Introduction

Traditionally, financial reporting is one of the most important types of entity communication, providing information on the past, the present, the entity’s economic activity, and its perspectives (Falschlunger et al., 2015). Also, it is an opportunity for entities to legitimate themselves and their activities (Dhanani & Kennedy, 2022). The evolution of disclosures entails new challenges related to the content of the information since “increasing the amount of information being disclosed does not necessarily imply an improvement in the quality of the disclosure about underlying activities” (Sahyoun and Magnan, 2020, p. 796). Therefore, due to the lack of specific rules guiding a significant part of entities’ disclosures, the credibility of corporate narratives and their characteristics still represent matters of increasing relevance as a guarantee of reporting usefulness (El-Sayed et al., 2021). Increasingly, different types of accounting narratives have been included or separately disclosed as complementary and relevant information to stakeholders (Clatworthy & Jones, 2003; Tauringana & Mangena, 2014). Therefore, entities’ disclosures have been “a longstanding pre-occupation of accounting researchers and policymakers” (Leung et al., 2015, p. 275).

Within the notes to the financial statements, the International Accounting Standard (IAS) 10: Events after the reporting period, issued by the International Accounting Standards Board (IASB), are intended for the disclosure of those events, favorable or not, which take place before the authorization to the financial reporting release by the management board. When related to existing conditions before the end of the reporting period, they must be subject to adjustment and disclosure in the notes to the financial statements. Otherwise, they should be disclosed only. Listed entities in the European Union must use the IAS and International Financial Reporting Standards when preparing their consolidated reporting under Regulation 1606/2002 of the European Parliament and of the Council of 19 July 2002. Therefore, the military conflict in Ukraine, which began in 2022 and has Russia as an invading country, is likely part of a non-adjustable event after the reporting period to be disclosed by those entities.

Research into the content of the reporting of events after the balance sheet date, a matter that falls within the scope of IAS 10, is still incipient, a fact that is corroborated in the few studies on this subject, including the audit perspective of such events (Al Nawaiseh & Jaber, 2015; Ambarchian & Ambarchian, 2022; Honko et al., 2020; Kellgren, 2018; Kuzmenko & Shalimova, 2018; Ozdemir & Gokcen, 2016; Soares & Carvalho, 2019). The event proposed in this research was only specifically assessed by Ambarchian and Ambarchian (2022) from the reporting of 14 multinational groups regardless of their economic activity sector. Notwithstanding, the entities’ disclosures of this event are assessed in that research from an exclusive economical perspective of its impacts.

Considering the lack of literature on a topic that has relevant social and economic effects, this paper aims to assess the disclosures by listed European entities from the energy-related sectors regarding Russia’s

invasion of Ukraine in 2022. This sector was chosen considering the significant impacts of a reduction of energy imports from Russia, particularly in the European Union countries, as highlighted, for instance, by Korosteleva (2022) and Nerlinger and Utz (2022).

For this purpose, the consolidated financial or integrated reporting for the reporting period that ended in 2021 is used as the source of information. The following overall research question underlies this purpose: is there a set of relevant information provided by the European listed companies that are likely mostly impacted by this event to their stakeholders? To provide an answer to this question, a set of specific objectives underlying the following specific research questions (Q) was formulated as follows:

- In which component (mandatory or voluntary) of their companies’ financial or integrated reporting this information can be found?

- Which is the main nature (qualitative or quantitative) of the information provided by those entities?

- Is the information provided in each component specific (not redundant) to its goal and, therefore, is not also provided in another distinct component?

- Does the information disclosed by entities under IAS 10 provide data that allow stakeholders to understand the possible adjustments made to their financial information at the end of the reference reporting period (2021), their level of exposure, and the likely material impacts from this event, i.e., Russia’s invasion of Ukraine in 2022?

The relevance of this research may be justified by the analysis of how entities have been disclosing an event of such nature (the war) that has potentially relevant social and economic impacts worldwide (e.g. Leon et al., 2022; Mbah & Wasum, 2022), also contributing to mitigate a gap in the literature in what concerns the analysis of the notes relating to events after the reporting period under IAS 10.

Being preliminary and still exploratory research, the literature in accounting on diverse theories and the related explanatory factors that explain the entities’ mandatory or voluntary disclosure levels are not the focus of this paper. Those which include agency, signalling, and stakeholders’ theory, as well as the hypotheses within the positive accounting theory, to mention the most traditional, are proposed as future avenues for this research development. Different investigation lines on the entities’ disclosures, such as on the use of impression management strategies, can be also relevant from a perspective of a qualitative content analysis of the information used as the object of this research.

