Introduction

The overall and therefore economic development of a nation is correlated with the qualitative aspects of governance, largely depending on the ability of political institutions to achieve the desired behavior, the tools selected for action and how they are handled, the characteristics of the targeted group etc.

Budgetary consolidation appears to be a task undertaken by public authorities, which through government financial policy measures directly aim at reducing public deficit and, in a secondary plan, at ensuring the soundness of the real economic processes, as support to ensure a robust (sustainable) public budget and a sustainable economic growth. In a Rationally, budgetary consolidation should be a perpetual concern for public authorities, reflected in early warning systems and clear mechanisms for its achievement, which would allow for a more “prophylactic” approach. However, it is usually related to economic and financial crises, as a “reparatory” approach to deal with their negative effects.

On the background of the economic crisis, budgetary consolidation came to the forefront of the economic policy agenda of many EU member states, especially developed ones, whose public balances and debt recorded a significant deterioration after 2008. Although the objectives are quite similar, addressing the burden of budgetary consolidation by public authorities showed major differences from one country to another, in relation to the concrete situation and particularities of the crisis, the effects also being different. It is therefore important, in this context, to examine the design of the consolidation strategies from the point of view of their mix of measures, seeking to anticipate the long-term effects (particularly on economic growth and development), the practices that deserve to be replicated or the public financial policy errors that should be avoided by other countries.

Objectives, Methodology and Literature Review

Our work mainly analyzes the strategies and budgetary consolidation efforts undertaken by EU Member States, with the aim to highlight the strategic particularities, their determinants and registered or expected effects, in order to allow for the extraction of some useful lessons. In analyzing the particularities of EU budgetary consolidation strategies, we will try to answer the following:

- How do the background elements affect the configuration of the budgetary consolidation strategy and the depth of adjustments?

- Can we talk about a preference towards consolidation by strengthening revenues or reducing expenses?

- Is there any type of revenues or expenditures “preferred” as strategic orientation and what are the potential effects of such “preference”?

- What mutations predict EU budgetary consolidation measures when it comes to budgetary resources and their use?

Our work in mainly conceived as a theoretical research grounded on statistical data. The quantitative evaluation of EU Member States budgetary consolidation strategies will be based on data reported by Eurostat, AMECO and national authorities. Our analysis will primarily focus on those EU Member States that recorded budgetary consolidation episodes during 2009-2012. Our conclusions are to some extent limited by the lack of data for the analysis of the profile and impact of budgetary consolidation strategies, as official statistical databases do not contain all necessary information, particularly as regards the structure of cyclically adjusted revenues and expenditures and that of overall revenues and expenditures for 2012.

Regarding the state of knowledge, we can first identify a set of scientific papers which, while addressing issues related to budgetary consolidation, do not focus on it, dealing, more generally, with issues of public financial policies. Although when it comes to analyzing the convenient way of handling taxes and government spending as compounds of different growth models (by means of demand or supply stimulating), the budget deficit is brought into question, these works do not provide a separate treatment of the alternatives for reducing it and their implications.

A more direct approach to budgetary consolidation, in terms of the concern to extract lessons from past experiences that can help public policy makers in shaping present consolidation strategies, can be found in works such as those of Mulas-Granados (2003), Alesina (1995, 1997 and 2011), Alesina, Plain and Tabellini (2008), Ilzetzki and Vegh (2008), Aiginger and Schratzenstaller (2011), Polito and Wickens (2011), Blöchliger, Song and Sutherland (2012), Socol (2010). The instruments used in budgetary consolidations and foreshadowing their effectiveness for certain groups of countries, such as the OECD, are treated in the work of Hagemann (2012) and Molnar (2012).

A special attention is also paid to the long-term growth effects of alternative budgetary consolidation measures (Arnold, 2008; Alesina, 2009; Johansson, 2008; Socol, 2010), respectively to the issue of judicious dosage or sizing of consolidation efforts (Sutherland, 2012) and their success factors in different countries (Gupta, Baldacci, Clements, and Tiongson, 2005).

Some studies are focused on comparing the situation, adopted measures and results in different states or groups of countries, with the aim to identify some common elements that can be benchmarks of good practice in the field of budgetary consolidation (Dolls, Fuest and Peichl, 2010; Zohlnhöfer, 2005 ).

