Introduction

Corporate social performance was pronounced in the academic and professional domain after the agitation for global best business practices in line with the sustainability campaign and green initiatives. The agitations were driven towards compelling companies to have a human face in their daily activities by engaging in business activities that will preserve the social state of the human as well as the naturalness of the environment. These arguments were centered on the sustainability theory, green accounting among others. The corporate social performance aspect of this theory centered mostly on corporate social responsibility (CSR) as well as other non- financial parameters for the evaluation of company performance. The adoption of the philosophy of corporate social performance depends largely on the ideologies of the top management of each company, particularly the board. This is because all the activities of a company in terms of management, policies, strategies and vision, depend upon the decision taken at the board. If there is a deficiency in the board, it will flow down to the day-to-day activities of the company, which will have a negative ripple effect on the economy. It is based on these premises that various studies were conducted to determine how various board dynamics influence the corporate social responsibility of firms.

The findings of previous studies revealed that dynamics such as board attributes, ownership structure and; board citizenship, among others, are some of the factors that influence the social performance of firms. From the analysis of the previous studies conducted on board attributes, most studies found a statistically significant relationship between the female gender and the social performance of the firms (Dienes and Velte, 2016; Betz, O’connell & Shepard, 2013; Ciocirlan & Pettersson, 2012). From the various assertions, it will be logical to opine that the presence of women in a corporate board increases the social welfare activity, and thereby, improves the quality of its CSR performance.

As much as this holds true, the circumstance surrounding women in boards will determine the extent to which they will contribute to the quality of the company. Firstly, the composition of the female representation in the board; the activities of the board in decisions and reaching consensus dwell on numbers. The consensus is reached based on the number of votes. If the men representation in the board outnumbers that of women there is no likelihood that women will work to benefit the company because they have been limited by the deficiency of their numbers (Konrad, Kramer & Erkut, 2008). This, therefore, implies that it is not enough to have women in boards; the number of women in such boards is noteworthy. The editorial board of Business day (2020) stated that according to the report of Mckinsey global institute, it was observed that the progress towards gender equality has been stalled and African women lag behind other women in most other regions.

Secondly, the expertise of females in boards is not limited to their educational backgrounds, but also the CSR related managerial experience that will add value to the CSR drive of the management (Yusoff, 2010). Most studies focused on the accounting and financial knowledge of female directors as embedded in their educational backgrounds. The recent evolution in the economic environment is an indication that much more is expected to maximize the worth of a director. Thirdly, the independence of females in board, submissions of various studies showed that the board’s independence significantly influences its effectiveness and control of agency cost (Patelli & Prencipe, 2007; Michelon & Parbonetti, 2012). The female gender is caught in the web of independence deficiencies because of their insecurity perspectives and high subjection to the male gender across all spheres of life. Most women in Nigeria due to financial incapabilities and political power, found seats on companies’ boards with the help of their male counterparts and as such their decision are usually subjective.

Although most studies have upheld the significance of women on CSR, but however, based on the forgoing, it is evident that it is not enough to have women in boards as proposed by previous studies, but there is need to examine attributes of women in the board of directors to determine whether they significantly contribute to decision making, especially as it relates to social performance. This study focuses specifically on the boards of the listed Nigerian deposit money banks because it is one of the sectors that have a significant contribution to the capitalization of the Nigerian stock market.

The broad objective of this study is to examine female directors in boards and corporate social performance. The study focused on three key components of female board members traits; these includes female directors in board composition, female directors’ expertise, and female directors’ independence.

The paper is structured into five separate headings and other subheads; these cover the introductory aspect of the study, the review of the literatures and hypotheses development to clarify concepts, and showing interactions between variables in line with previous studies. The third heading is the explanation of data and methods used in the study. The analysis and discussion of findings are explained in the fourth heading and finally, the conclusion and recommendations are outlined in the fifth heading.

Literature Review and Hypotheses Development

The definition of CSP centered mostly on the definitions of Wood’s CSP model. Wood (1991) defines CSP as “a business organization’s configuration of principles of social responsibility, processes of social responsibility and policies, programs and observable outcomes, as it relates to the firms’ societal relationships”. Jiang and Yang (2015) also stated that CSP can be evaluated by assessing the social responsiveness processes of the firm to determine how it influences their policies and action plans regarding its actualization. From the definitions, it is obvious that CSP has to do with the firms developing a process that will promote their interactions with stakeholders to ensure an outcome that will be sustainable. This, therefore, implies that CSP cannot be discussed in isolation of corporate social responsibility (CSR) in interacting with stakeholders. The firms must ensure an outcome that will positively impact the social and environmental aspects, which depends largely on the CSR activities of the firm (Odetayo, Adeyemi & Sajuyigbe, 2014). This study measured CSP as the total CSR expenditure of a company on its host communities and other philanthropic spending in a given year.

