Introduction

A significant role is played by the internet in connecting to information and people. Internet has significantly helped shortening the distance between people and their prospects, hence given birth to online services and ventures. Online shopping is trending in the world giving increased output every year. Virtual marketplaces are catering to all kinds of consumer needs be them tangible or intangible, standardized or general and durable or perishable (Datamonitor, 2010). Computer appliances, books and accessories lead the market share for online shopping being the standardized goods. Whereas products like groceries are still struggling to attain popularity for consumers opting to purchase online (Grewal, Iyer, Levy, & Michael, 2004).

Grocery products include the edible commodities that are purchased often or on continuous basis from supermarkets, usually at regular intervals of time. Traditionally, groceries are bought in set-up where the consumer can inspect the product before buying (Klein, 1998). The sense of touch, smell and sight directly affects the buying decision of consumers. Also, the marketplaces are not just limited to the perishable products, durable eatables (such as canned and packet food) and non-food goods such as household appliances are also available (Schuster & Sporn, 1998). Hence, grocery shopping becomes an actual expedition where physical activity is undertaken and strong senses help determine the choice.

Online grocery shopping looks promising when compared to other products available online but it faces rather different challenges of its own for its buyers as well as sellers. Benefit of doubt increases where a buyer takes sensory attributes involved in the traditional process. Also, delivery/transportation of fragile items becomes a delicate problem. In some cases, the buyer is just not interested to leave their deep-rooted shopping habits and switch to new ones; regardless of how much of their time and money is saved. It is crucial to explain the variables that influence buyers towards the purchase of grocery products online (Liao & Cheung, 2001).

It is important to note that online shopping takes more than just the desire to act. Although it does not involve traveling, carrying heavy weight or work-hour restriction, the presence of certain resources is mandatory that makes the transaction possible (Chu, Arce-Urriza, Cebollada-Calvo, & Chintagunta, 2010). Thus it is important for buyers to be well equipped and aware of the technicalities of online shopping so that their experience is without any hindrance (Shim et al., 2001). Individuality of each potential customer also plays an important role in defining sales. A person with more internet exposure will tend to shop more than the person who has less experience with internet (Frambach, Roest, & Krishnan, 2007).

Online grocery trade has a lot of potential as Generation Y and their predecessors use technology frequently to save time and seek convenience as compared to the previous generations who are accustomed to buying groceries from brick and mortar stores. The grocery shoppers of new age are identified as better educated and risk taking individuals who try new things and opt for easier solutions to problems. From the research related to internet usage of people, findings conclude that complex decision making of consumers is based on the social cognition of individuals.

This research study aims at identifying the key factors that tend to increase the adoption of online grocery, what consumers want from a grocery store and what are their current attitudes towards the concept. Furthermore, the research aims to identify the pain points of consumers that need to be catered to increase online grocery shopping adaptability.

The past few years have seen a tremendous growth in e-commerce. Use of online platforms to seen goods and services has created a differentiation between the market leaders and laggards in various industries. According to e-commerce statistics 40 percent of the worldwide internet users have bought some form of products or goods online via desktop computer, mobile phone, tablet or other online devices (Statistica, 2014). Express tribune, (2014), stated that the e-commerce industry in the Asian region has seen a boom. Pakistan, though is a late entrant in e-commerce, however, a massive rise in online shopping trends has been observed. In the next five years it is expected that Pakistan’s e-commerce market will surpass $1 billion.

Online grocery’s market share in Pakistan is around $25 million (Arshad, 2015). It is also expected that Pakistan’s e-commerce revenue will reach US $ 600 million by 2017 (Ahmad, 2015). To further facilitate the adoption of online grocery, analysis of consumer needs and their behavior is crucial. The study layouts consumer perception and readiness towards online grocery shopping and to highlight the pain points that need to be eliminated for better acceptance of online platforms for shopping.

Literature Review

Researchers have worked a lot on online grocery, how consumers adopt a new buying behavior and what compels them to change their behavior. One such research group is Hartman. According to Hartman, (2015), the attempt of selling grocery online in 1990’s appeared to be a failure, but now online shopping is taking over the shift. Unquestionably, consumers are now more interested in buying packaged goods that can be stored for days. This is also aiding the online grocery trend. The increasing scope of digital platforms has got many brick and mortar stores worried for their digital presence as new digital players are taking away their consumer share of wallet and are making presence in the consumer mind. Many stores are now planning to enter into the digital era and create their presence online (Hartman Group, Forbes, 2015).