Budgetary Consolidation Options and Particularities of EU Member States’ Budgetary Background

In terms of their composition, fiscal adjustment measures could be aimed at both increasing revenues and reducing public spending or a mix of these alternatives. As prerequisites for our assessments, you must say that national crisis call for national solutions, as there is no universal successful solution. However, some comparative appreciations can be made for different options, by taking into consideration the background situation and the anticipated effects of the consolidation measures, as depicted in the literature, based on the experience of previous fiscal consolidation episodes of different countries.

A first determining factor for the design of the composition of budgetary adjustment measures will be the budgetary situation of the economy at the onset of the crisis, reflected by the value of public revenues, expenditures, budget balance and public debt (Oprea and Bilan, 2012). In other words, the start position will, from the outset, consistently influence the design of public authorities’ consolidation plan. Studies on fiscal consolidation episodes in different countries and moments in time reached the conclusion that fiscal consolidation strategies mainly focusing on public expenditure cuts had more consistent results than those focusing on revenue adjustments (Afonso, Nickel and Rother, 2005). Among these strategies, more convincing in terms of their effects and durability proved to be those focusing on reducing current or sensitive to elections expenditures (public transfers). However, in practice it is often easier as political decision to reduce investment ones (with negative medium and long term effects). Although the option for increasing revenues or cutting expenditures basically is absolutely discretionary, the size of budgetary variables recorded at the beginning of the consolidation episode acts, to a certain extent, as factor constraining this decision. In this respect, it should be admitted that when countries are recording a large negative budget balance, the need for rapid consolidation prevails and it is easier to get there by cutting public expenditures. At the same time, an unacceptably high budget deficit (as was the case of Ireland and Greece) will practically require for concerted action, both by reducing public spending (with quicker effects) and increasing revenues (in which case the effects are slower).

Also, the challenge of public authorities should not be interpreted in simple terms, as a necessary effort for countering the effects of the crisis, but in the context of a real opportunity incurred (paradoxically) by the crisis, to reform in a strategic manner both the system of taxes and public expenditures. In these circumstances, the strategic mix of revenue and expenditure measures will be customized for each individual country in accordance with the inconsistencies existing prior to the crisis. Thus, it is necessary to accurately identify the underlying deficiencies, as prerequisite for designing a realistic strategy, and to position the consolidation strategy as a core element of wider structural reforms.

Another determining factor for the design of budgetary adjustment measures should be their anticipated effects on economic growth. Especially when such consolidation strategies are conducted on the background of economic recessions or fragile economic growth, the mix of measures should be designed so as to minimize its potential adverse effects on economic growth. By its nature, a budgetary consolidation strategy acts, at least apparently, against the traditional Keynesian view, which advocates for increasing spending and reducing revenues in times of recession. However, it must be noticed and acknowledged that the viability of this theoretical approach essentially depends on the starting point situation and that the evolution of the economy may force in practice, at some point, public authorities to take contrary action on the short-term, such as a shock for stabilization, thus, allowing for a margin of maneuver required to stimulate the economy. In addition, in some cases budgetary austerity proved to have expansionary effects (Giavazzi et. al, 2000; Giudice et al., 2003), partially explained by the fact that any fiscal system allows for internal reassessments and improvements that do not conflict with economic growth requirements.

Referring to the complementary objective of economic growth, ceiling or reducing public expenditures generally has smaller negative effects compared to the increase of fiscal burden, also revealing (in terms of the consolidation strategy’s credibility) a more serious commitment of the authorities. The need to reduce public expenditures should not necessarily be considered in terms of giving up some objectives, but in terms of rationalization, which would allow for some expenditures to grow while some others are reduced, without jeopardizing economic growth. Basically, a careful analysis of any country’s budget expenditure system will prove, at any time, there are expenses that can be reconsidered by reducing them. In terms of the credibility of the consolidation strategy, is important for the effective plan and steps to fallow to be enacted, so as to reveal that public authorities firmly assume it and will avoid taking reversed measures due to emotional reactions.

The strict control over the proposed and resulting level of budgetary spending must be accompanied, in many cases, by an increase in budgetary revenues, achieved by complementary ways and not by higher tax rates. It stands out as possible option mainly the broadening of the tax base, the shortest path consisting of the reconsideration or cancellation of some tax privileges (exemptions, deductions etc.). In addition, authorities should make consistent efforts to enhance the compliance of taxpayers to paying taxes.