CSR activities of an organization stem from the policies and ideologies of the firm, which can be driven by the philosophy of the owners of the company; such a philosophy actualized by the organs of the company which comprises the board of directors and management. This development made the activities of the board a relevant aspect in the discussion of CSP and CSR. The strategic role of the board involves approving, monitoring, and reviewing strategies at one end, along with a leadership role of establishing the goals and values and setting direction at the other end (Ingley & Vander Walt, 2001). This, therefore, implies that the value attributed to a company in terms of its business practices, depends largely on the caliber of individuals that are seated in its board (Daily, Dalton & Cannella, 2003). This study also shares the views of previous authors in this direction, by examining the individual traits of the female on the boards to reveal the value they add to the company’s CSR practises from three focal perspectives, which are; composition, expertise and independence.

Theoretical Underpinning

This study is based on the assumptions of the agency, stakeholders and gender socialization theories. It is necessary to hinge this study on a combination of theories because of the peculiarity of the study; and the fact that the component of the study is independently and jointly related. The agency theory, as developed by Jensen (1976), assumes that relationships in a company are likened to principal and agent, where the principal is the owner (provider of capital), while the directors are likened to agents that perform duties according to the mandate of the owners. Here, the directors are expected to perform their duties solely in the interest of the owners. However, the theory stated that because of the conflict of interests, an agency problem arises when the agent pursues his personal interest to the detriment of the interest of the principal which usually leads to the owners incurring agency cost (Sundaram & Inkpen, 2004). This theory applies to this study because the board of directors are the agents that perform a strategic role that involves approving, monitoring, and reviewing strategies at one end, along with leadership role of establishing the goals and values and setting direction at the other end (Ingley, & Van der Walt, 2001). This, therefore, implies that the value attributed to a company in terms of its business practices, and the extent of agency cost they will incur, depends largely on the caliber of individuals that are seated in its board (Daily, Dalton & Cannella, 2003).

The stakeholder theory developed by Freeman (1984) is a theoretical perspective that argues that companies should look beyond the relationships that exists between owners and managers and consider other individuals or groups that may be affected by the activities of the firm; namely, the stakeholders (Freeman & McVea, 2001). The stakeholder theory birthed the corporate social responsibility practices of firms globally and it has become a yardstick for performance evaluation of companies despite the fact that it is regarded as a philanthropic and voluntary action. The significance of this concept in the evaluation of firms has made it part of companies’ strategic plan; which is part of the mandate of the board of directors. This study, therefore, predicts that the extent of corporate social performance of a firm is largely determined by the attributes of its board members. The issue of attributes made the injection of the gender socialization theory necessary. Silic-Micanovic (1997) define gender socialization as the process where human in the course of their social interactions are moulded and shaped in a culturally appropriate image of femaleness and maleness. The ideologies of gender socialization emanated from the family system where a child is introduced to the world and the expectation of his/her gender (McHale, Updegraft, Helms-Erikson & Crouter, 2001). The study, therefore, speculates that the peculiarities of the moulding of the female gender can have a significant influence on their relationship with the principal as agents, as well as their relationship with other individuals as stakeholders.

Female board composition and Corporate social performance

Bhagat and Black (2002) describe board composition as a reflection of various levels of heterogeneity. Based on the agency theory, the resource dependency theory and the corporate governance literatures, board composition is measured as the ratio of non-executive board members to executive ones and the number of directors in a firm’s board. This study however modified the measurement by narrowing it down to the female representation in boards based on the objective of this study. Female board composition is therefore measured in the context of this study as the number of women in company board in proportion to the total number of directors in that board.

Most studies conducted in developed and developing countries including Nigeria (Pucheta-Martinez, Bel-Oms & Olcina-Sempre, 2018; Cook & Glass, 2017; Deschenes, Roubacar, Prud’hommie and Ouedraogo, 2015; Garba & Abubakar, 2014); confirmed that the number of women in a company’s board significantly affect its social responsibility practices. Other studies conducted on non-financial evaluation also revealed that women, as part of the board of directors, have a significant impact on the corporate philanthropy of firms (Valls, Martinez, Rambaud & Parra-Oller. 2019; Fodio & Oba, 2012). Studies conducted by Stephenson (2004) and Fernandez-feijoo et. al (2012) also assert that boards with more women have a significant effect on CSR disclosure. However, Stephenson (2004) made a clause to his findings that boards that had up to three women had a significant effect.