Hartman group (2015) is of an opinion that Brick & Mortar stores will not completely get off the market but few shoppers are getting over the conventional notion of doing grocery. Important point to ponder over is the idea that, will online grocery shopping become acceptable and provide share of wallet from a good number of consumers? Hartman Group (2015) report states that online grocery shopping helps early adopters save around 39% of their time, 36% of money and around 27% of fuel.

In order to widen the scope, online grocery needs to focus on under stated areas:

- Target Households: young urbans and families

- Meet Underserved Needs: highlighting convenience

- Look for Cultural Hooks: try to get monthly subscriptions etc.

Online grocery shopping helps buyers eliminate the activity of physically visiting the stores, providing convenience to get things delivered on a single click, no standing in long lines and no carrying of heavy bags. They also reduce unnecessary shopping habits and picking extra items while shopping in a store. It will quickly grab the attention of consumers who are procrastinators and are not fond of visiting the stores. While people who visit physical stores in terms of outing and for fun will still prefer brick and mortar stores, unless they find some super quick delivery or discounts or coupons or other order processing conveniences. However, considering the food culture it is evident that digital food will make its place and technology will help earn greater shares. (Hartman Group, Forbes, 2015).

Nielson group investigated five factors to know about online grocery shopping, which are:

- Consumers love online grocery shopping but it will take them time to get comfortable with it. The supply side needs to make the shopping experience easy by making user friendly interface of the web or app. It must be easy to navigate and provide time saving and efficient delivery service.

- Online store should provide maximum number of listings and product options to choose from as it is different to buy online than offline. The e-store should have good number of packages and categories available.

- Consumer perception and behavior while buying online is affected in various ways. It is important to provide an easy to use platform. Greater variety would help the buyer choose and make comparisons.

- Online shopping has greater transparency, price visibility, extensive distribution and customization available.

- It is important to build proper marketing strategy to align your store with the best marketing strategies to increase interactions and link customers with your brand. Create, excite, bring innovative ideas and build relationship on social media platforms along with spreading awareness.

Court, Elzinga, Mulder and Vetvik, (2009) researched about the process the consumer goes through while making a decision. According to them, the aim of marketing is to reach the target audience the exact moment that will most influence the decision of the consumers. Marketers try to identify those specific moments and term them as touch points to influence customer decisions. Consumers use a funnel approach to reach a final decision. Consumers start with a wide range of options (brands/products) and start to filter them methodically till they reach to a single brand which they opt to purchase as a final solution to their need. However, in the modern time due to an explosion of options present in the market for consumers along with digital channels to seek information about those options, the funnel approach is a failure. To overcome this failure a new approach called consumer decision journey has come into play. This approach facilitates geographic markets using different forms of media to access information regarding product choices.

In the cluttered and proliferated market, marketers need to develop new methods to get their products in consumers’ list of consideration of valid options. In the past marketers were the only influencers of decision making through one way communication however, now the consumers not only influence the marketers but also each other through feedbacks and reviews on digital platforms about products and services. Now the consumers are generating marketing content on behalf of the companies and marketers in many situations. The companies can use this to their advantage by reinvigorating their loyalty programs and by aligning their message, strategy and spending to create a worthwhile experience for the target audience (Court, Elzinga, Mulder and Vetvik, 2009).

Proliferation of products and fragmenting of media reduces the number of brand choices consumers have to face. Bombardment of information also reduces the interest of consumers in a wide range of options and they tend to purchase the product which they considered initially. In this scenario brand awareness is the key for the selction of a particular product/brands (Court, Elzinga, Mulder and Vetvik, 2009).

Consumers now tend to pull information about their options before purchase. The most effective form of information perceived by the consumers includes positive word of mouth received from peers, family members or friends and online reviews. However, authentication of online reviews is also an important factor. In case of brick and mortar stores in-store interactions with the retailers, other buyers, purchase experience and recollection of past experience plays a significant role in consumer decision making. The cycle does not end at the purchase but continues and moves into the post purchase experience of the consumer which will either make the consumer loyal, defector or a dissatisfied lost client for the company (Court, Elzinga, Mulder and Vetvik, 2009).

