Background of the Study

Throughout history, families and businesses have always existed to a large extent in tandem (Morck and Yeung, 2002; Narva, 2001). The economic necessity of earning a living and supporting a family is often the underlying reason for starting and growing a business (Winter et al. 1998). Among other motivators, lifestyle and wealth accumulation goals play an important role in whether a particular family member or members choose to start a business in conjunction with their family. The economic landscape of most nations remains dominated by family businesses (Heck and Stafford, 2001; Klein, 2000) which constitute a greater percentage of the private sector. Family businesses carry the weight of economic wealth and job creation in most economies. For example, in the US, Canada and Slovenia, etc., family businesses account for about 80 to 90 percent of the business enterprises and about 50 percent of employment and GNP (Phan et al., 2005; Dun et al., 2007). Other researchers have also observed that generally about 66% of new jobs in the world are created by family businesses (Perreault, 2000; Gaspé Beaubien, 1995). Similarly, Etcheu (2003) observed that 90% to 95% of businesses in Cameroon are small and medium size enterprises comprising of family businesses and account for about 49.7% of employment (Perdrix, 2005). Since the mid-1980s, most African countries implemented both economic and financial reforms to achieve macroeconomic stability and improve economic governance. These reforms in many countries however were still unsatisfactory as concerns fiscal and monetary management. Therefore, more efforts are needed for these countries to improve their macroeconomic environment and achieve sustainable growth rates in order to meet most of their development targets gearing towards poverty reduction. The private sector is an important channel through which this could be realized, and therefore there is a need for these governments to re-examine microeconomic reforms needed to stimulate the private sector by improving on the business environment and investment climate to facilitate firm entry, growth and survival (Tabi and Fomba (2013). Entrepreneurship is a determining factor in the economic growth of most nations. The family businesses, most of which fall within the small and medium size enterprises (SMEs), are at the centre of such growth in most developing countries including Cameroon. They are seen as the engines of employment, alleviating poverty and improving equality (Okpukpara, 2009; Ayyagari et al., 2011). In Cameroon, a family business usually starts as a small scale sole proprietor with just a few paid employees, who are bound by geographical, ideological or psychological factors. They ensure the day-to-day running of the business. It is virtually managed by the manager-owner, who is generally responsible for both physical and psychological maintenance of the workers (Fomba, 2007). An analysis of the country’s growth factors reveals that its economy depends more than 50 percent on Household and Sole Proprietor Businesses which constitute a sector comprising mostly informal units with no guarantee of sustainable growth due to their generally fluctuating performances. Most of these are family businesses characterized by the concentration of capital in the hands of one person, with family members of the proprietor involved in the management of the company and low financing by bank loans.

One of the major weaknesses of most African Economies and Cameroon in particular could be the absence of a clear understanding of the role of entrepreneurship in the economic development of a nation. However, just like every other business, family-owned and managed businesses in Cameroon and elsewhere are facing a considerable number of challenges ranging from their initiation to management and consequently their lifespan. For example, report from the Family Business Consulting (2009) indicates that only about 30% of family businesses survive into the second generation, 12% are still viable into the third generation and only about 3% of all family businesses operate into the fourth generation and beyond. Dyer & Whetten (2006), in their article titled “Entrepreneurship Theory and Practice”, observe that even though family businesses outperform non-family controlled firms on social responsibility, family firms do not endure over time. Wayne (2010), in his article “Creating a Sustainable Family Business”, found that less than 30% of family businesses survive into the third generation of family ownership. These challenges inevitably provide a base for several preoccupations to be raised on issues pertaining to the sustainability of family businesses in general and factors that contribute to their non-sustainability in particular.

Problem Statement: Family-owned and managed businesses in Cameroon have not been an exemption to the issues that plague the existence of family enterprises around the world, given that they face a considerable number of challenges ranging from their initiation to management and consequently their lifespan. This situation has been observed with many family businesses in Cameroon. Given the importance of this sector and its contributions to the economy of Cameroon, the worry is the fact that most of these family businesses in Cameroon close down when their initiators die, leaving many people unemployed. This inevitably has a negative impact on the economic development of Cameroon. Based on this, our study therefore is preoccupied with the following questions, objectives and hypothesis as it seeks to carry out an in-depth investigation on issues pertaining to sustainability of family- owned and managed businesses in Cameroon.

Research questions: To what extend are family-owned and managed businesses in Cameroon sustainable? What are the factors that affect the sustainability of family-owned and managed enterprises in Cameroon? What can be done to ensure that family-owned and managed businesses in Cameroon are more sustainable?

The Research Objectives: To find out the extent to which family businesses in Cameroon are sustainable, to investigate and analyze factors that affect sustainability of family-owned and managed businesses in Cameroon, to propose measures that can be put in place by both the policies’ makers and owners of family businesses to ensure that these businesses should be more sustainable.

Research Hypothesis: This study is guided by the following testable hypothesis, other things being equal:

Family owned and managed businesses in Cameroon are not sustainable and cultural, managerial and technical factors are responsible for the non-sustainability of family owned and managed businesses.

The Scope of the Research: This research will be conducted in the English speaking part of Cameroon which are the Northwest and southwest Regions.

Cameroon is a country in Central Africa with a population of about 23,130,708 as of 2014 and has a surface area of 475,440 sq km. Cameroon is bordered by Nigeria to the west, Chad to the northeast, the Central Africa Republic to the east, Gabon, Equatorial Guinea and the Republic of Congo to the south. Cameroon is divided into 10 administrative regions and has two official languages; French and English. The empirical part of this study will be conducted in the Northwest and Southwest Regions which make part of the ten administrative regions of Cameroon and which are the two English speaking regions of Cameroon. Within this area of study we shall focus on family-owned and managed businesses operating in the main towns of Bamenda in the Northwest region, Kumba, Buea and Limbe in the Southwest region. The designated sample size for our study is 30 family businesses, targeting 130 respondents, with at least 4 respondents expected to be selected from each family-owned and managed business. .

