Introduction

Drucker (2006) considers innovation an idea converted into a business to create a value that would raise both economic cost and customer satisfaction. However, trends and demand are changing rapidly, requiring new ideas and new solutions for emerging problems. Indeed, innovation is vital for organisations and a fundamental component of economic progress and development (Drucker, 2006; Freeman and Soete, 2017; Martins, Rindova, and Greenbaum, 2015). “Innovation capability consists of encouraging collaboration, connectivity, creativity, diversity, and confrontation between different perspectives in a given region or country” (Lopes et al, 2021, p. 3). The level of innovation activity in an organisation, either public or private, forecasts the scope of its development, growth, improvement, and new experience, and is crucial for its survival.

Moreover, and in particular, companies benefit from successfully implemented innovations by creating new markets and needs, improving the product, process or organisational structure, and establishing a new source of supply. So, the study of the innovation activity foresees observing the influencing environment of innovation, which includes drivers and barriers. Therefore, there is the need to identify the critical drivers for innovation activity in the companies (namely in the ones that have small and medium-size – SMEs) and, accordingly, strengthen or reduce them. Studying factors that influence innovation allows promoting innovation activity in organisations, in general, and business companies in particular.

The purpose of the study is to inspect the impact on innovation activity worldwide from 2011 to 2017. The mission of the current research work is to find out which business environmental factors – inside and outside of the companies – are presenting an effect on the innovation made and/or introduced by companies. Moreover, it is aimed to measure to which degree such factors influence the innovation made and/or introduced by SMEs. Recently, several publications have been released on this topic, using different subsets of the GEM available dataset and methodologies. It is the case of the research of Lopes et al (2021), Arabiyat et al (2019) or Fuentelsaz, Maicas, and Montero (2018). Considering the above-mentioned, the current paper intends to contribute and increase value to the GEM-based publications regarding innovation activity and give clues to companies, in particular, and the economies’ policymakers on how to boost innovation.

Data about the innovation activity and business factors in organisations worldwide from 2011 to 2017, which will be used and applied in this work, were exported from Global Entrepreneurship Monitor (GEM). GEM is an international collaborative study on entrepreneurship, which provides a primary data-based measurement and assessment tool regarding all forms of entrepreneurship and other socio-economic renewal derivatives (GEM, 2021). A consortium of national teams builds a unique dataset. It directs their social survey at individuals starting and doing the business to measure entrepreneurial activity in different phases of the businesses’ existence (Bosma et al, 2008). Besides the definition of entrepreneurs, GEM includes questions related to innovation to address this topic. The novelty of the product or service to potential customers, the number of competitors in the same market, and the time when the technology has been put into practice are questions that assess the level of innovation in a company (Fuentelsaz, Maicas, and Montero, 2018).

Panel data econometric methods have been selected for the current study since it studies a set of worldwide economies (100 economies) for seven years. Both individual and time dimensions are present in an extensive global panel of data.

The paper is divided into five sections. This one introduces the topic, while the next one presents a brief literature review on the barriers and drives of innovation. Section 3 presents the methodology followed in the research work, which allows obtaining the results presented in section 4. Section 5 concludes the paper.

Innovation: barriers and drivers

Implementation of innovation in the companies brings significant changes (Baldwin and Gellatly, 2003; Bessant and Tidd, 2011; European Union and Eurostat, 2017). For example, Brown and Ulijn (2004) believe that innovation is all about managing knowledge creatively in response to market demand and other social needs. They argue that, firstly, innovation depends on effective interaction between the science and the business sector. Secondly, some factors like competitive markets and technological change may force firms to innovate more rapidly. By innovating, the organisation can improve its overall performance and increase demand or reduce costs. In addition, new organisational practices can help to enhance the company’s ability to gain and create new knowledge that can be used to elaborate on other innovations. Organisations need to evaluate the communication between stakeholders, knowledge flows and other aspects of the innovation process to develop policies that support innovation (OECD & Statistical Office of the European Communities, 2005). More recently, Rauter et al (2018) have shown evidence that involving stakeholders such as universities, customers, and non-governmental organisations (NGO) in open innovation activity could benefit the companies.

The process is not an easy one. Organisations engaged in innovation activity are often facing many problems and barriers. The obstacles that hamper innovation implementation could originate from both external and internal environments (Joachim, Spieth and Heidenreich, 2018). Pikkemaat, Peters, and Chan (2018) mention the following list of problems and barriers causing the failure of innovation: (1) the unprofessionalism of entrepreneurs, (2) the attitude of locals toward innovation, (3) policies, (4) bureaucracy, (5) environmental issues and natural protection, (6) the lack of willingness to cooperate, (7) complication of project application procedures, among others. When the focus is the small and medium-sized enterprises (SMEs), the authors refer to the lack of knowledge, willingness to cooperate and the management of human resources and projects. Previously, Baldwin and Gellatly (2003), regarding the small and medium-sized enterprises (SMEs), mentioned: (1) lack of financing, (2) use of outmoded technology and (3) maintaining the favourable personnel.

Nonetheless, it is considered more significant to review the factors that influence innovation activity rather than problems. Katila and Shane (2005) mention the following environmental factors considered to affect the innovation activity: (i) degree of competition, (ii) availability of financial resources, (iii) manufacturing intensity of the production process, and (iv) size of the market. Other authors (D’Este et al, 2012; Bayarçelik, Taşel, and Apak, 2014) consider, as well, financial obstacles important regarding the innovation activity of the companies. Furthermore, Law, Lee, and Singh (2018) observe the value of the financing issue in supporting innovation. The same authors pointed on that efficient financial allocation facilitates funding research and development. Also, Brown and Ulijn (2004) took into account the factors that influence organisations related to a country’s specificity, such as (i) financial system and corporate governance, (ii) legal and regulatory frameworks, (iii) level of education and skills, (iv) degree of personal mobility, (v) labour relations, and (vi) dominant management practices. Indeed, the role of government policies and support should be considered while considering innovation. According to Baldwin and Gellatly (2003), small and medium-sized companies acknowledge the importance of government programs, including training, industrial support, and procurement. For example, a high level of taxes may reduce firms’ innovation as it decreases firms’ internal cash flows, which are assumed to be a major source of innovation financing (Howell, 2016).

