Introduction

The banking system is an important area for economic development in any country. Its practical importance is determined by the way in which payments and settlements function in the national system. Commercial banks, operating in accordance with the national monetary policy, exert control over cash flow, which affects the rate of their turnover, emissions, including ready cash amounts in circulation.

Banks play a vital role in each country’s economy, since growth can be achieved if the savings are effectively channeled for investments. In this context, failure to involve the banking system is often defined as the main weakness of the centralized planned economy.

The world has been witnessing an economic recession for the last years or so and there seems to be no end in sight. The genesis of this financial disaster has been the supreme mortgage crisis in the USA. In a period of unbridled optimism that precluded the recession, American banks, mortgage companies and saving and loan associations provided housing loans and mortgages to thousands of eager buyers, and that enabled less than stellar credit worthy individuals to purchase an ownership in homes and other long term assets of their choice. The EU has also taken steps to revive its industries, enacting new capital requirements, governance and other rules and regulations that it hopes will prevent such a crisis from happening again. But by and large, the world economy needs to be rescued and put back on its feet (Abrahamson, 2000).

Clearly something is wrong with the way business has been conducted in banks. We not only need another business model, we need good and honest governance in order to make banking a success. The greed of bankers and their short-term insistence on earning fees and commissions needs to be looked at thoroughly. New rules need to be enforced that would look at the long-term fundamentals and prevent a crisis in any of the sectors that are so important for our business progress. Consequently, the banks also need to introduce economic innovations, as banks play a significant role in the Latvian economy (Komsomolskaya Pravda, 2006).

One of the most important conditions for economic development is an effective Latvian banking system. In the recent years the country created and developed a modern two-tier banking system. Competitive credit and financial infrastructure is gradually emerging, and commercial banks are its basic elements. Some of them have received high international ranking. Association of Latvian banks has become a national banking association.

However, the peculiarity of the Latvian banking system in that all of its assets may be compared with the assets of the relatively few North American bank, which means a lack of competitiveness of the banking industry. Thus, the total asset of Latvian commercial banks with assets of the Bank of Latvia at the end of 2009 did not exceed 30 billion LVL. For example, 6.9 thousand commercial banks operate in the USA (2.4 thousand in Germany). In this case, four of them – JPMorgan Chase, Citigroup, Bank of America and Wells Fargo – owned 64% of total banking assets in the country. Assets of only one of them – Bank of America Corp., exceeded 2.2 trillion USD (Bank of America Corporation, 2009).

There are both positive and negative points in this comparison. On the positive side one should include the fact that Latvia is a small country and the scale is not comparable, for example, with Germany, but rather comparable with Montenegro. We have different scales. Another thing is the USA, where the total assets of 416 problem banks at the end of June 2009 amounted to 299.8 billion dollars (Ria News, 2009). So the current situation in Latvia should not be complicated in order not to get lost in broad daylight.

The negative point is that the current level of aggregate capital of Latvian banks does not meet the requirements of economic growth and does not allow the banking system lending sector to deploy the real sector. The problem of capitalization of the Latvian banks lies in the fact that the increase of their lending exacerbated the growth of bad loans.

One of the most important issues that affect commercial banks is their profitability. Therefore it is essential to understand the extent to which the Latvian commercial banking profitability and efficiency indicators could affect the financial system, not only on micro-level, but also on the macro-level.

The aim of the present article is to determine the impact of the external and internal factors of bank performance on the profitability indicators of the Latvian commercial banks in the period from 2006 to 2011.

To achieve the goal the following research methods were used: quantitative and qualitative methods, including correlation and regression analysis results, monographic and descriptive method.

Literature Review

The issue of bank profitability and performance efficiency has been widely discussed in the scientific literature, it has also been considered in a number of theoretical and empirical researches of different kind. However, return on assets (ROA) and return on equity (ROE) have always been mentioned among the main indicators characterizing bank performance.

Bourke (1989) was one of the first who discovered in his research that exactly the internal factors of bank performance, such as net income before and after tax against total assets and capital and reserves factors, have the greatest impact on profitability indicators.