Significance of the Study: This study will provide a better understanding on how businesses that are failing can draw from those that have recorded a marked success as far as sustainability is concerned. With review of lessons drawn from other businesses worldwide that have succeeded in remaining considerably sustainable even after the death of their initiators, it will be interesting for Cameroonian family business stakeholders to know how factors responsible for failure of family-owned and managed businesses can be avoided or curbed during the running of a business. Lastly, apart from contributing to the existing literature on Family business sustainability in Cameroon, this study builds on actual practices and experiences, such that it can be linked to action and their insights contribute to changing practice in the field of family entrepreneurship undertaken by Cameroonians as a whole. Apart from providing useful information for the country’s current and future achievements, this work would also likely arouse the interest of other research students to conduct more research in this field of study.

Review of Related Works

This section deals with the literature review, comprising of the conceptual framework and the theoretical framework. The conceptual framework consists of the review and definition of some basic terms and concepts while the theoretical framework on its part presents some theories on family businesses, bringing out some empirical literature and some models on family businesses.

Conceptual Framework: A conceptual framework is an analytical tool with several variations and contexts. It is used to make conceptual distinctions and organize ideas. In fact, it can be defined as a way ideas are organized to achieve a research project’s purpose.

Review of Basic Terms and Concepts: Here we are going to review some of the fundamental concepts and terms that are shared across this study ranging from definitions to the consideration of different opinions as regards some concepts.

Business: According to the Business Dictionary, a business is an organization or economic system where goods and services are exchanged for one another or for money. Businesses can be privately owned, not-for-profit or state-owned. Family businesses, which are the main thrust of our research work, are part of privately owned businesses.

Family: The definitions of a family are evolving following a continuous change in the demographic structure of different countries and in different contexts. In the United States, the definition of a family is based on the ‘nuclear’ model of a heterosexual married couple, living with their children in a household headed by the husband (Rothausen, 1999). However, the demographic structure of American families has changed significantly with increasing divorce rates and single-parent households (Fields, 2003) together with the prevailing homosexuality marriages leading to a different perception of what a family is. In many Asian countries, a family includes three or more generations living in one household, sometimes with aunts, uncles and cousins in addition to parents and children (Rothausen-Vange, 2005). The African countries definition of a family is very similar to that of Asian countries but for the fact that this extended family may not necessarily be living in one household. The role of extended families is becoming progressively more important given increases in marital instability and divorce rates (Bengston, 2001). This also raises a number of questions with respect to the definition of a family business.

Family Business: The concept of family business and family enterprise are often used interchangeably although the latter and the former are closely associated with the Anglo Saxon and French traditions respectively. The concept of family enterprise is also bound to vary considering the fact that they are based on unique socio-cultural realities of a given group of people and institutions. This justifies differences in Western and African based definitions due to predominant practices of nuclear and extended family systems respectively. The literature on family businesses or family firms ranges widely with respect to definitions of what family businesses are. Although, there is a lack of a widely accepted definition of what a family business is (Bennedsen et al., 2010) , authors like Miller et al,.(2007); have succeeded in giving a comprehensive review of various definitions of family businesses.

Considering that the definition of a family business can vary widely from study to study, Dyer (2006) suggests two versions of such definitions. The first one is subjective, defining a family firm as one whose management is controlled by the family members who own it. In this case, outside persons are not involved in the management and there is strict family ownership/management. The second definition is more objective, considering a firm to be a family business if it meets certain criteria such as the family’s ownership percentage or the number of family members holding directorships or filling key management posts.

According to Allouche and Amann (2008), a family business is a business in which one or several families significantly influence its development through ownership of its capital, placing the emphasis on family ties with regard to the process of selecting company directors, whether they are family members or workers recruited externally, and expressing a desire to transmit the business to the next generation while understanding the importance of the business for the interests and objectives of the family. This definition emphasizes the sustainable dimension of the business, characterized by the desire to transmit the patrimony it represents from one generation to another, in addition of the presence of the family. This definition seems to suit our work since we are more interested in seeing the family businesses transmitted from one generation to another and hence the concept of sustainability which is considered as the main performance indicator of family business needs to be taken into consideration.

In Cameroon, authors like Tchankam (2000) have attempted a definition of a family business taking into consideration all specific aspects of the Cameroonian context. As such he defines a family business as a type of enterprise where members of the same family control activities or work and actively participate in the management, and maintain a strong relationship between the family and the enterprise. Such enterprises possess unique characteristics, as compared to those with non-family characteristics, since they rely much on family members and kinsmen that influence the vision, perception and values that determine the structure and functioning of the enterprises. With regard to motives behind this business, family growth, personal occupation, extra family income and containment of jobless family members have usually been observed. The definition of a family business in our context therefore is very close to the one used by Amit and Villalonga (2006) and the objective version of Dyer (2006).

Business Sustainability: Business sustainability, also known as corporate sustainability is the management and coordination of environmental, social and financial demands and concerns to ensure responsible, ethical and ongoing success (Wigmore, 2013). According to the ‘Financial Times’, business sustainability represents resiliency over time-businesses that can survive shocks because they are intimately connected to healthy economic, social and environmental system. Such businesses create economic value and contribute to healthy ecosystem and strong communities. Some practices that foster business sustainability include: stakeholder engagement, environmental management system, life cycle analysis, reporting and disclosure etc.

Theoretical Framework: A theoretical framework is a collection of interrelated concepts linking to the area of study. It guides our research, determining what things we will measure, and what statistical relationships we will look for. It presents some theories related to the field of study together with some models connected to the study. Even though family businesses represent a dominant form of economic organization throughout the world (Beckhard and Dyer, 1983; Shanker and Astrachan, 1996), it is unfortunate that family businesses have received scant attention in the mainstream management literature, particularly with respect to the development of theories of the firm (James J. Chrisman, 2003). However, considering its number and contributions to the world economy, researchers are now interested in the development of theories on family businesses. This research will examine some of the theories related to the creation and management of family businesses, and also theories which are in line with the explanation of factors responsible for the non-sustainability of family businesses especially after the death of the initiators.