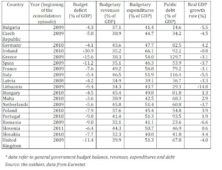

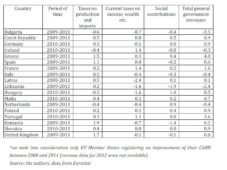

Table 1:EU Member States’ economic and financial position at the beginning of consolidation episodes

At the onset of the crisis, many EU countries found themselves on disadvantageous budgetary positions, requiring for more trenchant consolidation strategies and with higher short run costs, while the economic recovery was still quite fragile (see table 1). Relevant is the situation of Ireland, Greece and Spain which were facing, when the need for consolidation occurred, overwhelming budget deficits, associated with negative economic growth rates (although lower than in some other countries such as Bulgaria, Italy, Lithuania or Romania). It is also relevant for the design of the consolidation strategies that, in some countries, the high budget deficits were associated with high levels of public spending (Greece – 54.0% of GDP, UK – 51.3%), low budget revenues (Romania – 32.1%, Slovakia – 32.3%, Lithuania – 34.3%) or a mixture of such values (Ireland —expenditures of 66.1% and revenues of only 35.2%), which would suggest and even prefigure the orientation of consolidation measures towards the corresponding part of the budget.

From another perspective, it also appears to be relevant for the design of budgetary consolidation strategies the relation between a country’s budget deficit and public debt. In general, high levels of public debt, although considered sustainable prior to the crisis due either to their association with relatively small budget deficits or to the possibility to continuously rollover them, become “flammable” in times of crisis and thus, require for actions aimed at reducing budget deficits (although, as they are small, they do not involve, on themselves, a real danger), avoiding potential vulnerabilities against liquidity crises. Accordingly to the data in table 1, such is the situation of countries like Italy, Germany, Hungary and Malta.

The Design of Budgetary Adjustments During Recent Budgetary Consolidation Episodes in EU Member States

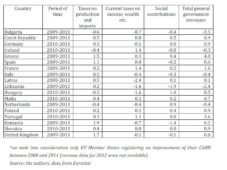

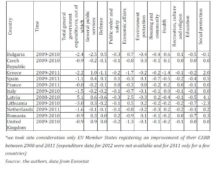

The analysis of the results of budgetary consolidation strategies firstly involves looking at the values of overall changes in the cyclically adjusted budget balance (CABB). The data summarized in table 2 confirm the assumption that countries with the worst background budgetary situations were virtually obliged to run faster consolidations, assuming toughest austerity programs. Ireland and Greece are relevant cases, registering CABB adjustments of 21.2% of GDP and 13.73% respectively, over a period of only 2 and 3 years. This performance can be, at least partially, explained by the constraints imposed by the main creditors (the IMF and the European Commission), and these countries’ membership to EU confirms that institutional arrangements are a good factor of pressure to rationalize budgetary adjustment options.

Similarly, Hungary can be considered a good example for the assumption that high levels of public debt, although associated with lower budget deficits (for times of crisis), call for a faster pace of consolidation. While in Hungary CABB decreased by 8.05% of GDP in only one year, in Bulgaria, a less indebted country (with a public debt of only 14.6% of GDP in 2009 – table 1), recorded in three years an overall adjustment of only 2.31%. In the case of Italy, even a medium value budget deficit, in combination with a historically high level of public debt, were not enough impetus for deeper consolidation (the recorded adjustment was of only 2.26% of GDP in three years).

Trying to identify the main budgetary consolidation strategic options in EU countries, we can find a heterogeneity of approaches that allow for the following systematization: countries where the adjustments were carried out mainly by the contribution of public expenditures (Bulgaria, Ireland, Latvia, Lithuania, Portugal, Slovenia), countries where the adjustments were carried out mainly by the contribution of public revenues (Malta, Hungary and France) and countries where public revenues and expenses had a more balanced contribution to the adjustments (Germany, Czech Republic, Greece and UK). However, an overview of data supports the idea of a preference for the expenditures side, which could theoretically be explained for two reasons: on the one hand, the effects of expenditure cutting are faster and can be more easily controlled and, on the other hand, an increase in taxation is generally associated with an economic contraction, at least in the short run, completely undesirable on the background of a crisis. The data in table 2 show that, out of the 19 countries of our analysis, only for 4 of them the option for budgetary revenues adjustments appears to be more evident in relation to the adjustment of the expenses.

