Introduction

Sustainable and responsible investment (SRI) could be defined as the “type of investment which aims to achieve financial returns while performing in terms of extra-financial aspects, such as social, environmental, governance and ethical objectives”, as proposed in Vermeulen, C., Mention, A.L. (2011a). In recent years, the interest in SRI has been growing and new SRI-specific actors and roles have emerged. They provide services of marketing, labeling, rating, audit, etc., and thus contribute to the value chain specific to this type of investment. These new SRI-specific activities remain unregulated, which is partially due to the novelty and constant evolution of this domain. Nonetheless, with the profusion of labels and funds claiming to be responsible and sustainable, the potential investor may find it difficult to discern which SRI aspects are covered by each label, and consequently be confused with the existing investment offers. This situation calls for establishing the regulative framework enabling better control of SRI-related activities. It should in the first place enable a clear distinction of roles and responsibilities of different SRI stakeholders.

This paper aims to contribute to achieving better understanding of the specificity of SRI fund industry and involved stakeholders. The roles within the SRI- specific value chain are formalized with goal- and-value-modelling languages, and within this frame the researchers propose to analyse the dependencies and existing/possible value exchanges between the actors. The presented study is part of a broader research project which aims to understand what is really underlying the concept of SRI funds.

In this paper, the modelling techniques employed are first briefly introduced in section 2, while the proposed models are further discussed in section 3. The prospects of this on-going work are discussed in the conclusion.

Methodology

The approach the researchers rely on in this study consists of two stages: In the first stage, the models are developed relying on the academic and professional literature. The second stage, which is still to be executed, will comprise the validation of the model through the interviews with a representative sample of stakeholders identified at the European level.

As introduced earlier, two modelling techniques are combined to develop the models presented in this paper: goal modelling and value modelling.

Goal Modeling

Goal modeling aims to determine what various actors want and how (and whether) those wants will be achieved. We used the i* language, introduced in Yu, E. (2006) and Gordijn, J. & al. (2006), which stands for distributed intentionality, and builds on the premise that actors don’t merely interact with each other through actions or information flow but relate to each other at an intentional level.

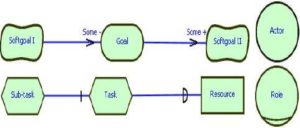

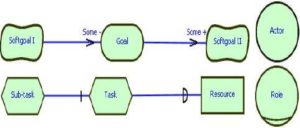

A role conveys the notion of an abstract actor, meaning that one or more concrete physical actors can assume the role. Actors in i* are strategic in that they seek relationships that will best suit their strategic interests. Each actor has its own strategic goals to pursue. Such goals are achieved through a network of intentional dependencies; that is, the actors depend on each other to achieve goals, perform tasks and furnish resources:

- Goal: A condition or state of affairs to be achieved. An actor can choose freely among different ways to achieve a goal.

- Resource: A physical or informational entity needed to achieve some goal or to perform some task.

- Soft Goal: A goal without a clear-cut criterion for achievement, thus requiring further refinement and judgment. You might typically use this to represent quality goals.

- Task: A course of action to be carried out. It specifies a particular way of doing something, typically to achieve some goal.

Typical relationship types used to relate these elements are:

- Means-ends: means-ends link shows a particular way (typically a task) to achieve a goal.

- Decomposition: decomposition link Show how an intentional element (typically a task) is decomposed into sub-elements, which can include goals, tasks, resources and soft goals.

- Contribution: contribution link shows a contribution toward satisfying a soft goal, typically from a task or another soft goal.

Figure 1: i* Constructs

The goal structures enable us to the space of alternatives available to each actor. The identified dependencies between actors offer opportunities but can also create vulnerabilities.

Using i* two types of models can be created:

- Strategic Dependency (SD) model, where each link between two actors indicates that one actor depends on the other for something in order that the former may attain some goal. The SD model is used to express the network of intentional, strategic relationships among actors.