In turn, the studies conducted in the USA and Europe demonstrate that a great concentration of banks and financial institutions surpass profitability (Petersen and Rajan, 1995; Koskela, 2000; Shaffer, 2004; Degryse and Ongena, 2007). At the same time, Ramlall (2009) and Sufian (2009) discovered a positive relationship between the size of the bank and profitability – the larger the bank is, the more profitable it is in comparison with a smaller bank, thus demonstrating the effect of economy of scale. In contrast, Kosmidou (2008) states that large size of the banks may leave a negative impact on bank profitability, and Luo (2003) and Hannan and Prager (2009) note that small banks can earn higher profit because they have lower expenses and better performance efficiency. At the same time, Sayilgan and Yildirim (2009) maintain that bank liquidity declines along with the growth of the number of debtors and interest rate increase. Other studies, which address profitability, discuss positive operational efficiency. Kosmidou (2008) states that profitability grows along with the increase of the operational efficiency, in their turn, Berger et al (2000) correlate it with routine practical activities of an enterprise. Despite difference of opinion, all scholars agree that profitability and efficiency indicators consist of external and internal factors. For example, Rasiah et al (2010) in his research mentions asset portfolio mix, loans and interest income, investments, non-interest income earning assets, total expenses, operating expenses, personnel expenses, liability composition, deposit composition, liquidity ratios, capital structure as internal factors influencing profitability. In turn, external factors comprise regulations, inflation, interest rate, short and long terms effects of interest rate on assets, market share, market growth, firm size. Gul et al (2011) mention size, capital, loans, and deposits as internal factors influencing profitability of the bank, and GDP and inflation as external factors.

Internal Indicators

Internal indicators are bank size, operating efficiency, capital, credit risk, portfolio composition and asset management (Ramlall, 2009). These rates are variable and controllable. For example, asset quality provides loans to total assets, which can affect profitability (Aydogan, 1990), so the higher is the ratio, the higher is portfolio risk. Loans to total assets (LTA) and total loans (TL) are usually used as asset quality indicators. Asset size –total assets are used to determine the size of the bank, in the financial literature this indicator is referred to as log A (Smirlock, 1985). But capital adequacy determines the equity ratio of total assets (CA). CA is one of the main indicators for determination of the capital, which shows the bank’s capacity to cover losses (Hassan and Bashir, 2003). Deposits (DP)is an important source for funding of banks at the lowest cost.The more deposits are used to finance the loan, the higher will be the profits and interest margins, which together with the banks also make a positive impact on profitability. Liquidityis characterized by proportion of the liquid assets to total assets (LQD), since insufficient liquidity is one of the largest bank failures. So the income and expenditure structures determine the income and expenditure ratios, and their values are used to determine the Net Interest Margin (NIM) and Non-Interest Income (NII). Net Interest Margin debt has effect on the interest, and thus the bank’s efficiency. Other indicators include Non-Interest Income, debt commission, income and expenses, net gains and losses, as well as other operating income.

External Indicators

External indicators include macro-economic changes, and the banks are unable to exert control over them, since their impact occurs on the macro-level. Three main macroeconomic indicators that are used to determine a bank’s earning capacity are growth of annual gross domestic product (GDP) and annual inflation (INF). Gross domestic product growth (GDP) shows the total economic activity, as determined by demand and supply of bank loans and deposits, as well as the financial services industry profitability (Bikker and Hu, 2002). But increase of the overall rate of annual inflation (INF) in relation to all the goods and services can have both positive and negative effects on the profitability indicators of commercial banks (Kosmidou, 2006).

Specific Indicators

Specific indicators of the banks, such as return on assets (ROA) and return on equity (ROE), demonstrate how successfully the banks maintain their profitability. For instance, Fitch (2012) stressed that exactly ROA is one of the main indicators determining profitability of a bank.

Latvian Banking System

The Latvian banking system has evolved rapidly after Latvia regained independence. During the first four years from 1991 until 1994 licenses were received by 67 banks. Although total sum of assets of the banking system tripled between 1992 and 1994, only 47 out of 55 licensed banks at the end of 1994 could submit an annual report within the prescribed time-limits and only 16 of those ended the year with profit.

There are several reasons why Latvia had to go through the banking crisis. The banking sector developed too rapidly and much faster than the economic environment in which the sector operated. Real estate and securities markets were not developed enough to provide liquid collateral for the granted loans. Due to lack of experience bankers and businessmen made mistakes in crediting and evaluation of business plans.

There are also other reasons that aggravated the critical situation. There were the banks’ shareholders, who abused their position and the credence given to them, and used funds of the bank to finance their personal business. There were also such banks, management whereof facilitated fiddling of the accounting data and gave false information to the Bank of Latvia (Bikse, 2009).

