Introduction

The Internet revolution has brought a lot of changes in all areas of doing business (Gaffar, 2016). Hence, there is a remarkable impact upon service companies in general and the financial services sector in particular. Thus, the Internet is now considered a strategic weapon to satisfy the ever-changing customers’ demand and innovative business needs (Mohammad et al., 2016).

As a result of this technological development, business environment in financial sector such as e-banking is extremely dynamic and changes rapidly to serve their customer electronically. Also banks have more and more e-banking services that are conducted via different electronic channels such as ATM, credit card, debit card, Internet Banking (IB), m-banking, electronic fund transfer, electronic clearing services (Hossain et al., 2015). In addition, e-banking is considered effective in saving time by automating banking processes and introducing easy ways for managing the customer’s money. It is a highly informative and modernized way of banking (Muhammad et al., 2016).

Nowadays, financial institutions are becoming more aggressive in adopting e-banking capabilities that include sophisticated marketing systems, remote-banking and stored value programs. Although, e-banking has a great potential in the Egyptian market as it provides banks with a competitive advantage and offers customers speedier, easier, more reliable, and available customer services to clients, e-banking service quality is considered a crucial barrier for e-banking acceptance and use (Abdullahi, 2012).

For service sector companies such as banking, the issues and challenges of service quality are of the most significance because customers are becoming more powerful, increasingly critical of the quality of service and will not hesitate to switch from a bank to another if their needs were not well met. Hence, this highlights the importance of improving the quality of service in banks rather than just making it available (Beigi et al., 2016).

Egyptian banking is among the oldest and well established banking sectors in the Middle East. Despite the fact that e-banking is developing and fast growing, it does not dominate the Egyptian industry. This may be due to the major issue of e-banking which is the quality, where IB providers should pay more attention to quality in order to better understand customers’ view of e-banking service quality and determine the optimum mix of e-banking service quality attributes.

Accordingly, the main aim of the paper is to develop a decision support system for the critical e-service quality dimensions using system dynamics simulation model with regards to the bank’s websites or Internet banking in the Egyptian context from both perspectives namely customers and Internet service providers.

Literature Review

E-Banking Service Quality

In today’s global environment, banks have realised the importance of service quality in order to survive with the fierce competition. The financial sector is becoming more conscious about the performance evaluation regarding the quality of products/services according to customers’ expectations. Thus, it is important for the banks to know the factors that influence the customer adoption of IB through focusing on improving their banking service quality since they are the main sources of the competitive advantage (Brahmbhatt et al., 2011) (Hassan et al., 2012). In a research by Fuentes-Blasco et al. (2008), they suggest that certain modifications of SERVQUAL are required for application in various settings, including the e-banking sector because e-service is different from traditional service in terms of three noticeable aspects which are the absence of human interaction, the absence of traditional tangible dimension, and the self-service of customers (Fuentes-Blasco et al., 2010).

Consequently, e-service quality is defined as a consumer’s overall evaluation and judgment on the quality of the services that is delivered through the Internet (Liao et al., 2011). Also, Rolland and Freeman, (2010) suggested that the conceptualizations of e-service quality must be expanded to the global level and e-service quality needs consideration on all aspects of the transaction, including service delivery, customer service and support.

Moreover, IB is one of the alternatives within the context of e-banking (Kumbhar, 2011). A study by Sohail and Shaikh (2007) identifies three factors that influence the user’s evaluation of service quality of Internet banking services in Saudi Arabia. These factors were labelled as “efficiency and security”, “fulfillment”. In 2008, Wu et al., found eight key factors that influence the service quality of IB. Also, in a research study by Sohn and Tadisinia (2008), they put forward a 6-dimension model for e-service quality assessment based on their empirical study in Internet-based financial institutions. Another study by Khan and Jham (2008) showed that customers are satisfied with the quality of service dimensions such as reliability, accessibility, privacy/security, responsiveness and fulfillment, but least satisfied with the “user-friendliness‟ dimension in India. Herington and Weaven (2009) found four dimensions of e-ServQual: personal needs, site organization, user friendliness, and efficiency; and all factors are rated as an important factor to determine the e-service quality.

In 2010, (Fuentes-Blasco et al.,) an interesting contribution was made when they adapted items from the two scales to assess service quality in an e-bank. Their study confirmed that e-service quality has a positive effect on perceived value. In Taiwan, Ho and Lin, (2010) developed a multiple item scale for measuring Internet banking service quality. The five dimensions included customer service, web design, assurance, preferential treatment, and information provision.

