

- Elliott, Robert and Jacobson, P.D (2002). ‘The Evolution of the Knowledge Professional’. Accounting Horizons: Vol. 16, No. 1, pp. 69-80.

- Ikpaahindi, L. (1985) An Overview of Bibliometrics: its Measurements, Laws and their Applications. Libri, vol. 35, n. 2, p.163-176.

- Kitchenham, B. and Charters, S (2007): Guidelines for performing systematic literature reviews in software engineering. Technical Report EBSE 2007-001, Keele University and Durham University Joint Report.

- Ku Bahador, Ku Maisurah & Haider, Abrar. (2013). The maturity of information technology competencies: A professional accountants’ perspective. 2013 Proceedings of PICMET 2013: Technology Management in the IT-Driven Services. 2488-2497.

- Martens, Mauro & Brones, Fabien & Carvalho, Marly. (2013). ‘Gaps and Trends in the Sustainability Literature in Project Management: A Systematic Review Merging Bibliometry and Content Analysis’. Management and Projects Magazine. 04. 10.5585 / gep.v4i1.123.

- Perkhofer, Lisa Maria and Hofer, Peter and Walchshofer, Conny and Plank, Thomas and Jetter, Hans-Christian (2019). “Interactive visualization of big data in the field of accounting Asurvey of current practice and potential barriers for adoption”. Journal of Applied Accounting Research. 497-525. Vol. 20.

- Quinn, Martin, Strauss, Erik. (2017). The Routledge Companion to Accounting Information Systems. Routledge.1st Edition.

- Siddaway AP, Wood AM, Hedges LV (2019). ‘How to do a systematic review: a best practice guide for conducting and reporting narrative reviews, meta-analyzes, and meta-syntheses’. Annu Rev Psychol. 70: 747-70.

- Stanciu, V. and Bran, F.P (2015). ‘The accounting proffesion in the digital era’. Quality – Access to Success: 546-550. Vol.16

- Tan, B.S. and Low, K.Y (2019). ‘Blockchain as the Database Engine in the Accounting System’. Australian Accounting Review. 312-318. Vol. 29

- Tomelin, I. P .; Novaes, J. B. V .; Bucker, P. P (2010). ‘Accounting in the digital age: Digital Bookkeeping’. Journal of Management Sciences, v. 14, n. 19, p. 249-268.

- Weiss, M. (2019). Sensored society: the society of digital transformation. Advanced Studies, 33 (95), 203-214. Retrieved from http://www.revistas.usp.br/eav/article/view/159485.

- Wilson, R.A. and Sangster, A. (1992). ‘The automation of accounting practice’. Journal of Information Technology: 65-75. Vol 7.