Introduction

It was 8 am in the morning on a sunny spring day in 2010 in Cairo, when Mr. Hazem Morsy, the marketing head of Seven K, just parked his car in front of the office building in Gesr El Suez industrial zone, the location of the plant and office buildings of Seven K where manufacturing and marketing functions were only a few meters away. Mr. Hazem hadn’t have a good sleep the previous night as he was preparing for the top management review meeting where he would be presenting the next fiscal year 2010/2011 plans to the CEO and the other functional heads as well as the master plan for the next five years. The next fiscal year, starting in only three months, was expected to be quite challenging. Growth options and business expansions were the main topics that needed to be aligned across the different organizational functions under the leadership of the Board of Directors. As the head of marketing and the business development functions, Mr. Hazem was assigned the strategic growth and expansion plans for the company.

A few weeks ago, Mr. Hazem had received the results of the focus groups and market research surveys from Seven K’s market research agency. Thus, he had to incorporate this output in a solid growth plan which would bring more sales to the company in the coming five years.

Seven K’s largest share of sales came from the local market with around 90%, which was complemented by the export to various countries such as UK and Jordan which constituted around 7% in those two countries specifically. The company had a broad product line of quality leather products clearly targeting fashionable upper class market segment rather than a mass consumer. Mr. Hazem had to define how the company could strategically expand in light of the current local and export markets conditions. Would the company need to expand locally or to expand externally in other foreign markets keeping the same upper class segment focus? Was the current breadth of the product line the optimum to support such expansions? What kind of strategic focus should the management of Seven K gives across the various departments in the organization in order to support such growth plans? All these questions puzzled Mr. Hazem as he was about to prepare a strategic expansion plan proposal for Seven K.

This case paper is structured as follows. First, we briefly describe the leather industry in general, and its aspects in Egypt. Then we present the background on Seven K, its history and current situation. Several sections that follow address Seven K’s original strategy, its product portfolio, its brand image and manufacturing process. After a discussion of recent Seven K’s performance, the case ends with a contemplation of key challenges facing the company going forward. The students are expected to use their knowledge of management concepts to develop a new corporate strategy for Seven K on behalf of Mr. Hazem.

Leather Industry

Background

According to Spain Exchange International Student resource website (2010-2011), quality leather products are a result of an extremely stringent and meticulous process of production which leads to the great transformation of a piece of a raw leather to various glamorous products in the market. The quality of leather processing technology and the principles and practices involved in processing leather ultimately determines the quality of the final product.

The leather industry can be broken down into upstream and downstream. Upstream part of the sector deals with producing leather pieces suitable for manufacturing, while downstream segment of the sector deals with manufacturing and distribution of the products.

The upstream segment starts with preparation of the raw materials. The raw materials in producing leather are the hides of animals. These raw materials undergo various processes before they reach the state of being useable for actual manufacturing of a wide range of leather products. Such range might include bags, belts, shoes, purses, upholstery, gloves, saddles, accessories, etc. The most famous and widely used raw material in the leather industry is the cattle hide. Hides of lamb, sheep, pig, goat, kangaroo, crocodile, snake, alligator, and deer are used as well. The use of hide of ostrich is popular in the extravagant leather products of high end brands such as Gucci, Prada, and Louis Vuitton.

Skinning the animals in a slaughter house is the first stage of the leather production workflow. The next process is the trimming and sorting of hides, eliminating of unusable and/or defective parts. Removal of hair and dirt is first done by machines, with a manual quality control and further removal. The next stage, tanning, is considered the most critical. The purpose of tanning is to prevent raw materials from rotting and degradation to make it pliable and water-resistant. It may take from a few days to a year to finish, depending on the methods used.

Furthermore, it involves the use of various chemicals and can be done in a number of methods, depending on the intended final product. Oiling and dyeing follow the tanning process. These processes are done to bring back the natural oil that got lost during the application of chemicals during tanning and to give the leather a color that suits its intended purpose. Drying is the next process and is followed by the finishing touches.

Quality inspection is needed at every step of the workflow to look for possible quality problems (e.g., uneven dyeing) and correct it until the product gets accepted as quality leather. At this point, the leather is ready for further processing by the leather goods manufacturers.

The leather tanning industry is criticized for being a hazard to the environment, people, and animals. This above mentioned process leaves toxic and poisonous wastes. There are studies showing that the chemicals used in tanning leather cause health problems to tanners. Moreover, these chemicals are released into river streams, poisoning water consumed by both animals and humans. In order to help solve such issues, there are rules and regulations about proper disposal of the toxic wastes from the process, and leather technologists are in continuous search for new approaches (new process or new chemicals) that would minimize the harmful effect of by-product of leather processing. There’s a high need for improvement in this industry to make it an environmental-friendly one. Regardless of the many issues that the industry faces, there is a continuing high demand for leather products.

The downstream segment of leather sector is manufacturing where the raw leather is transformed and crafted into leather products like purses, belts and bags. This process is highly dependent on the labor technical capabilities as it’s, in most countries, a manual process. The leather manufacturing process uses tools and cutting machines only as supporting tools in the overall leather products manufacturing process .Famous countries which are competing in this industry globally are China and India due the availability of cheap labor that produce the handmade leather products with reasonable prices. In the Middle East and Africa, Egypt is considered one of the main producers of leather products due to the availability of qualified labor that can produce leather products that can compete globally.