- Strategic Rationale (SR) model is a graph that provides a representational structure for expressing the rationales behind dependencies. The actors with the SD model show their specific intentions.

Value Modelling

Value modeling allows representing a network of actors creating, distributing and consuming things of economic value. The “Business Model Drawing Tool”, edited by Board of Innovation (2012), is used as a simplification of the constructs of e3value language.

The main concepts used in value modeling are:

- Actor: an actor is perceived by its environment as an independent economic (and often also legal) entity. An actor makes a profit or increases its utility. In a sound, sustainable, e-business model each actor should be capable of making a profit.

- Value object: actors exchange value objects. A value object is a service, good, money, or experience which is of economic value to at least one actor.

- Value exchange: a value exchange represents one or more potential, direct or indirect, trades of value objects.

Figure 2: Value Modeling Constructs

SRI Value Network

Sustainable and responsible investment can be considered as a specific case of a classical investment value chain. To be able to understand the strategic rationale of SRI actors, we analyse the intentions of key actors within the classical investment process.

Classical Investment Chain – Actors’ Rationale

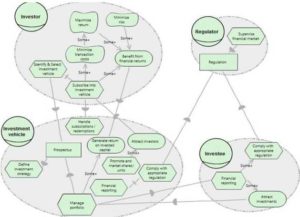

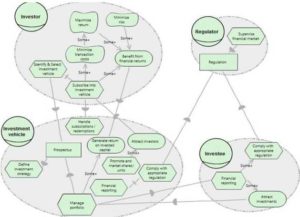

Figure 3 shows a simplified SR Model describing rationales and dependencies between actors involved in investment activity: (i) investor, (ii) investment vehicle, (iii) investee and (iv) regulator.

Generally speaking, investors, whether individual or institutional, put their money into some investment vehicle with goals of getting return from the invested capital. Investors seek to minimize the risks and maximize the returns. Subscribing to an investment vehicle is one of the means to minimize transaction costs. The investor investment choice is partially based on the information provided in the prospects of the fund, which has to be validated by the regulation authority.

For the purpose of simplicity, the researchers group together the activities of the fund promoter, distributor and asset manager (investment manager) into a generic role investment vehicle. This is to underline that main objectives of this role consist in attracting investments and generating a return on invested capital. The investment vehicle has to comply with appropriate regulation, issued by the regulator⎼ the official body in charge of the supervision of the financial market.

Investee is the business entity in which an investment is made. The investee would need to attract investments, and would for this purpose perform financial reporting required by the regulator.

Figure 3: Simplified Investment Strategic Rationale Model

Specificities of Socially Responsible Investment

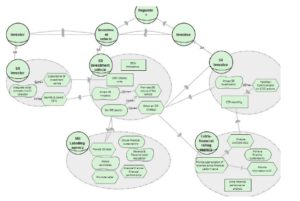

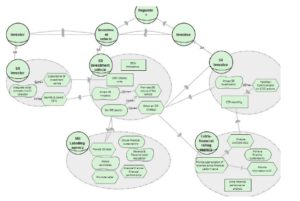

To study SRI, the researchers focused on identifying the specific concerns adding to them more “classical” roles in the SRI context. Moreover, the researchers included in their analysis several new actors/roles brought by this specific investment sector. Figure 4 presents a preliminary Strategic Rationale Model for SRI, involving : (i) Sustainable and responsible investors (SR Investor); (ii) Sustainable and responsible investment vehicle (SR Investment vehicle); (iii) Sustainable and responsible investee (SR Investee), respectively as specific cases (specialisations) of the roles are (i) Investor, (ii) Investment vehicle and (iii) Investee.

A SR Investor would seek investment opportunities integrating extra-financial aspects, along with reaching satisfactory financial performance. SR Investment vehicle, on the other hand, targets this investor profile by adopting an SRI strategy integrating environmental, social & governance concerns into its investment process. In addition, an SR Investment vehicle would perform activities promoting the SRI orientation of the vehicle.

