Introduction

Cultural values indeed cause considerable differences in risk-averse and risk-taking in societies (Rieger, Wang, and Hens, 2011). Risk aversion is critical in multinational business, behavioral economics, entrepreneurship, life insurance, financial institutions, banking, consumer behavior and unemployment (Gandelman and Hernández-Murillo, 2015). Risk aversion has a notable effect on the country’s economy and entrepreneurial investments (Guiso, 2012). Therefore, it is worthwhile for researchers to examine many factors that could influence risk preference at the individual, firm and country level. Managers and other policymakers make decisions in several areas that affect businesses in organizations and economies in countries. These decisions might be influenced in one way or another by business and policy decision-makers level of risk preference. The micro-level decisions made by policymakers, business managers and executives could influence a country’s development outcome and economic growth (Gandelman and Hernández-Murillo, 2015).

There are few studies on cultural values and their impact on risk-taking (i. e., willingly making risky decisions or taking some actions that may have unwanted results), risk aversion (i. e., avoid taking a few risks to minimize uncertainty and get around failure), and risk acceptance at the firm and individual levels. However, the majority of the studies on risk, aversion has focused on the cultural values of masculinity (MAS), individualism (IND), uncertainty avoidance (UA), power distance (PD), indulgence-restraint (ING), long-term/short-term orientation (LTO), and gender (i.e., male/female). Previous studies have used various proxies as a measure of risk aversion, such as the Z-score, Hofstede uncertainty avoidance, self-assessed risk attitudes, the Pratt-Arrow measure of absolute risk aversion, and other proxies. For example, Kanagaretnam, Lim and Lobo (2014) found that banks in high uncertainty and low individualism cultures are more risk-averse than banks in low uncertainty avoidance and high individualism cultures. This study tries to fill the gap by empirically examining the relationship between the Hofstede cultural values of long-term-short-term orientation (LTO), indulgence-restraint (ING), and risk aversion at the country level in 53 developed and developing countries using the coefficient of relative risk aversion as a proxy for risk aversion.

Literature Review and Hypotheses Development

Risk Aversion

Risk aversion as a concept in business has been defined by many researchers. In this study, risk aversion is defined as a person’s preference for a riskless outcome by avoiding making risky decisions (Mandrik and Bao, 2005). Hence, individuals who are risk-averse have the tendency to seek guaranteed outcomes and avoid ambiguity.

Risk aversion is an essential factor in everyone’s life decisions, including investors, economists and policymakers, for financial and the economic development decisions that might influence many people’s lives. Risk aversion is viewed as a cultural trait at the country level because people with shared cultures are more likely to cluster inside one country (Lehnert, Frijns, Gilbert and Tourani-Rad, 2011). At the country level, risk aversion plays an important part in the economic development and the country’s competitiveness (Zahra, 1999). For example, entrepreneurs’ risk aversion has a critical influence on a country’s employment rate and innovation because entrepreneurs create new job opportunities and innovate new services and goods to consumers (Burton, 2015).

Researchers have developed several measures as proxies to measure risk aversion. For instance, Szpiro (1986) developed the relative risk aversion constant by examining data from liability insurance in 15 countries between 1950 and 1980. Gandelman and Hernández-Murillo (2015) developed the coefficient of relative risk aversion using the Gallup World Poll self-reports data of self-reports on personal well-being in 117 developed and developing countries worldwide in 2006.

Power Distance

Power distance is the degree of expectations and acceptance of individuals to inequality and power differentials in their society. Karimi and Toikka (2014) found a negative and a significant relationship between power distance (i.e., the degree of expectations and acceptance of unequal power distribution by less powerful individuals in a society) and risk acceptance. In other words, societies, in countries that score high in power distance, have less risk acceptance than societies in countries that score low in power distance.

Individualism versus Risk Aversion

Individualism is the extent to which individuals in a society prioritize their personal needs and goals over their groups’ goals and well-being. The extant literature shows that there is a relationship between Hofstede’s cultural values and risk attitudes (i.e., risk aversion). Researchers have examined the influence of cultural values on risk aversion among individuals. Breuer, Riesener and Salzmann (2014) found that investors in low individualistic countries are more risk-averse than their counterparts in high individualistic countries. In the study conducted by Karimi and Toikka (2014) on the influence of Hofstede’s cross-cultural dimensions on risk acceptance, the two researchers concluded that the positive and significant relationship between the cultural value of individualism and risk acceptance means that societies in individualistic countries have more risk acceptance than societies in collectivistic countries. Therefore, in countries with a high level of individualism, investors will be less reluctant to invest in assets that contain high elements of risk.