Since 30 June 2010 the Latvian state has managed to keep three banks as its ownership – a newly created bank JSC Citadele Bank, which was separated from the JSC Parex Bank, now performing the functions of a settlement bank and State JSC Latvian Mortgage and Land Bank, which also performs functions of a development bank (at the end of September 2009 its share capital was 6.1% from the bank’s paid-up fixed capital). By decision of the government of the Republic of Latvia, 85.14% of JSC Parex Bank’s shares owned by the state on February 27, 2009, were transferred into holding of the State JSC Privatization Agency. Fixed capital of the JSC Parex Bank at the end of September 2009 was 16.1% from the banks’ paid-up fixed capital (Financial and Capital Market Commission, 2011).

As shown by the Association of Commercial Banks of Latvia (ACBL) data for the 4th quarter of 2011, in Latvia banking services are provided by 22 banks and branches of 9 foreign bank, the European Economic Area countries also established credit institutions or their branches, which submitted the application to the FCMC, one bank – VEF Banka –has its license revoked from 26.05.2010. JSC LatvijasKrājbankafiled bankruptcy.

Methodology

In the research the authors analyzed the Latvian commercial banks and branches of foreign banks, as well as credit institutions incorporated in the European Economic Area countries or their branches in Latvia for the time period from 2006 till 2011. The balance sheet data used in the study were derived from financial stability accounts of the Bank of Latvia and data available on the internet homepage of the Association of Latvian Commercial Banks.

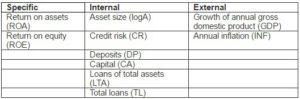

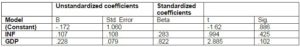

On the basis of research conducted by other authors and research by Rasiah (2010) and Gul et al. (2011), the authors determined internal and external factors influencing profitability indicators of Latvian commercial banks. The factors and their abbreviations are presented in Table 1.

Table 1: Bank Profitability Indicators, Abbreviations

In order to determine profitability of the banks and macroeconomic indicators, the authors have evaluated performance indicators of return on assets (ROA) and return on equity (ROE) of the Latvian commercial banks. For assessment of the profitability indicators the authors have used descriptive method and by using the SPSS data determination methods, correlation and regression analyses of the obtained data have been performed. The authors have also used a linear regression model for determination of the profitability indicators.

Research Results

Descriptive Statistic and Data from Correlation

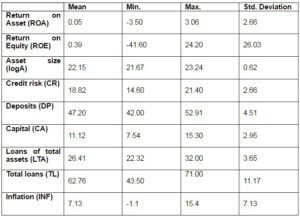

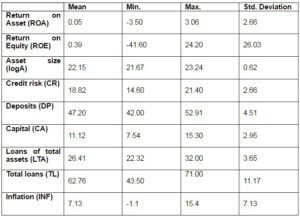

Descriptive statistical variables are summarized and presented in Table 2, which shows the mean value for each variable, as well as minimum and maximum values, and standard deviation. As shown by the data, average earnings of equity (ROE) in Latvian commercial banks during the period from 2006 till 2011increased by 0.39%, while return on assets (ROA) is 0.05% , which is explained by the fact that the crisis on the Latvian financial system of 2009 and 2010 has had its consequences. While the average capital adequacy ratio is 11.12%, corresponding to the bank’s requirements – 8%, the average credit – 18.82%, deposit rate – 62.76%, inflation rate – 7.13%.

Table 2: Indicators of Banks according to Descriptive Statistics

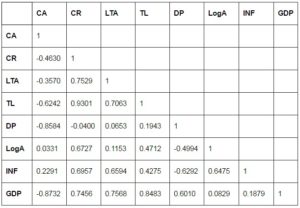

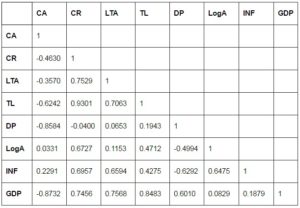

The obtained correlation data (Table 3) shows that there is a strong positive correlation between the CR and TL (r = 0.9301), but there is a negative correlation (- 0.8732) between capital (CA) and gross domestic product (GDP). By contrast, there is a weak correlation among many internal and external factors of bank performance, which may suggest that there is a problem of multicollinearity or this data interrelation does not exist.

Comparing with the previous research conducted by the authors, in which the data on Latvian commercial banks for the period from 2006 till the 2nd quarter of 2011 were considered, Pearson’s correlation data also showed negative correlation between CA un GDP (-87639), in turn, there was a strong positive correlation between TL and GDP (r = 0.942533) (Erina and Lace, 2011).

But as shown by the information available in the scientific literature, multicollinearity problem is observed only when the correlation is over 0.80, as stated in the study by Kennedy (2008). Consequently, the authors concluded that between bank representative indicators for internal and external data are nonexistent.

