Introduction

Home has been recognized as one of the essential needs and significant component in the urban economy. Additionally, owning a house is one of the major goals of citizens, and it represents a single investment of a lifetime. It acts as a shelter to support household living. Besides, the need for housing is the main priority for the citizens to ensure their ongoing lives. However, one of the biggest problems lower-income Malaysian households face today is finding affordable, secure, and appropriate housing, since housing within an urban area is more expensive compared to housing in a rural area. Thus, housing ownership should consider factors such as the financial capability of the buyers, development cost, and the selling price.

Malaysians are facing problems in housing ownership since the house price has increased significantly. Besides, housing prices in the urban area in Malaysia are becoming severely unaffordable recently. The high rate of urban growth due to migration, increase in population size, and income level significantly contributed to the housing market. The change in the housing markets was due to the increasing demand and fluctuating prices that affect housing affordability. Housing affordability is not a new issue and it has taken over the global attention. Besides, housing affordability has become one of the most critical development issues and a considerable challenge, especially for low incomes households. Most of the world, including Hong Kong, Japan, Australia, Ireland, Nigeria, Indonesia, and Singapore are facing the problem of unaffordable housing. The affordable housing issue has become the main focus of managing the growth of housing prices and reducing the effects of the housing issue.

A significant number of previous research on housing affordability have been focusing on housing costs and household income. Thus, a need has arisen for a broad and better understanding of housing affordability rather than simple measures based on housing expenditure and household income which cannot deal with issues such as housing conditions, location, and access to quality. Mulliner and Maliene (2012) criticized that pre-existing affordability literature focused on house prices rather than the condition, location, and neighborhood characteristics of the housing. Therefore, this study seeks to measure housing affordability by considering not only the cost of housing but also the condition and location efficiency through measuring transportation costs.

Literature Review

Concept of housing affordability

In many countries, housing affordability has drawn the main considerable attention for several years. Affordability is the ability of the person to provide something; that is usually referred to as the ability in financial terms. Housing affordability can be defined in three different ways (Gan and Hill, 2009); purchase affordability, repayment affordability, and income affordability. Purchase affordability is considering the ability of the household to borrow enough funds to purchase a house. Repayment affordability is considering the burden on the household to pay the mortgage, while income affordability refers to the measurement of the ratio of house prices to the income of the purchaser. Besides, housing affordability is defined as the condition where people have the potential to save a certain portion of income to buy the house as well as any other consumption (Mostafa et al., 2006). In Malaysia, housing affordability is denoted as the rent-to-income ratio or house price-to-income ratio, known as income affordability. The median multiple is a common measurement suggested by the World Bank and the United Nations which rates the affordability of housing by dividing the median house price and annual median household income. Housing markets are rated as affordable at or below 3 times median multiple, moderately unaffordable at or below 4 times median multiple, seriously unaffordable at or below 5 times median multiple, and above 5 times rated as severely unaffordable (Suhaida et al., 2011).

Locational attributes

Location attributes are highly related to the site or place where the housing is located; within an urban area or rural area. Distance is considered as the main factor that affects the buyer’s preference in decision making, such as distance from the workplace, schools, shops, and other facilities (Sean and Hong, 2014). Daly et al. (2003) mentioned that location is a primary value attribute that impacts the buyer’s preference in purchasing residential properties in Australia, UK, and Ireland. Besides, Kauko (2007) stated that location is an important factor to determine the success or failure of the residential housing project. Natasha and Hassan (2015) found that location attributes have a positive relationship and can have a positive impact on the intention to make a property investment. Location was considered as the highest contribution that influences the housing price (Olanrewaju et al., 2018).

Neighborhood attributes

The neighborhood is also one of the most important attributes to measure housing affordability. According to Sean and Hong (2014), neighborhood is defined as an area in which residents live together for the common interest. Previous research by Źróbek et al. (2015) has shown that cleanliness and low crime trends are examples of good neighborhood environments that are important aspects of the purchase of residential properties. A good neighborhood has a positive impact on housing prices. According to Teck-Hong (2011), a house in a good neighborhood is preferred, as households are willing to pay extra for a house of good environmental quality. Thaker and Sakaran (2016) mentioned that the good quality of a residential property can be valued by an excellent indoor and outdoor environment. Besides, Thanaraju et al. (2019) mentioned that the safety of the neighborhood is also considered as another important aspect when purchasing a residential property. This is due to the increase in the trend of crimes such as burglary and snatch. Besides, the security of the neighborhood is very important for the safety level of the residential area since the number of crimes in Malaysia is increasing (Mariadas et al., 2019).