Leather Industry in Egypt

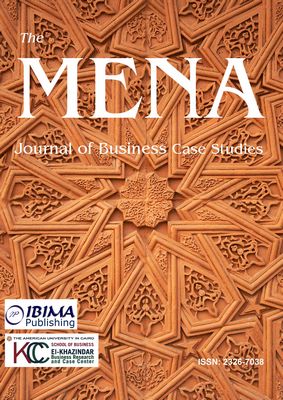

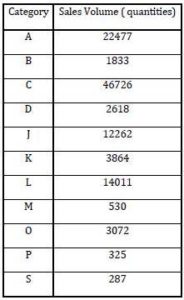

According to bikyamasr website (2010- 2011), federation of the Egyptian industry website (2010- 2011) and industrial modernization centre website (2010-2011), since hundreds of years ago, the Egyptian leather has been well known for its unique texture due to Egypt’s warm climate. Thus, the leather industry in Egypt has been considered one of the most important industrial sectors in the Egyptian economy representing about 5% of the total industrial production of the country. Egypt’s leather industry’s annual income is about US$600 million. The labor force is made up of about 250,000 workers and has 300 leather tanners. They produce 125 million square feet of leather a year. The 300 leather tanners and much of the industry are located in the old Cairo. Exhibit 1 shows the local sales distribution across Egypt.

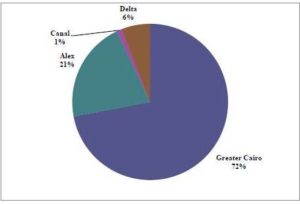

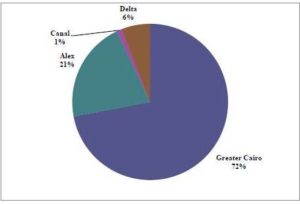

Major exporters of Egyptian leather include Spain, the United States, Italy and China as well as many other countries of the Gulf and Middle East region like Saudi, Lebanon and UAE. The Egyptian leather industry expects to reachUS$600 million of exports in the next three years. Exhibit 2 shows the trend of the export sales during 2006-2010.

The leather industry in Egypt is divided into two segments: the leather tanning industry which provides the raw leather ready for further processing, and the leather manufacturing industry which converts the raw leather into leather products for use.

The leather tanning industry is given the most attention in Egypt due to the high export potential. Usually, the developed countries located to the North seek such raw leather from developing countries in the South to further process it into leather products that are sold with a high profit margin. One of the reasons for such a trend is that the tanning process is prohibited in some environmentally cautious countries and thus they can only importing the tanned leather ready for manufacturing.

The leather tanning industry in Egypt has been radically developed through establishing a modern compound in Robiki region to attract national leather industry through encouraging the relocation of leather tanneries from Magra El Oyon region. This relocation will provide the industry a new setting called “The City of Leather.” This “City of Leather” will provide a modern leather technology center, design centers, vocational training schools, testing facilities and other major services important to the industry. The development of the “City of Leather” is already underway and expected to be completed by the year 2016.This could help the Egyptian product achieve increased competitiveness in the global market.

On the other hand, the leather manufacturing segment which is foreseen as a big unexplored opportunity area is forecasted to bring more profits if it receives significant investments. The complexities of manufacturing business are due to the fact that it requires highly skilled technical labor to be able to compete in the global markets.

Thus many investors tend to avoid this segment and prefer to invest in the simpler leather tanning industry. In addition, with this increasing trend of exporting raw leather, the prices of raw leather available for manufacturing in the local markets are increasing continuously. However, the Industrial Modernization Centre (IMC) in Egypt is trying to drive more attention to manufacturing. Two compounds for leather manufacturing are currently being established, one in 10th of Ramadan City accommodating 100 factories and the other in Morgham region in Alexandria accommodating 50 factories. Those two compounds could achieve a growth rate that would enable the Egyptian industry to benefit from opportunities available in global markets. Overall, the manufacturing sector has achieved very good progress during the past five years and hence, the segment has an export target of two billion Egyptian pounds (EGP) by the year 2013 (in December 2010 one US$ was equivalent to 5.9 EGP).

IMC has some action plans supporting such growth in both leather tanning and manufacturing segments in Egypt, including the establishment of a leather department at Helwan University in collaboration with the Industrial Training Council, the development of the leather industry technically through enhancing workers and middle management skills as well as the exports development through concentrating on North Africa, COMESA, European Union, India, Russia, Brazil, Argentina, and Vietnam.

Seven K is involved in manufacturing and distribution activities and thus can be considered a partially vertically integrated company (in downstream activities). In that sense, Seven K has no specific competitor as the industry is segmented as either leather tanning companies that export the raw leather to foreign countries or leather products distributors that import finished product leather goods from the foreign countries. The leather manufacturing companies are minimal as most companies in the leather business in Egypt defer from the complexities of the leather manufacturing process and prefer to either export the raw leather or import the handmade leather products.