Moreover, Francis and Bessant (2005) mention that the relationships between innovation and bureaucracy are assumed to be negative. More recently, Lundvall (2016) confirmed the significant role of the education of labour. To his mind, employees are the most considerable and dynamic resource in the innovation system. Hence, improving education and training is one of the key components that promote interaction between users and producers. Mihaela and Ţiţan (2014) also believe that education seriously contributes to development and innovation. Fuentelsaz, Maicas, and Montero (2018, p. 686) believe that “individual characteristics of the entrepreneur, such as risk tolerance, entrepreneurial alertness, education and previous entrepreneurial experience, influence innovation in new ventures but that their effect is reinforced by an institutional context with high economic freedom”.

Other authors like Hametner et al. (2018) admitted that public investment in R&D help to generate knowledge and talent. This may increase educational organisations, and innovative companies’ need. Besides, higher public investment in R&D supports private investment in research and innovation, providing new jobs in business, raising demand for scientists and researchers in the labour market. Baldwin and Gellatly (2003) had before argued that R&D capability and the intensity of investment in R&D tend to be greater in successful organisations. Surprisingly, a recent study by Schmidt, Balestrin, Engelman, and Bohnenberger (2016) concludes that services and infrastructure are necessary but not sufficient to facilitate R&D processes. Findings confirmed a significant role of the infrastructures as a resource in the efficient performance of the company as well as innovation activity (Frenz and Lambert, 2012). In addition, consumer preferences and market orientation are indicated as essential indicators for innovation (Bayarçelik et al., 2014). The study of D’Este et al. (2012) provides evidence that market barriers reflect the degree of difficulty on innovation. Based on the research of Anzola-Román, Bayona-Sáez, and García-Marco (2018), it can be assumed that the size and sector of the market are playing a specific role, relying on the type of technological innovation.

Research methodology: fixed and random panel data methodology

Considering the literature above-mentioned, this paper intends to identify the business environment factors that impact innovation activity in small and medium enterprises worldwide during the last decade (2011 to 2017). Innovation is not measured directly by the Global Entrepreneurship Monitor (GEM), but a proxy variable is used. The percentage of the companies involved in total early-stage entrepreneurial activity (TEA) considers that their product or service is new to at least some customers and that few/no businesses offer the same product. In addition, it is significant to research to which degree each factor has an impact on innovation. Experts evaluate the business environment of the Global Entrepreneurship Monitor (GEM) regarding factors that may have a substantial effect on the innovation activity in the scope of a business. GEM is a platform with many benefits due to the public use availability, the annual release of the global report on the entrepreneurial activity, and the inclusion of national experts who systematically provide the assessments of national entrepreneurship, political and social features.

The research will include all countries around the world in which public available and comparable data do exist – those 100 countries will define the space dimension of the study. As a time dimension, the study will operate with the observation data on the companies’ innovation activity from 2011 to 2017. Moreover, the research intends to contribute and increase the value of the GEM-based publications regarding innovation activity. According to Bergmann, Mueller, and Schrettle (2014), there is a lack of GEM-based works covering the topic of innovation. As mentioned, the variable that will be explained presents the percentage of the companies involved in total early-stage entrepreneurial activity (TEA) which consider that their product or service is new to at least some customers and that few/no businesses offer the same product (GEM, 2021). Table 1 presents and describes the dependent variable.

Table 1: Identification and description of the dependent variable

Source: Author’s elaboration based on the GEM (2021)