Table2: Budgetary consolidation episodes in some EU Member States after 2008

and contributing factors*

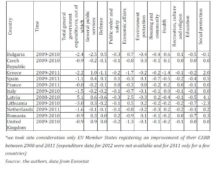

When it comes to budgetary revenues adjustments, we should notice the cases of Greece, France, Hungary and Portugal, which saw their public revenues, grow with ratios varying from 1.6% of GDP in France to 8.5% in Hungary (table 3). In structure, we can see the predominant orientation towards increasing indirect taxes (Greece, Spain, Romania and UK) and more rarely the direct ones (France and Ireland). The option for consumption taxation can be explained by the specific characteristics of indirect taxes, which ensure a more rapid mobilization of new fiscal revenues compared to direct taxes.

Table 3: Changes in public revenues and their structure in some EU Member States during recent budgetary consolidation episodes (% of GDP)*

Also, in terms of the facility of implementing austerity measures, indirect taxes may be preferred due to their “hidden” character. Also, the changes in indirect taxes would affect competitiveness and human capital formation to a lesser extent than the direct taxes on labor, which would more quickly act as brakes on economic activity. The same reasoning is available for social contributions, in which case eventual increases of the average tax rate would lead to an increase in the costs of labor, with negative impact on economic activity. Basically, the choice between the two broad categories of taxes resumes to choosing the least of two evils, in terms of transferring the tax burden either on producers or on consumers.

Operating VAT rates changes appears to be the most relevant for the strategies focused on indirect taxation. While only one of the Member States reduced its VAT rate in 2008 (Portugal, -1%), the others generally operated, even successively, VAT rates increases (UK reduced its rate with 2.5% in 2009, followed by two successive increases with the same percent in the coming years and Ireland increased its rate by 0.5% in 2009, returning to the initial value in 2010). In 2009, changes in VAT standard rates were operated by Estonia (+ 2%), Ireland (+ 0.5%), Latvia (+ 3%), Lithuania (+ 1%), Hungary (+ 5%) , UK (- 2.5%), in 2010 by the Czech Republic (+ 1%), Ireland (- 0.5%), Greece (+ 4%), Spain (+ 2%), Lithuania (+ 2%), Portugal (+ 1%), Romania (+ 5%), Finland (+1%), UK (+ 2.5%) and in 2011 by Latvia (+ 1%), Poland (+ 1%), Portugal (+ 2 %), Slovakia (+1%) and UK (+2.5%). It must be noted here that some states operated opposite and even successive VAT rates changes, such as Portugal, Ireland, UK or Latvia.

Although we could find some reasons for the oscillating attitude of the authorities, we consider that the stability of budgetary consolidation measures and their solid grounding on ex-ante impact assessments were not valued as they should have been. Divergent measures can also be observed when it comes to excise taxes, some countries operating increases (Estonia, Finland, Greece, Hungary, Latvia, Lithuania, Romania, Slovenia and Spain) and other reductions (Italy or Poland) of their excise tax rates.

As concerns direct taxes, the main trends in EU are, on the one hand, to slowdown the race for reducing the tax rates applicable to companies, while broadening the tax base and giving up certain categories of fiscal deductibility and, on the other hand, to increase individual income tax rates (in UK – an increase to 50% in 2010, in Spain, Portugal, France, Italy, Luxembourg and Finland), in contrast to substantial reductions (Hungary, in 2011, reduced its rates from a maximum marginal rate of 40% to 16% and Latvia with 12% between 2007 and 2009). Broadening the tax base and giving up some fiscal exceptions and deductibility largely exploited by businesses is actually a viable strategic option to increase revenues from direct and indirect taxes, with less negative impact on economic growth compared to increasing tax rates.

An overview of our data also shows that the strategic orientation towards revenue strengthening was not fully covered, failing to pay appropriate attention to the taxation of wealth, which also serves to a more equitable redistribution, sensitive issue especially in times of crisis. From our point of view, the imposition of a progressive tax on wealth, especially on housing, should have been a compulsory part of the consolidation strategies.

The prevalent orientation towards strengthening public revenues by increasing the average rate of indirect taxes prefigures a mutation in the structure of EU tax systems, consisting in a greater share of such revenues, despite the fact that they are associated with greater fiscal inequity. Countering this trend would be possible to the extent that budgetary consolidation measures will stabilize and help the economies grow, in which case public authorities would have the necessary margin of maneuver required to change their orientation from the allocation function to the distribution function of public budgets.