Structural attributes

Numerous empirical studies have identified structural attributes as influential components of households’ in the house-buying decision. According to (Teck-Hong, 2012), structural attributes that can impact home-buying preferences include lot size, the number of bedrooms and bathrooms, and the presence of a garden in a house. Hurtubia et al. (2010) mentioned that the number of bedrooms and bathrooms in a house are important characteristics to be considered when purchasing a residential property. For instance, in Saudi Arabia, private living spaces such as the number of bedrooms, the size of bedrooms, and the number of bathrooms are considered to be important factors because they have a direct relation with the problem of privacy (Opoku and Abdul-Muhmin, 2010). A similar finding by Chia et al. (2016) concluded that the private living space is considered to be a key housing attribute because it can be directly related to the issue of privacy. Besides, Sundrani (2018) also mentioned that the number of bedrooms and the size of bedrooms are the most important features to be considered in their homeownership decisions.

Financial attributes

Financial attributes are important features that the household needs to consider in their homeownership decisions. Besides, financial attributes strongly influence the decision of homebuyers to purchase a residential property (Sean and Hong, 2014; Thaker and Sakaran, 2016). As mentioned by Mariadas et al. (2019), there are several key areas regarding the financial consideration such as interest rate, house price, household income, and ability to obtain financing. Li et al. (2014) also mentioned that financial factors such as length of the period for the payment, interest rate, and amount of monthly payment are the main considerations while choosing a residential property to purchase. Zainon et al. (2017) concluded that the financial factor has a positive relationship with housing affordability.

Transport expenditure

In recent years, there has been a new indicator of housing affordability that includes transport expenditure (Sabri et al., 2013; Yusoff et al., 2014). Housing and transportation are the two largest expenses for most households. Besides, housing and transport expenditure show a more complete picture of affordability in the neighborhood. The traditional measure of housing affordability generally focused on housing cost alone, while ignored the transportation cost which incurs a relatively high proportion of income. Therefore, combining housing and transportation cost offers an expanded view of affordability. Previous research suggested that incorporating transportation costs into housing affordability calculations can reveal a different pattern of affordability, especially in less accessible locations (Dewita et al. 2018). Several studies from European countries provide a similar result of the importance of incorporating transportation costs to reveal more appropriate measures of housing affordability. Transportation expenditure consists of three important variables which are vehicle ownership, vehicle usage, and public transit. Vehicle ownership is determined by the number of the vehicles, the monthly payment of the vehicles, and the annual amount of insurance and taxes. Vehicle usage is based on the amount of fuel consumption, monthly amount toll, and parking fees, as well as cost and maintenance of the vehicles. Public transit is the total amount of monthly expenses on public transit.

Summary of the Previous Research

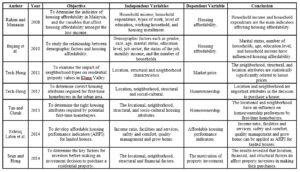

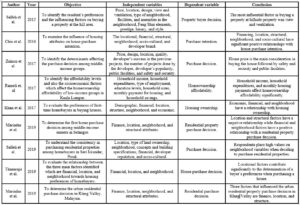

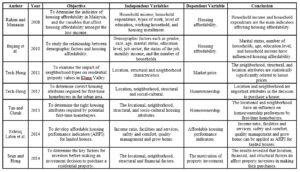

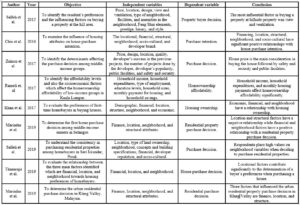

Table 1: Summary of previous research on housing affordability.

Sources: Authors’ analysis

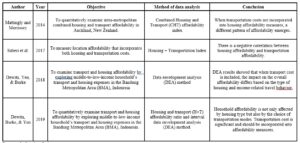

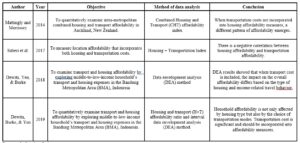

Table 2: Summary of previous research on transportation expenditure on housing affordability.

Sources: Authors’ analysis

Methodology

As discussed before, there a plethora of attributes has been tested concerning their influence on housing affordability. In this study, however, these attributes are proposed to assess and absent in most previous research, especially in the local context.