There was a divergent submission in the study conducted by Colakoglu, Eryilmaz and Martinez-Ferrero (2020) after enquiring into the antecedents of board diversity on corporate social responsibility using the biggest Turkish companies as their focus. It was found that the ratio of females and foreign board members does not have any significant effect on CSR performance. This finding shows a drift from the normal trend regarding female directors in boards. Similarly, in a study conducted on U.S firms, Manita, Bruna, Dang & Houati (2018) also affirmed that there is no significant relationship between gender diversity and environmental and social governance. Kyaw, Olugbode and Petracci (2017), in a study conducted on CSR across industries and countries, found that although there is a positive relationship between gender diversity and CSR across industries, the effect is more pronounced for firms in emerging markets. The inconclusiveness of the findings and the scepticism that still exists in yielding to the policy of increasing the number of female directors in boards in developing countries, including Nigeria, has further increased the uncertainties. Based on these, it is therefore hypothesized that:

Ho1: Female board composition does not significantly affect corporate social performance of listed DMBs in Nigeria

Female Director Expertise and Corporate social performance

Stakeholders are more interested in a board that comprise members that have skills, attributes and dynamics to respond to changes in business models (Barka & Dardour, 2015). Although education has the ability to drive the value system and the perspectives of an individual, the degree of exposure and experiences are also required to address peculiar situations such as social and environmental concerns. Although the previous studies have measured the expertise of directors based on their accounting and financial knowledge (Yusoff, 2010; Dienes & Velte, 2016), this study takes a leap to incorporate the social and environmental work experiences of female in boards. The measurement is done using dummy variable of 1 and 0. If the company board has up to 3 female directors that meet the criteria of accounting or finance experience with 8years environmental and social works experience, it is allotted 1, if not, 0.

Board expertise has been upheld in previous studies as one of the characteristics of board members that affect performance. Yusoff (2010) found, in a study conducted on a Malaysian board that knowledge and educational qualifications are vital components that determine the effectiveness of the boards. Harjoto, Laksmana and Yang (2019); Dienes and Velte (2016); and Yusoff and Amrstrong (2012) also supported the position in various studies conducted, as stating that financial expertise is the most required skill from board members to influence CSR performance. However, Jizi, Salama, Dixon and Stratling (2014) revealed that board members’ financial knowhow was indifferent to CSR reporting. The submissions on the significance of the educational and financial expertise on CSP, from previous studies seem inconclusive. Also, the submission of Jizi et.al (2014) is an indication that the knowledge of female directors regarding social and environmental issues should also be considered alongside the educational and financial expertise. This assertion is based on the premise that financial expertise only is inadequate to influence CSR reporting. Thus, the following hypothesis is stated:

Ho2: Female Director Expertise does not affect corporate social performance of listed DMBs in Nigeria

Female Director Independence and Corporate social performance

The ideology of board independence in the code of corporate governance is a call for the majority of the board members to be independent from the company. However, it is submitted that the mere compliance with the code is not enough if the board members fail to maximize their independence effectively (Sharifah, Syahrina & Julizaerma, 2016). The female gender has lots of peculiarity when it comes to socialization and interaction with people. This peculiarity is well explained in the gender socialization theory, which is the process where individuals are taught how to socially behave in accordance with their assigned gender which is assigned at birth based on their biological sex. This psychological underpinning calls for a need to examine female directors in boards to ensure that their independence can have a significant influence on companies’ social performance. Board independence is mostly measured in terms of the proportion of non-executive directors to the total directors in the board (Das, Dixon and Michael, 2015). So, in a bid to assess the level of independence of females in boards, this study measured female directors’ independence as the percentage of non-executive female directors to the total non-executive directors sitting on a company board. If the percentage is above 25%, FDE = 1, otherwise, FDE = 0

According to previous studies, a positive relationship exists between board independence and corporate social performance (García-Sánchez & Martinez-Ferrero, 2018; Mallin, Michelon & Raggi, 2013; Jo & Harjoto, 2012). There was a clause in the study conducted by Ortas, Alvarez & Zubeltzu (2017) on the effect of firm board independence on corporate performance using the meta- analytic approach. The study revealed that there is a positive association between board independence and CSP but it is stronger in civil law countries; and the strength of the influence varies significantly in different market condition. Leung, Richardson & Jaggi (2014) studied board independence and firm performance with relation to family ownership concentration in Hong Kong. It was found that board independence is not associated with firm performance in family firms, it but has a positive relationship with non-family firms. Fitriya, Fauzi & Locke (2012) showed that there was a negative and significant association between non-executive directors and firm performance. Michelon and Parbonetti (2012) also found that there is no relationship between independent directors and CSR disclosure among US and European firms. However, the study conducted by Ponnu & Karthigeyan (2010) in Malaysian listed firms, found that there was no association between the variables. The inconsistencies in the submission regarding board independence are an indication that there are underlining factors that determine the independence of directors. The following hypothesis is therefore stated:

