Introduction

The governance of an organisation is typically related to its policies, organizational structures and procedures by which the organisation is administered and manages itself both internally and externally. The Cadbury Committee (1992) viewed corporate governance as “the system by which companies are directed and controlled’ (p.15). With the increasing importance of corporate social responsibility (CSR) in today’s business environment, organisations have no choice but to include social and environmental risks management as part of their enterprise risk management system. The scope of corporate governance of organisations today has expanded to include the management of social and environmental risks to ensure that the organisations comply with the applicable laws and regulations. The board of directors of a corporation as the highest governing body has a critical role to play in the governance of an organization including managing the social and environmental risks. The board of directors as agents has the duty of making sure that management of the organisation is behaving in a way that will provide the optimal value for shareholders (Coles et al., 2001) to ensure that the firms’ activities are aligned with the set objectives of the organisation. The board of directors is therefore required to direct and monitor the activities of top management as such activities have been argued will be able to improve the quality of the managers’ decisions (Monks and Minow, 1995).

Therefore, one critical aspect of the role of the board members relates to overseeing risks management system as such risks management system will ensure that the organisations will not be exposed to excessive financial and business risks that could result in the organisation becoming financially distressed. Anderson and Anderson (2009) pointed out that an effective risk management system will enable an organization to reduce the adverse effects of various risks both quantitatively and qualitatively. They argued that a proper risk management implementation allows an organization to respond to the negative consequences caused by various risks and furnishes a steady stream of business opportunities that can reduce the volatility in corporate earnings. However, despite the emergence of social and environmental risks in today’s business environment, risks mitigation systems involving such risks are still ignored by many organisations where they still do not spend time in planning risk reduction strategies relating to such risks for their organisations. Therefore, the focus of this study is to examine the extent to which plantation companies in Malaysia address their social and environmental risks management issues and the role of the board of directors in influencing the quantity of disclosure of social and environmental risk management information. Such study in the context of an emerging economy such as Malaysia is still lacking even though the emergence of such risks is becoming more prevalent especially in plantation industries.

The aim of this study is to examine the extent to which plantation companies in Malaysia address their social and environmental risks management issues and the role of the board of directors particularly board characteristics in motivating the disclosure of risk management information by plantation companies in Malaysia for the year 2013. In this context, it is expected that the board of directors as agents for the shareholders will be motivated to disclose the social and environmental risks management information in their corporate reports to reduce information asymmetry and to ensure greater transparency. Therefore, the Agency theory is used to underpin arguments for this study. The focus of this study is in the plantation industry where such industry is subjected to a higher degree of social and environmental risks and is expected to provide more information in their corporate reports relating to social and environmental risks. In summary, this paper seeks to answer the following two questions:

- To what extent do the plantation companies in Malaysia address their social and environmental risks?

- What is the relationship between board characteristics and the disclosure of social and environmental risks management information?

The findings of this study will help to identify the gaps that may exist between the roles of the board of directors in determining the risks information disclosed. Despite the importance of the disclosure of risks management information to stakeholders for decision-making purposes specifically about equity and debt investment decisions, prior research reveals that the amount of disclosure of risks information in corporate annual reports remains inadequate (Ntim et al., 2013; Taylor, 2011). The inadequacy is especially critical for studies on social and environmental risks disclosure.

The remainder of this paper is organized as follows. Section 2 discusses the literature review and hypotheses generation. Section 3 presents the research methodology. The research findings are presented in Section 4. The last part highlights the conclusion and implications of the results.

Literature Review and Hypotheses Generation

Agency Theory

Agency theory has been widely used in empirical research published on the subject of the board of directors. Therefore, corporate governance problems may arise when two parties are involved, the managers as agents and the shareholders as principals where there is no substantial reason to believe that the managers will always act in the shareholders’ best interest (Jensen and Meckling, 1976). Therefore, it is the responsibility of the board to represent the shareholders’ interests. Jensen (1993) also argues that the board of directors is crucial to ensure the effectiveness of a company’s internal control systems:

“The problem with corporate internal control systems starts with the board of directors. The board, at the apex of the internal control system, has the final responsibility for the functioning of the firm. Most importantly, it sets the rules of the game for CEO” (Jensen, 1993, p.862).

Therefore, since risks management is part of the internal control system of an organization, the role of the board of directors is critical to ensuring that the organisation considers and develops a system to mitigate all types of risks that it is exposed to including social and environmental risks.

