Introduction

From the start accounting has been considered as an important information source. The reason for its formation was the need to monitor business relationships and assets. Paciolli Luca was the first who compiled comprehensive documentation about the principles of double-entry book-keeping in the 15th century. Then there was an increase in the requirement for the availability and accuracy of the information necessary for management and decision making.

Information is a basic working tool for managers. If the enterprise does not have accurate, timely, relevant and sufficient information, management loses its way meaning, the company can not fulfill its objectives, targets and declines. The largest source of information is accounting (Cilíková and Lapková, 2008). The main task of accounting is to provide the important information needed to assess the financial situation of the company, give information about profit and loss and to set up the company’s ability to generate profit and cash (Šlosárová, 2011).

The current output and also the primary importance of accounting is reliable information about the financial situation of the company and its profit for the accounting period. Based on this information, the owners of the company are able to determine how succesfull leaders are in their positions, how the company evaluates its capital, and if the company has long-term stability. Most important is the prognosis for the financial situation, which indicates their economic development for the future. Accounting is based on several assumptions, principles and quality requirements which are required, in the process of accounting, because of the quality and predictive value of accounting data (Strouhal, 2014).

Any information should be assessed in three levels:

- a semantic (content) level – in terms of sensory content and the correct interpretation of information. The content of information in relation to reality, where reality is pattern and information is reflective. It is about the characteristics that reflect the quality of content in relation to the design.

- a pragmatic (user) level – in terms of achieving its objectives. This is the usefulness of the information in relation to the objectives for which it was collected and will be used.

- a syntax level – from the point of view of material, energy, character, technological and also from the point of information transfer. It is a way of expressing information. Accordingly, we can speak about the pragmatic, semantic and syntactic characteristics of information (Kokles and Romanova, 2014).

Accounting information should satisfy quality characteristics to be useful to users. The most important qualitative characteristics of financial information include: relevance, objectivity, timeliness and clarity (Soukupová, 2008). Users of accounting information have different requirements. A management entity, as one group of users, needs much more specific and detailed information than other users. Financial information which provides an overall view of the financial position is sufficient for external users. Accounting can provide these different requirements for financial information from users only as an accounting information system. (Škorecová, 2010).

Many authors consider accounting as the information system. The accounting information system summarizes the financial data of the enterprise and organizes them into useful reports. Fiľa and Repovský (2008) define information system as a set of attributes and their properties, functions and mutual interactions, resulting in the transformation of input data into final information with high explanatory power created in favour of its users. The main tasks of an information system are acquiring, classification, processing and dissemination of necessary information – with proper timing, amount and quality. Závodný (2006) finds information systems important not only in the acquiring and processing of information but also in providing information on when they could be useful. Thus, the modern IS is not a passive tool waiting for a piece of information to be required; it analyses the on-going situations and sends messages automatically or actively affects business processes and information systems. The author further emphasises the fact that information system is a sub-system of management and high-quality information is inevitable to reach high-quality management. In cooperation with supportive methods, such information objectivises the decisions of managers while the decisions and related responsibilities are performed by managers who decide how to deal with the information.

High quality accounting information has a key importance for a large number of users, as it influences the quality of decision making. Providing high quality and useful accounting information is a prerequisite for the efficiency of the enterprise. Usefulness is determined by the quality of the accounting information. Measuring and assessing quality and usefulness of accounting information is of particular importance, as these activities will not only enhance the quality of economic decision-making for the users, but also the overall market efficiency of the business (Nicolaou, 2000; Tsoncheva, 2014).

Accounting provides information for a wide range of users. Managers make serious decisions based on this information. Therefore, it is very important that managers can fully rely on accounting information. We deal with these issues in our research. The research aim of the article is to assess the quality of accounting information and its application in business management. The object of the investigation is the enterprise information system in selected companies with a focus on accounting. The subject of research is accounting information. Basic research questions are:

- On which characteristics it is possible to assess the qualitative aspects of accounting information?

- What requirements of accounting information are necessary for it to be a solid source of information for enterprise management?