Seven K History and Background

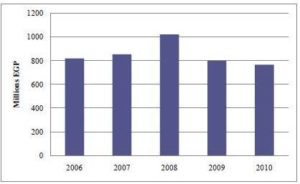

In reference to Seven K official website (2010- 2011) and the Italian chamber of commerce in Egypt website (2010-2011), Seven K is the brand name for the Cairo Leather Industries company. The company was established in 1990 as a joint stock company located in Egypt. Seven K is under the umbrella of the big investment company “Lasheen Group.” This group has several investments in various industries in Egypt, including electronics, paper, legal consultancy, architectural consultancy, medical services, sports equipment and graphical designs.

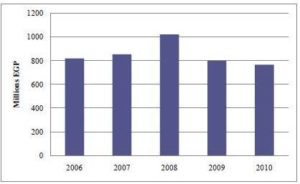

In 2000, the management took the decision of investing heavily in the local growing market. Thus, the company expanded, drastically to support a capacity increase of 150% over the available production capacity and the company was transformed to an integrated leather manufacturer having a plant, a standalone office building and several showrooms. Such bold decision was coming at the right time where the Egyptian market reflected high growth rates of about 25% year on year. Exhibit 3 gives a brief summary of the company’s several locations and other company data.

Seven K is specialized in manufacturing and distributing genuine leather goods such as brief cases, attaché cases, wallets, belts, portfolios and ladies handbags; all produced from the full leather (as opposed to a semi-artificial leather whereby the leather skin is glued to another material, e.g. cardboard). The company is producing products for both the local and the export markets such as the U.K, Russia, Australia, Austria, Jordan and Saudi Arabia. To be able to compete in the export markets, Seven K utilizes the high quality local leather along with the latest fashionable foreign accessories and designs to produce a high end product for the upper class market. Moreover, the company has decided to have a representative office in the UK which is its biggest export market. This office helps the expansion in the exports volume to the UK as well as provides a closer interaction with the British consumers, enabling Seven K to present its products at the appropriate showrooms and exhibitions in the country.

Seven K has grown throughout the years, starting with a founding capital of ten million EGP and an additional paid in capital of six million till. Starting from the year 2003, the additional paid in capital started growing till it reached the maximum of ten million EGP in 2010. Hence, the company is currently heading for an increase in its authorized capital.

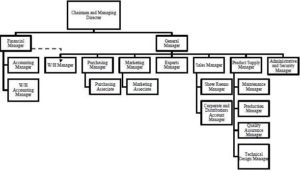

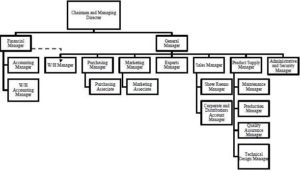

Sevek K has a very lean management structure. With such big investments and large business, in 2010 the company had only 150 employees in total, including manufacturing, marketing and sales as well as administrative functions. The organization structure is shown in Exhibit 4.

Since leather manufacturing industry relies heavily on the technical expertise of the operators, Seven K is focusing on retaining the high caliber experienced technicians in its operations even if it requires paying higher wages due to the fact that such caliber can’t be substituted easily in the Egyptian market.

Manufacturing

Generally speaking, leather manufacturing in Egypt is a manual process. At Seven K, 75% of the overall manufacturing process is manual with the rest being automated. This helps managing technical issues especially those related to frequent design change.

The process starts with receiving the raw materials (leather, accessories, adhesives, liners and other materials). The raw materials are checked for any supplier defects and then classified based on the animal type (i.e. buffalo, goat and cattle leather) and on the type of tanning it has.

After the raw materials are checked, they get stored at the raw materials warehouse. The production manager checks the daily production plan and defines the raw materials needs based on the requested models and their quantities. Each model has its own unique bill of materials list defining the raw materials needed to produce it. The first processing stage starts at the preparation stage where the leather is cut according to the model pattern as well as the liner is being prepared.

The next stage is the assembly stage where the leather gets sewed and glued together with the liners and the strengthening materials. Accessories are also fixed at that stage. The assemble stage is the most crucial where it requires a team of four to be working on each process order out of which is the experienced team leader who’s responsible of giving the directions to the team. Each assembly unit is called a bank; and the plant consists of eight banks working simultaneously on different process orders.

Afterwards, the finished products are transferred to the quality control stage where they are checked before having the final release.

Last stage is transferring the finished products to the finished product warehouse where they are stored before the transportation to customers, distributors and show rooms.

The plant operates six days a week with one shift starting from 8:30 am till 6 pm with Fridays off.

The capacity planning and forecasting process at the production department is done in three month increments which may sometimes hinder the visibility of a capacity balanced plan across the year and jeopardize the inventory levels. Inventory levels may sometimes pile up causing shortage of cash and in other times they may go below the base levels leading to shortages of finished products. Base levels of inventory are roughly estimated only for the fast moving high-demand products but not to all.

Distribution Channels

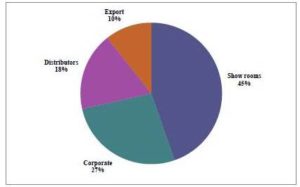

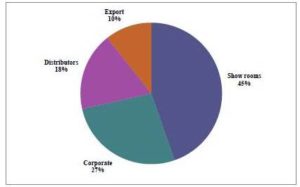

Distribution channels are crucial pillars to support growth and expansions. Seven K uses direct and indirect distribution channels to reach its customers. It has four main channels: 1) showrooms for direct sales to the end customers, 2) distributors, 3) corporate clients and 4) export clients.