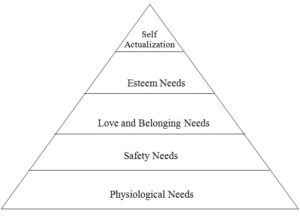

Maslow’s Hierarchy of Needs Motivation Theory: Maslow (1943) observed that human beings are driven by different factors at different times and that these driving forces are hierarchical, starting from the bottom layer to the top. Maslow then came up with the Hierarchy of Needs in which he attempted to capture these different levels of motivation. He also observed that the high needs do not appear unless and until the unsatisfied lower needs are satisfied. The different levels of needs also correspond to the different stages of life. The basic physiological needs at the bottom are predominant in infancy; safety needs come into focus in early childhood; esteem needs predominate in early adulthood and self-actualization only really comes into focus in mature adulthood.

Figure 1: Illustration of Maslow’s Hierarchy of Needs

The first level, at the bottom of the pyramid, consists of short- term basic needs, also known as physiological needs; food, warmth, water etc. The second level consists of longer-term safety needs; security, order, stability etc. The third level represents the social needs for affiliation, also known as “love and belonging”. At this level, the human beings want to have stable relationships. The fourth level represents the need for esteem. Within the different social groups human beings want to be recognized and admired as individuals who accomplish things; want prestige and power. Almost at the top of the pyramid, self-actualization is the desire to experience ever deeper fulfillment by realizing (actualizing) more and more human potential. At the very top of the pyramid is the desire for self-transcendence; to experience, unite with and serve that which is beyond the individual self (peak experiences): the unity of all being( Koltko-Rivera, 2006). This theory is in line with this research since it gives us reasons why people create family businesses. It is on the basis of the various needs that individuals create businesses. This is supported by Winter et al. (1998) who acknowledged that the economic necessity of earning a living and supporting a family is the underlying reason for starting and growing a business. At this level the motivation of creating a business is first to satisfy physiological and safety needs. Among other motivators, lifestyle and wealth accumulation goals play an important role in urging a family member or family members to start a business. Here, the motivation is the needs for self-esteem. Understanding the motivations of starting a business may help us understand how sustainable will the business be.

Stewardship Theory: This is a theory that explains the situation whereby when managers are left on their own, they will act as responsible stewards of the assets they control. This theory is an alternative view of the agency theory which explains the phenomenon whereby managers of businesses tend to act to their own self-interests at the expense of those who actually own the business (Barney and Hersterly, 2008). This theory specifies certain mechanisms which reduce agency loss such as tie executive compensation, levels of benefits, and also manager’s incentive schemes by rewarding them financially or offering shares that align the financial interest of executives to motivate them for better performance. It will be important to understand this theory in this study which is aimed at examining the sustainability of family businesses in Cameroon. The importance of motivating both family members and non-family members who occupy managerial positions in family businesses should not be undermined. When managers are offered shares through incentives schemes, they will be protecting their interests by protecting the business and hence making the business sustainable.

Agency Theory: Agency theory and stewardship theory are two interconnected theories that describe the relationship between two actors: the principal and the agent. Therefore, stewardship theory extends agency theory by integrating the views of other disciplines. The agency theory, also known as principal-agent theory is theoretically based on divergent interests, asymmetric information, opportunistic behaviour, and deals with the conflict of interest between an agent, who acts as the representative of the principal, and the principal who delegates work to an agent. This is always associated with agency costs as a result of conflict in a situation where the two have different interests to protect. In a situation where the principal and the agent have the same interests, no conflict of interest exists and no agency costs arise (Jensen and Meckling, 1976). Typically, an agent will possess more or better information, the decision situations about himself than the principal will do (Ross, 1973). As a result of this asymmetric information, two types of agency conflict can be distinguished: Adverse selection and moral hazard. Adverse selection describes a situation before contracting, where the principal unknowingly chooses an agent who is less performing, committed and industrious than the principal expected. Moral hazard describes a situation after contracting, where the agent acts on his or her own interests rather than the interests of the principal. Complete contracts, which anticipate and provide for every eventuality, can only exist if information is perfect and costless and people are unbounded in their mental capabilities (Williamson, 1975). But this is often not the case in reality, where people have bounded rationality (Simon, 1957). This leads to incomplete contracts between the principal and the agent. In order to control the adverse selection and moral hazard problems, principals have to invest in the recruiting process and align interests between themselves and agents. The costs related to the control of these agency problems are called agency costs. In family businesses, three different agency conflicts may occur, namely: family owner versus non-family manager, family owner versus non-family shareholder, and family owner versus family manager. We are going to examine these different agency conflicts situations separately.

Family Owner versus Non-Family Manager: Many family businesses would in many cases employ non-family managers because of lack of qualified members or lack of agreement as of which family members should manage the business. In this case the relationship between the family owner (principal) and the non-family manager (agent) appears deceptively as the case with non-family businesses. Family members are highly interested in the good performance and the future of the business since most of their lives depend on it (Andres, 2008). This high interest of the family members to the success of the business would lead to a very close monitoring of the non-family manager, a situation Demsetz and Lehn (1985) state that such concentrated ownership indicates a strong economic incentive to monitor the non-family manager and hence reducing agency costs. This close and more effective control of the non-family manager can decrease information asymmetries between family owner (principal) and non-family manager (agent). This would limit the possibilities of non-family managers using the business resources for their own purposes which always reduce the performance of the business and affect the owner’s interests negatively (Ang et al., 2000).

