Introduction

The primary concern of banks today is to build customer loyalty, regain their trust and, above all, satisfy their needs. Faced with the evolution of the banking system and strong competition, marketing must follow these changes and adapt to new environmental, societal and economic requirements. A dynamic of innovation enables banks to better manage the constraints linked to these three dimensions, and to propose offers that are better adapted to the environment, by gradually replacing old-design products and services with new products and services that are better adapted to new requirements. As well as the importance for banks to communicate better with their environment.

As a result of the recent financial crisis, the banking sector is obliged to restore its reputation and inspire confidence once again, as its image has been tarnished by this incident. The marketing function has to cope with this situation, as the role of marketing goes beyond simply winning over customers and sales. It must also build customer loyalty and care for the company’s image and reputation, and to do this it must be a generator of value. This uncertain and increasingly complex environment (Callon et al., 2001) impacts the organization (Lawrence and Lorsch, 1967) much more strongly today than it did a few years ago. And it is precisely in such a context that leaders have a key role to play in taking into account the expectations of stakeholders in their strategy(F. G. Arcelus, N. Sharffer).

In this context, sustainable development represents a lever of performance and value creation, which can combine economic and financial efficiency, as well as a lever of competitiveness. Given that banking innovation is the set of activities leading to the launch of new products and services and/or the implementation of new ways of doing things, which the bank makes available to its customers with the aim of increasing its competitiveness and ensuring its sustainability with, in particular, the increase in competition, the pace of technological renewal and the rise in environmental and social concerns which mean that innovation should no longer be an occasional activity but a recurring business activity.

The study topic aims to shed light on the emerging and compelling dynamics of integrating sustainable development into marketing strategy. Of general scope, the research takes place at the level of corporate strategy and tends to demonstrate that sustainable development, a lever of innovation, is a powerful vector for creating shared (or societal) value, providing competitive advantage and long-term performance. The study aims to identify decision-making levers that encourage the bank to move towards responsible economic or managerial models. It identifies key conditions and factors of success to ensure long-term performance by the marketing function, and observes the current situation by interviewing a number of bank executives and analysing their responses.

Our research questions that we have tried to answer are as follows: What is the degree of consideration of sustainable development issues in the marketing strategy of Algerian banks? What is the role of marketing in the perception and integration of these issues? Does the managerial and strategic policy within the banks favour the implementation of an innovative strategy in terms of marketing practices in the long term? Can Algerian banks currently respond to logic of sustainable development? Are they socially responsible? These are the questions around which our research work was conducted.

To answer these questions, we have put in place two hypotheses:

Hypothesis 1: Sustainable development is very little taken into account by the managers of Algerian banks.

Hypothesis 2: Algerian banks do not follow a marketing innovation strategy focused on sustainable development.

The reasons for this assumption include the lack of communication by the banks on their long-term visions and strategies, as well as the lack of clearly identified mechanisms for practices oriented towards a dynamic of sustainable development and social responsibility. Our field survey will either confirm or refute these assumptions.

Marketing innovation in the sense of sustainable development

Innovation according to the Oslo Manual is “an iterative process initiated by the perception of opportunity, whose development, production and marketing attempt to lead to commercial success”. Marketing innovation occurs when product and service innovation is no longer sufficient. Banking innovation is a necessity, as the launch of new products on the market gives the bank an edge over its competitors (Favre-Bonte & al., 2008). Sustainable development, which incorporates the concept of customer relations, is a key element of the bank’s strategy, which involves extending the range of products on offer and integrating new technologies (De Jong, Vermeulen, 2003).

Clearly and generally speaking, innovation is a driver of business growth. Marketing innovation pushes companies to be creative by playing on the variables of the marketing mix, be it on the product or the service, the price or the fair price, the distribution or the communication, which multiplies innovations and constitutes a real instrument of introduction and popularization of any type of innovation.

