Introduction

Despite the substantial increase in the extent and scope of organizational use of IT, very few studies examined the determinants of IT expenditure. Most previous studies investigated the relationship between IT expenditure and organizational performance, focusing on the payoffs of IT investment. The empirical findings are inconclusive ranging from positive relationship to no relationship, or even negative relationship. It is therefore not appropriate to assume that IT expenditure can be explained in terms of anticipated organizational performance effects that may or may not be realized. There is clearly a need to study IT expenditure as the dependent variable, since we still lack a good understanding of the firm and industry factors that affect IT expenditure levels. Dewan et al. (1998) and subsequently Kobelsky et al. (2008) are a few studies that made good progress towards addressing this void by investigating firms’ annual IT budgets (1992-1997) as determined by the industry strategic IT role (i.e., the firm’s membership in industries undergoing IT-driven transformation), external environment (e.g., industry concentration) and organizational factors (e.g., profitability).

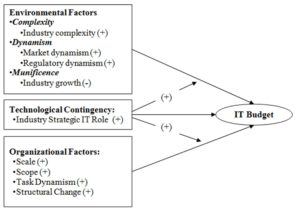

Built upon previous research, this research aims to develop a more comprehensive theory for explaining/predicting IT budget. The resulting theoretical model represents an important extension of the IT expenditure literature with several new constructs capturing internal and external dynamic complexity sources, extending the scope of the theory to turbulent environments. The extended model provides a better explanation of the role of external dynamic complexity factors such as competitive volatility, regulatory dynamism, and market volatility. It also accounts for the effects of internal dynamic complexity factors such as structural change. In addition to the main effects, we also examine the interaction between technological and non-technological factors. Practically, this research will provide practitioners with valuable insights into the IT budget decision.

The paper is organized as follows. In the next section, we develop and provide conceptual justification for the theoretical model. This is followed by a discussion of the methodology; then, we report the results and conclude the paper with a discussion of the implications and suggestions for future research.

Theoretical Development

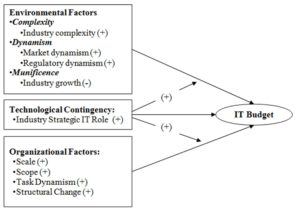

According to contingency theory, organizational strategy needs to be fit with environmental and organizational contingencies (Zajac, Kraatz., & Bresser, 2000). IT expenditure, considered as a strategic decision (Dehning, Richardson, & Zmud, 2003a; Kearns & Sabherwal, 2007) is also driven by the managers’ attempts to align their business strategy with the organizational and environmental contingencies. Thus, contingency theory is an appropriate framework for explaining IT expenditure. Accordingly, we conceptualize IT expenditure as a function of both environmental and organizational contingencies (Simon, 1999) that influence the direction and pace of the strategic deployment of IT (Johnston & Carrico, 1988). Furthermore, as the industry strategic IT role was found in previous research to have both direct and moderating effects on IT, we separate this technological contingency from the other environmental contingencies. As illustrated in Figure 1, our model stipulates three categories of contingencies driving IT expenditure: organizational contingencies, technological contingencies and environmental contingencies. Within each category, we include both static contingencies, e.g., scope and scale, and dynamic contingencies, e.g., rate of change. The need to account for dynamic contingencies is particularly salient for turbulent environments. The rapid pace of change and increasing global interdependencies in a turbulent environment require more flexible and adaptive organizations.

Figure 1: Theoretical Model for IT Budget

Environmental Contingencies and IT Expenditure

Research in both organizational theory and business policy has identified the firm’s competitive environment as an important contingency in understanding firm strategies and their relationships with firm performance (Pfeffer & Salancik, 1978). Environmental uncertainties create the need for greater innovation and product differentiation, requiring a higher level of dependence on IT (Kearns & Lederer, 2004; Sabherwal & Chan, 2001). According to the strategy literature, environmental uncertainty is conceptualized as a function of three environmental characteristics, i.e. complexity, dynamism and munificence (Bourgeois, 1980; Sharfman & Dean Jr., 1991).