Seven K’s own showrooms channel around 50% of the total local sales volume. The company has three show rooms: two in Cairo and one in Alexandria. These showrooms sell all the various models of Seven K products without any particular specialization. The locations of the showrooms were chosen in a way to be closer to the intended high-end target segments (Mohandeseen, Heliopolis and San Stefano Mall).

Another channel, wholesale distributors are well known specialized leather goods chains having several branches across the big governorates of Egypt, such as “Choice” and “Leather Home.” These chains are usually specialized in one or two of the product categories (e.g. women handbags) and not in the full range. Seven K considers its distributors as partners rather than customers and thus such partners enjoy a good discount percentage depending on their sales volume. Starting a business with a new distributor is not a decision to be solely made by the sales representatives. It needs to be approved by both the Sales and Marketing managers. This is done to ensure that a candidate distributor is up to the Seven K’s standards in order to preserve the brand image.

Corporate orders are different from the above two distribution channels as they come on a seasonal basis and their sales volumes can’t be forecast easily. Such orders come when Seven K receives a request from a corporate entity to provide certain gifts during seasonal occasions (e.g. Ramadan) or corporate events. Such requests are the trickiest in terms of forecasting as you can’t adequately determine forecasted sales volumes nor define certain fast moving models based on such corporate trends. Peak times may vary from year to year. In addition, the tastes of the decision makers in the corporate world might be deceptive in terms of the models choice (i.e. it’s only one person who chooses the model for the whole corporate entity and thus this doesn’t reflect neither real market trends nor collective consumers’ tastes). Seven K normally receives such corporate orders online through its website, fax, or in person at any of the show rooms. Exhibit 7 shows a sample of an online order request. In some cases, Seven K, works on tailored orders from the customers who specify certain design requirements and needs. The design is then developed and a sample is agreed with the customer before processing the overall order.

The fourth distribution channel is the export shipments whereby Seven K exports its products to various distributors and companies in the U.K., Russia, Australia, Austria, Jordan and Saudi Arabia. Seven K has an office at the UK, since it’s the biggest export market, where this facilitates the expansion in such market being closer to the consumers’ trends.

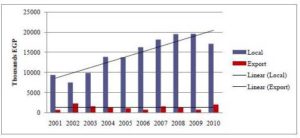

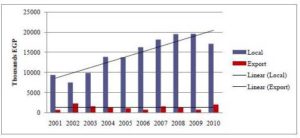

Seven K Sales

As mentioned before, Seven K sells its products to both the export and local markets. The increase in the total sales volume one year after the other was led by an increasing trend in the local market. Exhibit 8 shows the sales trend for both the export and local sales for the past 10 years.

One interesting fact is the seasonality of the demand. The winter season witnessing the Christmas, Valentine day and Mother’s day reflect the peak season for the demand in the local market. Exhibit 9 shows the local sales per month for the year 2010.

In addition, the share of the different distribution channels across the years have been almost unchangeable which shows the steady increasing trends across all such channels with no certain growth focus on any compared to the others. Exhibit 10 shows the share of each distribution channels out of the total sales volume.

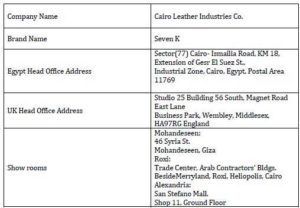

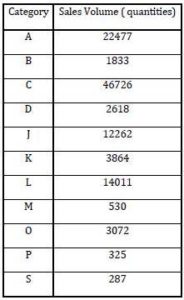

Moreover, the variety of the products models and categories helped to maintain a steady sales growth. Exhibit 11 shows the quantity of volume sold per each product category for the year 2010.

Seven K Strategy

“To design and create elegant useful leather goods for your personal lifestyle. We are proud of our craftsmanship” is the mission statement of Seven K which reveals a lot about the company’s strategy. The mission statement of the company reflects the company’s direction to produce high quality leather products for the high end market. Its main target segment is the upper class who is concerned with the quality and the design of the product rather than with the price.

Seven K is mainly competing on quality and fashion. It makes significant investments in getting quality materials as well as in creating a differentiated design. The company emphasizes the fact that it’s one of the few players which uses 100% non-artificial leather in all of its goods. Along with differentiated designs, this creates their major competitive advantage. Consequently, the company’s target segments are A and B classes, defined as people earning 7000 EGP and 3000 EGP per month respectively. These two segments constitute no more than 10% of the total Egypt population of 85 millions.

In addition, the value of Seven K’s products is enhanced by the fact that they are 75% handmade which adds more to the value proposition for the consumers.

Seven K gets its supply of raw leather from the local suppliers while the rest of the accessories and threads are all imported from Switzerland, Italy, UK& Germany. The reason for that is because the Egyptian leather is well known for its quality due to the warm environment that animals are grown up in and a close location of local suppliers of tanned leather. On the other hand, the company has imported its machinery and spare parts from Germany to be able to ensure the trendy designs.

Marketing Communication Strategy

When the company started up, their slogan was “Prestige” reflecting their strategy of targeting the upper class market. A few years ago, the company has decided to change this slogan to “Quality is a lifestyle” to reflect a more decisive strategy of their commitment to produce both high quality and trendy goods.