From the point of view of achieving budgetary consolidation through reductions in public expenditures, it is important promote a “smart budgetary consolidation”, which means not to affect those categories of expenditure which have, over the long term, a substantial positive impact on economic growth (spending on education, research and development, environment). Also, their restructuring under the pressure of countering the effects of the crisis should not conflict with the objectives of the EU 2020 Strategy, to support smart, sustainable and inclusive growth or, under the pressure of current needs, should not overlook long term pressures (such as the aging of the population).

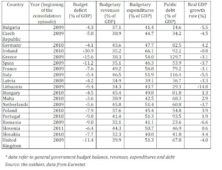

Table4: Changes in public expenditures and their economic structure in some EU Member States during recent budgetary consolidation episodes (% of GDP)*

The data summarized in table 4, on the changes in public expenditures and their economic structure, indicate common trends among analyzed EU countries. A particular situation is recorded by Latvia, in which case the overall result can be apparently interpreted as being against the “European wave”, although a careful analysis of the structure of public expenditures confirms a rational approach. In terms of overall expenditure reductions, stand out as positive examples Lithuania, Bulgaria and Greece, less consistent results being recorded by France, Czech Republic, Romania and the UK.

From a structural perspective, we should firstly note the focus of some countries on payroll expenditures (Latvia -1.9% of GDP, Lithuania — 1.7% and Romania -1.2%), which meets the real need for government sector rationalization, against the background of its questionable expansion prior to the crisis. However, at least in the case of Romania, compared to the declared need to rationally restrict this sector and to assumed budgetary consolidation objectives, the results recorded in the reference period are rather modest. Moreover, in the case of Romania for example, some wage cuts or the refusal to operate increases in wages regulated just before the crisis emerged, were contested and won by employees in the courts of law, so the budgetary effort, although staggered by the Government until 2016, will undoubtedly have a great impact. It is objectionable in this regard that the legislated document that supports the configuration and implementation of budgetary consolidation (the fiscal strategy, covering a three years timeframe) did not at all consider such an impact.

As for social benefits, we can notice the situation of Latvia (an increase of 4.5%) and Lithuania at the opposite side (a reduction of 2.3%). Moreover, Lithuania is unique in kind in EU, both the IMF and the European Commission finding at least questionable its recent decision to continue to cut social assistance benefits, while the results of previous adjustments can be appreciated as more than satisfactory. In our opinion, we consider that Lithuanian authorities demonstrate that they have well learned the lessons of the crisis, meaning that they prove a strategic orientation indispensable for obtaining lasting positive effects, based on the idea that social assistance should represent an active tool for labor encouragement. At the opposite side, Romanian authorities have repeatedly claimed aiming at such an objective and consequently reformed the relevant legislation, but the result recorded (0.3% of GDP) does not confirm the success of the new approach.

Sensitive issues also raises the evolution of gross capital formation expenditures, which registers positive values only in Lithuania (0.7% of GDP), double negative values being recorded in Greece and Spain. The evolution of this category of expenditures in the overwhelming majority of the analyzed countries can be considered as inadmissible both by reference to the stated and enacted objectives and to the real development needs of the countries in question, being essential for public decision makers to give greater emphasis to this source of growth. The pressure is even greater for countries until recently in transition, whose economies cannot yet be considered “mature” (Bulgaria and Romania) and where public needs as those for infrastructure must be urgently met.

Looking at the major changes in public expenditures and their structure by function, we find that the concern for stimulating economic activity was not a primary objective for more than half of the analyzed countries (table 5), only Latvia assuming a wider support for the corresponding public expenses. Relevant is the case of Greece, where expenditures on general public services increased by 1% of GDP, while expenditures on economic affairs (together with those on environment protection and housing, with economic results) decreased by 2.1%.

