Introduction

Information and communication technologies (ICT) affect society as a whole, the world economy, including all sectors of the economy. New and evolving information and communication technologies are bringing about innovations that are digitally transforming the economy and society through digital technologies. Digital technologies represent digital innovations that are an opportunity and a challenge for society as a whole, involving government, business, and the public, transforming mainly activities, processes and models. In the current situation, companies are under increasing pressure from the digital transformation, which includes elements such as: digitization and digital technologies, and consequently are influenced by innovative competitors. Companies in the financial services industry are also under increasing pressure: digital transformation, innovative FinTech competitors, industry convergence, financial services availability, customer expectations, growing volume and speed of financial operations, including transactions, goals, profitability, which represents the need to adapt and change business in the form of innovation.

Literature Review

Enterprises and entrepreneurs in emerging economies face a set of opportunities and challenges from the Fourth Industrial Revolution (4IR) – Industry 4.0 (Vuong, 2020). Global industry, according to Scaravetti & François (2021), is at the center of its fourth industrial revolution, driven by the emergence of new digital solutions. The Fourth Industrial Revolution is affecting all levels of global society, increasing the incomes and quality of life of the world’s population by shifting from simple digitization to a much more complex form of innovation based on combining multiple technologies in new ways (Schwab, 2016). The 4IR is realized by the combination of numerous physical and digital technologies such as sensors, embedded systems, cloud computing and internet of things (IoT) (Cevik Onar & Ustundag, 2018). The driving force and most important element of the 4IR is digitalization, which is causing the greatest transformation of the economies of countries and societies, which will change what is happening with its speed and power. Digitalization is the most significant technological trend (Leviakangas, 2016) and the role of digitalization in the economy has increased over the years, especially after the advent of the 4IR (Yuan et al, 2021). Gu et al (2021) state that the 4IR was significantly affected by various economic sectors, including the financial sector, which dramatically changed the way it operates, thus providing new opportunities. According to Bhandari (2021), the financial sector or the financial services industry is a segment of the economy that includes the services of banks, investment houses, creditors, financial companies, insurance companies and others, and was one of the first sectors to experience digital transformation. The financial world is currently observing real changes and fluctuations, most of which are perceived as positive and helping to transform the financial sectors (Aghav-Palwe & Gunjal, 2021). Snedaker and Rima (2014) report that, in the last few decades, the financial services industry has become fully electronic and financial services companies rely on instant access to real-time financial data worldwide. The financial sector, and banking in particular, is a dynamic industry with strong competition for products and services, leading to the growth and transformation of companies to outperform the competition (Machkour & Abriane, 2020).

Digitalization precedes digitization, which, according to Brenner and Kreiss (2016), represents a material process of converting the analog format of information into digital bits. Digitization characterizes Bican and Brem (2020) as a technical process in which analog information is transformed into a digital format. According to Xie and Matusiak (2016), digitization is the process of creating digital representations of information sources recorded on analog media. Digitization is the process of converting an analog signal or code into a digital signal or code (Lee, 2001). Gartner (2022) defines digitization as the process of changing an analog form to a digital form that represents digital activation, and no other kinds of changes in the process itself occur when the form changes. Digitization precedes digitalization, without which digitalization cannot occur. Digitalization is defined by Brenner and Kreiss (2016) as a way of restructuring many domains of social life around a digital communication and media infrastructure. According to Fielke, Taylor and Jakku (2019), digitalization consists in introducing digital technological innovation into existing (organizational, industrial, and social) systems in a way that changes their functioning. Digitalization, according to Gartner (2022), is the use of digital technologies to change the business model and provide new opportunities to generate revenue and value, which is the process of transition to a digital business. Gartner’s definition of digitalization focuses on changing business models rather than social interactions. Digitalization is multifaceted and involves the use and application of a wide range of technologies for a variety of purposes, such as enabling better access to markets and end-users to greater integration of business processes or increasing business capacity information technology (IT), etc. (OECD, 2021). According to Ritter and Pedersen (2020), digitalization is an application of digital technologies and, together with digitization, they represent major trends that affect many aspects of business.

We are experiencing a period of intense digital transformation of our society, in which the integration of various technologies (artificial intelligence, sensor networks, blockchain, 3D printing and others) with digital data changes every aspect of our daily lives (Craglia, Hradec & Troussard, 2020). Digital transformation (DT) according to Fischer et al (2020), is changing societies and industries and is driven by the convergence of social, mobile, cloud and smart technologies as well as the growing need for automation and integration. A profound change in business is digital transformation, which accelerates business activities, processes, competencies, models, to take full advantage of the changes and opportunities in digital technology and its impact on society in a strategic and priority way (Bican & Brem, 2020). DT is the integration of digital technologies into business processes (Liu, Chen & Chou, 2011) based on the direct and indirect impact of the use of digital technologies and techniques on organizational and economic conditions on the one hand and new products and services on the other (Pousttchi, 2020). According to Paavola, Hallikainen and Elbanna (2017), digital transformation is marked by the use of new digital technologies to enable significant business improvements in operations and markets, such as improving the customer experience, streamlining operations or creating new business models. Vial (2019) states that DT is a process that aims to improve an entity by initiating significant changes to its characteristics through a combination of information, computing, communication and interconnection technologies. DT represents a qualitative change in the company’s strategy and business processes under the influence of extensive digitization in the company’s business management processes (Obukhova, 2020). According to Deryzemly and Ter-Grigoryants (2021), digital transformation is a way of doing business that uses information and digital technologies. Digital transformation involves profound changes taking place in society and industry through the use of digital technologies (Awarwal et al, 2010). The concept of digital transformation according to Syabek, Suieubayev and Utegenov (2020) was created by combining personal and business IT environment and encapsulates the transformation effect of new digital technologies – SMACIT (social, mobile, analytical, cloud technologies and the internet of things). Digital transformation refers to unprecedented disruptions to society, industry, organizations stimulated by advances in digital technologies such as: artificial intelligence, big data analytics, cloud computing and the internet of things (Feroz, Zo & Chiravuri, 2021). According to Henriette et al (2016), the dimensions of digital transformation are digital technologies and user experience.

Digital technologies are transforming today’s economies and can be seen as part of the current technological paradigm based on information and communication technologies (Reljic, Evangelista & Pianta, 2019). In the process of digital transformation, digital technologies create disruptions that trigger strategic responses by organizations seeking to change their value creation pathways while managing structural changes and organizational barriers that affect both positive and negative outcomes of the digital transformation process (Vial, 2019). Bhardwaj et al (2013) consider digital technologies as a combination of information, computing, communication, and connective technologies that fundamentally transform business strategies, business processes, business opportunities, products and services and key business relationships in the extended business networks of different companies from different industries and sectors. Digital technology is a highly interconnected organizer of innovation in the platform and digital environment with transformational changes in business (Bican & Brem, 2020). The trend in the digital economy is represented by digital technologies (UN, 2019) and according to Laxman (2021) digital technology supports the use of various devices that allow access to cyberspace, the use of digital audio, video and information and communication technologies. Digital technology is the result and foundation of the development of digital innovations, which represent the innovation of products, processes or business models through digital technology platforms as a means or goal within and between organizations (Ciriello, Richter & Schwabe, 2018).

