Introduction

Accounting is important to report financial information for a business entity and a service activity. The function provides and analyses financial information that is intended to be useful in making economic decisions (Sirisom et al., 2008). Moreover, elements which are financial in nature include business entities, government departments, charitable organisations and not-for-profit organisations, family units and individuals. They all engage in economic activities which involve decision making about allocating available resources effectively. People need relevant information to be able to make sound economic decisions (Davila, Foster & Pearson 2004). Furthermore, accounting and management decision-making is dependent on the fit of the accounting information system with the organisation requirements. AIS plays an important role in business management, strategic and can provide assistance in all phases of decision making (Ismail & King 2005; Sirisom et al. 2008). Thus, many organisations needs to be seen as well adopting AIS, which is critical to a company in order to organise, manage and operate process in all sections. Ismail (2009) indicates that organisations are highly concerned to the problems of their AIS quality by continuously seek to improve the AIS adoption efficiency of their operations.

In order to implement AIS successfully, it is important to understand the underlying factors that influence the AIS adoption’s quality. Quality is the capability of information to be fit for use, it has become an important consideration for many organisations to perform better in their business (Strong, Lee & Wang 1997). Xu (2003) indicates that 26 factors can affect data quality in AIS, understanding of the critical factors that influence data quality in AIS will assist organisations to improve their AIS’ data quality. Furthermore, Ismail (2009) indicates that factors inflecting AIS such as manager accounting knowledge, vendor effectiveness, and accounting firm have a positive impact and an effective influence on AIS performance. In addition, other authors (e.g. Davila, Foster et al., 2004; Naomi and Kevin, 2007; Ismail, 2009; Romney and Steinbart, 2009) state that within organisations there must be an attention given to the accounting standards and laws of each country because they impact in accounting management (Davila, Foster & Pearson 2004; Romney & Steinbart 2009). For example, Davila, Foster et al., (2004) state that management AIS adoption is the initial framing of the accounting adoption decision under GAAP (Generally Accepted Accounting Principles) constraints supported financial planning. Furthermore, this research finds a significant increase in the size of the company about the adoption of functioning budgets; moreover faster adoption of operating budgets is associated with faster growing companies.

Moreover, AIS and AIS adoption has some different tasks. Romney and Steinbart(2009) state that AIS is a system that collects, records, stores and processes data to produce information for decision makers. AIS adoption chooses and uses software applications to support operations, strategic management, and decision making in accounting information system. Therefore, this research intends to study this perspective of factors influence and impact on AIS adoption quality. The model provides specific insights into the critical factors that influence AIS adoption quality, which will assist organisations to improve their accounting information systems. The model is developed based upon the existing literature review and multiple case studies. The model has been designed to illustrate factors influences in AIS adoption quality. It also attempts to identify the critical success factors that organisations should focus on, to ensure the adoption on accounting process.

Background

As Information Systems (IS) capability is essential to doing business growth now and in the future. Many organisations are adopting management IS for the collection, storage, retrieval, reproduction, processing, diffusion, and transmission of information (Ussahawanitchakit and Phonnikornkij, 2007). Organisations can be seen as a system which has become a capability of firms. Nowadays, many organisations use vendors for implementing their system (Bandor & INST. 2006; Oracle 2008; Phonnikornkij et al., 2008). Vendors such as SAP, Oracle, Microsoft etc., to integrated business management system covering functional areas of an enterprise like Finance, Human Resources, Production, Sales and Logistics etc. Panorama consulting group (2011) indicates that many organisations increased information system need by used vendors to implementation; additionally, vendors have increased their market share from 23% in 2008 to 30% in 2009. For example, overall markets share distribution for the time period 2005-2009 of ERP vendor consists of SAP and Oracle are the top two ERP vendors where SAP rank highest by capturing 32% of the market, followed by Oracle with 23% of total market share(Panorama-ConsultingGroup 2011). ERP systems are considered to be an important data source for most new accounting practises. However, the relationship between ERP system and the management accounting techniques being used have not changed significantly (Maletic & Marcus 2000). The characteristics of management accounting techniques are different in a number of ways such as allocations, frequency, precision, scope, etc.