Consistent with its overall brand strategy, Seven K bases its marketing communication on the word of mouth rather than having a big marketing campaign more appropriate for a mass market. In 2004, the company has decided to experiment and spend extensively on TV and newspapers ads with intent to boost the brand awareness across the targeted segments. This advertising campaign helped the sales volumes to jump up to 40% in one year in the local market reaffirming the wisdom of this decision. On the other hand, the company decided to do a major upgrade in the decorations and designs of its show rooms to reflect a trendier fashionable image.

Product Portfolio

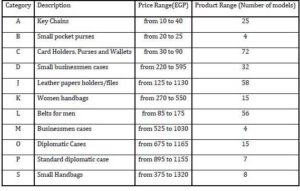

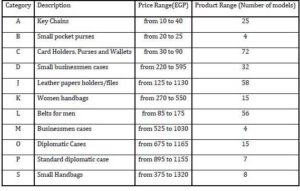

Seven K has a wide variety of product range of almost 300 different models in 11 different categories. This product ranges between wallets, belts, handbags, card holders and even key chains.

This range ensures satisfying the needs of the upper classes (A and B)target segments with their sub segments (A, A-, B+, B and B-). The products target both men and women of the different ages ranging between mid twenties up to sixties. Each product model can have a variety of colors such as black, chocolate brown, hazelnut brown and reddish brown. Moreover, in each product category, there are a variety of models with a variable price range so that customers can select what suits them the most.

Seven K is revising the models range annually where the management takes decisions to introduce new models or discontinue some of the old models. New models are normally designed at the technical design department which constantly works on being in line with the market trends.

Exhibit 5 shows the various categories, number of models per category as well as the price range for each category. Exhibit 6 shows several examples of Seven K products.

Seven K is currently working on a new product line targeting A class called the “Luxury line” which uses luxury leather types like the crocodile, snake and ostrich leathers which are not generally used in the rest of the product models.

Brand Image and Perceptions

Consumers’ perceptions play a very important role in affecting the sales of any brand. Such perceptions affect the consumers’ buying decisions as well as their satisfaction. “It was essential for Seven K to conduct focus groups and surveys to understand what customers really want and how customers perceive us” Mr. Hazem recalls. Seven K has decided to conduct focus groups in an attempt to define where it stands in the customers’ minds and how it can improve to support further growth strategies.

Focus group outputs showed that Seven K is well known in its target segments yet the brand image relates more to a masculine product (i.e. men leather products like belts and wallets). Respondents seemed not being aware that Seven K has a women product line for producing handbags and purses. People who visit the show rooms were coming for the sake of the men products and in many cases were not aware that a women product line does exist as well. This could explain the fact that most of the women product lines’ sales come from the distributors rather than the company’s show rooms.

Another interesting finding was that customers perceive Seven K products to be for the middle and upper age groups (i.e. starting from the mid thirties and up). Nevertheless, the various models across the different categories show that there are designs which are targeting the youth in their twenties and early thirties with trendy colors and designs. Yet, youth would still put Seven K as the elegant brand which they can buy for their parents and not for themselves.

On the other hand, focus group results showed that the brand is perceived as a high quality brand across all the various age groups which reflected a major strength. People believed in the quality of both the materials and the finishing of the products. Moreover, they all agreed on the elegant classic designs that Seven K products possess.

Key Challenges Ahead

“How can we convert these findings to shape our marketing, operations and the overall corporate strategy to capture growth opportunities”, that was the question Mr. Hazem was trying to find an answer for that whole previous night. He was recalling the Chairman’s point of view who believed that the business needs a fully integrated strategy across the various functions to drive an overall growth. The Board and the functional heads had a previous discussion earlier in a preparation for the upcoming top management meeting on strategy. The discussion, which should be finalized in today’s meeting, will be tackling cost reduction plans, expansion plans in the current existing markets both export and local, as well as plans to develop new unexplored markets.

Mr. Hazem kept on recalling the discussions that happened previously in previous week’s meeting. “We are suffering from the increased prices of the leather and thus the plant can’t be pushed more to reduce costs” said the plant manager explaining the increasing trend of the production costs in the past period. The plant manager believed that the master plan for the company’s growth shouldn’t be based primarily on reducing manufacturing costs as this is not an easy thing to drive in light of the volatile Egyptian market conditions. On the other hand, the financial manager believed that there’s a big opportunity of reducing costs through reducing the scrap costs (i.e. the losses due to scrapping raw materials during the manufacturing process when cutting or trimming the materials) which currently constitutes millions of pounds from the overall production budget. This point of view is very much supported by the low material utilization percentage which needs to be improved to reflect maximum utilization of the available raw materials to produce the expected number of finishing product units.

Mr. Hazem was asked to integrate all these inputs in one business development master plan that would capture all growth opportunities that the company foresees in the coming five years. How would the company grow strategically benefiting from its current resources? What should be the marketing plan that would drive such growth? What should be the operating strategy that would support the overall corporate growth strategy? What focus areas should be given due attention in the current operating strategy?

All such thoughts and questions were revolving in Mr. Hazem’s mind as he entered the big meeting room where the meeting was about to start.