Environmental Complexity

(labeled industry complexity) is conceptualized as the diversity and interdependence of environmental factors that organizations have to contend with (Dess & Beard, 1984). Market complexity or competition complexity encompassing factors such as customer demand, and suppliers’ and competitors’ actions (Dess & Beard, 1984) has been emphasized as impacting business strategy in general, and IT strategy in particular (Kuan & Chau, 2001). Complex markets make it more difficult for firms to both identify and understand the key drivers of performance (Wade & Hulland, 2004). Furthermore, market complexity creates the need for organizations to compete less on cost effectiveness, due to many dissimilar products/services, and more on innovation and differentiation of products and services (Porter, 1985). In other words, organizations must rely on economies of scope instead of economies of scale for competitiveness in such an environment (Miller, 1987). IT supports better integration and coordination of different organizational subunits and products (Malone, 1987). Therefore, the demand for both information processing and economies of scale provides a strong incentive for firms to increase IT expenditure. We accordingly hypothesize:

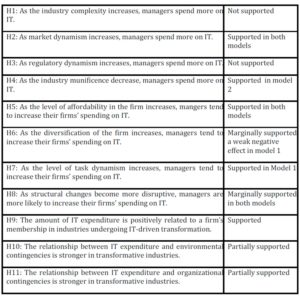

H1: As the industry complexity increases, managers spend more on IT.

Environmental Dynamism

describes the degree of environmental instability over time, and the turbulence caused by interconnectedness between organizations (Aldrich, 1979). Prior research focused on the dynamism caused by fast changes in products/services, as well as the unpredictability of the actions of suppliers, customers and competitors (Dess & Beard, 1984). However, as Baron (1995) pointed out, the environment of a business is also comprised of factors related to the government and these should not be ignored in any strategy research. Therefore, we specify two dimensions for environmental dynamism, i.e. market dynamism and regulatory dynamism. Market dynamism can be caused by innovation, change in technology, entry and exit of competitors, and change in customer demand (Badri, Davis, & Davis, 2000; Boyd & Fulk, 1996). Fast changes in competition and demand require firms to have more dynamic capabilities for anticipating and detecting these changes in a timely manner, and for quickly responding to their implications (e.g., new business models, increased interconnections, new basis of competition, new value proposition). Therefore, the higher the rate of change in competition and demand, the stronger is the need to build dynamic capabilities that permit the firm to flexibly combine IT and business resources (Sambamurthy, Bharadwaj, & Grover, 2003), in order to enhance surveillance, interpretation, initiative and opportunism. We accordingly hypothesize:

H2: As market dynamism increases, managers spend more on IT.

While market dynamism is representative of the actions of competitors, suppliers and customers,

Regulatory dynamism

highlights the influences of government and regulatory agents. Frequent changes in regulations may force firms to keep re-evaluating and adjusting their operations if they want to remain competitive (Badri, et al., 2000). As institutional theorists argue, firms are driven by coercive isomorphic pressures to conform to legal, social and cultural expectations (DiMaggio & Powell, 1983). With changes in regulations, these coercive pressures cause firms to adjust their structures, processes, and strategies in order to secure stability, legitimacy and access to resources (Haveman, Russo, & Meyer, 2001; McKay, 2001). The resulting adjustments often incur IT expenditures. Accordingly, we hypothesize:

H3: As regulatory dynamism increases, managers spend more on IT.

Environmental Munificence

generally refers to the extent to which an environment can provide sufficient resources for the firms operating within it (Aldrich, 1979). The rate of industrial sales growth (Dess & Beard, 1984) and the competition for resources (Mintzberg, 1979) serve as the key variables underlying this concept (Sharfman & Dean Jr., 1991). A market that has little growth may be extremely munificent if it contains few competitors, while a rapidly growing market may have little capacity for a given firm if there are many competitors (Bain & Qualls, 1987). Studies of business policy often address the effects of environmental munificence on a range of strategy and organization options (Tushman & Anderson, 1986). Firms in non-munificent environments are required to devote greater analytical effort to understand and master threats (Khandwalla, 1973). Koberg (1987) also observed that greater environmental scarcity causes frequent administrative, personnel, and strategic changes in firms, as well as the adoption of organic structures. Furthermore, in a non-munificent environment, the increasing demand for innovation provides a strong incentive for IT expenditure. IT adoption by itself is actually an innovation which transforms the previous organizational processes and proves to be important to obtain competitive advantages (Zahra & George, 2002).

H4: As the industry munificence decreases, managers spend more on IT.