Masculinity versus Risk Aversion

Masculinity is how much a society assigns different gender social rules for females and males. Iliyanova (2016) measured masculinity by using the industry sector where men and women work, and found that masculinity has no significant impact on risk aversion. However, Iliyanova (2016) found that gender does have a relationship with risk aversion, where men are less risk-averse than women. It is important to keep in mind that at this point, Hofstede’s or the Globe Study indices were not used as a proxy for masculinity. In addition, Karimi and Toikka (2014) found a negative and significant relationship between masculinity and risk acceptance. In other words, societies in countries that scorehigh in masculinity have less risk acceptance than societies in countries that score low in masculinity.

Uncertainty Avoidance versus Risk Aversion

Uncertainty Avoidance Index (UA) is the cultural value that measures the extent to which society members adapt to changes, handle anxiety, and deal with uncertainty. Hofstede (2001) suggests that cultures with high UA values usually feel less comfortable with ambiguous situations and prefer official rules. In contrast, cultures with low UA values feel safe and enjoyable towards the unknown. Countries with high UA values are more likely to be less socially, economically, and politically stable than countries with low UA values (Khambata and Liu, 2005). There is a belief that UA and risk aversion are related because the two dimensions are caused by the same psychological actors (Kahn and Sarin, 1988).

Another study conducted by Munro-Smith (2002) found that individuals with high UA are inclined toward bureaucracy and risk-aversion. In addition, Karimi and Toikka (2014) found a negative and significant relationship between uncertainty avoidance and risk acceptance, long-term orientation and risk acceptance, and indulgence and risk acceptance. In other words, societies in countries that score high in uncertainty avoidance have less risk acceptance than societies in countries that score low in uncertainty avoidance.

Long-Term Orientation versus Risk Aversion

Long-term orientation (LTO) – short-term orientation (STO) is the extent to which individuals in a society are future-oriented toward rewards, especially thrift (i.e., using money and other resources wisely and not wastefully) and the determination in pursuing something regardless of difficulty (Hofstede, 2001). LTO societies are expected to be more cautious about making risky decisions, and therefore, more risk-averse. On the other hand, short-term orientation individuals are more oriented toward the present and the past, specifically, face-saving, credibility, reputation, respect for tradition, and satisfying social obligations” (Hofstede, 2011). Hence, STO societies are expected to be less cautious about making risky decisions, and therefore, less risk-averse. Following the above argument, hypothesis 1(H1) is proposed:

H1: Societies in countries that score high in the cultural value of long-term orientation will be more risk-averse than societies in countries that score low in the same cultural value.

Indulgence versus Risk Aversion

Indulgence is defined by Hofstede and Minkov (2010) as “the extent to which people try to control their desires and impulses.” According to Hofstede (2001), societies in low indulgence countries are inclined to distrust and skepticism. On the other hand, societies in high indulgent countries are inclined to be more confident, optimistic and hopeful about the future (Hofstede, 2011). According to Yıldırım, Arslan and Barutçu (2016), trust relates to optimism, and trust depends on optimism when it comes to the future as trustful people believe that tomorrow is always going to be better than today. Studies have shown that there is a correlation between pessimism and risk tolerance, as there is a belief among scholars that optimistic people are less risk-averse than pessimistic people (2008). In finance, Guiso (2012) found that investors who are optimistic and have a high level of trust are more likely to accept risky investments such as stocks. In other words, optimism decreases risk aversion. Prior research done on developed nations has suggested that people who are trustful tend to take more financial risks when it comes to investing in stocks (2018). However, greater risk aversion could decline trust between people (2001).

