Introduction

The inconclusive prior empirical findings of the relationship between environmental performance and financial performance have led to conflicting results due to the three competing school of thoughts that exist recently in this field (Horváthová, 2011). Researchers within the neoclassical school argue that environmental regulation imposes additional costs for firms (Palmer, Oates, and Portey, 1995; Walley and Whitehead, 1994). Meanwhile, standard neoclassical theory argues that improved environmental performance leads to an increase in costs. This view is based on the premise that pollution abatement and environmental improvements have been decreasing marginal net benefits. Nevertheless, a third line of thought that proposes an inverse U-shaped relationship (Lankoski, 2000, Wagner, 2001) challenges these two views, i.e. a negative traditionalist vs. a positive “revisionist” relationship between environmental performance and financial performance. This view predicts a positive relationship between environmental performance and financial performance up to the level of environmental performance where economic benefits are maximized. Different from other schools of thoughts, McWilliams and Siegel (2001) argue for a neutral relationship between social (environmental) and financial performance because firms that do not invest in social responsibility will have lower costs and lower prices, while firms that invest in social responsibility will have higher costs but will have customers eager to pay higher prices.

Those competing thoughts intuitively produce contradictory empirical findings. It is because prior studies on this topic posit either a positive relationship or a negative relationship. For instance, Spicer (1978) found a significant positive correlation between environmental performance in the pulp and paper industry and firm financial performance. However, Mahapatra (1984) concluded, on the contrary, by using a larger sample and time period and Jaggi and Freedman (1992) report similar findings. In the context of event studies of firm performance over time, Klassen and McLaughlin (1996) found significant negative abnormal returns when firms had bad environmental news such as oil spills, and positive returns when firms received environmental awards. Similar results for negative environmental events were reported by Karpoff, Lott, and Rankine (1999) and Jones and Rubin (2001). This “event” phenomenon is expanded by Konar and Cohen (1997) showing that these abnormal returns were important enough to affect future firm environmental performance. In particular, firms that had the largest stock-price reaction to the announcement of an environmental performance report subsequently performed a better report than their industry peers. However, Wagner (2001) has summarized these non-clear conclusive findings simply in his study that previous literature reviews indicate a moderate positive relationship between environmental performance and financial performance or that no systematic relationship exists. Cordeiro and Sarkis (1997) enrich this argument revealing previous empirical evidence tends to find a short-term negative relationship, while long-term impacts appear to be more promising.

To explain these different findings, Konar and Cohen (2001) argue that prior empirical researches to have suffered from several problems, such as a small sample size and the lack of objective environmental criteria. Cohen, Fenn, and Konar (1997) explain that a lack of objective criteria to evaluate environmental performance also exists. Other problems with early studies are that they often did not account for important moderating factors such as the firm size or country location (Wagner 2001). Filbeck and Gorman (2004) suggest that the contradictory findings are influenced by the fact that environmentally efficient companies can be efficient in other production processes as well. Other studies point out to the difficulty of generalizing the results because of the absence of clear definitions of environmental performance and financial performance (Griffin and Mahon, 1997). Meanwhile, Elsayed and Paton (2005) argue that the omitting certain variable that influence profitability is the main problem of contradictory findings.

However, most of those studies do not pay fully attention to the environmental disclosure variable that is one way of building firm reputation and credibility in the context of environmental performance. It is in Indonesia, referring to Indonesia Capital Market Executive Agency Act No. 38/1996, information disclosure in environmental performance is considered as voluntary disclosure that could help investors assessing the business strategies taken by management. According to Indonesia Statement of Financial Accounting Standard No. 1/2004 Chapter 9, enterprises can also present additional statements such as environmental reports and value added statements, particularly in industries where environmental factors are significant and where employees are considered to be an important user group.

Prior studies reveal that increasing stakeholder pressure is leading to an increase in corporate reporting on social and environmental performance, largely through the issuance of standalone sustainability-type reports (Ballou, Heitger, and Landes, 2006). Even KPMG International, in its 2008 survey of corporate social responsibility and sustainability reporting, claims that “nearly 80 percent of the largest 250 companies worldwide” are now issuing some type of a corporate social responsibility report (KPMG International, 2008, p.13). Given the concerns with the effect of voluntary environmental disclosure on firm performance and the growth of standalone reporting as a tool for disseminating this information, it is important to include environmental disclosure into the determinant of the relationship between environmental performance and financial performance.