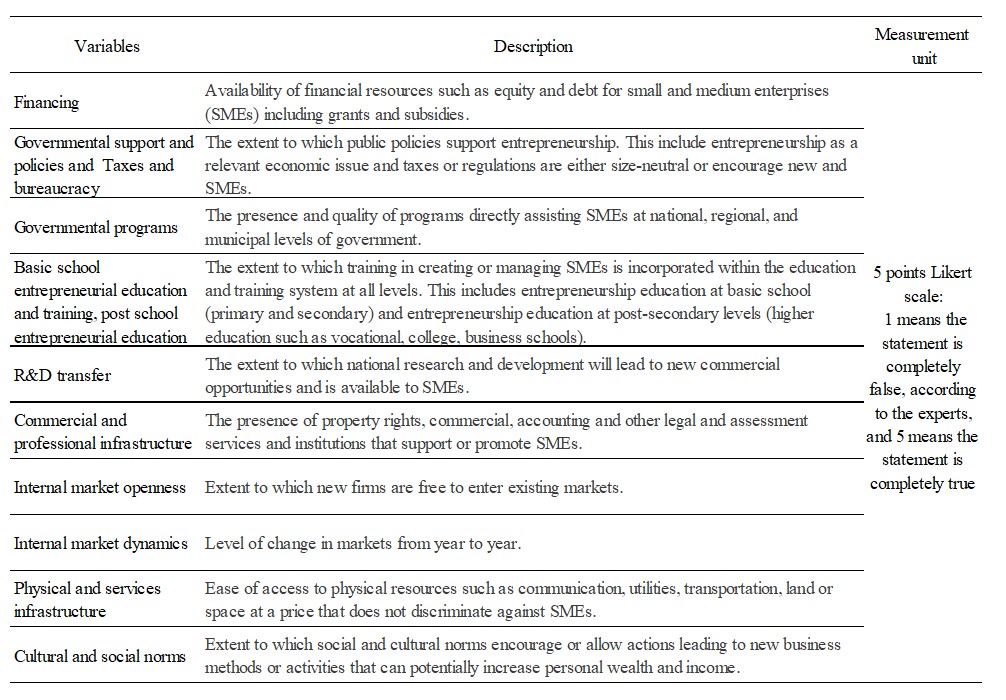

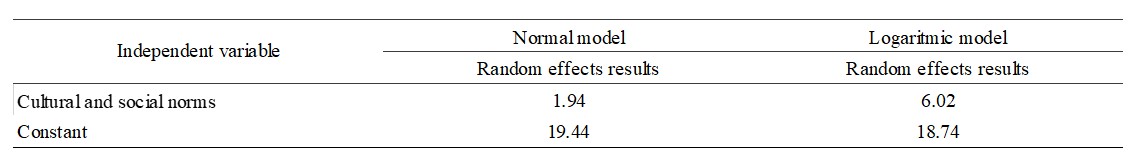

The variables that will be used to explain the innovation activity in the companies are the ones that, according to experts, define the business environment of economies. These variables are the following (Table 2): financing for entrepreneurs, governmental support and policies, taxes and bureaucracy, governmental programs, basic school entrepreneurial education and training, post-school entrepreneurial education and training, R&D transfer, commercial and professional infrastructure, internal market dynamics, internal market openness, physical and services infrastructure, and cultural and social norms. The environment framework conditions are measured in a 5 points Likert scale where one (1) represents the lowest classification and five (5) the highest.

Table 2: Identification and description of the independent variables

Source: Author’s elaboration based on the GEM (2021)

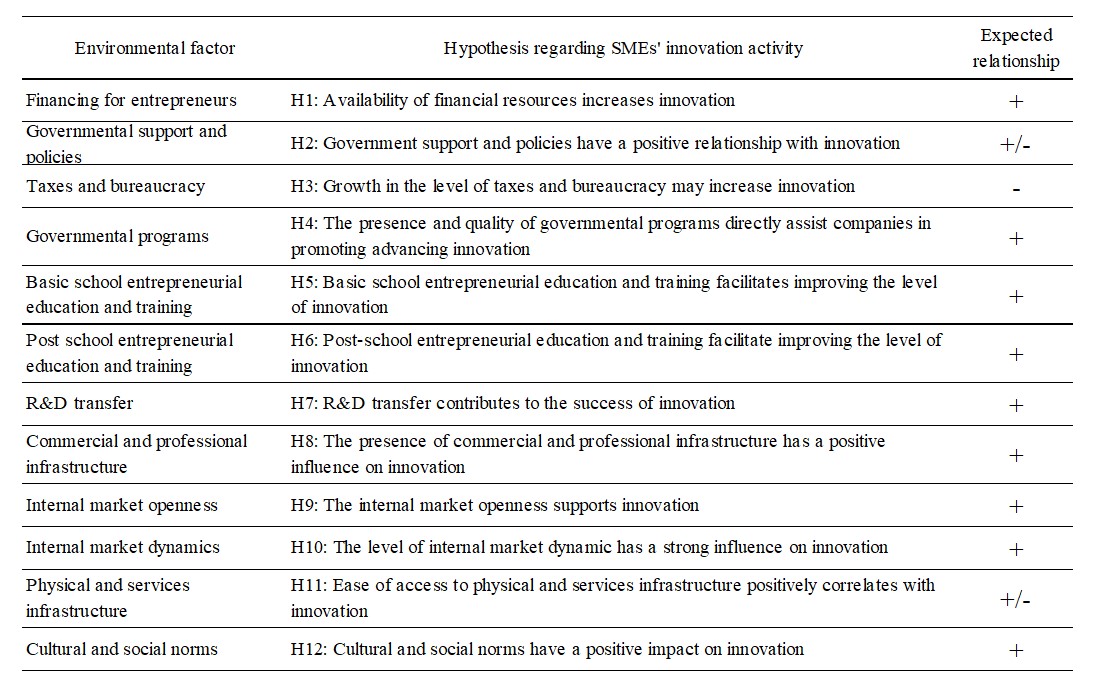

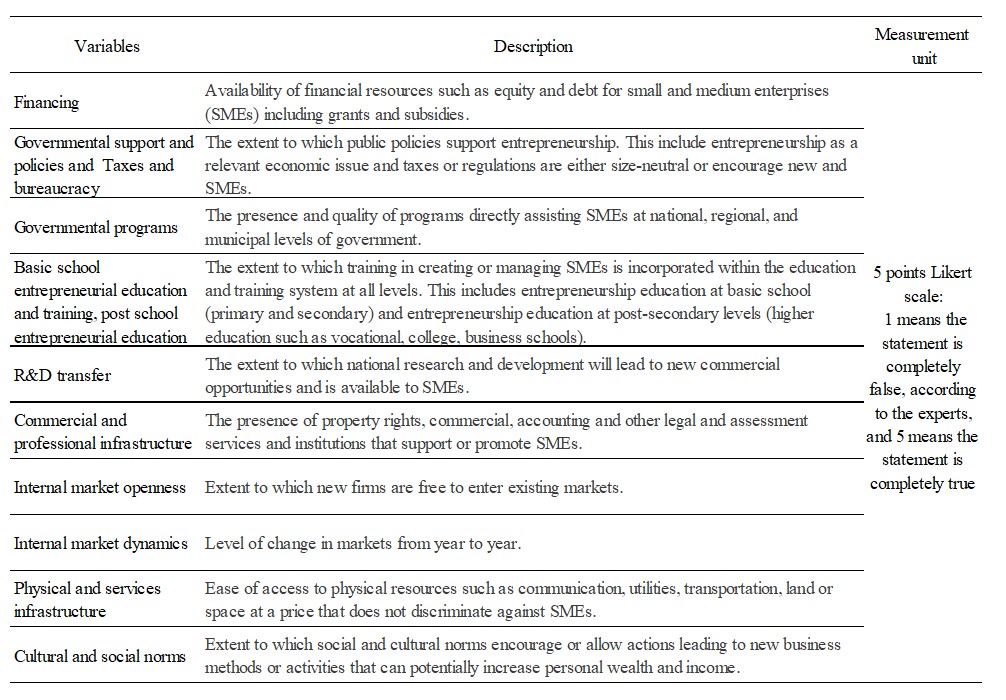

Table 3 identifies the research study hypothesis. The set of the hypothesis presented is based on the literature reviewed. The table makes it possible to observe the hypothesis postulated about each of the individual variables and the expected relationship with innovation.