Table 3: Correlation Data on Interrelationships between the Bank’s Internal and External Indicators

Linear Regression Analysis

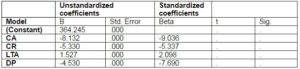

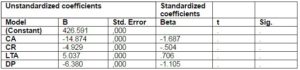

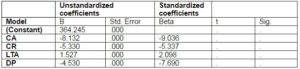

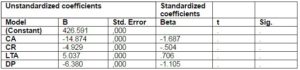

Table 4 shows the linear regression analysis of return on assets as an internal indicator. For the final model (TL) with dependent variable ROA, influence statistics cannot be completed because the fit is perfect. For the obtained data Durbin-Watson test indexis – 2.677.

Table 4: Return on Assets (Internal Indicators) – The Linear Regression Analysis

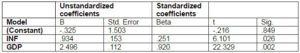

Table 5 shows the linear regression analysis of return on assets as an external indicator. The Durbin-Watson test index is 2.514.

Table 5: Return on Assets (External Indicators) – The Linear Regression Analysis

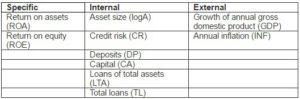

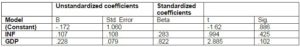

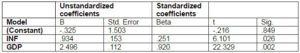

Table 6 shows the linear regression analysis of return on equity as an internal indicator. For the final model (TL) with dependent variable ROE, is the same than in TL and ROA model, the influence statistics cannot be completed because the fit is perfect. Durbin-Watson test was also used on the obtained data, the index is – 2.117.

Table 6: Return on Equity – The Linear Regression Analysis

Table 7 shows the linear regression analysis of return on assets as an external indicator. The Durbin-Watson test index is 2.300.

Table 7: Return on Equity (External Indicators) – The Linear Regression Analysis

The obtained data from linear regression analysis and Durbin-Watson test show when models have no absence of autocorrelation considering ROA and ROE internal indicators. Therefore ROA and ROE external indicators models indicate the absence of autocorrelation, there is also correlation between ROA internal and external indicators and ROE external indicators.

As shown by the obtained data, scientific literature and other researches to carry out researches then there exist data matching when took about bank profitability. For example, Alexiou and Sofoklis (2009) found the correlation between ROE and GDP and also discovered when these data together can ensure profitability. The same can be said about ROA and external indicators of bank performance. In the literature it was also discussed when ROE can influence only such internal indicators as credit risk. Researchers from Tunisia suggest that when there is a positive autocorrelation between ROA and internal and external indicators, there is the same correlation with ROE, and they can influence profitability.

Conclusion

Profitability is an important criterion for assessing operational efficiency of banks in the changing financial environment. With current research authors were able to find interconnection between bank specific and macroeconomic indicators in the Latvian commercial banks in the period from 2006 to 2011.

On the basis of the obtained results, the authors conclude that profitability has had a positive effect on operational efficiency, portfolio composition and management, while it has had a negative effect on the capital and credit risks, as measured according to ROA, while according to ROE, positive influence is exerted on composition of the capital portfolio and negative – on operational efficiency and credit risk. With regard to macroeconomic indicators, the authors have revealed that GDP has a positive impact on profitability as measured by ROA and ROE.

Considering the changes in macroeconomic indicators, the banks should be able to anticipate potential crises in order to avoid negative consequences for the bank-specific indicators. This issue is topical not only for researchers but also for the bankers themselves, including bank management and shareholders. In future research the author intends to perform comparison of profitability of the banks in the entire European Union to find the links that exist between the Latvian and foreign financial systems.

(adsbygoogle = window.adsbygoogle || []).push({});

References

Abrahamson, E. (2000). “Change without Pain,” Harvard Business Review, 1 July, 5.

Publisher – Google Scholar – British Library Direct

Alexiou, C. & Safoklis, V. (2009).”Determinants of Bank Profitability: Evidence from the Greek Banking Sector,” Economic Annals, 182, 93-118.

Publisher – Google Scholar

Association of Latvian Commercial Banks. (2011). Indices of Bank Activities in Q4 of 2011. [Online], [Retrieved September 1, 2011], http://www.bankasoc.lv/lv/statistika/

Publisher

Aydogan, K. (1990). “An Investigation of Performance and Operational Efficiency in Turkish Banking Industry,” Turkey, The Central Bank of Turkey.

Publisher – Google Scholar

Bank of America Corporation. (2009). [Online], [Retrieved July 8, 2011], http://finapps.forbes.com

Publisher

Berger, A. N., Bonime, S. D., Covitz, D. M. & Hancock, D. (2000).”Why are Bank Profits so Persistent? The Roles of Product Market Competition, Informational Opacity, and Regional-Macroeconomic Shocks,” Journal of Banking & Finance, 24(7), 1203-1235.