Materials and Methods

The data necessary to solve tasks, related to the assessment of the quality of accounting information, have been drawn from available literary sources and from research carried out in selected companies and software companies (we focused on information systems for double-entry bookkeeping). The underlying data were obtained by observation, direct interviews and questionnaires. The questionnaire consisted of two types of questions (open and closed). Closed questions provided respondents with a fixed number of options from which the respondent could choose one or more answers. The second group consisted of open-ended questions, in which respondents were asked to provide their own answer. The resulting questionnaires were screened. Incorrect or partial answers in questionnaires were not evaluated.

The object of the investigation was the information system in selected companies which operate in the agriculture and food area. The subject of the research was accounting information, the main focus was on the qualitative aspects of the information and its application in business management. We focused on two main areas: legislation and management to assess the quality of accounting information.

We applied basic scientific methods of analysis, comparison, synthesis and also mathematical and graphical evaluation during the process of considering the underlying data. We applied basic scientific methods during the processing of the underlying data. An analysis of the legislative documents that we found, the criteria that accounting information has to comply with. We determined the significance of the individual criteria for managers by the analysis of the data obtained from the questionnaires. By comparison and synthesis, we identified some important criteria for assessing the quality of accounting information from the aspect of business management. We also applied mathematical methods and graphical displays while we evaluated the questionnaire data.

Results

An enterprise information system in general can be defined as a set of activities that provide for the collection, transfer, process, storage and distribution of information to meet the needs of management and decision-making (Kokles, Romanová and Hamranová, 2015). The enterprise information system (EIS) in all the companies investigated is implemented with software, which consists of individual subsystems. Each subsystem is focused on a relatively independent area of business activity. For example recording and processing of documents for fixed assets, inventory, cash, bank transactions, receivables, payables, payroll and personnel administration, production and so on.

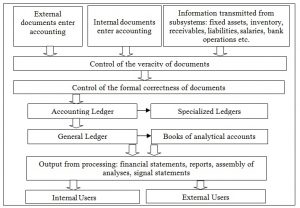

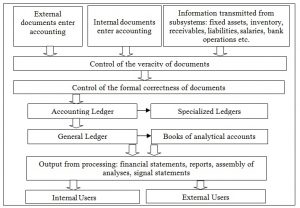

The companies investigated have differences in the number and also structure of the subsystems. But it is one subsystem – the accounting subsystem, which is common for all enterprises. This is an integrating element of the whole EIS. The accounting subsystem centralizes information and data from other subsystems, it enables the registration of external and internal documents which are not recorded in other subsystems. The Accounting Subsystem enables registered data to be processed and provided, in the form of output reports, or as supporting information for further analysis. These processed data are passed to managers at various levels of management. The flow of accounting data for processing in the organisation is represented in Figure 1.

Fig. 1: The flow of data in an enterprise information system: Accounting subsystem

Source: Authors´ own

Recorded and processed accounting data in the enterprise information system are provided for internal and external users. The quality of information is most important in both cases, because relevant decisions are made based on it. Managers use them for operational, tactical and even strategic management. External entities, such as business partners will decide to cooperate with companies based on this information. They are also important for government authorities mainly for the collection of taxes etc.

On the basis of our research, we considered the main aspects (areas) for the assessment of the quality of accounting information. Based on that, we determined the characteristics (requirements) that must be fufilled to provide high quality accounting information. We focused on two main areas: legislation and management.

Legislative Area

Based on the legislative regulations, we focused on the laws in force in the Slovak Republic and the internationally recognized principles of IFRS and US GAAP. In 2010, the International Accounting Standards Board (IASB) updated the document “The Conceptual Framework for Financial Reporting”. International Accounting Standards Board has a significant effect on the development of a range of International Financial Reporting Standards IFRS with an impact on EU legislation. The Council’s goal is to create a single set of high quality and globally applicable accounting standards and to help harmonize national standards with the international IAS / IFRS. In 2015, the IASB published an Exposure Draft, which proposes an amendment to its conceptual framework. The conceptual framework describes the concept of general purpose financial reporting. They stated the qualitative characteristics of accounting (financial) information as Prudence, prudence Caution, Asymmetric Prudence, substance over form, reliability, understandability and the degree of complexity (International Accounting Standards Board information, 2016).