Organizational Contingencies and IT Expenditure

Prior research identified two main categories of firm characteristics, i.e., scope and scale (Kobelsky, Richardson, & Zmud, 2002). Organizational scope describes how organizations may achieve higher levels of efficiency through the common and recurrent use of specialized and indivisible physical assets (Teece, 1980), while organizational scale refers to the size of the organization. Although prior research has demonstrated that scope is usually correlated with the scale or size of the firm, the strategy literature also asserts the independence of these two variables. The theory of core competencies (Prahalad & Hamel, 1990) implies that firms may increase their scale without necessarily changing their scope. Similarly, a diversification strategy implies that firms can expand their business lines under their current scale. Therefore, it is necessary to consider both scale and scope variables in modeling the effects of organizational contingencies on IT expenditure (Dewan, Michael, & Min, 1998). Organizations may use IT to address the internal control and coordination requirements of scale and scope. The role of IT, however, is not limited to control and coordination. It also extends to building dynamic capabilities, i.e. enhancing flexibility and adaptability of the organization. Therefore, it is also important to account for dynamic organizational contingencies in addition to static ones (scale and scope).

Organizational Scale is indicative of the availability of the resources needed for the acquisition and ongoing expenses of IT. Similar to other kinds of discretionary expenditures, such as R&D and advertising, IT expenditure is also subject to the level of affordability (Kobelsky, et al., 2002). Larger firms are usually richer in resources such as financial reserves, marketing expertise, production capability and general management experience, which can be viewed as potentially important facilitators of expansion and innovation (Kraatz & Zajac, 2001). Even within the small business category, the larger ones are more able to take risks with new technologies (Palvia, Means, & Jackson, 1994).

Furthermore, firms with large scale tend to perceive greater profit potential and ability to harness IT to exploit that potential, which provide strong incentives for IT investment (Dewan & Mendelson, 1998). Finally, firms with large scale also have higher demand for IT to realize economies of scale than smaller firms, which is obviously another driving force for IT adoption or use and subsequent IT expenditure.

H5: as the level of affordability in the firm increases, mangers tend to increase their firms’ spending on IT

Organizational Scope (Diversification)

contributes another major incentive for IT expenditure. As firms become more diversified, the demand for coordination or integration also increases. Firms may use IT as a common infrastructure to coordinate shared assets across products, markets and business units. Therefore, organizations with a broad scope require more coordination or control, driving the need for IT expenditure (Dewan, et al., 1998). Furthermore, large organizations tend to have increasing specialization and subsequent coordinative difficulties (Miller & Droge, 1986).

H6: As the diversification of the firm increases, managers tend to increase their firms’ spending on IT.

In response to new opportunities or trends, e.g., the rise of Internet and subsequent e-commerce, firms have to extend their set of activities, as well as modify many of their policies with respect to their existing activities. The resulting changes in organizations, together with advances in IT itself, provides strong motivation for mangers to reconsider the role of IT in shaping their business strategies. Using IT as ‘automate’ or ‘informate’ tools has been necessary, but insufficient in seizing opportunities and obtaining competitive advantages. The changing role of IT implies that, in addition to the ‘stable’ contingencies discussed above, IT expenditure is also driven by dynamic organizational contingencies. Thus, we further identify the following two dynamic organizational contingencies.

Task Dynamism (Dynamics of Diversification)

Competition in a turbulent environment is characterized by greater frequency of technological changes, shorter product life cycles, and faster changes in demands. In order to defend and improve their competitive position and to fully leverage their resources, managers may continuously extend their knowledge bases over time via entry into related product-markets (Helfat & Raubitschek, 2000), which is denoted as dynamics of diversification (Helfat & Eisenhardt, 2004). During this dynamic process, task dynamism, i.e., the number of exceptions or the frequency of unanticipated and novel events which require different methods or procedures for doing the job, increases (Van de Ven & Delbecq, 1974). Task dynamism also creates strong demand for information processing and fast response times (Bensaou & Venkatraman, 1995).

H7: As the level of task dynamism increases, managers tend to increase their firms’ spending on IT.

Structural Change can be defined in terms of the scale, scope and speed of change, distinguishing between convergent/incremental and radical/disruptive change (Greenwood & Hinings, 1996). Incremental change involves fine tuning the existing orientation and happens slowly and gradually, emphasizing continuity. Disruptive change, on the other hand, happens swiftly and affects almost all parts of the organization simultaneously, e.g., flattening, reengineering, downsizing or decentralizing. Compared with incremental change, disruptive change involves more vertical and horizontal communication to ensure coordinated actions (Nahm, Vonderembse, & Koufteros, 2003). When IT is convergent, it provides opportunities for firms to realize the overall shift in structure by creating capacities for action (Greenwood & Hinings, 1996), enabling the resulting structure to align with the changing environment (Keen, 1991). If successful, disruptive structural changes promise high returns (Venkatraman, 1994) that provide incentives for managers to invest in IT (Dewan & Mendelson, 1998). Therefore, we hypothesize that:

H8: As structural changes become more disruptive, managers are more likely to increase their firms’ spending on IT.