Table3: Research hypothesis and expected relationship among variables

Source: Author’s elaboration based on the literature review

Achieving the objective of this research work implies the use of a panel data econometric methodology to explain why companies innovate over time around the world regarding a set of explanatory factors. According to Longhi and Nandi (2015), panel data considers the individual unobserved heterogeneity. In the particular case of this research work, panel data can examine the differences between the economies in analysis over time. It is possible to apply such econometric techniques as fixed effects (FE) and random effects (RE). Panel data are multi-dimensional data that consist of measurement over some time. Equation [1] for panel model regression explains the relationship between the dependent variable (Y) at time t and observation dimensions and the independent variable (X). In the equation, α is an intercept, β is a parameter that quantifies how much the independent variable (X) influences (explains) the dependent variable (Y), and e is an error (Pillai, 2016).

Panel data may identify individual (group) effects, time effects (or even both effects). For that, panel data are analysed using the fixed effect panel data and the random effects panel data, respectively. The fixed effects (FE) model observes if intercepts vary across groups (countries) or time. The random effects (RE) model examines differences in the error variance components across countries or periods (Park, 2011). These differences are indicated as individual-specific heterogeneity or time-specific heterogeneity, and the fixed parameters will represent them. According to Baltagi (2020) and Park (2011), the equations for the FE model (equation [2]) and the RE model (equation [3]) are the following:

Note, that is a fixed or random effect specific to an individual (country) or time not included in the regression. It is assumed that errors are independent and identically distributed. For choosing between the FE or the RE models, the Hausman test has to be conducted. Hausman test considers the existence of a statistically significant p-value that results from the test to accept (or not accept) a null hypothesis. Hausman test assumes that the RE estimates are efficient and consistent as the null hypothesis. The alternative hypothesis claims that RE estimates are inefficient, and the results of the FE are the ones to be considered (Pillai, 2016). The models will be estimated using the level values of the variables, as presented by the GEM database and in logarithms.

Results and Discussion

Overall, for the 100 analysed countries over the seven years of study, on average, 25.7% of companies involved in early-stage entrepreneurial activities (TEA) indicate that their product or service is new to at least some customers and few or no businesses (at all) offer the same product. The standard deviation of innovation activity within a period of time is bigger than across countries. However, the standard deviation between observations reaches a relative value of around 40% of the average value (10.38% out of 25.7%), which indicates that a bigger variability can be observed for the total number of observations. Moreover, the variability of innovation among countries is bigger than the variability verified for each economy over time – the standard deviation (9.27%) between the economies is more significant than the standard deviation (5.16%) within each economy over time.

When describing the business environment factors, results show that the physical and services infrastructure indicators and the internal market dynamics present the highest overall assessment average values. The indicators that present the lowest overall assessment average values are the indicators related to the basic school entrepreneurial education and training (2.02%), the R&D transfer (2.35%) and the taxes and bureaucracy (2.40%). It is also important to notice that the average overall experts’ assessment is for most indicators below 3 point values – only the two above-mentioned indicators with a higher evaluation present an average overall higher assessment. However, the average hides the existence of significant differences in the expert’s assessment. Overall, there are economies, in specific years, with a very low assessment.

The following tables (Table 4 to 15) present the estimated results obtained using the random and fixed effects panel data econometric models for each of the twelve hypotheses.

- Hypothesis H1, which analyses the relationship between the availability of financial resources such as equity and debt for small and medium enterprises (SMEs), including grants and subsidies, statistically confirms the literature support. The availability of financial resources in an economy enhances the innovation activity in that economy worldwide.

Table 4: Panel data estimation: effect of the availability of financial resources

- Hypothesis H2 considers that a higher extension of government support and policies for entrepreneurship has a positive relationship with innovation activity in the country’s SMEs. The results in Table 5 confirm that the relationship between the public policies that support entrepreneurship and innovation is positive. Indeed, the results show the importance of the availability of financing resources to enhance the innovation activity of companies over countries, even if there are differences non-observed among them that the model does not capture.