Acknowledgements

I’d like to deeply thank the management team at Seven K and who donated their time to support me in this case study. They’ve provided me with all the needed and helpful information to bring this case study to light.

(adsbygoogle = window.adsbygoogle || []).push({});

References

Federation of the Egyptian Industry: Agreement with the University of Helwan on Local Manufacturing of Leather Industry Machinery. [Online], [Accessed Jan 20, 2011], http://www.fei.org.eg/newsdetails.asp?newsid=276

Publisher

Industrial Modernization Centre: Leather and Tanning Industries Co. “Seven K”. [Online], [Accessed Jan 20, 2011], http://www.imc-egypt.org/secleather.asp

Publisher

Italian Chamber of Commerce in Egypt: Cairo Leather Industries. [Online], [Accessed Jan 18, 2011],

http://cci-egypt.org/index.php?option=com_joodb&view=article&joobas=2&id=520%3 Acairo-leather-industries-co-qseven-kq&Itemid=59&lang=en

Publisher

Jordan C. Terrell. Bikyamasr: “Leather, more than Simple Economics,” [Online], [Accessed Jan 20, 2011], http://bikyamasr.com/wordpress/?p=17504

Publisher

Seven K Official Website.[Online], [Accessed Jan 11, 2011], http://www.cairoleather.com

Publisher

Spain Exchange International Student Resource: Leather Industry Studies. [Online], [Accessed Jan 19, 2011], http://www.spainexchange.com/article/269/leather_industry_studies

Publisher

Exhibit 1

Leather Industry Local Sales Distribution in Egypt in 2010

Exhibit 2

Egyptian Leather Industry Total Exports

Exhibit 3

Seven K Information Card

Exhibit 4

Seven K Organization Structure

Exhibit 5

Seven K Product Portfolio with Price Ranges

*Prices are based on 2010 pricing lists and might vary slightly vary between the various distributors

Exhibit 6

Seven K Product Categories

Exhibit 7

Seven K Order Form

Exhibit 8

Seven K Sales Volume from 2001 to 2010

*Real Sales volumes figures are disguised to protect confidentiality

Exhibit 9

Seven K Local Sales Volume in 2010

*Real Sales volumes figures are disguised to protect confidentiality

Exhibit 10

Seven K Distribution Channels Contribution to Total Sales

Exhibit 11

Seven K Sales Volume per Category in 2010

*Real quantities are disguised to protect confidentiality

Teaching Notes

Seven K Strategy Development

Synopsis

Seven K, also known as Cairo Leather Industries Co., was a joint stock company producing various leather products for both the local and the export markets. Since 1990, the company had grown to have currently a manufacturing plant, three self owned show rooms and fixed big distributors. After 20 years of its establishment, the company was assessing its growth strategies and expansion plans in both the local and the export markets. It needed to assess the growth opportunities and tackle any improvement areas that needed some focus across its different organizational functions. The key issue here is how to develop a growth strategy that integrates all of the functions together working on an overall unified corporate strategy. Such strategy needed to be broken down into clear action plans for each function to support such growth. The case presents useful information about the leather industry in general as well as the leather industry in Egypt. It also presents operational, financial and marketing data about the company to enable the students to assess such growth opportunities for the company as a whole.

Case Objectives

To assess the right growth strategies in a small niche market.

To mitigate the risks associated with the expansion of a local company into the foreign markets.

To identify the effect of the growth plans on the different organizational functions of a company unifying them all to support the overall company’s strategy.

To understand the importance of analyzing current opportunities in order to develop the right growth strategies.

To assess the challenges that local companies face in today’s economical environment.

Relevant Readings

Michael E. Porter, HBR. (Nov-Dec 1996). What is strategy?

Ferrell & Hartline. (Ed 5). Marketing Management Strategies. South-Western

Tim Laseter. (Winter 2009). An Essential Step for Corporate Strategy. Strategy Business. (Issue 57).

D. Farrell, HBR. (Dec 2004). Beyond Off shoring: Assess Your Company’s Global Potential.

Michael Lewis and Jose A.D. Machuca. (2003). Zara, Kasra Ferdows. Supply Chain Forum. Vol. 4(2).

Jones, Gareth & George, Jennifer. Boston. (Ed 6). (2009). Contemporary Management. McGraw-Hill.

Assignment Questions

What was the overall dilemma/ problem statement that Seven K faced based on the case?

What were the challenges that Seven K was facing based on your case assessment?

What were Seven K’s major strengths that the management need to build on?

If you were the general manager of Seven K, what kind of improvements you’d implement to tackle the major challenges the company was facing?

What are the possible alternatives (stating the pros and cons for each) that Seven K had in setting its corporate growth strategy?

What is the final solution that can be recommended to the management of the organization to set Seven K corporate growth strategy? Provide your arguments in support of the recommended solution.

Teaching Approach

It is recommended to use the Seven K case as either a term project or a discussion case within the semester.

A. Term Project:

Assign students to read the case carefully and analyze the company, its strategy and the product portfolio.

Ask students to prepare a detailed corporate growth strategy and action plan to solve the problem.

Students could be required to present their recommendations to class.

B. Case Discussion:

Ask the students to carefully read the case at home

Assign 15-20 minutes to discuss the main issues in the case stressing on strategy development and expansion issues. Make sure to identify the problem with students.