In the Slovak Republic, there is an applicable Act of the National Council no 431/2002 Coll. on Accounting (Ministry of Finance of the Slovak Republic, 2016), which was amended several times. Current Slovak legislation takes into regard the requirements of the directive of the European Union and also international accounting standards. Slovakia supports the efforts of the international community to harmonize accounting, the essence of which is the alignment of accounting policies, procedures and reporting of individual countries to ensure comparability and user friendliness of information in each country.

Based on the analysis, we can conclude that the basic requirements for accounting information are based on accounting law, under which it is mandatory to keep correct, complete, and comprehensible accounting information. The above requirements indicate that accounting is conducted:

- correctly when it meets the requirements of the Act and other special regulations,

- completely if all accounting transactions in the accounting period can be identified in the books, that for a particular accounting period there are individual or consolidated financial statements, there is an Annual Report, published data, stored documents in the Register and all these are notified as accounting records,

- demonstrably, if all accounting records are verifiable and inventories are taken,

- clearly if it allows the reliable identification of the contents of transactions following the accounting policies used and following the format of the records used.

The quality of accounting information; it is important to comply with these requirements. The quality can be asessed based on whether they meet the following characteristics:

- Accounting information that concerns the subject of the accounting or the method of its management,

- Financial information is based on the accounting records. The accounting records mean accounting documents, records, books, depreciation, inventory lists, chart of accounts, financial statements, annual report.

- The initial accounting information must be recorded on documents whose content is strictly limited and must include:

- verbal and numerical marks of the accounting document,

- the contents of accounting transaction and the identification of participants,

- a cash sum or unit price and quantity,

- the date of issue of the accounting document,

- the accounting transaction date, if not the same as the date of completion,

- the signature of the person responsible for the accounting transaction and the signature of the person responsible for the entry,

- marking the accounts on which the transaction shall be entered in the accounting entity, keeping accounts in the double-entry accounting, if it does not result from the software.

- Accounting information can take the form of written or technical accounting records. The written form is made by hand, typed, printing and reprographic equipment or computer printer, the content of which can be read in a natural way. The technical form is made using electronic, optical or any other way as written. In this process, the transferability of the record must be ensured in written form, it means that if an entity takes accounting records in a technical form, it is required to have such equipment, carriers and devices that enable the conversion of the accounting records into a natural form which may be read by a person. Most often an entity takes accounting documents in practice through computer processing. Under the Accounting Act, an entity may convert accounting records from one form into another, but must ensure that the content of the accounting record in the new form is the same as that accounting record in original form.

- Accounting information must be verifiable. Accounting information represents an economic reality. For a verifiable accounting record we consider that the accounting record must include:

- directly demonstrated facts,

- demostrate the facts indirectly through other erifiable accounting records,

- during the transfer of the accounting record through the information system, the entity must ensure that the transfer is free from misuse, damage, destruction, unauthorized interference and unauthorized access. The accounting record to be transferred through an information system outside the entity must be confirmed by a signature.

- The financial information must be credible. Credibility is given by the accounting records and the strict rules for possible correction (repair). If an entity determines that an accounting record is incomplete, inconclusive, or incomprehensible, it is obliged to repair it without delay. Repair shall be done such that it clearly identifies the person who carried out the correction, the day of the correction, and the date of the accounting record shall be recorded with such precision that uncertainty in the determination of the time does not give rise to uncertainty in the determination of the transaction. Correction of an accounting record must not lead to incompleteness, unverifiability, inaccuracy, incomprehensibility or lack of transparency in accounting,

- Accounting entries in the books must be understandable, transparent and durable:

- a clear entry means an entry which can reliably and unambiguously identify the contents of a transaction,

- transparent records present an opportunity for transparent orientation in the accounting entries,

- entries must be made in a manner that ensures permanence and regardless of the type of treatment, it means, whether the accounts are kept by hand or using software, the entity must be able to provide permanence throughout processing and safekeeping. The period of retention for individual accounts are specified in the accounting law, such as financial statements, annual reports and auditor’s reports as ten years following the year to which they relate.