Ho3: there is no significant association between female board independence and corporate social performance of listed DMBs in Nigeria

Data and Methods

Ex-post facto research design was applied to examine how female directors in boards influence the corporate social performance of listed deposit money banks in Nigeria. The study selected a sample size of 10 out of the population of 14 listed deposit money banks at 31st December 2018 using the Purposive Sampling Technique to purposively select banks that have not merged or discontinued operation during the period of the study. Data were obtained from published annual reports of the selected DMBs for the period of 2010 to 2018. The base year of 2010 was the selected because of the visibility of the drive for gender equality, as well as the social responsibility of Nigerian firms at that time (UNPD, 2010; Ifemeje & Ikpeze, 2012; Daubry, 2020). This is also the rising moments for banks in Nigeria after the global recession period. Data were analysed using descriptive statistics and panel regression analysis. The descriptive statistics shows the mean, standard deviation, minimum and maximum values including observations. Tests were also conducted to determine the viability and reliability of the data gathered before regression was done. The Hausman test helped to decide on the model that fits for interpretation between the fixed and random effects models.

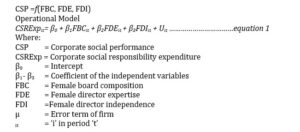

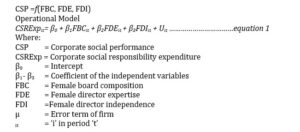

The model of this study was specified to show the nexus between variables in line with similar studies that were carried out in the study area. This study focused only on the diversity of female in boards. The study modified models stated in studies conducted by Colakoglu, Eryilmaz & Martínez-Ferrero, 2020; Gennari, 2016; Fodio & Oba, 2012) to incorporate only the dynamics of female directors in boards in line with agency, stakeholders and gender socialization theories. Thus the model is stated as follows;

Functional model:

The a priori expectation based on literatures reviewed and theories is as follows, β1 > 0, β2 > 0, β3 > 0.

Data Analysis and Discussion of findings

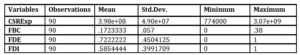

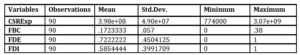

Descriptive Statistics

The descriptive statistics result in table 1 shows that on average, listed banks spend a total of ₦398m on CSR expenditure; with a maximum of ₦307m and a minimum of ₦774,000. The outcome of the descriptive statistics indicates that, on average, firms in the deposit money banks have a 17.2% of female representation in the board with a minimum of no female representation and a maximum of 38% female representation in the board of directors. These statistics indicate that the female gender is still marginalized in the boards. The maximum of 38% is an indication that females in the boards cannot have a strong voting power when issues are discussed. On the average, the proportion of female directors in boards is significantly below 20%. This presentation, therefore, implies that a woman cannot properly perform in a board in terms of voting right without the contribution of her male counterparts.

Furthermore, the descriptive statistics result shows that female directors with accounting expertise and social and environmental work experience are represented in some boards which is measured by 1, while some boards have no females with such expertise, which is represented by 0. The mix in the observation is an indication that not all boards of deposit money banks in Nigeria have female with accounting and financial knowledge coupled with social and environmental works experience. Also, the result shows that some board have female independent directors who comprise of 25% of the entire board which is represented by 1 and that some boards do not have female independent directors who comprise 25% of the entire board which is represented by 0.

Table 1: Summary of Descriptive Statistics

Source: Authors’ Computation using STATA13, (2020).

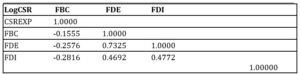

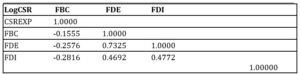

Correlation

The correlation matrix shows the relationship between the variables. The result also shows the relationship that exists between the independent variables and further shows symptoms of multi-collinearity if any. The result obtained shows that there exists a relationship between the dependent variable and the independent variables which signifies that the independent variables can affect the dependent variables. The independent variables are also associated with female board composition and female directors’ expertise having a strong relationship (0.7325) which might imply an issue of multi-collinearity. The symptom of multicollinearity may be because the FDE and FDI are indicator variables that represent categorical variables that have two categories. However, the issue of multi-collinearity will be determined using Variance Inflation Factor (VIF). The VIF result shows a mean of 1.96 and all of the individual variables have values less than the threshold of 10. This implies that it is safe to retain the variables as they cannot affect the outcome of the regression result.