Recently, organisations have experienced problems in the process of implementation of accounting information systems (Ismail 2009). The argument behind this finding is that accounting information systems often lack high-quality data. Ismail and King (2005) find that organisations may lack knowledge and the vision to incorporate accounting information systems; additionally, there are still problems in the process of accounting implementation and relate influencing AIS quality. What is more, AIS is specific software application, management process, and transmission of data (Malmi 2001; Rom & Rohde 2007; Scapens & Jazayeri 2003). Moreover, Rom and Rohde (2007) indicate that data integration in accounting should be studied more narrowly and specifically.

Xu (2003) indicates that in order to ensure AIS quality, it is important to understand the underlying factors that influence the AIS’s information quality. Xu (2003), examples of the many factors that can obstruct information quality are identified within various elements of the information quality literature, which has addressed the critical points and steps for accounting information systems. Moreover, this research indicates critical factors for accounting information quality of the top five were 1) top management commitment, 2) education and training, 3) nature of AIS, 4) personnel competency, and 5) input controls. The evidence in this study suggests that understanding of the critical factors that influence AIS will assist organisations to improve their accounting information systems quality.

In addition, Ussahawanitchakit and Phonnikornkij (2006) indicate that information technology (IT) capability is essential to accounting information quality. Refer from research finding IT has played a major role in social and economic change and including accounting information quality. IT capability has positive influences on firms’ accounting information quality, especially human resources and IT-enabled intangible resources as major components of IT capability (Phapruke Ussahawanitchakit 2006). What is more, Sirisom, Phonnikornkij et al., (2008) state that the implementation of AIS to enhance performance of Thai listed firms. this research indicates that the effect of organisational characteristics on implementation of AIS can be seen from five perspectives including the general environment and four major accounting stages, including the expenditure cycle, revenue cycle, production cycle, and financial accounting cycle. Furthermore, this evidence suggests that organisational contextual variables should be examined in the process of AIS design in order to enhance its implementation effectiveness.

Table1: Possible factors that influences in AIS adoption

In particular, Bandor (2006) indicates that affect selecting software package as part of a software acquisition strategy; most organisations will consider primarily the requirements such as the ability of the product to meet the need and the cost that impact in accounting software performance. This successful method for selecting accounting product is the use of a selection team (Bandor & INST. 2006). When selecting a Commercial off-the-shelf (COTS) component, the use of a team such as technical experts systems, software engineers and several developers are recommended. The use of a team can help to ensure situation of software selection and quality of information to business requirements. More specifically, when evaluating a possible software solution, most organisations are likely to consider the ability of the product to meet the functional requirements and business requirements. Others affect in accounting management, Naomi s & Kevin s (2007) argue that three factors affect specific accounting quality such as the quality of the standard, a country’s legal and political system, and financial reporting incentives. This is specific in accounting information system (Soderstrom & Sun 2007). Thus, business needs to be seen as a system using accounting information well, requiring quality data in organisations to perform well, obtain competitive advantage, and survive in today’s global economy. These are all critical to a company in order to organise, manage and operate processes in all sections. Furthermore, organisational structure is important to improve or adopt AIS systems. A well-managed, well-designed accounting system can improve work performance and increase the efficiency of activities in accounting responsibility.

Interestingly, organisations have become more attention to improve accounting information system because of achieving competitive advantages, global economic, and a rapidly growing business environment; there is a growing need for research to provide insight into issues and solutions related to management in AIS adoption. Thus, this research attempts to investigate the effect of other factors revealed in the adoption of AIS to enhance firm performance. The model is developed based upon the existing literature review and multiple case studies. The model has been designed to illustrate factors influence AIS adoption. It also attempts to identify the critical success factors that organisations should focus on, to ensure quality during the systems adoption process.

Model of the Relationships Between Influencing Factors and Accounting Information Systems Quality

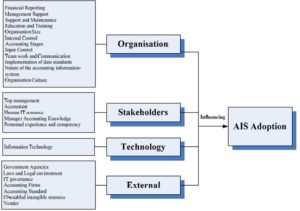

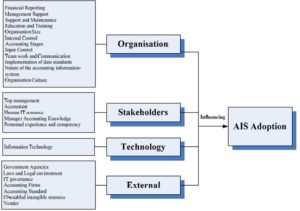

The research model for this study is presented in Fig.1. This model investigate the factors allow analysis through looking at the problem context form either organisational or stakeholders or technology or external organisation that have been identified by Xu (2003) and Romney and Steinbart (2009) adopted in this research because they include the most important critical factors in AIS addressed in AIS literature and have been reasonably accepted in the AIS field.