Divide them into groups of 4-5 students and give them 30 minutes to come-up with a corporate strategy with detailed links to both a marketing strategy and an operations strategy for the company as well as an action plan to support these strategies.

Ask students to present their findings in a brief 5-10 minute presentation.

Case Analysis

Question 1:

To answer this question, the definition of the strategy should be well understood. The importance of setting the right strategy for sustaining the growth of the company is the key concept here. Please refer to readings [1] and [3] in the “Relevant Readings” section to answer this question.

The problem definition was mentioned clearly in the opening paragraph in page 1 as well as the “Key Challenges Ahead” section in pages 10 and 11. The answer to this question can be as follows:

Seven K is reaching the point where it needs to assess its growth strategies. The company needs to set a clear corporate strategy and take it down to the functional level strategies to support such growth. The company had been established since 20 years and had taken some steps to expand in both the local and the export market. Yet, this needs to be done in a planned studied approach. The export market had been almost constant through the past ten years; yet the local market had been growing steadily. The company was in a state of assessing the next five years growth plans.

Question 2:

This question requires analyzing the challenges facing Seven K through analyzing its organizational environment. The forces affecting both the task and the general environments are essential elements in such analysis. Important readings for such question are found in chapter 6 in reading [6] mentioned in the readings section earlier.

Challenges are mentioned throughout the case in the different sections supported by Exhibit 9 showing the seasonality effect. The answer to this question can be as follows:

Seven K was facing several challenges in the horizon:

The increasing prices of the raw leather pushing the cost of the leather products to rise.

The difficulty to find talented experienced technical labor.

The ambiguity of the foreign markets trends making it challenging to explore new markets.

The misleading perceptions about Seven K brand being prohibited on a certain age group as well as being a masculine brand.

The seasonality effect of the demand which makes it crucial for an ongoing capacity balancing technique and a rigor inventory management strategy.

The fast changing fashion trends which require extra efforts of flexibility and initiatives lead time reductions.

The high scrap costs which drive the costs of the products higher.

Question 3:

This question suggests understanding the company situation well. Identifying the key strengths of the company is a vital step to start assessing where the company stands in order to set the right strategy.

This question can be further expanded during the discussions to include the full SWOT analysis. Readings from [2], (specifically chapter 5: Developing Competitive advantage and strategic focus) are quite useful to emphasize on the importance of the SWOT analysis and how to do it.

Strengths are mentioned throughout the case with the support of exhibits 3, 4,5,6,8 and 11. Possible answer to this question can be as follows.

Seven K had several key strengths that could be built on:

Considerable experience of 20 years in both the local and export markets.

Talented experienced workforce.

Strong brand image in its target segments.

Perceived as high quality products

High brand awareness among the target segments.

Fixed presence in the UK market through the Seven K office.

Good locations for the Seven K showrooms in both Cairo and Alexandria to attract the right target segments.

Establishment of business links with several distributors in Egypt.

Diversified product portfolio.

Flat organization structure enabling solid linkage between the different functions of the organization.

Sustainable sales growth in both the local and export markets.

Question 4:

The intent of this question is to apply the well known analysis tools to better improve the company. Tools like the BCG matrix, forecasting techniques, analysis of the product mix (4P’s are encouraged to be suggested in solving this question. Such tools are well explained in reference [2].

To answer this question, the overall case needs to be read thoroughly. Suggested answer is as follows:

Some improvements need to be implemented in the current organization and work processes in order to tackle the challenges discussed previously.

Capacity Balancing between the different seasons as well as solid inventory management techniques need to be in place. It’s obvious from the organization structure that there is no planning department responsible for linking forecasts to production plans. Thus it’s highly required to have such function which would take care of both the short term and long term planning based on both the plant available capacity, the market demand and inventory levels. Such function would also be responsible of the phasing in and phasing out models so as to reduce losses on remnants.

Scrap costs need to be monitored effectively. There should be a clear focus from the operational department to set up action plans to reduce such scrap costs that are actually decreasing the profit margin.

The product portfolio needs to be assessed to analyze each model within the different categories. A sort of a BCG matrix is required to understand which models are not profitable with minimal growth and need to be phased out and which models are considered as stars to be invested on.

The new designs and initiatives cycle need to be speeded up to be able to respond more to the market trends and thus be able to compete not only on quality but also on fashion and flexibility.

The overall marketing communication strategy needs to be assessed. The role of marketing and advertising in boosting a product’s sales and the effect of innovative marketing need to be rolled out to support the company’s growth. The company shouldn’t be relying only on the word of mouth.

Question 5:

The intent of this question is to train the students to come up with possible alternatives to solve the issue discussed in the case and accordingly start assessing them. Students need to exercise on how to assess their alternatives in terms of identifying the pros and cons of each. Useful readings to help open up ideas for this question are [4] and [5]. Those will help the students understand how companies can grow globally in light of applying the supply chain management concepts.

To answer this question, the overall case with its exhibits needs to be read thoroughly. Suggested answer is as follows but not restricted to:

There are several alternatives that the company can decide on in order to have a solid corporate growth strategy.