The cultural value of indulgence mirrors an inclination towards the gratification of human beings’ natural desires of enjoying life and having fun (Minkov and Hofstede, 2012). Indulgent cultures attach more importance to pleasure and leisure, which leads to more hedonic behaviors (i.e., behaviors that establish positive or pleasant experiences) (Hofstede and Bond, 1988; Minkov and Hofstede, 2012). Hedonic behaviors could lead to riskier decisions, and less risk-aversion since pleasure is believed to be more important than the cost of taking a risk (Minkov, 2007). Finally, Karimi and Toikka (2014) found a negative and significant relationship between indulgence and risk acceptance. In other words, societies in countries that score high in indulgence have less risk acceptance than societies in countries that score low in indulgence. Following this line of discussion, the author of this paper expects that indulgence negatively relates to risk-aversion and posits the following hypothesis (H2):

H2: Societies in countries that score high in the cultural value of indulgence will be less risk-averse than societies in countries that score low in the same cultural value.

Methodology

The Variables’ Measurements

The Dependent Variable

Risk aversion (i.e., avoid making risky financial and/or non-financial decisions) is the dependent variable for this study measured by the coefficient of relative risk aversion at the country level. The coefficient of relative risk aversion was developed by Gandelman and Hernández-Murillo (2015), using the Gallup World Poll self-reports data of self-reports on the personal well-being in 117 developed and developing countries worldwide in 2006. The coefficient of the relative risk aversion ranges from zero to three, where zero means the population of the corresponding countries is not a risk-averse society, and three means the population of the corresponding country is an extremely risk-averse society. The coefficient of risk aversion was chosen among many risk aversion proxies because this proxy incorporated many developed and developing countries (117 countries) which might be more comprehensive than other proxies that focused mainly on developed countries and covered fewer countries (15 and 31 countries, respectively) around the world. The dataset on relative risk aversion is available at https://dspace.ort.edu.uy/bitstream/ handle/20.50 0.11968/274 3/documentodeinvestigacion98.pdf.

The Independent Variables

Hofstede’s cultural dimensions of long-term orientation (i.e., the degree to which society members are future reward oriented, especially towards perseverance and prudence) and indulgence (i.e., the degree to which individuals in society show a favorable or unfavorable reaction to their desires) are the independent variables measured at the country level. The measures for these two cultural values were borrowed from Manikov and Hofstede’s (2012) study. Hofstede made his data on cultural values available to researchers at his website (https://www.hofstedeinsights.com/country comparison/). Hofstede measured the cultural values using a survey of IBM employees in many countries where the IBM subsidiaries are located. However, the long-term orientation cultural value was added from Hofstede and Bond (1988), where they compared between students from 23 different countries using Bond’s Chinese Value Survey. Hofstede adopted indulgence versus restraint in his study after he extracted this cultural value from the World Values Survey. Hofstede’s cultural measures have shown reliability and validity.

The Control Variables

Both Per capita income (i.e., the average income of an individual in a given country) and religiosity are used as control variables measured at the country level. The author controlled for religiosity because a prior study done by Noussair, Trautmann, Van de Kuilen and Vellekoop (2013) has shown that religious people (i.e., people who attend church regularly) are more risk-averse than non-religious people. The measures of religiosity in countries were borrowed from the Extensive Country-Level Religiosity Index (ECLRI) developed by Joshanloo and Gebauer (2019) at https://psycnet.apa.org /record/ 2019-76861-001. The ECLRI was derived from the 2005 – 2017 Gallup World Poll (GWP) data, where 1,862,900 randomly selected male and female respondents in 167 countries were asked about the importance of religion in their daily lives.

There are conflicting findings regarding the relationship between income and risk aversion. Shaw (1996) found a positive correlation between wage income and risk aversion at the individual level. Haushofer and Fehr (2014) concluded that poor countries are more risk-averse than rich countries. However, l’Haridon and Vieider (2019) showed that poorer countries are more risk tolerant than rich countries. In this study, per capita income data were borrowed from the World Development Reports in 2019 published by the World Bank at https://www.worldba nk.org/en/publication/wd r2019.

Data Analysis

The influence of the cultural values of long-term orientation and indulgence on risk aversion with per capita income and religiosity as control variables in 53 developed and developing countries was examined using multiple linear regression analysis because the dependent variable dataset is not normally distributed, which violates the least-squares regression assumptions. To run the multiple linear regression analysis: First, the Pearson correlation between the variables of interest was checked (see Table1). Second, the author checked the least-squares assumptions and found that the dependent variable data are not normally distributed. Hence, he decided to check for the multiple regression assumptions. It was found that the assumptions are fulfilled (i.e., the mean of the residuals is zero; equal variance or Homoscedasticity of residuals, and multi-collinearity) (se. Finally, the author ran the multiple linear regression analysis of the two independent variables (i.e., long-term orientation and indulgence) after controlling for per capita income and religiosity.