Even amongst loyal consumers there are two types the active loyalists who not just keep the specific brand as their first choice but also generate positive word of mouth and promote a company’s brand. While, the others are passive loyalists who purchase the brand but are not committed towards it. Furthermore, this type of loyalists are open to messages and offers from the competitors and will switch to the competitor’s brand when given a choice that they consider better than the current choice that your company brand is offering to them. Therefore, companies should spend more time and effort to increase the base of their active loyalists (Court, Elzinga, Mulder and Vetvik, 2009).

Marketers should perform four kinds of activities in order to influence consumer decision journey

- Prioritization of their objectives and spending accordingly

- Tailor made messaging/customized messaging

- Investment in consumer-driven marketing

- Win the in-store battle

Marketers are aware of the changes in the decision making dynamics of consumers and have adopted new strategies to keep up with their target audiences however, even then they have to face failures and defeat.

Hansen (2005), identified that consumers who purchase groceries online perceive that this mode of purchase id different from purchasing the same products from a brick and mortar store. The experience consumers receive while shopping for groceries online is quite different as it provides consumers with several benefits including convenience, time saving and any time ordering facility from anywhere.

Hansen (2005) categorized innovation into 3 types

- a) Discontinuous innovation

- b) Dynamically continuous innovation

- c) Continuous innovation

Hansen (2005) suggested that in case of shopping online the type of innovation employed was discontinuous innovation because this type of innovation uses technological advances linked with changes in consumer behavior. Therefore, developing an understanding of such innovations plays a crucial role in their adoption.

Rogers gave 5 factors to increase the rate of acceptance and adoption of such innovations:

- Communicability of the innovation. Which implies that how easy it is for consumers to observe the innovation and further communicate the usage of the innovation to other potential consumers

- Triability or divisibility implies the possibility of a consumer to try the innovation without incurring any large investments

- Complexity implies that how difficult it is for the consumers to use the innovation

- Compatibility refers towards the match up/congruency of the innovation with the past and current values of the consumer

- Relative advantage refers towards the consumers’ perceived usefulness of the innovation and consumers’ perception regarding its superiority in comparison to other competitor innovations

In addition to this, perceived internet grocery buying risk should also complement the stated 5 factors by Rogers. Three segments of various types of consumer adoption behavior were considered.

- Segment 1: non-adopters of online shopping

- Segment 2: online shopping adopters (excluding groceries)

- Segment 3: adopters of online shopping and online grocery-shopping

Adopters of online grocery shopping tend to attach higher relative advantage, lower complexity higher compatibility, and more positive social norms to online grocery shopping in comparison to non-adopters of online shopping. Furthermore, it was observed that the online shopping adopters tend to have higher annual income in comparison to non-adopters of online shopping which implies that higher buying power increases consumers risk taking (Hansen, 2005).

For success online grocery platforms need to adapt to the needs of the consumers and identify the daily hassles the consumer faces. Assuming that consumers will compromise on their needs is a farfetched idea if the online grocery platforms believe in it. These platforms should make the use of online grocery platforms easy and convenient for the users. Marketing the relative advantages of using online platforms for shopping groceries can be the first step towards success for such business models (Hansen, 2005).

Conceptual Framework

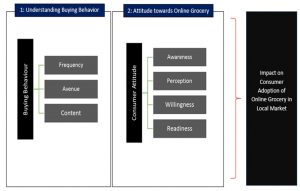

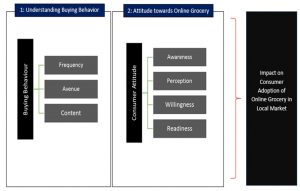

Figure 1 : Conceptual Framework – Online Grocery Shopping

The conceptual framework studies the impact that the pre-established buying behaviors have over the attitude towards online grocery buying. Both the buying behaviors of grocery shopping and the attitude towards grocery shopping are further analyzed through few factors which are discussed in the following section.

The conceptual framework initially studies the generic buying behavior of a consumer towards buying grocery. The intention is to analyze whether the current buying behaviors of local consumers are deeply rooted or not? In an actual market setting, the factors and behaviors associated with buying grocery are immense. However, in order to narrow down our research to focus on few significant behaviors, this research study intends to examine three main factors associated with buying grocery, which are as follow;

- Frequency: Frequency refers to the number of visits done to a grocery shop in a said time period. For instance – daily visits, weekly visits, bi-monthly visits or monthly visits.