Technological Contingency and IT Expenditure

The strategic role of IT in the industry is proposed to capture the leveragability of the industry context within which a major IT investment is directed (Dehning, Richardson, & Zmud, 2003b). Schein (1992) and Zuboff (1988) conceptualized four strategic roles for IT:

•Automate: replacing human labor by automating business processes.

•Informate up: providing information about business activities to senior management.

•Informate down: providing information about business activities to employees across the firm.

•Transform: applying IT in new ways to fundamentally redefine business processes and relationships.

Prior research, e.g. (Chatterjee, Pacini, & Sambamurthy, 2002) has applied this typology to investigate the relationships between IT investment and firm performance. Technological changes by themselves are a main source of environmental uncertainty, influencing the firm’s activities and strategic decision making. Especially for IT investment, the application of industry strategic IT reflects the dominant level of technical maturity and implies potential strategic options. When the ‘transform’ mode, for instance, comes to dominate an industry, the structural changes taking place regarding value chains and market spaces essentially partition the industry’s members into a set of strategic groups, with each strategic group reflecting a unique competitive strategy and operating at a differential profitability level (Dehning, et al., 2003b). Although not all firms are engaged in ‘transformative’ mode, those investing in transformative IT would be likely to gain first-mover advantages and, therefore, realize more payoffs. The potential returns provide a considerable incentive for IT investment (Kobelsky, et al., 2002). A similar rationale can be applied to ‘informate’ or ‘automate’ modes, but due to the difference in the inherent cost associated with each mode, we expect the highest expenditure in the industries undergoing IT-driven transformation.

H9: The amount of IT expenditure is positively related to a firm’s membership in industries undergoing IT-driven transformation.

Technological contingency plays multiple roles in affecting IT expenditure, not only as a main contingency, but also as a catalyst strengthening the other contingencies’ effects on IT expenditure. The decision about IT expenditures is the joint result from firm and environmental demands for IT, and the inherent characteristics of IT, such as related risks, technical maturity and external technological environments. Compared with firms in transformative industries, those firms in automate or informate industries, although faced with the same level of uncertainty and internal demands, are not likely to invest in transformative IT, since the less mature technological environment, e.g., un-standardization, would induce more risk and less return. On the contrary, if the industries are undergoing IT-driven transformation, those firms would likely have a stronger incentive in increase IT expenditure. Recent empirical research provides supportive evidence that transformative IT investments are given higher value by investors (Chatterjee, Richardson, & Zmud, 2001; Dehning, et al., 2003b). Therefore, we also hypothesize strategic role of IT in the industry as a moderating factor, and expect the effects of environmental and firm factors to be higher in transformative industries (Kobelsky, et al., 2002).

H10: The relationship between IT expenditure and environmental contingencies is stronger in transformative industries.

H11: The relationship between IT expenditure and organizational contingencies is stronger in transformative industries.

Research Methodology

Measurement

Since our study is aimed at investigating the general pattern of determinants of IT budget, rather than individual differences, we use the objective approach in measuring contingency factors, without including the perception of managers. Another advantage of objective measures is that data for these measures are available from archival sources, which, in turn, facilitate replication and comparative studies (Boyd & Fulk, 1996). Furthermore, Weick (1979) argued that generalizability, accuracy, and simplicity cannot be achieved simultaneously. Considering the unavoidable trade-offs among these approaches, this research, therefore, tries to maximize generalizability and simplicity, with an unavoidable reduction in accuracy. Table 1 summarizes the measurement for each variable.

Environmental Contingencies As noted, we examine three characteristics of external environments, i.e., complexity, dynamism and munificence, at the aggregated level. Environmental complexity or industrial complexity is operationalized as the total number of firms divided by the total number of segments in 4-digit SIC code industry. This measurement not only considers the number of players, but also the level of heterogeneity of competition, both of which are regarded as pillar components for environmental complexity (Dess & Beard, 1984). Environmental dynamism is operationalized with two variables, i.e., market dynamism and regulatory dynamism. Market dynamism is measured by the standard deviation of industrial sales over last 5 years, indicating the dynamism derived from competition. Regulatory dynamism is measured by the newly issued or updated regulations in the year prior to the IT budget, reflecting the changing nature of the regulatory environment. Finally, environmental munificence is measured by the average growth rate of industry sales scaled by the number of competitors over the previous 5 years. All environmental contingencies are operationalized at the 4-digit SIC industrial level to ensure consistency among the measurements.