Digital technologies or 4IR technologies are: artificial intelligence (AI), big data analytics (BDA), blockchain, cloud computing (CC), edge computing, quantum computing, internet of things (IoT), machine learning (ML), deep learning (DL), advanced manufacturing, additive manufacturing (AM) – 3D printing, virtual reality (VR), augmented reality (AR), robotics process automation (RPA), digital twin, sensors, cybersecurity, embedded systems, mobile internet technologies, simulation, horizontal and vertical integration, B2G interactions, enterprise resource planning (ERP), social media, customer relationship management (CRM), electronic invoicing, radio frequency identification (RFID), e-commerce, high-speed broadband, supplier-customer management (SCM), e-booking and orders (PwC, 2017; Cevik Onar & Ustundag, 2018; Sarvari et al, 2018; UN, 2019; Hoosain, Paul & Ramakrishna, 2020; Aquilani et al, 2020; Craglia, Hradec & Troussard, 2020; Gupta, Mothlagh & Rhyner, 2020; Feroz, Zo & Chiravuri, 2021; OECD, 2021). Key and most common types of digital technologies include:

- Additive manufacturing known as “3D printing” is a group of manufacturing processes in which three-dimensional parts are constructed by adding layers of materials to dot, line or planar surfaces (Hassanin & Jiang, 2015). 3D printing technology enables customized production of materials with high accuracy and resolution (Blessy et al, 2020). Gupta, Mothlagh and Rhyner (2020) refer to AM as the process of creating three-dimensional solid objects from a digital file using additive processes, where the object is created by placing successive layers of material by an additive process until the object is created. AM techniques are used in various industries to create physical prototypes as well as parts for end use (Paolini, Kollmannsberger & Rank, 2019).

- Augmented reality is, according to Gupta, Mothlagh and Rhyner (2020), a visualization technology that adds digital elements to a live image, often using a camera on a smartphone. AR is a direct or indirect view of the real-world physical environment in real time, which has been enhanced by the addition of virtual machine-generated information (Carmigniani & Furht, 2011).

- Artificial intelligence is, according to Voda and Radu (2019), a set of computing technologies that attempt to extend and expand human intelligence. AI is the use of science and technology (software or hardware) to create intelligent machines that can make and / or act on decisions that usually require organic intelligence (Gupta, Mothlagh & Rhyner, 2020). Frankenfield (2021) states that AI is about simulating human intelligence in machines that are programmed to think like humans and imitate their actions. The goals of artificial intelligence include: learning, reasoning, and perception (Bloomberg, 2018).

- Big data analytics is a logical extension of business intelligence, especially in the field of unstructured data processing and the necessary data analysis, and within the ecosystem, these two approaches to data work complementarily (Černý, 2020). According to Gartner (2022), big data is a large-scale, high-speed, and diverse information asset that requires cost-effective and innovative forms of information processing that enable better visibility, decision-making, and process automation. BDA uses effective analytical techniques to discover hidden patterns, correlations, and other findings from big data (Gharajeh, 2018). big data refers to large amounts of data produced very quickly by a large number of diverse sources (Gupta, Mothlagh & Rhyner, 2020).

- Blockchain is a distributed database that is organized as a list of ordered blocks where the blocks are fixed (Casino, Dasaklis & Patsakis, 2019). According to Christidis and Devetsikiotis (2016), blockchain is a distributed data structure that replicates and shares among network members and also represents a protocol whose records are dosed into time-stamped blocks. Each block is identified by a cryptographic hash, and each block refers to the hash of the block that preceded it, thus creating a link between the blocks, creating a blockchain (Christidis & Devetsikiotis, 2016).

- Cloud computing is the provision of computing services including servers, storage, databases, networks, software, analytics, and intelligence through the Internet cloud to offer faster innovation, more flexible resources, and economies of scale (Microsoft Azure, 2021). Jin et al (2010) state that CC refers to hardware, system software and applications provided as services over the Internet. According to Firdhouse, Ghazali and Hassan (2012), the CC architecture consists of physical hardware, virtualized hardware and cloud business layers, which represent the three main categories of CC and are: Infrastructure as Service (IaaS), Platform as Service (PaaS) and Software as Service (SaaS). CCs are a model that enables ubiquitous and convenient on-demand network access to a shared set of configurable computing resources (for example: networks, servers, storage, applications, and services) that can be quickly secured and released with minimal management effort or service provider interaction (Gupta, Mothlagh & Rhyner, 2020).

- Internet of things, according to Gillis (2021), is a system of interconnected computing devices, mechanical and digital machines, objects, animals or humans that are provided with unique identifiers (UIDs) and the ability to transmit data over networks without requiring interconnected interactions, human-to-human or human-to-computer. According to Gupta, Mothlagh and Rhyner (2020), IoT is a network of billions of interconnected devices or systems (“things”) that can be remotely controlled over the internet and collect and exchange data that can be analyzed and aggregated to monitor, maintain, and improve consumer product and service delivery processes. IoT is part of a society-wide transformation (industry, consumers, and the public sector) and is a factor in the wider digital transformation of physical process control – providing the ability to insert electronic devices into physical world objects and create smart objects that communicate with the physical world using capture or control, and IoT enables networking between intelligent objects, applications, and servers (Liberg et al, 2020). IoT and advanced analytics is the connection with knowledge-based technology and machine learning (Mesároš et al, 2018). The IoT ecosystem consists of intelligent web-connected devices that use embedded systems, such as processors, sensors, and communications hardware, to collect, send, and act on data they obtain from their environments. IoT devices share data from sensors that they collect by connecting to an IoT gateway or other peripheral device where the data are sent to the cloud so that they can be analyzed or analyzed locally (Techtarget, 2020).

- Machine learning is considered a subset of AI, exhibits experiential learning associated with human intelligence, and has the ability to learn and improve its analysis using computational algorithms (Helm et al, 2020). ML is the process of training a machine by developing algorithms to find patterns in a huge amount of data. (Gupta, Mothlagh & Rhyner, 2020). ML represents the field of artificial intelligence and refers to a concept from which computer programs can automatically learn and adapt to new data without human intervention – which means that the computer has a complex algorithm or source code that allows the machine to identify data and make predictions around data it identifies (Frankenfield, 2022).

- Robotics process automation is the automation of service tasks that reproduce human work, and automation is performed using software robots or using AI algorithms and techniques that are able to perform accurate and repetitive tasks (Ribeiro et al, 2021). RPA is used to automate basic tasks through software or hardware systems that run in a variety of applications and work like humans (Frankenfield, 2022). Lawton (2022) states that: RPA is the use of AI and ML software to handle high-volume, repeatable tasks, which may include: queries, calculations, and maintenance of records and transactions.

The application of digital technologies is possible in all sectors, no doubt also in the financial services sector, where these technologies are referred to as financial technologies and improve business operations and the provision of financial services. Financial technologies – “FinTech” are revolutionizing the financial services industry at an unbeatable pace (Frost et al, 2019; Panos & Wilson, 2019). According to Joia and Cordeiro (2021), the financial sector is experiencing an accelerated transformation process shaped by FinTech. According to Bhandari (2021), FinTech is a fusion of finance and technology, which means using technology to better provide and increase the range of financial services. The Fourth Industrial Revolution spread to financial technology or even FinTech and created a new business model based on financial services provided through important technological innovations (Shin & Choi, 2019). The National Bank of Slovakia (2021) states that FinTech is a new technology-based approach to finance that can lead to new business models for applications, processes or products, which can have a significant impact on financial markets, institutions and financial services. FinTech supports a paradigm shift that does not count on the products or services provided as well as on who provides them and how they are provided (Bayón & Vega, 2018). According to Machkour and Abriane (2020), the main FinTech technologies are: artificial intelligence, blockchain and cryptocurrency technology, robotics – robo assistants, and offer services in the areas of: mobile and digital payment systems, banking APIs, personal finance, retail and corporate investments, P2P lending, mass finance, asset management, money transfer, important data and analysis, financial platforms, InsurTech, RegTech and next generation banking. Deloitte (2021) states that digital technologies – artificial intelligence, robotics, blockchain are revolutionizing the financial services industry. Digitalization, in particular its link to finance, involves a wide range of technological developments such as big data, artificial intelligence, mobile platforms, blockchain and the internet of things (Sustainable Digital Finance Alliance, 2018). Bitcoin and the blockchain technology on which it is based are key drivers of the accelerated pace of the Fourth Industrial Revolution in finance (Su et al, 2020).

Digital technologies have changed the way we do business from business to business in terms of what they sell, how they sell, and they also place new demands on the company’s capabilities (Ritter & Pedersen, 2020). In many industries, digital technologies are at the heart of marketing and production strategies, and their transformational power is changing traditional business models, production chains and processes leading to the emergence of new products and services, platforms and innovations (Okhrimenko et al, 2019). By successfully integrating digital technologies into business activities and models, the company becomes digital. The integration of innovative ubiquitous technologies and ambient intelligence (AmI) is represented in almost all business sectors and areas and enables companies to optimize and streamline business processes, strengthen their market position and increase their competitiveness (Bolek, 2020).