- Avenue: Avenue refers to the situational context of a grocery store. We intend to study what a consumer prefers in terms of size and location of the store. Is a local consumer satisfied going to a small general store to buy groceries, situated at the end of his street? Or does he prefer to visit super stores and does not mind taking out his car for that?

- Content: Content refers to the products that make up the consumer’s grocery list and are purchased on a regular basis.

- As mentioned above, the conceptual framework intends to gauge the extent to which the buying behaviors towards grocery shopping are rooted in our local consumers. The higher the frequency, the higher the acceptance towards different grocery avenues and higher the list of items purchased – would translate into deeply rooted buying behaviors which are hard to overcome since they come naturally to consumers.

The given state of buying behavior and the established extent of its strength has a direct impact on a consumer’s attitude towards online grocery, which is the second part of our conceptual framework. The four primary factors which can be studied in order to gauge the consumer’s attitude towards online grocery are as follow;

- Awareness: Are the local consumers even aware of such a concept of buying groceries online?

- Perception: How do the local consumers perceive online grocery?

- Willingness: Are the local consumers willing to try online grocery?

- Readiness: On what readiness stage are the local consumers in terms of online grocery buying? (Buying Readiness Stages: Awareness, Interest, Desire and Action)

Attitude towards online grocery buying can be said positive if the aforementioned four factors are high/positive. Which means for an attitude to be positive, a local consumer should have acceptable levels of awareness, positive perception, and positive willingness and should be at least interested in doing groceries online.

Since the concept of online grocery is of novel nature in local market – thus, online grocery model can only be adopted by local consumers if attitude towards online grocery is positive and it does not adversely interplay with the pre-established grocery buying behaviors (Ali et al., 2017).

Methodology

The research targets the sample population of consumers drawn from Karachi who have or do not have any previous experience of online grocery shopping. The sample size for the study was 90 individuals and it employed purposive and snowball sampling techniques to get data from the respondents who were best suited for the research at hand. Data were collected primarily using questionnaire technique. The research questionnaire caters to five sections of questions designed to know different aspects of consumer behavior. Section one includes questions related to the demographic profile of respondents such as gender, age, relationship status, education etc. Section two consists of questions that relate to general online shopping and awareness of online grocery and grocery stores in Pakistan. Section three focuses on questions regarding their perception towards online grocery, their willingness to buy and the factors that refrain them to buy online grocery. Section four consists of Likert scale questions to assists in knowing the opinion of people regarding online grocery shopping, their preferences and value proposition they are looking for. Section five consists of questions that gauge consumer readiness towards online grocery shopping.

We distributed our questionnaire to respondents who are aged 18 years or above. The questionnaires were further divided into 3 target markets.

- Domestic household consumers

- Professionals

In the process of our research we identified a new target market and included it as part of our research i.e. lives alone, Students and young professionals who live alone in Karachi.

Research Questions

- What is the current understanding of online grocery in Pakistan?

- What is the general attitude of consumers towards online grocery?

- What factors are important to increase the adoption of online grocery?

- What value a consumer wants an online grocery store to offer?

Hypotheses

H1: Local consumers are not aware of online grocery shopping in local market

H2: Local consumers don’t have positive perception towards online grocery shopping in local market

H3: Local consumers are not willing to experience online grocery shopping in local market

H4: Local consumers are not ready to adopt online grocery shopping in local market

Analysis and Discussion

The internet phenomenon is providing a new mode to do business in Pakistan. With E-commerce expected to become a $1 Billion industry by 2020 (Tribune, 2015), the future outlook is bright with immense potential in all areas for this yet untapped market of 200 Million people of Pakistan. This massive transformation is leading a behavioral change in consumers as to how they shop for products and services across the board ranging from grocery items to automobiles. The focus of this paper will be on grocery products.