For instance, IB is increasing rapidly so it is important for the banks to know the preferences of the customers. A study by Hassan et al., (2012) found out the effects of eight dimensions web design, security, trust, product diversification, credibility, collaboration, access and communication on the service quality perception of IB. In addition, it is very important that the transactions and personal information must be fully secured. In case of any query, there must not be communication gap and the customer has access to the management and banking staff when needed. If banks work on these determinants, they would surely increase their customers using IB. Another study by Zavareh et al., (2013) revealed that the dimensions of e-SQ for Internet banking are assurance-fulfillment, efficiency-system availability, privacy, contact-responsiveness, and website aesthetics and guide.

In Developing countries, a study by Ismail and Abd El.Aziz (2013) identified seven dimensions namely; Usability, Reliability, Responsiveness, Privacy, Fulfillment, Efficiency, and Assurance, to investigate how customers perceive e-banking quality dimensions in terms of their importance through a structured questionnaire to attain better quality of life. Also, they extend their work in 2014 by AHP to weigh the same nine dimensions and to set the ranking and the importance of each dimension in Internet Banking environment (Ismail and Abd El.Aziz, 2014). The results shown indicate that ‘Privacy’ out of the nine service quality dimensions is considered as the most important; it entails the protection and appropriate use of the personal information of customers, this is logic as the bank handles some confidential and personal information. Also, Mohammad et al., (2016) emphasize that privacy/security is the essential factor for Internet banking. Moreover, In Thailand, Thaichon et al., (2014) revealed that service quality is influenced by network quality, customer service, information support, privacy and security. Furthermore, a paper by Ismail et al., (2014) aimed to collect decision maker’ s perceptions and ranking of the Internet banking service quality in public and private banks in Egypt, the results suggest to use seven dimensions which were also approached using semi-structured interviews to get the broader picture, where data were interpretively analysed and coded using Nvivo.

Research Methodology

Based on studies by Ismail and Abd El.Aziz, (2013, 2014) and Ismail et al., (2014), a research framework was investigated whether e-banking service quality dimensions determined in literature are actually considered in the Egyptian context. Furthermore, it shows how different e-banking stakeholders, namely the decision makers in banks and bank customers, perceive and rank electronic service quality dimensions and whether these dimensions are considered appropriate from both perspectives.

From the data analysis of the previous studies, they come up with a service quality model by taking some specific service quality dimensions namely Usability, Reliability, Responsiveness, Privacy, Fulfillment, Efficiency and Assurance. All these have significant impact on service quality in the banking industry. Thus, a revised dynamics model was drawn and simulated. A System Dynamics Approach was utilised to simulate the revised research model using Powersim software.

System Dynamics

System dynamics (SD) is a computer-aided approach for studying through modeling and simulating dynamical systems and used to enhance learning about complex systems (Sterman, 2000) (Moradipour, 2012). Furthermore, Oyo (2010) states that SD is a systemic approach based on feedback thinking or rational cause-effect relationships. It emphasizes dynamic relationships at the expense of static ones and relies heavily on the feedback concept. System Dynamics is a framework for thinking about how the operating policies of a company, its customers, competitors, and suppliers interact to shape the company performance over time. In addition, system dynamics simulation is an appropriate approach for any dynamic system characterized by interdependence, mutual interaction, information feedback and circular causality. System dynamics are built around a specific problem (Hines and Malone, 2011).

The system dynamics consists of two methods in order to make the implementation. The first is Causal loop diagram (qualitative) and the second is Stock and Flow (quantitative). The main reason to use both methods is to obtain more understanding regarding the current system as well as to identify the exact problem that occurs in the systems by using qualitative method. This qualitative method leads to analyzing the system by finding the loops and the interrelation for each parameter. This method focused on the feedback loop in order to see the cause and the reason for some events to happen. The quantitative method is using stock and flow diagram in order to see the continuity that occurs in the system using numerical data that are relevant to the systems. The tools must enable the modeler to understand how the structures create a system’s dynamics. These tools include causal mapping and simulation modeling (Yuan et al., 2010) (Sumari et al., 2013).

Simulation Software has many brands in the market such as Stell (Ithink), Vensim and Powersim are very common to those involved in system dynamics simulation. The use of a system dynamics platform encourages the modeler to think about critical feedback loops that impact system performance. This software is usually used to create the feedback and causal loop which shows that the current situation occurs in the system (Hoekema, 2011).

The paper at hand will use the Powersim, which is a tool for modelling and simulation of dynamic systems. It can be used to study time continuous progress (Cannella et al., 2008). Powersim is a flow-diagram-based modelling tool, which is able to show multiple models simultaneously and connect separate models to each other. Powersim was developed as a Windows based environment for the development of system dynamics models that facilitates packaging as interactive games or learning environments (Hussein, 2010). Powersim Studio™ is flexible and allowing the integration with databases, external files and ERP systems (Briano et al., 2010). Hoekema (2011) emphasizes that the Powersim Studio platform provides a powerful user interface that makes the model easier and it is an equally powerful way to build and test system dynamics models of environmental systems. Powersim was designed to provide a user-friendly, icon-based approach.