Family Owner versus Non-Family Shareholder: An agency conflict can also exist between a dominant shareholder and a minority shareholder. In publicly traded family firms, the family often holds large stakes while other shareholders hold only small stakes. In this case, information asymmetries and a conflict of interests may exist between the dominant shareholder and the minority shareholder. In particular, in family business groups where a family controls a large number of firms, minority shareholders can be disadvantaged. These family business groups often use a pyramidal structure in order to separate ownership from control. This means that a family directly controls a firm, which in turn controls other firms, each of which controls other firms and so on. Through this chain of ownership relations, the family achieves control over a large number of firms. Morck and Yeung (2003, p. 367) state that “such structures give rise to their own set of agency problems, as managers act for the controlling family, but not for shareholders in general.” Minority shareholders are used to bring in capital, but without receiving a majority of votes in one of the family business group’s firms. The conflict of interest increases when the family firm is managed by a family member. The information asymmetries between the family, as the dominant shareholder, and minority shareholders increase because the manager is a member of the family and shares more information with the family than he or she does with the external shareholders. Family management can lead to managerial entrenchment problems, which describe a situation where a family manager possesses so much power that he or she can act in his or her own interest or in the interests of the controlling family. In this case, external or minority shareholders are disadvantaged again.

Family owner versus family manager: Firms owned by a family are often managed by family members. In this case, agency costs may decrease, because there is no separation between ownership and control, Fama and Jensen (1983a). Principal and agent are unified in the family manager, who ideally acts in the interests of the family. The identity of the goals and interests between the family owner and family manager may lead to lower agency costs.

According to Miller and Le Breton-Miller (2006), family managers often have emotional relationships with their companies as their family’s wealth, personal satisfaction, and the satisfaction of the family are tied to firm performance. They observed that the Stewardship theory supports this view by describing family managers as stewards, who are intrinsically motivated by higher-level needs to act in the interests of the firm and/or the family. Stewardship theory is based on a different model of man and a different behaviour of individuals in comparison to agency theory, Davis et al. (1997), Donaldson and Davis (1991).

Resource-based View Theory: The resource-based view theory (RBV) aims at answering the question of why some firms outperform other firms. Apart from being used in family business research, the RBV has been used as an underlying theory by many studies in different fields of research. For example, Hitt et al. (2001b) show that human capital has an indirect and a direct effect on firm performance. Miller and Shamsie (1996) test the RBV and find evidence that in contrasting environments different types of resources (knowledge-based vs. property based) are the explanation of financial performance. In addition, family firm researchers have adopted the RBV to resolve family firm issues. The most widely known study using the RBV stems from Habbershon and Williams (1999, p. 1) who define “the bundle of resources that are distinctive to a firm as a result of family involvement as the ‘familiness’ of the firm.”This unique bundle of resources can arise when a family impacts a business. The interaction between a family, its members, and the business are inimitable for each family firm. Sirmon and Hitt (2003) identify five family firm-specific resources and attributes that have the potential to provide competitive advantages for family firms. In their resource management process model, they argue that family firms evaluate, acquire, shed, bundle, and leverage these resources in a different way than do non-family firms, resulting in a potential competitive advantage. These resources are human capital, social capital, survivability capital, patient financial capital, and governance structure.

Family Business Models: According to the Harvard Business Review Jan.23, 2015, a business model is a design for the successful operation of a business, identifying revenue sources, customer base, product, and detail financing. A successful family business can continue to grow and achieve for generations, but the nature of the family enterprise can often make managing the business and being part of the family at the same time very complicated. This increasing complexity has to be properly managed. This situation can be well handled if appropriate family business models are applied. In this research, we made use of two of such models; The Three-Circle Family Business Model which facilitates the understanding of the interactions that occur in a family-owned business, and a Multi-Level Family Business Choice Model which provides an actual decision-making process within a family-owned business.

The Three-circle Model of Family Businesses: The three circle family business system model was proposed and developed by Tagiuri and Davis in 1982. The idea was to create a tool such as a framework, for helping family businesses to analyze their existing business model at the succession time and to co-design a new one that the successor could execute to survive or grow. This framework clarifies, in simple graphic terms, the three interdependent and overlapping groups that comprise the family business system: family, business and ownership. As a result of this overlap, there are seven interest groups present, each with its own legitimate perspectives, goals and dynamics. The long-term success of family business systems depends on the functioning and mutual support of each of these groups.

The challenge for business families is that family, ownership and business roles involve different and sometimes conflicting values, goals, and actions. For example, family members put a high priority on emotional capital; the family success that unites them through consecutive generations. Executives in the business are concerned about strategy and social capital; the reputation of their firm in the marketplace. Owners are interested in financial capital; performance in terms of wealth creation. A three-circle family model is often used to show the three principal roles in a family-owned or -controlled organization: Family, Ownership and Management. This model shows how the roles may overlap. Everyone in the family (in all generations) obviously belongs to the Family circle, but some family members will never own shares in the family business, or ever work there. A family member is concerned with social capital (reputation within the community), dividends, and family unity. The Ownership circle may include family members, investors and/or employee-owners. An owner is concerned with financial capital (business performance and dividends). The Management circle typically includes non-family members who are employed by the family business. Family members may also be employees. An employee is concerned with social capital (reputation), emotional capital (career opportunities, bonuses and fair performance measures).A few people; for example, the founder or a senior family member; may hold all three roles: family member, owner and employee. These individuals are intensely connected to the family business, and concerned with any or all of the above sources of value creation. The three-circle model of family business is very important for the explanation of our work which is intended to investigate the sustainability of family businesses. It will be noticed that the mission and the structure of the family business with respect to the business, family and ownership has a lot to do with the sustainability of the family business. According to Jensen and Meckling (1976) the cost of reducing information asymmetries and their accompanying agency threats is lowest when owners directly participate in the management of the business. It therefore means that if most of the managers of family businesses are family members who also have ownership of the business (i.e those who fall in the region numbered 7, which is the intersection of the business, family and ownership), the agency costs will be greatly reduced, leading to a more profitability of the business and hence greater chances of sustainability.