Obtaining an SRI label, from the corresponding agencies (SRI labelling agency), is one of the means for the investment vehicle to be recognized as an SRI vehicle.

Investees willing to attract the SRI funding could communicate on its corporate social responsibility, thus proving the investee’s interest in: e.g. social, environmental and other aspects relative to SRI. The corresponding investee’s reports are reviewed by extra-financial rating agencies, providing appreciation of investee extra-financial performance. The asset selection process of the SR Investment vehicle usually relies on these evaluations.

Figure 4: SRI Strategic Rationale Model

Figure 4: SRI Strategic Rationale Model

SRI Value Network Proposition

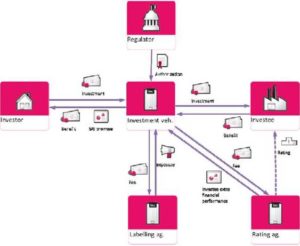

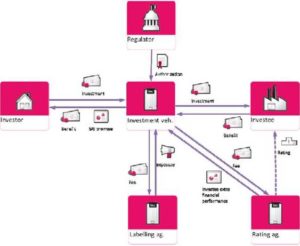

The presented value exchange model (Figure 5) is derived relying on the identified rationales and dependencies between the stakeholders discussed in the previously introduced SR models.

This model should serve as the basis for analysing the nature of direct or indirect exchanges taking place between the actors. In particular, even this preliminary model allows raising potential conflicts of interest and deviations, such as:

- SR Investment vehicle are subject to “administrative” fees for obtaining the SRI labels. This may pose concerns regarding the independency of the labelling agencies.

- Although rating agencies are not directly financed by the investee, these agencies have a great impact on the investee’s attractiveness on the financial market, and thus the investee may be led to influence in one or the other way the rating evaluation process.

- The investor has no other option than to trust the claims on SRI character of the assets held by SR investment vehicle, since the rules are not clearly established.

These and similar hypotheses resulting from the analysis and validation of the models will serve to propose a clear definition of the responsibilities among the value network and to make a contribution to the clarification of the SRI offer.

Figure 5: Preliminary SRI Value Network

Conclusion and Perspectives

This paper aims to identify the stakeholders participating to the SRI-specific value network and proposes to analyse their (potential) mutual exchanges. It is believed that the intended cycles of validating the models through questionnaires will help to clearly define roles and responsibilities of different SRI stakeholders.

The results of this on-going study are intended to serve the fund industry regulators, practitioners and researchers in SRI. The proposed models would serve as formalized tools to analyse the interactions between SRI market players; to detect possible conflicts of interest between the actors involved; to analyse overlaps or gaps with compliance matters; and other issues susceptible to have an impact on the value chain. Finally, the formalized SRI value network allows discussing its weaknesses that leave the space for deviations and misuses of SRI of various natures. In this way, the awareness of key actors can be raised in the value network with respect to the SRI impact and its limits.

The researchers believe that their work will as well contribute to identify the risks of SRI deviations that may occur (discuss and structure the critics of SRI concepts), and that it can consequently be used as an input when defining the adapted industry-specific regulative framework.

Finally, once the roles, expectations and possibilities for value exchange between the stakeholders are validated, it could help to explore the ways in which better social impact of sustainable and responsible investments can be guaranteed, i.e. through establishing alternative value networks or providing recommendations on portfolios composition.

Acknowledgment

The presented work is led in the frame of the project EMISSAIRE (Évaluation multi-dimensionnelle de l’investissement socialement responsable – Multidimensional evaluation of socially responsible investment) and is partially funded by the FEDER (Fonds Européen de Développement Régional) program.

(adsbygoogle = window.adsbygoogle || []).push({});

References

Avetisyan, E. (2010). “Emergence and Evolution of Sustainability Rating Agencies: An Institutional Approach,” July 2010.

Publisher

Board of Innovation (2012). www.boardofinnovation.com, Business Model Drawing Tool.