Research Question

Prior empirical findings have concluded that an unresolved research issue in environmental accounting is the empirical association between the level (i.e., amount) of corporate environmental disclosures and corporate environmental performance (Al-Tuwaijri, Christensen, and Hughes, 2004; Hughes, Anderson, and Golden, 2001; Patten, 2002). Even the results of previous studies on the relation between corporate environmental performance and environmental disclosure in financial reports have been mixed. For example, Patten (2002) attributes the failure to find a significant and consistent relation between environmental performance and environmental disclosure to problems in the research designs of existing research. These problems include failure to control for other factors associated with the level of environmental disclosure, inadequate sample selection, and inadequate measures of environmental performance and disclosure (Clarkson, Yue, Richardson, and Vasvari, 2007). Furthermore, those prior studies are lack for analyzing the close relationship among three important variables, i.e. environmental disclosure, environmental performance, and financial performance, which are investigated separately or mostly only two of them simultaneously. Especially, most of the studies were done in developed countries that it would be dangerous to generalize the results of studies on developed nations to emerging countries, as the stage of economic development is likely to be an important factor affecting environmental disclosure practices (Tsang, 1998).

This study seeks to bridge this gap by integrating altogether three variables into one model, which the interrelations among environmental performance, environmental disclosure and financial performance, are basic issues of firm environmental behavior. Our study will contribute to this part of the field by examining the relationship between companies’ environmental performance, the extent and quality of voluntary environmental disclosures and financial performance. In this study, we examine whether environmental disclosure is a valid indicator together with environmental performance in determining firm’s financial performance. Implications of this research will provide useful information for managers in order to deal with environmental factors at the strategic management level and to evaluate how they will contribute to the success of the firm. Most of the studies in the field are focused on analyzing this relationship for North American or European firms. Thus, a relevant contribution of this present work is that it considers a sample of Southeast Asian companies for the empirical research.

Literature Review

Referring to Wilmshurst and Frost (2000: 16), environmental disclosures are defined as: “Those disclosures that relate to the impact company activities have on the physical or natural environment in which they operate.” It is also the set of information items that relate to a firm’s past, current, and future environmental activities and performance. Corporate environmental disclosure as well comprises information about the past, current, and future financial implications resulting from a firm’s environmental management decisions or actions. These information items can make to take many forms, e.g. qualitative statements, quantitative facts or assertions, financial statements’ figures or footnotes (Berthelot, Cormier, and Magnan, 2003).

Prior studies suggest a number of reasons why companies would disclose voluntary environmental information. These include the desire to be legitimate with powerful stakeholders. Under legitimacy theory, it suggests that to achieve legitimacy an organization should be operating within the norms and expectations of the society within which it operates and implies that organizations make voluntary disclosures in order to gain legitimacy from, or maintain legitimacy with, relevant stakeholders or publics (Dowling and Pfeffer, 1975; Deegan, 2000; O’Donovan, 2002).

Legitimacy theory has been used as one of the underlying theories in environmental disclosure research. Under legitimacy theory, companies can follow a proactive or reactive approach towards achieving legitimacy. Many studies have found evidence of the reactive approach, meaning that companies publish environmental information in reaction to some event or crisis facing either the company (Deegan and Rankin, 1996; Deegan et al., 2002; Brown and Deegan, 1998) or the industry (Patten, 1992). The proactive approach, where disclosures are designed to prevent legitimacy concerns from arising, has been neglected in the literature.

According to ISO 14001, environmental performance is the relationship between the organisation and the environment. It includes the environmental effects of resources consumed, the environmental impacts of the organizational process, the environmental implications of its products and services, the recovery and processing of products and meeting the environmental requirements of law. Environmental performance comprises two important things: (1) measurable results of the environmental management system, related to an organization’s control of its environmental aspects, based on its environmental policy, objectives and targets, and (2) results of an organization’s management of its environmental impacts.

Prior studies record that “good” environmental performance is significantly associated with “good” economic performance (Al-Tuwaijri et al., 2004). It means companies are believed to be left behind if they cannot compete with others within the societal constraints characterized by ever-increasing environmental accountability. Those empirical findings lead to some important questions: Is the company going green good for profits? Do reputable companies concern about their environmental reputation and performance? Those questions have created special challenges to test in different places, which most empirical studies on this issue come from developed countries, where environmental awareness among the stakeholders is considered high, and the environmental performance measurement has been established for more than a decade.

The Relationship of Environmental Disclosure, Environmental Performance, and Financial Performance

Incompletely used by the firm, the elimination of such waste and inefficiencies benefits, both the environment and the bottom line.

However, later researchers have generally found the association of environmental performance and economic (financial) performance to be statistically insignificant, which are different from those early empirical studies, which suggested a positive relation (Rockness, Schlachter, and Rockness, 1986; Freedman and Jaggi, 1992). The best explanation of this inverse relation between environmental and economic performance is from traditional economic thought that depicts this relation as a tradeoff between the firm’s profitability and acting on its social responsibility (Friedman, 1962). From those prior empirical researches, we can conclude that the relation between environmental performance and economic performance is founded on contradictory theoretical support that those studies have failed to clarify.