Fig.1: Factors influencing AIS Adoption Quality Model

Here, organisational factors considers an organisation’s quality in terms of effectiveness, stakeholders factors focus on the individual’s concerns such as the issues of job description and job securities that are the main concerns in this perspective, technology factor refers to softwares and facilities, such as operating systems, database management systems, networking, multimedia and environment that support them and enable the processing of the application, and external organisational factors exist outside the organisation in its external environment, for example, customers’ concerns, competitive pressures, partnership, government policy, and accounting standard. Fig.1 presents our theoretical model, which summarizes the structure of relationships between influences factors and AIS adoption quality, which will be discussed in detail in the next sections.

Research Methodology

This research used qualitative, interpretive evidence. Interpretive research often involves using qualitative methods from which to develop awareness gained from the data collection, and analyses the research process (Avison & Myers 2002; Orlikowski & Baroudi 1991). In this study, collecting relevant information was done by conducting interviews following initial exploratory work. Literature reviews were used together with a conceptual study research method in order to develop interview questions.

The research was completed in four stages; the first stage involved a detailed and focused literature review, which led to the development of the preliminary research model representing possible critical factors impact in AIS adoption. (The prior model from the literature was used together with the pilot case study, in building the research model). A broad reading of the literature was followed by consultation with professionals in the related areas. This helped to identify and narrow the research. The second stage involved verifying the model by pilot case studies which, in two large Thai organisations, were used to provide useful insights into the nature of AIS involved in adopting an AIS. The third stage used case studies as confirmatory evidence, conducted as multiple case studies. The fourth stage involved analysis of the data to refine the data collection instruments.

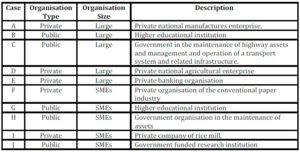

Case studies in ten organisations from 46 respondents as confirmatory evidence, which organisations were used to provide useful insights into the nature of adopting an AIS. Regarding this research, cases were selected by considering three dimensions – drawing on members of different industries, sizes and types of organisations, given that they have dissimilar structures, cultures, processes and outcomes (table 2). This methodology has been designed to help investigate the significance of the size of organisations as this can influence the potential and actual performance of AIS. In addition, it is desirable to determine, if it is possible, to generate some common critical success factors for different sizes of organisations (Choe 2004; Xu et al., 2002). In terms of the first dimension, there are different types of business – agricultural, financial, industrial, educational and governmental. Regarding final firm selections, these companies were selected as being well-known corporations in the Thai Listed Firms; they are regarded as powerful and also kindly provide high quality knowledge and valuable information for higher education providers in terms of education and data collection. Their contribution is acknowledged for the learning purposes of this research. The second dimension relates to organisation sectors, consisting of public and private groups. The third dimension focuses on the size of various organisations, especially large corporations and SMEs. The selected organisations are from Thailand, but enable the dimensions to be addressed. This study used in-depth interviews to collect information as well as a semi-structured interview with different AIS stakeholders (CEO, IT/IS, accountant/Audit, data manager, accounting manager).

In addition, data collection sources also included relevant documents, such as position descriptions, policy manuals, organisational charts, service records, and annual reports. The purpose of the case study was to investigate what factors affect the variation in accounting information systems adoption quality, before and during the adoption of an AIS. Moreover, qualitative data analysis methods used pattern-matching, content analysis, and cross-case synthesis as data gathered from case studies was qualitative. The analysis involved multiple processes by first having the interview transcriptions, next categorizing them using thematic approach and then the most critical process is the interpretation of interview transcripts. The interpretation identifies new information and findings based on the interview questions that became progressively focused towards the research framework. Having themes in a useful manner would ease the process of interpretation and reporting of interviews as a whole. The purpose of this stage was to gain a comprehensive, in-depth, understanding of the research issues, factors influencing AIS adoption, as well as to build framework of this research.