Social and Environmental Risks

In the current business setting, organisations cannot afford to ignore social and environmental issues if they are to survive and succeed in the present environment because these are emerging risks area that is of growing importance in an increasingly global economy. The traditional risk management framework does not address corporations’ exposure to social and environmental risks such as the implications of emitting greenhouse gasses and the global increase in carbon dioxide emissions. As a result, many new frameworks on risks have been developed to incorporate social and environmental concepts into businesses, namely, social, governmental and political systems. For example, Knott and Fox (2010) presented a model which enable users to follow a structured assessment process that integrates sustainability objectives and risks management technique. Delai and Takahashi (2011) also proposed a sustainability measurement system (SMS), which is designed into two phases. The first phase is to determine the steps necessary for developing SMS through an extensive sustainability and performance measurement system based on the development of literature review, whereas the second phase is to develop a comparative analysis of the eight sustainability measurement initiatives. Additionally, sustainability offers a new way of looking at risks. Sustainability, together with traditional risk identification, gives risk managers the information they need to make better-informed decisions on an array of risks including social and environmental issues (AON, 2008).

Board of Directors Characteristics

An active board of directors is expected to be able to lead and monitor the organisations appropriately. In corporate governance, directors are entrusted with the responsibilities and duties about a company’s affairs where they are accountable in steering the organisation to maximise shareholders’ value. Of late, there is a growing amount of literature that has provided evidence that the support and commitment from top leadership are essential for the enhancement of CSR initiatives (Maclean & Rebernak, 2007, Janggu, Darus, Mohamed Zain and Sawani, 2014). Such support and commitment by top leadership will result in organisations gaining competitive advantage (Guarnieri and Kao 2008). In this study, it is expected that the characteristics of board members can influence the organisation commitment to social and environmental risks management system which will subsequently lead to improved disclosure relating to social and environmental risks. In this study, board characteristics namely; board interlock, professionalism of board members in the context of their qualification and the size of the board is expected to influence the disclosure of social and environmental risks related information.

Board Interlock

Interlocking boards is a situation where the board members of one organization are also elected as members of the board of other organisations. In such case, these interlocking boards form a director network to carry the knowledge and corporate practices, either bad or good, between companies (Chiu, Teoh, & Tian, 2013). The board interlock could result in the spread of imitation practices (Westphal et al. 2001; Brandes et al. 2006; Chiu et al., 2013). These imitation practices are more likely to happen in a situation of uncertainty such as in risk management strategies relating to social and environmental risks where the strategies and mitigation practices of such risks are still new. Therefore, as interlocked directors observed social and environmental risk practices in other firms, they may adapt such strategies and practice choices. Therefore, the first hypothesis developed for this study is as follows:

H1. Board interlock is positively and significantly related to risks management disclosure.

Board Professionalism

According to DiMaggio and Powell (1983), there are two aspects of professionalisation. First, is through the formal education, either by universities or professional training institutions and second, is through professional networks, where the change of ideas and information has induced an organisation to be similar to its peers (DiMaggio & Powell, 1983, p. 152). Prior literature has found links between professionalism and the implementation of new accounting practices (Irvin 2008; Carpenter and Feroz, 2001; Touran, 2005). In this study, it is expected that formal education of the board of directors will influence their way of thinking in the context of social and environmental risks disclosure particularly when there is now more emphasis in universities training on issues of sustainability. Therefore, the second hypothesis developed for this study is as follows:

H2. Board professionalism is positively and significantly related to risks management disclosure.

Board Size

The relationship between board size and its effectiveness in making business decisions remains as an elusive area. For example Jensen (1993) concluded that larger board was less effective in coordinating communication and decision making and is more likely to be controlled by the CEO. However, Laiho (2011) found that large board size is believed to be able to monitor the management better than small board size as they internalize larger part of the monitoring costs and have sufficient voting powers to influence the corporate decisions thus reducing the agency costs. Darus, Mat Isa, Yusoff, and Arshad (2015) found that the number of directors on the board influences the CSR information disclosed in companies’ annual and sustainability reports. Due to the mixed findings, this study hypothesized that as risk is a critical aspect of the business operations with multitude facets; larger board size will be more efficient in managing risk. Thus, the third hypothesis for this study was developed as follows:

H3. The larger the board size, the higher the risks management disclosure.