Causal Loops

In this paper, the causal loop focuses on the dynamics of service quality. Service quality is increasingly important and a source of competitive advantage for all types of firms. Causal loop diagram will be used to build a model of service delivery and quality using the bank industry. The procedure used for the development of the electronic service quality dimensions follows the steps of Modeling Process suggested in Business Dynamics by Sterman, (2000).

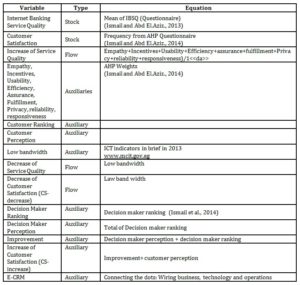

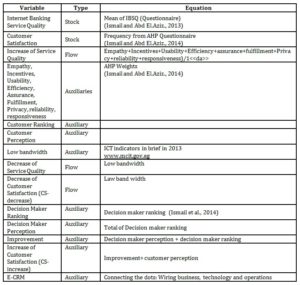

The key variables in the dynamic model are identified from the relationships between the variables that were postulated and examined. Delays and feedback were assigned appropriately, with the initial values drawn from current literature. The dynamic causal loop diagramming for the current study is represented as follows in Fig 1 with two positive feedback loops between e-service quality dimensions and stakeholders.

In Fig 1, the first qualitative causal loop ‘E-banking Service Quality for stakeholders’; it is labeled as R1. A paper by Ismail and abd El. Aziz (2013) emphasize such a framework of e-service quality and its key which can help banks better understand their clients’ perception and ranking of e-banking main dimensions in order to improve service delivery management to satisfy customers. Also, all e-service quality dimensions are correlated, as the Assurance dimension is associated with Fulfillment and Efficiency.

Besides, Sahar (2013) mentioned that Usability and Privacy are attributes that are correlated to each other. They become a core issue in the designing of modern computer softwares. Usability affects security in systems that aspire to protect data confidentiality. Another study by Culiberg and Rojšek (2011) stated that Reliability and Responsiveness relate to performance standards and can be addressed as process quality. Considering the banking sector, the identification of this dimension seems sound, as consumers do not want to have problems when dealing with their financial matters. They want to get a service without errors, performed to high standards, correctly, promptly and timely.

Furthermore, they noted that the more credibility customers had in the service and its speed and accuracy, the more satisfied they would get. In addition, Mengi (2009) found that Responsiveness and Assurance were important factors for customer satisfaction. Therefore, the diagram below shows when e-service quality increases, it will affect stakeholder perception and ranking positively.

In Fig 1, the ‘Customer Perception and Customer Satisfaction’ loop which is labeled as R2. This loop is based on Ngo and Nguyen (2016) who addressed a strong relationship between customers’ perceived overall service quality and their satisfaction. This conclusion is consistent with those of prior studies by Duffy and Ketchand (1998) and Srijumpa et al., (2002) in that the customers’ satisfaction is strongly influenced by the overall service quality provided for them. Other studies clarify the detailed determinants of e-service quality and their influence on customer perceptions, Janda et al., (2002), Yang and Jun (2002), Santos (2003), Jun et al., (2004) and Lee and Lin (2005). In 2010, a study by Alhemoud (2010) clarified that service quality is accepted as one of the basics of customer satisfaction. Accordingly, the findings of the study by Razavi et al., (2012) clarify that there are significant and positive relationships between service quality and perceived value and customer satisfaction. In the same way, Arokiasamy and Abdullah (2013) investigated the customer’s perceptions towards online service quality of the bank. Based on the previous studies, it shows that when the dimensions of electronic banking service quality increase, this will increase the customer perception, which positively affects customer satisfaction.

Figure 1: Electronic Banking Service Quality Causal Model

Stock and Flow Diagram

This is the second method that represents a system with stocks and flows. In other words, the causal loop diagram is translated to a stock and flow diagram that is used for simulating and modeling (Quantitative Method) among the variables that are relevant in the system. Stocks are usually accumulators of money, people, inventory, goods and information, calibrated to characterize the state of a system at a point in time and to generate the information on which decisions and actions are based on. Flows correspond to the change per period of time that increases or decreases levels in the system (Sterman, 2000) (Sumari et al., 2013).

Thus, the simulation model aims at testing and comparing different scenarios to predict the future behaviors of the system under consideration, Sterman (2000): a simulation model works as a decision-support system.

A stock and flow diagram was created based on the links and relationships constructed from the causal loop. At this stage, each variable was examined in detail and equations were assigned to each linkage to model the desired relationship. In short, the stock and flow diagram attempted to replicate the dynamics of the service quality. Once the model was completed, key variables and assumptions in the model were assigned values to simulate different scenarios in the e-banking service quality system.