Multi-Level Family Business Choice Model: Although the three circle model for family businesses facilitates our understanding of the interactions that occur in a family-owned business, it does not provide an actual decision-making process which may affect its sustainability. It is for this reason that the current research proposes a decision-making model for family-owned business that compliments the Tagiuri and Davis (1982) and Ward (1988) models of interaction. Hence, a Multi-Level Family Business Choice Model has come in to fill this gap.

Explanation of the Multi-Level Family Business Choice Model

The first level of the model requires the existence of a business opportunity requiring a decision; for example, the opportunity to extend a product line, or the consideration to dismiss an unproductive family employee. The second level consists of two prongs. The first prong is the current family situation. Members of the family business will assess whether the family situation is positive. If so, consideration of the business opportunity would continue to the next step. If the current family situation was deemed negative then consideration would stop. The second prong of level two entails the current business situation. For example, if the business was currently facing cash flow problems, then expansion at the current time would be unadvisable. If the family and business situations are considered positive then the opportunity should be considered further. The third level consists of two prongs. The first prong of level three concerns the direction of the family and the second prong concerns the direction of the business. That is, we consider whether deciding in the affirmative on the opportunity coincides with the mission statements of the family and of the business. If the objectives of the family and business are both being met then we would proceed to the fourth level of the decision making process. The fourth level entails analyzing the effect that deciding in the affirmative would have on the family and on the business. For example, a possible positive family effect could be an increase in the number of offices that exist, allowing for additional family members to assume management positions. A possible positive business effect would be an increase in sales. If both the family and the business are positively affected then the business opportunity should be pursued. We notice that this model has several layers to the actual decision-making process, but the order of these layers is very important.

This model is in line with this research work since it is intended to provide guidance in family business decision-making. In this case, if the decision-makers within a family business can objectively analyze the current status of the family and the business, interpret their family and business mission statements, and understand the outcome of the decision, then a good decision will be made which will help in the sustainability of the business even when the initiator dies. Due to the dual emphasis in decision making in this model, Koenig (1999) emphasized the need to place the family and business as a priority. For example, if the business mission statement emphasizes the goal of becoming a leader in the global economy, they may embark on the strategy of expansion. On the other hand, if the family mission statement emphasizes on the family legacy, they will embark on the strategy of sustaining the business from generation to generation. In this case, sustainability factor which is of interest to this study will have to be critically examined

Empirical Literature: This section reviews some empirical studies of the literature concerning family businesses. Olson et al. (2003) in their study defined a family business as a business that is owned and managed by one or more members of a household of two or more people related by blood, marriage or adoption. Their work was aimed at identifying strategies for families to utilize in order to increase the success of both their business and their family. The review of this work is essential to our study given that we aim at underscoring not only sustainability but also non-sustainability issues plaguing family-owned and managed businesses in Cameroon. Apart from finding out that aspects like business assets, age of the business, personnel management, owner’s weekly hours in the business, family employees and hiring temporary help were positively associated with increased achievements for both the business and the family, the result of their study also showed that the success of the business depended on family processes and how the family responded to disruptions rather than simply how the owner managed the business alone. For Olson et al., (2003), when families let tension build up within the family, the business suffers. Single-generation households were associated with less business revenue; however, if during hectic periods in the business the owner hired temporary workers rather than asking friends and relatives to help out, success increased. The family supply of labour to the business was key to whether the family had a net positive effect because family employees had a much larger effect on revenue than other variables. Olson et al recommended that consultants and family business programs need to help business owners realize the relationship between business revenue and employing relatives.