The next section presents the material and methods underlying the analysis proposed for this paper.

Material And Methods

To achieve the proposed objectives and find answers to the previous research questions, this paper is based on the archival method and content analysis as the technique. As a data source, the analysis uses the information gathered from the consolidated financial or integrated reporting published by entities included in the most relevant Euronext indexes from the energy-related sectors. The object of analysis is the disclosures on Russia’s invasion of Ukraine in 2022.

This research may be classified into a scientific approach that is both qualitative and quantitative, as its findings are also supported by descriptive analysis which intends to summarise the information gathered. Despite the diversity of literature covering different subjects and investigation lines on the explanatory factors of entities’ disclosure on different matters, this specific subject has not been previously assessed in the literature, as far as from the authors’ knowledge. Also considering the reduced sample, this paper is assumed, therefore, as mainly exploratory at the first stage of this research. Then, it intends to provide a preliminary overview, and not explanatory yet, on its subject.

Within financial or integrated reporting, the following voluntary and mandatory components were extracted to obtain the needed information:

- the message from the chairperson and/or the chief executive officer (CEO);

- the outlooks, forward-looking statements, or similar information of such nature;

- the entities’ perspective of the main risks they are facing;

- other topics, such as subsequent developments outside the notes to the financial statements;

- finally, the required disclosure on subsequent events (events after the reporting period) from the notes to the financial statements under IAS 10.

Following, the aspects or matters assessed from those pieces comprise the information summarised below:

- whether there is any reference to Russia’s invasion of Ukraine;

- whether there is quantitative information (for instance, some figures) associated with those possible references;

- whether there is repetitive information among those pieces of information.

Besides, further elements are specifically gathered from the analysis of the notes to the financial statements under IAS 10, namely:

- whether there are adjustments to the financial information at the end of the reference reporting period (2021);

- whether there is a reference to possible entities’ expositions to the effects of Russia’s invasion of Ukraine;

- whether there are references to the likely impacts of this event on the entities’ activities that can influence their future cash flows, financial position, or performance.

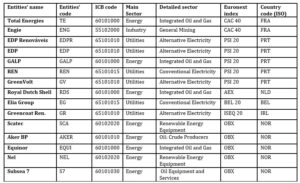

The following table lists the entities used as part of this research sample, along with their names, their codes for simplification purposes, the Industry Classification Benchmark (ICB) codes with their specific sector codes, the Euronext index to which they belong, and the representative country for those indexes.

Table 1. Research sample characteristics

Source: Own elaboration

The next section presents the findings from this research.

Results

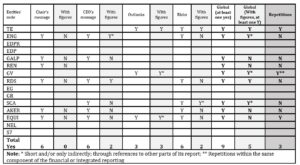

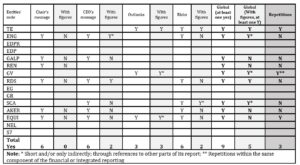

Table 2 shows a summary of the information gathered on Russia’s invasion of Ukraine in 2022 from the different components of financial or integrated reporting, other than subsequent developments or events. The assessment included the following components: the message from the chairperson and/or the CEO; the outlooks, forward-looking statements, or similar information of such nature; and the entities’ perspective of the main risks they are facing. The table indicates with yes (Y) those cases where any reference has been made in those components and, additionally, whether there are figures within the information found by each component or not (N) as well as repetitions between those components.

Table 2 indicates that nine out of 15 entities have made at least one reference on the matter under assessment in those components selected from their financial or integrated reporting. Five out of those nine entities also provided figures to indicate a potential impact or the entity’s exposition and, finally, one-third presents excerpts already included in a different piece of information. In this context, the chair’s and/or CEO’s message, as well as the component of risks’ disclosure should be highlighted, with six out of 15 entities mentioning the event object of this research by each one of those components under assessment. Notwithstanding, in only one-third of cases those references also included some figures. On the other hand, the references in the entities’ outlooks were accompanied by figures in all cases, despite being provided by just one-fifth of them. However, those figures were mostly provided as short and/or indirect information, through references to other parts of its report.

By entity, EQUI provided information in all possible components of financial or integrated reporting where a mention of the event could be found, despite some repetitions. Nonetheless, TE, RDS, and AKER provided a higher level of information, with no repetitions found for the latter two entities mentioned. Then, excepting GALP and S7, for which the event was mentioned only within the chair’s and/or CEO’s message (GALP) or not found at all (S7), the oil and gas sectors seem to provide more information on the matter under assessment in this research, conversely to those related to electricity sectors.