On our fact finding journey, we further conducted a thorough research and survey analysis pertaining to the Pakistani market. The idea was to understand the different consumer perspectives as to how they view the online grocery model in Pakistan. For the purpose of simplicity we have categorized the respondents into three groups which are as follow:

- Domestics: This segment is comprised of the local households of Karachi including both men and women. Traditionally women in domestics lead all the major purchase decisions for their households and have deep rooted cultural preferences as to what and where to buy from. It is a planned purchase for them, which occurs on a monthly basis, mostly at super markets and large retailers. Although they share the same touch point as professional women but are slightly more complex in their selection of products. An important aspect is their lack of awareness for the online model coupled with their ability to access computers and doubts about online buying of goods. For them, understanding of the model and addressing their fears is the first step towards their road to online shopping. Simple questions ranging from the time taken to deliver goods to the quality of the products supplied need to be promoted through well advocated channels. Furthermore the responses also uncovered the use of single products in the initial phase to encourage trials.

- Professionals: These respondents were women belonging to the age bracket of 20-29. For them grocery shopping is an experience which they enjoy; particularly if it involves going to the supermarkets like Naheed or Aghas. They make informed and planned purchase decisions unlike the live alone. For them, variety is important and becomes an important factor in choosing the shopping venue as well. Despite low awareness to the online model, 53% of the respondents favored towards giving the online model a try. This reflects that the segment does have a potential but needs to be pitched across the right touch points. Again, to tap this segment we need to align the product simultaneously on convenience and variety which will in turn be a determinant of how price sensitive they (professionals) become to that offering. But one obstacle identified in the responses was the physical inspection of the product, the answer to which lies in ‘360 degree’ display of products on the webpage along with clear photography to make the products vivid and more observable to the users. Factors like quick delivery, promotional offers and discounts coupled with authentic brand portfolio is what they are looking for. However despite the odds, the working women are willing to pay 5-8% premium if they are able to get the right product at the right moment. Bundle offers from multiple brands under one roof can again come in handy to attract such visitors over the website.

- Live Alones: As the name suggests, this class of respondents are people who are living single-handedly for education or job purposes in Karachi. With more than 70% being male and falling in the age bracket of 20-29, they have a high preference for home cooked meals and are the decision makers when it comes to grocery buying. Normally the ‘live alones’ don’t have a planned purchasing pattern but they do make weekly purchases based on their need. Although only 20% of the respondents were familiar with the online model for grocery but willingness to try was higher, making them a viable target to pursue. Being a highly price sensitive audience and significant preference for convenience, bundle offers is the ideal way to attract ‘live alones’ for online grocery shopping. By capitalizing on the need for convenience and properly positioning the offers to their budget, the ‘live alones’ can serve to be regular and loyal customers. The focus should be on how flexible the model can be for them in a time saving manner.

Strategic Findings

- Young people falling in the age group of 20-29 years of age are more likely to purchase online, while their older counterparts are less prone to shop for groceries online

- 72% respondents purchased groceries on monthly basis, while only 19% purchased on weekly basis and only 9% purchased on fortnightly basis

- 59% respondents did not feel the need to purchase anything after they had purchased for the entire month, while 41% did feel that there still was the need to shop for certain things even after their monthly purchase was done

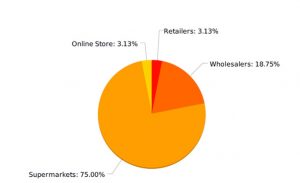

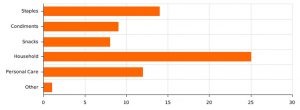

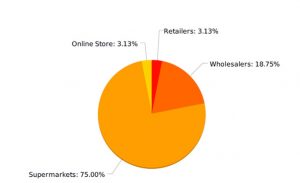

- Only 10% respondents were used to purchase groceries online while 61% respondents said that they would try online grocery shopping in the near future. However, 75% respondents purchased groceries from the supermarkets (Figure – 3)

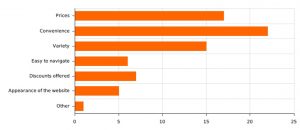

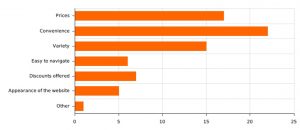

- When asked about the factors that influence the purchase of groceries online, the respondents stated that online grocery shopping provided convenience of sitting at home or office and order the needed things without any hassle, while prices and variety were the second and third most important factor that influenced the online purchase of groceries (Figure – 4). The respondents further elaborated that while purchasing online they were able to compare the rates and number and type of variants available on other online grocery shopping platforms which gave them an assurance that the purchase they were doing was worth their money