Miller et al., (2007) on their part adopt an empirical approach of small firms that are owned and managed by their founders. They compare family-owned and managed businesses with non-family businesses. Their findings showed significant support for aspects of stewardship perspective of family-owned businesses, and no support for any element of the stagnation perspective. According to them, family-owned businesses have unique characteristics of stewardship. The owners are said to care deeply about the long term prospects of the business, in large part because their family fortune, reputation and future are at stake. Miller et al., (2007) claim that the stewardship of family-owned businesses is said to be manifested by unusual devotion to the continuity of the company, by more assiduous nurturing of a community of employees and by seeking out closer connections with customers to sustain the business. Although the main thrust of our research work falls apart with the above point of view, it however goes in tandem with their second perspective of family-owned businesses which proposes that family-owned businesses are unusually subject to stagnation. This is because they are said to face unique resource restrictions, embrace conservative strategies, eschew growth, and are therefore doomed to short life. Kraiczy (2013) in his work accepts the challenges of developing a general definition of family business. He tries to give a definition of family business which according to him is the widely accepted definition. He affirms that this difficulty is due to the heterogeneity of family businesses. To him, a business is said to be a family business if one of the following characteristics applies; a family is the owner, the business is family-managed, or the business is controlled by a family. He equally delves into the presentation and analysis of the theories that are associated to family businesses. He presents four of such theories namely: the resource-based view theory, the social capital theory, the agency theory and the stewardship theory. He went further to compare the agency theory and the stewardship theory, taking into consideration the psychological mechanisms and the situational mechanisms. In our work, we attempt to define a family business taking into consideration the Cameroonian context. In this light, we view family business as a type of enterprise where members of the same family control the activities or work and actively participate in the management, and maintain a strong relationship between the family and the business. On the other hand, as our work seeks to determine and analyze the factors responsible for the sustainability of family-owned and managed businesses, especially when their initiators die, the agency theory and the stewardship theory become imperatively important since the sustainability of most businesses depends to a larger extent on management which itself is always subjected to the agency conflict between the owners, managers and employees at different levels. The detail study and understanding of these theories by the owners of family businesses will reduce this phenomenon which is always accompanied by the agency costs, and hence will improve on the profitability of their businesses which may equally enhance sustainability. According to Bertrand & Schoar (2006), involvement of families in businesses is very common in Latin America, Africa and the Middle East, and parts of Western Europe and Asia. They attempt to bring out some reasons why family businesses are so prevalent and the implications of family control for the governance, financing and overall performance of these businesses. They also try to verify whether family businesses evolve as an efficient response to the institutional and market environments, or whether they are the outcome of cultural norms that might be costly for corporate decisions and economic outcomes. To them a culture based on strong family ties may sometimes impede economic development. Their idea is supported by a view that dates back at least to Max Weber’s 1904 essay, which argues that strong cultural predetermined family values may place restraints on the development of capitalist economic activities. They put forward a similar argument developed by Fukuyama (1945), that in societies where people are raised to trust their closed family networks, they are also taught to distrust people outside the family, which impedes the development of formal institution in the society. That under such cultural views, suboptimal economic organizations can emerge when parents put too much weight on keeping the business in the family, maybe due to a strong sense of duty towards other family members or a selfish desire to turn the business into a family legacy. In their attempt to give reasons why family businesses exist and a lot of importance is given to them, they examine the words of Giovanni Agnelli, the late patriarch of the Italian industrial dynasty (as quoted in Betts, 2001). “The family company is an inheritance to be protected and handed on. It is the outcome of the next and each generation’s commitment to the last”. Similarly, John Walton of Wal-Mart describes his family’s perspective on their involvement with Wal-Mart as follows (Weber and Lavel, 2001): “We view the company really more as a trust, as a legacy we are responsible for, rather than something we own”. The underlying idea is that the links that bind current generation to future ones provide family businesses with a focus of maximizing long-run returns and the desire to pursue investment opportunities that more myopic widely held firms would not. To them, another important reason for the existence of family businesses is that family ties serve as a second-best solution in countries with weak legal structures, since trust between family members can be a substitute for missing governance and contractual enforcement. They present other reasons which include: human capital availability, politics; since it is believed that political connections can provide large benefits for private firms, especially in economies with high levels of corruption (Fisman, 2001; Faccio, forthcoming 2006). Family values, Nepotism, legacy, inheritance norms are some of the factors they believe influence the existence of family businesses. This work of Bertrand & Schoar (2006) is very much in line with this research work which seeks to determine the sustainability of family businesses especially after the death of their initiators. In this light, we notice that the sustainability of a business depends to a large extent on some cultural aspects as well as the reasons for which the business was created. If a family business is created in line with the view of Giovanni, which to him a family business is an inheritance to be protected and handed on from one generation to the other, it will certainly be protected and sustained for family legacy. On the other hand, if the initiator of the business created it to survive and sustain his/her life economically, the business will likely collapse after his/her death. In Cameroon, several works have also been done with respect to family-owned businesses and issues relating to their productivity. Tabi and Fomba (2013) have attempted to explain productivity performance between family and non-family firms in Cameroon, and also to determine whether the relative contribution to the social and economic development of a country by family businesses as opposed to non-family businesses is related to differences in production technology and production efficiency. Their work portrays the main features of corporate governance model of Cameroonian businesses. They concluded that family members are heavily involved in family firms than those of non-family firms which are mostly managed externally. They observed that non-family businesses employ more labour and invest more in capital compared to family-owned and managed businesses. Although their work provides evidence-based policy recommendation to enhance the sustainability and competitiveness of family and non-family enterprises in Cameroon, it fails to underline the need for the sustainability of family-owned businesses. Our work fills this gap by stressing not only on the need for sustainability of family-owned businesses but also on the factors responsible for the non-sustainability of family-owned and managed businesses.

Research Design and Methodology

Our research is an exploratory and causal study in which we made use of the survey and descriptive design and using a sample given that the population under study was large, making it difficult to access all the necessary and required information. We then resorted to conducting interviews and administering questionnaires to some selected respondents especially the initiators or proprietors of family-owned businesses, the managers, the accountants, influential family members, other workers etc, in our sampled family-owned and managed enterprises. The non-probability sampling techniques were used for this study; convenience sampling, judgmental sampling, and quota sampling were employed.

Data Analysis and Interpretation of Results

The data collected for this study were analyzed using descriptive statistics and logic regression using SPSS 17. A logistic regression analysis was employed using STATA 14, given that the dependent variable, sustainability of family-owned and managed businesses (S) is dichotomous or binary and takes values 1 for a business that is profitable and deemed to live long and 0 otherwis

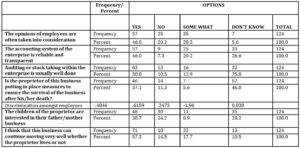

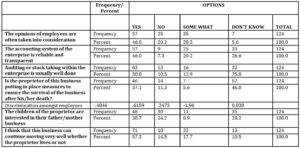

Table 1: Summary views of respondents concerning decision making

within the family business

The responses from the tables above are supported by the views of some former workers of some collapsed family businesses following some interviews held with them. As for the difficulties they faced when running the businesses, many indicated the constant intervention of the business owners in some technical issues such as recruitment. They always impose some family members in some posts of responsibility irrespective of their expertise.

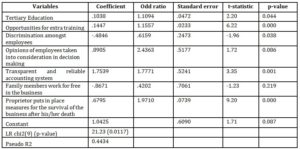

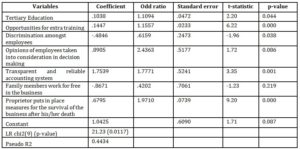

Table 2: Summary statistics of the result of the logistic model

Following the logistic model analysis, the independent variable “Proprietor puts in place measures for the survival of the business after his/her death” is very important for the sustainability of family businesses; with a t-statistic value of 9.2 at 1% level of significance. It is therefore evidence that if this variable is not well taken care of, the death of the proprietor will lead to the collapse of his/her business.