Table 2: Correlation Matrix

Results and Discussions

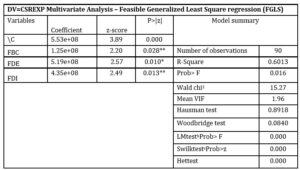

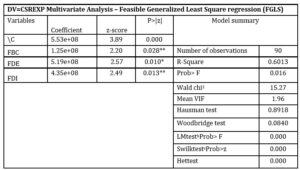

The Feasible Generalized Least Square regression (FGLS) was used for the interpretation of the tested hypotheses after conducting all relevant the tests as shown in table 3. After conducting the Hausman test to determine the best model to interpret between the fixed effect and random effect model, the test result showed that the random effect is the most appropriate. However, the Breauch Pagan Langangier Multiplier (LM) Test conducted to determine the most appropriate model between the random effect model and the pooled OLS showed a significant LM test result (0.000) which signifies that the random effect model should be interpreted. However, the significant result of the Breauch Pagan Langangier Multiplier (LM) Test is an indication of the presence of heteroskedasticity which made the result invalid, and as such, there is a need to correct this heteroskedasticity. This heteroskedasticity can be corrected by running and interpreting the Generalized Least Square or the Feasible Generalized Least Square result. The Feasible Generalized Least Square result was, however, selected in this study because the Cross-Sectionals in the data outweigh the time series.

The model of the study is statistically significant at 5% which is indicated by a Prob >; F value of 0.016 and a Wald Chi2 of 15.27. This clearly indicates that female directors in boards jointly have a significant effect on CSR expenditure. It was revealed from the result obtained that having more female representatives on the board of directors have a positive effect on CSR expenditure and this is statistically significant at 5%. The finding of this study corroborates previous studies conducted in various countries including Nigeria (Garba & Abubakar, 2014; Deschenes, Roubacar, Prud’hommie & Ouedraogo, 2015; Gennari, 2016; Cook & Glass, 2017; Pucheta-Martinez, Bel-Oms, & Olcina-Sempre, 2018) where they all submitted that the presence of women in boards has a significant effect on corporate social performance. The outcome of this study, therefore, implies that the presence of females in boards of directors of listed deposit money banks in Nigeria can influence their corporate social performance especially their corporate social responsibility expenditures.

Analysing the individual component of the traits of the females in boards and corporate social performance using the coefficient, Z-score and P-value as a basis of judgment; it was revealed that female board composition (FBC) had co-eff of 1.25; Z-score 2.20; P=0.028<0.05. This result indicates that FBC has a positively significant effect on corporate social responsibility expenditure of the listed banks. The study posits that it is not enough for women to be in boards, but the number of women should also be considered. This is corroborated in the findings of (Kyaw, Olugbode & Petracci, 2017; Roubacar, Prud’hommie & Ouedraogo, 2015; Gupta, Lam, Sami & Zhou, 2014; Stephenson, 2004) as stated that the positive relationship between gender diversity and CSR is evident in other countries and is more pronounced in firms in emerging markets. Although the descriptive statistics revealed that the percentage of women in the boards of the listed banks in Nigeria, on average, is about 17.2%, the regression result still indicates that they are significant. The literary explanation to that is that women have high potential of influencing the male gender in the boards to follow their bidding on issues that relate to CSP. This result, therefore, indicates that the null hypothesis which earlier stated that female board composition does not significantly affect corporate social performance of the listed DMBs in Nigeria will be rejected.

The result also shows that female director expertise (FDE) has co-eff of 5.19; Z-score 2.57; P=0.01 having a positive significant effect on CSR expenditure. This result point to the fact that the financial as well as social and environmental work experience significantly affect CSP. This implies that an increase in the number of female directors with more years of experience in social and environmental works in addition to the accounting and finance knowledge tend to push CSR spending high. The argument for the wings of expertise to be widened beyond accounting and finance knowledge has been further buttressed by the finding of this study in Nigerian listed DMBs. Although most studies conducted on female board expertise were limited to the accounting knowledge, their findings showed a positive relationship (Yusoff & Amrstrong, 2012; Dienes & Velte, 2016; Harjoto, Laksmana & Yang 2019). This study, however, attempts to include the social and environmental work experience. The finding conforms to Jizi et.al (2014) as stated that the knowledge of female directors regarding social and environmental issues should also be considered alongside their educational and financial expertise. This, therefore, implies that the null hypothesis which stated that female director expertise does not affect corporate social performance of the listed DMBs in Nigeria will be rejected.