Business Management

Data from financial statements are an irreplaceable source of information for managers. Continuous knowledge of the enterprise’s financial situation based on the analysis of financial statements enables managers to make the right decisions in obtaining financial resources, determination of optimal financial structure, allocation of invested funds, provision of business loans, the choice of dividend policy, profit distribution and so on.

The financial statements are the basis for making financial analyses, enabling the determination of factors such as the intensity and affect of the economic and financial situation. There are two possible methods of analysis:

- An analysis based on the experience of the executives, which is called fundamental analysis. This analysis is based on an extensive knowledge of the interrelations between economic and non-economic features on the basis of subjective estimates. This kind of analysis is based on the amount of information, but it processes information using the qualitative aspects and derives conclusions generally without the use of algorithms,

- Analyses that use mathematical and statistical methods that lead to the quantitative processing of accounting data and the subsequent interpretation of economic results. This is a technical analysis, the basic analysis techniques include comparison of selected values in absolute or percentage terms, the calculation of basic ratios of liquidity, profitability, stability and analysis of the speed of the turnover of funds.

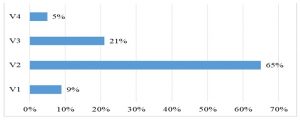

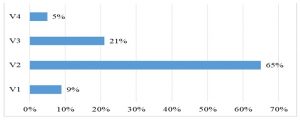

In this area, we investigated the requirements of managers for financial information. Based on the processed questionnaires we found that 95% of managers use the data from the financial statements. The graph evaluation of respondents’ answers to questions concerning the use of information from accounting during the year and from the financial statements at the end of the year.

Fig. 2: Use of accounting information for management

Source: Authors´ own

V1 managers use the information from the accounting books (throughout the year) and information from financial statements

V2 managers use accounting information in the form of reports (monthly) and information from financial

statements

V3 managers only use information from the financial statements

V4 managers do not use financial information

The most important characteristics of accounting information for managers were identified as: veracity, fidelity display properties, usefulness, significance, clarity, comparability, reliability, transparency and accessibility. In the next section we present content definitions under which it is possible to assess the quality of the following characteristics:

- Veracity, accounting information will be true if you observe accounting principles and methods that lead to a fair presentation of the financial statements,

- Fair view of facts. The report is true if the content of financial statement corresponds to reality and is in accordance with appropriate accounting principles and accounting methods;

- Usefulness, it means the information provides the required benefits to the user,

- Significance, the information is considered significant if its omission from the financial statements or a misstatement in the financial statements could influence the judgment or decision of a user,

- Clarity, information is easy to understand if you are able to reliably and unambiguously identify the contents of transactions and in connection with the applied accounting principles, methods and forms of accounting records,

- Comparability, the information is comparable if the entity uses over one accounting period the same accounting policies and principles,

- Reliability, information is reliable if it gives a true and fair view of the facts which are subject to accounting, information is complete and timely,

- Transparency, managers require current reports and presentations which are accessible in the simplest possible way,

- Accessibility, accounting information should be made available at the required location and time so that they can be the basis of appropriate decision making in real time. The question of availability of information is ensured nowadays through information technology (the current trend is for solutions in the form of cloud computing).

All the presented characteristics significantly influence the quality of accounting information. Based on their definition, it is possible to assess the quality of information in an enterprise by the comparison of the real state of accounting in the enterprise and the features that should meet in the accounting information from the viewpoint of two main areas: legislation and regulation, analyzed in our research and presented in this article.

Conclusions

Accounting provides information that helps companies assess the overall level of enterprise financial management, not only in terms of the past, but also the assessment of the ability of the enterprise management entrusted to secure resources for the future. For managers, financial information becomes a valuable source of timely and objective terms with which it is possible to carry out fair decisions. However, if these decisions are to lead to a successful outcome, there is a need for quality accounting information.

In our research activities, we considered the issue of quality in two areas, legislative and business management.