Meanwhile, in the context of the relationship between environmental disclosure and financial performance, prior research has used both market-based and accounting-based measures of economic performance. Freedman and Jaggi (1982) found a statistically insignificant association between environmental disclosure and six accounting ratios used to measure economic performance. Even Shane and Spicer (1983) documented a negative market reaction during the two days preceding the release of CEP environmental reports. Similarly, Stevens (1984) reported that a portfolio of firms that disclosed higher estimated future pollution-abatement costs experienced monthly returns consistently lower than did a similar portfolio of firms that disclosed lower estimates of future environmental costs. However, Richardson and Welker (2001) found a significantly negative relation between the level of financial disclosure and the cost of capital, which is consistent with prior research done by Botosan (1997), an association primarily driven by firms in fewer informationally rich environments. This evidence is not consistent with the argument that discretionary disclosure reduces asymmetrical information costs (Tietenberg, 1998).

These contradictory findings are supported by different evidence, such as the work of Klassen and McLaughlin (1996) and Jacob, Singhal, and Subramanian (2010), which found a positive relationship between environmental performance and stock returns in the general manufacturing industry, even though acknowledge that their findings only represent short-term responses based on the assumption of Efficient Market Theory.

Framework of the Study

Hypotheses Development

Managers involved in determining disclosures, especially voluntary disclosures, state that their disclosure decisions are based on the effect of such disclosures on their firms’ cost of capital/information risk and the disclosure’s ability to reduce uncertainty about the firm’s future prospects (Graham, Harvey, and Rajgopal 2005). However, conclusions about the impact of environmental disclosures on firm value are mixed. Some studies found a positive association. Belkaoui (1976) compared the average monthly abnormal returns of 50 voluntary environmental disclosure corporates and 50 corporates without environmental disclosure in same industry. He did not find significant differences. In the previous year report released, voluntary environmental disclosure corporate had lower monthly abnormal returns, while the opposite occurred four months after release. Belkaoui thought this was due to “environmental ethical investors.” The emergence of increased investment in pollution increased the stock demand, or judgments of the corporate value were modified when pollution-control information disclosed. Some studies could not find a significant association. Using a sample of 287 US companies, Ingram (1978) did not find significant impact on corporate value by voluntary environmental disclosure in annual reports. Cormier and Magnan (2001) found that the voluntary environmental disclosure in the annual report could not affect the share price directly. Other studies found a negative association. Richardson and Welker (2001) suggested that the additional environmental disclosure would increase the burden on the firm and increase the cost of equity capital. In summary, prior research has not found a consistently significant association between environmental disclosure and firm value. Therefore, based on those arguments, the second hypothesis is:

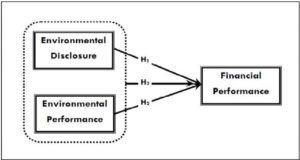

H1: There is an Association between Environmental Disclosure and Financial Performance.

Klassen and McLaughlin (1996) suggest that improve environmental performance could improve firms’ profitability through improving cost efficiency and sales performance. Potoski and Prakash (2005) argued that firms adopting well environmental performance are perceived less riskier than their non-well performed counterparts. Therefore, well performed environmentally firms shall encounter fewer frequent environmental inspections from the regulator, and it leads to additional cost savings. Moreover, those firms could enjoy economies of scale and reduced unit cost of manufacturing after widening their market access. Dowell, Hart, and Yeung (2000) found that firms, which adopt global environmental standards that go beyond legal requirements, have higher market values than firms, which adopt standards at or below the legal mandate. Stanwick and Stanwick (1998) determined that a significant correlation existed between low emissions levels and high profitability for firms with excellent reputations for social responsibility. Consequently, based on those arguments, the first hypothesis is:

H2: There is Association between Environmental Performance and Financial Performance

H3: Environmental Performance and Environmental Disclosures Simultaneously are Associated with Financial Performance.

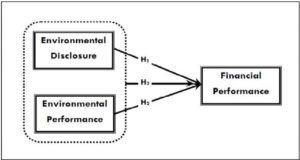

Fig. 1: Research Model of the Relationship of Environmental Disclosure, Environmental Performance and Financial Performance

Research Methodology

In this study, we used the 2009 environmental disclosures of 33 manufacturing firms drawn from PROPER list of Indonesian Ministry of Environment and had also reported their environmental management, e.g. sustainability report. PROPER, a business performance-rating program, is an alternative policy instrument to encourage compliance by companies. It was created in 1995 to address the heavy pressure on the environment due to the rapid growth of industrialization while the ability to conduct surveillance and environmental court systems were inadequate. Its original function was to provide a rating of compliance with water pollution control regulations; however, since 2002, it has been further developed to evaluate compliance with air pollution control, hazardous waste management, marine pollution control, and EIA. Activity under the program started with a selection of companies from manufacturing, the agro- industry, mining, oil, and gas, industrial estates and hazardous waste treatment facilities. These companies meet one or more of the following criteria: they are large companies, potentially pollute the environment, are listed on the capital markets, or are exported oriented. This initial step was followed by data collection, inspection and evaluation based on environmental regulations, standards, and assessment criteria. The Program started with 85 companies in 2002, increased to 627 companies in 2008, and is projected to escalate to 2,000 companies in the future. In PROPER, the five color-code rating is used to describe each company from best to worst: gold, green, blue, red, and black. We give a weight of 5 points for gold, 4 points for green, 3 points for blue, 2 points for red, and 1 points for black.