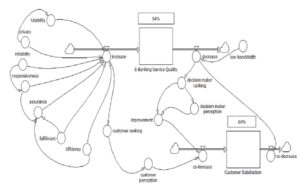

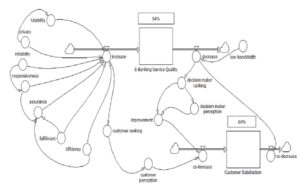

To understand the effects of the dynamics of perception, the model was developed as shown in figure 2. This model includes stakeholders about how to manage perception to diffuse new technology successively. This model demonstrates the flow of electronic banking service quality and its flows which can help banks better understand their clients’ perception and ranking of e-banking main dimensions in order to improve service delivery management to satisfy customers over two years. The two main stocks in the model are named electronic banking service quality and customer satisfaction.

The initial inputs are the service quality dimensions namely Privacy, Reliability, Responsiveness, Assurance, Fulfillment, Efficiency, and Usability that have a chance to increase ‘Service Quality’. By which Krishnamurthy et al., (2010) conclude that increase in the service quality of the banks can satisfy and develop customer satisfaction, which ultimately retains valued customers. This service quality determines how much change has to be done on both customer ranking and perception that has influence in turn on the level of customer satisfaction. Moreover, Nimako et al., (2013) found that management would need to increase the speed or bandwidth for effective browsing and opening of pages; especially that pages with video and pictures require high bandwidth.

Consequently, the flow of low bandwidth is considered as an initial input that has a chance to decrease ‘service quality’. This service quality determines how much change has to be done on both decision-making ranking and perception, which has influence in turn, the level of customer satisfaction. The change in both decision maker’s ranking and perception requires improvement for service quality and thus customer satisfaction will increase. Based on Spreng and Mackoy (1996) and Ganjinia et al., (2013), Customer satisfaction is an important aspect for service organizations and is highly related with service quality. As service quality improves, the probability of customer satisfaction increases. Increased customer satisfaction leads to behavioral outcomes such as commitment, intent to customer retention, creation of a mutually rewarding relationship between the service provider and the user (El. Naggar, 2010).

As a result, in this model customer satisfaction is affected by three different input measures and it in turn impacts other measures. Generally there is a proportional relationship between the selected input measures and customer satisfaction. Thus, any change in one of these measures impacts customer satisfaction.

Figure 2: E-Banking Service Quality Stock and Flow Diagram [Base case Scenario]

Model Equations

Formulating stock and flow model representing the variables model. In addition, it includes the development of decision rules (i.e. mathematical equations), the quantification of variables, and the model calibration using parameters to define initial conditions (Sterman, 2000). Based on Saremi and Nejad (2012), units of measure can help identify stocks and flows. Flows change the level of stocks and are usually measured in units per time (dollars/month, dollar/yr). In the current data, most of the figures have different units thus all figures are placing in one scale from 0 to 100.

Table 1: Figures used in system dynamic

Base Case Scenario

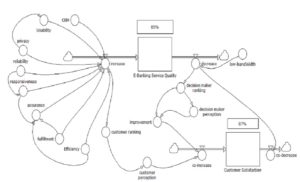

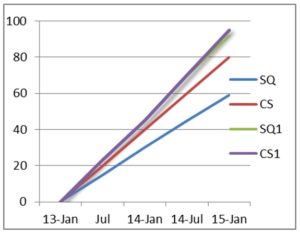

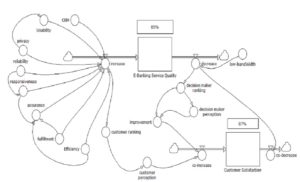

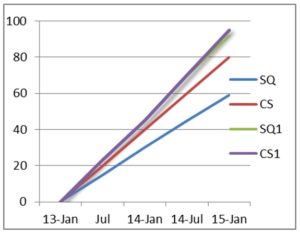

In figure.3 below was the output of the recent condition for IBSQ model. The total increase of IBSQ was the AHP weights of each dimension, which will affect the customer ranking, and customer perception in order to increase customer satisfaction. Then the decrease of IBSQ resulted due to the low bandwidth, which is mentioned by some interviewees that sometimes the Internet connection is low and MCIT (2013) refers that annual growth rate for International Internet bandwidth is low. Naturally, this will influence the decision maker’s dimensions ranking and perception. Thus, this will require the decision makers to improve customer satisfaction. The base case scenario result shows that customer satisfaction is increasing more than EBSQ to reach value of 80

Figure 3: Base Case Scenario Results

Customer Relationship Management Scenario (CRM)

This scenario is created using CRM, which is likely to change and have an impact on IBSQ and Customer satisfaction. Besides, CRM is a strategy mainly used to optimise customer loyalty and their lifetime experience in order to find a competitive advantage on which to base their business strategy.