Research Method

The sample for this study is comprised of forty (40) public listed companies from the Plantation industry in Malaysia for the year 2013 which is comprised of the whole population of the public-listed companies listed on Bursa Malaysia. A content analysis of the annual and sustainability reports was undertaken to determine the quantity of social and environmental risks information reported by the plantation companies. As suggested by Zeghal & Ahmed (1990), one of the limitations in using content analysis to measure disclosure quantity is the element of subjectivity involved in determining a particular type of disclosure. To overcome this limitation, the components of risks management disclosure to be investigated in this study were segregated between social and environmental disclosure and were grouped as follows:

Social risks

- human resources/workplace

- community involvement

- marketplace

- stakeholders

- occupational, safety, and health

Environmental risks

- law & regulation

- pollution abatement/environment awareness

- sustainability development/environmental commitment

- environmental management

The quantity of social and environmental disclosure was measured by the number of sentences relating to the categories disclosed. To test the relationship between independent and dependent variables in this study, the data were then analysed using the Partial Least Square – Structural Equation Modelling (PLS-SEM) approach using the software version 2.0 developed by Ringle, Wende and Will in 2005.

Results and discussion

Descriptive Analysis

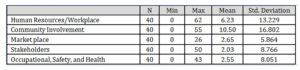

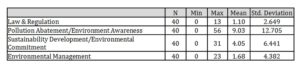

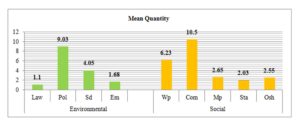

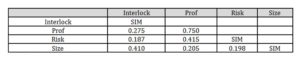

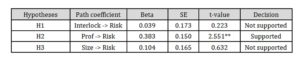

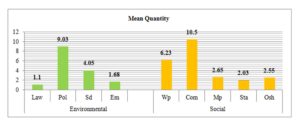

Table 1 and Table 2 present the descriptive analysis of the social and environmental risks disclosure. The results revealed that for the social risks disclosure, the highest mean score was for the Community Involvement (10.50) followed by the Human Resources/Workplace (6.23). The results suggest that the companies were concerned about the impact of their activities on the community and were taking steps to ensure that the risks of their business activities in the community were addressed and mitigated. The companies were also concerned about the risks exposure of the employees in the workplace. While for the environmental risks, the most disclosed item relates to Pollution Abatement/Environment awareness (9.03) while the least disclosed item was for the category Law & Regulation (1.10). Since the companies are comprised of plantation companies, the effects of their operation in the context of pollution were of primary concern to the companies, and they seemed to portray that they are aware of such risks and are having a proper environmental pollution abatement strategies to mitigate such risks.

Table 1: Descriptive Analysis for Social Risks Disclosures

Table 2: Descriptive Analysis for Environmental Disclosures

Figure 1 presents the mean score for the descriptive analysis of the social and environmental risks disclosure.

Figure 1: Mean Score for the Social and Environmental Risks Disclosure

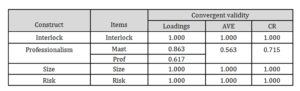

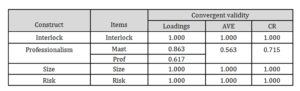

The Measurement Model

Table 3 summarizes the results of the internal reliability and convergent validity for the constructs. Convergent validity was assessed based on factor loadings, average variance extracted (AVE) and composite reliability (CR) through a procedure called Fornell and Lacker, (1981). All the factor loadings were above the recommended level of 0.5 (Chin, 1998). The AVE quantifies the amount of variance that a construct captures from its indicators relative to measurement error and should be greater than 0.50 (Chin, 1998) which means that 50 percent or more variance of the indicators should be accounted for. Meanwhile, CR should be greater than 0.7 as a benchmark for a “modest” reliability. This condition is satisfied for the CR and AVE as shown in Table 3.

Table 3: Measurement Model

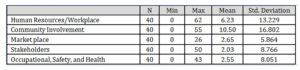

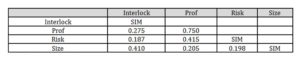

Table 4 presents the results for the discriminant validity of constructs. To assess discriminant validity, AVE should be greater than the variance shared between the construct and other constructs in the model (i.e., the squared correlation between two constructs). Discriminant validity is said to be adequate when the diagonal elements are significantly greater than the off-diagonal elements in the corresponding rows and column. This condition is satisfied as shown in Table 4.

Table 4: Discriminant Validity Constructs

Note: Diagonal represents the square root of the average variance extracted while the other entries represent the correlations.SIM=Single Item Measure

Therefore, from the results presented in Table 3 and Table 4, the measurement model used demonstrated adequate reliability, convergent validity, and discriminant validity.

The Structural Model

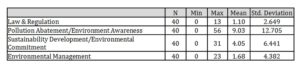

Figure 2 shows the explanatory capacity of the structural model for the study. The structural model indicates the causal relationships among the constructs in the model, which includes the estimates of the path coefficients and the coefficient of determination, R² value. Together, the R² and path coefficients (loadings and significance) indicate how well the data support the hypothesized model (Chin, 1998). The R² value for the relationship between the independent variables and risk management disclosures was 0.187 which indicates that 18.7% of the variance in risk management disclosures can be explained by board characteristics.