Research Objectives and Methodology

The aim of the scientific article is to review the integration of digital technologies into business processes in companies in the Slovak Republic and to compare the situation in companies in the European Union (EU) and selected countries with a specific focus on integrating digital technologies in financial market entities in Slovakia. The subject of the research is selected digital technologies, which were researched at the global, European, and Slovak level, based on a comparison of available and published research in this area. A systematic search of the literature was carried out using keywords such as: Industry 4.0, digitization, digitalization, digital transformation, digital technologies (e.g.: artificial intelligence, cloud computing, internet of things, machine learning, robotics process automation, 3D printing and others). The starting point for the elaboration of the scientific article were: study, analysis, synthesis and comparison of professional literature in the form of: books, professional articles, scientific studies, public authority surveys, press releases, statistical files, methodologies, etc. The statistical data came from: the Statistical Office of the Slovak Republic, the Statistical Office of the European Union – Eurostat and the European Investment Bank, the National Bank of Slovakia (NBS), Siemens, the Business Center, SAP and BDO. In the scientific article, in addition to analysis, comparison, synthesis, we also used other explanatory general theoretical methods such as: deduction and induction, and methods of descriptive statistics were also used.

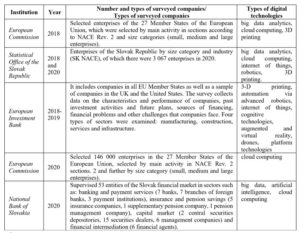

Table 1: Comparative research studies related to digital technologies

Source: Authors’ own processing

Results And Discussion

The geography of the digital economy according to the United Nations is highly concentrated in two countries of the world such as: the USA and China, where many leading technology companies are based in these countries and there is mini-technological competition. The Digital Economy Report United Nations 2019 provides the following facts about the share of digital technologies in the USA and China. In 2019, these two countries (USA and China) combined the following values: 75% share of all patents related to Blockchain technology, 50% of global IoT expenses, 75% share of the cloud computing market and together they also have a 90% share of global value market with a market capitalization of the 70 largest digital platforms. In the digital platform market in 2019, Europe had a share of only 3.6%, Africa 1.3% and Latin America 0.2%.

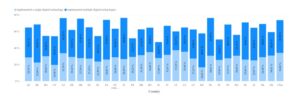

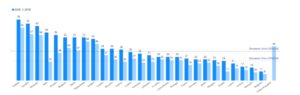

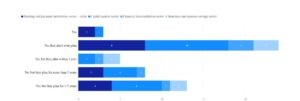

A survey by the European Investment Bank (EIB) in 2019 displayed that the EU companies surveyed lagged behind in the implementation of digital technologies compared to the USA surveyed companies. Active innovators in the EU accounted for 20% of the surveyed companies, while in the USA it was 25% of the surveyed companies, which, according to the survey, was due to lower use of IoT applications and drones. In the European Union, in 2019, at least one digital technology was implemented on average; an average of 28.8% of the surveyed companies had at least one implemented digital technology and 34.36% of the surveyed companies had implemented multiple technologies. The EU average with the share of surveyed companies lags behind the USA, where 34.06% of surveyed companies had one technology implemented and 39.50% of surveyed companies had implemented multiple technologies. The leading country in the EIB survey in 2019 was Finland, where 76.27% of the surveyed companies have implemented digital technologies. Furthermore, among the top 3 countries according to the implementation of digital technologies in 2019 were the Netherlands with a 76.17% share of surveyed companies and the Czech Republic with a 76.02% share of surveyed companies. By contrast, the fewest companies implemented digital technologies in Ireland (47.06%), where more than half of the companies surveyed did not use any digital technology. Other EU countries with the lowest share of digital technologies were Poland (50.2%) and France (51.59%). The implementation of digital technologies can be noticed in figure 1., where the implementation of single and multiple technologies in selected examined companies of the European Union is graphically represented.

Fig 1. Implementation of single and multiple digital technologies in selected companies in

the EU and USA in 2019

Source: Authors’ own processing according to European Investment Bank (2020)

The Slovak Republic ranked 7th among the EU countries, where 68.92% of the surveyed companies had digital technologies implemented, and compared to 2018, a decrease was recorded from 71.13% of the surveyed companies. In all examined sectors, Slovakia achieves better values than the average of EU member states in 2019, but they are still lower than the USA (Table 2). Overall, in the EIB survey 2019, Slovakia lags behind not only the USA (73.56%), Finland (76.27%), the Netherlands (76.17%), the Czech Republic (76.02%) but also Denmark (75.28%), Spain (73.84%) and Sweden (70.76%). In 2019, digital technologies were mostly used in the infrastructure sector and least in the construction sector in the EU (39.95% of companies), which is almost half less than in the USA (77.06%).

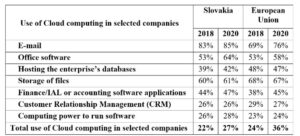

Table 2: Use of cloud computing in 2020 by enterprises in Europe

Source: Authors’ own processing according to European Investment Bank (2020).

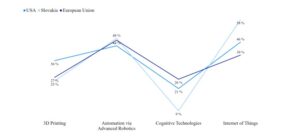

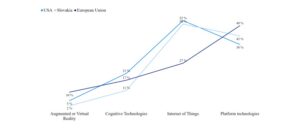

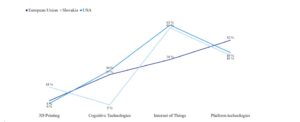

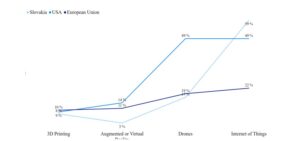

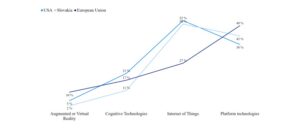

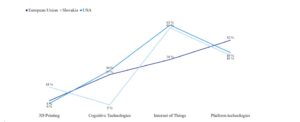

EIB in its survey examined the implementation of digital technologies in Slovakia, the European Union and the USA according to selected sectors – manufacturing (Fig 2.), construction (Fig 3.), services (Fig 4.), and infrastructure (Fig 5.), where she listed the four most implemented technologies from each sector.

Fig 2. Implementation of digital technologies by manufacturing sector (in 2020).

Source: Authors’ own processing according to European Investment Bank (2020).

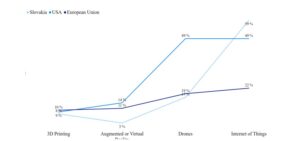

Fig 3. Implementation of digital technologies by construction sector (in 2020).

Source: Authors’ own processing according to European Investment Bank (2020).

Fig 4. Implementation of digital technologies by services sector (in 2020).

Source: Authors’ own processing according to European Investment Bank (2020).

Fig 5. Implementation of digital technologies by infrastructure sector (in 2020).

Source: Authors’ own processing according to European Investment Bank (2020).

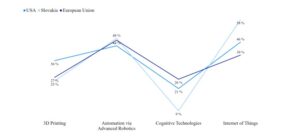

From the EIB survey, the most used digital technology in Slovakia was the internet of things (IoT), which used each type of the monitored sector on average 57% and was mostly used by the Infrastructure sector (61%) together with platform technologies (avg. 45.33%). Automation via advanced robotics was used in the EU, USA and Slovakia only in the Manufacturing sector, in companies in Slovakia at the level of 48% of companies, which is one percentage point higher than the EU average and four percentage points higher compared to the USA. The least used technologies were: in all monitored countries augmented or virtual reality (avg. 7.5%), 3D printing (avg. 16.33%), cognitive technologies (avg. 18.77%) and drones (avg. 28, 33%), which were used only in the construction sector with the highest – 49% popularity in the USA.