To measure environmental disclosure, we followed and used the Global Reporting Initiative (GRI) Index, which was launched in 1997 as a joint initiative of Coalition for Environmentally Responsible Economies, a US non-government organization and the United Nations Environmental Program. The GRI Guidelines follow 11 principles (transparency, inclusiveness, audit ability, completeness, relevance, sustainability context, accuracy, neutrality, comparability, clarity, and timeliness) to ensure that sustainability reports (1) present a reasonable and balanced account of economic, environmental, and social performance, (2) facilitate comparison over time and across organizations, and (3) credibly address issues of concerns to stakeholders. The first set of GRI Guidelines was published in 1999 as an Exposure Draft and several revisions have followed since then. For this study, we rely on the GRI Sustainability Reporting Guidelines published in 2002, by using its 18 core items. To calculate environmental disclosure:

Where

EDIs: Environmental Disclosure Index of sampling companies

Xis: Number of EDIs item for company j, nj = 18

Ns: Dummy variable, if EDI item is disclosed = 1, otherwise 0.

In order to test our hypotheses, we employ financial performance as dependent variable, environmental performance and environmental disclosure as independent variables. To measure financial performance, we used ROA, which is total return on assets measured as the ratio of income at the end of fiscal year 2009 and total assets at the end of fiscal year 2009. Why do we use ROA not Tobin’s q ratio in this study? It is true that most of the previous studies have used Tobin’s q ratio in assessing environmental and financial performance, in particular, after 2000. There are two reasons concerning why this study does not use Tobin’s q ratio as a financial performance measure. One of the two reasons is that the concept of Tobin’s q ratio is theoretically completed, but it lacks the computational procedure to estimate Tobin’s q ratio. Consequently, many finance researchers have proposed different computation procedures that produce different Tobin’s q estimates. The measurement of Tobin’s q ratio is only for approximation (Sueyoshi and Goto, 2009).

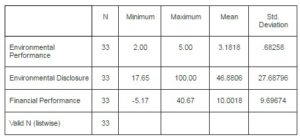

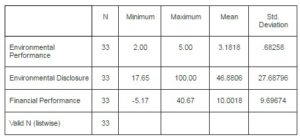

Table 1: Descriptive Statistics

Source: Elaborated Data

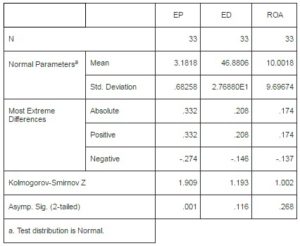

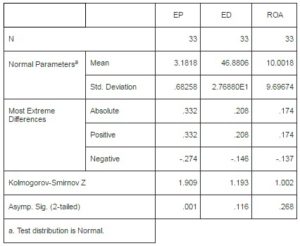

Before doing the regression test, there are three classical assumption tests need to be done, e.g. normality test, multicollinearity test, and heteroscedastic test. To test data normality, we used nonparametric test 1-sample K-S, as can be seen in Table 2. If Kolmogorov-Smirnov coefficient more than 0.05, it can be said that the data is normal distributed.

Table 2: One-Sample Kolmogorov-Smirnov Test

Based on information in Table 2, the data of environmental disclosure and financial performance is normal distributed, because the p values of two independent variables’ KS coefficients are more than 0.005. Even though the p-value of environmental performance is lower than 0.005, or it is not normal distributed, Sugiyono (2007) argued that for ordinal data that is grouped into the nonparametric statistics still can be used in data analysis. The second classical assumption test is the multicollinearity test. There are two assumptions that must be met, first, Variance Inflation Factor (VIF) value must be lower than 10, and second. The tolerance value is higher than 0.10.

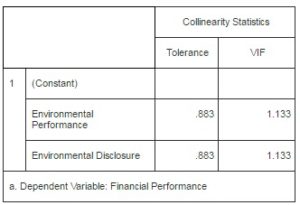

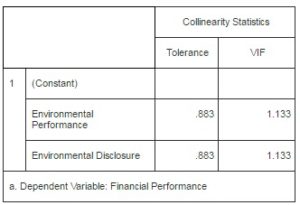

Table 3: Multicollinearity Test

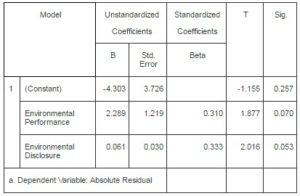

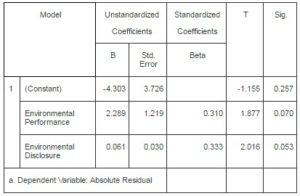

Based on information in Table 3, there is not any multicollinearity among independent variables. To test the presence of heteroscedasticity in our linear regression model, we use Glejser test, which is computed by regressing absolute residuals from the original regression against the original regressors (plus intercept). To determine whether heteroscedasticity is present or not, it can be seen from the p-value of each independent variable that must be higher than 0.05. From Table 4, we can conclude that all data is free from heteroscedasticity, which the p-values for environmental performance and environmental disclosure are bigger than 0.05, e.g. 0.07 and 0.53, respectively.