Discussion

Family businesses collapse after the initiators die because the notion of business sustainability was not in their mind when they were creating these businesses, and hence did not put measures in place to ensure their continuity after they die. This was supported by about 93% of the family business owners during a series of interviews with them. Businesses that offer extra training opportunities to their employees tend to be more profitable and sustainable than those that do not offer such opportunities. A family business will be more profitable and sustainable if the accounting system put place is transparent and reliable. Considering the opinions of the employees when taking decisions within the family business plays a vital role in the profitability and sustainability of a family business. When the initiators of family businesses encourage their children to participate and develop interest in their businesses, it will enhance the sustainability of the businesses. A bad tax system will affect the sustainability of family businesses.

Implications of Findings: The initiator of a family business should choose his/her successor when he/she is still relatively young and energetic. They should avoid changing employees so often since workers gain more experience as they spend more time in a particular business. In addition, there are costs incurred as a result of employees’ rotation and training. More attention should be placed on the recruitment process so as to select well qualified workers for the various posts of responsibility. Family business owners should constantly offer training opportunities to their employees. Family business owners should market their businesses to the younger generation by letting them see the benefits and rewards they derive from their businesses, instead of continuously letting their children understand how stressful the businesses are to them. Family business owners should always choose independent firms that can provide a candid appraisal of their accounting department’s operations so as to avoid fraud. The government should put in place regulations together with follow-ups to ensure that family businesses are being operated within the prescribed norms, and also to protect them from foreign threats such as importation favours. The government should create an enabling environment for the smooth running of the various family businesses through the provision of social amenities such as security, health facilities, infrastructures, energy, water etc. Tax laws should be simplified to the understanding of the common man and tax payers should be well informed of their rights so as to avoid exploitation whereby tax administrators.

Conclusion

The population under study was not homogeneous since the sub-groups were very different in size. On the field we realized that the businesses were very different in size and carrying out different operations. They therefore have different characteristics with different management principles. Most of the proprietors were very busy and mobile, and were reticent to give out information concerning their businesses. These made the realization of this research difficult. This study reveals that only about 17% of the businesses were considered sustainable to the second generation given that they have existed for at least twenty-five years. On the other hand, just about 7% existed for at least fifty years and are therefore considered as having survived into the third generation. This is very low compared to the finding by Family Business Consulting (2009) which indicates that only about 30% of family businesses survive into the second generation, 12% are still viable into the third generation and only about 3% of all family businesses operate into the fourth generation and beyond. This research brings out some factors that are seen to be critical to the sustainability of family businesses such as: poor succession planning which is as a result of the fact that the business initiators do not always have the notion of sustainability in mine; poor tax system and lack of transparent and reliable accounting system leading to corruption; discrimination among employees leading to unqualified workers occupying some key positions because they are family members, lack of children’s interests in their parents businesses together with lack of the involvement of their children in the management of these businesses, and lack of update of employees through training programs. Also, family business owners are not often willing to incorporate non-family shareholders and hence mostly operate with little capital which may not be able to enable them withstand competition within the various industries.

For better and recommendable findings, further research on family business sustainability should be carried out separately in the various sectors; for example in the transportation sector or educational sector.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Allouche, J., Amann, B., Jaussad, J., and Kurishina, T. (2008): The impact of family control on the performance of financial characteristics of family versus non-family businesses in Japan. A matched-pair investigation: Family business review; 21, 315-329

Google Scholar

- Anderson, Ronald C., and David M. Reeb (2003): “Founding-Family Ownership and Firm Performance: Evidence from the S&P 500”. Journal of Finance, p. 58, 1301 – 1328.

Google Scholar

- Anderson, R. C., &Reeb, D. M. (2004): “Board composition: Balancing family influence in S&P 500 firms”. Administrative Science Quarterly, p. 49, 209–237.

Google Scholar

- Anderson, R. C., Mansi, S. A., &Reeb, D. M. (2003): “Founding-family ownership and the agency cost of debt”. Journal of Financial Economics, p. 68, 263–287.

Google Scholar

- Astrachan, J. &Shanker, M. (2005): “Family Businesses’ Contribution to the U.S. Economy: Closer Look”. Family Firm Institute.

Google Scholar

- Ayyagari, M., Demirguc-Kunt, Maksimovic V. (2011): “Small vs. Young Firms across the World: Contribution to Employment, Job Creation, and Growth”. Policy Research Working Paper Series 5631.The World Bank

Google Scholar

- Beckhard, R., Dyer Jr., W.G., (1983). Managing continuity in the family owned business. Organ. 12 (1), 5–12.

- Bengtson, V.L. (2001) “Beyond the Nuclear Family: The Increasing Importance of Multigenerational Bonds”. Journal of Marriage and Family, 63(1): 20-31. DOI: 101111/j. 1741-3737. 2001.00001. x.

Google Scholar

- Bennedsen, M. and Nielsen, Kasper, M., (2010): “Incentive and Entrenchment Effects in European Ownership”, Journal of Banking and Finance p. 34.

Google Scholar

- Chrisman, J.J., Chua, J.H., Steier, L., (2002). The influence of national culture and family involvement on entrepreneurial perceptions and performance at the state level: Entrep. Theory Pract. 26 (4), 113–130

Google Scholar

- Churchill, G. A. (1996). Basic Marketing Research (3rd), Fort Worth, TX: The Dryden Press.

- Dyer, W. G. Jr., (2006). “Examining ‘Family Effect’ on Firm Performance”: Family Business Review, Vol. 19, No. 4, P. 253-273

Google Scholar

- Eugene F. Fama and Michael C. Jensen (1983): Agency Problems and Residual Claims: Journal of Law and Economics, Vol. 26, No. 2 (Jun., 1983), pp. 327-349.