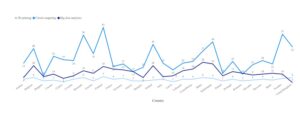

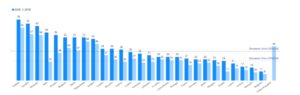

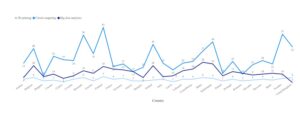

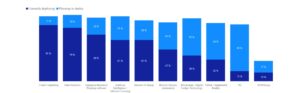

The statistical office of European Union – Eurostat examined the use of selected ICTs, also called digital technologies such as: 3D printing, cloud computing (CC) and big data analytics (BDA) in selected companies in EU countries. A survey conducted in 2018 found that CC was used the most (avg. 26% of companies), followed by BDA (avg. 12%) and the least 3D printing (avg. 4%). Finland was the leader in the use of CC (65% of companies) and 3D printing (7%) and when using BDA was Malta (24%), which we can see in the following figure 6.

Fig 6. Use of 3D printing, cloud computing and big data analytics in the countries of the European Union in 2018 (% of selected enterprises)

Source: Authors’ own processing according to Eurostat (2018)

EU survey from 2018 carried out on selected companies in the European Union shows that:

- 3D printing was used by 13% of large enterprises, 3% by small enterprises and 3D printing technology was used to produce prototypes or models for internal use in 57% of enterprises, 32% of enterprises selling prototypes or models, 27% of enterprises in the production process of goods and 17% of companies used 3D printing for other goods;

- enterprises in the use of BDA analyzed data types such as: geolocation data form the use of portable devices (49% share), followed by information generated by social media (45%), data form smart devices or sensors (29%) and other sources (26%);

- only 3 countries (Finland, Sweden and Denmark) accounted for more than 50% of cloud computing usage.

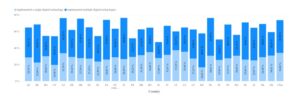

Fig 7. Use of cloud computing in 2018 and 2020 by enterprises in the countries of the European Union in 2018 (% of selected enterprises)

Source: Authors’ own processing according to Eurostat (2018) and Eurostat (2020)

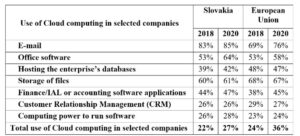

In 2020, according to Eurostat, there was an increase in the use of cloud computing (CC) in every single EU country, which increased the average from 24% to 36% of companies. Finland maintained its leading position with 75% utilization and a significant increase was recorded for companies in Italy, where utilization increased by 36 percentage points to 59% of companies. The least used CC was in Bulgaria (11%), followed by Romania (16%) and Greece (17%). Slovakia improved its position by one place in 2020 and is in 20th place with a 26.6% share of surveyed companies using CC, however the achieved value was repeatedly below the EU average in this period. The percentage of the use of CC in 2020 in selected EU countries is shown in figure 7., and a comparison of specific cloud computing services used in Slovakia and the EU is shown in the following table 3.

Table 3: Services use of cloud computing in Slovakia in % compared to the EU

Source: Authors’ own processing according to Statistical office of the Slovak Republic (2018), Statistical office of the Slovak Republic (2020) and Eurostat (2018)

Source: Authors’ own processing according to Statistical office of the Slovak Republic (2018), Statistical office of the Slovak Republic (2020) and Eurostat (2018)

Although Slovakia was below the EU average in total use of cloud computing, some services individually reached values above the EU average. Among the most used services in 2020 in Slovak companies was the use of a cloud solution: on e-mails (85% of companies), in office software, file storage, etc. (Table 3.). Out of all digital technologies used by companies in the Slovak Republic, the highest share was recorded in the use of CC (Fig 8.).

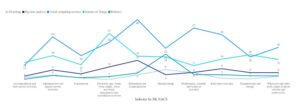

Fig 8. Use of digital technologies by selected industry in Slovakia in 2020

Source: Authors’ own processing according to Statistical office of the Slovak Republic (2020)

In 2020, the Statistical Office of the Slovak Republic examined the use of digital technologies in selected Slovak companies such as: 3D printing, big data analytics (BDA), cloud computing (CC), internet of things (IoT) and robotics. Figure 8. shows the use of digital technologies by industry and the largest representation in the use had the following industries: information and communication; professional, scientific, and technical activities, administrative and support services activities. These sectors have had ICT as an integral part of their business, and this results in efforts to digitize activities, but the statistics do not include the financial sector, which was the first in the world to digitize its activities. The least used digital technologies were in the following sectors: accommodation and catering services and in construction, where companies do not feel a high need for internet or ICT. The second most used technology in Slovakia among the examined digital technologies was IoT, where almost 17% of surveyed companies used interconnected devices or systems in 2020 that can be monitored or remotely controlled via the internet and the types of activities used could be seen in figure 9.

Fig 9. Types of activities using the internet of things in the surveyed Slovak companies in 2020

Source: Authors’ own processing according to Statistical office of the Slovak Republic (2020)

In Slovakia, in addition to the use of the internet of things (IoT), 3D printing and robotics, the use of big data analytics (BDA) was also investigated. In 2019, 5.6% of the surveyed companies in Slovakia used BDA by applying various methods such as: machine learning methods (23.6% of surveyed companies), natural language processing and creation or speech recognition methods (13.1% of surveyed companies) and 84.2% of the enterprises surveyed used methods other than those listed. Data sources for companies using BDA are data obtained from social media (47.7% of surveyed companies), geolocation data from the use of portable devices (46.5% of surveyed companies), own company data from smart devices or sensors (38.1 % of enterprises surveyed) and other sources accounted for 30.4% of enterprises surveyed. The reason for not performing BDA, which is reported by the surveyed companies, is mainly the lack of human resources, knowledge, skills, which is reported by up to 67.2% of surveyed companies that have ever considered performing BDA. 62% of the companies surveyed said that they did not apply them because it was not their priority and another problem they mentioned in relation to non-use was too high costs compared to the benefits (49.6% of companies surveyed).

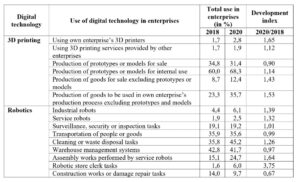

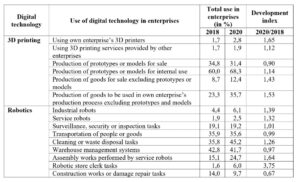

Robotics was used by 7.4% of the surveyed companies and 3D printing by 4% of the surveyed companies. A more detailed look at the individual categories of digital technologies used, such as: 3D printing and robotics, is given in the following table 4.

Table 4: Types of use of 3D Printing and Robotics in selected companies in Slovakia

Source: Authors’ own processing according to Statistical office of the Slovak Republic (2018) and Statistical office of the Slovak Republic (2020)

From surveys conducted in Slovakia, we found that the surveyed companies in 2018 implement and plan to implement digitalization projects in business areas such as: production (77%), planning (63%), management (52%), general operational processes (51%), decision support (43%) and administration to the extent of 36%. The Business Center (2019) reports from the European Payment Practices survey that: 14% of the companies surveyed had a high degree of digitalization and a total of 49% of companies rated their degree of digitalization as high or very high. Oxford Economics found that 94% of the companies surveyed in 2017 used BDA tools, 76% used IoT and half used machine learning.

Digital technologies in financial institutions

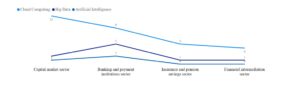

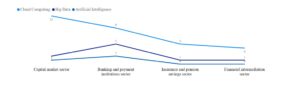

In 2020, the National Bank of Slovakia (NBS) conducted a survey on the implementation of innovations in 53 financial market entities (regulated financial institutions, including their branches), which included an analysis of the use of digital technologies such as: big data analytics, artificial intelligence and cloud computing. Figure 10 shows graphically the number of entities in the financial market sectors that use digital technologies.