Table 4: Heteroscedastic Test

To test the effects of environmental disclosures and environmental performance on financial performance, we employ a multivariate regression model as follows:

Financial Performance = α0 + α1Environmental Disclosure + α2Environmental Performance + ε1

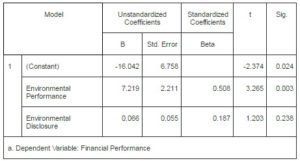

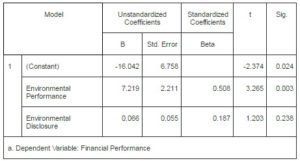

Table 5: Regression Result

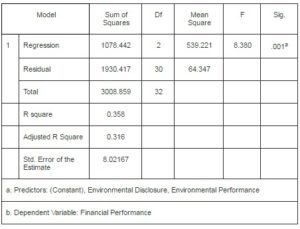

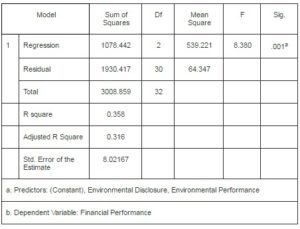

To test the effects of environmental disclosure and environmental performance simultaneously on financial performance, we use ANOVA to find F-value of the model as described in Table 6.

Table 6: ANOVA

Findings and Discussion

In this study, the results of hypothesis testing do not support the association of environmental disclosure and financial performance (β = 0.006; p > 0.1). This research is contrary to the first hypothesis stating the association of environmental disclosure and financial performance. This result could describe the behavior of Indonesian firms in reporting or disclosing its environmental management system. It reflects their perspective and perception on environmental disclosure, which t is voluntary in nature, and there is no rigid obligation to disclose it, as stated Indonesia Capital Market Executive Agency Act No. 38/1996 and Indonesia Statement of Financial Accounting Standard No. 1/2004 Chapter 9. Therefore, these firms’ financial performance is not influenced whether the company discloses or not its environmental report.

For the second hypothesis testing, the result reveals that the environmental performance affects positively financial performance (β = 7.219, p <0.01). In other words, this study supports the hypothesis that environmental performance affects learning. Firm with good environmental performance will have a better financial performance due to its ability to manage its environmental factors well that leads to decrease the environmental-related cost and boost its profit.

Finally, the result shows that environmental disclosure and environmental performance simultaneously affect financial performance (F-value = 8.380, p <0.01), as indicated in its F value that is significant at p < 0.01 level. It indicates that those independent variables had the predictive capability to the dependent variable. In other words, environmental disclosure and environmental performance simultaneously could predict the firm’s financial performance. A firm having environmental disclosure and environmental performance could expect a certain level of financial performance due to the good perception of market on company performance and ability to manage its environmental aspects well.

Discussions

In brief, our results are as follows. We find a positive association between environmental performance and financial performance. In other words, superior environmental performers will get better financial performance. The finding is consistent with some previous literatures that evidence a positive and significant relation between environmental performance and financial performance (Karpoff and Lott, 1993; Hamilton, 1995; Klassen and McLaughlin, 1996; Russian and Fouts, 1997; Kumar, Lamb, and Wokutch, 2002; Margolis and Walsh, 2003; Schnietz and Epstein, 2005; Luo and Bhattacharya, 2006; Wu, 2006; van Beurden and Gossling, 2008).

The results of this research are very important for a managerial perspective. Nowadays, stakeholder pressure highlights the need to include policies oriented towards environmental protection in companies’ strategic management. This study shows that improving its environmental performance could maintain the efficiency of the firm, consolidate its financial situation, and answer the demands of its stakeholders. This issue could be of interesting managers since ignoring environmental factors when establishing the firm’s strategic management policies could lead to a loss of competitiveness in the mid-long-term (Porter and Kramer, 2006). The conclusions are also useful for agents operating in the market because they can introduce the environmental variable into the evaluation criteria for making investment decisions. At the same time, it is also important to impose environmental disclosure as an obligatory report that companies should provide in its annual report. It will put the environmental report as awareness media to both related-agents, the company and the stakeholders, to learn and understand more about the environment as inseparable part in daily business life.

Conclusion

The study has supported previous empirical findings in a certain degree. The positive and significant effect of environmental performance on financial performance has lent a good indication for further research to explore this phenomenon in the context of Southeast Asian countries. Meanwhile, the positive and insignificant effect of environmental disclosure on financial performance has provided supporting findings of disclosure effect generalization, which it opens the good opportunities to explore more widely in the context of comparative studies in Southeast Asian countries. Finally, the simultaneously effect of environmental performance and disclosure on financial performance provides basic findings of those variables that have not been proposed previously in many empirical studies in the context of developing countries’ environment.