Conclusion

Housing affordability is a major challenge currently facing many countries. This paper stressed that housing affordability must be defined and assessed by a wider range of criteria. To determine whether the attributes matter, this paper includes several housing attributes. These include locational, neighborhood, structural and financial attributes of housing. This study also proposed a new factor namely transportation expenditure, along with other factors that were adopted from previous studies. These factors are expected to specifically highlight the issue of housing affordability. Finally, based on the review of the literature, a conceptual framework was proposed. This study is expected to identify the factors that influence the affordability issue, particularly involving transportation expenditure

Acknowledgment

The authors would like to express their sincere appreciation to Universiti Teknologi MARA for granting financial assistance to undertake this study.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Bujang, A. A., Zarin, H. A. and Jumadi, N. (2010) ‘The relationship between demographic factors and the participation of foreign workers’, Malaysia Journal of Real Estate, 5(1).

- Chia, J., Harun, A., Wahid, A., Kassim, M., Martin, D. and Kepal, N. (2016) ‘Understanding Factors That Influence House Purchase Intention Among Consumers in Kota Kinabalu : An Application of Buyer Behavior Model Theory’, Journal of Technology Management and Business, 3(2).

- Daly, J., Gronow, S., Jenkins, D. and Plimmer, F. (2003) ‘Consumer behavior in the valuation of residential property: A comparative study in the UK, Ireland and Australia’, Property Management, 21(5), pp. 295–314.

- Dewita, Y., Burke, M. and Yen, B. T. H. (2019) ‘The relationship between transport, housing and urban form: Affordability of transport and housing in Indonesia’, Case Studies on Transport Policy.

- Dewita, Y., Yen, B. T. H. and Burke, M. (2018) ‘The effect of transport cost on housing affordability: Experiences from the Bandung Metropolitan Area, Indonesia’, Land Use Policy, 79, pp. 507–519.

- Eshruq Labin, A. M. J., Che-Ani, A. I. and Kamaruzzaman, S. N. (2014) ‘Affordable housing performance indicators for landed houses in the central region of Malaysia’, Modern Applied Science, 8(6), pp. 70–86.

- Gan, Q., and Hill, R. J. (2009) ‘Measuring housing affordability: Looking Beyond the median’, Journal of Housing Economics, 18, pp. 115–125.

- Hurtubia, R., Gallay, O. and Bierlaire, M. (2010) ‘Attributes of households, locations, and real estate markets for land use modeling’, SustainCity Deliverable, 2(1).

- Kauko, T. (2007) ‘An analysis of housing location attributes in the inner city of Budapest, Hungary, using expert judgments’, International Journal of Strategic Property Management, 11, pp. 209–225.

- Khan, P. A. M., Azmi, A., Juhari, N. H., Khair, N. and Daud, S. Z. (2017) ‘Housing Preference for First Time Home Buyer in Malaysia’, International Journal of Real Estate Studies, 11(2).

- Li, J., Xu, Y. and Chiang, Y. H. (2014) ‘Property Prices and Housing Affordability in China: A Regional Comparison’, Journal of Comparative Asian Development, 13(3), pp. 405–435.

- Mariadas, P. A., Abdullah, H. and Abdullah, N. (2019a) ‘Factors Affecting Purchasing Decision of Houses in the Urban Residential Property Market in Klang Valley, Malaysia’, Journal of Social Sciences and Humanities, 16(4), pp. 1–9.

- Mariadas, P. A., Abdullah, H. and Abdullah, N. (2019b) ‘Factors influencing the first home purchase decision of middle-income earners in Selangor, Malaysia’, Journal of Social Sciences and Humanities, 16(1), pp. 1–11.

- Mattingly, K. and Morrissey, J. (2014) ‘Housing and transport expenditure: Socio-spatial indicators of affordability in Auckland’, Cities, 38, pp. 69–83.

- Mostafa, A., Wong, F. W. and Hui, C. M. E. (2006) ‘Relationship between housing affordability and economic development in Mainland China – Case of Shanghai’, Journal of Urban Planning and Development, 132, pp. 62–70.

- Mulliner, E. and Maliene, V. (2012) ‘What attributes determine housing affordability?’, International Journal of Social, Behavioral, Educational, Economic, Business and Industrial Engineering, 6(7), pp. 1833–1838.

- Natasha, I. and Hassan, Z. (2015) ‘Factors that influencing property investment decisions among Employees in Felcra Bhd’, International Journal of Accounting & Business Management, 3(2), pp. 160–177.