Fig 10. Use of digital technologies in individual financial market entities in 2020 (The value represents the number of entities within the sector)

Source: Authors’ own processing according to statistical data of the National Bank of Slovakia (2021)

The most used digital technology in the analyzed subjects of the financial market was cloud computing, which was used by 57% of the surveyed entities, followed by big data analytics (17% of the surveyed entities). Artificial intelligence was used by the least entities, namely 6%, which represents only 3 financial market entities. The largest trend in the use of digital technologies was in the banking and payment institutions sector (avg. 31%), and the lowest use of digital technologies was in the capital market sector (avg. 22%).

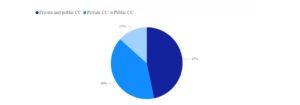

Cloud computing (CC), as we can see in the following figure 11, was used in 30 subjects, which represented a 57% share of use in the subjects. Cloud computing was the most used in the insurance and pension savings sector, where it is used by up to 71% of the surveyed entities, and in the financial intermediation sector (67%). If we take the use from an absolute point of view, it is mostly used in the capital market sector (12 surveyed companies) and then in the banking and payment institution sector (9 surveyed companies). A total of 43% of the surveyed companies do not use digital cloud computing technology, of which 17 companies do not even plan to use it, which represents 32% of all surveyed financial market participants. The prediction of the planned use of cloud computing represents one entity from the insurance and pension savings sector at the one-year horizon (2% share of the surveyed entities) and 9% of the surveyed entities plan to introduce it within 3 years.

Fig 11. Utilization of cloud computing in individual financial market entities in 2020 (The value represents the number of entities within the sector)

Source: Authors’ own processing according to statistical data of the National Bank of Slovakia (2021)

The typology of the purposes of using cloud computing in the surveyed companies was recorded for: data storage and sharing within the company, non-integrated training environment, client zone for storing client documentation, organizing virtual meetings and use was also recorded for the company’s insurance software.

Fig 12. Type of use of cloud computing (CC) in financial market entities using cloud computing

Source: Authors’ own processing according to statistical data of the National Bank of Slovakia (2021)

Financial market participants use the most hybrid cloud solutions (Fig 12.), which are a blend of public and private cloud computing, specifically in 47% of surveyed entities using cloud computing (14 surveyed entities). Private cloud computing is used by 12 surveyed entities (40%) and 4 surveyed entities (13%) use public cloud computing. Private cloud computing was mostly used by 50% of entities in the capital market sector. The largest percentage of the use of exclusively public cloud computing was recorded in the banking and payment services sector and represented 20% of entities, which may pose security risks. In contrast, none of the respondents in the sectors: insurance, pension savings and financial intermediation used exclusively public cloud computing.

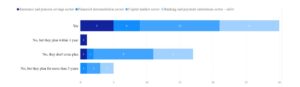

Big data analytics was the second most used digital technology according to the NBS survey for 2020 in regulated financial market entities and was used by 17% of surveyed entities (Fig 13.). Big data analytics digital technology was mostly used in the banking and payment services sector with a 29% share within the sector. In the other sectors, it was used by only four surveyed financial market entities, of which: two entities in the capital market sector (9% share within the sector), one entity in the insurance and pension savings sector (14% share within the sector) and one entity in the sector financial intermediation (17% share within the sector). Overall, 83% of the surveyed financial market participants do not use big data analytics, of which: 9% plan to implement the technology within one to three years, 32% plan to implement it within one to three years, 18% plan to implement it within three years and up to 41% do not plan to introduce the use of big data analytics at all. The largest share of non-use of big data analytics is in the capital market sector, where up to 21 entities from the given sector do not use big data analytics and 57% of entities do not even plan to introduce this digital technology. In other sectors, BDA is not used in: 86% of companies in the insurance and pension savings sector, 83% of companies in the financial intermediation sector do not use BDA and 71% of companies in the banking and payment sector.

In other sectors such as: insurance and pension savings are not used by big data analytics 86% of entities, financial intermediation 83% of the company does not use big data analytics, and in the banking and payment sector it is not used by 71% of companies.

Fig 13. Use of big data analytics in individual financial market entities in 2020 (The value represents the number of entities within the sector)

Source: Authors’ own processing according to statistical data of the National Bank of Slovakia (2021)

The purposes of using big data analytics were recorded in: in-depth data analytics, CRM and risk management, improvement of client services, data processing for employees and campaign documents, insurance contract analysis, fraud monitoring and storage of technological data. Of all the entities using big data analytics, only 33% of financial market entities cooperate with external companies and others do not cooperate (67%).

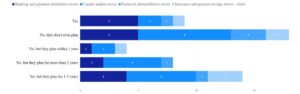

According to NBS data, artificial intelligence was the least used digital technology in the surveyed financial market entities, and the use was recorded in only three entities, which represented a 6% share among all surveyed companies. From the AI banking sector, two entities with a 12% share within the sector used digital technology, and from the capital market sector, only one entity with a 4% share within the sector used digital technology. As we can see in figure 14., 50 surveyed financial market entities do not use AI technology and 45% of all respondents do not plan to use this technology either. In the financial intermediation sector, 100% of the surveyed entities do not use this technology, but 50% of entities in the given sector plan to use the technology (33% within one year, 33% within one to three years and 33% over 3 years). Also, in the insurance and pension saving sector, no company uses artificial intelligence, but 57% of the surveyed companies plan to introduce the technology, which represents 4 companies. In the capital market sector, a total of 22 entities do not have AI in place (96% of entities within the sector) and in the banking and payment institution sector, 15 entities do not have established technology (88% of entities within the sector).

Fig 14. Use of artificial intelligence in individual financial market entities in 2020 (The value represents the number of entities within the sector)

Source: Authors’ own processing according to statistical data of the National Bank of Slovakia (2021)

According to the NBS survey, artificial intelligence in slovak financial market entities was used to improve the front office and back office for all entities used by AI tools and for purposes such as: predictions, chatbots, fraud prevention and algorithmic portfolio management. Cooperation with external companies in the use of artificial intelligence tools was recorded in two out of three subjects.

Fig 15. Current deployment and planning of digital technology deployment in financial institutions according to BDO

Source: Authors’ own processing according to BDO (2021)

The BDO (2021) states that investing in technology is a top business priority for financial institutions and uses key digital technologies to help achieve their goals. Financial institutions are currently using the most digital technologies (Fig 15.) such as: cloud computing (71%) and data analytics (79%), and the least 3D printing technology (13%).

It can be stated that the current situation in financial institutions operating in Slovakia is in line with the above findings of BDO. Currently, most of the digital technologies used in institutions in Slovakia are cloud computing (57%). The plans of these companies for the near future in the horizon of one year only very slightly indicate activity in this area – big data analytics 9% and artificial intelligence 10% of entities. A more positive trend can be seen in the planned activities in the horizon of 3 years where these values increase significantly – big data analytics 32% and artificial intelligence 26% of entities. These trends in comparison with the planned activities identified by BDO (2021) are gaining agreement only in the field of artificial intelligence, where the share of companies that plan to deal with such innovations is 35%. However, it should be noted that the survey of BDO (2021) identified the share of already existing innovations in this area or currently implemented innovations at the level of 61% compared to the situation in Slovakia, where it is only 6%. We also identified a lag behind global trends in the area of data analytics, where the share of these tools currently represents 79% and 17% in Slovakia (however, the question examined the use of big data analytics, and the adoption of a definitive statement researchers to define more precisely this area).

Finally, we would like to list the planned activities in the implementation of other digital technologies according to BDO (2021), which was most recorded in the following areas: 5G (69%), blockchain (55%), virtual and augmented reality (54%), robotic process automation (40%).