(adsbygoogle = window.adsbygoogle || []).push({});

References

Al-Tuwaijri, S. A., Christensen, T. E. & Hughes, K. E. (2004). “The Relations among Environmental Disclosure, Environmental Performance, and Economic Performance: A Simultaneous Equations Approach,” Accounting, Organizations and Society, 29(5-6), 447–471.

Publisher – Google Scholar

Ballou, B., Heitger D. L. & Landes, C. E. (2006). “The Future of Corporate Sustainability Reporting,” Journal of Accountancy, 200(6), 65-74.

Publisher – Google Scholar – British Library Direct

Belkaoui, A. (1976). “The Impact of the Disclosures of the Environmental Effects of Organizational Behaviour on the Market,” Financial Management, No. 5, 56-31.

Publisher

Berthelot, S., Cormier, D. & Magnan, M. (2003). “Environmental Disclosure Research: Review and Synthesis,” Journal of Accounting Literature, 22, 1-44.

Publisher – Google Scholar – British Library Direct

Botosan, C. A. (1997). “Disclosure Level and the Cost of Equity Capital,” The Accounting Review, 72(3), 323–349.

Publisher – Google Scholar – British Library Direct

Bragdon, J. H. & Marlin, J. (1972). ‘Is pollution profitable?,’ Risk Management, 19, 9–18.

Google Scholar

Brown, N. & Deegan, C. (1998). “The Public Disclosure of Environmental Performance Information – A Dual Test of Media Agenda Setting Theory and Legitimacy Theory,” Accounting and Business Research, Vol. 29, Issue 1, 21-41.

Publisher – Google Scholar – British Library Direct

Capital Market Executive Agency of Indonesia. (1996). Information Disclosure Act No. 38/1996, 1-35.

Clarkson, P. M., Yue, L., Richardson, G. D. & Vasvari, F. P. (2007). “Revisiting the Relation between Environmental Performance and Environmental Disclosure: An Empirical Analysis,” Accounting, Organizations and Society.

Publisher – Google Scholar

Cohen, M. A., Fenn, S. A. & Konar, S. (1997). “Environmental and Financial Performance: Are They Related?,” Working Paper Vanderbilt University, 1-40.

Publisher – Google Scholar

Cordeiro, J. J. & Sarkis, J. (1997). “Environmental Proactivism and Firm Performance: Evidence from Security Analyst Earnings Forecasts,” Business Strategy and the Environment, 6, 104–114.

Publisher – Google Scholar – British Library Direct

Cormier, D. & Magnan, M. (1999). “Corporate Environmental Disclosure Strategies: Determinants, Costs and Benefits,” Journal of Accounting, Auditing & Finance, Vol. 14, No. 4, 425-451.

Publisher – Google Scholar – British Library Direct

Deegan, C. & Gordon, B. (1996). “A Study of the Environmental Disclosure Practices of Australian Corporations,” Accounting and Business Research, 26(3), 187-199.

Publisher – Google Scholar – British Library Direct

Deegan, C. & Rankin, M. (1996). “Do Australian Companies Report Environmental News Objectively? An Analysis of Environmental Disclosures by Firms Prosecuted Successfully by the Environmental Protection Authority,” Accounting, Auditing and Accountability, 9(2), 50-67.

Publisher – Google Scholar – British Library Direct

Deegan, C. & Rankin, M. (1997). “The Materiality of Environmental Information to Users of Annual Reports,” Accounting, Auditing and Accountability Journal, 10(4), 562-583.

Publisher – Google Scholar – British Library Direct

Deegan, C., Rankin, M. & Voght, P. (2000). “Firms’ Disclosure Reactions to Major Social Incidents: Australian Evidence,” Accounting Forum, Vol. 24, Issue 1, 101-130.

Publisher – Google Scholar – British Library Direct

Dowell, G., Hart, S. & Yeung, B. (2000). “Do Corporate Global Environmental Standards Create or Destroy Market Value?,” Management Science, 46(8), 1059-74.

Publisher – Google Scholar – British Library Direct

Dowling, J. & Pfeffer, J. (1975). “Organisational Legitimacy: Social Values and Organisational Behavior,” Pacific Sociological Review, Vol. 18 Issue 1, 122-136.

Publisher

Elsayed, K. & Paton, D. (2005). “The Impact of Environmental Performance on Firm Performance: Static and Dynamic Panel Data Evidence,” Structural Change and Economic Dynamics, 16, 395–412.

Publisher – Google Scholar

Filbeck, G. & Gorman, R. F. (2004). “The Relationship between the Environmental and Financial Performance of Public Utilities,” Environmental and Resource Economics, 29, 137–157.

Publisher – Google Scholar – British Library Direct

Graham, J. R., Harvey, C. R. & Rajgopal, S. (2005). “The Economic Implications of Corporate Financial Reporting,” Journal of Accounting Economics, Vol. 40 No.1-3, 3-73.