Regardless of the reduced sample, some patterns by country can be mentioned. As for Portugal and Norway, sharing two-thirds of the research sample, two of their entities have not mentioned the event in their report, with a globally reduced level of information found in the Portuguese entities. Finally, the entities from Belgium and Ireland did not report any information on this event as well.

Table 2. Information gathered from different components of financial or integrated reporting other than subsequent developments or events

Source: Own elaboration

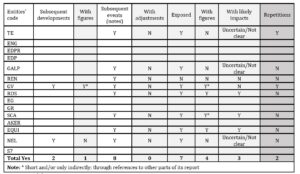

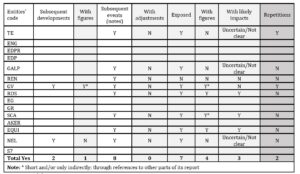

Following the previous analysis, Table 3 provides a summary of the information gathered on the same research object from the subsequent developments or events, including the information on the notes to financial statements. The table indicates with yes (Y) those cases where any reference has been made in those components and, additionally, whether there are figures within the information found by each component or not (N), as well as repetitions between those components. Furthermore, it was identified whether there were adjustments to the financial information at the end of the reference reporting period (2021), whether there were references to the entities’ expositions to the effects of Russia’s invasion of Ukraine, and, finally, to the likely impacts of this event on the entities’ activities that can influence their future cash flows, financial position, or performance.

Table 3 shows that only two entities mentioned the event under assessment in the scope of their subsequent developments and, even so, this information was replicated in the notes to the financial statements in one of those cases. Eight out of 15 entities disclosed information on this event. However, two cases should be particularly highlighted in this context. On the one hand, two entities provided information in previous components but not on the notes to financial statements (ENG and AKER, from France and Norway, respectively), and, on the other hand, there was a single entity that only disclosed information on this latter component (NEL, from Norway).

None of the entities has made any adjustments to the information presented at the end of the reporting period (2021), which is according to the initial expectations, considering the unpredictable character of this event. Notwithstanding, seven entities indicated that they are somehow exposed to possible impacts from those events in the coming future, but only three were clear regarding their likely impacts on the entities’ activities that can influence their future cash flows, financial position, or performance, and other three were unclear, imprecise, or vaguer referencing them. However, only four out of seven provided some figures that illustrated those likely effects, sometimes only shortly and indirectly. It is also interesting to highlight a case in which an entity indicates that it was somehow exposed but assumed that there are no predictable impacts in the upcoming years.

Finally, either by country or by sector, there is no clear profile to be stressed based on those figures.

Table 3. Information gathered from subsequent developments and events

Source: Own elaboration

Source: Own elaboration

The next section presents the conclusion from this research, as well as its limitations, and future avenues.

Conclusion

This paper assessed the disclosure of Russia’s invasion of Ukraine from the financial or integrated reporting by listed European entities from the energy-related sectors. The findings globally indicated a reduced level of information on this event, excepting some entities from the oil and gas sectors, which was particularly evident within the electricity sector. Furthermore, figures are usually missing, and repetitions, as well as unclear and vaguer information on the likely future impacts, were usually found. Those findings are consistent with Honko’s et al. (2020) findings as regards the analysis of the associated risks with Covid-19 based on the entities’ disclosures on subsequent events.

The research has also some limitations that need to be stressed, which mostly relate to the lack of research on this topic within IAS 10. The findings from this research shed light on two possible reasons that may explain that. The first is possibly explained by the mostly qualitative-descriptive nature of the information provided under IAS 10, which is a resource used by most entities to the extent that this standard provides for the impossibility of not reliably measuring the financial impacts of such events. This restriction eliminates the possible use of quantitative analysis using this information, other than the possible disclosure levels. The second relates to the fact that such events are often presented as specific to each reporting entity, resulting occasionally in non-disclosure. This constraint does not allow researchers to validate, for instance, the compliance level with the requirements of IAS 10, only to mention a single traditional line of investigation in the accounting area.

Besides, the exploratory purpose of this research, which is mostly derived from its limited sample, does not lead to the identification of the likely explanatory factors behind the findings. Consequently, as future avenues, it suggests increasing the sample under assessment and the resource of the disclosure theories to propose the determinants of the entities’ disclosure levels on this matter. Furthermore, the content of those disclosures could be also assessed in the light of diverse investigation lines, such as the impression management strategies adopted by entities and their underlying theories through discourse analysis. Those studies may either use quantitative or qualitative approaches. For instance, the level of the entities’ economic and political dependency concerning the countries and economic activity sectors that are most economically affected or politically involved with this conflict represents an important investigation field, regardless of the research methods to be proposed. Future investigations can also enlarge the sample to cover economic sectors and countries other than those included in this paper for a more comprehensive understanding of the entities’ disclosure levels and content.