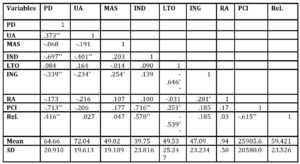

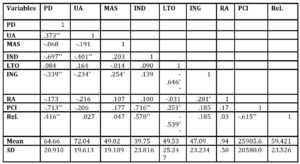

Table 1: Descriptive statistics and inter-correlations

Note: N = 53. PD = Power Distance. UA = Uncertainty Avoidance. MAS = Masculinity. IND = Individualism. LTO = Long-term Orientation. ING = Indulgence. RA = Risk Aversion. PCI = Per Capita Income. Rel. = Country Level of Religiosity. SD = Standard Deviation. Comp. = Country Level of Competitiveness.

Empirical Results

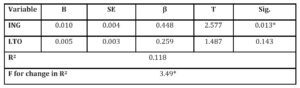

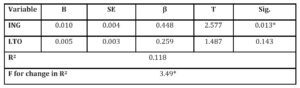

Through the regression analysis results, the author tries to explain the differences across countries that tend to be risk-averse. Table 2 summarizes the multiple linear regression analysis results for variables (i.e., LTO and ING) predicting risk aversion (N = 53). ANOVA shows that the model is significant and fit (i.e., R2 = 0.118; R2 change = 3.49*; P < 0.05). The multiple linear regression analysis results also show that indulgence appears to be a more important cultural variable than long-term orientation. Indulgence was significant when the two (i.e., religiosity and per capita income) control variables were included in the regression and did not control for per capita income and religiosity. Long-term orientation shows no significant relationship with risk aversion. Surprisingly, the two control variables (religiosity and per capita income) were not significant at the country level.

Table 2: Summary of the multiple linear regression analysis for variables predicting risk-aversion

Note. (N=53). ING = Indulgence. LTO = Long-Term Orientation. B = Unstandardized Coefficient. β = Standardized Coefficient. T = T-Value. Sig. = Significance. *P < 0.05.

Conclusion

The multiple linear regression results of examining 53 developed and developing countries suggest many conclusions about risk-aversion among countries:

- All countries’ national culture matters when it comes to the level of risk-aversion at the country level. Risk preference is a critical component of the economic behavior because it determines many of a country’s economic decisions, such as asset allocations, insurance purchases, and strategic decisions made by corporations (Rieger, Wang and Hens, 2015). In general, highly developed countries with strong economies are expected to be less risk-averse than developing countries.

- Not only do individualism and uncertainty avoidance influence risk-aversion in countries, but also the culture of indulgence. Indulgence might significantly influence a society’s level of risk-aversion because of confidence, trust, optimism and hedonic behavior.

- A country’s religiosity and per capita income seem to be less important

factors that influence risk-aversion among countries and societies.

The author found no significant relationship between religiosity and risk-aversion, as well as between per capita income and risk-aversion when religiosity and per capita income were regressed as independent variables on risk-aversion. Finally, this study used the coefficient of relative risk aversion as a proxy for risk-aversion developed by Gandelman and Hernández-Murillo (2015). It is a more comprehensive measure with data availability in many countries. However, future research could use other proxies for risk-aversion to understand whether different risk-aversion measures can provide similar results.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Ben-Ner, A. and Putterman, L., 2001. Trusting and trustworthiness. BUL Rev., 81, p.523.

- Ben Mansour, S., Jouini, E., Marin, J.M., Napp, C. and Robert, C., 2008. Are risk‐averse agents more optimistic? A Bayesian estimation approach. Journal of Applied Econometrics, 23(6), pp.843-860.

- Breuer, W., Riesener, M. and Salzmann, A.J., 2014. Risk aversion vs. individualism: what drives risk taking in household finance? The European Journal of Finance, 20(5), pp.446-462.

- Burton, E.L., 2015. The impact of risk aversion on economic development in Portugal.

- Chao, L.W., Szrek, H., Leite, R., Peltzer, K. and Ramlagan, S., 2015. Risks deter but pleasures allure: Is pleasure more important? Judgment and decision making, 10(3), p.204.