Publisher – Google Scholar – British Library Direct

Hamilton, J. T. (1995). “Pollution as News: Media and Stock Market Reactions to the Toxics Release Inventory Data,” Journal of Environmental Economics and Management, Vol. 28, 98-113.

Publisher – Google Scholar – British Library Direct

Hughes, S. B., Anderson, A. & Golden, S. (2001). “Corporate Environmental Disclosures: Are They Useful in Determining Environmental Performance?,” Journal of Accounting and Public Policy, 20, 217–240.

Publisher – Google Scholar – British Library Direct

Horváthová, E. (2010). “Does Environmental Performance Affect Financial Performance? A Meta-Analysis,” Ecological Economics, 70, 52–59.

Publisher – Google Scholar

Indonesian Institute of Accountant. (2004). Statement of Financial Accounting Standard No. 1, 1-22.

Ingram, R. W. (1978). “An Investigation of the Information Content of (certain) Social Responsibility Disclosures,” Journal of Accounting Research, (Autumn): 270-285.

Publisher – Google Scholar

Ingram, R. W. & Frazier, K. B. (1980). “Environmental Performance and Corporate Disclosure,” Journal of Accounting Research, Vol. 18 No.2, 270-285.

Publisher – Google Scholar

Jacobs, B. W., Singhal, V. R. & Subramanian, R. (2010). “An Empirical Investigation of Environmental Performance and the Market Value of the Firm,” Journal of Operations Management, 28(5), 430–441.

Publisher – Google Scholar

Jaggi, B. & Freedman, M. (1992). “An Examination of the Impact of Pollution Performance on Economic and Market Performance: Pulp and Paper Firms,” Journal of Business Finance & Accounting, 19(5), 697–713.

Publisher – Google Scholar

Jones, K. & Rubin, P. H. (2001). “Effects of Harmful Environmental Events on Reputations of Firms,” in Mark Hirschey, Kose John, and Anil K. Makhija (Eds.). Advances in Financial Economics. Amsterdam: Elsevier Science Publishers.

Publisher – Google Scholar

Karpoff, J. M. & Lott, J. R. (1993). “The Reputational Penalty Firms Bear from Committing Criminal Fraud,” Journal of Law & Economics, Vol. 36, 757-802.

Publisher – Google Scholar – British Library Direct

Karpoff, J. M., Lott, J. R. & Rankine, G. (1998). “Environmental Violations, Legal Penalties, and Reputation Costs,” Working Paper, 1-23.

Publisher – Google Scholar

Klassen, R. D. & McLaughlin, J. P. (1996). “The Impact of Environmental Management on Firm Performance,” Management Science, 42(8), 1199–1214.

Publisher – Google Scholar – British Library Direct

Konar, S. & Cohen, M. A. (2001). “Does the Market Value the Environmental Performance?,” The Review of Economics and Statistics, May 2001, 83(2), 281–289.

Publisher

Kumar, R., Lamb, W. B. & Wokutch, R. E. (2002). “The End of South African Sanctions, Institutional Ownership, and the Stock Price Performance of Boycotted Firms,” Business and Society, Vol. 41, 133-65.

Publisher – Google Scholar – British Library Direct

KPMG International. (2008). ‘KPMG International Survey of Corporate Responsibility Reporting 2008,’ Amstelveen, The Netherlands: KPMG International.

Google Scholar

Lankoski, L. (2000). “Determinants of Environmental Profit. An Analysis of Firm-Level Relationship between Environmental and Economic Performance,” Helsinki University of Technology Institute of Strategy and International Business Doctoral Dissertation, 1-188.

Publisher – Google Scholar

Li, Y., Richardson, G. D. & Thornton, D. B. (1997). “Corporate Disclosure of Environmental Liability Information: Theory and Evidence,” Contemporary Accounting Research, Vol. 14, 435-474.

Publisher – Google Scholar – British Library Direct

Luo, X. & Bhattacharya, C. B. (2006). “Corporate Social Responsibility, Customer Satisfaction, and Market Value,” Journal of Marketing, Vol. 70, 1-18.

Publisher – Google Scholar – British Library Direct

Mahapatra, S. (1984). “Investor Reaction to Corporate Social Accounting,” The Journal of Business Finance and Accounting, 11(1), 29–40.

Publisher – Google Scholar

Margolis, J. D. & Walsh, J. P. (2003). “Misery Loves Companies: Rethinking Social Initiatives by Business,” Administrative Science Quarterly, Vol. 48, 268-305.

Publisher – Google Scholar – British Library Direct

McWilliams, A. & Siegel, D. (2001). “Corporate Social Responsibility: A Theory of the Firm Perspective,” Academy of Management Review, 26 (1), 117–127.

Publisher – Google Scholar – British Library Direct

O’Donovan, G. (2001). “Environmental Disclosures in the Annual Report: Extending the Applicability and Predictive Power of Legitimacy Theory,” paper presented at APIRA 2001, Adelaide.