Table 5: Panel data estimation: effect of the governmental support and policies

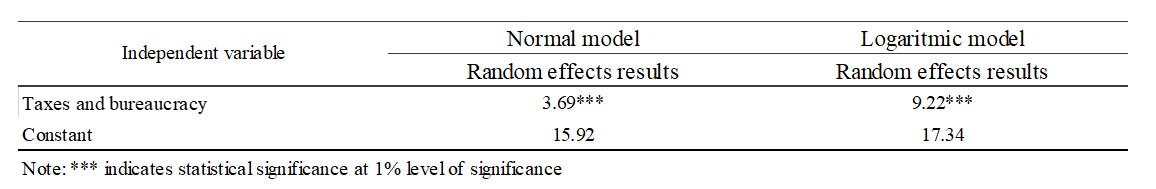

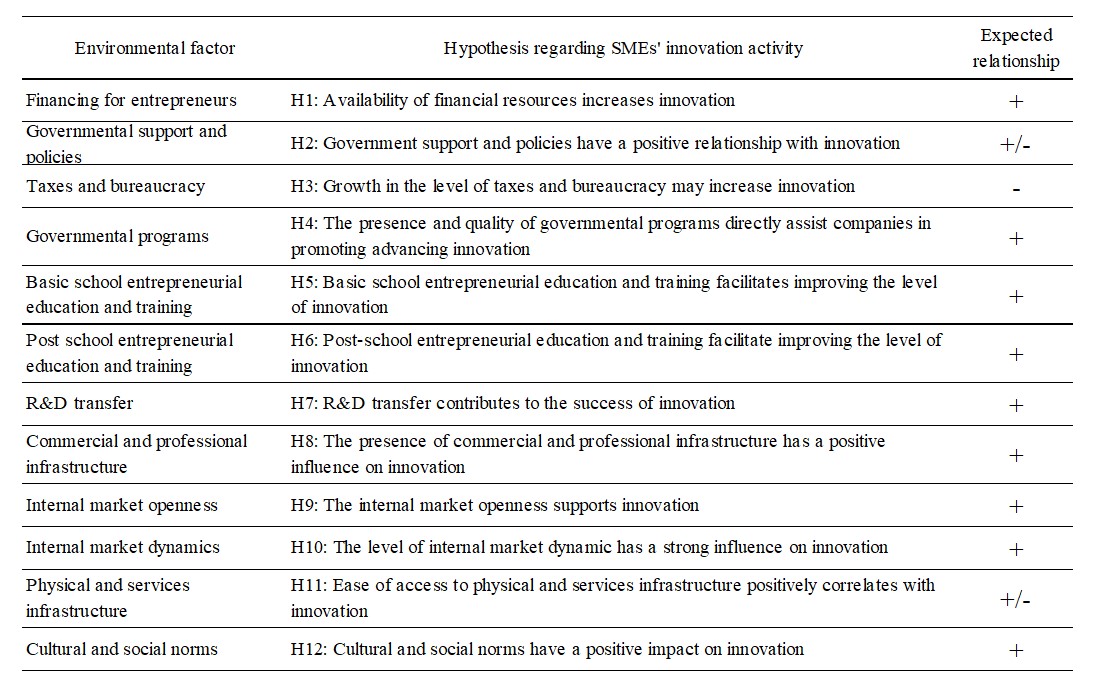

- Hypothesis H3, which analyses the extent to which taxes or regulations are either size-neutral or encourage SMEs to increase innovation, is confirmed empirically, and the results are statistically robust (Table 5). These values show the importance to reduce the red tape and the payment of taxes that represent difficulties in the business environment over countries, even if there are differences non-observed among them that the model does not capture.

Table 6: Panel data estimation: effect of the size-neutral taxes or regulations

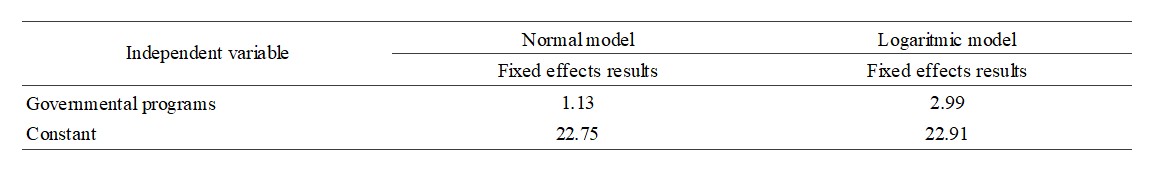

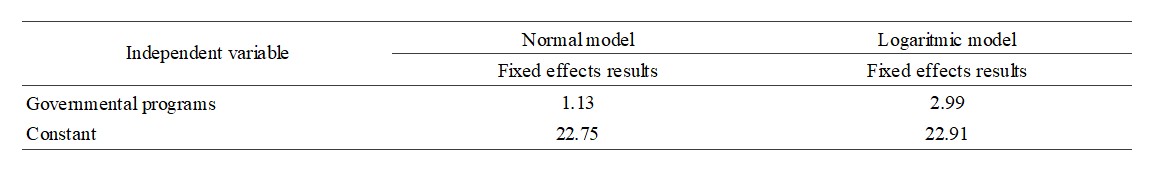

- Hypothesis H4 could not be accepted (Table 7). It is not possible to conclude that the presence and quality of programs directly assisting SMEs at national, regional, and municipal government levels are positively related to innovation activities. The estimated coefficients are not statistically significant, both for the normal model and for the logarithmic one.

Table 7: Panel data estimation: effect of the governmental programs

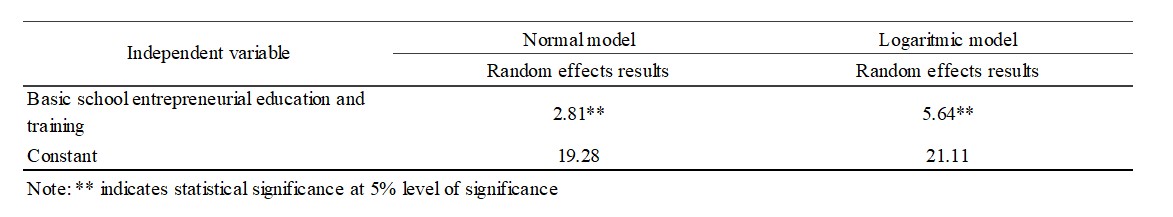

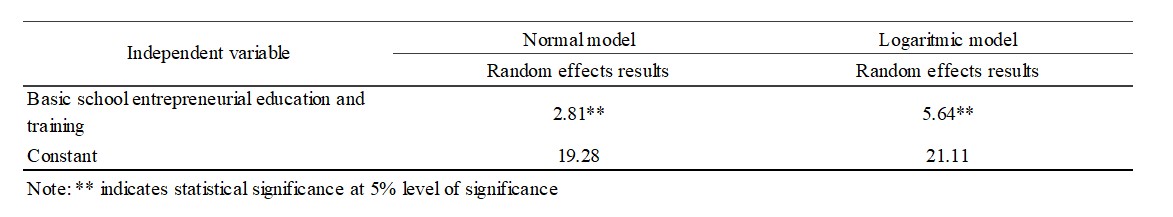

- Hypothesis H5, which takes into account the extent to which training in creating or managing SMEs is incorporated within the education and training system at primary and secondary levels, is accepted, confirming what had been expected after the literature review. Results – for both models – demonstrate that the extent of basic school entrepreneurial education and training facilitates the improvement of the level of innovation activity (Table 8).