Despite its limitation, this paper may contribute to the literature on this topic, by providing insights into the different patterns found by the entities concerning a current topic that has relevant social and economic impacts worldwide.

Acknowledgment

The authors extend sincere gratitude to The Instituto Politécnico de Lisboa (IPL/2022/REPUKRAINE_ISCAL) for the valuable support.

References

- Al Nawaiseh, M. A. L., & Jaber, J. (2015). Auditing subsequent events from the perspective of auditors: study from Jordan. International Journal of Financial Research, 6(3), 78-85.

- Ambarchian, M., & Ambarchian, V. (2022). Disclosure of information on geopolitical events after the reporting period in annual reports of multinational corporations. Economy and Society, 38.

- Clatworthy, M., & Jones, M.J. (2003). Financial reporting of good news and bad news: Evidence from accounting narratives. Accounting and Business Research, 33(3), 171–185.

- Dhanani, A., & Kennedy, D. (2022). Envisioning legitimacy: Visual dimensions of NGO annual reports. Accounting, Auditing and Accountability Journal. In Press

- El-Sayed, D., Adel, E., Elmougy, O., Fawzy, N., Hatem, N., & Elhakey, F. (2021). The influence of narrative disclosure readability, information ordering and graphical representations on non-professional investors’ judgment: Evidence from an emerging market. Journal of Applied Accounting Research, 22(1), 138–167.

- Falschlunger, L. M., Eisl, C., Losbichler, H., & Greil, A. M. (2015). Impression management in annual reports of the largest European companies: A longitudinal study on graphical representations. Journal of Applied Accounting Research, 16(3), 383–399.

- Honko, S., Remlein, M., Rowinska-Kral, M., & Swietla, K. (2020). Effects of COVID-19 on the financial statements of selected companies listed in the Warsaw stock exchange. European Research Studies Journal, 23(2), 854-87.

- Kellgren, J. (2018). IAS 10 Events after the Reporting Period Problematized: Some Questions Regarding the Standard’s (Read by its Letter) Understandability. Skattenytt, 3-35.

- Korosteleva, J. (2022). The Implications of Russia’s Invasion of Ukraine for the EU Energy Market and Businesses. British Journal of Management, 33(4), 1678-1682.

- Kuzmenko, H., & Shalimova, N. (2018). The Disclosure of Events after the Balance Sheet Date Related to the Status of the Company as a Taxpayer: Peculiarities of Ukrainian practice.

- Leon, D. A., Jdanov, D., Gerry, C. J., Grigoriev, P., Jasilionis, D., McKee, M., … & Vågerö, D. (2022). The Russian invasion of Ukraine and its public health consequences. The Lancet Regional Health–Europe, 15.

- Leung, S., Parker, L., & Courtis, J. (2015). Impression management through minimal narrative disclosure in annual reports. British Accounting Review, 47(3), 275–289.

- Mbah, R. E., & Wasum, D. F. (2022). Russian-Ukraine 2022 War: A review of the economic impact of Russian-Ukraine crisis on the USA, UK, Canada, and Europe. Advances in Social Sciences Research Journal, 9(3), 144-153.

- Nerlinger, M., & Utz, S. (2022). The impact of the Russia-Ukraine conflict on energy firms: A capital market perspective. Finance Research Letters, 50, 103243.

- Ozdemir, Z., & Gokcen, B. A. (2016). Auditing of subsequent events: a survey of auditors in the city of Istanbul in Turkey. Accounting and Finance Research, 5(2), 42.

- Regulation (EC) No 1606/2002 of the European Parliament and of the Council of 19

- July 2002 on the application of international accounting standards. Official Journal of the European Communities, 243.

- Sahyoun, N., & Magnan, M. (2020). The association between voluntary disclosure in audit committee reports and banks’ earnings management. Managerial Auditing Journal, 35(6), 795–817.

- Soares, A., & Carvalho, C. (2019). Relato dos acontecimentos após a data do balanço: um estudo para as empresas portuguesas com valores cotados. In XVII Congresso Internacional de Contabilidade e Auditoria, Porto.

- Tauringana, V., & Mangena, M. (2014). Board structure and supplementary commentary on the primary financial statements. Journal of Applied Accounting Research, 15(3), 273–290.