Publisher – Google Scholar – British Library Direct

Palmer, K., Oates, W. E. & Portey, P. R. (1995). “Tightening Environmental Standards: The Benefit-Cost or the No-Cost Paradigm?,” Journal of Economic Perspectives, 9 (4), 119–132.

Publisher – Google Scholar – British Library Direct

Patten, D. M. (2002). “The Relation between Environmental Performance and Environmental Disclosure: A Research Note,” Accounting, Organizations, and Society, 27, 763–773.

Publisher – Google Scholar

Porter, M. E. & Kramer, M. R. (2006). “Strategy and Society: The Link between Competitive Advantage and Corporate Social Responsibility,” Harvard Business Review, Vol. 84, 42-56.

Publisher – Google Scholar – British Library Direct

Porter, M. & van der Linde, C. (1995a). “Green and Competitive: Ending the Stalemate,” Harvard Business Review, 73(5), 120–134.

Publisher – Google Scholar – British Library Direct

Porter, M. & van der Linde, C. (1995b). “Toward a New Conception of the Environment-Competitiveness Relationship,” Journal of Economic Perspectives, 9(4), 97–118.

Publisher – Google Scholar – British Library Direct

Richardson, A. J. & Welker, M. (2001). “Social Disclosure, Financial Disclosure and the Cost of Equity Capital,” Accounting, Organizations and Society, Vol. 26, No.7/8, 597-616.

Publisher – Google Scholar – British Library Direct

Rockness, J. W. (1985). “An Assessment of the Relationship between US Corporate Environmental Performance and Disclosure,” Journal of Business Finance & Accounting, Vol. 12, Issue 3, 339-354.

Publisher – Google Scholar

Rockness, J. W., Schlachter, P. & Rockness, H. (1986). ‘Hazardous Waste Disposal, Corporate Disclosure and Financial Performance in the Chemical Industry,’ Advances in Public Interest Accounting, 1, 167–191.

Google Scholar

Russo, M. V. & Fouts, P. A. (1997). “A Resource-based Perspective on Corporate Environmental Performance and Profitability,” Academy of Management Journal, Vol. 40, 534-59.

Publisher – Google Scholar

Schnietz, K. E. & Epstein, M. J. (2005). “Exploring the Financial Value of a Reputation for Corporate Social Responsibility during a Crisis,” Corporate Reputation Review, Vol. 7, 327-45.

Publisher – Google Scholar

Spicer, B. H. (1978). “Investors, Corporate Social Performance and Information Disclosure: An Empirical Study,” The Accounting Review, 53(1), 94–111.

Publisher – Google Scholar

Stanwick, P. A. & Stanwick, S. D. (1998). “The Relationship between Corporate Social Performance and Size, Financial and Environmental Performance,” Journal of Business Ethics, 17(2): 195-204.

Publisher – Google Scholar – British Library Direct

Sueyoshi, T. & Goto, M. (2009). “Can Environmental Investment and Expenditure Enhance Financial Performance of US Electric Utility Firms under the Clean Air Act Amendment of 1990?,” Energy Policy, 37, 4819–4826.

Publisher – Google Scholar

Sugiyono (2007). ‘Statistic for Research,’ 12th edition. Bandung: IKAPI.

Tietenberg, T. (1998). “Disclosure Strategies for Pollution Control,” Environmental and Resource Economics, 11(3–4), 587–602.

Publisher – Google Scholar – British Library Direct

Tsang, E. W. K. (1998). “A Longitudinal Study of Corporate Social Reporting in Singapore: The Case of the Banking, Food and Beverage, and Hotel Industries,” Accounting Auditing and Accountability Journal, 11(5), 624–635.

Publisher – Google Scholar – British Library Direct

United Nations. (2010). The Millennium Development Goals Report 2010.

Publisher

Van Beurder, P. & Gossling, T. (2008). “The Worth of Values – A Literature Review on the Relation between Corporate Social and Financial Performance,” Journal of Business Ethics, Vol. 82, 407-24.

Publisher – Google Scholar

Wagner, M. (2001). ‘A Review of Empirical Studies Concerning the Relationship between Environmental and Financial performance. What Does the Evidence Tell Us?,’ Center for Sustainability Management, Vol. 52, 1-23.

Google Scholar

Walley, N. & Whitehead, B. (1994). “It’s not Easy being Green,” Harvard Business Review, 15, 46–52.

Publisher – Google Scholar

Wilmshurst, T. D. & Frost, G. R. (2000). “Corporate Environmental Reporting: A Test of Legitimacy Theory,” Accounting, Auditing & Accountability Journal, 13(1), 10-26.

Publisher – Google Scholar – British Library Direct

Wiseman, J. (1982). “An Evaluation of Environmental Disclosures Made in Corporate Annual Reports,” Accounting, Organizations and Society, Vol.7 No.1, 53-63.

Publisher – Google Scholar

Wu, M. L. (2006). “Corporate Social Performance, Corporate Financial Performance and Firm Size: A Meta-Analysis,” Journal of American Academy of Business, Vol. 8, 163-71.

Publisher – Google Scholar