The situation depicted in table 5 also shows little concern for designing adjustment strategies oriented towards “smart fiscal consolidations”. Basically, in the best of cases (Czech Republic and UK) education expenditures were kept unchanged, while they were reduced in all other countries. In general terms, penalizing education at the expense of other activities (such as general public services, which increased in more than half of the countries), may entail for those nations higher costs, affecting long-term growth and development. A similar situation is that of public health systems, whereby the negative effects of underfunding could arise even sooner than in the case of cutting education expenditures. At least for the case of Romania, it is objectionable the lack of a clear strategy to implement a rational mix of private and public supply in this field, which would equally serve to diminish the budgetary burden and to increase competition and the quality of services, often claimed for. We can also note the tendency to cut public order and safety expenditures, which we consider to be disputable as the destructive social effects of the crisis tend to act as factors generating or amplifying crime.

Table 5: Changes in public expenditures and their structure by function in some EU Member States during recent budgetary consolidation episodes (% of GDP)*

The trends revealed by the data in tables 4 and 5 prove the general need for rationally reconsidering the structure of budgetary expenditures, which must not and cannot be modeled simply on the paper, but should result from implementing complementary structural reforms globally reflecting the rationalization of public sector dimensions in considered countries. In this respect, there is a potential danger that the concern for the social protection of those affected by the crisis, permanently emphasized in the speeches of public decision makers, become an argument for the expansion of state’s involvement in the economy and society, which would impermissibly prejudice the freedom of market and its laws.

Besides the need for rationally structuring public expenditures, it is also particularly important the efficiency of spending, being imperative to generalize performance-based budgeting. The increase of amounts allocated to different activities cannot produce beneficial effects for economic growth as long as spending are not made on grounds of carefully judged cost and benefits. From this point of view, when designing the framework for budgetary surveillance in EU it should be taken into account the possibility of creating channels for specialized study, debate and review of the impact of financing various projects involving public expenditures in EU Member States.

Conclusions

In the midst of the current crisis, EU Member States were virtually forced to adopt specific budgetary consolidation measures, whose composition, pace and depth were different depending on the budgetary situation at the onset of the crisis. Our analysis reveals that a less comfortable start position (a higher budget deficit or public debt) acted as an impulse guiding public authorities’ preference towards the prevalence of public expenditure measures, as the positive effects were anticipated to come sooner. It also reveals that countries that have concluded stronger institutional commitments (for international aid or borrowing purposes), also implemented more consistent austerity packages, achieving higher deficit reductions.

Referring to the contribution of revenue adjustments to budgetary consolidations in EU Member States, we found a preference of the countries we analyzed for indirect taxes, explained by the expected effect of raising financial resources more rapidly. This may, however, cause an increase in fiscal system’s inequality and is thus objectionable from the perspective of the need for a more balanced distribution of social sacrifices for countering the crisis. It would have been desirable for the consolidation strategy to more strongly and explicitly relay on the (progressive) taxation of wealth, which could more adequately serve to a balanced distribution of sacrifices.

As for achieving budgetary consolidation through government expenditure measures, we can see that there is still a big gap between the stabilization requirements and stated objectives on the one hand, and recorded progresses on the other hand. While resizing government sector is rationally necessary and constantly declared in public speeches, the correspondent public expenditures remain high, alleviating the success of consolidation strategies. At the same time, expenditures for economic affairs, housing and community amenities and environment protection, which could have a positive impact on economic growth, were in many cases reduced or remained unchanged, while social spending slightly increased in some countries (the Lithuanian example of action and consistency with respect to these expenditures should be followed by many countries). Particularly sensitive seems to be the issue of financing education and health, as real sources of growth, in which case the reduction of correspondent expenditures prevailed, in contradiction to the principles of a smart budgetary consolidation, which requires for them to be increased.

It is, in general, necessary for public authorities to pay deeper attention to the mobilization and use of public funds, as the analyzed data may hide phenomena requiring wide complementary reforms, conditioning the sustainability of the adopted measures. As concerns taxation, ensuring a higher degree of tax compliance and increasing the efficiency of tax collection are essential (for example, in Romania, the 5% increase of VAT rate was almost completely offset by the diminishing efficiency of tax collection). For public spending, performance-based budgeting, multi-annual and objective-based planning should be a priority.

References

Aiginger, K. and Schratzenstaller, M. (2011), „Consolidating the Budget under Difficult Conditions — T en Guidelines Viewed against Europe’s Beginning Consolidation Programmes,” Intereconomics, 46(1), 36-42.

Publisher – Google Scholar

Afonso, A.F., Nickel, C. and Rother, P. (2005), “Fiscal Consolidations in the Central and Eastern European Countries,” ECB Working Papers, No. 473. [Online], [Retrieved February 25, 2013], http://www.ecb.int/ pub/pdf/scpwps/ecbwp473.pdf.