Vertical Integration to Include the Leather Tanning Industry. With this option Seven K, will be having a separate plant/ or the same plant yet extending the operations one step backward to include the leather tanning process. With this alternative, Seven K will have more control on the supply chain and above all the raw leather prices which are facing an increasing trend. The issue with this alternative is that the leather tanning industry is a total different operation than the leather manufacturing requiring different operational caliber as well as space requirements. Moreover, Seven K has no experience with the leather tanning at all.

Focusing Mainly on the Local Market and Terminating the Export Business. This alternative will require Seven K to stop exporting to any foreign country and focus all its marketing and sales efforts on the local market. This option might entail as well expanding the marketing strategy to target lower segments in the local market aiming at getting high sales volume. This option will help the company focus extensively on the local market which is easier to understand, forecast and satisfy the market requirements. On the other hand, with this alternative, the company will be ignoring the potential opportunities of exporting to profitable foreign markets. Moreover, the brand image might be affected when targeting the whole market segments with the same brand name making the brand lose its relevance to the niche and upper classes segments that will move away from buying the brand.

Focusing Mainly on the Export Market and Terminating the Local Business. This option might seem profitable as Seven K will be playing in more profitable markets which might be less price sensitive. However, as matter of fact, the export volume currently constitutes 10% of the total Seven K sales while 90% goes to the local market. It’d be very risky if the company transfers its 90% of the business to an unexplored focus area while it has a well established market locally.

Focusing on the Local Market and Creating a Joint Venture with other Brands at the Exports Markets. This option requires that Seven K will continue focusing on the local market growing it further and on the other hand create a joint venture with well established local brands at the foreign markets. This option will enable Seven K reap the fruits of focusing on the local market as well as capture the experience of the other local foreign brands at their markets saving lots of market analysis efforts. Seven K will build on the success of such brands in their markets and will provide such brands with cheap outsourced products under their names.

Develop a New Brand Targeting Women. With this alternative, Seven K will create a new brand to target women through the women leather products having a different brand name. Though this option might seem a logical one, yet building up a new brand is not an easy task to implement. The only advantage of this alternative is that it’ll create a new brand name differentiating it from Seven K which is associated to masculine leather products.

Create Different Product Lines Targeting the Different Age Groups and Genders within the Same Niche and Upper Segments. This alternative suggests having the same brand name “Seven K” with a target objective of classes A&B as it is yet classifying different product lines to reflect sub segments within those big segments. For example, Seven K will target the youth with a product line called “trendy” and will target the middle and upper age groups with a product line called “elegance”; it might also create another product line for the women products..etc. Through this alternative, Seven K will sustain targeting the main frame of segments yet targeting the sub segments with a better positioned product lines avoiding misperceptions about the brand image. This alternative requires lots of marketing efforts to identify how to target each sub segment separately.

Question 6:

This question is the most important in the case as it’s the one that’s coming as a conclusion after the assessment and the understanding of all aspects of the case. It’s the question where students play as real consultants to the case where every piece of information and analysis is needed. To answer this question, the overall case needs to be read thoroughly. There is no solution that is expected to be the best, so many arguments are expected and each group of students might come up with different solutions. Suggested answer is as follows but not restricted to:

The overall corporate strategy should suggest that Seven K is a brand that reflects both quality and fashion and thus the strategy should reflect these two areas of competence. On the other hand, the brand has a well established image among the niche and upper class segments which the company should continue to target. Moreover, the corporate strategy should capture both growth opportunities locally and externally.

The Solution Recommended by the Author is a Combination of Alternatives 4 and 6:

When focusing on the local market, Seven K will be tackling 90% of its current business which can be easily expanded further given the solid brand image it possesses among its target segments. Also the local market trends can be better forecasted as the company is closer to the market dynamics as well as being in control of the various distribution channels locally. Targeting the various sub segments with different product lines will help have a better positioning in each sub segment and at the same time build on the mother “Seven K” brand.

When expanding in the export market, Seven K needs an entity which is well established in each and every export market where they can exchange a profitable relationship together. The foreign entity/brand will have a better understanding for its local market trends and needs which would accordingly benefit Seven K when exporting to such market in terms of distribution and product portfolio. On the other hand this foreign entity will benefit out of Seven K relatively lower cost products and thus both will exchange value together.

Lessons Learnt

Setting the Right Corporate Strategies: Corporate growth strategies are only successful when brought down to functional strategies. Each function needs to understand how it’d be contributing to the overall corporate strategy. Moreover, Companies need to define their area of competence clearly and work accordingly.

Linking the Corporate Strategy to the Marketing Strategies: Identifying the right marketing strategies to ensure capturing the growth opportunities. Effective use of the SWOT analysis to identify the proper strategies and further course of action is quite necessary to ensure a successful long term market leadership.

Linking the Corporate Strategy to the Operations Strategies: Operations management is a key pillar in the overall corporate success. Operations should be going in line to support the overall corporate strategy. Flexibility and innovativeness are major requirements in today’s business.

Expansions of the Local Companies in the Export Markets: Local companies face challenges when expanding in the foreign markets which can only be overcome through a proper understanding and analysis of the foreign market dynamics.

Segmentation and Targeting with the same Brand name: How to target the different market segments with the same brand name using the appropriate product mix. The core product can be modified/ tiered to be able to meet the different segments’ needs and at the same time preserve the strong brand image across the various segments.