Table 8: Panel data estimation: effect of the basic school entrepreneurial education and training

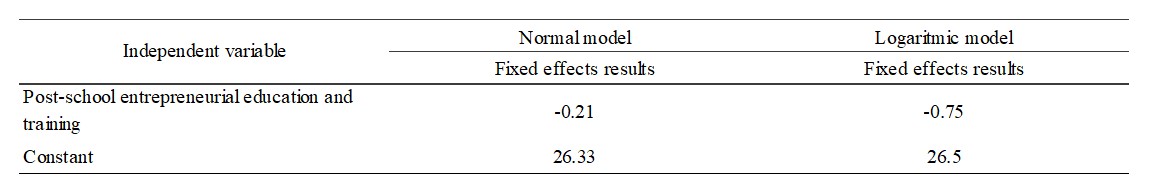

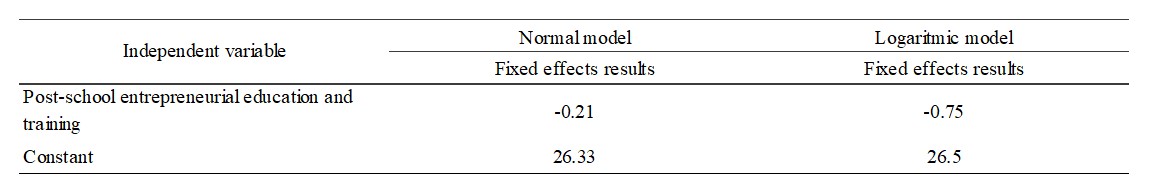

- Hypothesis H6, which considered the impact of the extent to which training in creating or managing SMEs is incorporated within the education and training system in higher education, could not be confirmed (Table 9). The impact cannot be proved if the same education/training for entrepreneurship is just present at a higher level of education and older age. As in the previous hypothesis, a positive relationship was expected between this explanatory variable and the innovation activity.

Table 9: Panel data estimation: effect of the post-school entrepreneurial education and training

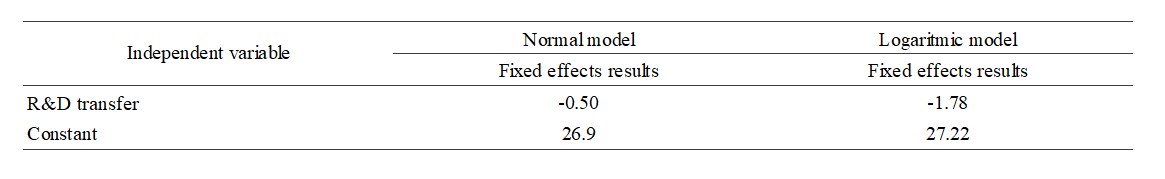

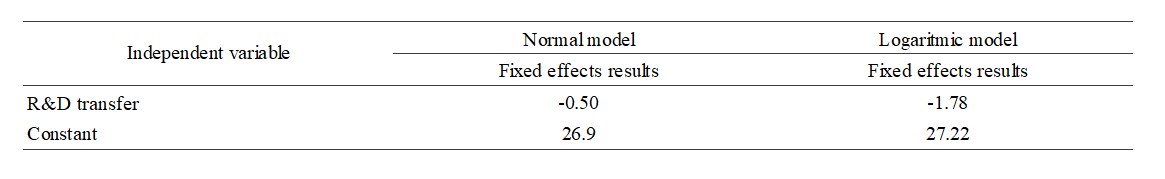

- Hypothesis H7 considering the extent to which national research and development will lead to new commercial opportunities available to SMEs could not also be confirmed (Table 10). The findings demonstrate no statistical significance of the extent to which national research and development will lead to new commercial opportunities and is available to SMEs on the innovation level.

Table 10: Panel data estimation: effect of the R&D transfer

- Hypothesis H8 was not also confirmed. So it was not possible to conclude that the presence of property rights, commercial, accounting and other legal and assessment services and institutions that support or promote SMEs, enhances innovation (Table 11).

Table 11: Panel data estimation: commercial and professional infrastructure

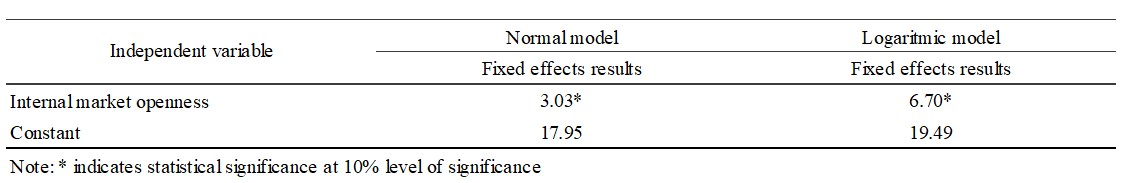

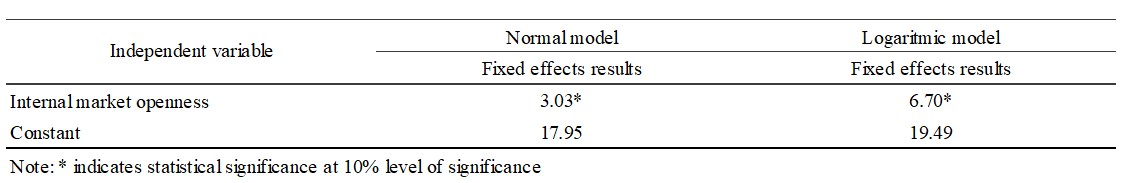

- Hypothesis H9, which takes into account the extent to which new firms are free to enter existing markets, has been confirmed with statistically robust results (Table 12). It is possible to assume that with the elimination of market entrance barriers, the level of innovation in SMEs will grow.