Despite the fact that filling those knowledge gaps would provide insight into the demand side of e-banking services, any attempt to improve the value of e-banking services must take account of the dynamic process between the demand and the supply sides of the service. Hence, the supply side of e-banking services, the banks, must be included into the value management process. Creating and delivering the best possible value of e-banking services requires implementing CRM strategy to manage people and technology to improve customers experience with service delivery encounters (Payne and Frow, 2005) (El.Naggar, 2010). CRM solutions have gained tremendous importance in today’s times, with the banking business being totally customer- centric with 57%. As a result after adding CRM to the model, a large enhancement has been observed (see figure 4). This simply means that CRM is considered important components of service quality. Thus, this scenario shows that both stocks continue growing more than the double and the gap starts to diminish compared to the above scenario.

Figure 4: Customer Relationship Management Results

This figure below shows the comparison between the first scenario and the second scenario by which both stocks (e-service quality and customer satisfaction) are increasing with small gap between each other. However, the second scenario shows that both stocks continue growing more than the double and the gap starts to diminish compared to the first scenario.

Figure 5: E-Banking Service Quality Scenario Results

System Dynamic Simulation Results

Based on the questionnaire and interview results, seven dimensions simulated using SD, there was still gap between customer expectation and perception; however when CRM was added to the dimensions, it closed the gap between what customers perceived and what they expected. This result reveals that CRM is considered to be important and related to service quality concept because this shows that customers want the bank to listen and meet their needs.

The work has resulted in a collection of quality factors and their connections, which are illustrated in the influence causal-loop and stock and flow diagrams. Based on the second scenario, system dynamics results show that customers are satisfied since what they expect meet what they perceived so service quality is high. These results are consistent with the theory that “perceived service quality is a component of customer satisfaction” Zeithaml et al., (2006, p. 106-107), because service quality had the highest part as reason for satisfaction. Besides, it is consistent with previous research, Woodside et al., (1989), Cronin and Taylor (1992), Oliver, (1993), Spreng and Mackoy (1996), Lee et al., (2000) that perceived service quality is correlated with customer satisfaction, proving that when it comes to customer-orientated industries like banking, the quality of services provided is the major source of customer satisfaction. This confirms Naeem and Saif’s (2009) conclusion that if banks properly and efficiently manage service quality, a significant contribution towards customer satisfaction will be marked.

Moreover, the simulation model also visualizes different relations in electronic banking service quality system that CRM increase the electronic banking service quality and customer satisfaction and close the gap between what customers expected and what they actually perceived. The report can be used to increase the competence on modelling and simulation of software processes.

Conclusion

The nature of banking services encourages customers to demand the highest possible quality. In order to achieve this, it is essential to be very close to customers to capture information on the customer’s current and future needs, expectations and perceptions. The main outcome of the paper was to develop a framework that would allow stakeholders to demonstrate the impact of electronic service quality dimensions on e-banking websites in Egypt banking quality by focusing on public and private banks from both perspectives to better organise their strategy and support the bank websites. This is an improvement over prior studies, which have focused solely on provider or user challenges. System dynamics results show that Customer relationship management is a dimension that increases electronic service quality (e-service quality) and customer satisfaction, thus the data analysis shows that service quality is an important antecedent of customer satisfaction.

The conclusions drawn from this study could be used as a tool to enable a greater degree of awareness of things that were previously unconsidered. As has been concluded by this paper, e-service quality of Egyptian banks was assessed using a framework that comprised the main 7 dimensions affecting e-service quality, which are: Privacy, Usability, Reliability, Responsiveness, Fulfillment, Efficiency, and Assurance. The framework developed shows the relationship between the above dimensions and service quality in addition to the weight of each dimension in order to prioritize them. Actually, customer relationship management is a dimension that increases electronic service quality and customer satisfaction.

The proposed model provides a good way for assessing each case study against certain dimensions. However by structuring the different dimensions and possible solutions, the model can provide managers with a set of guidelines for their actions. It also gives them the tools to become more aware of the Internet banking service quality issues, and allows customers to understand the impact of service quality on the services provided by the banks.

Finally, the findings of this paper provide a valuable and practical resource for those researchers wishing to further enquire into e-banking service quality. It also provides invaluable insight into the working environment of Egyptian banks highlighting the experience of the researcher during the study. By utilising the findings of this study, decision-makers would be better positioned to understand the impact of their bank websites on the perceptions of customers.

Recommendations

The findings are expected not just to add value to the existing body of knowledge but to bank managers too. The results can be used as critical guidelines for banks to follow when managing or attempting to improve the quality of their services thus boosting customer satisfaction. The recommendations would help banks create non-price competition and adopt it as their competitive advantage in light of the growing banking market in Egypt and the inflated competition in this dynamic industry.

It is also recommended that banks invest in understanding the needs of customers of the Internet banking and try as much as possible to meet their various needs associated with the services provided by Internet banking. In addition, the Egyptian banking sector should understand the importance and potential benefits of e-service quality and the value added to banks. As a result, this could improve the relationship between bank system and their clients.