Table1: Measurement

Organizational Contingencies Both organizational scope and scale variables are operationalized in the same way as in prior studies (Kobelsky, et al., 2002). We use market value of the firm to indicate its size. Net income, representing the level of affordability, refers to the income or loss reported by a company after expenses and losses have been subtracted from all revenues and gains for the fiscal period including extraordinary items and discontinued operations. Diversification is measured by the total number of market segments. Size and net income are used to represent the organizational scope. Consistent with (Kobelsky, et al., 2002) we use volatility of earnings to measure task dynamism, since the dynamics of diversification usually lead to the changes in the way firms conduct their tasks, or task dynamism, which is reflected in changes in sales and expenses (Kobelsky, et al., 2002). To indicate structural change, we develop the coding schemes based on the definition of different types of structural change, i.e., incremental change vs. disruptive change (Greenwood & Hinings, 1996).

Technological Contingency The coding for industry strategic IT role was adapted from (Chatterjee, et al., 2001). In their paper, they provided the coding for the industrial strategic role of IT from 1995 to 1997, which was then matched with the SIC classification scheme used in our study.

Control Variables In testing the model, we also control for the possible effects of time and industry differences by using industry (2-digit SIC) and annual dummies. We do not report the results for the control variables, since they had no effects on IT budget.

Sample and Data Collection

Consistent with (Kobelsky, et al., 2008), this research employed the annual IT budget as the firm’s spending on IT as a percentage of sales in previous year as the dependent variable, since it can reflect managerial decisions in dynamic settings and is also an intuitive and easily understood measure that is widely used in research and in practice (Mitra & Chaya, 1996). InformationWeek and ComputerWorld are the only two publicly available sources of data on corporate IT spending and other measures of IT use in the US. The data from these sources have been used in a number of studies in the past (Bharadwaj, 2000; Hitt & Brynjolfsson, 1996; Ravichandran, Han, & Hasan, 2009; Santhanam & Hartono, 2003). Specifically, our sample includes companies that provided at least two consecutive years’ IT budget in InformationWeek from 1995 through 1997. This time period was utilized because it was after the year of 1994 that the Internet emerged as a recognized and viable business platform, which brought about major change in the industry strategic role of IT (Chatterjee, et al., 2001; Dehning, et al., 2003a). Since one of our main interests is to investigate the effect of the changing role of IT, this period provides a suitable context for us to investigate the dynamic nature of contingencies, as well as providing enough variance for the industry strategic IT role.

As InformationWeek did not use the same company names consistently over the years, the company names had to be standardized before matching the IT budget data with the other data sources. For example, some companies use different names or the same names in different formats (e.g., short names or in capital) in each year as separate cases; while others changed names during the data period, due to M&A or bankruptcy. Two separate researchers collected and consolidated the records and then compared their results to ensure precision of the data. After carefully cleaning and comparing the data, we achieved 673 observations in total of 385 companies.

As we mentioned, the theoretical model requires measures of a series of organizational, technological and environmental contingencies across two levels. Different data sources are therefore employed and matched. In addition to using InformationWeek as a major source for the dependent variable, we also relied on the following three sources for other variables. The first is the database of Compustat, which contains fundamental financial and market information on over 10,300 actively traded U.S. and Canadian companies, over 7,600 inactive companies filed with the Securities and Exchange Commission, and over 175 indexes. Using the companies in InformationWeek as search entries, we obtained the financial and other firm-level data, such as number of segments, sales, income, earnings, and industrial names (with codes). The second data source is the Federal Register online database, which is published by the Office of the Federal Register, National Archives and Records Administration (NARA). The Federal Register is the official daily publication for rules, proposed rules, and notices of Federal agencies and organizations, as well as executive orders and other presidential documents. We use standard industrial names as search terms to find the regulations relevant to each industry in each year. The Boolean logics were derived from the definition of SIC codes rather than the literal meaning of industrial names. Finally, LexiNexi was used to identify the structural change by coding news for each company across time. The unified company name obtained from Compustat was used as key word to collect news related to the company. The news items in each year were then pooled and coded by two independent raters to indicate the overall organizational change. We used 200 observations for pilot coding, and only 19 out of 200 cases were differently coded. Differences were resolved through discussion, and coding schemes were further clarified, which enhanced the consistency of the coding processes. Then, based on the refined coding scheme, two coders worked separately and the test of inter-rater reliability did not indicate significant difference between the two coding results.