Table2: Overview of organisations

Analysis and Results

Factors Influencing AIS Adoption Quality

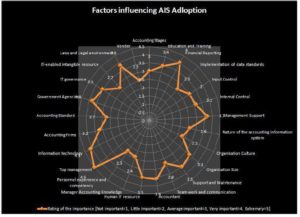

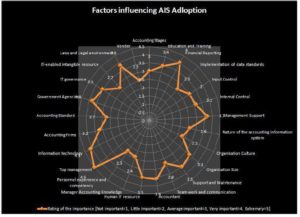

In this research, the results of factors influencing AIS adoption (all variables in this study), were measured by in-depth interviews. Furthermore, the research summarises the scores given by different stakeholders in Case A to Case J (the ten organisations). Fig. 2 shows the results of factors influencing AIS adoption quality from twenty-five among the 46 respondents from 10 organisations. Respondents were asked to indicate on a scale of five choices consisting of not important agree, little important agree, average important agree, very important agree, and extremely agree.

Thai listed organisation firms have average scores of 5 (extremely agree) referred to the most critical factor, which influenced AIS adoption from top management; an average score of 4 (very important agree) was achieved for factors influencing AIS adoption including financial reporting, management support, support and maintenance, accountant, human IT resource, information technology, government agencies, IT governance, and laws and legal environment. And firms with an average score of 3 (average important agree) addressed factors including accounting stages, education and training, implementation of data standards, input control, internal control, nature of the AIS, organisation size, team work and communication, accounting firms, accounting standard, IT-enabled intangible resource, and vendors. An average score of 2 (little important agree) applied to areas including organisation culture, manager accounting knowledge, personal experience and competency; a score of less than 2.00 for any factor was not revealed by the results.

Fig. 2: Result of factors influencing AIS Adoption form multiple case studies

Legend: 1, 2, 3, 4, 5 = Rating of the importance [Not important=1, Little important=2, Average important=3, Very important=4, Extremely=5]

Fig.2 shows the results of influential factors in AIS adoption quality for each factor’s importance. The values ranged from 2.30 to 4.50; the top five critical factors for ensuring quality in AIS adoption were: 1) top management rated much higher the other factors; 2) information technology influences and encourages firms to achieve competitive advantages such as increasing speed and accuracy of improved decision outcomes and enhance their products, services, markets, work processes; 3) financial reporting influences, accounting software to help accountants work and related to government agencies requirements; 4) government agencies influence on business performance and effect on accounting information quality related to accounting information systems adoption; and 5) laws and legal environment have a positive impact and an effective influence on accounting reports and financial reports.

The findings from the case studies indicated that adopting management accounting systems are important in an organisation, for it to effectively support business decision-making and growth. The results indicated the major impact of factors influencing AIS efforts to develop accounting system to obtain competitive advantage and survive in today’s global economy.

One of the interviewees illustrated the significance of positive relationships between the quality of an AIS adoption, and the influencing factors in AIS adoption. The CEO noted that:

“In order to ensure high quality in AIS adoption, it is important to understand the underlying factors that influence the AIS adoption. I think, one of the problems we have today is factors impact on quality in accounting information systems adoption such as financial reporting, education and training, management support, accounting stages, team work and communication, manager accounting knowledge, organisation culture, internal control, top management, human IT resource, personal experience and competency, IT-enabled intangible resource, implementation of data standards, information technology, capability of software, capability of hardware, accounting standard, government agencies, accounting firm and comptroller general’s department in Thailand. They are impact of factor influencing AIS system adoption effort to develop accounting system to obtain competitive advantage and survive in today’s global economy”.

CEO (Case A)

In addition, the accounting manager believes that AIS system is important to helping organisations to make profit. As one of the interviewees indicated that:

“We have been affected by information technology, by the organisation’s strategy and its culture. And also we need to have something in place that will assist us with significant business decision making.

Accounting Manager (Case A)

Another case study organisation also had a large group of personnel indicate that:

“I think we need to find out how to make AIS system quality for our organisation, and we should know what are the impacts of those AIS system problems, and how can those problems be solved….for example possible factors that impact on implementing AIS such as organisation behaviour, organisation culture, Human IT guys, Personal experience and competency, top management, system development, management support, social environment, regulatory environment, legal environment, ethics and accounting standards—GAAP, TFASB, AARF, FASB, government agencies, IT governance, and comptroller general’s department in Thailand. In our organisation, we need to improve AIS system as it requires supporting and developing different departments in corporations by enabling work processes of all sorts as well as decision making.