However, marketing is often blamed for all the evils, particularly that of over-consumption in our contemporary societies, and is also accused of lagging far behind other corporate services and functions that have been able to integrate CSR principles into their practices. However, the challenge of making marketing and sustainable development coexist, or even make them work together, is indispensable. The marketing function is essential for the integration of sustainable development into supply and demand, since it is the interface between the company and society.

Sustainable development is “development that meets the needs of the present without compromising the ability of future generations to meet their own needs”, quote from Dr Gro Harlem Brundtland, Prime Minister of Norway (1987). The title of the report was “Our common future”. Funded by the World Commission on Environment and Development, which defines sustainable development as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs”, it means that growth must be respectful of nature and mankind. It is a form of economic development whose main objective is to reconcile social progress with the preservation of the environment as a heritage to be passed on to future generations. Sustainable development creates value in many forms and impacts all areas.

The integration of sustainable development in the bank

The integration of sustainable development into the banking activity is done in different ways, it is part of a logic of marketing innovation strategy allowing the bank to create value for its customers and to take care of its image to gain their trust, by taking into account the consequences of its activity on the environment in the broad sense (nature, man and society). In becoming socially responsible, it must take steps to respect and ensure respect for the principles of sustainable development.

The concept of corporate social responsibility CSR according to the European Commission’s 2001 Green Paper is defined as “the voluntary integration by enterprises of social and environmental concerns into their business activities and their relations with their stakeholders”, the CSR consists of taking into account the environmental and social impacts of its activity by integrating sustainable development issues within its organization and in its interactions with its stakeholders. Aware of its social responsibility, the bank builds its CSR policy around five axes, the objective of which is to combine in an ethical manner, economic logic, social responsibility and eco-responsibility:

- The development of the green economy and responsible investment to participate in the energy transition and the emergence of a sustainable economic model;

- Taking into account social, environmental and governance criteria adapted to the different sectors with CSR risk management in financing and investment activities;

- Ensuring openness to civil society and engaging in solidarity projects by mobilizing its employees with associations and civil society organizations CSOs (patronage, sponsorship …);

- Reducing direct social and environmental impacts by limiting the consumption of resources and energy, greenhouse gas emissions and a responsible purchasing policy;

- The establishment of a responsible HR policy by developing sustainable performance in terms of recruitment, training, remuneration, working conditions and social relations;

With the effects of the financial crisis that began in 2008 and that continue to have a negative impact on the banking sector worldwide, adopting a CSR strategy seems difficult. And yet, many banks are placing CSR at the heart of their strategies, communications and actions. The notion of trust is extremely important, as customers expect banks to be vigilant about the funds they entrust to them and how they are used, including by turning them into loans (Green 1989).

However, this is not a fad, but a deliberate strategic choice, justified by the legal context, with the banks’ commitment to social responsibility, as well as the social context, with clients increasingly demanding transparency and more commitment to ethical, socially responsible and environmentally friendly behavior.

Two theories are most often associated with the integration and application of sustainable development, regardless of sector of activity, in a significant number of works on sustainable development: the triple bottom line theory and the stakeholder theory.

The bank’s actions that integrate sustainable development dimensions can thus become a differentiating asset in a difficult economic context that encourages banks, like all companies, to adopt new and innovative methods in order to reduce costs and better anticipate and control risks. In this context, CSR represents a value-creating, economically and financially efficient lever, as well as a lever for competitiveness.

Corporate social responsibility, an ambiguity of the term social or societal from one language to another, let us recall that the name CSR, which is the abbreviation of the Anglo-Saxon term CSR “Corporate Social Responsibility”, does not only include its social dimension, but also integrates the environmental dimension, as well as all the stakeholders of the company. It is precisely for this reason that the societal name seems more appropriate. However, the notion of CSR appeared long before that of sustainable development, from the 1950s onwards, although this does not prevent its association with sustainable development as the very application of its principles within companies.

Beyond these semantic considerations, CSR represents the interaction between the three complementary pillars that are essential to the performance of the company and whose balance is necessary for its effectiveness, namely: respect for the environment, social equity and economic performance.