Data Analysis and Results

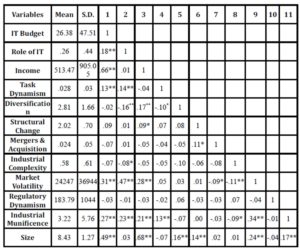

The hypotheses tested in this study include the main effects of contingencies and the moderation role of industry strategic IT roles. We use Ordinary Least Square (OLS) to test the model. Descriptive statistics and a pooled correlation matrix for all variables included in the study are summarized in Table 2. All variables exhibit reasonable variance in responses.

Table 2: Descriptive Results and Pearson Correlations

** p< 0.01; *p< 0.05 (2-tailed).

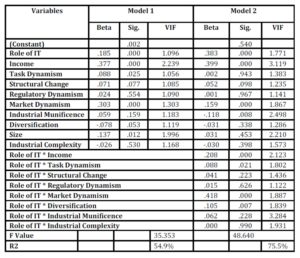

Table 3 provides the regression analysis results for both the reduced model (main effects) and the full model (with interactive effects). Both models are highly significant at p<0.001 with adjusted R2 of 54.9% (model 1) and 75.5% (model 2). Variance inflation factors (VIF) were computed for both models to assess multicollinearity. The highest value of VIF is lower than 4, indicating multicollinearity is not a serious problem in this study. The insignificant industry and annual dummies indicate that the IT budgeted expenditure is not influenced by industry differences and time effects.

Table 3: Regression Results

References

1. Aldrich, H. E. (1979). Organizations and Environments. Englewood Cliffs, NJ: Prentice-Hall.

2. Badri, M. A., Davis, D., & Davis, D. (2000). Operations Strategy, Environmental Uncertainty and Performance: a Path Analytic Model of Industries in Developing Countries. Omega, 28, 155-173.

Publisher – Google Scholar

3. Bain, J., & Qualls, P. D. (1987). Industrial Organization: A Treatise. Greenwich, CN: JAI Press.

4. Baron, D. (1995). Integrated Strategy: Market and Nonmarket Components. California Management Review, 37(2), 47-85.

Publisher – Google Scholar

5. Bensaou, M., & Venkatraman, N. (1995). Configurations of Interorganizational Relationships: A Comparison Between U.S. and Japanese Automakers. Management Science, 41(9), 1471-1492.

Publisher – Google Scholar

6. Bharadwaj, A. S. (2000). A Resource-Based Perspective on Information Technology Capability and Firm Performance: An Empirical Investment. MIS Quarterly, 24(1), 169-196.

Publisher – Google Scholar

7. Bourgeois, L. (1980). Strategy and Environment: A Conceptual Integration. Academy of Management Review, 5(1), 25-39.

Publisher – Google Scholar

8. Boyd, B. K., & Fulk, J. (1996). Executive Scanning and Perceived Uncertainty: A Multidimensional Model. Journal of Management, 22(1), 1-21.

Publisher – Google Scholar

9. Castrogiovanni, G. J. (1991). Environmental Munificence: A Theoretical Assessment. Academy of Management Review, 16(3), 542-565.

Publisher – Google Scholar

10. Chatterjee, D., Pacini, C., & Sambamurthy, V. (2002). The Shareholder-Wealth and Trading-Volume Effects of Information-Technology Infrastructure Investments. Journal of Management Information Systems, 19(2), 7-42.

11. Chatterjee, D., Richardson, V. J., & Zmud, R. W. (2001). Examining the Shareholder Wealth Effects of Announcements of Newly Created CIO Positions. MIS Quarterly, 25(1), 43-70.

Publisher – Google Scholar

12. Dehning, B., Richardson, V. J., & Zmud, R. W. (2003a). The value relevance of announcements of transformational information technology investments. MIS Quarterly, 27(4), 637-656.

Google Scholar

13. Dehning, B., Richardson, V. J., & Zmud, R. W. (2003b). The value relevance of announcements of transformational information technology investments. MIS Quarterly, 27(4), Forthcoming.

Google Scholar

14. Dess, G. G., & Beard, D. W. (1984). Dimensions of Organizational Task Environments. Administrative Science Quarterly, 29(1), 52-73.

Publisher – Google Scholar

15. Dewan, S., & Mendelson, H. (1998). Information Technology and Time-based Competition in Financial Markets. Management Science, 44(5), 595-609.

Publisher – Google Scholar

16. Dewan, S., Michael, S. C., & Min, C. (1998). Firm Characteristics and Investments in Information Technology: Scale and Scope Effects. Information Systems Research, 9(3), 219-232.

Publisher – Google Scholar

17. DiMaggio, P. J., & Powell, W. W. (1983). The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. American Sociological Review, 48, 147-160.