Table 12: Panel data estimation: internal market openness

- Hypothesis H10: Regarding the level of change in markets from year to year, a positive effect was expected on innovation. However, the results from this study analysis reached an opposite conclusion. Innovation seems to be limited by yearly changes in markets (Table 13).

Table 13: Panel data estimation: internal market dynamics

- For hypothesis H11, two possible results were expected considering the literature review on the impact of the ease of access on physical resources such as communication, utilities, transportation, land or space at a price that does not discriminate against SMEs. The present research found a negative statistically significant impact of this business environment factor on innovation. With 95% confidence, it may be claimed that the ease of access to physical resources such as communication at a price that does not discriminate against SMEs negatively correlates with innovation growth (Table 14).

Table 14: Panel data estimation: physical and services infrastructure

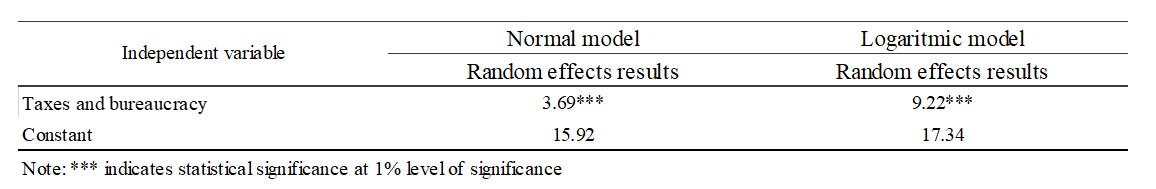

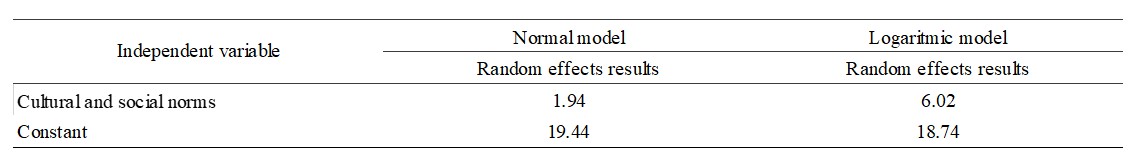

- Hypothesis H12, which examines the extent to which social and cultural norms encourage or allow actions leading to new business methods or activities that can potentially increase personal wealth and income, is accepted by the literature support and based on the analysis confirmed (Table 15).

Table 15: Panel data estimation: cultural and social norms

Main conclusions

The presented research enables identifying the key factors that impact innovation activity in small and medium-sized companies. In general, it should be mentioned that, on average, about 26% of companies worldwide involved in early-stage entrepreneurial activities (TEA) indicate that their product or service is new to at least some customers and few or no businesses (at all) offer the same product. Results also showed the noticeable variance of values indicating innovation activity. Regarding the business environment factors, the findings suggest that, worldwide, factors related to (i) physical and services infrastructure and (ii) economy internal market dynamics showed the highest degree and are essential drivers of innovation activity on SMEs. The factors related to the basic school entrepreneurial education and training, the R&D transfer and the degree of size-neutral taxes and bureaucracy, evidence the lowest degree of impact on such activity, even if they affect it positively.

Acknowledgements

The preparation of the paper was supported by UNIAG, R&D unit funded by the FCT – Portuguese Foundation for the Development of Science and Technology, Ministry of Science, Technology and Higher Education; “Project Code Reference UID/GES/4752/2019”. The authors also want to thank the reviewers and participants at the 34th IBIMA Conference for their important comments and insights included in this paper’s version.

References

- Anzola-Román, P., Bayona-Sáez, C., and García-Marco, T. (2018) ‘Organisational innovation, internal RandD and externally sourced innovation practices: Effects on technological innovation outcomes’, Journal of Business Research, 91, 233–247. https://doi.org/10.1016/j.jbusres.2018.06.014

- Arabiyat, T. S., Mdanat, M., Haffar, M., Ghoneim, A., and Arabiyat, O. (2019), ‘The influence of institutional and conductive aspects on entrepreneurial innovation: Evidence from GEM data’, Journal of Enterprise Information Management, 32(3), 366-389. https://doi.org/10.1108/JEIM-07-2018-0165

- Baldwin, J. R., and Gellatly, G. (2003) ‘Innovation strategies and performance in small firms‘, Edward Elgar Publishing.

- Baltagi, B. H. (2021) ‘Econometric analysis of panel data (6th edition)’, Springer, Switzerland.

- Bayarçelik, E. B., Taşel, F., and Apak, S. (2014) ‘A research on determining innovation factors for SMEs’, Procedia – Social and Behavioral Sciences, 150, 202–211. https://doi.org/10.1016/j.sbspro.2014.09.032

- Bergmann, H., Mueller, S., and Schrettle, T. (2014) ‘The use of global entrepreneurship monitor data in academic research: a critical inventory and future potentials’, International Journal of Entrepreneurial Venturing, 6(3), 242-276. https://doi.org/10.1504/IJEV.2014.064691

- Bessant, J., and Tidd, J. (2011) ‘Innovation and entrepreneurship’ (2th edition). John Wiley and Sons.