Moreover, banks’ readiness needs to be assessed in order to implement e-service quality, which enables them to compete in such a changing and competitive environment. This is particularly important because customers are becoming more powerful where they can easily switch from a bank to another if their needs were not efficiently and effectively met. All employees should be aware about banks policies and strategies in order to be able to update the bank hardware and software as needed. This enabled employees to identify their needs and accordingly enhance their computer skills through determining and taking the appropriate training courses.

Bank top management should start taking employees’ perception into consideration when taking decisions regarding the bank’s customers, especially because bank employees get in direct contact with customers on a daily basis, which puts them in a strong position to get the full picture and be able to detect customer problems, while at the same time be able to suggest and perhaps implement solutions to customers’ requirements and/or complaints

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Abdullahi, Y., 2012. Services Automation and Performance: Evidence From Deposit Money Banks In Nigeria. Department of Business Administration, Ahmadu Bello University, Zaria, 1(2), p.48.

Google Scholar

- Alhemoud, A. M. 2010. Banking in Kuwait: a customer satisfaction case study’. Competitiveness Review: An International Business Journal incorporating Journal of Global Competitiveness, 20(4), pp. 333-342.

Google Scholar

- Arokiasamy, A. R. A., and Abdullah, A. G. 2013. Service Quality and Customer Satisfaction in the Cellular Telecommunication Service Provider In Malaysia. Journal of Arts, Science and Commerce, 4(2), pp.1-9.

Google Scholar

- Beigi, A.N.M., Jorfi, S., Tajarrod, R.S. and Beigi, H.M., 2016. The Study of the Effects of E-banking Services Quality on Customers’ Satisfaction and Loyalty (Case Study: Agricultural Bank of Khuzestan Province). Journal of Current Research in Science, (1), p.375.

Google Scholar

- Brahmbhatt, M., Baser, N. and Joshi, N., 2011. Adapting the SERVQUAL scale to hospital services: An empirical investigation of patients’ perceptions of service quality. International Journal of Multidisciplinary Research, 1(8), pp.27-42.

- Briano, E., Caballini, C., Giribone, P., and Revetria, R. 2010. Using a system dynamics approach for designing and simulation of short life-cycle products supply chain. In Proceedings of the 4th World Scientific and Engineering Academy and Society, international conference on Computer engineering and applications.pp. 143-149.

Google Scholar

- Cannella, S., Ciancimino, E., and Márquez, A. C. 2008. Capacity constrained supply chains: A simulation study. International Journal of Simulation and Process Modelling, 4(2), pp.139-147.

Google Scholar

- Cronin,J.J and Taylor S.A. 1992. Measuring service quality: A Reexamination and Extension. Journal of Marketing, 56(3), pp. 55-68.

Google scholar

- Culiberg, B., and Rojšek, I. 2011. Identifying service quality dimensions as antecedents to customer satisfaction in retail banking. Economic and Business Review, 12(3), pp.151-166.

- Duffy, J. A. M., and Ketchand, A. A. 1998. Examining the role of service quality in overall service satisfaction. Journal of Managerial Issues, 10(2), pp. 240 – 255.

Google Scholar

- Naggar, R.A. 2010.The Value of E-Banking Services in the Egyptian Environment: An Integrated Model. PhD Thesis, Helwan University.

- Fuentes-Blasco, M., Saura, I. G., Berenguer-Contrí, G., & Moliner-Velázquez, B. 2010. Measuring the antecedents of e-loyalty and the effect of switching costs on website. The Service Industries Journal, 30(11), 1837-1852.

Google Scholar

- Fuentes, M., Gil, I., Berenguer, G., and Moliner, B. 2008. Measuring Multidimensional E-quality Service and its Impact on Customer Value Perceived and Loyalty’. Paper presented at 7th International MarketingTrends Congress, Venice, Italy, pp. 1-20.

- Gaffar Khan, A., 2016. Electronic Commerce: A Study on Benefits and Challenges in an Emerging Economy. Global Journal of Management and Business Research, 16(1), pp. 19-22.

Google Scholar

- Ganjinia, H., Gilaninia, S., and Tajani, T. K. 2013. Evaluation of Online Service Quality On Customer Satisfaction In Public Banks Of Guilan. Singaporean Journal Of Business Economics, And Management Studies, 1(9), pp. 1-14.

Google Scholar

- Hassan, M.T., Mukhtar, A., Ullah, R.K., Shafique, H., Rehmna, S.U. and Anwar, A., 2012. Customer service quality perception of internet banking. International Journal of Learning and Development, 2(2), pp.86-100.

Google Scholar

- Herington, C. and Weaven, S. (2009), “E-retailing by banks: e-service quality and its importance to customer satisfaction”,European Journal of Marketing, 43 (9/10), pp. 1220-1231.