Google Scholar

18. Greenwood, R., & Hinings, C. R. (1996). Understanding Radical Organizational Change: Bringing Together the Old and the New Institutionalism. The Academy of Management Review, 21(4), 1022-1054.

Publisher – Google Scholar

19. Haveman, H. A., Russo, M. V., & Meyer, A. D. (2001). Organizational Environments in Flux: the Impact of Regulatory Punctuations on Organizational Domains, CEO Succession, and Performance. Organization Science, 12(3), 253-273.

Publisher – Google Scholar

20. Helfat, C. E., & Eisenhardt, K. M. (2004). Inter-Temporal Economies of Scope, Organizational Modularity, and the Dynamics of Diversification. Strategic Management Journal, 25, 1217-1232.

Publisher – Google Scholar

21. Helfat, C. E., & Raubitschek, R. S. (2000). Product Sequencing: Co-Evolution of Knowledge, Capabilities and Products. Strategic Management Journal, 21(10-11), 961-980.

Publisher – Google Scholar

22. Hitt, L. M., & Brynjolfsson, E. (1996). Productivity, business profitability, and consumer surplus: Three different measures of information technology value. Mis Quarterly, 20(2), 121-142.

Publisher – Google Scholar

23. Iacovou, C. L., Benbasat, I., & Dexter, A. S. (1995). Electronic Data Interchange and Small Organizations: Adoption and Impact of Technology. MIS Quarterly, 19(4), 465-485.

Publisher – Google Scholar

24. Johnston, H. R., & Carrico, S. R. (1988). Developing Capabilities to Use Information Strategically. MIS Quarterly, 12(1), 37-48.

Publisher – Google Scholar

25. Kearns, G. S., & Lederer, A. L. (2004). The Impact of Industry Contextual Factors on IT Focus and the Use of IT for Competitive Advantage. Information & Management, 41, 899-919.

Google Scholar

26. Kearns, G. S., & Sabherwal, R. (2007). Systems Planning Integration. IEEE Transactions on Engineering Management, 54(4), 628-643.

Publisher – Google Scholar

27. Keen, P. G. W. (1991). Shaping the Future: Business Design through Information Technology. Boston: Harbard Business School Press.

28. Khandwalla, P. N. (1973). Resource Scarcity, Environmental Uncertainty, and Adaptive Organizational Behavior. Academy of Management Journal, 16, 285-310.

29. Kobelsky, K., Richardson, V. J., Smith, R. E., & Zmud, R. W. (2008). Determinants and Consequences of Firm Information Technology Budgets. The Accounting Review, 83(4), 957-995.

Publisher – Google Scholar

30. Kobelsky, K., Richardson, V. J., & Zmud, R. W. (2002). Determinants of Budgeted Information Technology Expenditures. Paper presented at the Twenty-Third International Conference on Information Systems.

Google Scholar

31. Koberg, C. S. (1987). Resource Scarcity, Environmental Uncertainty, and Adaptive Organizational Behavior. Academy of Management Journal, 30(4), 798-807.

Publisher – Google Scholar

32. Kraatz, M. S., & Zajac, E. J. (2001). How Organizational Resources Affect Strategic Change and Performance in Turbulent Environments: Theory and Evidence. Organization Science, 12(5), 632-657.

Publisher – Google Scholar

33. Kuan, K. Y., & Chau, P. Y. K. (2001). A perception-based model for EDI adoption in small businesses using a technology—organization—environment framework. Information & Management(38), 507-521.

Publisher – Google Scholar

34. Malone, T. W. (1987). Modeling Coordination in Organizations and Markets. Management Science, 33(10), 1317-1332.

Publisher – Google Scholar

35. McArthur, A. W., & Nystrom, P. C. (1991). Environmental Dynamism, Complexity, and Munificence as Moderators of Strategy-Performance Relationships. Journal of Business Research, 23, 349-361.

Publisher – Google Scholar

36. McKay, R. B. (2001). Organizational Responses to an Environmental Bill of Rights. organization Studies, 22(4), 625-658.

Publisher – Google Scholar

37. Miller, D. (1987). The Structural and Environmental Correlates of Business Strategy. Strategic Management Journal, 8, 55-76.

Publisher – Google Scholar

38. Miller, D., & Droge, C. (1986). Psychological and Traditional Determinants of Structure. Administrative Science Quarterly, 31, 539-560.