The second theory associated with sustainable development is that of stakeholders, which found its foundations in the work of Freeman (1984), which countered Friedman’s theory that the sole purpose of a company’s existence is to make a profit and then redistribute it to shareholders. In his theory, Freeman proposes a new vision regarding the purpose of the company and its reason for existence. He concludes that a company must meet the needs of its stakeholders and satisfy them in order to make a profit and ensure its sustainability.

This vision, considered revolutionary, is part of a systemic approach to the company, considered as part of a system of actors. Freeman defines stakeholders as: “any group or individual that can affect or be affected by the achievement of an organization’s objectives”.

We wanted to clarify the commitments of the above-mentioned banks by cross-referencing them with these theories representing the application of sustainable development. Through these commitments, the bank applies the Triple Bottom Line theory by integrating the three pillars of sustainable development into its strategy and it establishes policies related to its activity aimed at satisfying all stakeholders.

The bank’s corporate social responsibility is considerably particular because of the impact of banking activity on the economic fabric, as its business places it at the heart of environmental and social concerns by the consequences generated by the activities of the companies it finances. The bank has modernized in recent years and is more concerned with its image and communication by integrating responsibility and sustainability strategies into its activities.

Sustainable development and competitive advantage

The theories mentioned above highlight the need for the company to implement a strategy that enables it to respond favorably to the expectations of all its stakeholders. Sustainable development and the integration of its principles into a company’s strategy gives it, whatever its sector of activity, a lasting and sustainable competitive advantage, and this by making the link with innovation.

This requires, first of all, the company’s ability to make the most of all its internal resources by developing its skills with a view to creating and sustaining an activity centered on values, socially responsible and respectful of the environment, giving it a competitive advantage by enabling it to hold unique characteristics over the long term.

However, value creation and customer satisfaction is the key to competitive advantage, as not all resources are potentially a source of competitive advantage. Therefore, resources must enable value creation or constitute one or more values themselves, so that the company can implement strategies based on its internal competencies.

Sustainable development represents a way for the company to stand out and stay ahead of the competition, a strategic choice around which a great opportunity for value creation is offered to the company. Indeed, the strategic challenge is to transform the constraints and threats related to the application of such a strategy into opportunities, thanks to innovation, which is then seen as the necessary means for the company to develop a competitive advantage based on corporate social responsibility (Porter,Kramer, 2006).

Indeed, in the logic of competitiveness, sustainable development can be presented as an asset. Except that it can also be an environmental element causing the emergence of new constraints. The whole art of strategic management and innovation will be to transform these constraints into opportunities and to develop a competitive advantage based on corporate social responsibility. This is approached as a necessary change management (Faivre-Tavignot & al. Porter, Karmen, 2006).

The interest of our research lies in the interaction between sustainable development and marketing, as well as the latter’s capacity to transform the company’s practices in order to adapt to new global challenges, but above all to satisfy its customers and all of its stakeholders.Marketing plays a major role as it is the indispensable link in the creation of value and the link between the company and consumers (Diane Martin and John Schouten; 2012). A company that innovates in sustainability can have a pioneering advantage. Through innovation and change, tools, processes and marketing strategies can be put in place that promote sustainability goals and outcomes (Amine Béji, Nil Özçağlar 2014). Sustainable development, or CSR, on the other hand, can be seen as a constraint, generated by pressure from public opinion and governments (Nidumolu et al., 2009). As such, they are far removed from the business concerns of companies (Porter and Kramer, 2006).

However, if we stop opposing marketing to sustainable development, to get out of this paradoxical situation and these reductive schemes. These two concepts are, of course, common issues of vital importance, as shown in the diagram above.

Research Methodology

Production of the maintenance guide:

The methodology used in our research work is based on a qualitative design. “Qualitative studies are studies of an intensive nature that use an ‘open’, non-directive, permissive and indirect approach to data collection from respondents. Qualitative studies aim at a deeper understanding of the subject matter. The mode of questioning is unstructured and the number of contacts is relatively low. They look for the causes, the foundations of a behavior, an attitude, a perception”.