- Gandelman, N. and Hernández-Murillo, R., 2015. Risk aversion at the country level.

- Guiso, L., 2012. Trust and risk aversion in the aftermath of the great recession. European Business Organization Law Review, 13(2), pp.195-209.

- Haushofer, J. and Fehr, E., 2014. On the psychology of poverty. Science. 344 (6186), pp.862-867.

- Hofstede, G. and Bond, M.H., 1988. The Confucius connection: From cultural roots to economic growth. Organizational dynamics, 16(4), pp.5-21.

- Hofstede, G. and Minkov, M., 2010. Long-versus short-term orientation: new perspectives. Asia Pacific business review, 16(4), pp.493-504.

- Hofstede, G., 2001. Culture’s consequences: Comparing values, behaviors, institutions and organizations across nations. Sage publications.

- Hofstede, G., 2011. Dimensionalizing cultures: The Hofstede model in context. Online readings in psychology and culture, 2(1), pp.2307-0919.

- l’Haridon, O. and Vieider, F.M., 2019. All over the map: A worldwide comparison ofrisk preferences. Quantitative Economics, 10(1), pp.185-215.

- Iliyanova, E., 2016. Does Masculinity Affect Financial Risk Taking and Behavior? A Study on Dutch CentERpanel Data.

- Joshanloo, M. and Gebauer, J.E., 2019. Religiosity’s nomological network and temporal change: Introducing an extensive country-level religiosity index based on Gallup World Poll data. European Psychologist.

- Kahn, B.E. and Sarin, R.K., 1988. Modeling ambiguity in decisions under uncertainty. Journal of consumer Research, 15(2), pp.265-272.

- Kanagaretnam, K., Lim, C.Y. and Lobo, G.J., 2014. Influence of national culture on accounting conservatism and risk-taking in the banking industry. The Accounting Review, 89(3), pp.1115-1149.

- Karimi, F. and Toikka, A., 2014. The relation between cultural structures and risk perception: How does social acceptance of carbon capture and storage emerge? Energy Procedia, 63, pp.7087-7095.

- Khambata, D. and Liu, W.W., 2005. Cultural dimensions, risk aversion and corporate dividend policy. Journal of Asia-Pacific Business, 6(4), pp.31-43.

- Lehnert, T., Frijns, B., Gilbert, A.B. and Tourani-Rad, A., 2011, October. Cultural values, CEO risk aversion and corporate takeovers. In Paris December 2011 Finance Meeting EUROFIDAI-AFFI.

- Mandrik, C.A. and Bao, Y., 2005. Exploring the concept and measurement of general risk aversion. ACR North American Advances.

- Minkov, M., 2007. What makes us different and similar: a new interpretation of the world values and other cross-cultural data. na.

- Minkov, M. and Hofstede, G., 2012. Hofstede’s fifth dimension: New evidence from the World Values Survey. Journal of cross-cultural psychology, 43(1), pp.3-14.

- Munro-Smith, N., 2002, December. A tale of two cities: computer mediated teaching & learning in Melbourne and Singapore. In ASCILITE (pp. 861-864).

- Noussair, C.N., Trautmann, S.T., Van de Kuilen, G. and Vellekoop, N., 2013. Risk aversion and religion.

- Rieger, M.O., Wang, M. and Hens, T., 2011. Prospect theory around the world. NHHDept. of Finance & Management Science Discussion Paper, (2011/19).

- Rieger, M.O., Wang, M. and Hens, T., 2015. Risk preferences around the world. Management Science, 61(3), pp.637-648.

- Shaw, K.L., 1996. An empirical analysis of risk aversion and income growth. Journal of Labor Economics, 14(4), pp.626-653.

- Szpiro, G.G., 1986. Relative risk aversion around the world. Economics Letters, 20(1), pp.19-21.

- Yıldırım, E., Arslan, Y. and Barutçu, M.T., 2016. The role of uncertainty avoidance and indulgence as cultural dimensions on online shopping expenditure. Eurasian Business and Economics Journal, 4, pp.42-51.

- Xu, Y., 2018. Generalized trust and financial risk-taking in China–A contextual and individual analysis. Frontiers in psychology, 9, p.1308.

- Zahra, S.A., 1999. The changing rules of global competitiveness in the 21st century. Academy of Management Perspectives, 13(1), pp.36-42.