Act in place of Director of Finance and Store Division Office, Accounting Manager (Case B)

Organisation Factors

The results of the empirical research show that the relationships between quality of AIS adoption and influence factors are significantly influenced by the organisation’s factors. The effect of organisational factors on AIS adoption quality can be seen from ten perspectives including organisation culture, nature of the AIS, implementation of data standards, team work and communication, input control, organisation size, education and training, support and maintenance, management support, and financial reporting. Financial reporting is concerned with external reporting of information to parties outside the firm such as accounting firms, government agencies, customers, and so on. Especially, financial reporting must pay attention to government requirements and accounting standard formats. Accounting standards generate the ability to understand and have confidence in reports; this understanding is directly dependent upon standardisation of the principles and practices that are used to prepare the reports. In order to better understand the system that had been addressed by the information producer in Case E it was interesting to find that financial accounting respondents also highlighted the importance of systems.

“We have to send financial report to inform the public of the financial affairs and government of comptroller general’s department of Thailand by GAAP, TFASB format each year, which report is due by the end of March. Moreover, the financial report is concerned with external reporting of information to other firms, suppliers, and government agencies by used accounting software to process data into information, and internal reporting to top management useful for decision making”.

Accounting Manager (Case E)

In particular, AIS can provide assistance in all phases of decision making from accounting stages – expenditure cycle, revenue cycle, production cycle, and financial cycle. AIS implementation measures by AIS modules that might distinctively address the impact of each module on a firm’s performance. Moreover, organisations may use accounting software to manage all work performance in accounting process and can help to manage, collect and store data about activities and transactions, and process data into information that is useful for decisions. The CFO believed that accounting software can manage all accounting processes using the organisation’s data to provide accounting information and financial reporting. Regarding internal control and input control with GFMIS (Government Financial Management Information System), in Case G, they arranged the system so that certain information was mandatory with system checks. The accountants believed that the input control was the most important stage, because the most important quality control should be at the input stage when the information was entered. They set up certain procedures as well as system constraints to ensure only valid data could be entered.

“I’m an accountant, we used GFMIS application to manage and we believe this system can help us to collect and store data and transactions, and process data into accounting information useful for decision making. I am very satisfied with our accounting software which can help me to do all the edit checks and balances for the data when I actually enter. For example when I key accounting code into the accounting software if inputting accounting wrong and not matching after that the software can remind me to check and give notification to confirm data entry so it can relate to the system to make the system work correctly”.

Accountant (Case G)

Moreover, this research shows that a lack of appropriate education and training can cause serious problems for an organisation by having an impact on accounting information quality and accounting system quality. Organisations normally spend a lot of money on buying, configuring, and upgrading systems to improve AIS, but new accounting systems have generated some problems in the process of accounting software. Since people do not have the necessary skills to implement and control the system, even perfect systems would not be able to produce high accounting information quality. Transferring software skills to staff is very important for any company. For example, strong knowledge of accounting regulations is a critical training objective in this field to prevent companies from getting into legal trouble because of poor accounting practices. Moreover, the organisational culture influences accounting information systems adoption quality. It was believed that the organisational culture would have impact on implementation accounting systems.

“We have to train before use accounting programme, but still have problems to use accounting software properly. This is because some detail in manual training is different in real accounting software, and our organisation has gone through a number of different fads over the years. We used to have central training units, and then it was decided that each division was responsible for its own training. And employees do not have the necessary skills to change to new accounting systems”

Act in Place of Director of Finance and Store Division Office, Accounting Manager (Case B)

“In our company, everybody complains of not knowing what is going on, not being told the right things. Moreover, each division was responsible only for its own division’s system; it seemed that the control of this type of system was difficult. And each department had poor communication and teamwork between different departments. For example, accounting would complain about new technology, and could not get enough support from the IT professionals or vendors. The teamwork is not only within the department, but also between different departments. This lack of teamwork had the potential to cause AIS adoption problems”.

CEO (Case A)

It was believed that team work and communication would impact accounting systems quality.

Stakeholder Factors

The results of the empirical research show that the relationships between quality of AIS adoption and influence factors are significantly influenced by the stakeholder’s factors. The interaction between systems and people has always been an interesting and important issue in systems implementation, and it would be likely to impact on the quality of the accounting information systems. Both built-in systems controls and stakeholder related human controls are important in ensuring AIS adoption quality. The case study findings provide some insights about interrelationships between those two types of controls. While top management thought systems controls were more important, human IT resources are critical factors for encouraging AIS adoption to gain competitive advantage, achieve operational quality and high performance, and personal experience and competency as the effective management of accounting information systems functions, coordination, and interaction with the user community.