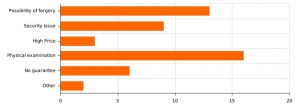

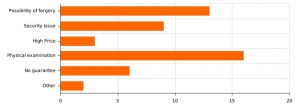

- The respondents stated that they avoid online grocery shopping because it lacks the element of physical examination by the buyer, and the chances of forgery are also present along with the possibility of security risk that the buyer’s personal and financial information might be misused (Figure – 5)

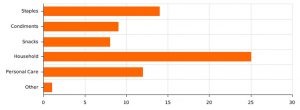

Figure 2 : Purchase Items mostly bought in Groceries

Figure 3 : Typical Mediums of Shopping

Figure 4: Factors Influencing Online Grocery Shopping

Figure 5 : Reasons for Avoiding Online Grocery Shopping

Conclusion and Recommendations

From the above analyses, it is clear that there is a long road to fully penetrate the market. Our analyses identified that there is a significant image problem for the online model, coherent across the three segments of respondents. Buying from retailers is a norm and disruption of any norm is not easy and nor is it always welcomed. Instead of positioning it as an alternative, we need to position the online grocery as something which can go hand in hand with the traditional model. The idea is to slowly encompass the user to accept the new way of shopping. Equally important is the fact as to how to create awareness amongst people. At the start we need to focus on users who will be the core drivers of growth for this industry like the live alone or professionals who actually can feel the need for this model.

The next step for online shopping platforms is to understand that how relevant their offerings are to the audience. As correctly pointed out in the survey, respondents were unclear as to what products can they actually buy over the internet. This shows that there exists a gap in communication which needs to be filled comprehensively so that the consumer expectations can be set at the right level. Equally important is the availability to house multiple brands. Consumers have deep associations with brands and would want to buy only their favorite brands. This brand power can be used to encourage those consumers to shop online, who face shortage of authentic brands.

Last but not least is the intrinsic aspect of shopping. Pakistan is experiencing a dynamic shift from general trade to modern trade. By every passing time, bigger retailers are opening up like Naheed etc., which indicates the new trend pertaining to the shopping experience. To cultivate a similar response, there is a need to offer the consumers something equal in value. This value can vary across the three segments that have been identified earlier in this research study. Each segment has its own needs and preferences and the best way is to have a step by step approach.

References

- Ahmed, J., 2015. The encouraging future of e-commerce in Pakistan. Retrieved June 26, 2016, from http://tribune.com.pk/story/975430/theencouraging-future-of-e-commerce-inpakistan/

- Ali, S., Saleem, M., Ahmed, M. E., Khan, M. M., Shah, N., & Rafiq, S., 2017. Models for Online Grocery Shopping–A Study of Pakistani Online Market. Journal of Internet and e-Business Studies. 2017(1), 1-15.

Google Scholar

- Arshad, A., 2015. Online and onwards. Retrieved June 26, 2016, from http://aurora.dawn.com/news/1140744

- Baloch, F., 2014. Online grocery shopping looking to find a way in. Retrieved July 9, 2016, from http://tribune.com.pk/story/680751/online-grocery-shopping-looking-to-find-a-way-in/

- Boyer, K. K., & Hult, G. T. M., 2005. Extending the supply chain: Integrating operations and marketing in the online grocery industry, 23, 642–661. http://doi.org/10.1016/j.jom.2005.01.003

- Breugelmans, E., Campo, K., & Gijsbrechts, E., 2007. Shelf sequence and proximity effects on online grocery choices. Marketing Letters, 18(1–2), 117–133.

Google Scholar

- Castaneda, L., Villegas, N. M., & Müller, H. A., 2014. Personalized Web-Tasking Applications: An Online Grocery Shopping Prototype. In 2014 IEEE World Congress on Services (pp. 24–29). IEEE. Retrieved from http://ieeexplore.ieee.org/xpls/abs_all.jsp?arnumber=6903239

Google Scholar

- Chu, J., Chintagunta, P., & Cebollada, J., 2008. A Comparison of Within-Household Price Sensitivity Across Online and Offline Channels. Marketing Science, 27(2), 283–299.