Google Scholar

- Hines, J., Malone, T., Gonçalves, P., Herman, G., Quimby, J., Murphy‐Hoye, M., and Ishii, H. 2011. Construction by replacement: a new approach to simulation modeling. System Dynamics Review, 27(1), pp.64-90.

Google Scholar

- Ho, C. T. B., and Lin, W. C. 2010. Measuring the service quality of internet banking: scale development and validation. European Business Review,22(1), pp.5-24.

Google Scholar

- Hoekema, D.J. 2011. A system dynamics approach for climate change impact analysis in the Snake River Basin. Master Thesis, Boise State University.

- Hossain, M.M., Irin, D., Islam, M.S. and Saha, S., 2015. Electronic-Banking Services: A Study on Selected Commercial Banks in Bangladesh. Asian Business Review, 3(3), pp.53-61.

Google Scholar

- Hussein, S., 2010. Education Quality Control Based on System Dynamics and Evolutionary Computation. INTECH Open Access Publisher.

Google Scholar

- Ismail, M., Abd El Aziz, R., and Giles, O. (2014), ‘Perception and Ranking of Internet Banking Service Quality from Banking Perspective in Public and Private Banks in Egypt’, International Journal of Research, 1(8), pp. 1117-1198.

Google Scholar

- Ismail, M. and Abd El Aziz, R (2014), ‘Evaluation and Prioritization of Internet Banking Service Quality: The Case of Egypt’, International Journal of Management and Information Technology, 8(3), pp. 1392-1404.

- Ismail, M. and Abd El Aziz, R (2013), ‘Investigating E-Banking Service Quality in one of Egypt’s Banks: A stakeholder Analysis’, The TQM Journal, Emerald, TQM special issue: Quality Improvement in East Africa, 25(5), pp. 557 – 576.

Google Scholar

- Janda, S., Trocchia, P.J. and Gwinner., K.P. 2002. Customer –oriented financial of Internet retail service quality.International Journal of electronic commerce, 1(2), pp. 59-88.

- Jun, M., Yang, Z., & Kim, D. 2004. Customers’ perceptions of online retailing service quality and their satisfaction’, International Journal of Quality & Reliability Management, 21(8), pp. 817-840.

Google Scholar

- Khan .K. M.. and Jham, V.2008. Determinants of performance in retail banking: Perspectives of customer satisfaction and relationship marketing. Singapore Management Review, 30(2), pp. 35-45.

Google Scholar

- Krishnamurthy, R., SivaKumar, M. A. K., & Sellamuthu, P. 2010. Influence of service quality on customer satisfaction: Application of Servqual model. International Journal of Business and Management, 5(4), pp.117-124.

Google Scholar

- Kumbhar .2011.Determinants of internet banking adoption. Indian Journal of Commerce & Management Studies, 2(4), pp. 20-30.

- Lee, GG and Lin, HF. 2005. Customer perceptions of eservice quality in online shopping. International Journal of Retail & Distribution Management, 33(2), pp. 161-176.

Google Scholar

- Lee, H., Lee, Y. and Yoo, D. 2000.The determinants of perceived service quality and its relationship with satisfaction. Journal of Service Marketing, 14(3), pp.217-231.

Google Scholar

- Liao, C.H., Rebecca Yen, H. and Li, E.Y., 2011. The effect of channel quality inconsistency on the association between e-service quality and customer relationships. Internet Research, 21(4), pp.458-478.

Google Scholar

- Mengi, P. 2009. Customer Satisfaction with Service Quality: an empirical study of Public and Private SectorBanks. IUP Journal of Management Research, 8(9), pp. 7-17.

Google Scholar

- Ministry of Communications and Information Technology (2007) mcit.gov.eg.

- Mohammad, S.S., and Md, A.H.S. 2016. Effect of E-Banking on Banking Sector of Bangladesh. International Journal of Economics, Finance and Management Sciences, 4(3), pp. 93-97.

- Moradipour, T. 2012. Acquisition policy design; An application of system dynamics for a heavy equipment dealer in Southeast Asia. Master Thesis. The University of Bergen.

Google Scholar

- Muhammad, J., Muhammad. Z., Shahihd. J. and Alamgir.K., 2016. Benefits and Risks of Electronic Banking in the Context of Customer Satisfaction. Journal of Applied Environmental and Biological Sciences, 6(3), pp.112-117.

- Naeem, H., and Saif, I. 2009. Service Quality and its impact on Customer Satisfaction: An empirical evidence from the Pakistani banking sector. The International Business and Economics Research Journal, 8(12), pp. 99-104.

- Ngo Vu M., Nguyen Huan H. (2016). The Relationship between Service Quality, Customer Satisfaction and Customer Loyalty: An Investigation in Vietnamese Retail Banking Sector. Journal of Competitiveness, 8 (2), pp.103-116.