“In our company, human IT resources consist of the IT manager, programming, systems analysis and design, technicians, and so on, [giving] effective management of accounting information function, improvement of project management, and leadership skills. If you have strong human IT resources you are able to integrate the IT and business planning processes to more effectively develop cost effective applications that support the account needs of the firms”.

“I think IT guys become key distinguishing factors that can affect the acceptance, involvement, and benefit of IT. Thus, we believe that human IT resources such as IT manager, IT project, programming, SA, Technicians, IT supporting are likely to have a positive relationship with accounting information systems adoption quality”.

Project Manager (Case B)

“Manager accounting knowledge is responsible for all accounting information system management efforts to improve quality of information in decision making for acquired AIS system”

Act in Place of Director of Finance and Division Office (Case B)

“In our company, when we need to improve new accounting modules we need the accounting manager to buy-in, support and critical review all processes of the AIS systems. Moreover, when implementing accounting system this depends on top management decisions”

IT Manager (Case E)

Technology Factors

The results of the empirical research show that the relationships between quality of AIS adoption and influence factors are significantly influenced by technology factors. Capability of software and hardware also provides a broad platform for exchanging data, coordinating activities, sharing information, and supporting private and public sectors influencing AIS adoption quality. At present it is difficult to buy accounting information software matched with the actual situation of an enterprise’s requirements. Some developers of accounting software lack accounting knowledge which means the software’s features are not comprehensive, and some software developers have only short-term training on only the contents for basic accounting.

“In our company, we have some problems in accounting software. We need accounting software to process data into financial reports matched with GAAP and TFASB format, but the software can’t process data matched with GAAP and TFASB format. We operate the management financial report outside the accounting software. Some reports are separated outside the accounting system”.

Furthermore, IT-enabled intangible resources have an effective influence on AIS adoption quality, such as improved customer service, enhanced product quality, increased market responsiveness, and achieving more knowledge assets. Thus, firms with stronger IT-enabled intangible resources are critical to meet customer satisfaction more effectively, improve unique learning for competing in the markets, and develop more synergy to high quality products.

“We’ve been considering that with IT-enabled intangible resources firms will achieve greater accounting information systems adoption and related improvements in accounting information quality”

Technical of IT (Case I)

External Factors

The results of the empirical research show that the relationships between the quality of AIS adoption and influence factors are significantly shaped by external factors. It is hard for organisations to avoid the impact of some external factors that they have no control of. Especially in today’s global economy, organisations are affected by other organisations, government regulation, important social and political events and many other external factors. The outside world of the organisation now has much more impact on an organisation’s operation, systems, and information quality. The findings from the case studies suggested that because of their increasing influence, external factors have become very important. In this research, external factors in AIS adoption quality are laws and the legal environment, government agencies, IT governance, accounting standards and accounting firms. It was found that people must first have an awareness of external issues, and then get a deep understanding of them and their impact on the organisation.

“My company, external organisation is an effective influence on AIS adoption such as law and legal, government agencies, IT governance, accounting standard, and accounting firms. We need to send the financial reporting to government every year upon TFASB standard, and comptroller general’s department in Thailand. We need to know legal requirements and laws in accounting information that impact AIS adoption, so we need situation of accounting software to help us follow this impact.

Accounting Manager (Case A)

“I think factors affect specific aspects such as AIS adoption quality, the quality of the standard, a country’s legal and political system, accounting firms, and government agencies. For example, we need to send financial report to The Revenue Department and comptroller general’s department in Thailand every year to check company financial”.

CFO (Case G)

Discussion and Conclusions

With respect to building an increasingly effective accounting information system, this study attempts to investigate whether the important factors that could impact on AIS adoption quality have significance. This analysis was done on the data of 46 respondents, from ten organisations within firms in Thailand; data was collected by in-depth interviews which involved semi-structured interviews. The level of influencing factors defined 25 factors from the case studies were categorised into four groups: organisation factors, stakeholder factors, technology factors, and external organisation factors as shown in Fig1. The level of importance of influencing AIS adoption was measured by a six point scale completed by the ten sample firms. The top five influencing factors for ensuring quality in AIS adoption were: 1) top management, 2) information technology, 3) financial reporting, 4) government agencies, and 5) laws and legal environment, which have positive impacts and an effective influence on AIS adoption. This research provides specific insights into the critical influencing factors that could have the most positive effect on high quality information outputs. Management of an organisation should be aware of the most important influencing factors in AIS adoption.