Alesina, A.F. and Perotti R. (1995), “Fiscal Expansions and Fiscal Adjustments in OECD Countries,” NBER Working Paper, No. 5214. [Online], [Retrieved February 20, 2013], http://www.nber.org/papers/w

5214.

Alesina, A.F. and Perotti R. (1997), “Fiscal Adjustments in OECD Countries: Composition and Macroeconomic Effects,” International Monetary Fund Papers, 44(2), 210-248.

Publisher – Google Scholar

Alesina, A., Campante, F.R. and Tabellini, G. (2008), “Why is Fiscal Policy Often Procyclical?,” Journal of European Economic Association., 6(5), 1006-1036.

Publisher – Google Scholar

Alesina, A.F. and Ardagna S. (2009)‚ “Large Changes in Fiscal Policy: Taxes versus Spending,” NBER Working Papers, No. 15438. [Online], [Retrieved February 25, 2013], http://www.nber.org/papers/w15438.

Alesina, A., Carloni, D. and Lecce, G. (2011), “The Electoral Consequences of Large Fiscal Adjustments,” NBER Working Papers, No. 17655. [Online], [Retrieved March 10, 2013], http://www.nber.org/papers/w17655.

Alesina, A., Favero, C. and Giavazzi F. (2012)‚”The Output Effect of Fiscal Consolidations,” NBER Working Papers, No. 18336. [Online], [Retrieved March 8, 2013], http://www.nber.org/papers/w18336.

Arnold, J. (2008)‚ “Do Tax Structures Affect Aggregate Economic Growth? Empirical Evidence from a Panel of OECD Countries,” OECD Economics Department Working Papers, No. 643. [Online], [Retrieved March 8, 2013], http://search.oecd.org/officialdocuments/displaydocumentpdf/?doclanguage=

en&cote=eco/wkp(2008)51.

Bakker, B.B. and Christiansen, L.E. (2011)‚ “Crisis and Consolidation – Fiscal Challenges in Emerging Europe”, Proceedings of the OeNB Workshops „Limited Fiscal Space in CESEE: Needs and Options for Post-Crisis Reforms, Oesterreichische Nationalbank, 28 February 2011, Vienna, Austria, 25-40.

Barrios, S., Langedijk S. and Pench, L. (2010), “EU Fiscal Consolidation after the Financial Crisis. Lessons from Past Experiences,” EC Economic Papers, No. 418. [Online], [Retrieved February 25, 2013], http://ec.europa. eu/economy_finance/publications/economic_paper/2010/pdf/ecp418_en.pdf.

Blöchliger, H., Song, D. and Sutherland D. (2012), “Fiscal Consolidation: Part 4. Case Studies of Large Fiscal Consolidation Episodes,” OECD Working Papers, No. 935, [Online], [Retrieved Febraury 23, 2013], http://www.keepeek.com/Digital-Asset-Management/oecd/economics/fiscal-consolidation-part-4-case-studies-of-large-

fiscal-consolidation-episodes_5k9fdf5xptlq-en.

Dinu, M., Socol, C., Marinaş, M. and Socol, A.G. (2011), “Automatic Stabilizers vs. Discretionary Fiscal Policy in Euro Area Countries,” African Journal of Business Management, 5(2), 608-617.

Dolls, M., Fuest, C. and Peichl, A. (2010), “Automatic Stabilizers and Economic Crisis: US vs. Europe,” NBER Working Papers, No. 16275. [Online], [Retrieved February 28, 2013], http://www.nber.org/papers/w16275.

Giavazzi, F, Jappelli, T and Pagano, M. (2000), “Searching for Non-Keynesian Effects of Fiscal Policy,” European Economic Review, 44, 1259-1290.

Publisher – Google Scholar

Giudice, G., Turrini, A. and Veld, J. (2003), “Can Fiscal Consolidations Be Expansionary in the EU? Ex-post Evidence and Ex-ante Analysis,” European Economy – Economic Papers, No. 195, [Online], [Retrieved February 28, 2013], http://ec.europa.eu/economy_finance/publications/publication_summary

6930_en.htm.