- Olanrewaju, A. L., Lim, X. Y., Tan, S. Y., Lee, J. E. and Adnan, H. (2018) ‘Factors affecting housing prices in Malaysia: Analysis of the supply side’, Journal of the Malaysian Institute of Planners, 16(2), pp. 225–235.

- Opoku, R. A. and Abdul-Muhmin, A. G. (2010) ‘Housing preferences and attribute importance among low-income consumers in Saudi Arabia’, Habitat International, 34, pp. 219–227.

- Rahim, N. M. S. @ A. and Munaaim, M. A. C. (2008) ‘Indicator of housing affordability in Malaysia’, in 2nd International Conference On Built Environment In Developing Countries, pp. 2075–2085.

- Rameli, N., Salleh, D. and Ismail, M. (2017) ‘Homeownership affordability of low-income group in Kuala Lumpur’, Advances in Social Sciences Research Journal, 4(3), pp. 215–227.

- Saberi, M., Wu, H., Amoh-Gyimah, R., Smith, J. and Arunachalam, D. (2017) ‘Measuring housing and transportation affordability: A case study of Melbourne, Australia’, Journal of Transport Geography. Elsevier, 65, pp. 134–146.

- Sabri, S., Ludin, A. N. M. and Johar, F. (2013) ‘Assessment of neighborhood affordability based on housing and transportation costs in Kuala Lumpur, Malaysia’, Planning Malaysia, pp. 75–100.

- Salleh, N. A., Murtadza, N. R., Johari, N. and Talib, Y. A. (2019) ‘Relative importance analysis of purchasing decision factors for residential properties in Bandar Seri Iskandar, Perak’, in 9th Asia Pacific International Conference on Environment-Behaviour Studies, pp. 159–164.

- Salleh, N. A., Zoher, S. A., Mahayuddin, S. A. and Abdul, Y. (2015) ‘Influencing factors of property buyer in hillside residential development’, Procedia – Social and Behavioral Sciences, 170, pp. 586–595.

- Sean, S. L., and Hong, T. T. (2014) ‘Factors affecting the purchase decision of investors in the residential property market in Malaysia’, Journal of Surveying, Construction & Property, pp. 1–13.

- Suhaida, M. S., Tawil, N. M., Hamzah, N., Che-Ani, A. I., Basri, H. and Yuzainee, M. Y. (2011) ‘Housing affordability: A conceptual overview for house price index’, Procedia Engineering, pp. 346–353.

- Sundrani, D. M. (2018) ‘Factors influencing the home-purchase decision of buyers of different types of apartments in India’, International Journal of Housing Markets and Analysis, 11(4), pp. 609–631.

- Tan, T. H. and Cheah, Y. Y. (2013) ‘Locational, Neighborhood, Structural and Socio-Cultural Attributes of Housing In Homeownership Decisions’, Journal of Chemical Information and Modeling, 53(9), pp. 1689–1699.

- Teck-Hong, T. (2011) ‘Neighborhood preferences of house buyers: the case of Klang Valley, Malaysia’, International Journal of Housing Markets and Analysis, 4(1), pp. 58–69.

- Teck-Hong, T. (2012) ‘Meeting first-time buyers’ housing needs and preferences in greater Kuala Lumpur’, Cities, 29, pp. 389–396.

- Thaker, H. M. T., and Sakaran, K. C. (2016) ‘Prioritisation of key attributes influencing the decision to purchase a residential property in Malaysia: An analytic hierarchy process (AHP) approach, International Journal of Housing, 9(4).

- Thanaraju, P., Khan, P. A. M., Juhari, N. H., Sivanathan, S. and Khair, N. M. (2019) ‘Factors affecting the housing preferences of homebuyers in Kuala Lumpur’, Journal of the Malaysian Institute of Planners, 17(1), pp. 138–148.

- Yusoff, Z. M., Adnan, N. A. and Rasam, R. A. (2014) ‘[H+T] Affordability Index for Low-Cost Housing Location-Distribution Procedure’, in Arte-Polis 5 Intl Conference – Reflections on Creativity: Public Engagement and the Making of Place.

- Zainon, N., Mohd-Rahim, F. A., Sulaiman, S., Abd-Karim, S. B. and Hamzah, A. (2017) ‘Factors affecting the demand of affordable housing among the middle-income groups in Klang Valley Malaysia’, Journal of Design and Built Environment, pp. 1–10.

- Źróbek, S., Trojanek, M., Źróbek-Sokolnik, A. and Trojanek, R. (2015) ‘The influence of environmental factors on property buyers’ choice of residential location in Poland’, Journal of International Studies, 8(3), pp. 164–174.