Publisher – Google Scholar

39. Mintzberg, H. (1979). The Structure of Organizations. Englewood Cliffs, NJ: Prentice-Hall.

40. Mitra, S., & Chaya, A. K. (1996). Analyzing Cost-Effectiveness of Organizations: The Impact of Information Technology Spending. Journal of Management Information Systems, 13(2), 29-57.

Google Scholar

41. Nahm, A. Y., Vonderembse, M. A., & Koufteros, X. A. (2003). The Impacts of Organizational Structure on Time-based Manufacturing and Plant Performance. Journal of Operations Management, 21, 281-306.

Publisher – Google Scholar

42. Palvia, P., Means, D. B., & Jackson, W. M. (1994). Determinants of Computing in Very Small Businesses.Information & Management, 27, 161-174.

Publisher – Google Scholar

43. Pfeffer, J., & Salancik, G. R. (1978). The External Control of Organization: A Resource Dependence Perspective. New York: Harper & Row.

44. Porter, M. E. (1985). Competitive Advantage. New York: Free Press.

45. Prahalad, C. K., & Hamel, G. (1990). The Core Competence of the Organization. Harvard Business Review, 79-93.

46. Ramanujam, V., & Varadarajan, P. (1989).Research on Corporate Diversification: A Synthesis. StrategicManagement Journal, 10(6), 523-551.

Publisher – Google Scholar

47. Ravichandran, T., Han, S., & Hasan, I. (2009). Effects of Institutional Pressures on Information Technology Investments: An Empirical Investigation. IEEE Transactions on Engineering Management, 56(4), 677–691.

Publisher – Google Scholar

48. Sabherwal, R., & Chan, Y. E. (2001). Alignment Between Business and IS Strategies: A Study of Prospectors, Analyzers, and Defenders. Information Systems Research, 12(1), 11-33.

Publisher – Google Scholar

49. Sambamurthy, V., Bharadwaj, A., & Grover, V. (2003). Shaping Agility Through Digital Options: Reconceptualizing the Role of Information Technology in Contemporary Firms. MIS Quarterly, 27(2), 237-263.

Google Scholar

50. Santhanam, R., & Hartono, E. (2003). Issues in Linking Information Technology Capability to Firm Performance. MIS Quarterly, 27(1), 125-153.

Google Scholar

51. Schein, E. H. (1992). The Role of the CEO in the Management of Change: The Case of Information Technology. In T. A. Kochan & M. Useem (Eds.), Transforming Organizations (pp. 325-345). Oxford: Oxford University Press.

Google Scholar

52. Sharfman, M. P., & Dean Jr., J. W. (1991). Conceptualizing and Measuring the Organizational Environment: A Multidimensional Approach. Journal of Management, 17(4), 681-700.

Publisher – Google Scholar

53. Simon, C. A. (1999). Public School Administration: Employing Thompson’s Structural Contingency Theory to Explain Public School Administrative Expenditures in WAshington State. Administrative & Society, 31(4), 525-541.

Publisher – Google Scholar

54. Teece, D. J. (1980). Economics of Scope and the Scope of the Enterprise. Journal of Economic Behavior and Organization, 1(3), 223-247.

Publisher – Google Scholar

55. Tushman, M. L., & Anderson, P. (1986). Technological Discontinuities and Organizational Environments.Administrative Science Quarterly, 31, 439-465.

Publisher – Google Scholar

56. Van de Ven, A., & Delbecq, A. L. (1974). A Task Contingent Model of Work Unit Structure. Administrative Science Quarterly, 19(183-197).

Publisher – Google Scholar

57. Venkatraman, N. (1994). IT-Enabled Business Transformation: From Automation to Business Scope Redefinition. Sloan Management Review, 35(2), 73-87.

Google Scholar

58. Wade, M., & Hulland, J. (2004). The Resource-Based View and Information Systems Research: Review, Extension, and Suggestions for Future Research. MIS Quarterly, 28(1), 107-142.

Google Scholar

59. Weick, K. E. (1979). The Social Psyhcology of Organization (2nd. ed.). Reading, MA: Addison-Wesley.

60. Zahra, S. A., & George, G. (2002). The Net-Enabled Business Innovation Cycle and the Evolution of Dynamic Capabilities. Information Systems Research, 13(2), 147-150.

Publisher – Google Scholar

61. Zajac, E. J., Kraatz., M. S., & Bresser, R. K. (2000). Modeling the Dynamic of Strategic Fit: A Normative Approach to Strategic Change. Strategic Management Journal, 21(429-453).

Publisher – Google Scholar

62. Zuboff, S. (1988). In the Age of the Smart Machine: The Future of Work and Power. New York: Basic Books.

Google Scholar