Google Scholar

- Fafchamps, M., El Hamine, and Zeufack, A. (2002) “Learning to Export: Evidence from Moroccan Manufacturing,” CSAE Working Paper Series, WPS/2002-02, Oxford University

Google Scholar

- Fomba, E. (2007): Managing Human Resources in the Familistic Family Business in Cameroon, (pp.56-72) in Gupta, ; Levenburg, N.; Moore, L.; Motwani, J.; and Schwarz,T. (eds.). A Compendium on the Family Business Models around the World (ten volumes), Hyderabad: ICFAI University Press

- Fred N. Kerlinger, Foundation of Behavioral Research; 3rd (New York: Holt, Rinehart and Winston, 1986) p. 279

- Fritz B. Simon (2009): The Success Gene of Family Businesses Government of Cameroon (2009): Growth and Employment Strategy Paper: Reference Framework for Government Action Over the Period 2010-2020”. Ministry of Planning, Programming and Regional Development

- Government of Cameroon (2013): (PDF) (in French). Retrieved 17 March 2013 “Background Note: Cameroon” 2010. Government of Cameroon. Accessed 11 March 2013

- Heck, R.K.Z., and Stafford, K. (2001). “The Vital Institution of Family Business: Economic Benefits Hidden in Plain Sight”: In G.K. McCann & N. Upton (Eds.), Destroying myths and Creating value in Family Business (pp. 9-17). Deland, FL: Stetson University Press. Hellerstein, J. K., D. Neumark, and K

- James W. Lea (1991): “Keeping it in the Family”: successful succession of family business.

- James H. Davis, F. David Schoorman and Lex Donaldson (1997): Toward a stewardship theory of management. The Academy of Management Review Vol. 22, No. 1 (Jan., 1997), pp. 20-47

Google Scholar

- Jay B. Barney and William S. Hesterly (2008): Strategic Management and Competitive Advantages. Pearson Prentice Hall p. 273

- Jensen, M. C., & Meckling, W. H. (1976): Theory of the firm: Managerial behaviour, agency costs, and ownership structure. Journal of Financial Economics, 3: 305-360.

Google Scholar

- Kaplan, B. & Duchon, D. (1988): Combining Qualitative and quantitative methods in Information System Research: A case study MIS Quarterly Vol. 12, No 4 (Dec., 1988), pp. 571-586

Google Scholar

- Klein, S. (2000). “Family Businesses in Germany: Significance and Structure”. Family Business Review, 13, 157-181.

Google Scholar

- Koenig, N. (1999). You can’t fire me: I’m your father. Franklin, TN: Hillsboro Press

- Koltko-Rivera, M.E. (2006) Rediscovering the Later Version of Maslow’s Hierarchy of Needs: Self-Transcendence and Opportunities for Theory, Research, and Unification. Review of General Psychology, 10(4), 302–317.

Google Scholar

- Kraiczy N. (2013) Innovations in small and medium sized family firms, an analysis of innovation related top management team behaviours and family firm- specific characteristics. Springer .p.173

- Marianne Bertrand and Antoinette Schoar (2006): The Role of Family in Family Firms: Journal of Economics perspectives Vol. 20, Spring 2006, pp. 73-96.

Google Scholar

- Maslow, A. H. (1943). A theory of human motivation: Psychological Review, 50, 370 –396.

Google Scholar

- Miller D., I Le Breton-Miller (2006): Family governance and Firm performance: Agency, stewardship, and Capabilities. Family business review 19(1), 73-87

Google Scholar

- Morck, R. and B. Yeung (2003): “Agency Problems in Large Family Business Groups.” Entrepreneurship: Theory & Practice 27(4): 367-382.

Google Scholar

- Neuman, L. W. (2000). Social Research Methods: Qualitative and Quantitative Approaches (4th), USA: Allyn and Bacon.

- Okpukpara, B. (2009). Strategies for Effective Loan Delivery to Small Scale Enterprises in Rural Nigeria: Journal of Development and Agricultural Economics 1(2), 041-048

Google Scholar

- Pashev, Konstantin. (2005).Corruption and Tax Compliance: Challenges to Tax Policy and `Administration. Centre for the Study of Democracy, Sofia, Bulgaria

Google Scholar

- Perdrix, P. (2005). Il faut privilégier l’emploi, Jeune Afrique Intelligent, http://www.jeuneafrique.com/partenariat.

- Perreault, G. (2000). La relève dans l’entreprise familiale : Comment faire passer les descendants d’un rôle de figurant à un rôle de réalisateur? Revue Organisation et Territoires, vol.9, n° 1.

- Olson, P. D., Zuiker, V. S., Danes, S. M., Stafford, K., Heck, R.K. Z., & Duncan, K. A. (2003). The impact of the family and the business on family business sustainability: Journal of Business Venturing, 18(5), 639–666

Google Scholar

- Troske (2002) “Market Forces and Sex Discrimination, “Journal of Human Resources, 37(2).

- Ross, S. (1973), “The Economic Theory of Agency-The Principal’s Problem”, :American Economics Review, Vol. 63, pp. 134-139.

Google Scholar

- Rothausen, T.J. (1999). ‘Family’ in organizational research: A review and comparison of definitions and measures. Journal of Organizational Behavior,20,817-836.: http://www.businessdictionary.com/definition/business.html#ixzz3Wi5VLIV6

- Shanker, M.C., Astrachan, J.H., 1996: Myths and realities: family businesses’ contributions to the US economy. Fam. Bus. Rev. 9, 107–123

Google Scholar

- Tabi Atemnkeng J. and Fomba Emmanuel M. (2013): Comparative Business Practices and Productivity Performance between Family and Non-Family Firms: Perceptions and Poverty Reduction Effects in Cameroon.

- Tchankam J. (2000). L’entreprise Familiale au Cameroun: Cahier 2000-05 CREF:

- Weiping Liu, Haibin Yang & Guangxi Zhang (2010). “Does family business excel in firm performance? An institution-based view”: Asia Pacific Journal of Management