The legislative area shows the current applicable laws at the national level and also with regard to the harmonization of accounting. In the article, we presented the basic characteristics upon which it is possible to assess the quality of accounting information.

Based on the analysis of the accounting situation in the researched enterprises, we considered accounting information in regards to the Accounting Act (comparison of the characteristics, which are specified in this article in part I, the legislative area). We found a high quality of information in all enterprises (legislative requirements have been met). Sometimes this kind of assessment is hard for the manager in light of the frequent changes in legislative regulations. Therefore, we recommend the use of the services of auditors not only to verify the financial statements at the end of the year, but also throughout the year. We see the audit function, particularly that the auditor expresses a qualified independent opinion on the reliability of accounting information and the substantive accuracy of financial statements. Of course, the responsible entity must consider accuracy of the accounting, therefore managers should have some basic knowledge with which they themselves can assess the accuracy of the accounts on the legislative side.

The area of business management is demanding of support information. Today it is commonplace to have an automated enterprise information system. An important part of the accounting subsystem. It is therefore very important that the accounting information meets the demands of managers. The majority of managers surveyed in companies (65 %) use information from the accounting system in the form of monthly reports and financial statements. The financial statements give a true and fair view of the assets and liabilities, profit and financial position and provide data for the results of financial analysis which allows managers to analyze the selected period, to assess the current economic situation of the enterprise, recognize critical situations and avoid them, set out a financial strategy of the enterprise. An assessment of the quality of accounting information is therefore very important for managers. Based on our research, we can conclude that managers use accounting information in business management and the quality of this information is very important. To assess the quality of accounting information, we selected and defined the most important requirements and characteristics based upon which it is possible for each enterprise to assess their quality.

The issue of the quality of information is very large and challenging area. The article presents a part of our research work that focuses on the area of accounting and its practical use for managers. The result of our research is the basic characteristics upon which it is possible to assess the quality of accounting information in the enterprise.

Acknowledgement

This paper was created within the project VEGA Increasing the efficiency of decision making by managers, with the support of information systems and accounting. Project registration number 1/0489/15.

References

Cilíková, O . and Lapková, M. (2008). Management accounting. Matej Bel University, Faculty of Economics in collaboration with OZ Economics, Banská Bystrica.

Fiľa, M. and Repovský, A. (2008). Business information systems and their deficiencies in the agro-business environment (in Slovak). In: 4th International Bata Conference for PhD Students and Young Scientists. Zlín, Tomas Bata University in Zlín. (4), 2008.

International accounting standards board. (2016). Conceptual Framework for Financial Reporting. [Online], [Retrieved February 15, 2017], http://www.ifrs.org/About-us/IASB/Pages/Home.aspx

Kokles, M. and Romanová, (2014). Informatics. Sprint 2, Bratislava.

Kokles, M., Romanová, A. and Hamranová, A. (2015). Information systems in the post-transition period in enterprises in Slovakia. Journal of Global Information Technology Management, 18(2), 110-126.

Google Scholar

Ministry of finance of the Slovak republic, (2016). Act no. 431/2002 Coll. on Accounting. [Online], [Retrieved February 10, 2017], http://www.finance.gov.sk/Default.aspx?CatID=4833

Nicolaou, A. I. (2000). A contingency model of perceived effectiveness in accounting information systems: Organizational coordination and control effects. International Journal of Accounting Information Systems, 1(2), 91-105.

Soukupová, B. et al. (2008). Financial management accounting. Súvaha, Bratislava.

Strouhal, J. et al. (2014). Accounting. BizBooks, Brno.

Škorecová, E. (2010). Cost accounting. Slovak university of Agriculture in Nitra, Nitra.

Šlosárová, A. (2011). Accounting. Iura Edition, Bratislava.

Tsoncheva, (2014). Measuring and assessing the quality and usefulness of accountinf information. IZVESTIA Journal of University of Economics, (1), 52-64.

Google Scholar

Závodný, P. (2006). Information Systems Project Management (in Slovak). Bratislava, Iura Edition, 166 p.