- Bosma, N., Jones, K., Autio, E., and Levie, J. (2007) ‘Executive report. Global Entrepreneurship Monitor‘. World Bank.

- Brown, T. E., and Ulijn, J. M. (2004) ‘Innovation, entrepreneurship and culture: the interaction between technology, progress and economic growth’. Cheltenham: Elgar.

- D’Este, P., Iammarino, S., Savona, M., and von Tunzelmann, N. (2012) ‘What hampers innovation? Revealed barriers versus deterring barriers’, Research Policy, 41(2), 482–488. https://doi.org/10.1016/j.respol.2011.09.008

- Drucker, P. F. (2006)I ‘Innovation and entrepreneurship: practice and principles‘ (Reprint). New York, NY: HarperBusiness.

- European Union and Eurostat. (2017) ‘Smarter, greener, more inclusive? Indicators to support the Europe 2020 strategy’, from https://ec.europa.eu/eurostat/statistics-explained/index.php

- Francis, D., and Bessant, J. (2005) ‘Targeting innovation and implications for capability development’, Technovation, 25(3), 171–183. https://doi.org/10.1016/j.technovation.2004.03.004

- Freeman, C., and Soete, L. (2017) ‘Economics of industrial innovation’ (3rd edition). London New York: Routledge Taylor and Francis Group.

- Frenz, M., and Lambert, R. (2012) ‘Innovation dynamics and the role of infrastructure’, Department for Business Innovation and Skills, occasional paper 3. Retrieved November 13, 2018, from https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/34586/12-1035-bis-occasional-paper-03.pdf

- Fuentelsaz, L., Maicas, J. P., and Montero, J. (2018) ‘Entrepreneurs and innovation: The contingent role of institutional factors’, International Small Business Journal, 36(6), 686-711. https://doi.org/10.1177/0266242618766235

- Global Entrepreneurship Monitor (GEM) (2021) ‘GEM WIKI. What is the National Expert Survey (NES)?‘, from https://www.gemconsortium.org/wiki/1142

- Hametner, M., Kostetckaia, M., Ruech, R., Dimitrova, A., De Rocchi A., Gschwend, E., Evans, N., Prahl A. (2018) ‘Smarter, greener, more inclusive? Indicators to support the Europe 2020 strategy-2018 edition’, from https://ec.europa.eu/eurostat/documents/3217494/9087772/KS-02-18-728-EN-N.pdf/3f01e3c4-1c01-4036-bd6a-814dec66c58c

- Howell, A. (2016) ‘Firm RandD, innovation and easing financial constraints in China: Does corporate tax reform matter?’, Research Policy, 45(10), 1996–2007. https://doi.org/10.1016/j.respol.2016.07.002

- Joachim, V., Spieth, P., and Heidenreich, S. (2018) ‘Active innovation resistance: An empirical study on functional and psychological barriers to innovation adoption in different contexts’, Industrial Marketing Management, 71, 95–107. https://doi.org/10.1016/j.indmarman.2017.12.011

- Katila, R., and Shane, S., (2005) ‘When does lack of resources make new firms innovative?’ Academy of Management Journal, 48 (5), 814–829, from https://web.stanford.edu/~rkatila/new/pdf/Katilanewfirminnovation.pdf

- Law, S. H., Lee, W. C., and Singh, N. (2018) ‘Revisiting the finance-innovation nexus: Evidence from a non-linear approach’. Journal of Innovation and Knowledge, 3(3), 143–153. https://doi.org/10.1016/j.jik.2017.02.001

- Longhi, S., and Nandi, A. (2015) ‘Using Panel Data. A Practical Guide’, Sage, Los Angeles

- Lopes, J., Oliveira, M., Silveira, P., Farinha, L., and Oliveira, J. (2021) ‘Business dynamism and innovation capacity, an entrepreneurship worldwide perspective’, Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 94. https://doi.org/10.3390/joitmc7010094

- Lundvall, B.-Å. (2016) ‘The Learning Economy and the Economics of Hope‘, Anthem Press. https://doi.org/10.26530/OAPEN_626406

- Martins, L. L., Rindova, V. P., and Greenbaum, B. E. (2015) ‘Unlocking the hidden value of concepts: A cognitive approach to business model innovation’, Strategic Entrepreneurship Journal, 9(1), 99–117. https://doi.org/10.1002/sej.1191

- Mihaela, M., and Ţiţan, E. (2014) ‘Education and Innovation in the Context of Economies Globalization’, Procedia Economics and Finance, 15, 1042–1046. https://doi.org/10.1016/S2212-5671(14)00667-4

- OECD, and Statistical Office of the European Communities. (2005). Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data (3rd edition). OECD. https://doi.org/10.1787/9789264013100-en

- Park, H. M. (2011) ‘Practical guides to panel data modelling: A step by step analysis using Stata’, Public Management and Policy Analysis Program, Graduate School of International Relations, International University of Japan, 1-52.

- Pikkemaat, B., Peters, M., and Chan, C.-S. (2018) ‘Needs, drivers and barriers of innovation: The case of an alpine community-model destination’, Tourism Management Perspectives, 25, 53–63. https://doi.org/10.1016/j.tmp.2017.11.004

- Rauter, R., Globocnik, D., Perl-Vorbach, E., and Baumgartner, R. J. (2018) ‘Open innovation and its effects on economic and sustainability innovation performance’, Journal of Innovation & Knowledge, 4(4), 226-233. https://doi.org/10.1016/j.jik.2018.03.004

- Schmidt, S., Balestrin, A., Engelman, R., and Bohnenberger, M. C. (2016) ‘The influence of innovation environments in RandD results’, Revista de Administração, 51(4), 397–408. https://doi.org/10.1016/j.rausp.2016.07.004