Furthermore, the result obtained regarding female directors independence showed that female directors independence (FDI) (co-eff 4.35; z- score 2.49; P=0.013<0.05) has a positive significant effect on CSR expenditure. This finding further supports the previous studies which stated that the effectiveness of the board is largely dependent on their level of independence (Ortas, Alvarez & Zubeltzu, 2017; Mallin, Michelon & Raggi, 2013). It can be therefore inferred that in the case of females in boards of directors, the assumption of the gender socialization theory that individuals are taught how to socially behave in accordance with their assigned gender which is assigned at birth based on their biological sex does not hold in the boards.

Although the findings of prior studies, Fitriya, Fauzi and Locke (2012); Michelon and Parbonetti (2012); Ponnu and Karthigeyan (2010) contradicts the finding of this study, where they stated that a negative or an indifferent relationship existed between female gender independence and corporate social performance, this assertion does not, however, hold in the case of the listed DMBs in Nigeria, as it is evident that the independent female directors are seen to be independent of the executive directors and act in the interest of the organization at all time while keeping stakeholders satisfied. As such, the null hypothesis which states that there is no significant association between female board independence and corporate social performance of the listed DMBs in Nigeria is rejected.

Table 3: Effect of Female Directors on CSP of listed DMBs in Nigeria

Note: * and ** represent 1% and 5% levels of significance respectively

Note: * and ** represent 1% and 5% levels of significance respectively

Source: Authors’ Computation (2020)

Policy Implication of the findings

The findings of this study have further confirmed the significance of the female gender in the boards of deposit money banks in Nigeria; as reflected in most developed and developing countries. In the past, the female gender has suffered negligence and discrimination majorly because of the weakness attributed to this gender which has relegated them to the rare positions in administration. There have been various agitations for a gender inclusion method by governance in the private and public sectors. These agitations have birthed various submissions and arguments. One of the schools of thought is the SDG-5 goals developed by the United Nations; whose one of their goal is to urgently eliminate the factors that promote the discrimination against women and maximize their rights in the private and public sector (UN Women, 2020). This drive includes the change of laws and legislations that discriminate against women. Despite the position of the law, the female gender has continued to make a significant positive impact in companies’ administration. This, therefore, implies that the call for female inclusion is not sentimental but a wake-up call for owners of companies to maximize the exposed significance of the female gender.

Corporate social responsibility has become global issue; any company that wants to be recognized and highly valued must embrace the ideologies of CSR and integrate it into its strategic plan. This is because the CSR activities of firms have become one of the performance evaluation criteria and yardstick for acceptability in the global market. The female gender exhibits all the traits needed to achieve impactful CSR because of the empathetic nature of the female gender; considering the philanthropic nature of CSR, the female gender is the most suitable class that can help companies achieve their desired goals in this regard. It is therefore logical for companies to leverage on the laws that promote gender equality to include more females in their companies’ boards of directors.

Conclusion and Recommendations

The study attempts to provide an in-depth understanding of the effect of female directors in boards on corporate social performance of DMBs in Nigeria. Although previous studies have upheld the significance of the female gender on firm performance and social performances when studying board diversity; there is a need to examine the quality of the females to determine if they possess attributes that can influence the strength of corporate social performance in the boards that they operate in. The corporate social performance of DMBs is measured based on the corporate social responsibility expenditure (CSRexp). The study found that female directors in board jointly have a significant effect on CSRexp. Individually, the results revealed that female board composition, female director expertise and female director independence have a positive and statistically significant effect on CSRexp. Based on these findings, the study therefore concludes that the presence of females in board has a significant influence on the CSR activities of a firm; however, the number alone might not achieve the desired result without considering the financial, social and environmental knowledge of the female directors; as well as ensuring that they operate in an environment that is devoid of bias and undue pressure that can threaten their independence.

The study therefore recommends that;

- The proportion number of females in the boards of Nigerian DMBs should be increased in line with the proposition of codes of corporate governance of some other countries. This is because having more women in boards will lead to a better performance and improved connection with stakeholders.

- Expertise of the female directors should not be limited to their accounting and financial knowledge as posited in previous studies, but the level of experience and skills acquired on social and environmental issues should also be considered alongside. This will enables companies to harness the full potential of women and enhance their productivity.

- Deposit Money Banks in Nigeria still need to ensure that policies are put in place to protect female directors from social, cultural or political factors that can adversely influence the independence of women in the boards.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Barka, H., and Dardour, A. (2015), ‘Investigating the Relationship Between Director’s Profile, Board Interlocks and Corporate Social Responsibility,’ Management Decision, 53(3), 553-570.

- Bhagah, S., and Black, B. (2002), ‘The Non-Correlation Between Board Independence and Firm Performance,’ Business Lamper, 54(3), 921-963.

- Ciocirlan, C., and Pettersson, C. (2012), ‘Does Workforce Diversity Matter in the Fight Against Climate Change? An Analysis of Fortune 500 Companies,’ Corporate Social Responsibility and Environmental Management, 19, 47–62.