Conclusion

Digital technologies, together with digitalization, are the main elements and driving forces of the fourth industrial revolution that is still going on. The application of digitization, the increasing rate of digitalization and digital transformation, the development of information and communication technologies, the exponential growth of the Internet connection and the sharing of information in electronic form hide the opportunities for innovative business development. The terms: digitization, digitalization and digital transformation are often interchanged. Digitization is the technical process of converting from analog to digital format. Digitalization is the process of using digitization and integration of digital technologies in companies, which result in their digital transformation and thus change business activities, models, processes, products and services, and ultimately the company becomes digital. Digital technologies represent: a combination of information, computing, communication and connective technologies enabling access to cyberspace. Digital technologies are digital innovations of products and services, strategies, processes, activities and business models in organizations. Digital technologies 4IR include: artificial intelligence, big data analytics, blockchain, cloud computing, edge computing, internet of things, quantum computing, machine learning, deep learning, advanced manufacturing, additive manufacturing (3D printing), virtual reality, augmented reality, robotics process automation, digital twin, sensors, cybersecurity, embedded systems, mobile internet technologies, simulation, horizontal and vertical integration, 5G and other digital technologies include: b2g interactions, enterprise resource planning, social media, customer relationship management, electronic invoicing, radio frequency identification, e-commerce, high-speed broadband, supplier-customer management, e-booking and orders. The integration of digital technologies within industries is wide and has applications in different sectors and in each size category of enterprise, whether one or more depending on the type of business activities. However, there are still companies that do not need to use advanced digital technologies and basic ICT is enough for them, which does not make them a fully digital enterprise. Information and communication technologies, including digital technologies, are an important part of companies for their economic growth, efficiency, competitiveness, and innovation.

From the reviewed data, we can state that there is a growing trend in the world to use digital technologies in companies when applied in various business processes. The most frequently used technologies in the world are: internet of things, cloud computing, artificial intelligence, 3D printing, blockchain, big data analytics. The top countries of the European Union in the implementation of digital technologies include Finland, the Netherlands and the Czech Republic. Finland is also one of the countries that use cloud computing the most, followed by Sweden and the good position of the Netherlands is also confirmed. Slovakia achieves relatively good indicators in the digitalization rankings of the European Union, in the implementation it ranked 7th, where almost 69% of companies have implemented digital technologies and the values are above the average of the European Union. However, when comparing the use of cloud computing in 2020, Slovakia was among the 8 worst countries and the use of CC is below the EU average. According to the Statistical Office of the Slovak Republic, cloud computing is the most used technology, according to the EIB it is the internet of things and automation via advanced robotics. According to a survey by the National Bank of Slovakia, the most widely used digital technologies in financial institutions are cloud computing and big data analytics, and the banking and payment institutions sector have the highest use and the lowest use in the capital market and financial intermediation sectors. According to BDO, the most used digital technologies are: cloud computing, data analytics and 3D printing technology. However, based on the findings, it is not possible to clearly determine which digital technologies are most used and the position of the selected countries, because the survey was always conducted on a different sample, in different sectors and in different size categories. The ideal would be to examine every business entity, but this is not possible.

The integration of digital technologies together with the implementation of digitalization are part of the digital transformation. Among the first industries to experience the digital transformation was the financial services industry, which in their business does not only change the way of processes and models in the internal environment but also in the external environment – from back, through middle to front office, which represents interactions with clients and companies. The new business models of a company providing financial services based on the use of digital technologies are changing market positions and clients who, depending on innovation, may stop using services or, conversely, start using them in the form of new innovations. The rapid growth of digital technology and financial convergence offers significant benefits to financial services institutions such as: digital currencies – cryptocurrencies, use of smart contracts, increasing the volume and speed of transactions, increasing the availability and delivery of financial services, improving liquidity management, creating digital branch offices and the abolition of stone branches, less manpower, automation of activities, increase of cyber and general security of institutions, facilitation of financial operations, acceleration of financial flows, implementation of better prevention against AML (Anti Money Laundering), better control of KYC (Know Your Client) and others.

During the current course of the Fourth Industrial Revolution, the digital age and the COVID-19 pandemic, the importance of digitalization and the use of digital technologies in companies resulting in digital transformation has been confirmed, resulting in changes in the business environment and digital transformation cannot be avoided. The problem is insufficient investment in digitalization, a lack of digital strategy, a lack of staff with digital and analytical knowledge, including low management knowledge, which should seek to implement digital strategy and interact with technologies, thus increasing business opportunities and leading to an agile digital enterprise. Businesses should primarily strive to interact with digital technologies that are innovative and lead to digital transformation at all levels of management in all activities.

Acknowledgment

The paper was elaborated within VEGA No. 1/0388/20 IT Management in Enterprises in Slovakia: International Standards and Norms Versus Individual Business Processes in proportion 100 %.

References

- Agarwal, R., Gao, G. G., Desroches, C. M. and Jha, A. K. (2010), ´ The Digital Transformation of Healthcare: Current Status and the Road Ahead,´ Information Systems Research , 21 (4), 796-809

- Aghav-Palwe, S. and Gunjal, A. (2021), Chapter 1 – Introduction to cognitive computing and its various applications, Cognitive Data Science in Sustainable Computing, Cognitive Computing for Human-Robot Interaction, Mittal, M. et al (ed), Academic Press.

- Aquilani, B., Piccarozzi, M., Abbate, T. and Codini, A. (2020), ´The Role of Open Innovation and Value Co-creation in the Challenging Transition from Industry 4.0 to Society 5.0: Toward a Theoretical Framework,´ Sustainability, 12 (21), 8943

- Bayón, P. S. and Vega, L. G. (2018), ´An outlook on the role of Finance Regulation under the Fourth Industrial Revolution,´ Archives of Business Research. 6 (10)

- BDO, (2021), “2021 Financial Services Digital Transformation Survey”, [Online], [Retrieved February 22, 2022], https://www.bdo.com/BDO/media/Report-PDFs/Digital%20Transformation/2021-Financial-Services-Digital-Transformation-Survey_web.pdf

- Bhandari, V. (2021), Banking and Financial Services Industry in the Wake of Industrial Revolution 4.0: Challenges Ahead, Handbook of Research on Disruptive Innovation and Digital Transformation in Asia, Pablos, P. O. (ed), IGI Global.

- Bharadwaj, A., El Sawy, O. A. Pavlou, P. A. and Venkatraman, N. (2013), ´Digital Business Strategy: Toward a Next Generation of Insights,´ MIS Quarterly, 37 (2), 471-482

- Bican, P. M. and Brem, A. (2020), ´Digital Business Model, Digital Transformation, Digital Entrepreneurship: Is There A Sustainable “Digital”?,´ Sustainability, 12 (13), 5239

- Blessy, J., Jemy, J., Yves, G., Nandakumar, K. and Sabu, T. (2020), Material aspects during additive manufacturing of nano-cellulose composites, Structure and Properties of Additive Manufactured Polymer Components, Friedrich, K. et al (ed), Woodhead Publishing, 409-428

- Bloomberg, J. (2018), “Digitization, Digitalization, And Digital Transformation: Confuse Them At Your Peril”, [online], Forbes, [Retrieved February 22, 2022], https://www.forbes.com/sites/jasonbloomberg/2018/04/29/digitization-digitalization-and-digital-transformation-confuse-them-at-your-peril/#135d8ada2f2c

- Bolek, V. (2020), ´The Integration of Innovative Pervasive Technologies in Business Processes: Integrácia inovatívnych pervazívnych technológií v podnikových procesoch,´Logos Polytechnikos, 11 (3), 233-252

- Brennen, J. S. and Kreiss, D. (2016), Digitalization, The International Encyclopedia of Communication Theory and Philosophy, John Wiley & Sons, Inc., New Jersey, USA.

- Casino, F., Dasaklis, T. K. and Patsakis, C. (2019), ´A systematic literature review of blockchain-based applications: Current status, classification and open issues,´ Telematics and Informatics, 36, 55-81

- Černý, M. (2020), ´Cooperation of Business Intelligence and Big Data in One Ecosystem. In Current Problems of the Corporate Sector´, International Scientific Conference. Current Problems of the Corporate Sector 2020: 17th International Scientific Conference, ISSN 2261-2424, 2020 , Paris: Édition Diffusion Presse Sciences, 1-8.

- Cevik Onar, S. and Unstundag A. (2018), Smart and Connected Product Business Models, Industry 4.0: Managing The Digital Transformation, Industry 4.0: Managing The Digital Transformation, Pham, D. T. (ed), Birmingham, UK.