Indeed, qualitative studies allow researchers to observe individuals separately, which allows for a better understanding of the drivers of human decision making. The objective of our study is not to quantify the data, and to analyze them statistically, we try to know the reality of the integration of sustainable development in the marketing strategy of Algerian banks.

In order to conduct our study, we produced a semi-structured interview guide that allows bank managers to express their ideas freely and is relatively easy to use for the analysis part.

We relied on: the book “Social science methodology And qualitative approaches To organizations: An Introduction To The Classical Approach And A Critique”.

– On several speakers of Doctorate and Magister:

The interview guide consists of 15 questions in 3 parts:

- Banking Marketing ;

- Innovation Marketing ;

- Sustainable development.

This qualitative survey took place between April and July 2018 among 12 managers, including branch managers and regional managers of 12 banks, 6 of which are public banks.

The choice of bank managers as a field of investigation was motivated by their in-depth knowledge of the application of sustainable development and marketing innovation within their institutions.

The methodology we used in this research is based on a qualitative design, data collection and processing makes extensive use of qualitative techniques.” Qualitative studies are studies of an intensive nature that use an ‘open’, non-directive, permissive and indirect approach to data collection from respondents. Qualitative studies aim at a deeper understanding of the subject matter. The mode of questioning is unstructured and the number of contacts is relatively low. They look for the causes, the foundations of a behaviour, an attitude, a perception”.

The main objective of qualitative research is to obtain empirical assessments of levels of knowledge, attitudes, behaviour or performance.

Qualitative research studies take longer than quantitative research because the answers to the questions are open-ended. The main purpose of these studies is to understand the logic behind the opinions of this type of population on a given topic.

The Analysis tool:

The most appropriate tool for this type of study is content analysis. This tool is an analytical technique characterized by a set of structured procedures for classifying data that are found in a “discourse” (Article, Interview, document…). “Content analysis is a research technique for the objective, systematic and quantitative description of the manifest content of communications in order to interpret them.

We followed the main steps of the content analysis process to conduct our thematic analysis of the content of the semi-structured interviews conducted with the interviewed executives. After the transcription of the content of the 12 interviews, we coded the responses to cut the corpus of all the interviews into units of analysis. We then classified these units of analysis into the themes we defined.

We took the following steps:

Defining the Evaluation Unit:

The choice of the unit of analysis is a major choice which is essentially based on the objective of our study to determine the nature of the coding scheme, which allows the interpretation of the content of the interview guides, thus allowing the choice of quantification indices. For this, we opted for a thematic analysis. The analysis is based on a set of sentences, as it refers to situations, objectives or related concepts. We have retained the same themes from the interview guide in order to cut the corpus and to be able to proceed to a ranking:

– Knowledge of the concept;

– The flaws;

– The trend in the future.

Categorizing data:

We defined the categories based on our information needs on the one hand and on the other hand on our research hypotheses. We categorized each sub-theme identified in the content of each interview. In addition, the themes we selected earlier represent the intermediate level between sub-themes and categories. We then calculated the frequencies of each category.

Presentation of results:

We interviewed 12 Algerian bank executives; the choice of these banks was random. We divided our interview guide into three parts:

- Banking marketing;

- Marketing innovation;

- Sustainable development.

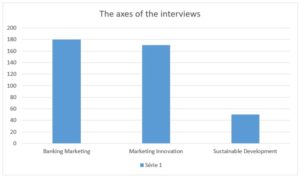

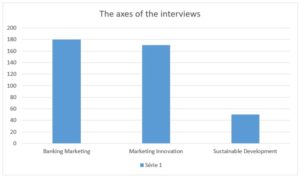

Figure 1: Presentation of the research axes in order of importance by the authors;

After processing and analysing the content of these twelve interviews, we note that the first two axes are very important, however, the leaders interviewed give little importance to the sustainable development axis.