- Colakoglu, N., Eryilmaz, M., and Martínez-Ferrero, J. (2020), ‘Is Board Diversity an Antecedent of Corporate Social Responsibility Performance in Firms? A Research on the 500 Biggest Turkish Companies,’ Social Responsibility Journal, ahead-of-print (ahead-of-print)

- Cook, A., and Glass, C., (2017), ‘Women on Corporate Board: Do they Advance Corporate Social Responsibility?

- Daily, C.M., Dalto, D.R, and Canella, A.A. (2003), ‘Corporate Governance: Decades of Dialogue and Data, ‘Academy of Management Review, 28(3), 371 – 382.

- Das, S., Dixon, R. and Michael, A. (2015), ‘Corporate Social Responsibility Reporting: A Longitudinal Study of Listed Banking Companies in Bangladesh,’ World Review of Business Research, 5(1), 130-154.

- Daubry,M. (2020) ‘Corporate Social Responsibility and Organizational Performance of Oil Companies in Southern Nigeria,’ Ph.D thesis: College of Management and Technology, Walden University, United States of America. https://www.socialworks.waldenu.edu

- Deschênes, S., Rojas, M., Boubacar, H., Prud’homme, B. and Ouedraogo, A. (2015). The Impact of Board Traits on the Social Performance of Canadian Firms. Corporate Governance, 15(3), 293-305.

- Dezso, C. L., and Ross, D. G. (2012), ‘Does female representation in top management improve firm performance?’ A panel data investigation? Strategic Management Journal, 33, 1072–1089.

- Dienes, D., and Velte, P. (2016), ‘The Impact of Supervisory Board Composition on CSR Reporting. Evidence from The German Two-Tier System,’ Sustainability 8, 63

- Fauzi, F., and Locke, S. (2012), ‘Board Structure, Ownership Structure and Firm Performance: A Study of New Zealand Listed-Firm,’ Asian Academy of Management, 8(2), 43-67

- Fernandez – Feijoo, B; Romero, S. and Ruiz, S. (2012), ‘Does Board Gender Composition Affect Corporate Social Responsibility Reporting?’ International Journal of Business and Social Science, 1, 31 – 38.

- Fodio, M.I., and Oba, V.C. (2012), ‘Gender Diversity in the Board Room and Corporate Philanthropy: Evidence from Nigeria,’ Research Journal of Finance and Accounting, 2(8), 63-69.

- Freeman, R. E. (1984) Strategic Management: A Stakeholder Approach, Boston, Pitman

- Freeman, R.E., and Mcvea, J.F. (2001), ‘A Stakeholder Approach to Strategic Management,’ SSRN Electronic Journal, http://papers.ssrn.com/paper.taf?abstract.id=263511

- Garba, T., and Abubakar, B.A. (2014), ‘Corporate Board Diversity and Financial Performance of Insurance Companies in Nigeria,’ Asian Economic and Financial Review, 4(2), 257-277

- Gennari, F. (2016) ‘Women on Boards and Corporate social responsibility,’ Corporate Board: Role, Duties and Composition, 12(1), 101-108.

- Gupta, P.P., Lam, K.C., Sami, H., and Zhou, H. (2017). Board Diversity and Its Long-Term Effect on Firm Financial and Non-Financial Performance. [accessed on 10th September 2020]. Available online: http://dx.doi.org/10.2139/ssrn.2531212

- Harjoto, M.A., Laksmana, I., and Yang, Y.W. (2019), ‘Board Nationality and Educational Background Diversity and Corporate Social Performance,’ Corporate Governance, 19(2), 217-239.

- Ifemeje, S., and Ikpeze, O. (2012), ‘Global Trend Towards Gender Equality: Nigeria’s Experience in Focus,’ Kuwait Chapter of Arabian Journal of Business and Management Review, 2(3), 51-63

- Ingley, C.B., and Vander walt, N.T (2001), ‘The Strategic Board: The Change Role of Directors in Developing and Mandatory Corporate Capability,’ Corporate Governance: An International Review, 9(3), 174 – 185.

- Ingley, C.B., and Vander walt, N.T (2001), ‘The Strategic Board: The Change Role of Directors in Developing and Mandatory Corporate Capability,’ Corporate Governance: An International Review, 9(3), 174 – 185.

- Jensen, M (1976) ‘Theory of The Firm: Managerial Behaviour, Agency Costs and Ownership Structure,’ 305-360.

- Jiang, L., and Yang, G. (2015), ‘The Relationship Between Corporate Social and Financial Performance: Evidence from Chinese Heavy Polluting Industries,’ Master Thesis of Department of Business Studies, UPPSACA University.