- Transformation, Industry 4.0: Managing The Digital Transformation, Pham, D. T. (ed), Birmingham, UK.

- Christidis, K. and Devetsikiotis, M. (2016) ´Blockchains and Smart Contracts for the Internet of Things,´ IEEE Access, 4, 2292-2303

- Ciriello, R., Richter, A. and Schwabe, G. (2018), ´Digital Innovation,´ Business & Information Systems Engineering, 60, 563–569

- Craglia, M., Hradec, J. and Troussard, X. (2020), Chapter 9 – The Big Data and Artificial Intelligence: Opportunities and Challenges to Modernise the Policy Cycle, Science for Policy Handbook, Elsevier.

- Deloitte, (2021), “Disruptive digital technologies in the financial services industry”, [Online], [Retrieved February 22, 2022], https://www2.deloitte.com/us/en/pages/financial-services/articles/disruptive-digital-technologies-in-the-financial-services-industry.html

- Deryzemlya, V. E. and Ter-Grigoryants, A. A. (2021), ´Methodological provisions for assessing the digital maturity of economic systems,´ RUDN JOUNAL OF ECONOMICS, 29 (1), 39-55

- European Investment Bank, (2020), “Slovakia, Overview, EIB INVESTMENT SURVEY 2020”, [online], European Union, [Retrieved February 22, 2022], https://op.europa.eu/en/publication-detail/-/publication/e23d93e8-440a-11eb-b59f-01aa75ed71a1/language-en

- European Investment Bank, (2020), “The EIB Investment Survey”, [online], [Retrieved February 22, 2022], https://www.eib.org/en/publications-research/economics/surveys-data/eu-overview-2020.htm

- European Investment Bank, (2020), “Who is prepared for the new digital age?”, [online], [Retrieved February 22, 2022], https://www.eib.org/attachments/efs/eibis_2019_report_on_digitalisation_en.pdf

- Eurostat, (2018), “Cloud computing services used by more than one out of four enterprises in the EU”, [online], European Union, [Retrieved February 22, 2022], https://ec.europa.eu/eurostat/documents/portlet_file_entry/2995521/9-13122018-BP-EN.pdf/731844ac-86ad-4095-b188-e03f9f713235

- Eurostat, (2021), “Cloud computing – statistics on the use by enterprises”, [online], European Commision, [Retrieved February 22, 2022], https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Cloud_computing_-_statistics_on_the_use_by_enterprises

- Feroz, A. K., Zo, H. and Chiravuri, A. (2021), ´Digital Transformation and Environmental Sustainability: A Review and Research Agenda,´ Sustainability, 13, 1530

- Fielke, S., Taylor, B. M. and Jakku, E. (2020), ´Digitalisation of agricultural knowledge and advice networks: A state-of-the- art review,´ Agricultural Systems, 180, 102 763

- Firdhous M., Ghazali O. and Hassan S. (2012), ´A Memoryless Trust Computing Mechanism for Cloud Computing´, NDT 2012 Networked Digital Technologies, Communications in Computer and Information Science, 293, ISBN 978-3-642-30506-1, Berlin, Heidelberg.

- Fischer, M., Imgrund, F., Janiesch, Ch. And Winkelmann, A. (2020), ´Strategy archetypes for digital transformation: Defining meta objectives using business process management,´ Information & Management, 57 (5), 1-13

- Frankenfield, J., (2021), “Artificial Intelligence (AI)”, [Online], Investopedia, [Retrieved July 21, 2021], https://www.investopedia.com/terms/a/artificial-intelligence-ai.asp

- Frankenfield, J., (2022), “Robotic Process Automation (RPA)”, [Online], Investopedia, [Retrieved February 22, 2022], https://www.investopedia.com/terms/m/machine-learning.asp

- Frost, J., Gamacorta, L., Huang, Y., Song Shin, H. and Zbinden, P. (2020), ´BigTech and the changing structure of financial intermediation.´ Economic Policy, 34 (100), 761-799

- Gartner (2022), “Big Data”. [Online], [Retrieved February 22, 2022], https://www.gartner.com/en/information-technology/glossary/big-data

- Gartner, (2022), “Digitization”, [Online], [Retrieved February 22, 2022], https://www.gartner.com/en/information-technology/glossary/digitization

- Gharajeh, M. S. (2018), Chapter Eight – Biological Big Data Analytics, Advances in Computers, Elsevier, 231-355.

- Gillis, A. S., (2021), “What is internet of things (IoT)?”, [Online], IoT Agenda, TechTarget. [Retrieved December 6, 2021], https://internetofthingsagenda.techtarget.com/definition/Internet-of-Things-IoT

- Gu, J., Gouliamos, K., Lobonţ, O. R. and Moldovan, N. C. (2021), ´Is the fourth industrial revolution transforming the relationship between financial development and its determinants in emerging economies?,´ Technological Forecasting and Social Change, 165, 120563

- Gupta, S., Motlagh, M. and Rhyner, J. (2020), ´The Digitalization Sustainability Matrix: A Participatory Research Tool for Investigating Digitainability,´ Sustainability, 12 (21), 9283

- Hassanin, H. and Jiang, K. (2015), Chapter 10 – Net Shape Manufacture of Freestanding Ceramic Micro-components through Soft Lithography, Micro and Nano Technologies, Micromanufacturing Engineering and Technology (Second Edition), Qin, Y. (ed), William Andrew Publishing.

- Helm, J. M., Swiergosz, A. M., Haeberle, H. S., Karnuta, J. M., Schaffer, J. L., Krebs, V. E., Spitzer, A. I. and Ramkumar, P. N. (2020), ´Machine Learning and Artificial Intelligence: Definitions, Applications, and Future Directions,´ Current Reviews in Musculoskeletal Medicine ,13, 69–76

- Henriette, E., Feki, M., and Boughzala, I. (2016), ´Digital Transformation Challenges´, MCIS 2016: 10th Mediterranean Conference on Information Systems, September 2016, Paphos, Cyprus.

- Hoosain, M. S., Paul B. S., and Ramakrishna, S. (2020), ´The Impact of 4IR Digital Technologies and Circular Thinking on the United Nations Sustainable Development Goals,´ Sustainability, 12 (23), 10143

- Jin, H, Ibrahim, S., Bell, T., Qi, L., Cao, H., Wu, S. and Shi, X. (2010). Tools and Technologies for Building Clouds, Cloud Computing, Computer Communications and Networks, Antonopoulos, N. and Gilliam, L. (ed), Springer, London.

- Joia, L.A. and Cordeiro, J.P.V. (2021), Unlocking the Potential of Fintechs for Financial Inclusion: A Delphi-Based Approach,´ Sustainability, 13 (21), 11675

- Lawton, G., (2022), “What is RPA? Everything you need to know”, [Online], SearchCIO, TechTarget. [Retrieved February 22, 2022], https://searchcio.techtarget.com/definition/RPA

- Laxman, L. K. P. (2021), Legal and Regulatory Challenges in Facilitating a Sustainable ASEAN E-Commerce Sector, Handbook of Research on Innovation and Development of E-Commerce and E-Business in ASEAN, Universiti Brunei Darussalam, Brunei.

- Lee, S. D. (2001), ´Digitization: Is It Worth It?,´Computer Libraries, 21 (5)

- Leviäkangas, P. (2016), ´Digitalisation of finland’s transport sector,´ Technology in Society, 47, 1-15

- Liberg, O., Sundberg, M., Wang, Y.-P. E., Bergman, J., Sachs, J. and Wikström, G. (2020), Chapter 1 – The Internet of Things, Cellular Internet of Things (Second Edition), Liberg, O., Sundberg, M., Wang, Y.-P. E., Bergman, J., Sachs, J. and Wikström, G. (ed), Academic Press.