Figure 2: Explanatory capacity of the structural model

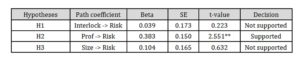

Table 5 presents the results of the hypotheses testing. The results from Table 5 revealed that the professionalism of the board of directors is significant with risk management disclosure. Therefore, H2 is supported.

Table 5: Results of Hypotheses Testing

**p 2.33)

The results of the study imply that even when the board members of one organization are also elected as members of the board of other organisations, such practices are not facilitating the social and environmental risks management strategies between the organisations. This finding, therefore, does not support arguments made by Chiu, Teoh, & Tian (2013); Westphal et al.(2001); Brandes et al. (2006) wherein such situation imitation practices were argued to be more likely to happen. The insignificant results could be because the interlocking directorships were on the board of companies where good social and environmental risks management strategies have not been put in place resulting in non-imitation practices. Therefore, H1 is rejected. Similarly, the result for H3 reveals that the size of the board is not significant in the context of this study. Therefore, the size of the board plays no role in determining the risk management strategies relating to social and environmental disclosure. These findings are contrary to previous studies done on board size and CSR disclosure where the results of these studies reveal that board size is a predictor of CSR reporting (Said et al. 2009; Darus et al. 2015).

With regards to professionalism, the results from H2 imply that companies whose board members are professionally qualified will facilitate the organisations to address issues of social and environmental risks management. The findings are therefore consistent with prior literature that has found links between professionalism and the implementation of new practices (Irvin 2008; Carpenter and Feroz, 2001; Touran, 2005). Therefore, H2 is accepted.

Conclusion

The aim of this study is to examine the extent to which plantation companies in Malaysia address their social and environmental risks management issues, and the role of the board of directors particularly board characteristics in motivating the disclosure of risks management information for the year 2013. The agency theory was used to underpin arguments where the board of directors as agents would be motivated to disclose the social and environmental risks management information in their corporate reports to reduce information asymmetry and to ensure greater transparency. The results of the study revealed that for social risks, the plantation companies were concerned with Community Involvement issues and were taking steps to ensure that their business activities were not causing harm to the community. While for the environmental risks, the companies were concerned with Pollution Abatement/Environment awareness risk management issues. The findings are consistent with the nature of the plantation companies where the effects of their operation may cause harm to the environment and as such they seemed to be taking the necessary steps to address this issue by having proper environmental pollution abatement strategies to mitigate such risks.

Further statistical analysis revealed that board professionalism is a determinant for risk management disclosures. However, board interlock and board size were found to be insignificant. The results suggest that professionalism of the board of directors supports the organization in addressing issues of social and environmental risks management system which are a new risk management area especially in an emerging economy such as Malaysia. The insignificant results for board interlock in this study merit further investigation. The insignificant results could be because interlocking directorships happen in companies with poor social and environmental practices resulting in no imitation of such practices.

One of the biggest challenges for plantation companies in Malaysia is to ensure that their operations do not take place at the expense of the natural ecosystems because the palm oil industry is vital to the economy of the nation. This study provides empirical evidence that the plantation industry in Malaysia is taking steps to safeguard the social and environmental impact of their business operations by protecting the community rights and undertaking pollution abatement strategies as an integral part of the plantation management system. The board of directors as agents needs to play their roles to ensure that the best interest of the shareholders as principals of the organisations is being upheld.

Acknowledgements

The authors would like to express their gratitude to the Accounting Research Institute, Ministry of Education, Malaysia and Universiti Teknologi MARA for funding and facilitating this research project.

References

- Anderson, D. R., & Anderson, K. E. (2009). Sustainability Risk management. Risk Management and Insurance Review, Vol.12 (No.1).

Google Scholar

- (2008). Sustainability – Beyond Enterprise Risk Management. AON Industry Update – Sustainability.

- Brandes, P., Hadani, M., & Goranova, M. (2006). Stock Options Expensing: An Examination of Agency and Institutional Theory Explanations. Journal of Business Research, 59, 595-603.

Google Scholar

- Cadbury Code, The (December 1992). Report of the Committee on the Financial Aspects of Corporate Governance: The Code of Best Practice, Gee Professional Publishing, London.