Axis 1: Banking Marketing

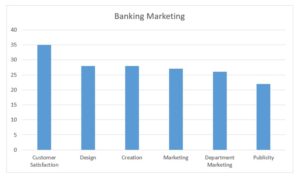

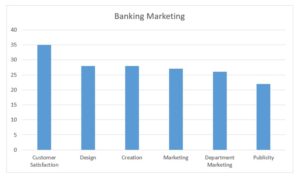

Figure 2: Banking marketing by the authors;

According to the answers given to the questions concerning our first line of research, the managers gave great importance to the marketing department with 27 points. The first function of this department is customer satisfaction through the feedback survey of customers and the actions taken to satisfy them and build their loyalty.

in second place, the design and creation of new products, which is generally done by the marketing department, which also deals with advertising and the dissemination of information, always based on the responses of these same managers. In fact, marketing of banking products and advertising are the last two functions according to the ranking of the importance of the concepts according to the 12 bank managers interviewed.

Axis 2: Marketing innovation

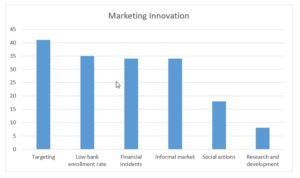

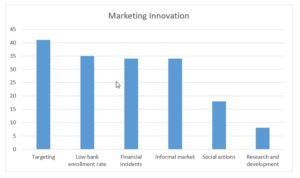

Figure 3: Marketing innovation in Algerian banks by the authors;

In the area of marketing innovation, we find that banks attach little importance to the R&D department. According to the answers, the bank managers interviewed all agree that Algeria has a very low rate of bankization, the lowest in the Arab world, a weakness due to several factors, including the informal market which generates more than 60% of the added value of the national economy.

As well as the financial incidents in the history of Algerian banks, such as the EL-Khalifa scandal and that of BCIA BANK, a lack of confidence is taking hold. To this end, banks need to innovate to attract this non-banking sector clientele. Indeed, the leaders interviewed gave character to the targeting of particular segments such as product offers that can satisfy this category of the population. Then, the bank executives discussed the concept of social actions with which the bank can improve its brand image and reputation vis-à-vis it’s current and potential customers.

Axis 3: Sustainable development

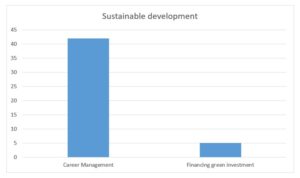

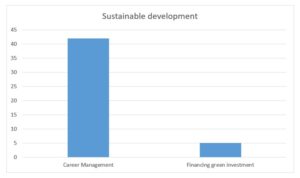

Figure 4: Sustainable development in Algerian banks by the authors;

In this axis, two concepts emerge from the interviews carried out with the 12 managers. The first concept to which the managers attached great importance is that of career management, indeed all the banks in Algeria have career management as a priority in their management to enhance the internal human factor and to create competitiveness among employees. The second concept is that of the financing of the green investment which had a very weak importance in the interviews carried out, the banks give the greatest importance in their steps of exploitation to the return. The green investment isn’t profitable because it does not constitute any interest for the banks according to all managers interviewed.

Conclusion

Our study allowed us, through a methodological approach as well as a deep theoretical research gathering many scientific contributions in the field of marketing and sustainable development, to conduct a qualitative survey in the banking sector in Algeria to know the reality of the link existing between marketing strategy and sustainable development in the Algerian banking sector.

We have succeeded in drawing a first conclusion with the result of the analysis of the data of the information collected; sustainable development exists in the banking sector for economic reasons related to the image of these financial institutions.

The degree of pries in account is not important but varies from one bank to another which will lead us to deepen our research by comparing the public sector to the private sector.

This integration clearly manifests itself in a policy of human resources and cost reduction in terms of energy use or new technologies. Thus our hypothesis is confirmed by demonstrating that the degree of integration of sustainable development is relatively low, and that Algerian banks do not currently apply a strategic policy of sustainability.

Acknowledgment

We thank the Maghreb Technology (Maghtech) network led by Pr. A. DJEFLAT for his support and his contribution to this work during our scientific stays at the University of Lille 1 in France.