Publisher

EFAMA (2011). “Asset Management in Europe: Facts and Figures,” EFAMA’s Third Annual Review, Pp.37, 2010.

Publisher

Ferguson. M. & Al. (2010). “Investment Funds in Luxembourg: A Technical Guide,” Ernst & Young, Pp.246, 2010.

Publisher

Gordijn, J., Petit, M. & Wieringa, R. (2006). “Understanding Business Strategies of Networked Value Constellations Using Goal- and Value Modeling,” In Martin Glinz and Robyn Lutz Editors, Proceedings of the 14th IEEE International Requirements Engineering Conference, Pages 129-138, IEEE CS, Los Alamitos, CA, 2006.

Publisher – Google Scholar

Gordijn, J., Yu, E. & Van Der Raadt, B. (2006). “e-Service Design Using I* and e3value Modeling,” IEEE Softw. 23, 3, May. 2006, 26-33.

Publisher – Google Scholar – British Library Direct

Hoff, B. & Wood, D. (2008). “The Use of Non-Financial Information: What Do Investors Want?,” Institute for Responsible Investment, March 2008. I* Wiki (2012), Istarwiki.Org

Publisher

Malcom. K. & Wilsdon. T. (2006). “Potential Cost Savings in a Fully Integrated European Investment Fund Market,” CRA Project No D0-8482, Pp.144, 2006.

Publisher

Owen, D. L. (2003). “Recent Developments in European Social and Environmental Reporting and Auditing Practice – A Critical Evaluation and Tentative Prognosis,” Research Paper Series, International Centre for Corporate Social Responsibility, ISSN 1479-5124.

Publisher – Google Scholar

Production Jocelineaste (2010). Moi, La Finance et Le Développement Durable. Documentary, 1h34mn. Distribution Jocelineaste. Sept. 2010.

Publisher

Statman, M. (2008). ‘Sustainable and Responsible Investors and Their Advisors,’ The Journal of Investment Consulting, Vol. 9, Num. 1, Fall 2008.

Turki, S., Bjekovic, M. & Vermeulen, C. (2011a). ‘Understanding SRI: Stakeholders’ Value Exchange,’ Innovation for Financial Services Summit, Luxembourg, Sep. 2011.

Turki, S., Bjekovic, M. & Vermeulen, C. (2011b). ‘Exploring Socially Responsible Investment: Stakeholders’ Value Exchange,’ Proc. Of IBIMA’17, Milan, Nov. 2011.

Vermeulen, C. & Mention, A.- L. (2011a). “Sustainable Financing: Collaborative Innovation Restoring Confidence in Regulated Environments,” In Proc. of the ISPIM Conference, Hamburg, June 2011.

Publisher – Google Scholar

Vermeulen, C. & Mention, A.- L. (2011b). ‘Sustainable Finance: Collaborative Innovation Improving Confidence Towards SRI Funds,’ Innovation for Financial Services Summit, Luxembourg, Sep. 2011.

Vermeulen, C. & Mention, A.- L. (2011c). ‘Reporting Extra-Financial Performance in the Context of Socially Responsible Investments: Convergence between ESG and Intellectual Capital Approaches,’ 7th EIASM Workshop on Visualizing Measuring and Managing Intangibles and Intellectual Capital, Warsaw, Poland, Sep. 2011.

World Economic Forum (2005). ‘Mainstreaming Responsible Investment,’ Global Corporate Citizenship Initiative, January 2005.

Google Scholar

Yu, E. S. K. (1997). “Towards Modelling and Reasoning Support for Early-Phase Requirements Engineering,” Proc. 3rd IEEE Int. Symp. Requirements Eng. (RE 97), IEEE CS Press, 1997, Pp. 226–235.

Publisher – Google Scholar

ZEW/OOE (2006). “Current Trends in the European Asset Management Industry,” Lot 1, Pp.21, 2006.

Publisher