- Carpenter, V. L., & Feroz, E. H. (2001). Institutional Theory and Accounting Rule Choice:An analysis of four US State Governments’ Decisions to Adopt Generally Accepted Accounting Principles. Accounting, organizations and Society, 26, 565-596.

- Chin, W.W. . (1998). The Partial Least Square approach to Structural Equation Modeling. London Erl Associates, UK.

- Chiu, P.-C., Teoh, S. H., & Tian, F. (2013). Board Interlocks and Earnings Management Contagion. American Accountig Association, 88(3), 915-944.

- Coles, J.W., McWilliams, V.B. and Sen, N. (2001). An examination of the relationship of governance mechanism to performance, Journal of Management, Vol.27, pp 23-50.

Google Scholar

- Darus, F., Mat Isa, N.H., Yusoff, H. and Arshad, R. (2015), Corporate Governance and Business Capabilities: Strategic Factors for Corporate Social Responsibility Reporting, Journal of Accounting and Auditing: Research & Practice, Vol 2015, 1-9

- Delai, I., & Takahashi, S. (2011). Sustainability measurement system: a reference model proposal. Social Responsibility Journal, 7(3), 438-471.

Google Scholar

- DiMaggio, P. J., & Powell, W. W. (1983). The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. American Socialogical Review, 48(April), 147 – 160.

- Fornell, C., & Larcker, D. F. (1981). Evaluating Structural Equation Models with Unobseved Variables and Measurement Error. Journal of Marketing Research, 18(1), 39-50.

Google Scholar

- Guarnieri, R., & Kao, T. (2008). Leadership and CSR – a perfect Match: HowTop Companies for Leaders Utilize CSR as a competitive People & Strategy, 31(3).

Google Scholar

- Irvin, H. (2008). The Global Institutionalization of Financial Reporting: The Case of United Arab Emirates. Accounting Forum, doi:10.1016/j.accfor.2007.1012.1003.

Google Scholar

- Janggu, T., Darus, F., Mohamed Zain, M., and Sawani, Y., (2014), Does good corporate governance lead to better sustainability reporting? An analysis using structural equation modelling, Procedia – Social and Behavioral Sciences, Volume 145, 25 August 2014, Pages 138—145,

Google Scholar

- Jensen, C.M. and Meckling, W.H. (1976). Theory of the firm: Managerial Behaviour, agency costs and ownership structure, Journal of Financial Economics 3, pp 305-360.

Google Scholar

- Jensen, M. (1993). The modern industrial revolution, exit and failure of internal control system, Journal of Finance, Vol. 48, pp 831-880.

Google Scholar

- Knott, G., & Fox, A. (2010). A model of sustainability risk management. Emergency Management, 38-42.

- Laiho, T. (2011). Agency theory and ownership structure – Estimating the effect of ownership structure on firm performance. Master’s Thesis Aalto University.

Google Scholar

- MacLean, R., & Rabernak, K. (2007). Closing the credibility Gap: The Challenges of corportae responsibility reporting. Environmental Quality Management, Summer, 1-6.

Google scholar

- Monks, R., Minow, N., (1995) Corporate Governance, Blackwell, Cambridge, MA

- Ntim, C. G., Lindop, S., & Thomas, D. A. (2013). Corporate governance and risk reporting in South Africa: A study of corporate risk disclosures in the pre- and post – 2007/2008 global financial crisis periods. International Review of Financial Analysis, 30, 363 – 383.

Google Scholar

- Ringle, C., Wende, S., & Will, A. (2005). SmartPLS 2.0 (Beta). Hamburg, (www.smartpls.de)

- Said, Roshima, Zainuddin, Yuserrie HJ, & Haron, Hasnah. (2009). The relationship between corporate social responsibility disclosure and corporate governance characteristics in Malaysian public listed companies. Social Resposibility Journal, 5(2), 212-226.

Google Scholar

- Taylor, D. (2011). Corporate Risk Disclosures: the Influence of Institutional Shareholders and Audit Committee. (Unpublished), RMIT.

- Touran, P. (2005). The adoption of US GAAP by French firms before the creation of the International Accounting Standard Committee: an institutional explanation. Critical Perspective on Accounting, 16, 851-873.

Google Scholar

- Westphal, J. D., Seidel, M.-D. L., & Stewart, K. J. (2001). Second-order Imitation: Uncovering Latent Effects of Board Network Ties. Administrative Science Quarterly, 46, 717-747.

Google Scholar

- Zeghal, D., & Ahmed, S. A. (1990). Comparison Of Social Responsibility Information Disclosure Media Used By Canadian Firms. Accounting, Auditing & Accountability Journal, 3(1), 38-53.

Google Scholar