- Jizi, M.I., Salama, A., Dixon, R., and Stratling, R. (2014), ‘Corporate Governance and Corporate Social Responsibility Disclosure: Evidence from the US Banking Sector,’ Bus. Ethics 125, 601–615.

- Jo, H., and Harjoto, M.A. (2012). The Causal Effect of Corporate Governance on Corporate Social Responsibility. Bus. Ethics, 106, 53–72

- Konrad, A. M., Kramer, V., and Erkut, S. (2008), ‘Critical Mass: The Impact of Three or More Women on Corporate Boards,’ Organizational Dynamics, 37, 145–164.

- Kyaw, K., Olugbode, and Petracci, B. (2017), ‘Can Board Gender Diversity Promote Corporate Social Performance?’ Corporate Governance, 17(5), 789-802.

- Leung, S., Richardson, G. and Jaggi, B. (2014), ‘Corporate Board and Board Committee Independence, Firm Performance, and Family Ownership Concentration: An Analysis Based on Hong Kong Firms,’ Journal of Contemporary Accounting and Economics 10, 16-31

- Mallin, C., Michelon, G., and Raggi, D. (2013), ‘Monitoring Intensity and Stakeholders’ Orientation: How Does Governance affect Social and Environmental Disclosure?’ Bus. Ethics, 114, 29–43.

- Manita, R., Bruna, M.G., Dang, R. and Houanti, L. (2018), ‘Board Gender Diversity and ESG Disclosure: Evidence from the USA,’ Journal of Applied Accounting Research, 19(2), 206-224.

- Mchale S. M., Updegraff, K. A., Helms-Erikson, H., and Crouter, A. C. (2001), ‘Sibling Influences on Gender Development in Middle Childhood and Early Adolescence: A Longitudinal Study,’ Developmental Psychology, 37, 115-125.

- Michelon, G., and Parbonetti, A. (2012), ‘The Effect of Corporate Governance on Sustainability Disclosure,’ Manag. Gov, 16, 477–509.

- Odetayo, T.A., Adeyemi, A.Z., & Sajuyigbe,S. (2014), ‘Impact of Corporate Social Responsibility on Profitability of Nigerian Banks,’ International Journal of Academic Research in Business and Social Sciences, 4(8), 252-263.

- Ponnu, C.H., and Karthigeyan, R.M. (2010). Board Independence and Corporate Performance. African Journal of Business Management, 4(6), 859-868

- Pucheta- Martinez, M.C., Bel-Oms, I., and Olicina-Sempe, G. (2018), ‘The Association Between Board Gender Diversity and Financial Reporting Quality, Corporate Performance and Corporate Social Responsibility Disclosure: A Literature Review,’ Academia Revista Latinoamericanade Administracion, 31(1), 177 – 194.

- Sharifah, F.S.F., Syahrina, A.A., & Julizaerma, M.K (2016), ‘Board Independence and Firm Performance,’ Procedia Economics and Finance, 37(2016), 460-465

- Stephenson, C. (2004) ‘Leveraging Diversity to Maximum Advantage. The Business Case for Appointing More Women to Board’ Ivey Business Journal, 69(1), 1 – 5.

- The Editorial Board (2020), ‘Gender Party in Nigeria…. When?’ Businessday Newspaper, 9th March, Retrieved from Http://Businessday.Ng

- UN Women (2020). SDG-5: Achieve Gender Equality and Empower All Women and Girls. [accessed on 25th October 2020]. http://Www.Unwomen.Org/En/News/In-Focus/Women-And-Sdgs/Sdg-5-Gender-Equality

- UNDP, HDR (2010). The Real Wealth of Nations: Pathway to Human Development. [accessed on 25th September 2020]. Http://Hdr.Undp.Org/En/Reports/Global/Hdr2010/Chapters/

- Valls Martinez, M.C., Ramband, S.C., and Parra Oller, I.M. (2019), ‘Gender Policies on Board of Directors and Sustainable Development,’ Corporate Social Responsibility and Environmental Management, 26, 1539-1553.

- Wood, D.J. (1991) ‘Corporate Social Performance Revisited’ Academy of Management Review, 16(4) 691-718.

- Yusoff, W. F. W. (2010) ‘Characteristics of Boards of Directors and Board Effectiveness: A Study of Malaysian Public Listed Companies,’ Ph.D. Thesis, Victoria University, Melbourne.

- Yusoff, W. F. W., and Amrstrong, A. (2012), ‘What Competencies Should Directors Possess?’ Malaysia Perspective. International Journal of Business and Management, 7, 142–150.