(adsbygoogle = window.adsbygoogle || []).push({});

Bibliography

- Acosta P., Acquier A., Carbone V., DelbardO.,Fabbri J., Gitiaux F., Manceau D., Ronge C. (2013), Innovation+ sustainable developpment = new business models, study sustainable innovation –institut I7-ESCP EUROPE- WEAVE AIR).

- AKTOUF , O. (1987) Social science methodology and qualitative approaches of organizations : An introduction to the classical approach and a critique, Les presses de l’Université du Québec.

- Arcelus, F. G. and Sharffer, N. , (1982), “Social demands as strategic issues: some conceptual problems”, Strategic Management Journal, vol. 3, 347-357.

- AUDOUIN, A., COURTOIS, A., and RAMBAUD-PAQUIN, A., (2011). The responsable communication: the communication in front of the sustainable developpement, EYROLLES Editions d’Organisation, pp 29.

- Batac (2016), the bank institution or corporate ?, Bank Revue, N°797, p69, 70, 71.

- CONSTANTINOU D , Ashta A . (2011). Financial crisis: Lessons from microfi nance. Strategic Change 20 ( 5/6 ): 187 – 203 . consulted on 15/05/2018.

- DANNON H. ,DUMOULIN R. , VERNIER E. , (2011), Innovation and sustainable development in the bank: challenges and prospects.

- DE JONG, J.P.J., VERMEULEN, P.A.M., 2003, « Organizing successful new service development: a literature review », Management Decision, Vol. 41 Iss : 9, pp.844-858.

- FELLEMANS, (P): Quantitative Marketing Research, Boech & Larcier, 1999.

- FRISCH, F. (1999) : ” Qualitative studies “,Edition d’organisation, p.07.

- GARDES N. , BEGUINET S. , and LIQUET JC. , (2013), La Revue des Sciences de Gestion, Direction et Gestion n° 261-262 – Marketing, p.157-166.

- GAUTHY-SINECHAL, M and VANDERCAMMEN, M. (2005). Market Research: Methods and Tools, BERTI Editions, 2éme édition, p.87- 88.

- GERMAN, I. and BRULLEBAUT, B. , (2007), Sustainable development: an overview of the banking sector, published on http://www.aderse.org. Consulted on 18/03/2018.

- GIANNELLONI, JL. (1994), Market survey, Editions Uuibert, p. 97.

- JACQUEMOT P., (2017), The Encyclopaedic Dictionary of Sustainable Development, Editions Sciences Humaines, p. 378.

- https://www.insee.fr/fr/metadonnees/definition/c1644 consulted on 20/05/2018.

- https://www.insee.fr/fr/metadonnees/definition/c1644, Accessed on 15/09/2018.

- https://www.natixis.com/natixis/jcms/tki_5048/fr/rse. Accessed on 12/09/2018.

- http://www.novethic.fr/novethic/site/article, Accessed on 13/09/2018.

- Le Nagard-Assayag E., Menceau D., Morin-Delerm Sophie, (2015), Marketing of innovation, 3ème édition, DUNOD, pp.12, 27, 89, 90.

- LOUPPE A , (2006). marketing’s contribution to sustainable development, Revue Française Du .Margeting – N” 208 – 3/S, p.7-35 ; Consulted on 10/03/2018.

- ST-ONGE S. , (2011) ; «Sustainable development as a strategic lever », Gestion 2011/1 (Vol. 36), p. 54-55. https://www.cairn.info/revue-gestion-1-page-54.htm, consulted on 28/02/2018.

- PELLEMANS, P. (1999) : Quantitative Marketing Research, Boech & Larcier, p.15.

- VAILLANCOURT JG. , (2002), «Agenda 21 and sustainable development », Vertigo – la revue électronique en sciences de l’environnement [En ligne], Volume 3 Numéro 3 | mis en ligne le 01 décembre 2002, consulted on 09/05/2018. URL : http://journals.openedition.org/vertigo/4172 ; DOI : 10.4000/vertigo.4172

- VIEL, K. (2011), Marketing and sustainable development, Edition Comité 21, Paris, p.21.