Guichard, S., Kennedy, M., Wurzel E. and André C. (2007)‚”What Promotes Fiscal Consolidation: OECD Country Experiences,” OECD Economics Departments Working Papers, No. 553. [Online], [Retrieved March 3, 2013], http://search.oecd.org/officialdocuments/displaydocumentpdf/?doclanguage

=en&cote=eco/wkp(2007)13.

Gupta, S., Baldacci, E., Clements, B. and Tiongson, E.R. (2005)‚ “What Sustains Fiscal Consolidations in Emerging Market Countries?,” International Journal of Finance and Economics, 10, 307—321.

Publisher – Google Scholar

Hagemann, R. (2012), “Fiscal Consolidation: Part 6. What Are the Best Policy Instruments for Fiscal Consolidation?,” OECD Economics Department Working Papers, No. 937. [Online], [Retrieved February 23, 2013], http://www.oecd-ilibrary.org/economics/fiscal-consolidation-part-6-what-are-the-best-policy-instruments-for-fiscal-

consolidation_5k9h28kd17xn-en.

Hagen, J., Hallett, A H. and Strauch, R. (2001), “Budgetary Consolidation in EMU,” EC Working Papers, No. 148. [Online], [Retrieved March 3, 2013], http://ec.europa.eu/economy_finance/publications/publicat

ion 11056_en.pdf.

Ilzetzki, E. and Vegh, C.A. (2008)‚ “Procyclical Fiscal Policy in Developing Countries: Truth or Fiction,” NBER Working Paper, No. 14191. [Online], [Retrieved February 25, 2013], http://www.nber.org/papers /w14191.pdf.

Johansson, A., Heady, C., Arnold, J., Brys, B. and Vartia, L (2008), “Taxation and Economic Growth,” OECD Economics Department Working Paper, No. 620. [Online], [Retrieved February 28, 2013], http://management-class.co.uk/financial_centre/5kzhpz16qlhb.pdf.

Maroto I. R. and Mulas-Granados C. (2002), “Duration of Fiscal Budgetary Consolidations in the European Union,” European Economy Group Working Paper, No. 18. [Online], [Retrieved February 28, 2013], http://pendientedemigracion.ucm.es/info/econeuro/documentos/documentos/dt182002.pdf.

Molnar, M. (2012), “Fiscal Consolidation: Part 5. What Factors Determine the Success of Consolidation Efforts,” OECD Economics Department Working Papers, No. 936. [Online], [Retrieved February 23, 2013], http://www.oecd-ilibrary.org/economics/fiscal-consolidation-part-5-what-factors-determine-the-success-of-consolidation-

efforts_5k9h28mzp57h-en.

Mulas-Granados, C. (2003), “The Political and Economic Determinants of Budgetary Consolidation in Europe,” European Political Economy Review, 1(1), 15-39.

Oprea, F. and Bilan, I. (2012)‚ “EU Fiscal Consolidation Strategies In Times Of Crisis — Comparative Approaches,” Analele Universităţii Tibiscus Timişoara, Seria Ştiinţe Economice, 18, 890-898.

Polito, V. and Wickens, M. (2011), “Assessing the Fiscal Stance in the European Union and the United States, 1970-2011,” Economic Policy, CEPR, 68, 599-647.

Publisher – Google Scholar

Socol, C. (2010)‚ “Experienţe ale Ajustărilor Fiscale Largi în UE. Cazul României,” Economie teoretică şi aplicată, Vol. XVII, 12(553), 21-28.

Sutherland, D., Hoeller P. and Merola R. (2012), “Fiscal Consolidation. Part 1. How Much is Needed and How to Reduce Debt to a Prudent Level?,” OECD Economics Department Working Paper, No. 932. [Online], [Retrieved March 8, 2013], http://www.keepeek.com/Digital-Asset-Management/oecd/econom

ics/fiscal-consolidation-part-1-how-much-is-needed-and-how-to-reduce-debt-to-a-prudent-level_5k9h28r

hqnxt-en.

Wagschal, U. and Wenzelburger G. (2011), “The Pre-crisis Perspective: When do Governments Consolidate? A Quantitative Analysis of 23 OECD Countries (1980-2005),” [Online], [Retrieved March 3, 2013], http://www.wipo.uni-freiburg.de/.

Zohlnhöfer, R. (2005), “The Politics of Budget Consolidation in Britain and Germany: The Impact of Blame-Avoidance Opportunities,” West European Politics, 30(5), 1120-1138.

Publisher – Google Scholar