Publisher – Google Scholar – British Library Direct

Bikker, J. A. & Hu, H. (2002).”Cyclical Patterns in Profits, Provisioning and Lending of Banks and Procyclicality of the New Basel Capital Requiriments,” BNL Quarterly Review, 143-175.

Publisher – Google Scholar – British Library Direct

Bikse, V. (2009). Ekonomika un Bankas, Riga, LKA Konsultāciju un mācību centrs.

Publisher

Bourke, P. (1989). “Concentration and Other Determinants of Bank Profitability in Europe, North America and Australia,” Journal of Banking & Finance, 13, 65-67.

Publisher – Google Scholar

Degryse, H. & Ongena, S. (2007).”The Impact of Competition on Bank Orientation,” Journal of Financial intermediation, 16(3), 399-424.

Publisher – Google Scholar

Erina, J. & Lace, N. (2011). “Latvian Commercial Bank Profitability Indicators,” Proceedings of the 17th International Business Information Management Association (IBIMA), ISBN: 978-0-9821489-6-9, 14-15 November 2011, Italy, Milan.

Publisher – Google Scholar

Financial and Capital Market Commission. (2011). [Online], [Retrieved August 7, 2011] http://fktk.lv/en/market/credit_institutions/banks1/

Publisher

Fitch (2012). Fitch Ratings – ‘Definitions of Ratings and Other Forms of Opinion,’

Gul, S., Irshad, F. & Zaman, K. (2011). “Factors Affecting Bank Profitability in Pakistan,” The Romanian Economic Journal, 39, 61-87.

Publisher – Google Scholar

Hannan, T. H. & Prager, R. A. (2009). “The Profitability of a Small Single-Market Banks in an Era of Multimarket Banking,” Journal of Banking & Finance, 33(2), 263-271.

Publisher – Google Scholar

Hassan, M. K. & Bashir, A. H. M. (2003).”Determinants of Islamic Banking Profitability,” International Seminar on Islamic Wealth Creation. University of Durham, 7-9.

Publisher – Google Scholar

Kennedy, P. (2008). A Guide to Econometrics, Malden, MA, Blackwell Publishing.

Publisher – Google Scholar

Koskela, E. & Stenbacka, R. (2000). “Is there a Tradeoff between Bank Competition and Financial Fragility?,” Journal of Banking & Finance, 24(12), 1853-1873.

Publisher – Google Scholar

Kosmidou, K. (2008). “The Determinants of Banks’ Profits in Greece during the Period of EU Financial Integration,” Managerial Finance, 34(3), 146-159.

Publisher – Google Scholar – British Library Direct

Luo, X. (2003). “Evaluating the Profitability and Marketability Efficiency of Large Banks. An Application of Data Envelopment Analysis,” Journal of Business Research, 56(8), 627-635.

Publisher – Google Scholar

Petersen, M. A. & Rajan, R. G. (1995). “The Effect of Credit Market Competition on Lending Relationships,” Quarterly Journal of Economics, 110(2), 407-443.

Publisher – Google Scholar – British Library Direct

Ramlall, I. (2009). ‘Bank-Specific, Industry-Specific and Macroeconomic Determinants of Profitability in Taiwanese Banking system: Under Panel Data Estimation,’ International Research Journal of Finance and Economics, 34, 160-167.

Google Scholar

Rasiah, R., Gammeltoft, P. & Jiang, Y. (2010). “Home Government Policies and Outward Foreign Direct Investment from Emerging Economies: Lessons from Asia,” International Journal of Emerging Markets, 5(3), 333-357.

Publisher – Google Scholar

Ria News. (2009). [Online], [Retrieved September 10, 2011], http://en.rian.ru

Publisher

Sayilgan, G. & Yildirim, O. (2009).’Determinants of Profitability in Turkish Banking Sector: 2002-2007,’ International Research Journal of Finance and Economics, 28, 207-214.

Google Scholar

Shaffer, S. (2004). “Patterns of Competition in Banking,” Journal of Economics and Business, 56(4), 287-313.

Publisher – Google Scholar

Smirlock, M. (1985). “Evidence on the (Non) Relationship between Concentration and Profitability in Banking,” Journal of Money Credit and Banking, 17, 69-83.

Publisher – Google Scholar

Sufian, F. (2009). “Determinants of Bank Efficiency during Unstable Macroeconomic Environment: Empirical Evidence from Malaysia,” Research in International Business and Finance, 23, 54-77.

Publisher – Google Scholar