- Liu D. Y., Chen, S. W., Chou, T. Ch. (2011), ´Resource Fit in Digital Transformation – Lessons Learned From The CBC Bank Global E-Banking Project,´ Management Decision, 49 (10), 1728-1742

- Machkour, B. and Abriane, A. (2020), ´Industry 4.0 and its Implications for the Financial Sector,´ Procedia Computer Science, 177, 496-502

- Mesároš, P., Mandičák, T., Behun, M. and Smetankova, J. (2018) ´Applications of Knowledge Technology in Construction Industry,´ 16th International Conference on Emerging eLearning Technologies and Applications (ICETA), Starý Smokovec, Slovakia, 2018, 367-372.

- Microsoft Azure, (2021), „What is cloud computing? A beginner´s guide“, [online], [Retrieved March 10, 2021, https://azure.microsoft.com/en-in/overview/what-is-cloud-computing/.

- Národná banka Slovenska, (2021), “Prehľad inovácií v dohliadaných subjektoch finančného trhu v SR”, [Online], [Retrieved February 22, 2022], https://www.nbs.sk/_img/Documents/_Dohlad/Fintech/SK-2021-prehlad-inovacii.pdf

- NEXTECH, (2018), “Prieskum: digitalizácia potrebuje nabrať na obrátkach (Research: Digitization needs to gain momentum)”, [Online], [Retrieved February 22, 2022], https://www.nextech.sk/a/Prieskum–digitalizacia-potrebuje-nabrat-na-obratkach

- Obukhova, A., Merzlyakova, E., Ershova, I. and Karakulina, K. (2020), ´Introduction of digital technologies in the enterprise,´ The 1st International Conference on Business Technology for a Sustainable Environmental System (BTSES-2020), 159, 04004.

- OECD, (2021), “The Digital Transformation of SMEs”, [Online], [Retrieved February 22, 2022], https://doi.org/10.1787/bdb9256a-en

- Okhrimenko, I., Sovik, I., Pyankova, S., and Lukyanova, A. (2019), ´Transformación digital del sistema socioeconómico: perspectivas de digitalización en la sociedad,´ Revista ESPACIOS, 40 (38), 26

- Paavola, R., Hallikainen, P. and Elbanna, A. (2017), ´ ROLE OF MIDDLE MANAGERS IN MODULAR DIGITAL TRANSFORMATION: THE CASE OF SERVU,´ Proceedings of the 25th European Conference on Information Systems (ECIS), ISBN 978-989-20-7655-3, 5-10 June 2017, Guimarães, Portugal, 887-903.

- Panos, G. A. and Wilson, J. O. S. (2020), ´Financial literacy and responsible finance in the FinTech era: capabilities and challenges,´ The European Journal of Finance, 27 (4-5), 297-301

- Paolini, A., Kollmannsberger, S. and Rank, E., (2019), ´Additive manufacturing in construction: A review on processes, applications, and digital planning methods,´ Additive Manufacturing, 30, 100894

- Podnikateľské centrum, (2019), “Stupeň digitalizácie v Európe: Z prieskumu skupiny EOS vyplýva, že polovica spoločností má stale čo robiť”, [Online], [Retrieved February 22, 2022], https://podnikatelskecentrum.sk/stupen-digitalizacie-v-europe-z-prieskumu-skupiny-eos-vyplyva-ze-polovica-spolocnosti-ma-stale-co-robit/

- Pousttchi, K., (2020), “Digitale Transformation”. [online]. Enzyklopädie der Wirtschaftsinformatik. [Retrieved February 22, 2022], https://www.enzyklopaedie-der-wirtschaftsinformatik.de/lexikon/technologien-methoden/Informatik–Grundlagen/digitalisierung/digitale-transformation/digitale-transformation

- PwC, (2017), “Innovation for the Earth Harnessing technological breakthroughs for people and the planet”, [Online], [Retrieved February 22, 2022], https://www.pwc.com/ee/et/publications/pub/innovation-for-the-earth.pdf

- Reljic, J., Evangelista, R. and Pianta, M. (2019) ´Digital technologies, employment and skills,´ LEM Working Paper 2019, 36

- Ribeiro, J., Lima, R., Eckhardt, T. and Paiva, S. (2021), ´Robotic Process Automation and Artificial Intelligence in Industry 4.0 – A Literature review,´ Procedia Computer Science, 181, 51-58

- Ritter, T. and Pedersen, C. L. (2020), ´Digitization Capability and the Digitalization of Business Models in Business-to-business Firms: Past, Present, and Future,´ Industrial Marketing Management, 86 (4), 180–190

- SAP Insights, (2017), “Digital Transformation: 4 Ways Leaders Set Themselves Apart”, [Online], [Retrieved February 22, 2022], https://insights.sap.com/sap-digital-transformation-executive-study-4-ways-leaders-set-themselves-apart/

- Sarvari, P. A., Ustundag, A., Cevikcan, E., Kaya, I. and Cebi, S. (2018), Technology Roadmap for Industry 4.0, Industry 4.0: Managing The Digital Transformation, Industry 4.0: Managing The Digital Transformation, Pham, D. T. (ed), Birmingham, UK.

- Scaravetti, D. and François, R. (2021), ´Implementation of Augmented Reality in a Mechanical Engineering Training Context,´ Computers, 10 (12), 163

- Schwab, K. (2016), The Fourth Industrial Revolution, The World Economic Forum, Geneva, Switzerland.

- Shin, Y. J. and Choi, Y. (2019), ´Feasibility of the Fintech Industry as an Innovation Platform for Sustainable Economic Growth in Korea,´ Sustainability, 11 (19), 5351

- Snedaker, S. and Rima, Ch. (2014), Business Continuity and Disaster Recovery in Financial Services, Business Continuity and Disaster Recovery Planning for IT Professionals, Snedaker, S. and Rima, Ch. (ed), Syngress.

- Statistical office of the Slovak Republic, (2018), Survey on Information and Communication Technologies Usage In Enterprises 2018.

- Statistical office of the Slovak Republic, (2020), Information and communication technologies usage in enterprises 2020.

- Su, Ch.-W., Qin, M., Tao, R. and Umar, M. (2020), ´Financial implications of fourth industrial revolution: Can bitcoin improve prospects of energy investment?,´ Technological Forecasting and Social Change, 158, 120178

- Sustainable Digital Finance Alliance, (2018), “Digital Technologies for Mobilizing Sustainable Finance: Applications of digital technologies to sustainable finance”, [Online], Green Finance Platform, [Retrieved February 22, 2022], https://www.greenfinanceplatform.org/research/digital-technologies-mobilizing-sustainable-finance-applications-digital-technologies

- United Nations, (2019), Digital Economy Report 2019, Value Creation and Capture: Implications for Developing Countries, Geneva, Switzerland.

- Vial, G. (2019), ´Understanding digital transformation: A review and a research agenda,´ The Journal of Strategic Information Systems, 28 (2), 118-144

- Voda, A. and Radu, L. D. (2019), Chapter 12 – How can artificial intelligence respond to smart cities challenges?, Smart Cities: Issues and Challenges, Visvizi, A. and Lytras, M. D. (ed), Elsevier.

- Vuong, Q. H. (2020), ´An Unprecedented Time for Entrepreneurial Finance upon the Arrival of Industry 4.0,´ Journal of Risk and Financial Management, 13 (10), 224

- Xie, I. and Matusiak, K. K. (2016), Chapter 3 – Digitization of text and still images, Discover Digital Libraries, Xie, I. and Matusiak, K. K. (ed), Elsevier.

- Yuan, S., Musibau, H. O., Genç, S. Y., Shaheen, R., Ameen, A. and Tan, Z. (2021), ´Digitalization of economy is the key factor behind fourth industrial revolution: How G7 countries are overcoming with the financing issues?,´ Technological Forecasting and Social Change, 165, 120533

- Ziyadin S., Suieubayeva S. and Utegenova A. (2019), ´Digital Transformation in Business,´ Proceedings of the International Scientific Conference “Digital Transformation of the Economy: Challenges, Trends, New Opportunities”, Digital Age: Chances, Challenges and Future, ISCDTE 2019, Lecture Notes in Networks and Systems, ISBN: 978-3-030-27014-8,. 26-27 April 2019, Samara, Russia, 84.