Google Scholar

- Nimako, S. G., Gyamfi, N. K., and Wandaogou, A. M. M. 2013. Customer Satisfaction With Internet Banking Service Quality In The Ghanaian Banking Industry. The International Journal of Research Journal of Social and Management, 3(4), pp 1-14.

Google Scholar

- Oliver RL, 1993. A conceptual model of service quality and service satisfaction: Compatible goals, different concepts. Advances in Service Marketing management, 2,pp. 65-85.

- Oyo, B. 2010. Integration of system dynamics and action research with application to higher education quality management. PhD Thesis, Makerere University.

Google Scholar

- Payne, A. and Frow, P., 2005. A Strategic Framework for Customer Relationship Management. Journal of Marketing, 69(4), pp. 167-176.

Google Scholar

- Razavi, S. M., Safari, H., & Shafie, H. 2012. Relationships among Service Quality, Customer Satisfaction and Customer Perceived Value: Evidence from Iran’s Software Industry. Journal of Management and Strategy, 3(3), pp.28-37.

Google Scholar

- Rolland, S. and Freeman, I., 2010. A new measure of e-service quality in France. International Journal of Retail & Distribution Management, 38(7), pp.497-517.

Google Scholar

- Sahar, F., 2013. Tradeoffs between Usability and Security. IACSIT International Journal of Engineering and Technology, 5(4), pp.434-437.

Google Scholar

- J .2003. E-service quality – a model of virtual service dimensions. Managing Service Quality,13(3), pp. 233-247.

Google Scholar

- R.L. and Nejad, A.Sohrabi. 2012. A Dynamic Simulation of Service Quality, Customers Satisfaction and Cash Flow in a Pharmaceutical Distribution Company. Global Journal of Researches in Engineering, 2(2), pp.1-10.

Google Scholar

- Sohail, M.S. and Shaikh, N.M. 2007. Internet banking and quality of Service: Perspectives from a developing nation in the Middle East. Online Information Review 32(1), pp. 58-72.

- Sohn, C., and Tadisina, S.K. 2008. Development of e-Service Quality Measure for Internet-based Financial Institutions. Total Quality.

Google Scholar

- Spreng, R.A. and Mackoy, R.D. 1996.An empirical examination of a model of perceived service quality and satisfaction. Journal of Retailing, 72(2), pp. 201-14.

Google Scholar

- Sterman, J. D. 2000.Business Dynamics: Systems Thinking and Modeling for a Complex World. Irwin McGraw-Hill: Boston, MA.

- Srijumpa, R., Speece, M., Paul, H. 2002. Satisfaction drivers for internet service technology among stock brokerage customers in Thailand Journal of financial services marketing, 6(3), pp. 240 – 253.

Google Scholar

- Sumari, S., Ibrahim, R., Zakaria, N. H., and Ab Hamid, A. H. 2013. Comparing Three Simulation Model Using Taxonomy: System Dynamic Simulation, Discrete Event Simulation and Agent Based Simulation. International Journal of Management Excellence, 1(3), pp. 54-59.

Google Scholar

- Thaichon, P., Lobo, A. and Mitsis, A., 2014. An empirical model of home internet services quality in Thailand. Asia Pacific Journal of Marketing and Logistics, 26(2), pp.190-210.

Google Scholar

- Van Der Merwe, S. 2010. The Impact of Electronic Service Quality Dimensions on Customer Satisfaction. Research proposal Magister in Business Management, Nelson Mandela Metropolitan University.

- Woodside, A.G., Frey, L.L., and Daly, R.T. 1989. Linking service quality, customer satisfaction and behavioral intention. Journal of Health Care Marketing, 9, pp. 5-17.

- Wu,Y. ,Chang M.C.S., Yang P. and Chen Y. 2008. The Use of E-SQ to Establish the Internet Bank Service Quality Table. IEEE Xplore, pp.1446-1456.

Google Scholar

- Yuan, X., Shen, L., & Ashayeri, J. 2010. Dynamic simulation assessment of collaboration strategies to manage demand gap in high-tech product diffusion. Robotics and Computer-Integrated Manufacturing, 26(6), pp.647-657.

- Z. and. Jun. M. 2002. Consumer perception of e-service quality: From Internet purchaser and non-purchaser perspectives. Journal of Business Strategies, 19 (1), pp. 19-41.

- Zavareh, F.B., Ariff, M.S.M., Jusoh, A., Zakuan, N., Bahari, A.Z. 2012. E-Service Quality Dimensions and Their Effects on E-Customer Satisfaction in Internet Banking Services. The International Conference on Asia Pacific Business Innovation and Technology Management. Procedia – Social and Behavioral Sciences, 40, pp. 441-445.

- Zeithaml, Valarie A., M. J. Bitner, and Gremler. 2006. Services Marketing – Integrating.