Google Scholar

- Dada, H., 2016. Online grocery shopping becoming famous in Pakistan Retrieved from http://www.moremag.pk/2016/01/27/online-grocery-shopping-in-pakistan/

- Danaher, P. J., Wilson, I. W., & Davis, R. A., 2003. A comparison of online and offline consumer brand loyalty. Marketing Science, 22(4), 461–476.

Google Scholar

- Dawes, J., & Nenycz-Thiel, M., 2014. Comparing retailer purchase patterns and brand metrics for in-store and online grocery purchasing. Journal of Marketing Management, 30(3–4), 364–382.

Google Scholar

- De Kervenoael, R., Yanık, S., Bozkaya, B., Palmer, M., & Hallsworth, A., 2016. Tradingup on unmet expectations? Evaluating consumers’ expectations in online premium grocery shopping logistics. International Journal of Logistics Research and Applications, 19(2), 83–104.

Google Scholar

- Gevaers, R., Van de Voorde, E., & Vanelslander, T., 2011. Characteristics and typology of last-mile logistics from an innovation perspective in an urban context. City Distribution and Urban Freight Transport: Multiple Perspectives, Edward Elgar Publishing, 56–71.

- Grewal, D., Iyer, G. R., & Levy, M., 2004. Internet retailing: enablers, limiters and market consequences. Journal of Business Research, 57(7), 703-713.

Google Scholar

- Hanif, A., 2016. Do Pakistan’s online grocery stores deliver what they promise? We find out. Retrieved July 9, 2016, from http://www.dawn.com/news/1242498

- Hans, P. P., 2013. Selling groceries online is catching up in India. Retrieved July 9, 2016, from http://www.businesstoday.in/moneytoday/smart-spending/online-grocery-shoppingvegetables-new-trend-inindia/story/197141.html

- Hansen, T., 2005. Consumer adoption of online grocery buying: a discriminant analysis. International Journal of Retail & Distribution Management, 33(2), 101–121.

Google Scholar

- Hong, W., Thong, J. Y., & Tam, K. Y., 2004. The effects of information format and shopping task on consumers’ online shopping behavior: A cognitive fit perspective. Journal of Management Information Systems, 21(3), 149–184.

Google Scholar

- Mazhar, A., 2014. Pakistan’s Youth Bulge: Human Resource Development (HRD) Challenges: Islamabad Policy Research Institute. Retrieved June 26, 2016, from http://www.ipripak.org/pakistans-youthbulge-human-resource-development-hrdchallenges/#sthash.ymlpRqDi.dpbs

- Milkman, K. L., Rogers, T., & Bazerman, M. H., 2010. I’ll have the ice cream soon and the vegetables later: A study of online grocery purchases and order lead time. Marketing Letters, 21(1), 17–35.

Google Scholar

- Niu, T., 2008. Strategies for success in the e-grocery industry. Retrieved from http://scholarworks.rit.edu/theses/388/Online grocery shopping looking to find a way in. (2014, March 9). Retrieved July 9, 2016, from http://tribune.com.pk/story/680751/online-grocery-shopping-looking-to-find-a-way-in/

- Park, A. C. W., Iyer, E. S., Smith, D. C., Iyer, E. S., & Smith, D. C., 1989. The Effects of Situational Factors on In-Store Grocery Shopping Behavior: The Role of Store Environment and Time Available for Shopping. Journal of Consumer Research. 15(4), 422-433.

- Pozzi, A. (2012). Shopping cost and brand exploration in online grocery. American Economic Journal: Microeconomics, 4(3), 96–120.

Google Scholar

- Pozzi, A. (2013). The effect of Internet distribution on brick-and-mortar sales. The RAND Journal of Economics, 44(3), 569–583.

- Retail, G. T., & Survey, C., 2015. Total Retail 2015 (February). Statistica. (2016). ECommerce. Retrieved June 26, 2016, from https://www.statista.com/markets/413/ecommerce/U.S. Census Bureau News. (2016). Retrieved from http://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf

- , 2015. By 2020: Pakistan’s e-commerce market to surpass $1 billion. Retrieved May 23, 2017, from https://tribune.com.pk/story/1016706/by-2020-pakistans-e-commerce-market-to-surpass-1-billion/

- , 2015. Online Groceries in India: Will Consumers Bite? Retrieved July 9, 2016, from http://knowledge.wharton.upenn.edu/article/online-groceries-in-india-will-consumersbite/