Moreover, most critical influence factors for AIS adoption quality have been detailed in this research, which managers can use as a guide for focusing their attention and resource allocation. As AIS adoption is essential to doing business now and in the future, research analysing the methodology will contribute significantly toward understanding how firms achieve AIS adoption quality, and utilise this guide to gain more accounting information systems quality. This evidence suggests that an adequate understanding of influential factors by management must be discussed in relation to the existing accounting processes in organisations.

Limitations & Future Research

The results of this study are only drawn from Thai organisations; there might be similar results if a study was conducted in other Asian countries. Whether or not there are similarities and differences needs to be further investigated. It is acknowledged that cultural differences may impact upon the results, but these are beyond the scope of this research, and those issues could be addressed by further research. To improve the level of reliable results, future research is needed to collect data from other populations, allowing for mediators and moderators of the influential factors in AIS adoption.

(adsbygoogle = window.adsbygoogle || []).push({});

References

Avison D, Myers M (2002) ‘Qualitative Research in Information Systems: A Reader.’ (SAGE Publications)

Bandor MS, INST. C-MUPPSE (2006) Quantitative Methods for Software Selection and Evaluation. In. ‘ (Citeseer)

Choe J (2004) The relationships among performance of accounting information systems, influence factors, and evolution level of information systems. Journal of Management Information Systems 12(4), 215-239.

Davila T, Foster G, Pearson A (2004) Management accounting systems adoption decisions: Evidence and performance implications from startup companies.

Granlund M, Malmi T (2002) Moderate impact of ERPS on management accounting: a lag or permanent outcome? Management Accounting Research 13(3), 299-322.

Publisher – Google Scholar

Ismail N (2009) Factors Influencing AIS Effectiveness Among Manufacturing SMEs: Evidence frfom Malaysia. EJISDC 38(10), 1-19.

Ismail N, King M (2005) Firm performance and AIS alignment in Malaysian SMEs. International Journal of Accounting Information Systems 6(4), 241-259.

Publisher – Google Scholar

Malmi T (2001) Balanced scorecards in Finnish companies: a research note. Management Accounting Research 12(2), 207-220.

Publisher – Google Scholar

Oracle (2008) Oracle Customer Case Study. In. Vol. 2008′. (Oracle Corporation )

Orlikowski W, Baroudi J (1991) Studying information technology in organizations: Research approaches and assumptions. Information Systems Research 2(1), 1-28.

Publisher – Google Scholar

Panorama-ConsultingGroup (2011) 2010 ERP REPORT- ERP Vendor Analysis. In. ‘ Centennial)

Phonnikornkij N, Sirisom J, Sonthiprasat R, Prempanichnukul V, Konthong K, Piriyakul P (2008) The implementation of AIS to enchance performance of Thai listed firms: An investigation on the effect of organisation characeristics. IABE-2008(October 19 – 22, 2008,Las Vegas, Nevada, USA).

Rom A, Rohde C (2007) Management accounting and integrated information systems: A literature review. International Journal of Accounting Information Systems 8(1), 40-68.

Publisher – Google Scholar

Romney MB, Steinbart PJ (2009) ‘Accounting information systems.’ (Peason Prentice Hall)

Scapens RW, Jazayeri M (2003) ERP systems and management accounting change: opportunities or impacts? A research note. European Accounting Review 12(1), 201-233.

Publisher – Google Scholar

Sirisom J, Phonnikornkij N, Sonthiprasat R, Prempanichnukul V, Konthong K, Piriyakul P (2008) The imploementation of AIS to enchace performance of Thai Listed Firms: an investigation on the effect of organization characteristics. International Business and economics(Sept, 2008).

Soderstrom NS, Sun KJ (2007) IFRS Adoption and Accounting Quality: A Review. European Accounting Review 16(4), 675 – 702.

Publisher – Google Scholar

Ussahawanitchakit P, Phonnikornkij N (2006) Roles of Information Technology Capability in Accounting Information Quality. International Journal of Business Research 3(1), 2005, 133-140.

Xu H, Nord J, Brown N, Nord G (2002) Data quality issues in implementing an ERP. Industrial Management and Data Systems 102(1), 47-58.

Publisher – Google Scholar